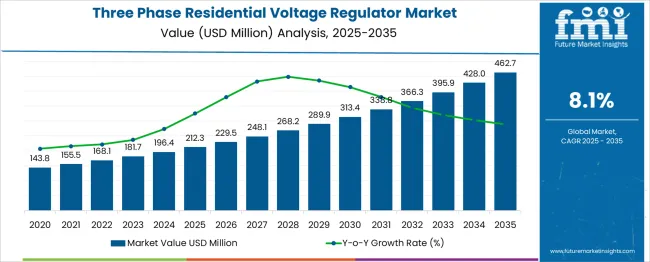

The three phase residential voltage regulator market is projected to grow from USD 212.3 million in 2025 to USD 462.7 million by 2035, generating an absolute gain of USD 250.4 million and a growth multiplier of 2.18x over the decade. Supported by an 8.1% CAGR, this growth is driven by increasing demand for stable and reliable voltage regulation in residential and small commercial settings.

During the first five years (2025–2030), the market will expand from USD 212.3 million to USD 313.4 million, adding USD 101.1 million, which accounts for 40.4% of the total incremental growth, with a 5-year multiplier of 1.47x. The second phase (2030–2035) contributes USD 149.3 million, representing 59.6% of incremental growth, reflecting strong momentum driven by expanding adoption in emerging markets, growing power demands, and increased grid infrastructure investments. Annual increments rise from USD 15.5 million in early years to USD 23.5 million by 2035, indicating accelerating growth as technology improves and regulations demand greater energy efficiency. Manufacturers focusing on improving the performance, cost-efficiency, and adaptability of voltage regulators will capture the largest share of this USD 250.4 million opportunity.

| Metric | Value |

|---|---|

| Three Phase Residential Voltage Regulator Market Estimated Value in (2025 E) | USD 212.3 million |

| Three Phase Residential Voltage Regulator Market Forecast Value in (2035 F) | USD 462.7 million |

| Forecast CAGR (2025 to 2035) | 8.1% |

The market is observing notable growth, driven by increasing demand for stable and reliable power supply in residential settings. Rising incidences of voltage fluctuations, coupled with the growing dependence on sensitive electronic appliances, have accelerated the adoption of advanced voltage regulation solutions.

Corporate press releases and investor communications have highlighted how improved urban infrastructure and electrification initiatives in emerging economies are creating favorable conditions for market expansion. Furthermore, advancements in materials and control software, as detailed in technology whitepapers and product announcements, have enhanced the efficiency and durability of voltage regulators, appealing to both end users and utility providers.

The future outlook remains positive as energy efficiency standards become more stringent and consumers continue to prioritize uninterrupted power delivery. Sustained investments in smart grid technologies and residential energy management systems are expected to open additional avenues for growth in the coming years.

The three phase residential voltage regulator market is segmented by productvoltage, and geographic regions. By product of the three phase residential voltage regulator market is divided into LinearSwitching. In terms of voltage of the three phase residential voltage regulator market is classified into ≤ 5 kVA, > 5 kVA to 20 kVA> 20 kVA to 40 kVA. Regionally, the three phase residential voltage regulator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

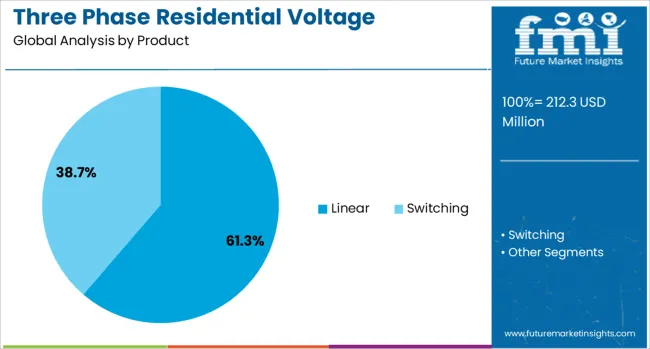

The linear product segment is anticipated to hold a dominant share of 61.3% in the Three Phase Residential Voltage Regulator market in 2025. This leadership is being supported by the segment’s proven capability to deliver precise voltage control and high reliability, as highlighted in technical datasheets and engineering journals.

Linear regulators are being preferred in residential applications due to their simplicity of design, quiet operation, and lower electromagnetic interference, which aligns with the needs of sensitive household electronics. Industry news and corporate presentations have also noted the segment’s strong acceptance because of its cost-effectiveness and minimal maintenance requirements, further enhancing its appeal in cost-conscious residential markets.

The segment’s robust performance under fluctuating load conditions and ability to maintain stable output without complex configurations have reinforced its relevance. Collectively, these advantages have ensured the linear segment’s continued dominance in the market landscape.

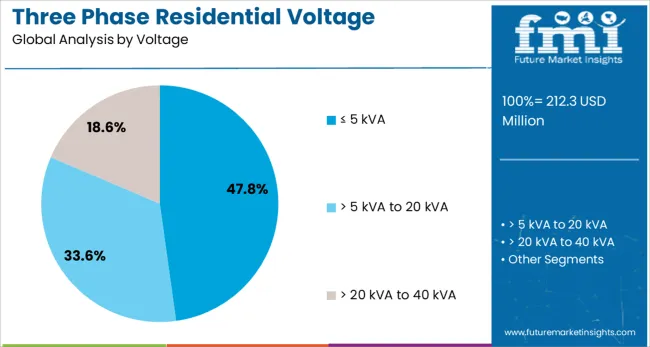

The ≤ 5 kVA voltage segment is projected to lead the market with a share of 47.8% in 2025, underscoring its suitability for residential use. This dominance is being attributed to the compatibility of ≤ 5 kVA regulators with typical household power demands, as observed in manufacturer product sheets and utility guidelines.

Their compact form factor and energy efficiency have been cited in industry updates as key drivers for widespread adoption in urban and semi-urban residential areas. Investor briefings have emphasized the segment’s popularity owing to its affordability and ease of installation, meeting the requirements of average residential loads without unnecessary oversizing.

Additionally, the segment has benefited from increasing regulatory emphasis on efficient energy utilization, making ≤ 5 kVA regulators an optimal choice for sustainable home energy systems. These factors have collectively contributed to the segment maintaining its leading position in the market in 2025.

The three-phase residential voltage regulator market is driven by increasing demand for stable power supply and protection against voltage fluctuations in residential areas. Opportunities are expanding with the rise of smart home installations and energy-efficient systems. Emerging trends in energy-efficient and smart regulators are reshaping the market. However, high initial costs and installation complexities remain significant barriers. By 2025, addressing these challenges will be crucial for ensuring continued growth and broader adoption in residential markets.

The three-phase residential voltage regulator market is growing due to the increasing demand for stable and reliable power supply in residential areas. As more households rely on electronic devices and appliances, the need for consistent voltage to prevent damage and ensure efficiency is becoming crucial. Voltage regulators help manage fluctuations and provide protection. By 2025, this market will continue to expand as more regions focus on improving power infrastructure for residential areas.

Opportunities in the three-phase residential voltage regulator market are increasing with the growth of smart home installations. Voltage regulators play a critical role in protecting sensitive smart devices and appliances from power surges or dips. As smart home technologies continue to grow, particularly in energy-efficient homes, the demand for reliable voltage regulation solutions is expected to rise. By 2025, these trends will present substantial growth opportunities in residential buildings, especially those incorporating advanced home automation systems.

Emerging trends in the market show a shift toward energy-efficient and smart voltage regulators. These advanced regulators not only manage power fluctuations but also integrate with smart grids to optimize energy usage and improve power quality. As the demand for more efficient power management systems increases, smart voltage regulators are becoming integral in energy-saving systems. By 2025, this trend is expected to dominate, with regulators offering enhanced functionality and automation to improve overall energy efficiency in residential buildings.

Despite growth, challenges such as high initial costs and complex installation processes persist in the three-phase residential voltage regulator market. The installation of these devices often requires professional expertise and can involve high upfront investment, making them less accessible for some homeowners. Additionally, the complexity of integrating these systems into existing electrical setups can limit widespread adoption.

| Country | CAGR |

|---|---|

| China | 10.9% |

| India | 10.1% |

| Germany | 9.3% |

| France | 8.5% |

| UK | 7.7% |

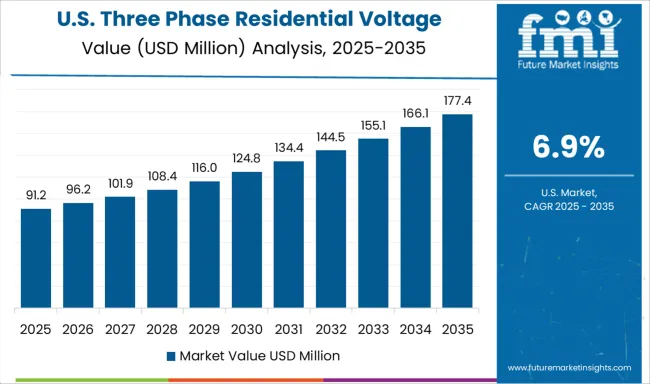

| USA | 6.9% |

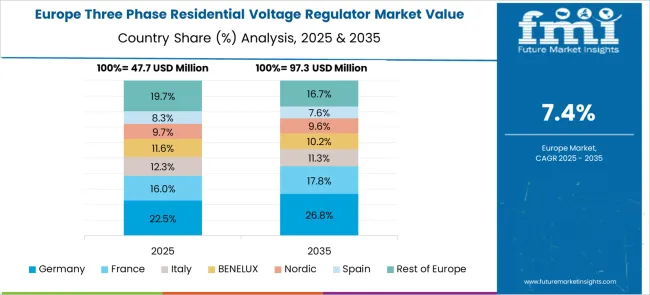

| Brazil | 6.1% |

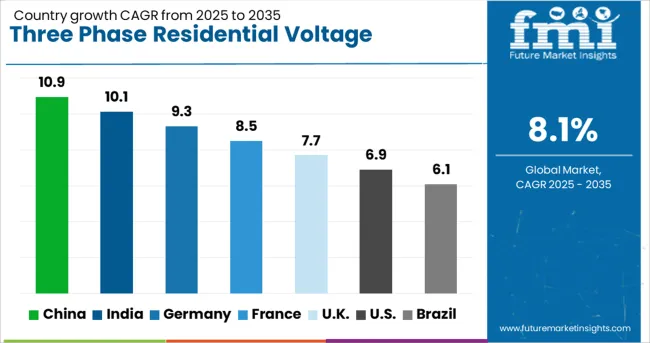

The global three phase residential voltage regulator market is projected to grow at an 8.1% CAGR from 2025 to 2035. China leads with a growth rate of 10.9%, followed by India at 10.1%, and France at 8.5%. The United Kingdom records a growth rate of 7.7%, while the United States shows the slowest growth at 6.9%. These varying growth rates are driven by factors such as increasing demand for stable and reliable power supply in residential areas, growing energy consumption, and rising adoption of voltage regulation technologies for improving the efficiency of electrical systems. Emerging markets like China and India are witnessing higher growth due to rapid industrialization, urbanization, and the increasing need for electrical infrastructure improvements, while more mature markets like the USA and the UK experience steady growth driven by existing demand and regulatory compliance. This report includes insights on 40+ countries; the top markets are shown here for reference.

The three phase residential voltage regulator market in China is growing at a robust pace, with a projected CAGR of 10.9%. China’s rapid urbanization and expansion of residential and commercial infrastructure are major drivers of the demand for reliable and stable power supply systems. The country’s large-scale industrial development, coupled with increasing energy consumption in residential areas, is further boosting the adoption of voltage regulators. Additionally, the Chinese government’s initiatives to enhance the electrical grid infrastructure and improve power quality support the continued demand for three-phase voltage regulators in both urban and rural areas.

The three phase residential voltage regulator market in India is projected to grow at a CAGR of 10.1%. India’s expanding residential sector, coupled with rising electricity consumption, is significantly contributing to the market growth. As urbanization continues and the need for reliable power supply in residential areas increases, the demand for voltage regulators is expected to rise. Additionally, India’s government initiatives to improve the power distribution network, along with a focus on energy efficiency and reducing power losses, further support the adoption of voltage regulators. The growing demand for electrical infrastructure improvements in rural areas also fuels market expansion.

The three phase residential voltage regulator market in France is projected to grow at a CAGR of 8.5%. France’s well-established residential and industrial sectors, coupled with the growing demand for energy-efficient power solutions, are driving the adoption of voltage regulators. The country’s commitment to sustainable energy and improving electrical grid reliability further boosts the demand for voltage regulation technologies. Additionally, France’s efforts to reduce power losses in the grid and improve power quality across residential areas are contributing to the growth of the voltage regulator market, particularly as demand for smart grid technologies increases.

The three phase residential voltage regulator market in the United Kingdom is projected to grow at a CAGR of 7.7%. The UK’s growing focus on improving the energy efficiency of electrical systems, coupled with the increasing demand for stable power supply in residential areas, is supporting the steady growth of the market. The country’s commitment to reducing power losses, along with the rising demand for smart grid technologies, is further driving the adoption of voltage regulators. Additionally, the UK’s strong regulatory frameworks for power quality and energy efficiency continue to support the growth of the market.

The three phase residential voltage regulator market in the United States is expected to grow at a CAGR of 6.9%. The USA remains a key player in the global voltage regulator market, driven by the need for efficient power systems in residential areas. The growing demand for voltage regulators is fueled by increasing energy consumption, the expansion of residential infrastructure, and the rising adoption of smart grid solutions. Additionally, the USA government’s initiatives to improve the power grid’s reliability, reduce power interruptions, and enhance power quality across residential areas further contribute to market growth, despite slower growth compared to emerging markets.

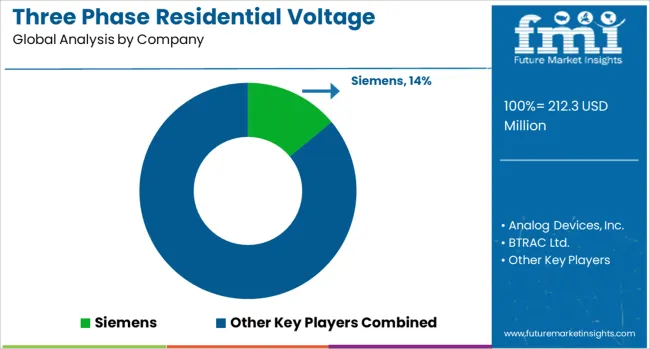

The three-phase residential voltage regulator market is dominated by Siemens, which leads with its innovative and high-performance voltage regulation solutions for residential and light commercial applications. Siemens’ dominance is supported by its extensive portfolio, which includes advanced voltage regulators designed to improve power quality, enhance energy efficiency, and ensure the stability of electrical systems. Key players such as Eaton, General Electric, and Analog Devices, Inc. maintain significant market shares by offering reliable and efficient voltage regulation solutions that cater to the growing need for stable power supply in residential areas. These companies focus on integrating digital technologies, improving energy efficiency, and offering smart grid-compatible voltage regulators that adapt to fluctuating electrical demands.

Emerging players like BTRAC Ltd., Infineon Technologies AG, and Legrand are expanding their market presence by providing specialized voltage regulators designed for niche residential applications such as smart homes, renewable energy systems, and energy storage solutions. Their strategies include enhancing the precision of voltage regulation, improving user-friendliness, and integrating advanced control features. Market growth is driven by the increasing adoption of electric vehicles, smart home technologies, and the rising need for reliable, energy-efficient voltage regulation in residential sectors. Innovations in solid-state regulation, power electronics, and energy management systems are expected to continue shaping competitive dynamics and drive further growth in the global three-phase residential voltage regulator market.

| Item | Value |

|---|---|

| Quantitative Units | USD 212.3 Million |

| Product | Linear and Switching |

| Voltage | ≤ 5 kVA, > 5 kVA to 20 kVA, and > 20 kVA to 40 kVA |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens, Analog Devices, Inc., BTRAC Ltd., Eaton, General Electric, Infineon Technologies AG, Legrand, Maschinenfabrik Reinhausen GmbH, MaxLinear, Microchip Technology Inc., NXP Semiconductors, Purevolt, Ricoh USA, Inc., ROHM Co. Ltd., SEMTECH, Sollatek, STMicroelectronics, TOREX SEMICONDUCTOR LTD., Vicor, and Vishay Intertechnology, Inc. |

| Additional Attributes | Dollar sales by regulator type and application, demand dynamics across residential, commercial, and industrial sectors, regional trends in three-phase voltage regulator adoption, innovation in energy efficiency and smart grid integration, impact of regulatory standards on safety and performance, and emerging use cases in renewable energy integration and power quality management. |

The global three phase residential voltage regulator market is estimated to be valued at USD 212.3 million in 2025.

The market size for the three phase residential voltage regulator market is projected to reach USD 462.7 million by 2035.

The three phase residential voltage regulator market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in three phase residential voltage regulator market are linear and switching.

In terms of voltage, ≤ 5 kva segment to command 47.8% share in the three phase residential voltage regulator market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Three Wheeled Motorcycle Market Size and Share Forecast Outlook 2025 to 2035

Three-Wheel E-Scooter Market Growth - Trends & Forecast 2024 to 2034

Three Piece Cans Market

Three Phase String Inverter Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Inverter Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Recloser Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Green Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Micro Inverter Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Power Device Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Commercial Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

On-grid Three Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Electric Three Wheeler Market - Trends & Forecast 2025 to 2035

Automotive Three Way Catalytic Converter Market Size and Share Forecast Outlook 2025 to 2035

Standalone Three Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Three Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Commercial Three Phase Micro Inverter Market Size and Share Forecast Outlook 2025 to 2035

Phase Shifting Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dual-Phase Cleanser Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA