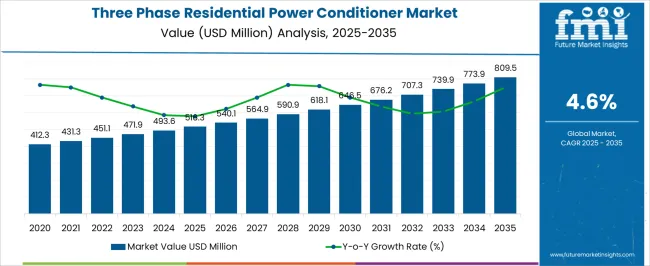

The Three Phase Residential Power Conditioner Market is estimated to be valued at USD 516.3 million in 2025 and is projected to reach USD 809.5 million by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period. The annual increments range between USD 23.8 million and USD 35.6 million, illustrating a consistent expansion without abrupt changes. The market value rises gradually each year, with no signs of rapid acceleration or sudden spikes.

Early years see moderate growth, moving from USD 516.3 million in 2025 to USD 590.9 million in 2028. This steady climb indicates a stable demand for power conditioning solutions in residential settings, driven by increasing awareness of power quality and electrical protection needs. Between 2029 and 2033, the market continues its steady trajectory, reaching USD 739.9 million. The growth pattern remains smooth, showing no evident signs of saturation or market exhaustion during this mid-term phase. The later years, from 2034 to 2035, show the market approaching USD 809.5 million, indicating sustained growth but at a slightly slower pace compared to earlier years. This trend suggests the market might be approaching a saturation point, where incremental growth will become more challenging due to market maturity and penetration levels. The market growth curve depicts a mature but steadily expanding sector with no immediate saturation concerns, although long-term growth might gradually slow as the market reaches higher penetration.

| Metric | Value |

|---|---|

| Three Phase Residential Power Conditioner Market Estimated Value in (2025 E) | USD 516.3 million |

| Three Phase Residential Power Conditioner Market Forecast Value in (2035 F) | USD 809.5 million |

| Forecast CAGR (2025 to 2035) | 4.6% |

The three phase residential power conditioner market is expanding steadily, driven by increased demand for voltage stability, equipment protection, and uninterrupted power quality in modern smart homes. Growing integration of sensitive electronic appliances, energy storage systems, and rooftop solar infrastructure in residential buildings has elevated the need for advanced conditioning solutions.

Rising electricity load variations and grid disturbances, particularly in urban and semi-urban regions, are pushing homeowners to invest in three-phase conditioners that ensure consistent supply and protect appliances from harmonic distortions. Government initiatives promoting energy efficiency and distributed energy infrastructure are also creating tailwinds for the market.

Looking ahead, the increasing electrification of household operations such as EV charging and automation combined with declining component costs, is expected to further drive the adoption of compact, scalable, and efficient power conditioning technologies.

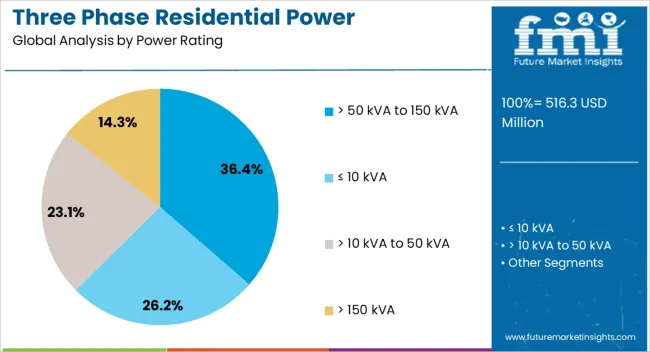

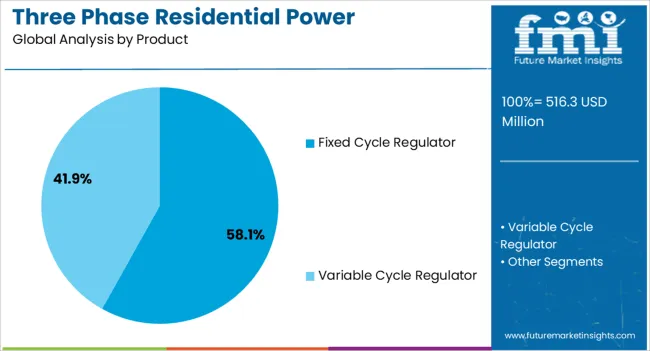

The three phase residential power conditioner market is segmented by power rating, product, and geographic regions. By power rating, the three phase residential power conditioner market is divided into > 50 kVA to 150 kVA, ≤ 10 kVA, > 10 kVA to 50 kVA, and > 150 kVA. In terms of the product, the three-phase residential power conditioner market is classified into Fixed Cycle Regulator and Variable Cycle Regulator.

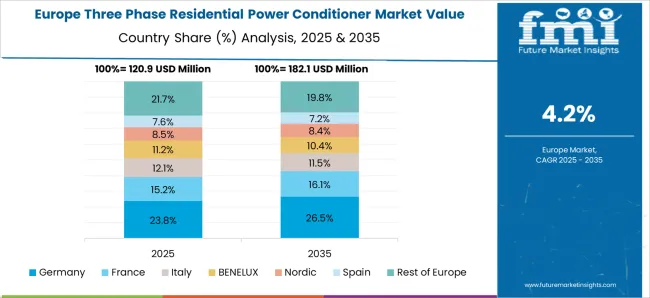

Regionally, the three phase residential power conditioner industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The > 50 kVA to 150 kVA segment is anticipated to capture 36.4% of the total market share in 2025, making it the dominant range within power rating classifications. This range is being favored for its suitability in mid- to large-sized residential buildings where multiple high-load appliances operate simultaneously.

The ability to handle voltage fluctuations and harmonics across diverse household system such as HVACs, water pumps, and smart energy panels has made this rating increasingly relevant. Adoption is also being reinforced by the compatibility of these systems with backup generators, solar inverters, and energy management units.

As the residential sector continues to adopt three-phase configurations for balanced load distribution and improved energy performance, this power range is expected to remain a preferred choice for enhanced reliability and energy safety.

The fixed cycle regulator segment is projected to lead the market by contributing 58.1% of total revenue in 2025. Its leadership stems from the segment’s effectiveness in delivering consistent voltage regulation, reduced maintenance needs, and cost-efficiency in residential environments.

These regulators are well-suited for applications where incoming power quality is unstable and protection from voltage transients is required. Their robust design and straightforward operation allow seamless integration with existing electrical setups without complex calibration.

Additionally, their ability to offer quick correction time and high overload capacity has been instrumental in maintaining power quality across increasingly tech-dependent households. The rising need for reliable conditioning at the appliance level, especially in homes adopting automation and real-time monitoring, has further driven the preference for fixed cycle regulator solutions.

The market has been growing steadily as residential consumers increasingly recognize the need for enhanced power quality and protection of sensitive electrical equipment. These conditioners play a crucial role in regulating voltage fluctuations, suppressing electrical noise, and improving the overall stability and reliability of three-phase power systems commonly used in larger homes and multifamily units. With rising adoption of energy-intensive appliances and smart home technologies, the demand for consistent and clean power supply has intensified.

The surge in residential electrification, characterized by the growing penetration of high-power appliances and smart home devices, has substantially increased the demand for reliable power conditioning solutions designed for three phase systems. Larger residences and multifamily housing units often utilize three-phase power for efficient load distribution and energy management. However, these systems are susceptible to voltage sags, surges, harmonic distortions, and transient spikes that can adversely impact the performance and lifespan of sensitive household electronics and appliances. Power conditioners mitigate such power quality issues by stabilizing voltage, filtering electrical noise, and providing surge protection. This ensures uninterrupted operation of essential systems such as HVAC units, home automation controllers, and entertainment devices.

Recent advancements in three phase residential power conditioners have led to substantial improvements in device functionality, energy efficiency, and integration capabilities with modern home automation systems. The development of compact, modular designs enables easier installation within limited residential spaces, reducing disruption and infrastructure requirements. Microprocessor-based control systems allow real-time monitoring and adaptive voltage regulation, ensuring that power supply anomalies are detected and corrected swiftly. Enhanced surge protection mechanisms safeguard sensitive electronics from transient voltage spikes caused by lightning strikes or switching events. Additionally, the integration of smart home connectivity and remote monitoring platforms empowers users to track power quality metrics, receive alerts on anomalies, and perform remote diagnostics, facilitating proactive maintenance and reducing downtime.

Increasing consumer awareness regarding the negative consequences of poor power quality on electrical appliances has become a significant growth driver for the three phase residential power conditioner market. Manufacturers, utility providers, and industry associations are actively conducting educational campaigns to highlight the importance of voltage stabilization and surge protection in protecting costly household electronics. Homeowners have started recognizing that power conditioners can prevent frequent appliance failures, reduce repair costs, and extend equipment lifespans. Furthermore, the rise in warranty claims and insurance costs linked to electrical damage has encouraged builders, property managers, and developers to recommend or incorporate power conditioning devices in new residential projects. This growing understanding among consumers and stakeholders about the value and benefits of power conditioning technologies continues to propel demand and expand market opportunities.

Despite the clear operational benefits, the widespread adoption of three phase residential power conditioners is constrained by challenges related to relatively high initial investment, installation complexity, and limited consumer awareness. The devices often require professional assessment for proper sizing, customized design, and expert installation, which can increase upfront costs and project lead times. Many homeowners remain unaware of the potential damage caused by power quality issues or the availability of effective conditioning solutions, limiting organic demand growth. Maintenance requirements and occasional calibration also add to the total cost of ownership and can be deterrents for budget-conscious consumers. To address these barriers, manufacturers are focusing on developing cost-effective, plug-and-play models that simplify installation and reduce dependency on specialized labor.

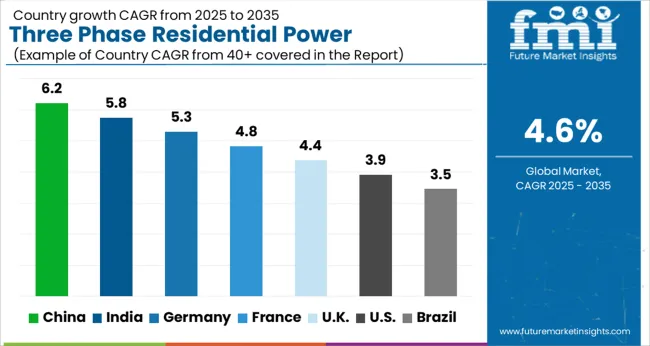

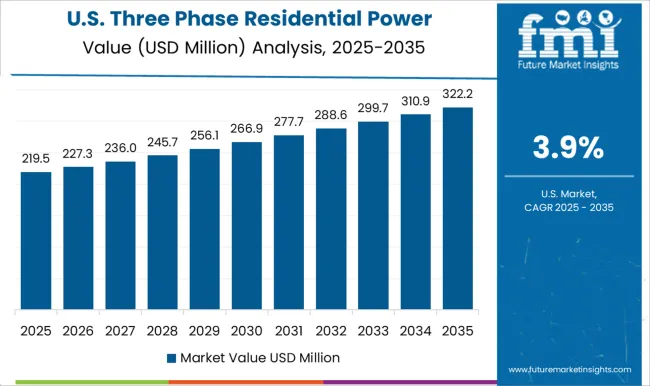

The market is expected to grow at a CAGR of 4.6% between 2025 and 2035, supported by increasing residential power quality concerns and growing adoption of energy management systems. China leads with a 6.2% CAGR, driven by expanding urban housing and smart home initiatives. India follows at 5.8%, fueled by rising residential electrification and demand for voltage stabilization. Germany, growing at 5.3%, benefits from energy efficiency regulations and advanced residential power solutions. The UK, at 4.4%, experiences steady adoption in modern housing developments. The USA, with a 3.9% CAGR, reflects ongoing investments in home power quality and safety equipment. This report includes insights on 40+ countries; the top markets are shown here for reference.

The demand for three phase residential power conditioners in China is projected to grow at a CAGR of 6.2% from 2025 to 2035, driven by increasing investments in residential electrical infrastructure and rising awareness of power quality issues. Leading manufacturers such as Huawei and Midea are developing advanced conditioners with improved voltage stabilization and surge protection tailored for high-rise apartment complexes. Government programs supporting smart grid initiatives enhance market opportunities. The integration of these conditioners in new housing projects and retrofit applications in older residential buildings boosts sales. Rising electricity consumption and sensitivity to power fluctuations in urban centers reinforce demand.

In India, the market for three phase residential power conditioners is expected to expand at a CAGR of 5.8% through 2035, supported by growing rural electrification and urban housing development. Domestic players like Luminous and Su-Kam focus on energy-efficient power conditioners designed for residential voltage irregularities. Increasing penetration of electronic appliances and demand for stable power supply in tier 2 and tier 3 cities create new growth avenues. Government incentives for clean and reliable power infrastructure also contribute to market momentum.

Germany’s three phase residential power conditioner sales are forecast to increase at a CAGR of 5.3%, driven by high standards for residential electrical safety and growing adoption of renewable energy systems. Key players such as Siemens and ABB supply conditioners with advanced harmonic filtering and voltage regulation. Integration with photovoltaic and energy storage systems is becoming common. The focus on smart homes and energy management solutions supports consistent demand. Retrofit and new construction segments both contribute to market growth.

Sales of three phase residential power conditioners in the United Kingdom are expected to grow at a CAGR of 4.4% from 2025 to 2035. The demand is stimulated by increasing adoption of electrical heating and home automation systems requiring consistent power quality. Companies such as Schneider Electric offer solutions focused on surge protection and voltage stabilization for residential properties. Retrofitting older housing stock and new developments with modern power conditioning equipment support market expansion. Awareness campaigns on power quality improvements contribute to consumer interest.

The United States three phase residential power conditioner market is anticipated to grow at a CAGR of 3.9% through 2035, led by modernization efforts in residential power distribution and increasing smart home adoption. Manufacturers like Eaton and Leviton supply conditioners with enhanced voltage regulation and real-time monitoring features. The rise of electronic appliances and demand for uninterrupted power supply in suburban homes boost sales. Regulatory focus on power quality standards supports market stability.

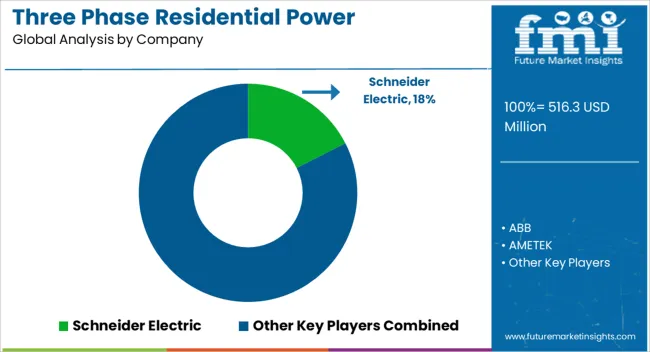

The market features a variety of global and regional manufacturers delivering solutions to enhance power quality and protect household electrical systems. Schneider Electric and ABB dominate with comprehensive product portfolios that combine advanced voltage regulation, surge protection, and energy efficiency. Delta Electronics and Eaton offer reliable power conditioning equipment designed to ensure stable power supply and prevent electrical disturbances in residential settings. Emerson Electric and Fuji Electric provide robust conditioners that cater to diverse power requirements, emphasizing durability and ease of installation. Legrand and Mitsubishi Electric are recognized for integrating smart features and scalable designs suitable for modern residential infrastructure. Neelkanth Power Solutions, NXT Power, and Servomax contribute regionally with cost-effective and customized solutions aimed at emerging markets. Panasonic and Sollatek offer versatile power conditioners that focus on user-friendly operation and enhanced protection against voltage fluctuations. Vishay complements the market with components and modules that improve the efficiency and reliability of power conditioning systems. The market growth is supported by increasing awareness of power quality issues, the rising use of sensitive electronic appliances, and the demand for uninterrupted power supply in homes. Barriers to entry include technological expertise, compliance with safety standards, and the need for effective distribution and after-sales support. Established manufacturers leverage these strengths to maintain leadership while innovating to meet evolving residential power demands.

| Item | Value |

|---|---|

| Quantitative Units | USD 516.3 Million |

| Power Rating | > 50 kVA to 150 kVA, ≤ 10 kVA, > 10 kVA to 50 kVA, and > 150 kVA |

| Product | Fixed Cycle Regulator and Variable Cycle Regulator |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schneider Electric, ABB, AMETEK, Delta Electronics, Eaton, Emerson Electric, Fuji Electric, Legrand, Mitsubishi Electric, Neelkanth Power Solutions, NXT Power, Panasonic, Servomax, Sollatek, and Vishay |

| Additional Attributes | Dollar sales by power rating and application type, demand dynamics across residential complexes, small commercial buildings, and smart homes, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in voltage stabilization technologies, harmonic filtering, and IoT-enabled monitoring, environmental impact of energy efficiency improvements, electronic waste management, and material sourcing, and emerging use cases in renewable energy integration, electric vehicle charging stability, and smart grid interoperability for residential users. |

The global three phase residential power conditioner market is estimated to be valued at USD 516.3 million in 2025.

The market size for the three phase residential power conditioner market is projected to reach USD 809.5 million by 2035.

The three phase residential power conditioner market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in three phase residential power conditioner market are > 50 kva to 150 kva, ≤ 10 kva, > 10 kva to 50 kva and > 150 kva.

In terms of product, fixed cycle regulator segment to command 58.1% share in the three phase residential power conditioner market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Three Wheeled Motorcycle Market Size and Share Forecast Outlook 2025 to 2035

Three-Wheel E-Scooter Market Growth - Trends & Forecast 2024 to 2034

Three Piece Cans Market

Three Phase Commercial Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Three Phase String Inverter Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Inverter Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Recloser Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Micro Inverter Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Power Device Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Green Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

On-grid Three Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Electric Three Wheeler Market - Trends & Forecast 2025 to 2035

Automotive Three Way Catalytic Converter Market Size and Share Forecast Outlook 2025 to 2035

Standalone Three Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Three Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Commercial Three Phase Micro Inverter Market Size and Share Forecast Outlook 2025 to 2035

Phase Shifting Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dual-Phase Cleanser Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA