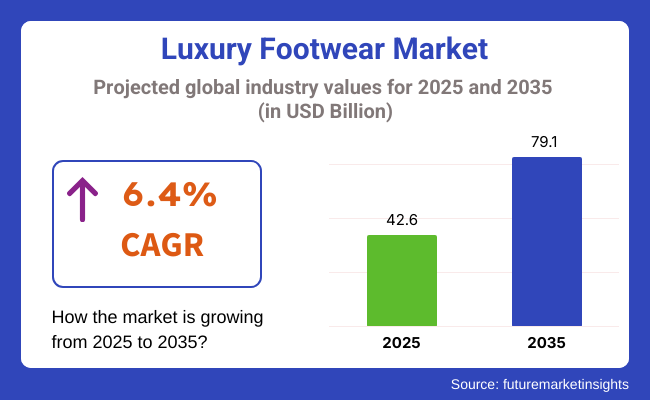

The size of the global luxury footwear market is expected to be USD 42.6 billion in 2025 and is anticipated to grow at a 6.4% CAGR during the forecast period of 2025 to 2035. The global industry is expected to reach USD 79.1 billion in 2035. One of the major growth drivers is the rising high-net-worth base and rising cultural correlation of footwear with identity, status and style-conscious individuality.

The demand for luxury footwear has boomed as mature and emerging economies' fashion-conscious consumers treat high-end shoes not just as practical accessories but also as fashion statements, signs of taste and exclusivity, and declarations of lifestyle. It is a world trend across men's, women's, and unisex categories in which limited-series collections, hand-finishing and fashion-conscious silhouettes drive purchasing behavior.

Luxury sneakers have especially revolutionized casual wear into a top revenue earner, especially with newer affluent youth consumers. Digital acceleration is transforming the luxury retail model. Online and Omni channel experiences are now the center of customer engagement, with virtual try-ons, online exclusives and personalized styling becoming more popular. Brands also use NFTs and blockchain to verify ownership and enable resale, especially for collectible and limited-edition models.

Sustainability is no longer optional but mandatory. Consumers are more aware of material provenance, carbon impact and fair labor. Luxury brands are reacting by introducing circular economy strategies, biodegradable materials and transparent supply chains that make their eco-friendly credentials visible without compromising on luxury appeal.

Asia Pacific remains a vibrant growth driver, driven by a growing middle class, rising Western brand affinity, and globalization of high-fashion luxury. In contrast, North America and Europe are fortressed industries for entrenched luxury consumption. Brands must integrate storytelling, exclusivity, and innovation to stay in the game and keep pace with changing consumer values and global socio-economic change.

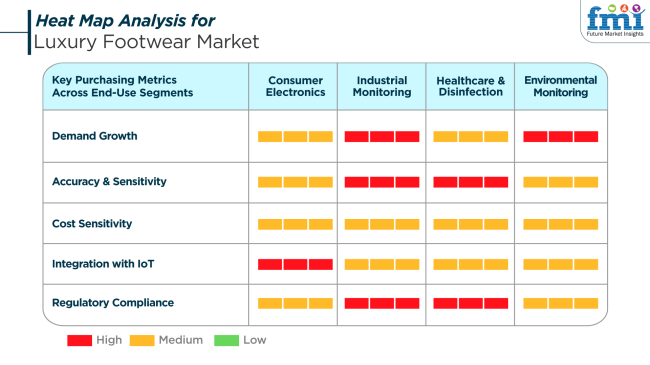

In the industry, consumer electronics integration has been manifested through smart insoles, app-enabled fit diagnostics, and digital customization tools. These innovations enhance the user experience by fusing comfort with advanced performance analytics. Brands targeting tech-forward consumers increasingly offer smart-enabled luxury models that bridge functionality with fashion.

From a healthcare and wellness lens, orthopedic design elements are being integrated into high-end footwear, addressing demands for support and anatomical precision without compromising aesthetics. This is particularly relevant in premium segments for older consumers or those with lifestyle health needs, making comfort an equally important luxury dimension.

Sustainability in environmental monitoring intersects with luxury footwear via green certifications, cruelty-free sourcing, and end-of-life product recyclability. With cost sensitivity relatively low in this segment, environmentally conscious consumers are willing to pay a premium for sustainability-aligned offerings. Brand narratives are increasingly centered around responsible luxury, positioning eco-innovation as both ethical and aspirational.

The industry is notably sensitive to macroeconomic fluctuations and shifts in discretionary spending. Economic downturns, inflationary pressures, or political instability can constrain consumer confidence, particularly among aspirational buyers. Even affluent consumers may pivot toward investment pieces over seasonal collections during uncertain times, slowing purchase frequency.

Another significant risk is the proliferation of counterfeit products, especially in the digital space. Online marketplaces and social media platforms have made it easier for counterfeiters to replicate and distribute high-end designs. This not only erodes brand equity but also challenges supply chain traceability and consumer trust.

The growing prioritization of authenticity, inclusivity, and environmental impact means that traditional luxury cues-exclusivity, price, and logo-are no longer sufficient. Brands must continuously evolve their identity to remain culturally relevant while maintaining their heritage and prestige. Failure to balance innovation with authenticity could lead to brand dilution or loss of generational loyalty.

Between 2020 and 2024, the high-end footwear business grew with respect to changes in consumer patterns, especially post-pandemic when people shifted their focus towards socializing, occasions, and high-end lifestyles. No matter the misfortune brought upon by COVID-19, the industry eventually rebounded with a strong emphasis on web sales and direct-to-consumer selling.

Comfort and flexibility became defining concerns, with luxury shoemakers beginning to attend to ergonomic forms as much as looks. Luxury sneakers, fashion sandals, and flats were trendy, with luxury comfort features such as memory foam soles, arch support, and cushion insoles.

From 2025 to 2035, the trend will be an even greater convergence of technology and sustainability. AI-driven design will allow businesses to offer bespoke shoes in sync with the wearer's size and fashion. Also, smart shoes with features like temperature, health monitoring, and activity monitoring can be an enormous vertical.

Green luxury goods involving green materials like plant-based and biodegradable products will be one of the major drivers as consumers become more and more inclined to demand green luxury goods. Virtual try-ons and augmented reality shopping experiences will also transform the manner in which luxury footwear is bought by consumers, fusing style and technology.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Post-pandemic recovery of luxury wear, e-commerce expansion, comfort, versatility, and sustainability trends. | Smart technology incorporation, highly customized footwear, sustainability, and eco-friendly consumerism. |

| Wealthy millennials and Gen Z are for casual luxury, customization, and sustainability. | Tech-conscious luxury buyers, environmentally friendly shoppers, and people looking for high-tech and eco-friendly fashion. |

| Luxury sneakers, multi-use sandals, high-end flats with comfort elements, and bespoke designs. | Intelligent footwear with built-in technology, customized luxury designs, and eco-friendly, sustainable materials. |

| E-commerce growth, virtual try-on, and influencer marketing for brand promotion. | Customization with AI, intelligent wearables, AR for virtual fitting, and incorporation of wearable technology into shoes. |

| Sustainable materials, responsible sourcing, and green packaging. | Employment of biodegradable materials, plant-based alternatives, and a circular economy model. |

| Online luxury platforms, direct-to-consumer sales, and high-end department stores. | Omnichannel retail, virtual fitting rooms, and AR-driven personalized shopping experiences. |

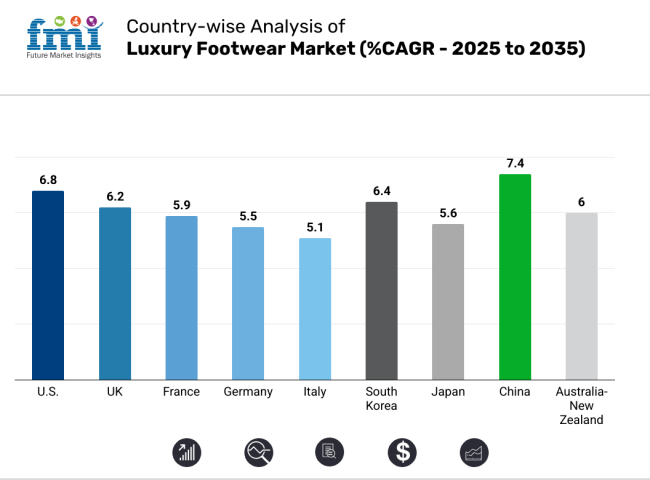

The USA industry will increase at 6.8% CAGR during the study period. As one of the largest luxury consumer industries globally, the USA remains a powerhouse in driving demand. Healthy consumer spending power, and a robust infrastructural desire for designer labels, fuels a high-ecosystem for existing international and upcoming luxury brands. Changing shopper attitude, especially from the youth population, is reframing the template.

There is a discernible trend towards eco-friendly materials, customization, and limited drops that reflect the overlap between technology and fashion. Online and omni-channel selling models have also contributed significantly to industry growth and availability. Partnerships with luxury fashion houses and American celebrities or social media influencers create significant industry momentum. Experiential luxury, where products offer more than mere functionality-status, beauty, and collectibility-continues to drive purchase decisions.

Resale sites for luxury products have also gained traction, enabling a circular luxury economy. With brands localizing inventory and marketing, the USA industry will remain a key contributor to global revenue through to 2035.

The UK industry will expand at 6.2% CAGR over the forecast period. The UK remains a bastion for luxury fashion, and London is a global fashion center. Luxury footwear demand is resistant to macroeconomic volatility, supported by robust tourism infrastructure and fashion-inclined culture embedded in the nation. British consumers are increasingly demanding craftsmanship, exclusivity, and sustainability-giving birth to the key pillars of the luxury sector.

As classic retailers in famous shopping streets continue to underpin the industry, digital transformation is reconfiguring consumer interaction. Luxury fashion has succeeded in combining e-commerce with profound digital experiences, underpinning strong growth online. The rise in demand for men's luxury footwear and increased interest in specialist designer brand names give depth to the industry.

Sustainability is a unifying note, with UK consumers turning to ethical production and traceable supply routes. Post-Brexit realities have changed trade flows, but the overall impact on consumer attitudes has been met through shrewd brand placement and local alliances. The UK industry remains poised for healthy growth in the decade ahead.

French industries will grow at a 5.9% CAGR during the study period. Being the hub of many heritage luxury brands, France is leading the world in luxury looks. Domestic consumption is boosted by national pride, and indigenous companies are preferred, while Paris-led foreign tourism boosts solid demand for high-quality shoes.

Traditional style, fine craftsmanship, and heritage play an important role in the home industry and maintain the home industry mature and vast. France's luxury shoe industry is more lively, as newer players come in with eco-friendly and fashionable offerings.

Customers are increasingly merging luxury with fashion casual, hence the popularity boost for hybrid footwear and designer sneakers. The innovation of direct-to-consumer channels and more focus by brands on digital storytelling has helped immensely to complement consumer engagement.

Although the industry is not expanding as rapidly as in North America or Asia-Pacific, its established base and existing fashion culture guarantee steady performance. Favorability towards sustainable fashion and eco-friendly consumers will continue to shape the direction of the French industry to 2035.

The German industry is expected to develop at a 5.5% CAGR over the period of analysis. Renowned for its dedication to quality and precision, Germany offers an elegant consumer segment looking for functionality with aestheticism in premium footwear. The industry is covered by emerging concern for environment-friendliness, craftsmanship, and increasing attractiveness of ecologically sustainable ec-luxury offerings, mostly led by urban and youthful consumers. Germany's robust economy and high disposable incomes are the basis for sustained investment in luxury goods.

Besides, the higher availability of global luxury brands across German cities and airports broadens industry accessibility. Online luxury buying has picked up pace, driven by strong logistics and a technologically savvy population. Consumers are becoming more sophisticated, with more focus on transparency and ethical sourcing.

Limited edition releases and customization are also becoming popular, especially in cities such as Berlin, Hamburg, and Munich. As prestige brands globalize and localize products and advertising campaigns to meet German tastes, the industry will experience moderate but consistent growth during the forecasting period.

Italy's industry is predicted to record a 5.1% CAGR over the research period. Italy's history of artisanal shoe production puts it firmly in the industry. Traditions based on leatherworks and bespoke production control the industry, and it remains a destination for quality-conscious buyers. Strong brand equity and international reputation support domestic brands, but the maturity of the industry temper growth.

Italian consumers show a liking for understated elegance and eternal style, frequently choosing enduring value in place of rapidly evolving fashions. Domestic consumption is firm, though foreign demand, particularly from Asia and North America, for Italian-produced luxury footwear underpins export-driven growth.

Digitization is slowly expanding the visibility of Italian brands, with increasing numbers of businesses committing to online sale channels and social media promotion. Yet, relative to other areas, digital uptake is more sluggish. Further focus on sustainability and traceability will also resonate with changing global desires well. Italy's role as a manufacturer and consumer of luxury footwear provides a balanced growth path through to 2035.

The South Korean industry will be growing at 6.4% CAGR during the forecast period. South Korea is a potential luxury industry of high fashion sensibility, digitally born consumers, and stylish pop culture. Individuals, especially metropolitan dwellers like Seoul and Busan, prefer niche and superior products actively and thereby have created demand for upper-class footwear.

Luxury pop-up shopping, collaboration with influencer endorsement by K-pop idols, and scarcity have driven intense brand activity. South Korea's exemplary e-commerce ecosystem enables high online penetration, with brands enjoying the capability of building exclusive drops with fast sell-through.

Growing demand for athleisure-laced luxury footwear and gender-neutral fashion is also being witnessed in the marketplace. A robust gifting culture and social differentiation culture further reinforced the demand for luxury buying. With consistent advertising spending by global giants and a developing taste for luxury craftsmanship, South Korea is a rapidly emerging industry for the next decade.

The Japanese industry will grow by 5.6% CAGR throughout the period of research. Japan's luxury sector is well known for perfection-seeking, detailing, and unmatched attention to craftsmanship. Luxury shoes are favored by high-quality material preferences and subtle sophistication. While previously conservative in orientation, Japan's industry is adopting newer trends, including luxury sneakers and green footwear. Tokyo and Osaka remain powerhouse luxury consumption centers sustained by local consumer spending and strong tourist volumes.

In contrast to Japan's overall aging, the young generation's high demand for high-end fashion counterbalances the population trend. Omnichannel retailing and personalized shopping are increasingly going mainstream, especially in concept and flagship stores. Consumers look to brands to maintain honesty, quality, and ethics. While expansion is moderate relative to other proximate Asian markets, Japan's high cultural affinity for luxury and customer loyalty make it a consistent contributor to regional industry performance through 2035.

The Chinese industry will grow at 7.4% CAGR throughout the forecast period. China remains the biggest and fastest-growing industry. Urban affluence, an expanding middle class, and an appetite for status spending have made it the main driver of international luxury sales. Shanghai, Beijing, and Shenzhen are cities that are hubs for heritage boutiques and advanced digital engagement. Digital technology is a key driver of China's luxury industry, with social commerce, livestreaming, and influencer marketing creating a strong ecosystem.

Luxury footwear is now universally regarded as an investment item and identity statement. Both formal and informal attire have demand, with specific interest in collaborations and bespoke-ings. Young consumers, especially, are especially influential, wanting authenticity and sustainability. As local touch points rise for luxury brands through pop-ups, regional exclusives, and locally-told stories, China's industry drive should remain unparalleled over the next decade.

Australia-New Zealand will witness a growth rate of 6% CAGR during the forecast period. Australia and New Zealand are trend and affluent economies with strong Western brand loyalties, thereby posing encouraging growth opportunities for high-end footwear.

Both countries feature increasingly responsive consumers to foreign tastes, and they also exhibit high levels of urbanization, promoting demand for form and lifestyle premium footwear. Strong online penetration, as consumers prioritize convenience, variety, and access to global luxury brands. Local demand is supported by stable incoming tourism and growing fashion sustainability consciousness.

Social media pull, along with international travel, drives the prominence of high-end products. Although the industry is smaller than in Asia or North America, consistent growth is being fueled by changing consumer behavior and the need for sophisticated fashion experiences. Strong performance in cities like Sydney, Melbourne, and Auckland continues to put the region at the forefront of the global luxury footwear story through 2035.

In 2025, formal shoes will dominate the industry, accounting for 58.8% of the total industry share, while casual shoes will capture 41.2%.

Continued improvement in the demand for formal shoes in the luxury segment parallels the popular belief that the most appropriate place for formal shoes is at the office, business, or on certain occasions. These have really become the conventional names in this category for footwear construction- Gucci, Prada, and Christian Louboutin. They have created collections that feature excellent construction together with superior materials and different styles and designs for the formal shoe category.

They sell their products in simple leather cut from special leathers, high-quality suede, and even exotic leathers like alligator and crocodile- so that customers buy shoes that are as comfortable as they are elegant. Further, the reason formal luxury level demands are growing is that, with these durable investment purchases, consumers are able to mix them with business wear or set them apart for occasion dressing.

Although the share occupied in the luxury industry today is not hugely impressive, casual shoes are steadily making their way to a crescendo with the increasing popularity of athleisure and luxury streetwear. Casual footwear, like designer sneakers, loafers, and pick-ups, has made young consumers, who are bold enough to escape from the mundanities called street and work, even more convincing with the high value placed on comfort while maintaining the fashion aspect.

There are very significant contributions made by brands like Balenciaga, Off-White, and Alexander McQueen toward the exciting trend that casuals bring into luxury from high-end, fancy sneakers and casual shoes that are ideally combined with comfort. This part of footwear is very popular with millennials and Gen Zs because it enables them to go from daily wear to a semi-formal occasion.

The growing importance attached to casual luxury footwear is an illustration of a broader attitudinal change in developing societies toward fashion, where comfort and functionality go hand in hand with styling. Even as the sales continue to inch upward for casual shoes, formal shoes continue to rule the luxury shoe industries because of their timelessness and value for long-term investments.

The industry is likely to have a balanced split between online and offline channels by 2025, with offline channels will lead with a 52.4% share of the industry, while online channels account for 47.6%. This distribution demonstrates the changing dynamics of consumer shopping preferences, wherein both brick-and-mortar and e-commerce play important roles in reaching luxury footwear consumers.

Offline retail continues to stay strong due to the in-store experience offered by luxury brands. Consumers who want luxury footwear always prefer to try on products, have an immediate purchase gratification experience, and get personalized service.

Flagship stores and high-end department stores by Louis Vuitton, Gucci, Christian Dior, and the like remain much valued in preserving the prestige of the brands and the exclusivity of the shopping experience. This experience provides consumers with an opportunity to touch and feel the craftsmanship and materials while getting in-depth consultations, forging a strong emotional bond with the product.

Online sales might have a slightly lower share, but they are a rapidly developing segment that is changing the dynamics. The paramount attractions for the consumers are convenience, wider selection, and opportunity for price comparisons.

Online channels like Far fetch and Net-a-Porter, as well as luxury brand e-commerce platforms-who may have the likes of Gucci and Prada on their A-list-dazzle shoppers with their enticing offers, detailed product descriptions, free returns, and home delivery, which can enchant a truly global clientele. Plus, the rise of luxury resale platforms such as The Real and Vestiaire Collective helps to boost online sales by making pre-owned luxury footwear accessible to consumers at more affordable prices.

Offline stores will remain key for providing high-touch experiences, but the growing online business signifies major transitions in how consumers buy luxury goods worldwide.

This industry sector is a mix of heritage brands and current names that cater to the taste of the discerning, high-end consumer, as well as to any peculiar blend of exclusivity, craftsmanship, and style. LVMH, Chanel, and Burberry delight the industry with a distinguished history of manufacturing upscale footwear that entertains the dualism of traditional design and modern luxury.

These luxury powerhouses rightly benefit from their high brand equity, heritage, and truly global industry presence and span. Furthermore, Salvatore Ferragamo and John Lobb lead modern luxury shoe that promise exclusivity and top-quality materials. On the other hand, some relatively new players, such as A. Testoni, Silvano, Lattanzi, and Lottusse-Mallorca, differentiate themselves well, vying for the same very demanding clientele with the idea of providing bespoke, artisanal footwear.

There is evidently a greater collaboration between luxury footwear brands and sportswear giants like Adidas to introduce items such as limited-edition, high-fashion sneakers that marry luxury and street chic. Dr. Martens has ingeniously overturned its image from that of a workwear brand to a luxury offering with collaborations and premium materials.

Base London, fusing the casual with the formal, along with other niche players, is starting to secure their niches by targeting specific segments of the space. Trade is becoming increasingly competitive as brands begin to offer lines with a focus on sustainability and eco-friendly materials without compromising on luxury and craftsmanship.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| LVMH (Louis Vuitton) | 18-22% |

| Chanel Limited | 14-16% |

| Burberry Group PLC | 10-12% |

| Silvano Lattanzi | 7-9% |

| Prada S.p.A | 6-8% |

| Other Players | 33-45% |

Key Company Insights

Among its profusion of luxury footwear affiliates, Louis Vuitton and Christian Dior, LVMH engages in a constant struggle toward the forward edge of the industry with a marriage of heritage and innovation. The company parades exclusivity in fashion footwear alongside the wider fashionable luxury ecosystem, creating demand via limited releases and collaborations. Added to a vast global reach, the sustainability approach of the organization has conferred further dominance over the industry.

Prada, Salvatore Ferragamo, and John Lobb symbolize the very spirit of classic European tradition. These brands thrive by virtue of their reputation for craftsmanship, timelessness of styles, and commitment to quality leather goods. Whereas John Lobb enjoys an esteemed reputation in bespoke footwear, Prada and Ferragamo are equally known for balancing exclusivity with trendy modern appeal. Together, they command industry power by catering to royalty, who appreciate refined style and elegance.

The industry is segmented into formal shoe and casual shoe.

The industry is categorized into men, women, and children.

The industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The industry is expected to reach USD 42.6 billion in 2025.

The industry is projected to grow to USD 79.1 billion by 2035.

The industry is expected to grow at a CAGR of approximately 6.4% during the forecast period.

Formal shoes are a key segment in the industry.

Key players include LVMH (Louis Vuitton), Chanel Limited, Burberry Group PLC, Silvano Lattanzi, Prada S.p.A, A.Testoni, Dr. Martens, Base London, John Lobb Bootmaker, Salvatore Ferragamo, Lottusse – Mallorca, and Adidas AG.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Pairs) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 4: Global Market Volume (Pairs) Forecast by Product, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 6: Global Market Volume (Pairs) Forecast by End-user, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 8: Global Market Volume (Pairs) Forecast by Distribution Channel, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Pairs) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 12: North America Market Volume (Pairs) Forecast by Product, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 14: North America Market Volume (Pairs) Forecast by End-user, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 16: North America Market Volume (Pairs) Forecast by Distribution Channel, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Pairs) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 20: Latin America Market Volume (Pairs) Forecast by Product, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 22: Latin America Market Volume (Pairs) Forecast by End-user, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: Latin America Market Volume (Pairs) Forecast by Distribution Channel, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Pairs) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 28: Western Europe Market Volume (Pairs) Forecast by Product, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 30: Western Europe Market Volume (Pairs) Forecast by End-user, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 32: Western Europe Market Volume (Pairs) Forecast by Distribution Channel, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Pairs) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 36: Eastern Europe Market Volume (Pairs) Forecast by Product, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 38: Eastern Europe Market Volume (Pairs) Forecast by End-user, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 40: Eastern Europe Market Volume (Pairs) Forecast by Distribution Channel, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Pairs) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Pairs) Forecast by Product, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Pairs) Forecast by End-user, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Pairs) Forecast by Distribution Channel, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Pairs) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 52: East Asia Market Volume (Pairs) Forecast by Product, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 54: East Asia Market Volume (Pairs) Forecast by End-user, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 56: East Asia Market Volume (Pairs) Forecast by Distribution Channel, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Pairs) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Pairs) Forecast by Product, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Pairs) Forecast by End-user, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Pairs) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by End-user, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Pairs) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 10: Global Market Volume (Pairs) Analysis by Product, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 14: Global Market Volume (Pairs) Analysis by End-user, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 18: Global Market Volume (Pairs) Analysis by Distribution Channel, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 21: Global Market Attractiveness by Product, 2024 to 2034

Figure 22: Global Market Attractiveness by End-user, 2024 to 2034

Figure 23: Global Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Product, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by End-user, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Pairs) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 34: North America Market Volume (Pairs) Analysis by Product, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 38: North America Market Volume (Pairs) Analysis by End-user, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 42: North America Market Volume (Pairs) Analysis by Distribution Channel, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 45: North America Market Attractiveness by Product, 2024 to 2034

Figure 46: North America Market Attractiveness by End-user, 2024 to 2034

Figure 47: North America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Product, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by End-user, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Pairs) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 58: Latin America Market Volume (Pairs) Analysis by Product, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 62: Latin America Market Volume (Pairs) Analysis by End-user, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 66: Latin America Market Volume (Pairs) Analysis by Distribution Channel, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Product, 2024 to 2034

Figure 70: Latin America Market Attractiveness by End-user, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by End-user, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Pairs) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 82: Western Europe Market Volume (Pairs) Analysis by Product, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 86: Western Europe Market Volume (Pairs) Analysis by End-user, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 90: Western Europe Market Volume (Pairs) Analysis by Distribution Channel, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Product, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by End-user, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by End-user, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Pairs) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Pairs) Analysis by Product, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Pairs) Analysis by End-user, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Pairs) Analysis by Distribution Channel, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Product, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by End-user, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by End-user, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Pairs) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Pairs) Analysis by Product, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Pairs) Analysis by End-user, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Pairs) Analysis by Distribution Channel, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by End-user, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Product, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by End-user, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Pairs) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 154: East Asia Market Volume (Pairs) Analysis by Product, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 158: East Asia Market Volume (Pairs) Analysis by End-user, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 162: East Asia Market Volume (Pairs) Analysis by Distribution Channel, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Product, 2024 to 2034

Figure 166: East Asia Market Attractiveness by End-user, 2024 to 2034

Figure 167: East Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by End-user, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Pairs) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Pairs) Analysis by Product, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Pairs) Analysis by End-user, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Pairs) Analysis by Distribution Channel, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Product, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by End-user, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Women's Luxury Footwear Market Trends – Size, Demand & Forecast 2025–2035

India Women's Luxury Footwear Market Report – Trends, Demand & Outlook 2025-2035

Italy Women's Luxury Footwear Market Trends – Size, Demand & Forecast 2025-2035

France Women's Luxury Footwear Market Outlook – Size, Share & Innovations 2025-2035

Luxury Travel Market Forecast and Outlook 2025 to 2035

Luxury Wood Doors For Residential Interiors Market Size and Share Forecast Outlook 2025 to 2035

Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Luxury Rigid Box Market Size and Share Forecast Outlook 2025 to 2035

Luxury Hotel Market Size and Share Forecast Outlook 2025 to 2035

Luxury Electric Vehicle (EV) Market Size and Share Forecast Outlook 2025 to 2035

Luxury Vinyl Tile Flooring Market Size and Share Forecast Outlook 2025 to 2035

Luxury Car Market Size and Share Forecast Outlook 2025 to 2035

Luxury Mattress Market Size and Share Forecast Outlook 2025 to 2035

Luxury Fine Jewellery Market Analysis - Size, Share, and Forecast 2025 to 2035

Luxury SUV Market Size and Share Forecast Outlook 2025 to 2035

Luxury Plumbing Fixtures Market Size and Share Forecast Outlook 2025 to 2035

Luxury Coaches Market Size and Share Forecast Outlook 2025 to 2035

Luxury Interior Fabric Industry Analysis in North America and Europe Growth, Trends and Forecast from 2025 to 2035

Luxury Furniture Market Insights - Demand, Size, and Industry Trends 2025 to 2035

Competitive Overview of Luxury Yacht Market Share & Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA