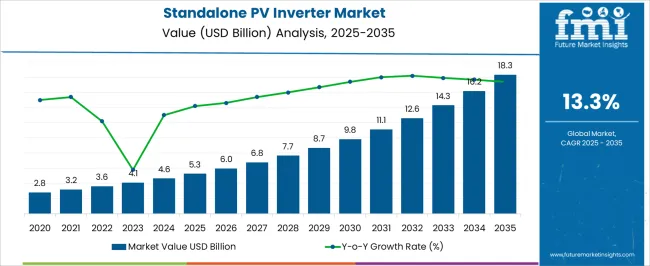

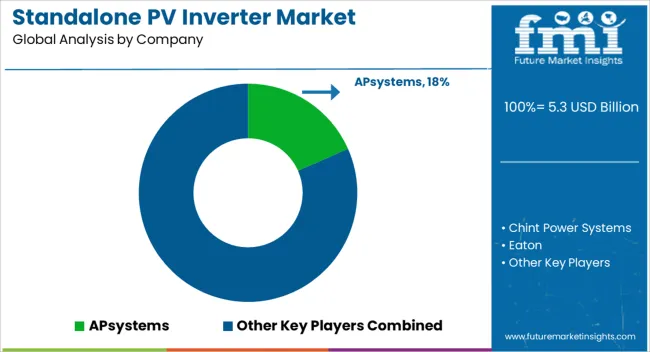

The Standalone PV Inverter Market is estimated to be valued at USD 5.3 billion in 2025 and is projected to reach USD 18.3 billion by 2035, registering a compound annual growth rate (CAGR) of 13.3% over the forecast period.

This steep trajectory highlights the increasing penetration of decentralized solar installations, especially in regions with limited grid connectivity and rural electrification programs. Growth in the first half of the period, 2025 to 2030, will likely be driven by small-scale residential projects and community-based solar systems that rely heavily on standalone inverters for independent operation.

Between 2030 and 2035, expansion is expected to accelerate as large-scale off-grid applications, agricultural power supply systems, and backup solutions for commercial facilities gain prominence. The absolute growth of USD 13.0 billion underscores a rising preference for reliable, cost-effective alternatives to centralized grid systems.

Competitive intensity is projected to deepen, with manufacturers focusing on higher efficiency, longer operational lifespans, and integration with battery storage. Emerging markets in Asia, Africa, and Latin America will play a pivotal role, as policy incentives and falling solar module costs encourage adoption.

| Metric | Value |

|---|---|

| Standalone PV Inverter Market Estimated Value in (2025 E) | USD 5.3 billion |

| Standalone PV Inverter Market Forecast Value in (2035 F) | USD 18.3 billion |

| Forecast CAGR (2025 to 2035) | 13.3% |

The standalone PV inverter market is experiencing notable growth due to increasing global reliance on off grid renewable energy systems and the rising deployment of solar power in remote and underserved regions. Demand for uninterrupted and self sufficient energy generation has led to broader integration of standalone systems in residential, agricultural, and commercial settings.

Advancements in inverter technology, including improved energy conversion efficiency, enhanced thermal management, and remote monitoring capabilities, are accelerating adoption across multiple geographies. Government subsidies and incentives for decentralized solar installations, especially in emerging economies, are also supporting market momentum.

As energy resilience becomes a priority amid rising grid instability and climate concerns, standalone PV inverters are positioned as critical components for sustainable energy infrastructure.

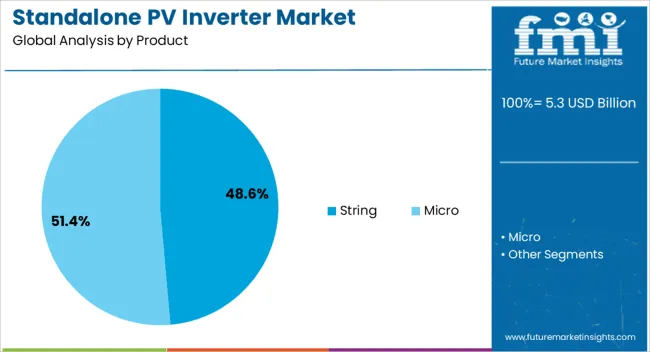

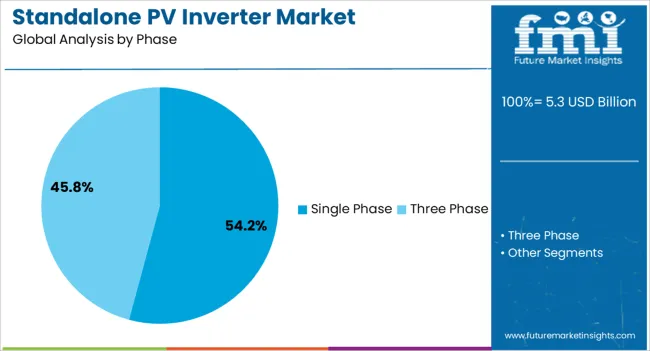

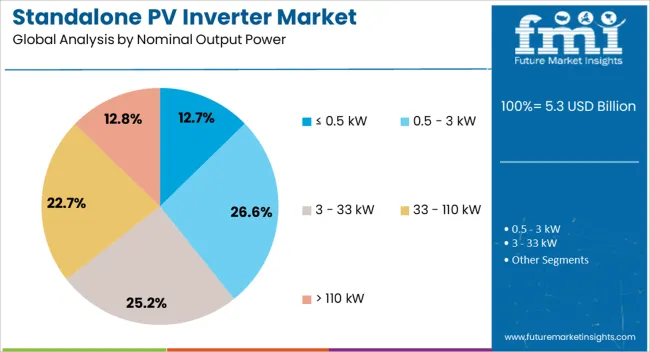

The standalone PV inverter market is segmented by product, phase, nominal output power, nominal output voltage, application, and geographic regions. By product, the standalone PV inverter market is divided into String and Micro. In terms of phase, the standalone PV inverter market is classified into Single Phase and Three Phase. Based on nominal output power, the standalone PV inverter market is segmented into ≤ 0.5 kW, 0.5 - 3 kW, 3 - 33 kW, 33 - 110 kW, and > 110 kW.

By nominal output voltage, the standalone PV inverter market is segmented into ≤ 230 V, 230 - 400 V, 400 - 600 V, and > 600 V. By application of the standalone PV inverter market is segmented into Residential and Commercial & Industrial. Regionally, the standalone PV inverter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The string segment is projected to contribute 48.60% of total revenue by 2025 within the product category, establishing it as the leading segment. This prominence is driven by its scalability, cost efficiency, and ease of installation in both residential and small commercial solar systems.

String inverters are preferred for their modularity, allowing flexible system design and simplified maintenance. Additionally, their compatibility with common photovoltaic configurations and ability to support multi-string layouts enhances their operational appeal.

As users prioritize reliability and low upfront costs for medium-sized standalone installations, the dominance of string inverters in this market segment continues to grow.

The single phase segment is expected to hold 54.20% of the total market share by 2025 under the phase category, making it the dominant configuration. Its widespread use in residential and rural off-grid applications, where electricity demand is lower, has reinforced its market position.

Single-phase inverters are known for their compact size, ease of integration, and suitability for lower power solar systems, especially in individual households and small farms. Their economic viability and availability in standardized configurations support rapid deployment in emerging solar markets.

These attributes collectively contribute to their substantial share and continued preference in the standalone PV inverter landscape.

The nominal output power segment of 0.5 kW and below is anticipated to account for 12.70% of market revenue by 2025. This share reflects growing demand for low capacity inverters in basic off grid systems such as remote lighting, water pumping, and telecom applications.

The simplicity, affordability, and portability of sub 0.5 kW inverters make them ideal for minimal load requirements in isolated settings.

As solar electrification efforts expand to target energy poverty and support micro infrastructure in underserved areas, the relevance of this output power category is expected to increase, sustaining its steady share in the overall market.

The standalone PV inverter market is expanding due to rising demand for decentralized solar solutions, with growth driven by consumer awareness, regulatory support, and competitive pricing. While challenges remain, the market is set for gradual growth with technological and policy support.

The standalone PV inverter market is witnessing growth due to the rising adoption of decentralized energy systems, particularly in residential and commercial sectors. Increasing consumer awareness about renewable energy and the desire for energy independence are key drivers. Government incentives and subsidies in various regions are encouraging consumers to adopt solar power solutions, including standalone inverters. Moreover, the growing demand for off-grid solar power systems in remote areas further accelerates market growth. As solar power installations rise, the need for efficient, reliable inverters that can handle individual solar systems is also increasing, fueling demand for standalone inverters.

The standalone PV inverter market is becoming more competitive with the presence of key players offering a range of solutions tailored to residential and small commercial applications. Competition is driven by the need for efficient, cost-effective, and reliable inverters. Companies are focusing on developing inverters that provide ease of installation, enhanced durability, and compatibility with various solar panels and energy storage systems. Market players are also focusing on offering products with superior performance, such as better conversion efficiency, to stand out in the growing competitive market. As the market becomes more fragmented, pricing pressure is expected to intensify.

Standalone PV inverters are benefiting from advancements in power conversion technologies that improve energy efficiency and reduce costs. However, the technology is still evolving to match the performance capabilities of integrated inverters. One of the challenges faced by manufacturers is achieving a balance between inverter performance, system cost, and ease of use. Standalone inverters must be compatible with various types of solar panels and energy storage systems, which can complicate product development. The demand for smarter inverters with better monitoring and grid connectivity features is growing, but integrating these technologies into affordable standalone solutions presents a challenge.

Regulatory support plays a crucial role in the expansion of the standalone PV inverter market. Policies and incentives that encourage solar energy adoption directly impact the growth of the market. Countries with high electricity costs and a strong focus on reducing carbon footprints provide fertile ground for standalone PV inverter adoption. Regulations concerning the efficiency and safety standards of solar equipment, including inverters, also drive the development of higher-quality products. As more regions focus on clean energy targets, the regulatory landscape is expected to support the market’s growth, fostering wider adoption of standalone inverters.

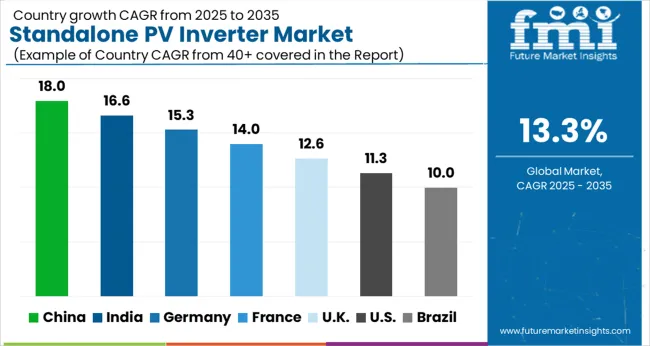

| Countries | CAGR |

|---|---|

| China | 18.0% |

| India | 16.6% |

| Germany | 15.3% |

| France | 14.0% |

| UK | 12.6% |

| USA | 11.3% |

| Brazil | 10.0% |

The standalone PV inverter market, projected to grow at a global CAGR of 13.3% from 2025 to 2035, is witnessing significant growth across key countries. China leads with an 18.0% share, driven by strong government incentives for solar energy adoption and extensive investments in renewable energy infrastructure. India follows with a 16.6% share, supported by growing demand for decentralized solar systems and the country's focus on renewable energy expansion. France accounts for 14.0%, benefiting from government policies aimed at increasing solar energy penetration. The UK and USA follow with 12.6% and 11.3% shares, respectively, as both countries continue to invest in decentralized and off-grid solar solutions, driving growth in standalone PV inverters. The report provides a detailed analysis of 40+ countries, with the top five countries highlighted above as key market drivers.

The CAGR for the United Kingdom’s standalone PV inverter market grew from approximately 9.5% during 2020–2024 to 12.6% for the period 2025–2035, driven by increased adoption of residential and commercial solar systems. During 2020–2024, the market grew at a moderate pace as larger-scale integrated solar systems dominated. However, the 2025–2035 period is expected to see a higher CAGR due to growing government incentives for renewable energy, advancements in inverter technology, and increasing interest in off-grid solutions. The UK market benefits from its strong focus on energy independence and residential solar-plus-storage solutions, further accelerating growth in this sector.

China’s standalone PV inverter market has experienced significant growth, with a CAGR of 16.5% during 2020–2024, projected to reach 18.0% for 2025–2035. The market was driven by China’s rapid expansion of solar energy installations and increasing investments in decentralized energy solutions. During 2020–2024, the growth was tempered by a focus on utility-scale solar systems. From 2025 onward, the growth rate is expected to rise due to government policies supporting decentralized solar energy, advancements in inverter technologies, and growing demand for energy independence. China's large-scale adoption of solar solutions, both residential and commercial, is expected to fuel significant growth.

India’s standalone PV inverter market is projected to grow at a CAGR of 15.2% during 2020–2024, with significant acceleration to 16.6% for the 2025–2035 period. The market has been driven by India’s ambitious renewable energy targets and increasing government initiatives to promote solar energy adoption. During 2020–2024, the market was focused on affordability and scaling up large solar installations. However, the 2025–2035 period will see stronger growth due to increased adoption of residential and off-grid systems, supported by incentives, technological advancements, and India's push for energy independence.

France’s standalone PV inverter market is projected to grow at a CAGR of 13.2% during 2020–2024, with a rise to 14.0% for the period 2025–2035. The market's early growth was driven by government incentives for solar energy and a rising interest in residential solar power systems. During 2020–2024, the French market focused on large-scale installations, but from 2025 onward, the shift to decentralized, off-grid solutions will accelerate growth. France’s increased emphasis on energy independence, coupled with technological advancements in standalone inverters, will further drive the market forward.

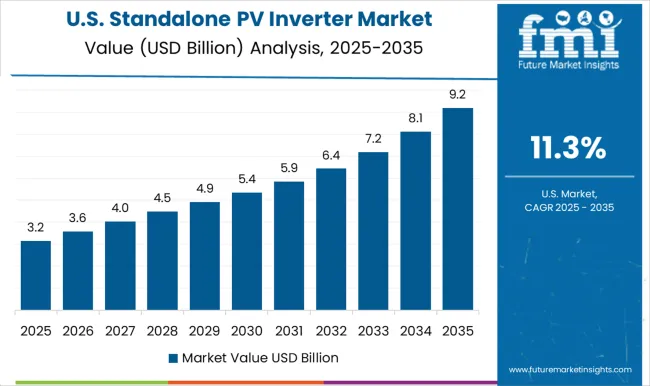

The standalone PV inverter market in the USA grew at a CAGR of 10.3% during 2020-2024 and is projected to reach a CAGR of 11.3% for the 2025-2035 period. The USA market during 2020-2024 was primarily driven by government incentives and increasing adoption of residential solar systems. However, growth was tempered by the dominance of large-scale utility solar projects. The 2025-2035 period will see increased growth driven by the shift to decentralized solar solutions, energy storage systems, and the rise of rooftop solar installations. Technological advancements and a focus on energy independence will continue to push demand for standalone PV inverters.

In the standalone PV inverter market, several key players are focusing on technological advancements and strategic partnerships to drive innovation in solar power conversion. APsystems leads the market with its dual-module microinverters, offering solutions for residential and commercial applications. Chint Power Systems is a significant player known for its inverters that cater to both small and large-scale solar installations. Eaton brings a range of high-quality inverters designed for residential and commercial uses, providing energy-efficient solutions.

Hitachi Hi-Rel Power Electronics Pvt. Ltd offers cutting-edge inverter solutions with a focus on power efficiency and system integration for decentralized solar power systems. INVTSolar and KACO new energy GmbH are making strides in inverter technology, focusing on high-performance, modular solutions for residential and industrial solar applications. NingBo Deye Inverter Technology Co.Ltd stands out with its range of inverters optimized for residential solar projects. OutBack Power Technologies offers reliable, off-grid and hybrid inverter systems that focus on energy storage integration.

Companies like Power Electronics, Servotech Power Systems, and SMA Solar Technology AG are enhancing their inverter offerings with advanced monitoring and control systems. SUNGROW and UTL Solar are recognized for their affordable and reliable inverter solutions, catering to both residential and commercial solar installations. Yaskawa Solectria Solar introduces high-efficiency string inverters to the market, focusing on delivering reliable solar power for residential and commercial sectors. The competition in the standalone PV inverter market is driven by ongoing innovation, the need for efficient, scalable, and cost-effective solutions, as well as increasing demand for residential and commercial solar power systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.3 Billion |

| Product | String and Micro |

| Phase | Single Phase and Three Phase |

| Nominal Output Power | ≤ 0.5 kW, 0.5 - 3 kW, 3 - 33 kW, 33 - 110 kW, and > 110 kW |

| Nominal Output Voltage | ≤ 230 V, 230 - 400 V, 400 - 600 V, and > 600 V |

| Application | Residential and Commercial & Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | APsystems, Chint Power Systems, Eaton, Hitachi Hi-Rel Power Electronics Pvt. Ltd, INVTSolar, KACO new energy GmbH, NingBo Deye Inverter Technology Co.Ltd, OutBack Power Technologies, Power Electronics, Servotech Power Systems, SMA Solar Technology AG, SUNGROW, UTL Solar, and Yaskawa Solectria Solar |

| Additional Attributes | Dollar sales projections and market share across different regions, they would be particularly interested in understanding market trends driving the demand for residential and commercial solar inverters, along with the competitive landscape and positioning of key players. |

The global standalone PV inverter market is estimated to be valued at USD 5.3 billion in 2025.

The market size for the standalone PV inverter market is projected to reach USD 18.3 billion by 2035.

The standalone PV inverter market is expected to grow at a 13.3% CAGR between 2025 and 2035.

The key product types in standalone PV inverter market are string and micro.

In terms of phase, single phase segment to command 54.2% share in the standalone PV inverter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Standalone Three Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

PVC UV Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

PVT Collectors Market Size and Share Forecast Outlook 2025 to 2035

PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

PVC Cling Film Market Size and Share Forecast Outlook 2025 to 2035

PV Combiner Box Market Size and Share Forecast Outlook 2025 to 2035

PVC Tapes Market Size and Share Forecast Outlook 2025 to 2035

PVC Footwear Market Analysis by Growth, Trends and Forecast from 2025 to 2035

PVC Packing Straps Market Report – Key Trends & Forecast 2025 to 2035

PV Module Encapsulant Film Market Analysis by Material Type, Application, Thickness, Weight, End-Use, and Region Forecast through 2035

Market Share Insights of PVC-Free Cap Liner Manufacturers

Leading Providers & Market Share in PVC Tapes Industry

PVDC Coated Film Market Growth and Outlook 2025 to 2035

PVC Cling Wrap Market Trends & Growth Forecast 2024-2034

PVC Blister Packs Market

PVC Container Market

PVC-Free Packaging Market

PVC-free Cap Liners Market

PVDC Food Packaging Market

PV Inverter Market Analysis by Product, Phase, Connectivity, Nominal Power Output, Nominal Output Voltage, Application, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA