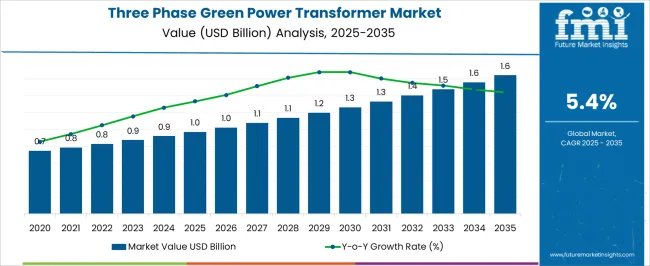

The three phase green power transformer market is estimated to be valued at USD 1.0 billion in 2025 and is projected to reach USD 1.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period. The steady progression reflects the increasing reliance on reliable and efficient transformers in power distribution networks, where performance, energy efficiency, and durability are critical factors for operational continuity and long-term infrastructure stability.

By 2035, the three phase green power transformer market is expected to reach USD 1.6 billion, driven by rising demand for robust transformers in industrial, commercial, and utility-scale applications. The gradual growth pattern indicates that power distribution operators are prioritizing equipment reliability, reduced downtime, and long-term operational cost efficiency.

As electricity networks expand and replacement demand rises for aging infrastructure, the market for three phase transformers is projected to maintain steady growth. This trend emphasizes the importance of high-performance transformers in ensuring consistent power delivery, positioning the market as a critical component within global electrical distribution systems and offering substantial opportunities for manufacturers and suppliers.

| Metric | Value |

|---|---|

| Three Phase Green Power Transformer Market Estimated Value in (2025 E) | USD 1.0 billion |

| Three Phase Green Power Transformer Market Forecast Value in (2035 F) | USD 1.6 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The three phase green power transformer market is a niche yet increasingly important segment within the broader power transformers market, where it currently accounts for around 5-6% of the total share. These transformers are designed to deliver higher energy efficiency, reduced losses, and environmentally friendly operations compared to conventional units, making them a preferred choice in modern power systems. In the electrical equipment market, their share is roughly 3-4%, reflecting their role as critical assets in substations and industrial setups that require reliable and sustainable power delivery.

Within the renewable energy market, three-phase green power transformers represent about a 4-5% share, as they are extensively used to integrate wind, solar, and hydroelectric power into grids while minimizing energy losses. In the power transmission and distribution market, the segment captures nearly 5% share, supporting efficient voltage regulation and long-distance electricity delivery across urban and rural networks. In the broader energy infrastructure market, the share is approximately 3%, highlighting their importance in modernizing grids and supporting sustainable energy initiatives.

With rising investments in renewable integration, smart grids, and low-loss equipment, the market is expected to expand steadily, strengthening its share across these critical sectors over the coming decade.

The three phase green power transformer market is witnessing robust expansion driven by growing sustainability mandates, industrial electrification, and the modernization of aging grid infrastructure. As global energy consumption rises, especially from commercial and industrial sectors, demand for efficient, environmentally friendly power distribution systems is increasing.

Governments and regulatory bodies are incentivizing the adoption of low-loss, biodegradable insulating materials and energy-efficient designs to align with carbon neutrality targets. Technological advancements in smart grid integration, load optimization, and thermal management further position green transformers as essential in both developed and emerging markets. Long-term growth is expected to accelerate with ESG investment trends and supportive public policy for green energy transmission.

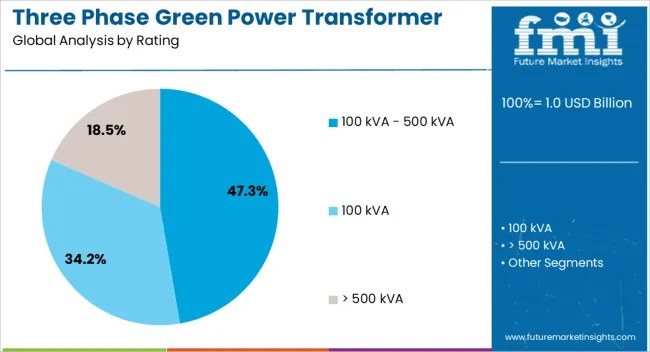

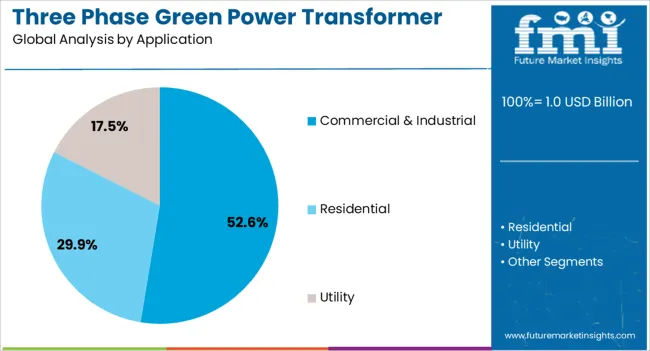

The three phase green power transformer market is segmented by rating, application, and geographic regions. By rating, three phase green power transformer market is divided into 100 kVA - 500 kVA, 100 kVA, and > 500 kVA. In terms of application, three phase green power transformer market is classified into Commercial & Industrial, Residential, and Utility. Regionally, the three phase green power transformer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 100 kVA – 500 kVA rating range is projected to lead the market with a 47.30% share by 2025. This dominance stems from its optimal sizing for small-to-medium-scale operations, particularly in distributed energy systems and microgrids.

These units offer a strong balance between capacity and energy efficiency, making them attractive for localized grid support, renewable integration, and power backup solutions. Their relatively lower upfront costs and ease of transport also support deployment in developing regions.

Growing commercial electrification and rural infrastructure projects further boost adoption, especially where modular or scalable transformer setups are prioritized.

The commercial and industrial segment is expected to capture 52.60% of the overall market share in 2025, emerging as the top application category. Growth in this segment is driven by increasing electricity demand across factories, data centers, hospitals, and commercial buildings, which require stable, efficient, and eco-compliant power systems.

With the global shift toward clean energy and energy optimization, businesses are prioritizing transformers that reduce power losses and minimize operational emissions. Implementation of green building certifications and carbon accounting is further influencing purchasing decisions. Industrial modernization and the rise of automated manufacturing are reinforcing the demand for high-performance, sustainable transformer solutions.

The three phase green power transformer market is growing due to rising renewable energy adoption and grid expansion. Opportunities are driven by energy-efficient designs and eco-friendly innovations, while trends highlight digital monitoring and smart grid integration. Challenges include high capital investment and operational complexities. Overall, the market outlook remains positive as demand for sustainable, efficient, and intelligent transformer solutions increases across utility, industrial, and commercial sectors worldwide.

The three phase green power transformer market is being driven by increasing adoption of renewable energy sources and expansion of power grids globally. Growing solar, wind, and hydroelectric projects require efficient transformers to handle variable loads and reduce energy losses. Utilities are investing in modern infrastructure to improve transmission efficiency and ensure stable electricity distribution. The focus on energy conservation, reduced operational costs, and long-term reliability is encouraging widespread deployment of environmentally friendly, energy-efficient three phase transformers across industrial, commercial, and utility sectors.

Significant opportunities are arising from the demand for energy-efficient and environmentally friendly transformer designs. Advanced green transformers use low-loss materials, biodegradable insulating fluids, and improved cooling technologies, reducing carbon footprint and operational costs. Governments are offering incentives and regulations to promote energy-efficient solutions, further expanding market potential. Manufacturers that provide tailored solutions for smart grids, microgrids, and renewable energy integration are well-positioned to capture these opportunities. Strategic partnerships with utilities and renewable energy developers are enhancing market reach and creating long-term growth prospects.

A notable trend is the integration of digital monitoring systems and IoT-enabled features in green power transformers. Remote monitoring, predictive maintenance, and real-time load analysis are enhancing operational efficiency and reducing downtime. Transformers equipped with smart sensors allow utilities to optimize load distribution, detect anomalies, and extend equipment lifespan. The adoption of smart grid infrastructure is accelerating this trend, with utilities increasingly relying on connected and intelligent transformers to manage distributed energy resources and support grid modernization initiatives.

Despite market growth, high upfront costs of three phase green transformers pose challenges for widespread adoption. Premium materials, specialized designs, and integration of advanced monitoring systems increase capital expenditure. Smaller utilities or emerging markets may face budget constraints, limiting deployment. Additionally, the need for skilled personnel to install, maintain, and operate advanced transformers adds to operational challenges. Supply chain disruptions for specialized core materials or insulating fluids can also delay projects. Overcoming these barriers requires cost optimization, financial incentives, and scalable solutions tailored to regional market needs.

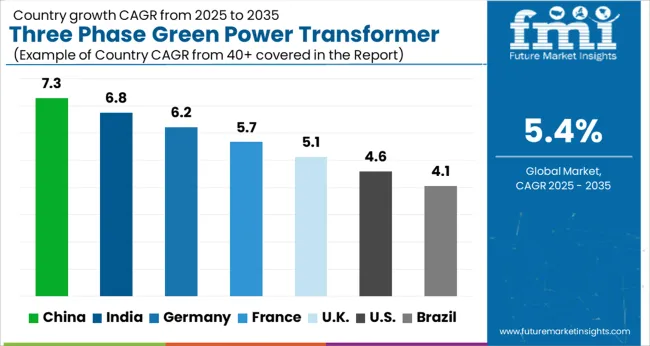

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

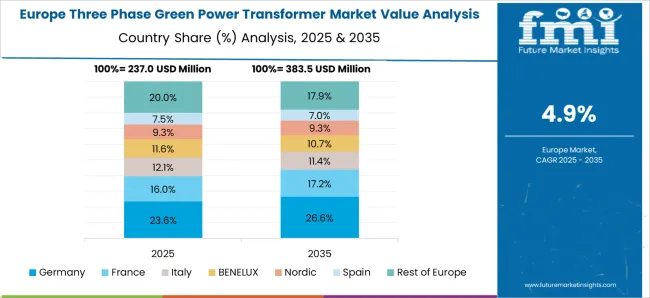

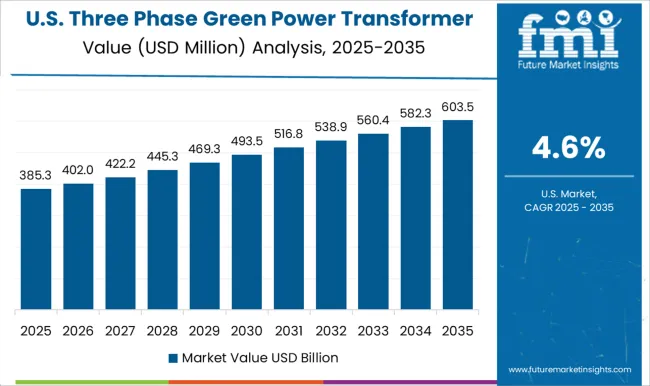

The global three phase green power transformer market is projected to grow at a CAGR of 5.4% from 2025 to 2035. China leads with a growth rate of 7.3%, followed by India at 6.8% and Germany at 6.2%. The United Kingdom records a growth rate of 5.1%, while the United States shows the slowest growth at 4.6%. Expansion is supported by the rising adoption of energy-efficient transformers, the modernization of power infrastructure, and government initiatives promoting green energy.

Emerging economies such as China and India benefit from grid expansion and renewable energy integration, while developed markets like the USA, UK, and Germany focus on replacing aging transformers and enhancing energy efficiency. This report includes insights on 40+ countries; the top markets are shown here for reference.

The three-phase green power transformer market in China is growing at a 7.3% CAGR, the highest among leading nations. Growth is fueled by increasing power demand, renewable energy integration, and government incentives promoting energy-efficient infrastructure. Large-scale investments in smart grids and high-voltage transmission lines are driving the adoption of green transformers. Domestic manufacturers are expanding production capacity and integrating advanced cooling and insulation technologies. Industrial and commercial demand for low-loss transformers further strengthens market growth.

The three-phase green power transformer market in India is advancing at a 6.8% CAGR, driven by rapid grid expansion and renewable energy deployment. The government’s focus on reducing transmission losses and improving energy efficiency is boosting the adoption of advanced transformers. Utilities are investing in low-loss and eco-friendly transformer technologies to support growing electricity demand. Industrial sectors and large-scale infrastructure projects are increasingly specifying green transformers. Partnerships with global technology providers enhance access to advanced designs and support market growth.

The three-phase green power transformer market in Germany is growing at a 6.2% CAGR, supported by the modernization of aging transmission and distribution networks. German utilities are adopting transformers with reduced energy losses and improved cooling efficiency. Renewable energy integration, particularly wind and solar, creates additional demand for transformers capable of handling variable loads. Advanced transformer technologies, including smart monitoring systems, are being implemented to enhance grid stability and efficiency. Replacement of older equipment remains a steady growth driver.

The three phase green power transformer market in the United Kingdom is expanding at 5.1% CAGR, influenced by renewable energy growth and grid modernization initiatives. Transformers with high energy efficiency and low environmental impact are being adopted across transmission and distribution networks. Offshore wind projects and urban infrastructure upgrades further strengthen demand. Utilities are investing in smart transformers with predictive maintenance and real-time monitoring capabilities. The UK market emphasizes reliability, reduced losses, and environmental compliance.

The three-phase green power transformer market in the United States is growing at a 4.6% CAGR, the slowest among leading countries. Growth is supported by the replacement of aging infrastructure and the integration of renewable energy projects. Utilities are increasingly adopting energy-efficient transformers to reduce losses and meet regulatory requirements. High industrial electricity demand and the modernization of transmission networks contribute to steady adoption. Collaborations with technology providers ensure access to advanced transformer designs, including low-loss and eco-friendly solutions.

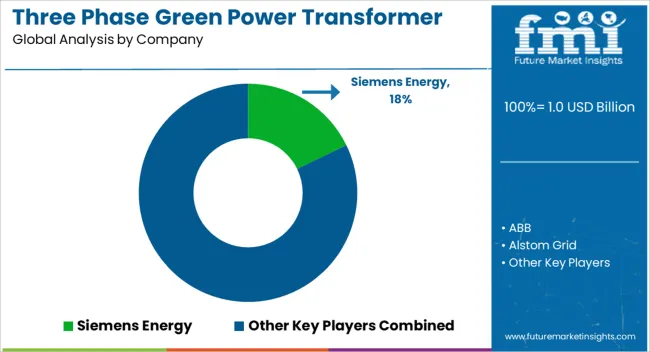

Leading companies in the three phase green power transformer market, such as Siemens Energy, ABB, and GE Grid Solutions, are competing by offering energy-efficient transformers that reduce losses and support sustainable power distribution. Siemens Energy emphasizes transformers designed for high reliability and low environmental impact, presenting brochures that highlight reduced core losses and eco-friendly insulating fluids. ABB focuses on compact designs and advanced cooling systems to improve efficiency in industrial and utility applications. GE Grid Solutions markets solutions that integrate smart monitoring and predictive maintenance, positioning their products as both reliable and future-ready.

Other players, including Alstom Grid, Hitachi Energy Ltd., and Schneider Electric, differentiate through tailored solutions for renewable integration and high-capacity networks. CG Power and Industrial Solutions and Eaton emphasize robustness and scalability for heavy-duty applications, while Hyosung Heavy Industries and Ormazabal focus on regional energy projects, highlighting local service and quick deployment. WESTRAFO SRL targets specialized industrial segments with compact and customizable units. Product brochures across the market underline efficiency ratings, lifecycle benefits, and compliance with international standards. Competition is driven by how persuasively companies present transformers as not only energy-saving assets but also as critical enablers for modern, resilient, and low-loss electrical networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.0 Billion |

| Rating | 100 kVA - 500 kVA, 100 kVA, and > 500 kVA |

| Application | Commercial & Industrial, Residential, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens Energy, ABB, Alstom Grid, CG Power and Industrial Solutions, Eaton, GE Grid Solutions, Hitachi Energy Ltd., Hyosung Heavy Industries, Ormazabal, Schneider Electric, and WESTRAFO SRL |

| Additional Attributes | Dollar sales by transformer type (oil-immersed, dry-type) and capacity range (low, medium, high) are key metrics. Trends include rising demand for energy-efficient, environmentally friendly transformers, integration with renewable energy systems, and focus on grid stability. Regional adoption, technological advancements, and government incentives are driving market growth. |

The global three phase green power transformer market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the three phase green power transformer market is projected to reach USD 1.6 billion by 2035.

The three phase green power transformer market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in three phase green power transformer market are 100 kVA - 500 kVA, 100 kVA and > 500 kVA.

In terms of application, commercial & industrial segment to command 52.6% share in the three phase green power transformer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Three Wheeled Motorcycle Market Size and Share Forecast Outlook 2025 to 2035

Three-Wheel E-Scooter Market Growth - Trends & Forecast 2024 to 2034

Three Piece Cans Market

Three Phase Commercial Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Three Phase String Inverter Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Inverter Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Recloser Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Micro Inverter Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Power Device Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

On-grid Three Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Electric Three Wheeler Market - Trends & Forecast 2025 to 2035

Automotive Three Way Catalytic Converter Market Size and Share Forecast Outlook 2025 to 2035

Standalone Three Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Three Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Commercial Three Phase Micro Inverter Market Size and Share Forecast Outlook 2025 to 2035

Phase Shifting Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dual-Phase Cleanser Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA