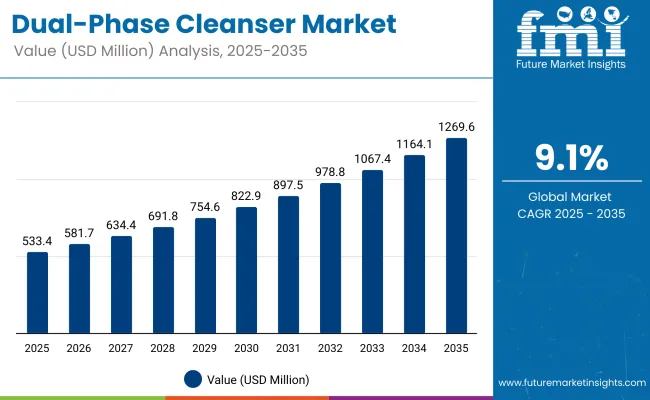

The Global Dual-Phase Cleanser Market is expected to record a valuation of USD 533.4 million in 2025 and USD 1,269.6 million in 2035, with an increase of USD 736.2 million, which equals a growth of ~139% over the decade. The overall expansion represents a CAGR of 9.1% and more than a 2X increase in market size. During the first five-year period from 2025 to 2030, the market increases from USD 533.4 million to USD 822.9 million, adding USD 289.5 million, which accounts for ~39% of the total decade growth.

Global Dual-Phase Cleanser Market Key Takeaways

| Metric | Value |

|---|---|

| Global Dual-Phase Cleanser Market Estimated Value in (2025E) | USD 533.4 million |

| Global Dual-Phase Cleanser Market Forecast Value in (2035F) | USD 1,269.6 million |

| Forecast CAGR (2025 to 2035) | 9.1% |

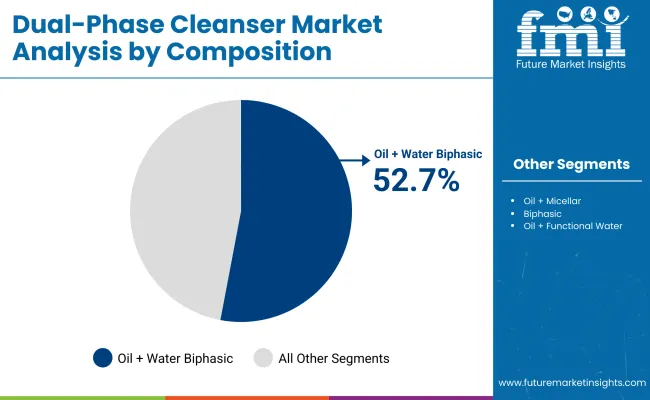

This phase records steady adoption in daily cleansing routines, premium skincare, and professional beauty services, driven by the need for effective waterproof makeup removal. Oil + Water Biphasic dominates this period as it caters to over 52% of global sales, appealing to consumers seeking proven two-phase cleansing performance.

The second half from 2030 to 2035 contributes USD 446.7 million, equal to ~61% of total growth, as the market jumps from USD 822.9 million to USD 1,269.6 million. This acceleration is powered by widespread adoption of clean beauty standards, sustainability-focused packaging, and online-driven skincare sales.

Plant Oil + Water and Oil + Micellar Water Biphasic together capture a larger share above 45% by the end of the decade. Ingredient innovation, sustainable oil sourcing, and refillable packaging formats add recurring revenue opportunities, increasing the premium and masstige tier share beyond 60% in total value.

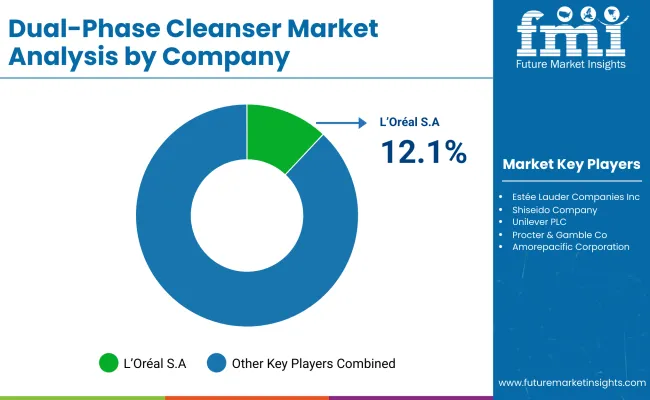

From 2020 to 2024, the Global Dual-Phase Cleanser Market grew steadily from USD 430.0 million to USD 510.0 million, driven by premium skincare adoption and the expansion of waterproof makeup segments. During this period, the competitive landscape was dominated by multinational cosmetics giants controlling nearly 65% of revenue, with leaders such as L’Oréal S.A., Shiseido Company, Limited, and Estée Lauder Companies Inc. focusing on innovation in oil-phase blends and skin barrier-supportive formulations.

Competitive differentiation relied on formulation efficacy, ingredient safety, and sensory experience, while packaging sustainability was an emerging but secondary driver. Professional and service-based models had minimal traction, contributing less than 5% of the total market value.

Demand for dual-phase cleansers will expand to USD 533.4 million in 2025, and the revenue mix will shift as premium, clean-label, and eco-friendly offerings grow to over 40% share. Traditional multinational leaders face rising competition from indie and clean beauty brands offering vegan-certified, cruelty-free, and microbiome-friendly formulations.

Major incumbents are pivoting to hybrid product strategies, integrating sensorial innovation with sustainable packaging to retain relevance. Emerging entrants specializing in refill systems, bio-based surfactants, and personalized cleansing solutions are gaining share. The competitive advantage is moving away from price and distribution scale alone to brand trust, sustainability leadership, and multi-channel consumer engagement.

The market is segmented by composition, skin concern, pack size, sales channel, and region. Composition categories include Oil + Water Biphasic, Oil + Micellar Water Biphasic, Silicone Oil + Water, Ester Oil + Water, Plant Oil + Water, and Oil + Functional Water. Skin concerns include Waterproof Makeup Removal, Daily Gentle Cleansing, SPF/Sunscreen Removal, Sebum Control, Hydration & Barrier Repair, and Redness & Soothing.

Pack size categories include <100 ml (Travel/Trial), 100-150 ml, 150-250 ml, and >250 ml. Sales channels include offline (hypermarkets/supermarkets, drugstores/pharmacies, beauty specialty stores, department stores, spa/salon retail) and online (e-commerce marketplaces, brand D2C websites, subscription/autoreplenishment, social commerce). Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

| Composition Segment | Market Value Share, 2025 |

|---|---|

| Oil + Water Biphasic | 52.7% |

| Others | 47.3% |

The Oil + Water Biphasic segment is projected to contribute 52.7% of the Global Dual-Phase Cleanser Market revenue in 2025, maintaining its lead as the dominant composition category. This leadership is driven by its proven effectiveness in removing waterproof makeup, its mild skin compatibility, and its presence across mass, masstige, and premium offerings. Ongoing innovations in natural oil sourcing, skin-soothing additives, and sustainable packaging are expected to reinforce this dominance through 2035.

| Skin Concern Segment | Market Value Share, 2025 |

|---|---|

| Waterproof Makeup Removal | 48.9% |

| Others | 51.1% |

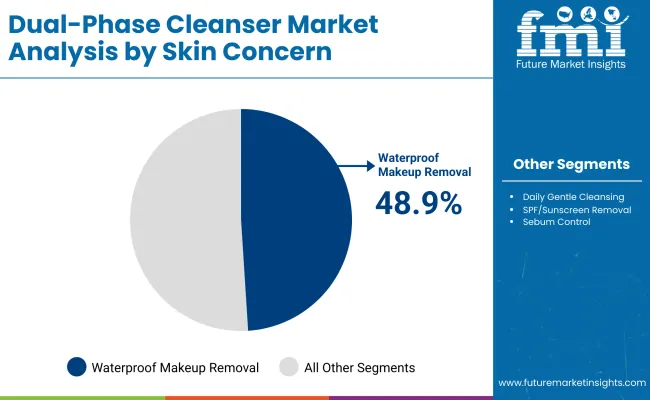

The Waterproof Makeup Removal segment is forecasted to hold 48.9% of the market share in 2025, making it the largest defined use-case category. Its dominance is fueled by rising demand for long-wear and smudge-proof cosmetics in both daily and event-focused makeup routines. This segment benefits from marketing narratives around “one-swipe removal” and reduced skin irritation, appealing to time-conscious consumers seeking convenience and effectiveness.

| Pack Size Segment | Market Value Share, 2025 |

|---|---|

| 150-250 ml | 65.4% |

| Others | 34.6% |

The 150-250 ml pack size segment is projected to account for 65.4% of the Global Dual-Phase Cleanser Market revenue in 2025, making it the standard retail choice globally. This pack size balances affordability with longevity of use, making it attractive for repeat purchases. It also aligns with online retail shipping efficiency and is increasingly offered in PCR PET or refillable formats, supporting sustainability objectives.

Advances in formulation science have improved cleansing efficacy and skin compatibility, enabling dual-phase cleansers to effectively remove waterproof and long-wear cosmetics while preserving the skin barrier. Oil + Water Biphasic formats have gained popularity due to their versatility across skin types and suitability for both daily gentle cleansing and heavy makeup removal.

The rise of clean beauty, vegan-certified formulations, and sustainable packaging has contributed to broader market appeal, especially in premium and masstige segments. Expansion of online retail, social commerce, and direct-to-consumer channels has fueled accessibility and awareness.

Segment growth is expected to be led by Oil + Water Biphasic in composition, Waterproof Makeup Removal in skin concern, and 150-250 ml packs in size preferences, due to their performance, convenience, and consumer trust.

Performance Differentiation in Waterproof & SPF Removal

Dual-phase cleansers are uniquely positioned to remove both waterproof cosmetics and modern high-coverage sunscreens, including hybrid SPF formulations with film-forming agents. This dual-performance capability is a decisive purchase driver, especially in East Asia and urban Western markets where daily sunscreen application is non-negotiable. This advantage is reinforced by consumer education campaigns emphasizing skin protection and the need for thorough but gentle cleansing at the end of the day.

Rise of Microbiome-Friendly and Barrier-Supportive Cleansers

Advanced biphasic formulas are being reformulated with barrier-repair lipids (ceramides, cholesterol) and non-disruptive surfactants. The result is strong uptake in sensitive-skin segments, with dermatologist-tested and microbiome-safe claims enabling premium pricing in markets like the USA, UK, and Germany. These formulations address post-cleansing tightness and irritation, offering a comfort-based differentiation that mass-market micellar waters often lack.

Phase Separation Stability Issues in Clean-Label Formulations

The removal or reduction of synthetic emulsifiers in clean beauty SKUs increases challenges in long-term phase stability. This leads to shorter shelf life or visual phase inconsistencies, which can erode consumer confidence if not addressed with new stabilizing systems. Brands serving warm-climate regions face heightened risks, as heat accelerates separation, increasing returns and shelf-rejection rates at retail.

Slow Adoption in Low-Makeup Penetration Markets

In regions where heavy or waterproof makeup usage is low, dual-phase cleansers struggle to justify their premium over single-phase micellar waters, limiting penetration outside core urban demographics. This is compounded by low consumer familiarity with the shake-to-activate format, requiring higher marketing investment to drive trial.

Shift Toward Refillable and PCR PET Mid-Size Packs (150-250 ml)

With the 150-250 ml pack size already holding 65.4% share in 2025, brands are migrating this segment to refillable cartridge systems and high PCR PET content. This both appeals to sustainability-conscious consumers and supports retail price maintenance amid raw material inflation. Retailers in Europe and APAC are incentivizing brands with shelf-space preference for eco-friendly packaging, accelerating adoption in this segment.

Ingredient Hybridization for Multi-Functionality

Emerging formulas combine plant oils with micellar water phases to achieve dual claims-high cleansing power and hydrating or brightening benefits. These hybrid formats blur the line between cleansing and skincare treatment, targeting consumers looking to reduce steps in their nighttime routine. This aligns with the growing “skip-care” trend in beauty, where consumers seek fewer products that deliver multiple benefits without compromising performance.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 11.1% |

| India | 13.3% |

| Germany | 5.8% |

| USA | 3.6% |

| UK. | 7.1% |

| Japan | 10.1% |

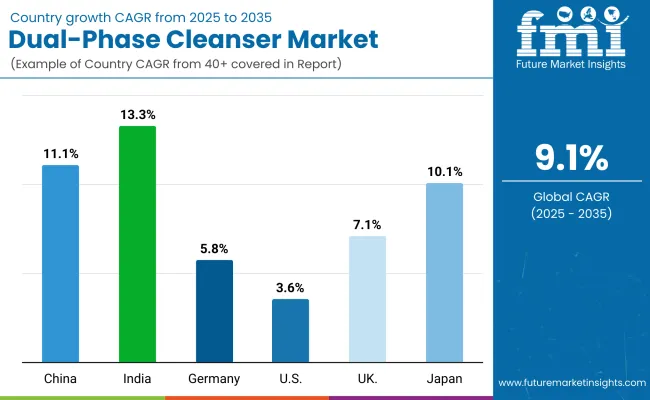

The Global Dual-Phase Cleanser Market shows pronounced regional disparities in adoption speed, strongly influenced by premium skincare penetration, waterproof makeup usage patterns, and e-commerce-driven retail expansion. Asia-Pacific emerges as the fastest-growing region, anchored by China at 11.1% CAGR and India at 13.3% CAGR. China’s momentum is driven by high consumption of waterproof cosmetics and SPF layering, supported by domestic beauty giants and cross-border K-beauty imports.

Government emphasis on promoting local cosmetic manufacturing and export competitiveness further boosts dual-phase cleanser penetration in both mass and premium channels. India’s trajectory reflects rising skincare sophistication in urban and tier-2 cities, with influencer-led education on double cleansing and dermatology-endorsed formats, making dual-phase cleansers a staple in urban skincare routines.

Europe maintains a strong growth profile, led by Germany at 5.8% CAGR and the UK at 7.1% CAGR, supported by stringent EU cosmetic safety compliance, sustainability packaging mandates, and the stronghold of dermocosmetic brands in pharmacies. High adoption of refillable packaging and PCR PET formats keeps Europe ahead of North America in sustainable beauty offerings.

North America shows moderate expansion, with the USA at 3.6% CAGR, reflecting maturity in core skincare categories and slower incremental growth in waterproof makeup removal relative to Asia. Growth is more innovation-driven, with a shift toward microbiome-friendly, barrier-supportive formulas and refill systems. Brand strategies increasingly target loyalty through subscription-based D2C programs rather than purely retail expansion.

Japan, at 10.1% CAGR, retains steady demand anchored in cultural adherence to double cleansing and preference for gentle, skin-compatible formulations. The market is characterized by high loyalty to domestic brands and ongoing innovations in oil-phase blends designed for sensitive skin.

| Year | USA Berberine Market (USD Million) |

|---|---|

| 2025 | 117.88 |

| 2026 | 129.19 |

| 2027 | 141.58 |

| 2028 | 155.15 |

| 2029 | 170.03 |

| 2030 | 186.34 |

| 2031 | 204.21 |

| 2032 | 223.79 |

| 2033 | 245.25 |

| 2034 | 268.77 |

| 2035 | 294.55 |

The USA Dual-Phase Cleansers Market is projected to grow at a CAGR of 3.6%, led by the strong presence of established multinational beauty corporations and robust offline and online retail networks. Waterproof makeup removal remains a key driver, with the Oil + Water Biphasic composition holding 52.7% share (USD 62.09 million) in 2025 (share based on global composition applied proportionally to the USA market value). Growth is supported by clean beauty trends, dermatologist-backed product endorsements, and integration of refillable mid-size pack formats into mainstream retail.

The Dual-Phase Cleansers Market in the United Kingdom is expected to grow at a CAGR of 7.1%, supported by high per-capita spending on premium skincare, demand for sustainable packaging formats, and growing preference for multifunctional cleansing products. UK consumers show strong adoption of Waterproof Makeup Removal variants, driven by long-wear cosmetic trends.

India is witnessing rapid growth in the Dual-Phase Cleansers Market, which is forecast to expand at a CAGR of 13.3% through 2035. Market expansion is concentrated in metro cities and emerging tier-2 hubs, where double cleansing is being promoted by dermatologists and beauty influencers as a key step in urban skincare. Waterproof makeup removal is gaining traction in professional beauty services, while online-exclusive launches are reaching first-time buyers in smaller cities.

The Dual-Phase Cleansers Market in China is expected to grow at a CAGR of 11.1%, one of the highest among leading economies. This growth is underpinned by the category’s Waterproof Makeup Removal segment, which holds 48.9% share (USD 37.03 million) in 2025 (share based on global skin concern composition applied proportionally to China’s market value). Cross-border imports of K-beauty and J-beauty products, coupled with domestic innovation in clean beauty formulations, are accelerating adoption.

| Countries | 2025 |

|---|---|

| China | 14.2% |

| India | 5.9% |

| Germany | 10.3% |

| USA | 22.1% |

| UK | 8.7% |

| Japan | 7.2% |

| Countries | 2035 |

|---|---|

| China | 13.2% |

| India | 6.2% |

| Germany | 12.8% |

| USA | 23.2% |

| UK | 7.9% |

| Japan | 8.2% |

| Composition Segment | Market Value Share, 2025 |

|---|---|

| Oil + Water Biphasic | 55.2% |

| Others | 44.8% |

The USA Dual-Phase Cleansers Market is valued at USD 117.88 million in 2025, with Oil + Water Biphasic formulations leading at 55.2% (USD 65.07 million), followed by other compositions at 44.8% (USD 52.81 million). The dominance of biphasic cleansers is driven by the USA consumer preference for proven performance in waterproof makeup and sunscreen removal, supported by dermatologist endorsements and strong distribution through both offline and online channels.

The category benefits from the maturity of the USA skincare market, where premium and masstige brands integrate clean beauty standards, microbiome-supportive actives, and refillable packaging into their biphasic offerings. Growing adoption of subscription-based D2C models further strengthens brand loyalty. Specialty retailers enhance the experience by offering skin diagnostics and personalized recommendations, making biphasic cleansers an integral part of advanced cleansing routines.

| Skin Concern Segment | Market Value Share, 2025 |

|---|---|

| Waterproof Makeup Removal | 42.1% |

| Others | 57.9% |

The China Dual-Phase Cleansers Market is valued at USD 75.74 million in 2025, with Waterproof Makeup Removal leading the skin concern segment at 42.1% (USD 31.89 million), followed by other concerns at 57.9% (USD 43.86 million). China’s leadership in waterproof makeup removal is closely tied to high adoption of long-wear cosmetics, SPF layering, and K-beauty imports, combined with domestic innovation in oil-phase blends.

The segment’s growth is also driven by the rapid rise of social commerce platforms such as Douyin and Tmall, where live-streaming demonstrations boost immediate purchase intent. Government policies promoting local cosmetic manufacturing, sustainability initiatives, and ingredient safety regulations reinforce trust in domestic brands while enhancing competitiveness in premium and mid-tier categories. Emerging refill systems and plant-based formulations are gaining ground, aligning with China’s clean beauty movement.

The Global Dual-Phase Cleanser Market is moderately fragmented, with global beauty conglomerates, regional skincare specialists, and niche clean beauty brands competing across diverse consumer segments. Global leaders such as L’Oréal S.A., Estée Lauder Companies Inc., and Shiseido Company, Limited hold significant market share, driven by extensive product portfolios, strong brand equity, and multi-channel distribution strategies. Their competitive edge is reinforced by investments in clean beauty innovation, sustainable packaging formats, and dermatologist-backed marketing campaigns that strengthen consumer trust.

Established mid-sized players, including Amorepacific Corporation, LG Household & Health Care Ltd., and Beiersdorf AG, cater to growing demand in Asia and Europe through regionally tailored formulations and plant-oil-based dual-phase products. These companies are accelerating adoption through strategic collaborations with e-commerce platforms, influencer-driven campaigns, and premium positioning in pharmacy and specialty retail.

Specialized and emerging providers such as indie clean beauty brands, cruelty-free labels, and niche sustainable skincare startups focus on targeted claims like microbiome-friendly cleansing, SPF removal efficacy, and refillable packaging systems.

Their strength lies in agility, innovation speed, and the ability to capture consumer loyalty in trend-sensitive segments. Competitive differentiation is shifting away from simply delivering high cleansing efficacy toward building integrated product ecosystems-combining high-performance formulations, refill and subscription programs, and personalized product recommendations powered by AI-driven skin diagnostics.

Key Developments in Global Dual-Phase Cleanser Market

| Item | Value |

|---|---|

| Quantitative Units | USD 533.4 Million |

| Composition | Oil + Water Biphasic, Oil + Micellar Water Biphasic, Silicone Oil + Water, Ester Oil + Water, Plant Oil + Water, Oil + Functional Water |

| Skin Concern | Waterproof Makeup Removal, Daily Gentle Cleansing, SPF/Sunscreen Removal, Sebum Control, Hydration & Barrier Repair, Redness & Soothing |

| Pack Size | <100 ml (Travel/Trial), 100-150 ml, 150-250 ml, >250 ml |

| Sales Channel | Offline (hypermarkets/supermarkets, drugstores/pharmacies, beauty specialty stores, department stores, spa/salon retail), Online (e-commerce marketplaces, brand D2C websites, subscription/ autoreplenishment , social commerce) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | L’Oréal S.A., Estée Lauder Companies Inc., Shiseido Company, Limited, Unilever PLC, Procter & Gamble Co., Amorepacific Corporation, LG Household & Health Care Ltd., Beiersdorf AG, Kao Corporation, Johnson & Johnson Services, Inc., Clarins Group, Coty Inc., Mary Kay Inc., Natura &Co Holding S.A., Henkel AG & Co. KGaA |

| Additional Attributes | Dollar sales by composition type and skin concern, adoption trends in clean beauty and sustainable packaging, rising demand for vegan-certified and cruelty-free formulations, segment-specific growth in premium and masstige categories, revenue segmentation by online/offline channels, integration with refillable packaging systems, regional trends influenced by beauty consumption shifts, and innovations in oil phase blends and micellar technology. |

The Global Dual-Phase Cleanser Market is estimated to be valued at USD 533.4 million in 2025.

The market size for the Global Dual-Phase Cleanser Market is projected to reach USD 1,269.6 million by 2035.

The Global Dual-Phase Cleanser Market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key composition types in the Global Dual-Phase Cleanser Market are Oil + Water Biphasic, Oil + Micellar Water Biphasic, Silicone Oil + Water, Ester Oil + Water, Plant Oil + Water, and Oil + Functional Water.

In terms of composition, Oil + Water Biphasic is expected to command 52.7% share in the Global Dual-Phase Cleanser Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Face Cleansers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Wound Cleansers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA