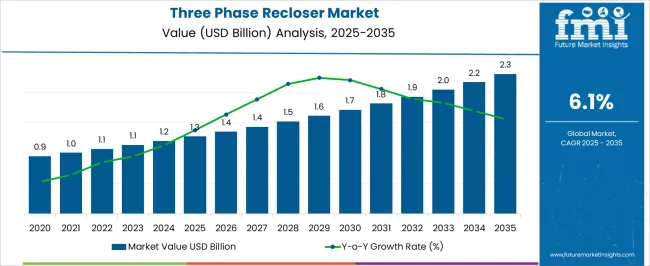

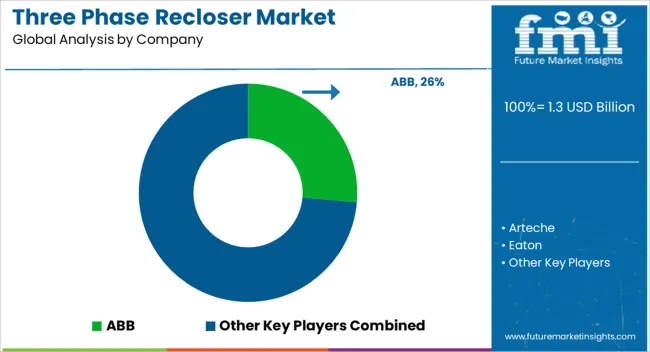

The three phase recloser market, estimated at USD 1.3 billion in 2025 and projected to reach USD 2.3 billion by 2035 at a CAGR of 6.1%, reflects a gradual yet consistent growth pattern indicative of a stable and structured value chain. The cost structure in this market is dominated by high-value components such as insulation materials, switching mechanisms, and control electronics, which collectively account for a significant portion of production expenditures.

Manufacturing operations are capital-intensive due to precision requirements, quality testing, and adherence to stringent electrical standards. The value chain begins with raw material sourcing, including specialized metals, polymers, and electronic components. Tier-one suppliers of control systems and insulating materials contribute to the upstream cost, while contract manufacturers and system integrators handle assembly, testing, and calibration in the midstream segment. Downstream, distribution channels include utility providers, industrial buyers, and regional electrical contractors, each adding operational and logistics costs that influence final pricing. After-sales services, maintenance, and technical support represent additional value-chain layers, impacting long-term revenue and customer retention.

Economies of scale are moderately realized as production volumes increase, though high compliance and certification requirements limit rapid cost reduction. The market’s cost-structure and value-chain dynamics emphasize the integration of high-quality components, rigorous manufacturing processes, and service-oriented downstream operations as key drivers for sustainable growth across the forecast period.

| Metric | Value |

|---|---|

| Three Phase Recloser Market Estimated Value in (2025 E) | USD 1.3 billion |

| Three Phase Recloser Market Forecast Value in (2035 F) | USD 2.3 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The three phase recloser market represents a specialized segment within the global electrical distribution and grid protection industry, emphasizing reliability, fault management, and automated switching. Within the broader distribution equipment market, it accounts for about 5.3%, driven by adoption in utilities, industrial facilities, and urban infrastructure. In the medium and high voltage switchgear sector, it holds nearly 4.8%, reflecting use for rapid fault isolation, power restoration, and network stability. Across the smart grid and digital substation segment, the market captures 4.1%, supporting advanced monitoring, remote operation, and predictive maintenance.

Within the renewable energy integration category, it represents 3.7%, highlighting applications in wind, solar, and hybrid energy systems. In the industrial electrical infrastructure sector, it secures 3.4%, emphasizing operational reliability, automation, and regulatory compliance. Recent developments in this market have focused on digitalization, IoT-enabled monitoring, and enhanced fault detection. Innovations include intelligent reclosers with remote control, self-healing capabilities, and integrated communication protocols for real-time data exchange. Key players are collaborating with utilities, grid operators, and technology providers to improve network resilience, reduce outage duration, and optimize maintenance schedules.

Adoption of predictive analytics, cloud-based monitoring, and condition-based maintenance is gaining traction for proactive grid management. The designs with compact footprints, arc-resistant technology, and environmental durability are being deployed to meet evolving infrastructure and safety standards.

Utilities and power distribution companies are increasingly deploying reclosers to improve network efficiency, reduce downtime, and support renewable energy integration.

The shift towards smart grid infrastructure is further accelerating adoption, as reclosers equipped with advanced control and communication capabilities allow faster fault detection and restoration. Expanding electrification in emerging regions, coupled with modernization programs in mature markets, is paving the way for higher demand.

Cost advantages from reduced maintenance, combined with the ability to minimize outage durations, are also driving widespread utilization. With the continued push towards decarbonization and distributed generation, the market outlook remains strong, supported by ongoing technological advancements that enhance performance, flexibility, and integration into digital grid management systems.

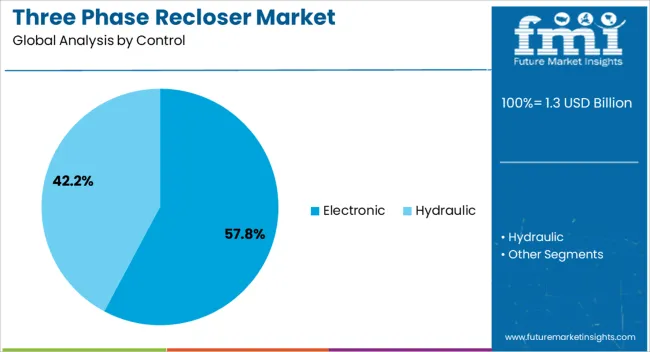

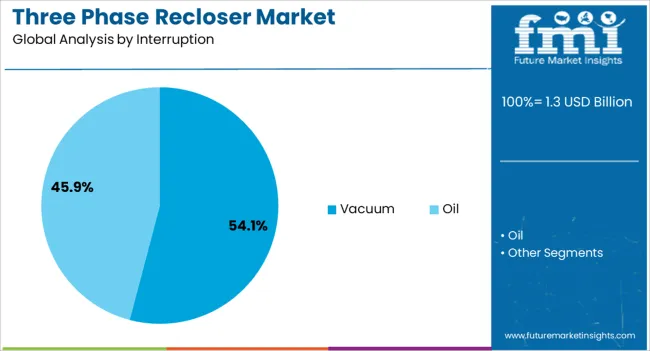

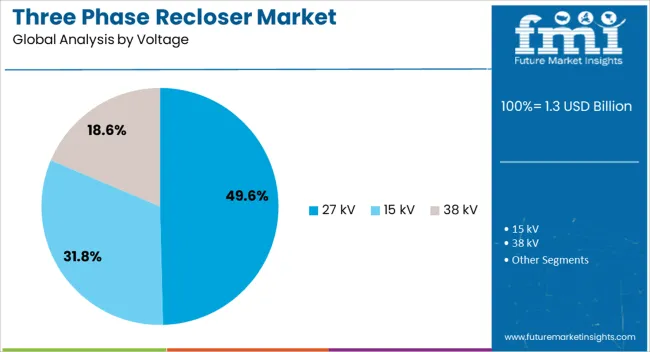

The three phase recloser market is segmented by control, interruption, voltage, and geographic regions. By control, three phase recloser market is divided into electronic and hydraulic. In terms of interruption, three phase recloser market is classified into Vacuum and Oil. Based on voltage, three phase recloser market is segmented into 27 kV, 15 kV, and 38 kV. Regionally, the three phase recloser industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The electronic control segment is projected to account for 57.8% of the three phase recloser market revenue in 2025, making it the dominant control type. This leading position is being attributed to the ability of electronic control systems to deliver precise fault detection, rapid response, and adaptive protection schemes.

The segment’s growth has been driven by increasing demand for intelligent monitoring and automation capabilities in modern grid systems. Electronic controls allow seamless integration with supervisory control and data acquisition systems, enabling utilities to remotely configure settings, update firmware, and analyze performance data.

The reduced maintenance requirements and enhanced operational efficiency offered by electronic control units have encouraged utilities to transition from traditional electromechanical systems. As grid networks expand and face more complex load patterns, the preference for adaptable and software-upgradable electronic control solutions is expected to reinforce their market leadership.

The vacuum interruption segment is expected to hold 54.1% of the market revenue in 2025, emerging as the leading technology type. This dominance is being supported by the superior arc-quenching capabilities and minimal environmental impact offered by vacuum interrupters.

Their long operational life, reduced need for servicing, and high reliability under various load conditions have driven their adoption across transmission and distribution networks. The absence of greenhouse gas emissions during operation, along with compliance with environmental regulations, has further boosted demand.

Utilities favor vacuum technology for its capability to handle frequent operations without significant wear, making it ideal for modern distribution systems that require consistent fault-clearing performance. As network automation grows and the industry moves towards sustainable technologies, the vacuum interruption segment is expected to retain its leading position due to its efficiency, durability, and alignment with global sustainability goals.

The 27 kV voltage segment is anticipated to account for 49.6% of the market revenue in 2025, making it the largest voltage category. This leadership is being driven by its optimal suitability for medium-voltage distribution networks, where it offers a balance between capacity, operational flexibility, and cost-effectiveness.

The segment’s growth has been fueled by its widespread use in urban, suburban, and rural grid systems, enabling efficient fault isolation and service restoration. Utilities are increasingly standardizing on 27 kV systems to streamline maintenance practices and reduce inventory complexity.

The segment also benefits from compatibility with a wide range of network configurations and its adaptability to varying load demands. As infrastructure upgrades continue and distributed energy resources expand, the 27 kV voltage class is expected to maintain its prominence, supported by its proven reliability and cost advantages in medium-voltage applications.

The market has been expanding steadily as utilities focus on improving power distribution reliability, minimizing outage durations, and enhancing grid automation. These devices automatically interrupt and restore power in response to temporary faults, reducing downtime and operational losses. They are widely applied in medium voltage distribution networks, renewable integration points, and industrial facilities.

Investments in smart grid infrastructure, digital communication capabilities, and remote monitoring systems have further strengthened demand. The market growth is driven by the increasing need for resilient electrical distribution, rising penetration of renewable energy, and adoption of intelligent switching devices that support predictive maintenance, load management, and improved safety standards in modern power networks.

Three phase reclosers are critical components for enhancing grid reliability and enabling automated fault management. By detecting and isolating temporary faults, these devices minimize power interruptions and reduce manual intervention. Utilities increasingly deploy reclosers with advanced sensors and digital communication protocols, allowing real time monitoring and remote operation.

Integration with SCADA systems and IoT-enabled controls ensures faster response to distribution network anomalies. The devices help manage load balancing, prevent cascading outages, and improve operational efficiency. The combination of automation, fault tolerance, and remote management capability positions three phase reclosers as essential tools for modern power networks aiming to enhance reliability, reduce maintenance costs, and support energy efficiency initiatives across industrial and urban distribution grids.

The integration of renewable energy sources such as solar, wind, and distributed energy resources has significantly influenced the adoption of three phase reclosers. These devices help stabilize voltage fluctuations and prevent disruptions caused by variable generation. In microgrids, hybrid systems, and grid tied renewable setups, reclosers ensure seamless power restoration and protection against transient faults. Utilities are deploying smart reclosers to manage bidirectional power flows from distributed energy resources while maintaining system stability. The rising global renewable energy capacity, coupled with regulatory mandates for grid modernization, continues to drive the demand for reliable and automated recloser solutions. As renewable penetration grows, three phase reclosers play a critical role in ensuring safe, resilient, and efficient electricity distribution networks.

Industrial facilities, mining operations, and utility distribution networks have emerged as primary users of three phase reclosers due to their ability to protect equipment and maintain continuous operations. In industrial settings, reclosers prevent costly downtime caused by temporary faults and equipment overloads. Utilities utilize these devices across medium voltage feeders to isolate faulty sections without affecting the entire network. Their capability to handle high currents, combined with automated reset and fault logging features, ensures operational reliability. Deployment in remote or harsh environments with exposure to weather, voltage surges, and line faults has underscored the importance of robust design and advanced control systems. This widespread application across utilities and industrial infrastructure sustains steady growth in the market.

Advancements in control electronics, digital communication, and predictive analytics have driven innovation in three phase reclosers, enhancing operational efficiency and monitoring capabilities. Devices equipped with smart sensors, fault diagnostics, and remote control interfaces enable predictive maintenance and reduce service interruptions. Integration with advanced grid management systems allows for real time monitoring, fault analysis, and optimized switching operations. Manufacturers are also focusing on compact, energy efficient designs to reduce installation and operational costs. The incorporation of IoT and data driven analytics enables utilities to make informed decisions on load management, fault response, and energy distribution planning. These innovations have strengthened market appeal by improving reliability, reducing operational costs, and supporting smarter electricity networks.

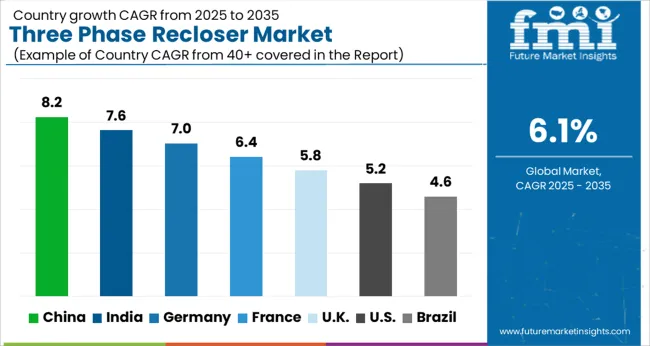

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

The market is experiencing steady growth driven by modernization of power distribution networks and automation initiatives. India records 7.6%, supported by grid expansion and reliability improvement programs. Germany reaches 7.0%, fueled by integration of smart grid technologies and industrial adoption. China leads with 8.2%, driven by large-scale infrastructure projects and renewable energy integration. The United Kingdom achieves 5.8%, supported by regulatory focus on distribution efficiency. The United States posts 5.2%, with growth aided by modernization of aging electrical grids. Together, these nations represent a blend of technological advancement, deployment scale, and strategic investment shaping the global three phase recloser landscape. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to expand at a CAGR of 8.2%, driven by rapid power distribution network upgrades and industrial electrification. Adoption has been accelerated by the increasing deployment of smart grid solutions and automation in urban and rural areas. It is observed that domestic manufacturers have focused on enhancing the reliability and compactness of reclosers, integrating advanced fault detection and remote control features. Major state owned utilities have invested in reclosers to reduce downtime and improve distribution efficiency. The market is expected to remain strong as the government continues to promote grid modernization, ensuring stable electricity supply to industrial and residential consumers across China.

India is expected to witness a CAGR of 7.6% in the market, supported by government programs aimed at strengthening the electricity distribution network. Adoption has been encouraged by increasing demand for reliable power supply in urban and semi-urban regions and by smart grid pilot projects. Indian utilities have deployed reclosers to minimize outages, particularly in regions prone to electrical faults and weather related disruptions. Local manufacturers are collaborating with global technology providers to offer cost effective and technologically advanced solutions. The market outlook indicates continued investment in grid automation and protection, particularly as renewable integration expands across India.

Germany is anticipated to grow at a CAGR of 7.0% in the market, supported by renewable energy integration and industrial distribution needs. Reclosers are increasingly deployed to ensure stable electricity delivery in wind and solar dominated grids. It is considered that advanced fault detection, remote monitoring, and automated switching capabilities are key features driving adoption among utilities. German manufacturers such as Siemens and ABB supply high performance reclosers for both domestic and European markets. Continuous grid modernization and focus on decentralized energy generation are expected to sustain demand for reclosers, ensuring operational reliability and minimizing service interruptions across industrial and residential networks.

The three phase recloser market in the United Kingdom is projected to grow at a CAGR of 5.8%, influenced by grid modernization and reliability enhancement initiatives. Utilities have deployed reclosers extensively to reduce outage durations and support distributed renewable generation, particularly in rural and coastal regions. Adoption has been driven by the need for real time fault monitoring, remote control, and automated switching in medium voltage networks. Major players, including Schneider Electric and ABB, have supplied advanced recloser solutions integrated with smart grid software. The market outlook indicates that demand will continue steadily as investments in energy infrastructure modernization increase and the U K continues to strengthen resilience in electricity distribution.

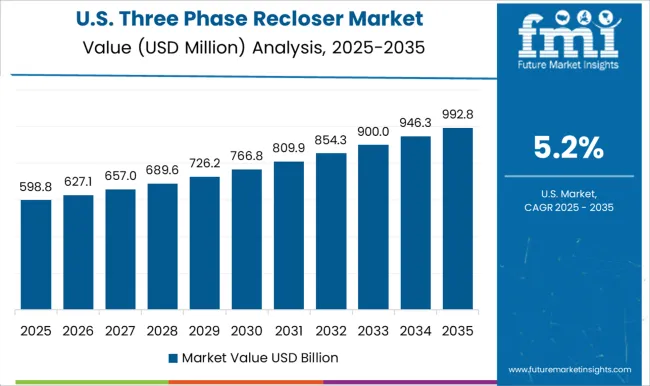

The market in the United States is expected to expand at a CAGR of 5.2%, driven by aging distribution infrastructure upgrades and renewable energy deployment. Utilities are adopting reclosers to improve service reliability and reduce outage duration in residential, commercial, and industrial networks. It is observed that smart reclosers with remote monitoring and automation features are increasingly preferred to support grid stability and compliance with regulatory standards. U S manufacturers such as Eaton and ABB have provided advanced reclosers for both domestic and export markets. Continuous grid investment, particularly in storm prone regions, ensures sustained demand for three phase reclosers.

The market is characterized by the presence of leading global electrical equipment manufacturers providing advanced grid protection and automation solutions. ABB and Siemens offer high-voltage reclosers with integrated monitoring, fault detection, and remote control capabilities, targeting utility-scale deployments and smart grid modernization projects. Schneider Electric and Eaton focus on modular and scalable recloser solutions that combine reliability with ease of maintenance, addressing both urban and rural power distribution networks.

Companies such as G&W Electric, Noja Power, and Hubbell emphasize innovations in automated switching, self-healing grid technology, and digital communication integration, enabling utilities to improve system resilience and minimize outage durations. Arteche, Ensto, and Entec provide specialized solutions optimized for regional power distribution standards, supporting utilities in emerging markets with cost-effective yet technologically advanced options. Rockwell, Hughes Power Systems, Shinsung, and Tavrida Electric strengthen the market through niche applications, robust product engineering, and strategic collaborations with local distributors to expand reach and enhance service capabilities.

Market competition is driven by technological innovation, digitalization, and smart grid integration, with companies prioritizing research and development in fault monitoring, IoT-enabled reclosers, and predictive maintenance. Strategic partnerships, regional customization, and a strong service network remain key for market players to secure long-term growth and strengthen customer trust in high-reliability distribution automation solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 billion |

| Control | Electronic and Hydraulic |

| Interruption | Vacuum and Oil |

| Voltage | 27 kV, 15 kV, and 38 kV |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Arteche, Eaton, Entec, Ensto, G&W Electric, Hubbell, Hughes Power System, Noja Power, Rockwell, S&C Electric, Schneider Electric, Shinsung, Siemens, and Tavrida Electric |

| Additional Attributes | Dollar sales by recloser type and voltage class, demand dynamics across distribution, transmission, and industrial networks, regional trends in automated fault management adoption, innovation in durability, smart monitoring, and remote operation, environmental impact of material usage and energy efficiency, and emerging use cases in renewable integration, grid resilience, and smart distribution systems. |

The global three phase recloser market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the three phase recloser market is projected to reach USD 2.3 billion by 2035.

The three phase recloser market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in three phase recloser market are electronic and hydraulic.

In terms of interruption, vacuum segment to command 54.1% share in the three phase recloser market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Three Wheeled Motorcycle Market Size and Share Forecast Outlook 2025 to 2035

Three-Wheel E-Scooter Market Growth - Trends & Forecast 2024 to 2034

Three Piece Cans Market

Three Phase Commercial Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Three Phase String Inverter Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Inverter Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Green Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Micro Inverter Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Three Phase Power Device Analyzer Market Size and Share Forecast Outlook 2025 to 2035

On-grid Three Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Electric Three Wheeler Market - Trends & Forecast 2025 to 2035

Automotive Three Way Catalytic Converter Market Size and Share Forecast Outlook 2025 to 2035

Standalone Three Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Three Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Commercial Three Phase Micro Inverter Market Size and Share Forecast Outlook 2025 to 2035

Phase Shifting Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dual-Phase Cleanser Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA