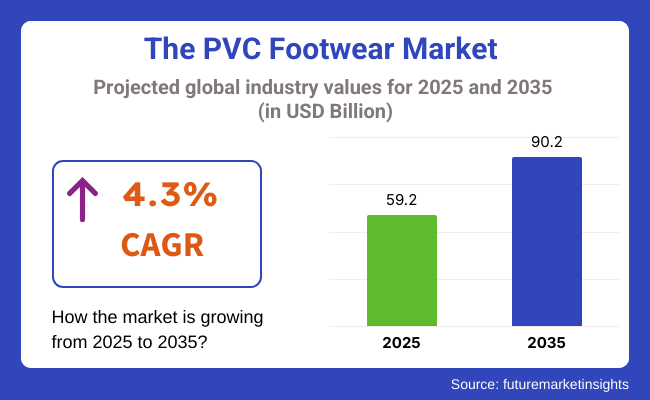

The global PVC footwear market was USD 59.2 billion in 2025 and is expected to reach a 4.3% CAGR during 2025 to 2035. The valuation size is expected to be USD 90.2 billion in 2035. Constant demand for low-price, water-resistant, and inexpensive-to-make footwear across the globe, especially in developing economies where price is one of the most important considerations.

PVC (polyvinyl chloride) has become a popular material in the manufacture of various footwear, including rain boots, sandals, working shoes, and casuals, because it is strong, low-cost in production, and flexible. Demand in tropical and monsoon climates where waterproofing becomes critical is high. Urbanization and the development of infrastructure also explain the demand for PVC working shoes and boots for industrial use.

With style blurring with function, the industry is evolving from lackluster utility to design-oriented offerings. Companies are adding bold colors, ergonomic molds, and trendy silhouettes to their PVC ranges. The shift is helping acquire momentum in fashion and leisure segments, particularly with Gen Z and millennial consumers who appreciate visual value and value for money.Technological developments in plasticizers and non-toxic additives have enhanced the softness and flexibility and reduced environmental impact.

Moreover, manufacturers, with increasing pressure on sustainability, are also searching for recyclable and biodegradable PVC substitutes. These developments are directed towards minimizing the environmental impact of PVC products and achieving international standards of sustainability.

Retailing dynamics are also shifting, with mass distribution networks and internet channels speeding access to a widened consumer base. Firms investing in responsive supply chains, responsive inventory models, and effective last-mile delivery networks are poised to gain a competitive advantage in reaching price-sensitive but quality-focused customers in rural and urban regions.

In 2025, the industry will be dominated by shoes, which were projected to take 49.6% share, followed by flip flops with 28.4%. PVC (polyvinyl chloride) footwear has emerged as a favored and typical choice mainly because it is cheaper, more durable, and cared for easily, making it a preferred choice among both day-to-day usage and occasional wearing.

Key leaders will include shoes made of PVC because of their common usage across casual, formal, and work-related purposes. People like PVC shoes if they are waterproof because they may be used during wet seasons and environments.

Lightweight and comfortable in their slip-on designs by Crocs, a popular brand, and stylish and eco-friendly designs of PVC-produced shoes by Melissa, a worldwide footwear brand, both have successful collection lines that include PVC. Even big brands like Nike or Adidas have also involved themselves in these PVC footwear collections, mostly to deliver durable sports shoes and slides featuring water-resistant properties.

Flip flops account for 28.4% of the share and remain the core products of the PVC footwear industry. Flip flops are popular due to their comfort and breathability; they are easy to use, especially for coastal or tropical climates.

Hence, brands such as Havaianas, a Brazilian brand famous because of its durable and colorful flip flops, and Ipanema, another Brazilian brand known for its stylish PVC flip flops, have used the benefit of PVC attributed to durability and lightness.

Old Navy offers some PVC flip-flops available for a larger consumer base at quite reasonable price points. These types of flip flops are known for their durability, especially in pool and beach settings, environments with a lot of water.

In 2025, offline sales will be dominant, accounting for 77.1% of the share, while online channels will contribute to 22.9% of the industry. Offline sales remain the largest distribution channel for PVC footwear due to the product nature and consumer buying behavior. Shoe retail outlets, supermarkets, and departmental stores are ideal outlets, as they provide customers with an opportunity to see, touch, and try on the footwear before purchase.

Such tactile experiences become even more crucial for purchasing PVC shoes and flip-flops, where fitting, comfort, and style are the main deciding factors. National retailers such as Walmart, Target, and Foot Locker are major players in the offline channel, providing a variety of PVC footwear selections, from casual flip-flops to more niche-generated designs for certain occasions. Instore marketing strategies such as seasonal promotions and displays of PVC shoes and flip-flops also encourage consumer purchase decisions at brick-and-mortar stores, which increases impulse buying.

Online sales accounts for 22.9% of the share. The comfort of shopping from home, together with online-exclusive deals and wider selections of styles and sizes, has further tilted consumer attention toward shopping online.

E-commerce giants like Amazon and eBay, together with niche footwear retailers like Zappos, spur the sales of PVC footwear. Online stores are immensely favored by the younger generation, who are more knowledgeable about technology due to the convenience of home delivery and easy returns. Furthermore, online platforms tend to offer suggestions based on their recent activities and promotions designed for them, boosting their shopping experience.

When it comes to PVC shoes, demand building is even because of its functional appeal as a shoe type for work purposes and daily life. It's very cost-sensitive, especially among nations where thriftiness rules above high-end image branding. Still, stylish variants within budgeting are helping revive the category as a value fashion choice.

Product differentiation is more and more focused on ergonomics, safety characteristics, and eco-friendliness claims. Consumers in industrial or wet conditions consider aspects such as sole grip, foot support, and longer wearability. Sensitivity to such features is very high, encouraging ongoing product innovation by manufacturers.Compliance is emerging as a critical purchasing criterion as well.

Regulatory agencies are giving priority to reducing toxic chemicals employed in plastic material, and buyers are aligning themselves with suppliers to meet safety, environmental, and quality standards. It applies especially in export-oriented manufacturing belts.

The industry is subject to several strategic and environmental risks that can affect its stability in the long term. The most critical of them is the material's environmental impact. While inexpensive and durable, PVC is an oil-based plastic with significant recycling issues. Growing environmental regulations and consumer awareness may induce a ban on the use of PVC, forcing manufacturers to use more costly substitutes.

Supply chain volatility is also an issue, especially given the sector's reliance on petrochemicals and artificial raw materials. Volatility in crude oil prices, shifting chemical production regulations, and geopolitical conflicts can all influence input costs and disrupt production schedules, especially with leading emerging economies that are powerhouse manufacturers.

There is a threat of commoditization. As there is increased competition and thinning margins, especially in the lower market segment, brands are struggling to differentiate based on price alone. Without design innovation, green material substitution, ecogenreity, or branding innovation, the players will be commoditized. To neutralize this, R&D, green material choices, and user-centered design investment will be important to help continue staying relevant and at the leading edge.

From 2020 to 2024, the industry was fueled by the growing demand from consumers for low-cost, long-lasting, and waterproof footwear. The pandemic indirectly helped create greater demand since people were at home and in relaxed environments for longer periods, which increased demand for low-maintenance and comfortable footwear.

PVC, being light and water-resistant, became popular in indoor slippers as well as outdoor wear, such as sandals, slides, and rain boots. The simplicity of producing PVC shoes in a wide variety of styles, colors, and designs made it a sought-after option for consumers looking for diversity and personalization.

During the forecast period 2025 to 2035, the PVC footwear industry will transform with a still higher focus on sustainability. The utilization of biodegradable PVC, nature-based substitutes, and environmentally friendly production technologies will play a leading role.

In addition, innovative manufacturing technologies like 3D printing may enable more personalized and creative designs. Consumers will continue to look for versatile and trendy options that blend fashion and functionality, which will encourage brands to continue innovating with design and materiality. The application of smart technology in shoes, i.e., temperature-regulating materials and sensor-embedded soles, can become a trend, both among fashion and tech-savvy consumers.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Comfortable, waterproof shoes, affordability, durability, and growth in e-commerce. | Sustainability, advanced manufacturing technology, customization, and integration of smart technology. |

| Cost-conscious, practical consumers, casual consumers, and environmentally friendly consumers seek more economical alternatives. | Environmentally friendly consumers, technologically savvy consumers, and fashion-oriented consumers interested in sustainable and innovative footwear. |

| Waterproof, lightweight sandals, slides, rain boots, and slippers made from PVC. | Sustainable materials, biodegradable PVC, 3D-printed shoes with specially designed formulas, and smart technology compatibility (temperatures controlled by soles with sensors). |

| Internet commerce, online customization, and recycling production with PVC. | 3D-printing luxury production, luxury production, and smart shoe fabrics. |

| Green processes with recycling PVC integration are placed higher on the agenda. | Biodegradable PVC integration completely, green process-friendly plant material-based production, and zero-waste production. |

| Direct selling to the consumer through websites, websites, and retail outlets. | Omnichannel retailing, 3D printing, and luxury customization capabilities with websites. |

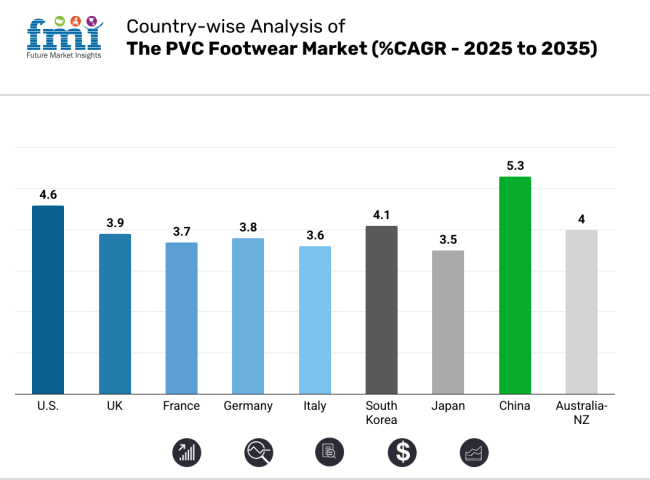

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.6% |

| UK | 3.9% |

| France | 3.7% |

| Germany | 3.8% |

| Italy | 3.6% |

| South Korea | 4.1% |

| Japan | 3.5% |

| China | 5.3% |

| Australia-NZ | 4.0% |

The USA is expected to witness a growth of 4.6% CAGR during the study. The increased consumer demand for water-resistant and durable footwear, along with the increasing demand for outdoor and casual wear fashion, is boosting product demand in the USA The versatility of PVC as a material, as well as its affordability, has contributed to it being a widely used material among manufacturers looking to offer fashionable but affordable footwear.

The urban dweller trend and the growing emphasis on comfort and convenience have been factors in the increased popularity of synthetic footwear for both men and women. Additionally, stores and websites are expanding their product lines to include green and recyclable PVC shoes because consumers have begun turning toward eco-friendly choices.

It is most prevalent among young age groups, which are highly sensitive to eco-fashion trends. Through quality e-commerce platforms and targeted promotion campaigns, companies can access an even wider universe of consumers and further drive growth. In addition, collaborations among local fashion labels and global apparel brands have produced a surge of designer PVC sneakers, driving up the premium of the segment.

The UK is expected to witness growth at a 3.9% CAGR during the study period. Economic recovery, increasing fashion sentiment, and preference for weather-insensitive footwear are some of the key drivers. The low cost and low maintenance of this footwear make it particularly sought-after, aspects of which resonate with price-sensitive buyers. The environment in the UK, with periodic rain, also offers favorable situations for waterproof shoe adoption, propelling PVC-based products.

Sustainability is prioritized, pushing manufacturers to be innovative with eco-friendly and recyclable forms of PVC formulations. Regulatory pressures also see companies cutting the environmental impact of production processes, which has, in turn, driven investment in embracing circular economy initiatives.

Strong retail infrastructure and the growth of omnichannel strategies fuel the industry. As urbanization and immigrant populations influence fashion trends, consumers are looking more for diversified footwear styles, which is leading to steady growth throughout the forecast period.

France is expected to post a 3.7% CAGR during the study period. Local demand for fashionable yet economical footwear continues to increase, fueling the application of PVC shoes. Traditionally marked by high-quality leather shoes, France is also undergoing a transition as consumers-especially younger groups-embrace synthetic alternatives that adapt to casual lifestyles and modern styling preferences. PVC shoes are perfectly at home in this niche, offering functionality without compromising on style.

French fashion brands and mid-range labels are profiting from this trend by introducing PVC-based footwear lines that are both stylish and functional. The demand from the urban population for water-resistant and low-maintenance products is fueling the segment's growth. Sustainability initiatives are also emerging in a stronger light, and firms are considering bio-based PVC materials to cater to consumer demands and regulatory obligations.

Creative advertising campaigns and endorsement collaborations have been important in redefining consumer perception of synthetic products. Increased penetration of online retail channels further facilitates reach across the nation, especially in suburban and rural locations where offline options are scarce.

Germany is expected to expand at 3.8% CAGR in the forecast period. With Germany having one of the largest economies in Europe, it offers a healthy foundation for steady growth driven by rising demand for functional, durable shoes suitable for everyday use.

PVC footwear is gaining momentum in Germany because they are durable, water-resistant, and inexpensive to manufacture. German customers place a high value on comfort and quality, features that are increasingly met by modern footwear through advanced production techniques.

The manufacturers also access Germany's green consumers by manufacturing recyclable PVC and promoting more environmentally friendly production techniques. Top sports footwear brands' high visibility and organized retail channels also make the availability of PVC products more conspicuous and accessible.

Fashion and sports leisure fashion trends continue to dominate demand, especially in cities where fashion and functionality are sought equally. German trade fair exhibitions and product innovation exhibitions have also driven interest in synthetic shoe products. Urbanization and an increasing youth population over the next few years will continue to propel demand.

Italy will advance at 3.6% CAGR over the study period. Traditionally a stronghold for luxury footwear and leather, Italy is gradually experiencing a consumer preference shift as PVC shoes gain ground for being affordable and suitable for incorporation in casual apparel fashion today.

Italian consumers are more and more accepting of synthetic materials, particularly in metropolitan areas where convenience and trend-following are more important than traditional material preference. Trendy cities such as Milan are leading the way in broader use trends, and fashion designers are experimenting with PVC to create concept-based shoes for fashion lines.

The local shoe industry is responding by incorporating PVC into mass-budget lines that attract locals and tourists alike. The influence of online fashion sites and online media has popularized PVC footwear and made it easily available across the country. Climate variability also adds to the demand for water-resistant products. The industry is competitive due to the commonality of traditional footwear; PVC products are creating a niche that is expected to grow steadily during the forecast period.

South Korea is projected to expand at 4.1% CAGR over the study period. South Korea's fashion-conscious population and high level of digital connectivity are some of the key drivers. Consumers, particularly youth groups, are turning to products that possess an aesthetic quality as well as functionality. PVC footwear is usually launched in contemporary and style-driven designs that balance both considerations with weather resistance and low maintenance.

PVC's low and flexible cost structure helps facilitate fast production cycles to allow brands to keep up with movements in demand quickly. Sustainability issues are also at work, impacting both consumer activity and production methodology.

Domestic manufacturers are adding recyclable PVC products and environmentally friendly logos to help draw in the consumer who values doing the right thing. Sales penetration is led by the nation's robust e-commerce infrastructure, followed by support through social media and influencer efforts and supporting brand awareness. The popularity of K-fashion and its dissemination across the globe have been reflected in increased PVC footwear exports.

Japan is projected to grow at 3.5% CAGR during the study period. Consumers in Japan value quality, precision, and neat design, qualities that have become increasingly dominant in recent footwear launches.

Although traditionally dominated by leather and fabric footwear, the industry is gradually embracing synthetic counterparts, especially for casual and utility footwear. Increasing numbers of older people and consumer demand for comfort-oriented products have driven up demand for lightweight, slip-resistant shoes-ground in which PVC dominates.

Moreover, fashion-oriented youth are experimenting with contemporary and minimalist PVC styles that appeal to streetwear aesthetics. Domestic brands enhance the style and functionality of PVC footwear. Seasonal rainfall and wetter conditions in a large part of Japan also contribute to the demand for waterproof and easy-to-maintain footwear. Retailers are also embracing omnichannel strategies to serve both urban and rural consumers, while product innovation and sustainability narratives are resonating with those ecologically conscious consumers.

China is expected to register a 5.3% CAGR during the period of study. As the largest manufacturing hub, China presents immense growth opportunities. The convergence of rising disposable incomes, urbanization, and heightened consciousness of fashion and usability is driving demand for affordable and usability-based footwear solutions. PVC footwear is benefiting from the trend due to its affordability and adaptation to varied climates and uses.

Chinese consumers increasingly welcome synthetic products offering comfort, water resistance, and fashion. Incentives from the government towards local production and export facilities also boost manufacturing capacity.

E-commerce continues to be the major distributor in town, with busy marketing campaigns and influencer alliances behind product awareness. As sustainability ranks high among China's policy and business agendas, investment in recyclable and biodegradable PVC alternatives gains traction. This dual focus on mass affordability and environmental responsibility is poised to solidify China's leadership in the production and consumption of PVC footwear.

The Australia-New Zealand region is expected to grow at 4.0% CAGR during the period of study. The area is witnessing increasing demand for functional, weather-resistant footwear, and PVC shoes are emerging as a more attractive option for both regular and seasonal use.

Concern on the part of consumers regarding product sustainability and value for money is driving purchasing decisions, and PVC footwear meets both needs with durability in construction and affordability. Consumers in urban cities like Sydney, Melbourne, and Auckland are shifting towards versatile footwear that meets both style and practicality needs.

Beachwear and casual segments have lightweight and waterproof shoes, which are a major favorite. In addition, the growing popularity of eco-fashion in the region is making firms introduce sustainable PVC products with recycled content and environmentally friendly packaging. This penetration of e-commerce continues to rise, providing more choices and bigger brands for customers. Retailers adopt this trend by enhancing digital engagement and product range diversification online.

There is moderate fragmentation in the industry. Multinational brands and regional players are competing across value and premium segments. In the premium segment, Dr. Martens Plc leads with the offer of durable and stylish PVC footwear.

At the same time, Decathlon has a foothold in mass-market segments through its inexpensive and practical options under a host of brands. VKC Group, Liberty Shoes, and Khadim India Ltd cover a fair amount of share in South Asia by providing inexpensive PVC footwear for both urban and rural populations.

Havaianas and Grendene use their brand strength in the casual footwear segment in Latin America and some parts of Asia. This is mainly with sandals and flip-flops made of PVC materials. Bata Corporation continues to dominate through a mix of affordable looks and world-brand recognition, reaching out to a wide range of population segments.

Ajanta Shoes and Thinge Shoes Company are meanwhile trying to compete on mass-market penetration by offering competitively priced PVC footwear. The markets continue to thrive on the undercurrents of low cost, durability, and changing tastes, keeping the wheels generated by competition from players who ever seek to go ahead of their researchers by innovative pricing and distribution effectiveness.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Dr. Martens Plc | 14-16% |

| Decathlon | 12-14% |

| Havaianas (Alpargatas) | 10-12% |

| VKC Group | 8-10% |

| Bata Corporation | 7-9% |

| Other Players | 39-43% |

Key Company Insights

Dr. Martens Plc blends style with durability while retaining a premium position to enjoy higher margins even in a price-sensitive category of materials. The edgy, fashion-forward designs continue to appeal to younger consumers who seek footwear, making a statement with practical functionality. On the contrary, Decathlon targets outdoor, leisure, and budget consumers through volume-driven strategies, making cheap PVC footwear available across its wide retail network.

Regional champions VKC Group, Khadim India Ltd., and Liberty Shoes are focused on price competitiveness and extensive distribution networks, mainly for Tier 2 and Tier 3 markets. Products from the Havaianas and Grendene brands are introduced under the PVC lifestyle and casual wear markets, primarily relying on brand and design differentiation as the main tools for competition.

Bata Corporation has managed to continue to offer products that marry mass appeal with a good brand image, holding a firm grip across developing and developed markets. In the future, trendiness and sustainability will increasingly determine the success of products in the traditionally price-driven PVC footwear industry.

The segment is into shoes, flip-flops, and other products.

The segmentation is into Offline and Online channels.

The regions covered include North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa (MEA).

The industry valuation is expected to reach USD 59.2 billion in 2025.

The valuation is projected to grow to USD 90.2 billion by 2035.

The market is expected to grow at a CAGR of approximately 5.3% during the forecast period.

Shoes are a key segment in the PVC footwear market.

Key players include Dr. Martens Plc, Decathlon, VKC Group, Havaianas (Alpargatas), Bata Corporation, Grendene, Liberty Shoes, Khadim India Ltd, Ajanta Shoes, Thinge Shoes Company, and other players.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Pairs) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 4: Global Market Volume (Pairs) Forecast by Product, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 6: Global Market Volume (Pairs) Forecast by Distribution Channel, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Pairs) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 10: North America Market Volume (Pairs) Forecast by Product, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 12: North America Market Volume (Pairs) Forecast by Distribution Channel, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Pairs) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 16: Latin America Market Volume (Pairs) Forecast by Product, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 18: Latin America Market Volume (Pairs) Forecast by Distribution Channel, 2019 to 2034

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Europe Market Volume (Pairs) Forecast by Country, 2019 to 2034

Table 21: Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 22: Europe Market Volume (Pairs) Forecast by Product, 2019 to 2034

Table 23: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: Europe Market Volume (Pairs) Forecast by Distribution Channel, 2019 to 2034

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: East Asia Market Volume (Pairs) Forecast by Country, 2019 to 2034

Table 27: East Asia Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 28: East Asia Market Volume (Pairs) Forecast by Product, 2019 to 2034

Table 29: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 30: East Asia Market Volume (Pairs) Forecast by Distribution Channel, 2019 to 2034

Table 31: South Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia Market Volume (Pairs) Forecast by Country, 2019 to 2034

Table 33: South Asia Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 34: South Asia Market Volume (Pairs) Forecast by Product, 2019 to 2034

Table 35: South Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 36: South Asia Market Volume (Pairs) Forecast by Distribution Channel, 2019 to 2034

Table 37: Oceania Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: Oceania Market Volume (Pairs) Forecast by Country, 2019 to 2034

Table 39: Oceania Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 40: Oceania Market Volume (Pairs) Forecast by Product, 2019 to 2034

Table 41: Oceania Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 42: Oceania Market Volume (Pairs) Forecast by Distribution Channel, 2019 to 2034

Table 43: MEA Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: MEA Market Volume (Pairs) Forecast by Country, 2019 to 2034

Table 45: MEA Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 46: MEA Market Volume (Pairs) Forecast by Product, 2019 to 2034

Table 47: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: MEA Market Volume (Pairs) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Pairs) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 9: Global Market Volume (Pairs) Analysis by Product, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 13: Global Market Volume (Pairs) Analysis by Distribution Channel, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 16: Global Market Attractiveness by Product, 2024 to 2034

Figure 17: Global Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Product, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Pairs) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 27: North America Market Volume (Pairs) Analysis by Product, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 31: North America Market Volume (Pairs) Analysis by Distribution Channel, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 34: North America Market Attractiveness by Product, 2024 to 2034

Figure 35: North America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Product, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Pairs) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 45: Latin America Market Volume (Pairs) Analysis by Product, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 49: Latin America Market Volume (Pairs) Analysis by Distribution Channel, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Product, 2024 to 2034

Figure 53: Latin America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 56: Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 57: Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Europe Market Volume (Pairs) Analysis by Country, 2019 to 2034

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 63: Europe Market Volume (Pairs) Analysis by Product, 2019 to 2034

Figure 64: Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 66: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 67: Europe Market Volume (Pairs) Analysis by Distribution Channel, 2019 to 2034

Figure 68: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 70: Europe Market Attractiveness by Product, 2024 to 2034

Figure 71: Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: East Asia Market Value (US$ Million) by Product, 2024 to 2034

Figure 74: East Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 75: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: East Asia Market Volume (Pairs) Analysis by Country, 2019 to 2034

Figure 78: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: East Asia Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 81: East Asia Market Volume (Pairs) Analysis by Product, 2019 to 2034

Figure 82: East Asia Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 83: East Asia Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 84: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 85: East Asia Market Volume (Pairs) Analysis by Distribution Channel, 2019 to 2034

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 88: East Asia Market Attractiveness by Product, 2024 to 2034

Figure 89: East Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 90: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia Market Value (US$ Million) by Product, 2024 to 2034

Figure 92: South Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 93: South Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia Market Volume (Pairs) Analysis by Country, 2019 to 2034

Figure 96: South Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 99: South Asia Market Volume (Pairs) Analysis by Product, 2019 to 2034

Figure 100: South Asia Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 101: South Asia Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 102: South Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 103: South Asia Market Volume (Pairs) Analysis by Distribution Channel, 2019 to 2034

Figure 104: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 105: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 106: South Asia Market Attractiveness by Product, 2024 to 2034

Figure 107: South Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 108: South Asia Market Attractiveness by Country, 2024 to 2034

Figure 109: Oceania Market Value (US$ Million) by Product, 2024 to 2034

Figure 110: Oceania Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 111: Oceania Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: Oceania Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: Oceania Market Volume (Pairs) Analysis by Country, 2019 to 2034

Figure 114: Oceania Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: Oceania Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: Oceania Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 117: Oceania Market Volume (Pairs) Analysis by Product, 2019 to 2034

Figure 118: Oceania Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 119: Oceania Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 120: Oceania Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 121: Oceania Market Volume (Pairs) Analysis by Distribution Channel, 2019 to 2034

Figure 122: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 123: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 124: Oceania Market Attractiveness by Product, 2024 to 2034

Figure 125: Oceania Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 126: Oceania Market Attractiveness by Country, 2024 to 2034

Figure 127: MEA Market Value (US$ Million) by Product, 2024 to 2034

Figure 128: MEA Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 129: MEA Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: MEA Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: MEA Market Volume (Pairs) Analysis by Country, 2019 to 2034

Figure 132: MEA Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: MEA Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: MEA Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 135: MEA Market Volume (Pairs) Analysis by Product, 2019 to 2034

Figure 136: MEA Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 137: MEA Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 138: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 139: MEA Market Volume (Pairs) Analysis by Distribution Channel, 2019 to 2034

Figure 140: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 141: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 142: MEA Market Attractiveness by Product, 2024 to 2034

Figure 143: MEA Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: MEA Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PVC UV Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

PVC Cling Film Market Size and Share Forecast Outlook 2025 to 2035

PVC Tapes Market Size and Share Forecast Outlook 2025 to 2035

PVC Packing Straps Market Report – Key Trends & Forecast 2025 to 2035

Market Share Insights of PVC-Free Cap Liner Manufacturers

Leading Providers & Market Share in PVC Tapes Industry

PVC Cling Wrap Market Trends & Growth Forecast 2024-2034

PVC Blister Packs Market

PVC Container Market

PVC-Free Packaging Market

PVC-free Cap Liners Market

Non PVC Plasticizers Market Growth & Outlook 2022 to 2032

Rewritable PVC Cards Market

Residential PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

PVC Packaging Film Market from 2024 to 2034

Footwear Adhesives Market

Dog Footwear Market Size and Share Forecast Outlook 2025 to 2035

Vegan Footwear Market Insights - Demand & Forecast 2025 to 2035

Luxury Footwear Market Outlook – Size, Share & Innovations 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA