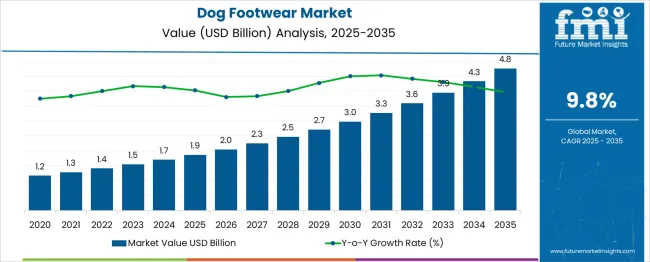

The dog footwear market is projected to grow from USD 1.9 billion in 2025 to USD 4.8 billion by 2035, generating an absolute gain of USD 2.9 billion and a growth multiplier of 2.53x over the decade. Supported by a CAGR of 9.8%, this growth is driven by increasing pet ownership, a growing focus on pet wellness, and rising consumer spending on premium pet accessories. During the first five years (2025–2030), the market is expected to expand from USD 1.9 billion to USD 3.0 billion, adding USD 1.1 billion, which accounts for 38% of the total incremental growth, with a 5-year multiplier of 1.58x. The second phase (2030–2035) contributes USD 1.8 billion, representing 62% of incremental growth, reflecting continued momentum as pet owners prioritize dog comfort and protection, especially in urban environments. Annual increments increase from USD 0.2 billion in early years to USD 0.4 billion by 2035, indicating steady growth. Manufacturers focusing on breathable, durable, and fashion-forward designs will capture the largest share of this USD 2.9 billion opportunity, as the market for premium and health-focused pet products continues to expand globally.

| Metric | Value |

|---|---|

| Dog Footwear Market Estimated Value in (2025 E) | USD 1.9 billion |

| Dog Footwear Market Forecast Value in (2035 F) | USD 4.8 billion |

| Forecast CAGR (2025 to 2035) | 9.8% |

The dog footwear market is witnessing increasing traction as pet humanization trends grow and consumers seek advanced protective solutions for their companion animals. With a focus on paw health, protection from extreme weather conditions, and hygiene maintenance during outdoor activities, the demand for pet shoes has expanded across urban and suburban demographics. Key market drivers include the rising adoption of pets in both developed and developing economies, combined with the growing influence of premium pet care lifestyles.

Technological advancements in breathable, weather-resistant materials and ergonomic design have further supported market expansion. Moreover, veterinary recommendations for orthopedic and post-surgery footwear are positively influencing the adoption of functional footwear for dogs.

The integration of fashion with functionality is also encouraging manufacturers to diversify offerings for various dog sizes and activity needs. In the forecast period, increased spending on pet apparel, rising climate awareness, and the expanding base of e-commerce-enabled pet retail are expected to sustain the market’s growth trajectory across all major regions.

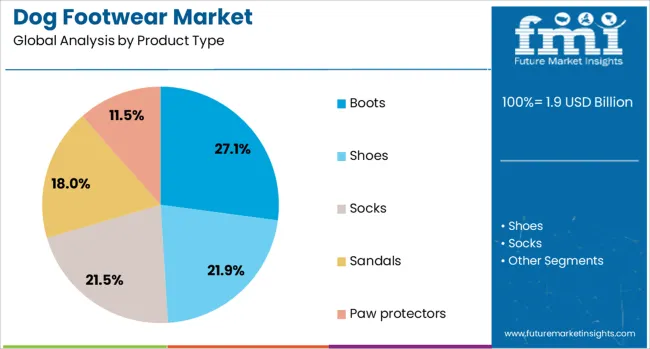

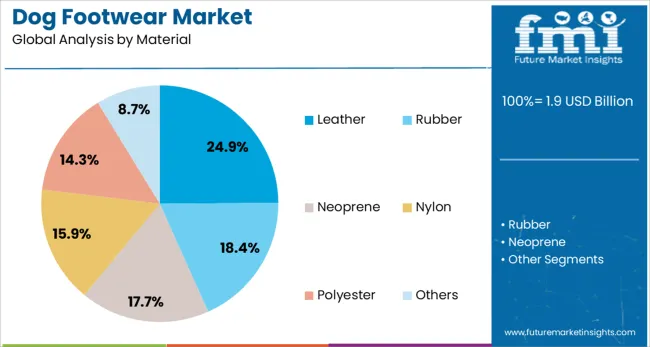

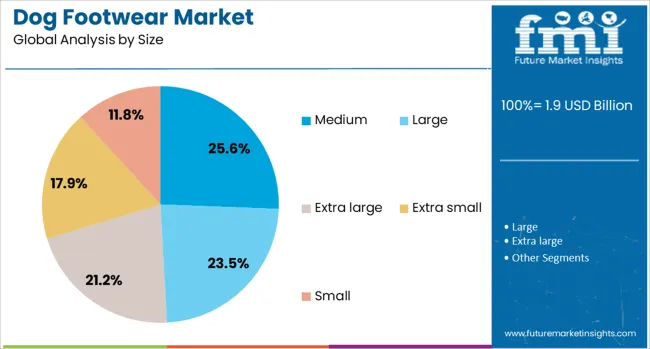

The dog footwear market is segmented by product type, material, size, dog age, price rangeend use, and geographic regions. By product type, the dog footwear market is divided into Boots, Shoes, Socks, Sandals, Paw protectors. In terms of material, the market is classified into Leather, Rubber, Neoprene, Nylon, Polyester, Others. Based on size, the market is segmented into Medium, Large, Extra large, Extra Small. By dog age, the market is segmented into Adult, Senior, and Puppy. By price range, the market is segmented into Medium, High, Low. By end use, the market is segmented into Individual, pet owner, Professional. Regionally, the dog footwear industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The boots segment is expected to account for 27.1% of the dog footwear market revenue in 2025, establishing its position as the leading product type. The dominance of this segment is being attributed to its superior coverage, which offers enhanced protection from heat, snow, ice, and rough terrains. The growing concern among pet owners regarding paw injuries during outdoor activities has supported the demand for high-coverage solutions like boots.

Their multi-seasonal utility has driven consistent adoption across geographies with varied climatic conditions. Furthermore, the inclusion of non-slip soles, padded interiors, and easy-fastening mechanisms has improved wearer comfort and retention, making them suitable for long-duration use.

The segment’s leadership is also reinforced by increasing visibility on online retail platforms where boots are prominently marketed as both functional and stylish. The durability of boots and their compatibility with active breeds and senior dogs have contributed to their wide acceptance, sustaining their share in the competitive landscape of canine footwear.

Leather material is projected to contribute 24.9% of the total revenue in the dog footwear market by 2025. This material's dominance is being supported by its natural resilience, water resistance, and premium aesthetic appeal, which resonate strongly with pet owners seeking quality and durability. Leather footwear has gained popularity for providing a secure fit while allowing natural paw movement, making it favorable for dogs with sensitive paws or skin allergies.

Its long-lasting nature reduces frequent replacement, positioning it as a sustainable investment for pet care. Additionally, the growing demand for handcrafted and eco-conscious pet products has supported the revival of leather as a preferred material in premium footwear ranges.

Leather's adaptability to custom stitching, padding, and ventilation also allows enhanced product innovation across different sizes and usage requirements. As pet owners increasingly look for both functional and luxurious products, leather remains a prominent material category in high-end pet footwear collections.

The medium size segment is forecast to hold 25.6% of the dog footwear market’s total revenue in 2025, reflecting its widespread relevance across multiple breeds. This segment's leadership is being driven by the high population of medium-sized dogs globally, which includes many of the most commonly owned pet breeds. Footwear for this category benefits from a balanced product design that accommodates both activity-focused and comfort-oriented applications.

Manufacturers are prioritizing this segment with innovations tailored to agility, traction, and fit that meet the demands of urban and suburban pet lifestyles. Additionally, veterinary and grooming service providers have emphasized the importance of paw hygiene and injury prevention for medium-sized dogs, further encouraging the use of protective footwear.

The availability of diverse styles and materials specifically suited to medium-sized breeds has allowed strong retail penetration. With increased customization, improved sizing standards, and broader brand focus, the segment continues to see high demand and repeat purchases from pet owners worldwide.

The dog footwear market is expanding due to the growing demand for pet care products. Key growth drivers include increasing pet ownership and the rising awareness of pet health and comfort. Opportunities lie in the growing preference for fashionable and functional pet accessories. Emerging trends include eco-friendly materials and designs. However, market restraints such as high product prices and the limited consumer awareness in developing regions may hinder further growth in the coming years.

The major growth driver in the dog footwear market is the rising trend of pet ownership. By 2024, the number of households with pets increased, which in turn fueled demand for products that enhance pet well-being, including footwear. With owners becoming more conscious of their pets' comfort, especially for outdoor activities, the need for high-quality, durable dog shoes is anticipated to continue growing in 2025, supporting the market’s expansion.

Opportunities in the dog footwear market are emerging from the demand for both fashionable and functional designs. In 2024, more pet owners began choosing dog shoes not only for comfort but also for style. The increasing trend of accessorizing pets has provided manufacturers with an opportunity to create trendy yet functional products. By 2025, the rise in customized and aesthetically pleasing designs is expected to further fuel market growth, especially among high-income pet owners.

An emerging trend in the dog footwear market is the shift toward eco-friendly materials. In 2024, more manufacturers started incorporating sustainable materials in their products, reflecting pet owners' growing concern for the environment. Recycled fabrics and biodegradable components are gaining popularity due to their environmental benefits. As consumers become increasingly aware of environmental issues, it is expected that this trend will continue to grow, particularly in the premium pet care segment by 2025.

Major restraints in the dog footwear market include high product prices and limited awareness in developing markets. In 2024, premium pricing and the perception that dog footwear is a luxury product prevented broader adoption, particularly among middle-income households. Additionally, limited awareness in regions outside of developed markets slowed expansion. These factors are expected to remain challenges for market growth through 2025, especially in emerging economies where pet care products are less established.

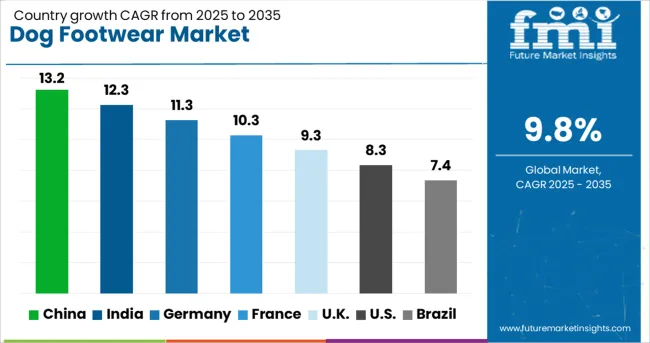

| Country | CAGR |

|---|---|

| China | 13.2% |

| India | 12.3% |

| Germany | 11.3% |

| France | 10.3% |

| UK | 9.3% |

| USA | 8.3% |

| Brazil | 7.4% |

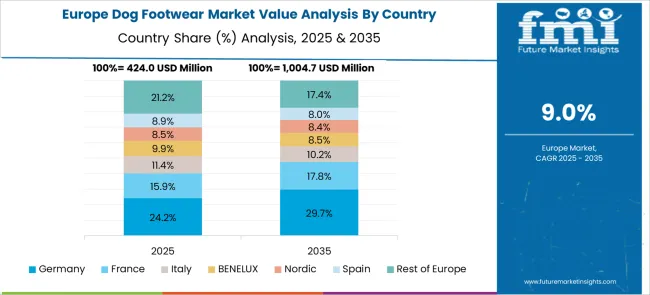

The global dog footwear market is projected to grow at a CAGR of 9.8% from 2025 to 2035. China leads with a growth rate of 13.2%, followed by India at 12.3%, and Germany at 11.3%. The United Kingdom records a growth rate of 9.3%, while the United States shows the slowest growth at 8.3%. These differences in growth rates are driven by various factors, including rising pet ownership, increasing awareness about pet health and comfort, and evolving consumer preferences for pet care products. Emerging markets like China and India are witnessing higher growth due to increasing disposable incomes and a rising trend of pet pampering, while mature markets like the USA and the UK experience steadier growth due to market saturation and established pet care markets.

The dog footwear market in China is experiencing significant growth, with a projected CAGR of 13.2%. As the country’s pet industry continues to expand, especially in urban areas, the demand for dog accessories like footwear is increasing. Pet owners are becoming more conscious of the comfort and safety of their pets, driving the demand for protective dog footwear. Furthermore, China’s rising disposable income and pet humanization trends, where pets are seen as family members, contribute significantly to market growth. The increase in outdoor activities and urban living, where pets are exposed to different environments, is also fueling the adoption of dog footwear.

The dog footwear market in India is projected to grow at a CAGR of 12.3%. India’s growing middle class, increasing pet ownership, and the rising trend of pampering pets with high-quality products are key factors driving the market. Pet owners are becoming more concerned about their pets’ comfort, especially in harsh weather conditions, increasing the demand for dog footwear. Additionally, urbanization and the increasing number of pets in cities where outdoor environments can be challenging for dogs further contribute to the market’s growth. The rise in e-commerce platforms also makes dog footwear more accessible to consumers across the country.

The dog footwear market in Germany is expected to grow at a CAGR of 11.3%. Germany, known for its strong pet care culture, continues to see steady demand for high-quality pet products, including dog footwear. German pet owners are increasingly seeking functional and stylish footwear to protect their pets from harsh weather conditions, especially in colder months. With a high level of awareness regarding pet health and safety, Germany's demand for dog footwear is expected to rise steadily. Additionally, the strong retail infrastructure, along with growing online sales, further supports the adoption of pet footwear in the country.

The dog footwear market in the United Kingdom is projected to grow at a CAGR of 9.3%. The UK is experiencing a growing trend of pet owners treating pets as family members, which is driving the adoption of premium pet products like footwear. As pet humanization increases, the demand for comfortable and durable footwear to protect pets from various environmental conditions is rising. The UK is also witnessing increased interest in outdoor activities, where protective footwear for pets is becoming more common. However, growth is slightly slower than in emerging markets due to the market's maturity.

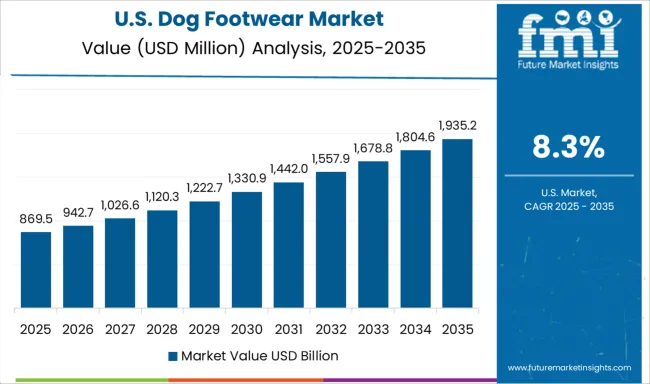

The dog footwear market in the United States is expected to grow at a CAGR of 8.3%. While the USA market is more mature, the increasing focus on pet comfort and safety continues to drive demand for dog footwear, especially for outdoor activities and protection from extreme weather conditions. Pet humanization trends, where pets are considered family members, contribute to the steady growth of the market. Additionally, the rise in e-commerce and online shopping platforms ensures that dog footwear is easily accessible to a broad consumer base, sustaining market demand despite slower growth compared to emerging markets.

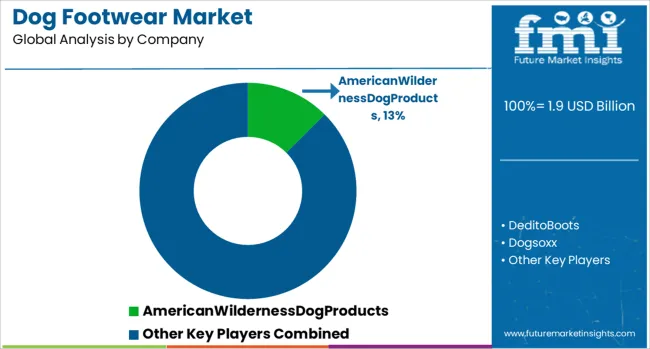

The dog footwear market is dominated by American Wilderness Dog Products, which leads with its durable and high-performance dog boots designed for outdoor activities, protection from rough terrain, and environmental factors. American Wilderness Dog Products' dominance is supported by its innovative designs and materials that ensure comfort, flexibility, and protection for pets during hiking, running, and other outdoor adventures. Key players such as Ruffwear, PetSafe Brands, and Qumy maintain significant market shares by offering a variety of dog footwear solutions, including waterproof boots, anti-slip shoes, and paw protectors, tailored to different dog breeds and activity levels. These companies focus on providing high-quality, reliable products that enhance pet mobility while ensuring their safety and comfort.

Emerging players like Dedito Boots, Dogsoxx, Neewa USA, and RocketDog are expanding their market presence by offering specialized dog footwear designed for specific needs such as winter protection, therapeutic support, and fashion-forward designs. Their strategies include focusing on customizable, eco-friendly materials and targeting regional markets with cost-effective products. Market growth is driven by increasing pet ownership, growing awareness of pet health and safety, and the rise in outdoor activities and travel with pets. Innovations in materials, including breathable fabrics and traction-enhancing soles, are expected to further shape competitive dynamics and provide growth opportunities in the global dog footwear market.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Product Type | Boots, Shoes, Socks, Sandals, and Paw protectors |

| Material | Leather, Rubber, Neoprene, Nylon, Polyester, and Others |

| Size | Medium, Large, Extra large, Extra small, and Small |

| Dog Age | Adult, Senior, and Puppy |

| Price Range | Medium, High, and Low |

| End Use | Individual pet owner and Professional |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AmericanWildernessDogProducts, DeditoBoots, Dogsoxx, LitianSocks, NeewaUSA, PetSafeBrands, Qumy, RenaPetProducts, Rifruf, RocketDog, Ruffwear, RukkaPets, ShanghaiChiguangIndustry, YeshiSocks, and ZoofProducts |

| Additional Attributes | Dollar sales by footwear type and application, demand dynamics across fashion, protection, and therapeutic sectors, regional trends in dog footwear adoption, innovation in materials for comfort and durability, impact of regulatory standards on safety and pet health, and emerging use cases in outdoor activities and medical rehabilitation. |

The global dog footwear market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the dog footwear market is projected to reach USD 4.8 billion by 2035.

The dog footwear market is expected to grow at a 9.8% CAGR between 2025 and 2035.

The key product types in dog footwear market are boots, shoes, socks, sandals and paw protectors.

In terms of material, leather segment to command 24.9% share in the dog footwear market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dog Treat Launcher Market Size and Share Forecast Outlook 2025 to 2035

Dog Training Equipment Market Size and Share Forecast Outlook 2025 to 2035

Dog Vaccine Market Size and Share Forecast Outlook 2025 to 2035

Dog Food Market Analysis - Size, Share, and Forecast 2025 to 2035

Dog Intestinal Health Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Dog Food and Snacks Market Size and Share Forecast Outlook 2025 to 2035

Dog Float Market Size and Share Forecast Outlook 2025 to 2035

Dog Gates, Doors, & Pens Market Analysis - Trends, Growth & Forecast 2025 to 2035

Dog Collars Market Analysis - Trends, Growth & Forecast 2025 to 2035

Dog Safety Leash Market Analysis - Trends, Growth & Forecast 2025 to 2035

Dog Dental Chews Market Analysis by Product Type, Age, Flavor, Application and Sales Channel Through 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Competitive Overview of Dog Gates, Doors and Pens Companies

Dog Food Topper Market Analysis - Size, Share, and Forecast 2024 to 2034

Dog Food Flavours Market

Footwear Adhesives Market

PVC Footwear Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Vegan Dog Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Footwear Market Insights - Demand & Forecast 2025 to 2035

Luxury Footwear Market Outlook – Size, Share & Innovations 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA