The standalone three phase PV inverter market is estimated to be valued at USD 4.8 billion in 2025 and is projected to reach USD 16.9 billion by 2035, registering a compound annual growth rate (CAGR) of 13.5% over the forecast period. This growth is driven by the increasing global emphasis on renewable energy adoption, especially solar power, and the rising demand for decentralized energy systems capable of delivering stable and efficient power in industrial, commercial, and residential applications. Technological advancements in inverter efficiency, reliability, and grid integration are further accelerating market expansion. Additionally, government incentives and supportive policies promoting clean energy adoption are expected to enhance market penetration across emerging economies. The standalone three-phase segment, in particular, benefits from its scalability and ability to manage high-capacity solar installations, making it a preferred choice for both off-grid and hybrid energy systems, ensuring long-term market resilience and opportunities for innovation.

| Metric | Value |

|---|---|

| Standalone Three Phase PV Inverter Market Estimated Value in (2025 E) | USD 4.8 billion |

| Standalone Three Phase PV Inverter Market Forecast Value in (2035 F) | USD 16.9 billion |

| Forecast CAGR (2025 to 2035) | 13.5% |

Rising demand from both commercial and utility‑scale segments is supporting the adoption of three phase inverters capable of managing higher power loads and delivering consistent output. This market is also benefiting from evolving energy regulations that promote the integration of renewable sources in remote and grid‑unstable areas. Technological advancements in power electronics and inverter firmware have enabled improved efficiency, real‑time grid support functionalities, and compatibility with a wide range of solar modules.

Additionally, the transition toward digital monitoring, fault detection, and predictive maintenance features has positioned software‑enabled three phase inverters as a vital component of modern energy systems. The market outlook remains positive as clean energy targets, rural electrification programs, and microgrid deployment accelerate the need for intelligent standalone inverters with three phase capability.

The standalone three phase PV inverter market is segmented by product, nominal output power, nominal output voltage, application, and geographic regions. By product, the standalone three phase PV inverter market is divided into String and Micro. In terms of nominal output power, the standalone three phase PV inverter market is classified into 3 - 33 kW, ≤ 0.5 kW, 0.5 - 3 kW, 33 - 110 kW, and > 110 kW.

Based on nominal output voltage, the standalone three phase PV inverter market is segmented into 400 - 600 V, ≤ 230 V, 230 - 400 V, and > 600 V. By application, the standalone three phase PV inverter market is segmented into Commercial & Industrial and Residential. Regionally, the standalone three phase PV inverter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The string inverter segment is projected to account for 67.3% of the Standalone Three Phase PV Inverter market revenue in 2025, making it the dominant product category. This leadership is being supported by the cost-effectiveness, scalability, and ease of installation offered by string inverters in both commercial rooftop and small utility setups.

Their modular architecture allows multiple strings of solar panels to be connected independently, providing enhanced design flexibility and simplified maintenance. As demand rises for distributed solar installations, the preference for string inverters has grown due to their lower upfront cost and reduced system downtime in case of individual string failure.

Integration with smart monitoring platforms and support for real-time diagnostics have further improved operational efficiency. The segment's growth has also been fueled by increasing deployment in regions with medium to high solar irradiance and supportive net metering frameworks that align with decentralized generation models.

The 3 - 33 kW nominal output power segment is expected to contribute 38.9% of the total market revenue in 2025, reflecting its strong position in supporting mid-scale solar installations. This range has been widely adopted across commercial buildings, agricultural sites, and community energy systems where intermediate load handling and system modularity are critical.

The segment's growth has been reinforced by its compatibility with varied project sizes and its ability to offer a balance between performance and affordability. Equipment in this range is often chosen for off-grid and hybrid systems due to its support for battery integration and load prioritization functions.

Favorable policies promoting medium-scale solar projects and declining inverter prices have also strengthened the demand for this output category. Additionally, innovations in cooling systems and digital controls within this range have contributed to enhanced reliability and energy yield over extended operating lifecycles.

The 400 - 600 V nominal output voltage segment is projected to hold 35.4% of the market revenue in 2025, driven by its alignment with standard industrial and commercial grid configurations. This voltage range enables efficient energy transfer and reduced transmission losses, making it ideal for medium and large scale installations.

The adoption of this segment has been supported by its capability to match common utility voltage levels and its suitability for connecting to three phase loads without requiring additional voltage transformation equipment. As commercial and agricultural consumers seek higher energy reliability and self-sufficiency, inverters operating in this voltage range have gained preference due to their system compatibility and lower integration costs.

Furthermore, equipment in this category is often designed with enhanced surge protection, thermal management, and digital fault analysis, making it a suitable choice for dynamic environmental conditions and long-duration operations.

The standalone three-phase PV inverter market is growing due to rising solar energy adoption, government support, and demand for cost-efficient solutions. Competition remains strong, with manufacturers focusing on improving performance and efficiency to cater to large-scale energy demands.

The demand for standalone three-phase PV inverters is being driven by the increasing adoption of solar energy systems in residential, commercial, and industrial sectors. These inverters are essential for efficiently converting DC to AC power in large-scale solar installations. A key factor propelling market growth is the growing desire for energy independence, as businesses and homeowners seek to reduce reliance on grid power. Supportive government policies, including tax incentives and rebates for solar installations, are boosting the adoption of three-phase inverters. These systems also cater to sectors requiring high-energy loads, such as commercial buildings, agriculture, and manufacturing, contributing to steady growth.

Government regulations and incentives play a crucial role in the expansion of the standalone three-phase PV inverter market. Various countries are increasingly offering financial incentives, tax benefits, and feed-in tariffs to support solar energy adoption. These policies promote energy transition goals and reduce fossil fuel reliance. International standards and grid compliance requirements ensure the efficiency and reliability of three-phase inverters in larger-scale installations. As governments continue to emphasize clean energy and renewable sources, the demand for high-quality inverters that comply with these regulations will remain strong. Manufacturers are focusing on aligning their products with these ever-evolving regulatory frameworks to stay competitive.

The price and performance of standalone three-phase PV inverters are critical factors influencing their widespread adoption. With solar power becoming a mainstream energy solution, cost-effective inverters that offer high efficiency are increasingly sought after by both commercial and residential users. Inverters with improved cost-performance ratios have led to greater affordability and increased demand, particularly in large-scale installations. The need for long-term reliability, reduced maintenance costs, and low operational downtime has made high-performance inverters an attractive choice. As the market for solar energy systems grows, consumers are also looking for inverters that offer energy savings over time, making price-to-performance ratios a decisive factor in purchasing decisions.

The competitive nature of the standalone three-phase PV inverter market has led companies to adopt various strategies for growth, including strengthening R&D, improving product efficiency, and expanding market reach. Manufacturers are continually enhancing their inverter offerings to meet the growing demand for higher energy outputs and smarter features. To stay ahead of the competition, many are focusing on offering versatile solutions for diverse market segments, especially residential and commercial sectors. The integration of remote monitoring and other energy optimization technologies ensures that these inverters remain the preferred choice for large-scale applications, sustaining their market position in the face of evolving competition.

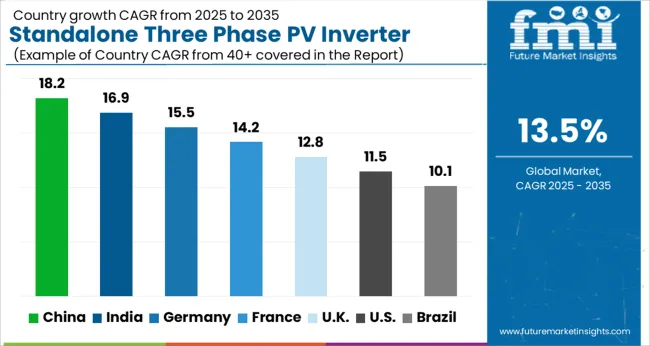

The standalone three-phase PV inverter market is projected to expand globally at a CAGR of 13.5% from 2025 to 2035, driven by growing demand for solar power systems, energy independence, and governmental incentives for renewable energy adoption. China leads with a CAGR of 18.2%, supported by strong government policies promoting clean energy, large-scale solar projects, and the increasing transition to renewable energy sources. India follows at 16.9%, boosted by the country’s expanding residential and commercial solar market, along with financial incentives and subsidies for solar installations. France experiences a CAGR of 14.2%, benefiting from the government’s commitment to carbon neutrality and increasing demand for solar power solutions in residential and industrial sectors. The United Kingdom grows at 12.8%, driven by the demand for renewable energy sources in urban and suburban areas, as well as government policies aimed at decarbonizing the energy sector. The United States posts a CAGR of 11.5%, reflecting steady growth driven by favorable policies for solar energy adoption, grid expansion, and an increase in residential and commercial installations. The analysis covers over 40 countries, with these five markets representing key benchmarks for production capacity planning, distribution strategies, and investment decisions in the global standalone three-phase PV inverter industry.

China is projected to post a CAGR of 18.2% from 2025 to 2035, compared to about 13.5% during 2020–2024, a notable increase in growth momentum. The earlier growth was driven by large-scale government-driven solar projects, urban commercial installations, and financial incentives for residential solar power. The stronger growth ahead is expected to stem from an aggressive push toward renewable energy, with increasing adoption in industrial, commercial, and residential solar markets. The expansion of solar farms and grid integration efforts across the country will also accelerate demand for standalone three-phase inverters, particularly as solar energy becomes more widely used.

India is expected to post a CAGR of 16.9% during 2025–2035, compared to about 12.5% during 2020–2024, indicating substantial growth. Early adoption was driven by financial incentives for solar energy in rural and urban areas, along with a growing awareness of energy independence. Moving forward, the increased penetration of solar power in the country, backed by the government’s ambitious renewable energy goals, will significantly contribute to the market’s expansion. The government’s focus on providing financial subsidies for solar panel installations and tax breaks for solar manufacturers will likely fuel further adoption of standalone three-phase inverters.

France is projected to grow at a CAGR of 14.2% during 2025–2035, compared to around 11.5% during 2020–2024, highlighting stronger growth. The initial growth was driven by the country’s renewable energy policy, which incentivized solar energy adoption, especially in urban areas and commercial sectors. The expected acceleration in the coming years will be fueled by France’s commitment to achieving carbon neutrality and reducing fossil fuel dependence. Solar installations are expected to expand, driven by both residential and industrial demand, with increasing interest in smart energy solutions and government-backed subsidies. Manufacturers are expected to align with national energy goals to maintain competitive advantages.

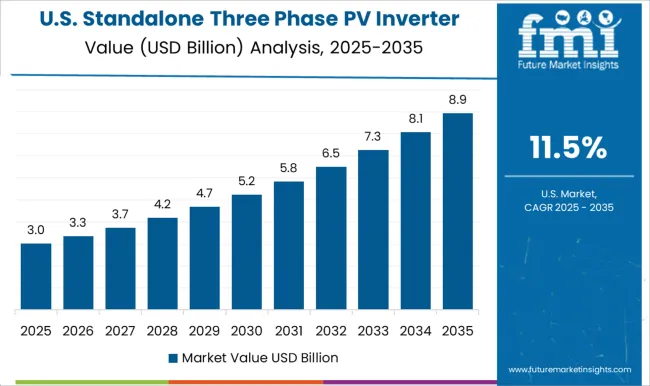

The United States is expected to experience a CAGR of 11.5% during 2025–2035, compared to 8.3% during 2020–2024, showing a consistent increase. Early growth was supported by strong demand for solar installations in sunbelt regions and growing awareness about the benefits of renewable energy. The market is projected to grow faster due to greater demand for clean energy solutions, driven by federal and state-level incentives, and increased adoption of commercial solar projects. The growing popularity of solar-plus-storage solutions and large-scale industrial applications will drive the demand for standalone three-phase inverters in the USA

The standalone three-phase PV inverter market is characterized by a competitive mix of global leaders, regional manufacturers, and emerging players aiming to capture the growing demand for reliable and efficient solar power solutions. Sungrow maintains its leadership with a broad product portfolio, focusing on high-efficiency inverters and extensive global distribution networks. Eastman Solar leverages its expertise in solar technology to produce affordable, high-performance inverters suitable for a variety of residential and commercial applications.

Growatt offers cost-effective, reliable inverters with strong market penetration in emerging economies. Hitachi Hi-Rel Power Electronics provides high-end, feature-rich inverters with a focus on grid integration and advanced monitoring systems. Kirloskar Solar targets both residential and commercial markets, offering durable, high-efficiency inverters tailored to Indian conditions. INVTSolar emphasizes smart inverters with remote monitoring and energy management capabilities. LEONICS focuses on high-quality inverters with superior reliability and efficiency. SMA Solar Technology continues to lead with its cutting-edge technology and scalability for large installations.

Sankopower provides robust inverters for high-demand applications, while Waaree Solar stands out with affordable inverters for residential customers. Strategic priorities across these manufacturers include enhancing energy efficiency, expanding e-commerce channels, improving grid compatibility, and increasing after-sales service to meet the growing demand for solar energy solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.8 Billion |

| Product | String and Micro |

| Nominal Output Power | 3 - 33 kW, ≤ 0.5 kW, 0.5 - 3 kW, 33 - 110 kW, and > 110 kW |

| Nominal Output Voltage | 400 - 600 V, ≤ 230 V, 230 - 400 V, and > 600 V |

| Application | Commercial & Industrial and Residential |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SUNGROW, Eastman Solar, Growatt, Hitachi Hi-Rel Power Electronics, Kirloskar Solar, INVTSolar, LEONICS, SMA Solar Technology, Sankopower, and Waaree |

| Additional Attributes | Dollar sales projections, market share by region, growth trends, key competitors, pricing strategies, government policies, and consumer preferences. |

The global standalone three phase PV inverter market is estimated to be valued at USD 4.8 billion in 2025.

The market size for the standalone three phase PV inverter market is projected to reach USD 16.9 billion by 2035.

The standalone three phase PV inverter market is expected to grow at a 13.5% CAGR between 2025 and 2035.

The key product types in standalone three phase PV inverter market are string and micro.

In terms of nominal output power, 3 - 33 kw segment to command 38.9% share in the standalone three phase PV inverter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Standalone PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Three Wheeled Motorcycle Market Size and Share Forecast Outlook 2025 to 2035

Three-Wheel E-Scooter Market Growth - Trends & Forecast 2024 to 2034

Three Piece Cans Market

Three Phase Commercial Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Recloser Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Green Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Power Device Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Inverter Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Micro Inverter Market Size and Share Forecast Outlook 2025 to 2035

Three Phase String Inverter Market Size and Share Forecast Outlook 2025 to 2035

On-grid Three Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Electric Three Wheeler Market - Trends & Forecast 2025 to 2035

Automotive Three Way Catalytic Converter Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Three Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Commercial Three Phase Micro Inverter Market Size and Share Forecast Outlook 2025 to 2035

Inverter Duty Motor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA