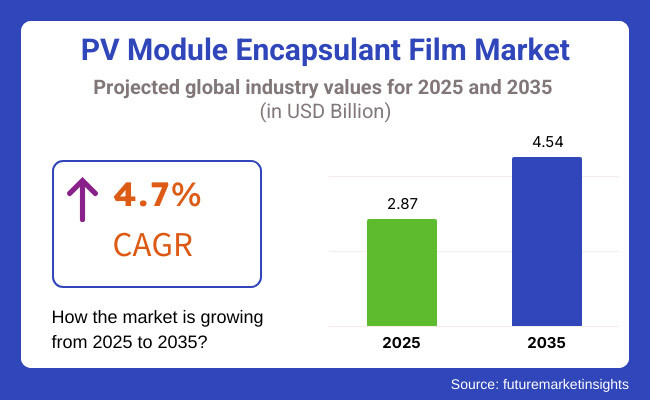

The PV module encapsulant film market is estimated to reach USD 2.87 billion in 2025. It is expected to grow at a CAGR of 4.7% during the forecast period and garner a value of USD 4.54 billion in 2035.

In 2024, the PV module encapsulant film market experienced steady growth, driven by rising solar energy installations worldwide. The incentives and subsidies rolled out by the governments in the important regions of the USA, China, and the EU, in particular, pushed for faster deployments of PV installations.

Supply chain disruptions due to raw material shortages, particularly affecting ethyl vinyl acetate (EVA) and polyolefin elastomer (POE), causing price fluctuations that impacted most module manufacturers. Increased investment in recycling and sustainable encapsulant materials may mitigate some of these risks in the long run. High-performance encapsulants showed improvement in UV resistance and durability.

Furthermore, the development of bifacial and thin-film solar technologies has increased the demand for higher encapsulation efficiency. It is likely that by 2025 and in years to come, there will be continuous growth in the expansion of solar energy due to intensified global net-zero commitments. Falling prices of solar PV modules combined with improving efficiencies of the encapsulant films will drive adoption.

Also, the localization of manufacturing in key regions aims to stabilize the supply chain. Emerging markets, particularly in Southeast Asia and Latin America, are expected to drive additional demand. While regulatory swings and material price volatility are expected to be critical issues, new developments in high performance, green, and sustainable encapsulants will already have implications on future dynamics.

In the recent survey by FMI with the players in the value chain of PV solar module encapsulant films, key insights were revealed concerning trends, challenges, and developmental drivers in the industry.

Supply chain stability was highlighted as the foremost issue, as above 60% of the manufacturers and suppliers responded with pertinent remarks; raw material availability has been able to disrupt production schedules. The stakeholders mentioned that they see increasing significance in regional supply chains to reduce dependency on overseas sourcing, especially for EVA and POE materials.

Over 70% of survey respondents highlighted a growing demand for encapsulant films excelling in durability, UV resistance, and thermal stability. This demand for enhanced product characteristics is partly driven by the advent of bifacial solar modules and thin-film technology, which push manufacturers to develop next-generation encapsulants that improve module efficiency and lifetime.

Also, over 50% of the respondents highlighted an increased interest in sustainable encapsulant solutions that match recyclable and bio-based materials to the worldwide sustainability strategy. Industry players also raise concerns regarding regulatory uncertainty, especially in jurisdictions that enforce stringent environmental regulations on what is permissible in the composition of encapsulant materials.

Virtually all interviewees indicated that government incentives and funding for solar projects have been instrumental in generating demand for high-performance encapsulant films, while the survey further revealed that customized encapsulant solutions geared to specific climatic conditions and module types are emerging as key differentiators in the industry.

Government policies and regulations drive the industry by enforcing quality, safety, and sustainability standards. Tax incentives, recyclability mandates, and certification requirements across regions shape production and adoption. Compliance with these evolving regulations is crucial for manufacturers seeking industry expansion and long-term growth opportunities.

| Countries/Region | Regulations & Certifications |

|---|---|

| United States | The Inflation Reduction Act (IRA) 2022 provides tax credits for solar projects using domestically produced materials, encouraging local encapsulant film production. Encapsulants must meet UL 1703 and IEC 61215 safety and durability standards. |

| European Union | The Eco-design Directive and Waste Electrical and Electronic Equipment (WEEE) Directive enforce recyclability standards for solar components, including encapsulant films. RoHS (Restriction of Hazardous Substances) compliance is mandatory to limit hazardous material use. |

| China | The 14th Five-Year Plan prioritizes solar energy expansion, leading to a high demand for encapsulants. The government enforces CQC (China Quality Certification) and GB/T 9535 to 2021 standards for encapsulant film safety and performance. |

| India | Under the Production Linked Incentive (PLI) Scheme, domestic manufacturers receive financial incentives for producing solar encapsulant films. The Bureau of Indian Standards (BIS) mandates compliance with IS 14286 and IS/IEC 61730 for module encapsulation. |

| Japan | The FIT (Feed-in Tariff) Program supports renewable energy expansion, indirectly driving demand for high-quality encapsulant films. JET (Japan Electrical Safety & Environment Technology Laboratories) certification ensures encapsulants meet safety standards. |

| South Korea | The Renewable Energy 3020 Policy aims to increase solar capacity, prompting strict quality control for encapsulant films. KS C 8565 is the national standard for PV module encapsulant materials. |

| Brazil | Norma ABNT NBR 16274 regulates the quality of encapsulant films used in solar modules. Government incentives under PROGD (Distributed Generation Program) support local production and adoption. |

| Australia | The Small-Scale Renewable Energy Scheme (SRES) promotes the adoption of certified solar components, including encapsulants. Compliance with AS/NZS 5033 and IEC 61730 is required. |

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Government incentives, solar adoption, and initial advancements in encapsulant technology drive moderate growth. | Accelerated growth is expected due to large-scale solar projects, rising bifacial module adoption, and stricter sustainability regulations. |

| Predominantly EVA-based encapsulants; early adoption of POE and advanced EVA variants. | Higher adoption of POE, thermoplastic polyolefin (TPO), and recyclable encapsulants for improved efficiency and sustainability. |

| Government subsidies, declining solar panel costs, and increasing residential solar installations. | Expansion of industrial and commercial solar projects, energy security concerns, and net-zero carbon commitments. |

| Supply chain disruptions due to COVID-19, dependence on imports for raw materials, and fluctuating raw material prices. | Increasing regulatory compliance, higher demand for recyclable materials, and the need for encapsulants with enhanced durability. |

| Dominated by a few key players with a strong industry presence, focusing on cost-effective encapsulants. | Greater competition with new entrants investing in R&D for high-performance and sustainable encapsulant materials. |

| Recyclability has not been a major focus, with traditional encapsulant materials remaining dominant. | Environmental policies drive a strong push for recyclable encapsulants and low-carbon footprint materials. |

| Growth concentrated in China, the USA, and Germany due to strong government backing. | Expansion in emerging regions such as India, Southeast Asia, and Africa, alongside continued dominance of key solar hubs. |

Ethyl Vinyl Acetate (EVA) dominates the industry due to its excellent optical transparency, flexibility, and cost-effectiveness. The segment recorded a CAGR of 5.4% from 2018 to 2022 and is projected to grow at 5.1% from 2023 to 2033. Extrapolating this trend, EVA encapsulant films will continue leading from 2025 to 2035, driven by increasing solar panel installations and the rising demand for high-performance encapsulation materials.

Among EVA variants, Transparent EVA is widely used for its superior light transmittance, ensuring maximum solar energy absorption. White EVA is in demand due to its reflective properties, which enhance module efficiency by improving light utilization. Anti-PID EVA is also experiencing strong adoption as it prevents power losses caused by leakage currents. These advancements in EVA encapsulants will play a crucial role in improving solar module performance and longevity.

The bifacial PV module segment is projected to witness the highest growth from 2025 to 2035, as bifacial technology enhances overall energy generation by capturing sunlight from both sides. This technology requires encapsulants with superior durability, high UV resistance, and excellent optical clarity.

Compared to monofacial modules, bifacial variants demand advanced materials like POE and specialized EVA formulations, increasing the need for high-performance encapsulants in modern solar applications. As solar farms expand their bifacial module installations, encapsulant manufacturers are focusing on developing films that enhance energy yield and extend module lifespan.

The growing emphasis on high-efficiency solar power generation is driving research into encapsulant solutions that improve performance in diverse environmental conditions. The increasing adoption of bifacial technology across residential, commercial, and utility-scale installations is expected to boost demand for next-generation encapsulant films.

Encapsulant films in the 0.40-0.60mm thickness range are experiencing the highest demand due to their optimal balance of flexibility, durability, and cost efficiency. Thinner encapsulants (0.20-0.40mm) are primarily used in lightweight solar applications, while thicker encapsulants (0.60-0.80mm) are gaining traction in high-efficiency modules.

The need for encapsulants capable of withstanding environmental stress is driving growth in the thicker encapsulant category, particularly in extreme-weather installations. The increasing focus on long-lasting solar panel performance is pushing manufacturers to develop encapsulant films with enhanced thermal stability and mechanical strength.

Thicker encapsulant films are particularly favored in installations exposed to harsh environmental conditions, as they provide improved resistance against moisture, temperature fluctuations, and mechanical stress. With rising investments in high-durability solar solutions, demand for 0.60-0.80mm encapsulant films is expected to grow significantly across utility-scale and industrial solar projects.

Encapsulant films weighing between 400-475 g/m² dominate the segment, offering an ideal balance of lightness and mechanical strength. Films below 400 g/m² are used in applications where reducing module weight is a priority, particularly in residential and portable solar solutions.

However, encapsulant films above 475 g/m² are witnessing growing demand in large-scale solar installations, where enhanced structural integrity is crucial for long-term efficiency and performance. As the solar industry advances, manufacturers are focusing on developing encapsulants with improved weight-to-strength ratios to optimize module efficiency.

The demand for encapsulants with superior resistance to harsh weather conditions is driving innovation in encapsulant weight categories. With increasing installations of solar panels in extreme environments, higher-weight encapsulants are expected to gain popularity in the coming years.

The Commercial and Industrial segments remain the largest consumers of PV module encapsulant films, driven by large-scale solar installations and corporate sustainability initiatives. Government policies and incentives are accelerating solar adoption in commercial and industrial sectors.

The Residential sector is also expanding as rooftop solar installations grow, contributing to the overall demand for high-performance encapsulant films. The Industrial segment is expected to witness the fastest growth due to rising investments in high-efficiency solar solutions for manufacturing plants and large-scale operations.

The need for encapsulants with superior durability and longer lifespans is increasing as industrial facilities prioritize energy efficiency. With stricter environmental regulations and sustainability commitments, encapsulant manufacturers are focusing on developing long-lasting, eco-friendly materials to cater to this expanding segment.

| Countries | CAGR |

|---|---|

| USA | 5.1% |

| UK | 4.3% |

| France | 4.5% |

| Germany | 4.8% |

| Italy | 4.6% |

| South Korea | 5.2% |

| Japan | 4.9% |

| China | 5.5% |

| Australia & New Zealand | 4.4% |

Expansion of Solar Manufacturing and Bifacial Module Adoption Driving Industry Growth

The USA is expected to grow at a CAGR of 5.1% from 2025 to 2035, driven by expanding domestic solar manufacturing and strong government incentives. The Inflation Reduction Act (IRA) 2022 promotes local solar production, reducing reliance on imports. The increasing adoption of bifacial and high-efficiency PV modules is further driving demand for advanced encapsulant films that enhance module durability and performance.

Government Incentives and Sustainability Regulations Supporting Encapsulant Film Demand

The UK is projected to expand at a CAGR of 4.3% from 2025 to 2035, supported by government-backed solar incentives and sustainability-driven regulations. The Contracts for Difference (CfD) scheme and tax incentives are boosting solar adoption and increasing encapsulant film demand. A shift toward recyclable encapsulant materials aligns with the UK’s environmental policies, driving innovation in durable and eco-friendly encapsulation solutions.

Eco-Design Policies and Recycling Mandates Boosting Industry Expansion

France is set to grow at a CAGR of 4.5% from 2025 to 2035, fueled by solar expansion initiatives like the PPE (Programmation Pluriannuelle de l’Énergie). The CRE (Energy Regulatory Commission) enforces eco-design and recycling mandates, encouraging the use of sustainable encapsulants. The increasing adoption of thin-film solar technologies also supports industry growth, as these modules require specialized encapsulation materials for long-term stability.

High-Efficiency PV Technologies and Stringent Environmental Compliance Fueling Growth

Germany is expected to register a CAGR of 4.8% from 2025 to 2035, driven by high-efficiency PV technologies and environmental regulations. The Renewable Energy Sources Act (EEG 2023) promotes solar expansion, increasing demand for UV-resistant encapsulant films. Additionally, recycling mandates under the WEEE Directive influence material selection, pushing manufacturers toward sustainable encapsulant alternatives that comply with Germany’s strict environmental policies.

Tax Incentives and Advanced PV Module Technologies Driving Demand

Italy is projected to expand at a CAGR of 4.6% from 2025 to 2035, backed by EU Green Deal policies and national incentives. The Superbonus 110% tax credit has significantly boosted residential and commercial solar adoption. With rising investments in advanced PV technologies, demand for durable encapsulant films is growing. Increasing regulations on recyclability and hazardous materials are also shaping encapsulant material choices.

Renewable Energy Policies and Next-Generation Encapsulant Films Accelerating Growth

South Korea is forecasted to grow at a CAGR of 5.2% from 2025 to 2035, supported by Renewable Energy 3020 Policy and government incentives. Rising demand for high-performance encapsulants tailored for humid and coastal environments is driving growth. Local manufacturers are investing in next-generation encapsulant films that enhance module durability, ensuring longer operational lifespans and better performance in diverse climatic conditions.

High-Performance Encapsulants and Quality Certifications Strengthening Position

Japan is anticipated to expand at a CAGR of 4.9% from 2025 to 2035, driven by carbon neutrality goals and strong government support for solar expansion. Programs like Feed-in Tariff (FIT) and Feed-in Premium (FIP) encourage solar investments. JET certification requirements enforce strict quality standards, pushing demand for weather-resistant encapsulants that ensure module longevity and efficiency in Japan’s variable climate conditions.

Large-Scale Solar Installations and Vertical Integration Enhancing Dominance

China is expected to witness a CAGR of 5.5% from 2025 to 2035, supported by large-scale solar installations and government-backed supply chain integration. The 14th Five-Year Plan prioritizes solar capacity expansion, increasing demand for EVA and POE encapsulants in bifacial solar modules. With leading encapsulant manufacturers based in China, innovation in cost-efficient and high-performance encapsulation is strengthening the country’s global position.

Renewable Energy Targets and Extreme Weather Conditions Shaping Encapsulant Demand

Australia and New Zealand are projected to grow at a CAGR of 4.4% from 2025 to 2035, driven by renewable energy targets and extreme weather conditions. The Australian Renewable Energy Target (RET) and New Zealand’s Zero Carbon Act are fueling solar adoption. High UV exposure necessitates durable encapsulant films, while compliance with AS/NZS 5033 standards ensures product quality and longevity.

As of 2024, the PV module encapsulant film sector has experienced significant expansion, driven by the increasing adoption of solar energy and advancements in photovoltaic (PV) technology. Leading players such as STR Holdings Inc., Mitsui Chemicals, Hanwha Solutions, First Applied Material, Siemens AG, and Bridgestone Corporation have been actively implementing strategies to strengthen their positions and cater to the growing demand for high-performance encapsulant films.

STR Holdings Inc. led with an estimated 20-25% share in 2024 to maintain tense consistency. The company has focused on innovation and sustainability, launching a new line of UV-resistant encapsulant films in early 2024. These products, designed for high-efficiency solar panels, have been well-received for their durability and performance. STR Holdings' strong distribution network and commitment to R&D have further solidified its leadership.

Mitsui Chemicals holds approximately 18-20% of the share in 2024. The company has prioritized technological advancements, introducing a new range of high-transparency encapsulant films with enhanced adhesion properties. These products, launched in mid-2024, have gained traction in the residential and commercial solar sectors due to their superior quality and reliability.

Mitsui Chemicals' focus on innovation and customer satisfaction has helped it maintain a competitive edge. Hanwha Solutions accounts for roughly 15-18% of the share in 2024. The company has invested heavily in R&D, launching a new series of encapsulant films with improved thermal stability and moisture resistance.

These products, designed for harsh environmental conditions, have been well-received for their performance and longevity. Hanwha Solutions' emphasis on innovation and sustainability has enabled it to capture a significant portion of demand.

First Applied Material has seen its presence grow to around 12-15% in 2024. The company has focused on developing sustainable encapsulant solutions and introducing a new line of recyclable encapsulant films in collaboration with industry stakeholders. First Applied Material's commitment to sustainability and its strong R&D capabilities have positioned it as a key player in the industry.

Siemens AG holds an estimated 10-12% share in 2024. The company has expanded its product portfolio by launching a new series of encapsulant films with enhanced electrical insulation properties. These products, designed for use in high-voltage solar panels, have been well-received for their safety and performance. Siemens' focus on specialized solutions has helped it carve out a niche.

Bridgestone Corporation has maintained a presence of approximately 8-10% in 2024. The company has focused on strategic partnerships, collaborating with solar panel manufacturers to develop customized encapsulant solutions for large-scale solar farms. Bridgestone's emphasis on innovation and collaboration has strengthened its reputation as a trusted provider of high-quality encapsulant films.

In 2024, the industry has also witnessed strategic collaborations and partnerships aimed at addressing emerging challenges in performance and sustainability. For instance, STR Holdings Inc. partnered with a leading solar panel manufacturer to develop a new line of encapsulant films for bifacial solar panels. This collaboration has enhanced STR Holdings' credibility and reach.

These six players dominate the sector, collectively holding a significant share of approximately 85%. These companies are leveraging innovation, sustainability, and technology to meet the growing demand for high-performance encapsulant films.

The global shift towards renewable energy is a primary driver for the industry. Governments worldwide are enforcing carbon neutrality targets, incentivizing solar energy adoption, and aiming to reduce reliance on fossil fuels. Policies like the Inflation Reduction Act (USA), the EU Green Deal, and China's 14th Five-Year Plan are boosting investments in solar manufacturing, increasing demand for high-performance encapsulant films.

Supply chain fluctuations, particularly for EVA, POE, and thermoplastic polyolefins, impact stability within the sector. Geopolitical tensions and trade restrictions on solar materials also influence production costs and accessibility. However, technological advancements in bifacial modules, thin-film PV, and recyclable encapsulants are driving innovation, enhancing durability, and improving cost efficiency.

As rising interest rates and inflation impact capital expenditure in solar projects, financial incentives, green bonds, and net-zero commitments help sustain industry growth. The industry's long-term growth aligns with the global energy transition and decarbonization efforts.

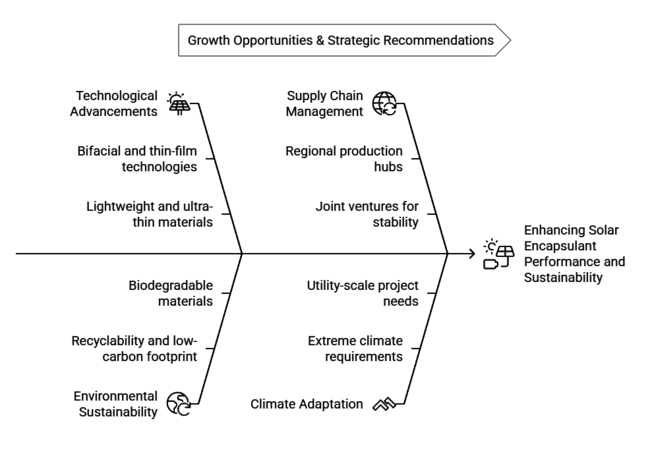

Expansion into bifacial and thin-film PV technologies

Bifacial solar modules are gaining traction due to their higher energy yield. Encapsulant manufacturers should focus on high-performance POE films that offer superior UV resistance and moisture protection. Additionally, thin-film PV modules are becoming popular in urban and space-constrained applications. Companies should develop lightweight, ultra-thin encapsulants tailored for these modules to capture new demand.

Investing in recyclable and sustainable encapsulants

With increasing environmental regulations, encapsulant films must meet recyclability and low-carbon footprint requirements. Stakeholders should prioritize R&D in biodegradable or fully recyclable encapsulants, especially in regions like the EU where circular economy policies are stringent. Partnering with solar panel recyclers to create closed-loop encapsulant solutions can offer a competitive edge.

Localizing production to reduce supply chain risks

Reliance on Chinese suppliers for EVA and POE resins increases supply chain risks. Establishing regional production hubs in the USA, Europe, and India can improve raw material access and mitigate tariff-related challenges. Joint ventures with polymer manufacturers can ensure stable supply and cost efficiency.

Customization for extreme climates and utility-scale projects

As solar adoption increases in deserts, coastal areas, and high-altitude regions, demand for encapsulants with better thermal stability, salt resistance, and UV shielding is rising. Developing climate-specific encapsulants and working with EPC contractors can enhance performance, especially in extreme conditions.

By material type, the sector is segmented into ethyl vinyl acetate (EVA), polyolefin elastomer (POE), thermoplastic polyolefin (TPO), and polyvinyl butyral (PVB).

By application, the industry is segmented into monofacial pv module and bifacial pv module.

By thickness, the sector is segmented into 0.20-0.40mm, 0.40-0.60mm, and 0.60-0.80mm.

By weight, the industry is segmented into below 400 g/m², 400-475 g/m², and above 475 g/m².

By end-use, the sector is segmented into commercial, industrial, and residential.

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Growing solar energy adoption, technological advancements in module efficiency, and government incentives promoting renewable energy are major drivers.

Ethyl Vinyl Acetate (EVA) dominates the industry, but Polyolefin Elastomer (POE) is growing rapidly due to its superior durability for bifacial solar modules.

Regulations promoting sustainable materials, mandatory recycling policies, and financial incentives for solar energy projects are increasing encapsulant film adoption.

Bifacial modules require encapsulants with high optical clarity and weather resistance, boosting demand for advanced materials like POE and high-performance EVA.

China, the United States, Germany, and Japan are witnessing rapid expansion due to large-scale solar installations and supportive government policies.

Table 1: Global Market Volume (Million m2) Forecast by Weight, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Weight, 2018 to 2033

Table 3: Global Market Volume (Million m2) Forecast by Material Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 5: Global Market Volume (Million m2) Forecast by Application, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 7: Global Market Volume (Million m2) Forecast by Thickness, 2018 to 2033

Table 8: Global Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 9: Global Market Volume (Million m2) Forecast by End-Use, 2018 to 2033

Table 10: Global Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 11: Global Market Volume (Million m2) Forecast by Region, 2018 to 2033

Table 12: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 13: North America Market Volume (Million m2) Forecast by Weight, 2018 to 2033

Table 14: North America Market Value (US$ Million) Forecast by Weight, 2018 to 2033

Table 15: North America Market Volume (Million m2) Forecast by Material Type, 2018 to 2033

Table 16: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 17: North America Market Volume (Million m2) Forecast by Application, 2018 to 2033

Table 18: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 19: North America Market Volume (Million m2) Forecast by Thickness, 2018 to 2033

Table 20: North America Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 21: North America Market Volume (Million m2) Forecast by End-Use, 2018 to 2033

Table 22: North America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 23: North America Market Volume (Million m2) Forecast by Country, 2018 to 2033

Table 24: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 25: Latin America Market Volume (Million m2) Forecast by Weight, 2018 to 2033

Table 26: Latin America Market Value (US$ Million) Forecast by Weight, 2018 to 2033

Table 27: Latin America Market Volume (Million m2) Forecast by Material Type, 2018 to 2033

Table 28: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 29: Latin America Market Volume (Million m2) Forecast by Application, 2018 to 2033

Table 30: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 31: Latin America Market Volume (Million m2) Forecast by Thickness, 2018 to 2033

Table 32: Latin America Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 33: Latin America Market Volume (Million m2) Forecast by End-Use, 2018 to 2033

Table 34: Latin America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 35: Latin America Market Volume (Million m2) Forecast by Country, 2018 to 2033

Table 36: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: Europe Market Volume (Million m2) Forecast by Weight, 2018 to 2033

Table 38: Europe Market Value (US$ Million) Forecast by Weight, 2018 to 2033

Table 39: Europe Market Volume (Million m2) Forecast by Material Type, 2018 to 2033

Table 40: Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 41: Europe Market Volume (Million m2) Forecast by Application, 2018 to 2033

Table 42: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 43: Europe Market Volume (Million m2) Forecast by Thickness, 2018 to 2033

Table 44: Europe Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 45: Europe Market Volume (Million m2) Forecast by End-Use, 2018 to 2033

Table 46: Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 47: Europe Market Volume (Million m2) Forecast by Country, 2018 to 2033

Table 48: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 49: East Asia Market Volume (Million m2) Forecast by Weight, 2018 to 2033

Table 50: East Asia Market Value (US$ Million) Forecast by Weight, 2018 to 2033

Table 51: East Asia Market Volume (Million m2) Forecast by Material Type, 2018 to 2033

Table 52: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 53: East Asia Market Volume (Million m2) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Volume (Million m2) Forecast by Thickness, 2018 to 2033

Table 56: East Asia Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 57: East Asia Market Volume (Million m2) Forecast by End-Use, 2018 to 2033

Table 58: East Asia Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 59: East Asia Market Volume (Million m2) Forecast by Country, 2018 to 2033

Table 60: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 61: South Asia & Oceania Market Volume (Million m2) Forecast by Weight, 2018 to 2033

Table 62: South Asia & Oceania Market Value (US$ Million) Forecast by Weight, 2018 to 2033

Table 63: South Asia & Oceania Market Volume (Million m2) Forecast by Material Type, 2018 to 2033

Table 64: South Asia & Oceania Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 65: South Asia & Oceania Market Volume (Million m2) Forecast by Application, 2018 to 2033

Table 66: South Asia & Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 67: South Asia & Oceania Market Volume (Million m2) Forecast by Thickness, 2018 to 2033

Table 68: South Asia & Oceania Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 69: South Asia & Oceania Market Volume (Million m2) Forecast by End-Use, 2018 to 2033

Table 70: South Asia & Oceania Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 71: South Asia & Oceania Market Volume (Million m2) Forecast by Country, 2018 to 2033

Table 72: South Asia & Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 73: Middle East & Africa Market Volume (Million m2) Forecast by Weight, 2018 to 2033

Table 74: Middle East & Africa Market Value (US$ Million) Forecast by Weight, 2018 to 2033

Table 75: Middle East & Africa Market Volume (Million m2) Forecast by Material Type, 2018 to 2033

Table 76: Middle East & Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 77: Middle East & Africa Market Volume (Million m2) Forecast by Application, 2018 to 2033

Table 78: Middle East & Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 79: Middle East & Africa Market Volume (Million m2) Forecast by Thickness, 2018 to 2033

Table 80: Middle East & Africa Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 81: Middle East & Africa Market Volume (Million m2) Forecast by End-Use, 2018 to 2033

Table 82: Middle East & Africa Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 83: Middle East & Africa Market Volume (Million m2) Forecast by Country, 2018 to 2033

Table 84: Middle East & Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Figure 1: Global Market Value (US$ Billion) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2022

Figure 2: Global Market Value (US$ Billion) and Market Volume (Million m2) Forecast and Analysis, 2023 to 2033

Figure 3: Global Market Value Y-o-Y Growth and Forecast, 2018 to 2033

Figure 4: Global Market Incremental $ Opportunity, 2022-2033

Figure 5: Global Market Share Analysis By Material Type- 2023 & 2033

Figure 6: Global Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 7: Global Market Attractiveness Analysis By Material Type 2023 to 2033

Figure 8: Global Market Share By Ethyl Vinyl Acetate (EVA)– 2023 & 2033

Figure 9: Global Market Attractiveness Analysis By Ethyl Vinyl Acetate (EVA)– 2023 to 2033

Figure 10: Global Market Share Analysis By Application- 2023 & 2033

Figure 11: Global Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 12: Global Market Attractiveness Analysis By Application, 2023 to 2033

Figure 13: Global Market Share Analysis By Thickness- 2023 & 2033

Figure 14: Global Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 15: Global Market Attractiveness Analysis By Thickness, 2023 to 2033-2033

Figure 16: Global Market Share Analysis By Weight 2023 & 2033

Figure 17: Global Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 18: Global Market Attractiveness Analysis By Weight, 2023 to 2033

Figure 19: Global S Market Share Analysis By End-Use 2023 & 2033

Figure 20: Global Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 21: Global Market Attractiveness Analysis By End-Use, 2023 to 2033

Figure 22: Global Market Share Analysis by Region - 2023 & 2033

Figure 23: Global Market Y-o-Y Growth Projections by Region, 2023 to 2033

Figure 24: Global Market Attractiveness Analysis by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2022

Figure 26: North America Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2023 to 2033

Figure 27: North America Market Value Y-o-Y Growth and Forecast, 2018 to 2033

Figure 28: North America Market Incremental $ Opportunity, 2023 to 2033

Figure 29: North America Market Share Analysis By Material Type- 2023 & 2033

Figure 30: North America Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 31: North America Market Attractiveness Analysis By Material Type 2023 to 2033

Figure 32: North America Market Share By Ethyl Vinyl Acetate (EVA)– 2023 & 2033

Figure 33: North America Market Attractiveness Analysis By Ethyl Vinyl Acetate (EVA)– 2023 to 2033

Figure 34: North America Market Share Analysis By Application- 2023 & 2033

Figure 35: North America Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 36: North America Market Attractiveness Analysis By Application, 2023 to 2033

Figure 37: North America Market Share Analysis By Thickness- 2023 & 2033

Figure 38: North America Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 39: North America Market Attractiveness Analysis By Thickness, 2023 to 2033

Figure 40: North America Market Share Analysis By Weight 2023 & 2033

Figure 41: North America Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 42: North America Market Attractiveness Analysis By Weight, 2023 to 2033

Figure 43: North America Market Share Analysis By End-Use 2023 & 2033

Figure 44: North America Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 45: North America Market Attractiveness Analysis By End-Use, 2023 to 2033

Figure 46: North America Market Share by Country– 2023 & 2033

Figure 47: North America Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 48: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2022

Figure 50: Latin America Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2023 to 2033

Figure 51: Latin America Market Value Y-o-Y Growth and Forecast, 2018 to 2033

Figure 52: Latin America Market Incremental $ Opportunity, 2023 to 2033

Figure 53: Latin America Market Share Analysis By Material Type- 2023 & 2033

Figure 54: Latin America Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 55: Latin America Market Attractiveness Analysis By Material Type 2023 to 2033

Figure 56: Latin America Market Share By Ethyl Vinyl Acetate (EVA)– 2023 & 2033

Figure 57: Latin America Market Attractiveness Analysis By Ethyl Vinyl Acetate (EVA)– 2023 to 2033

Figure 58: Latin America Market Share Analysis By Application- 2023 & 2033

Figure 59: Latin America Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 60: Latin America Market Attractiveness Analysis By Application, 2023 to 2033

Figure 61: Latin America Market Share Analysis By Thickness- 2023 & 2033

Figure 62: Latin America Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 63: Latin America Market Attractiveness Analysis By Thickness, 2023 to 2033

Figure 64: Latin America Market Share Analysis By Weight 2023 & 2033

Figure 65: Latin America Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 66: Latin America Market Attractiveness Analysis By Weight, 2023 to 2033

Figure 67: Latin America Market Share Analysis By End-Use 2023 & 2033

Figure 68: Latin America Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 69: Latin America Market Attractiveness Analysis By End-Use, 2023 to 2033

Figure 70: Latin America Market Share by Country– 2023 & 2033

Figure 71: Latin America Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 72: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2022

Figure 74: Europe Market Value (US$ Billion) and Market Volume (Million m2) Forecast and Analysis, 2023 to 2033

Figure 75: Europe Market Value Y-o-Y Growth and Forecast, 2019-2033

Figure 76: Europe Market Incremental $ Opportunity, 2023 to 2033

Figure 77: Europe Market Share Analysis By Material Type- 2023 & 2033

Figure 78: Europe Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 79: Europe Market Attractiveness Analysis By Material Type 2023 to 2033

Figure 80: Europe Market Share By Ethyl Vinyl Acetate (EVA)– 2023 & 2033

Figure 81: Europe Market Attractiveness Analysis By Ethyl Vinyl Acetate (EVA)– 2023 to 2033

Figure 82: Europe Market Share Analysis By Application- 2023 & 2033

Figure 83: Europe Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 84: Europe Market Attractiveness Analysis By Application, 2023 to 2033

Figure 85: Europe Market Share Analysis By Thickness- 2023 & 2033

Figure 86: Europe Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 87: Europe Market Attractiveness Analysis By Thickness, 2023 to 2033

Figure 88: Europe Market Share Analysis By Weight 2023 & 2033

Figure 89: Europe Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 90: Europe Market Attractiveness Analysis By Weight, 2023 to 2033

Figure 91: Europe Market Share Analysis By End-Use 2023 & 2033

Figure 92: Europe Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 93: Europe Market Attractiveness Analysis By End-Use, 2023 to 2033

Figure 94: Europe Market Share by Country– 2023 & 2033

Figure 95: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 96: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2022

Figure 98: East Asia Market Value (US$ Billion) and Market Volume (Million m2) Forecast and Analysis, 2023 to 2033

Figure 99: East Asia Market Value Y-o-Y Growth and Forecast, 2019-2033

Figure 100: East Asia Market Incremental $ Opportunity, 2023 to 2033

Figure 101: East Asia Market Share Analysis By Material Type- 2023 & 2033

Figure 102: East Asia Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 103: East Asia Market Attractiveness Analysis By Material Type 2023 to 2033

Figure 104: East Asia Market Share By Ethyl Vinyl Acetate (EVA)– 2023 & 2033

Figure 105: East Asia Market Attractiveness Analysis By Ethyl Vinyl Acetate (EVA)– 2023 to 2033

Figure 106: East Asia Market Share Analysis By Application- 2023 & 2033

Figure 107: East Asia Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 108: East Asia Market Attractiveness Analysis By Application, 2023 to 2033

Figure 109: East Asia Market Share Analysis By Thickness- 2023 & 2033

Figure 110: East Asia Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 111: East Asia Market Attractiveness Analysis By Thickness, 2023 to 2033

Figure 112: East Asia Market Share Analysis By Weight 2023 & 2033

Figure 113: East Asia Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 114: East Asia Market Attractiveness Analysis By Weight, 2023 to 2033

Figure 115: East Asia Market Share Analysis By End-Use 2023 & 2033

Figure 116: East Asia Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 117: East Asia Market Attractiveness Analysis By End-Use, 2023 to 2033

Figure 118: East Asia Market Share by Country– 2023 & 2033

Figure 119: East Asia Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 120: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 121: South Asia & Oceania Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2022

Figure 122: South Asia & Oceania Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2023 to 2033

Figure 123: South Asia & Oceania Market Value Y-o-Y Growth and Forecast, 2019-2033

Figure 124: South Asia & Oceania Market Incremental $ Opportunity, 2023 to 2033033

Figure 125: South Asia & Oceania Market Share Analysis By Material Type- 2023 & 2033

Figure 126: South Asia & Oceania Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 127: South Asia & Oceania Market Attractiveness Analysis By Material Type 2023 to 2033

Figure 128: South Asia & Oceania Market Share By Ethyl Vinyl Acetate (EVA)– 2023 & 2033

Figure 129: South Asia & Oceania Market Attractiveness Analysis By Ethyl Vinyl Acetate (EVA)– 2023 to 2033

Figure 130: South Asia & Oceania Market Share Analysis By Application- 2023 & 2033

Figure 131: South Asia & Oceania Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 132: South Asia & Oceania Market Attractiveness Analysis By Application, 2023 to 2033

Figure 133: South Asia & Oceania Market Share Analysis By Thickness- 2023 & 2033

Figure 134: South Asia & Oceania Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 135: South Asia & Oceania Market Attractiveness Analysis By Thickness, 2023 to 2033

Figure 136: South Asia & Oceania Market Share Analysis By Weight 2023 & 2033

Figure 137: South Asia & Oceania Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 138: South Asia & Oceania Market Attractiveness Analysis By Weight, 2023 to 2033

Figure 139: South Asia & Oceania S Market Share Analysis By End-Use 2023 & 2033

Figure 140: South Asia & Oceania Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 141: South Asia & Oceania Market Attractiveness Analysis By End-Use, 2023 to 2033

Figure 142: South Asia & Oceania Market Share by Country– 2023 & 2033

Figure 143: South Asia & Oceania Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 144: South Asia & Oceania Market Attractiveness Analysis by Country, 2023 to 2033

Figure 145: Middle East & Africa Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2022

Figure 146: Middle East & Africa Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2023 to 2033

Figure 147: Middle East & Africa Market Value Y-o-Y Growth and Forecast, 2019-2033

Figure 148: Middle East & Africa Market Incremental $ Opportunity, 2023 to 2033

Figure 149: Middle East & Africa Market Share Analysis By Material Type- 2023 & 2033

Figure 150: Middle East & Africa Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 151: Middle East & Africa Market Attractiveness Analysis By Material Type 2023 to 2033

Figure 152: Middle East & Africa Market Share By Ethyl Vinyl Acetate (EVA)– 2023 & 2033

Figure 153: Middle East & Africa Market Attractiveness Analysis By Ethyl Vinyl Acetate (EVA)– 2023 to 2033

Figure 154: Middle East & Africa Market Share Analysis By Application- 2023 & 2033

Figure 155: Middle East & Africa Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 156: Middle East & Africa Market Attractiveness Analysis By Application, 2023 to 2033

Figure 157: Middle East & Africa Market Share Analysis By Thickness- 2023 & 2033

Figure 158: Middle East & Africa Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 159: Middle East & Africa Market Attractiveness Analysis By Thickness, 2023 to 2033

Figure 160: Middle East & Africa Market Share Analysis By Weight 2023 & 2033

Figure 161: Middle East & Africa Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 162: Middle East & Africa Market Attractiveness Analysis By Weight, 2023 to 2033

Figure 163: Middle East & Africa S Market Share Analysis By End-Use 2023 & 2033

Figure 164: Middle East & Africa Market Value Y-o-Y Growth and Forecast, 2023 to 2033

Figure 165: Middle East & Africa Market Attractiveness Analysis By End-Use, 2023 to 2033

Figure 166: Middle East & Africa Market Share by Country– 2023 & 2033

Figure 167: Middle East & Africa Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 168: Middle East & Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 169: United States Market Value (US$ Million), and Market Volume (Million m2) Forecast and Analysis, 2018 to 2033

Figure 170: United States Market Share, By Weight, 2023 & 2033

Figure 171: United States Market Incremental $ Opportunity, 2023 to 2033

Figure 172: Canada Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2033

Figure 173: Canada Market Share, By Weight, 2023 & 2033

Figure 174: Canada Market Incremental $ Opportunity, 2023 to 2033

Figure 175: Brazil Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2033

Figure 176: Brazil Market Share, By Weight, 2023 & 2033

Figure 177: Brazil Market Incremental $ Opportunity, 2023 to 2033

Figure 178: Mexico Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2033

Figure 179: Mexico Market Share, By Weight, 2023 & 2033

Figure 180: Mexico Market Incremental $ Opportunity, 2023 to 2033

Figure 181: Germany Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2033

Figure 182: Germany Market Share, By Weight, 2023 & 2033

Figure 183: Germany Market Incremental $ Opportunity, 2023 to 2033

Figure 184: France Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2033

Figure 185: France Market Share, By Weight, 2023 & 2033

Figure 186: France Market Incremental $ Opportunity, 2023 to 2033

Figure 187: Italy Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2033

Figure 188: Italy Market Share, By Weight, 2023 & 2033

Figure 189: Italy Market Incremental $ Opportunity, 2023 to 2033

Figure 190: Spain Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2033

Figure 191: Spain Market Share, By Weight, 2023 & 2033

Figure 192: Spain Market Incremental $ Opportunity, 2023 to 2033

Figure 193: United Kingdom Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2033

Figure 194: United Kingdom Market Share, By Weight, 2023 & 2033

Figure 195: United Kingdom Market Incremental $ Opportunity, 2023 to 2033

Figure 196: Rest of Europe Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2033

Figure 197: Rest of Europe Market Share, By Weight, 2023 & 2033

Figure 198: Rest of Europe Market Incremental $ Opportunity, 2023 to 2033

Figure 199: China Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2033

Figure 200: China Market Share, By Weight, 2023 & 2033

Figure 201: China Market Incremental $ Opportunity, 2023 to 2033

Figure 202: Japan Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2033

Figure 203: Japan Market Share, By Weight, 2023 & 2033

Figure 204: Japan Market Incremental $ Opportunity, 2023 to 2033

Figure 205: South Korea Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2033

Figure 206: South Korea Share Value, By Weight, 2023 & 2033

Figure 207: South Korea Market Incremental $ Opportunity, 2023 to 2033

Figure 208: India Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2033

Figure 209: India Share Value, By Weight, 2023 & 2033

Figure 210: India Market Incremental $ Opportunity, 2023 to 2033

Figure 211: Australia Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2033

Figure 212: Australia Market Share, By Weight, 2023 & 2033

Figure 213: Australia Market Incremental $ Opportunity, 2023 to 2033

Figure 214: Rest of SAO Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2033

Figure 215: Rest of SAO Share Value, By Weight, 2023 & 2033

Figure 216: Rest of SAO Market Incremental $ Opportunity, 2023 to 2033

Figure 217: Egypt Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2033

Figure 218: Egypt Market Share, By Weight, 2023 & 2033

Figure 219: Egypt Market Incremental $ Opportunity, 2023 to 2033

Figure 220: GCC Countries Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2033

Figure 221: GCC Countries Market Share, By Weight, 2023 & 2033

Figure 222: GCC Countries Market Incremental $ Opportunity, 2023 to 2033

Figure 223: Algeria Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2033

Figure 224: Algeria Market Share, By Weight, 2023 & 2033

Figure 225: Algeria Market Incremental $ Opportunity, 2023 to 2033

Figure 226: Turkiye Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2033

Figure 227: Turkiye Market Share, By Weight, 2023 & 2033

Figure 228: Turkiye Market Incremental $ Opportunity, 2023 to 2033

Figure 229: Rest of MEA Market Value (US$ Million) and Market Volume (Million m2) Forecast and Analysis, 2018 to 2033

Figure 230: Rest of MEA Market Share, By Weight, 2023 & 2033

Figure 231: Rest of MEA Market Incremental $ Opportunity, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PVC-M High Impact Resistant Water Supply Pipe Market Size and Share Forecast Outlook 2025 to 2035

PVC UV Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

PVT Collectors Market Size and Share Forecast Outlook 2025 to 2035

PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

PV Combiner Box Market Size and Share Forecast Outlook 2025 to 2035

PVC Tapes Market Size and Share Forecast Outlook 2025 to 2035

PVC Footwear Market Analysis by Growth, Trends and Forecast from 2025 to 2035

PVC Packing Straps Market Report – Key Trends & Forecast 2025 to 2035

PV Micro Inverters Market Trends & Forecast 2025 to 2035

PV Inverter Market Analysis by Product, Phase, Connectivity, Nominal Power Output, Nominal Output Voltage, Application, and Region through 2035

Market Share Insights of PVC-Free Cap Liner Manufacturers

Leading Providers & Market Share in PVC Tapes Industry

PVC Cling Wrap Market Trends & Growth Forecast 2024-2034

PVC Blister Packs Market

PVC Container Market

PVC-Free Packaging Market

PVC-free Cap Liners Market

PVDC Food Packaging Market

PVC Cling Film Market Size and Share Forecast Outlook 2025 to 2035

PVDC Coated Film Market Growth and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA