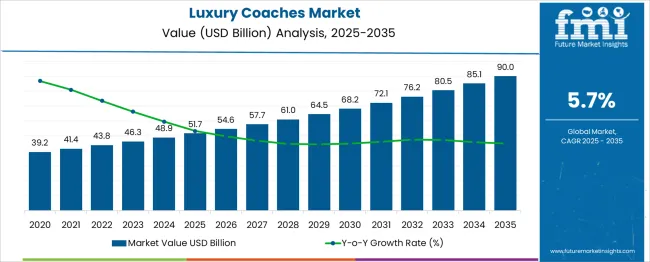

The Luxury Coaches Market is estimated to be valued at USD 51.7 billion in 2025 and is projected to reach USD 90.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period. Between 2025 and 2030, the market is expected to rise from USD 51.7 billion to USD 68.2 billion, driven by increasing demand for premium travel experiences, comfort-oriented mobility solutions, and long-distance tourism.

Year-on-year analysis highlights steady expansion, with values reaching USD 54.6 billion in 2026 and USD 57.7 billion in 2027, supported by rising adoption of high-end intercity transport services and luxury charter solutions. By 2028, the market is forecasted to hit USD 61.0 billion, followed by USD 64.5 billion in 2029 and USD 68.2 billion in 2030. This growth trajectory is expected to be strengthened by advancements in smart infotainment systems, enhanced passenger amenities, and electric-powered luxury coaches for environmentally conscious travelers.

Operators are likely to focus on custom-designed interiors, high-capacity seating, and connectivity-driven features to attract high-end customers. These factors position luxury coaches as a key segment within premium mobility services, offering growth opportunities in both domestic and international tourism markets while emphasizing comfort, safety, and innovation.

| Metric | Value |

|---|---|

| Luxury Coaches Market Estimated Value in (2025 E) | USD 51.7 billion |

| Luxury Coaches Market Forecast Value in (2035 F) | USD 90.0 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The luxury coaches market occupies a specialized segment within several transportation and travel-related markets. In the luxury vehicles market, its share is relatively small at around 3–4%, as premium cars and SUVs dominate this category. Within the passenger bus and coach market, luxury coaches account for approximately 8–10%, given the popularity of standard and mid-range buses in public and private transport services. In the luxury travel and tourism market, its share stands at about 5–6%, as it caters to high-end travelers seeking exclusive and comfortable ground transportation.

For the specialty and custom vehicle market, the contribution is higher, nearly 12–14%, since luxury coaches are highly customized to provide premium features such as reclining seats, entertainment systems, and on-board amenities. In the transportation and mobility services market, the share is around 2–3%, as this segment includes ride-hailing, shared mobility, and general transport services. Market growth is driven by rising demand for premium group travel experiences in tourism, corporate events, and high-end charters.

Increasing investment in advanced interiors, connectivity features, and eco-friendly drivetrains is further enhancing the appeal of luxury coaches. With the expanding trend of experiential travel, this market is expected to strengthen its share across these parent markets in the coming years.

The luxury coaches market is demonstrating consistent growth as rising demand for premium intercity and charter transport converges with advancements in comfort and safety technologies. Increased consumer inclination toward experiential travel, coupled with investments in tourism infrastructure, is contributing to the growing adoption of luxury coaches.

Manufacturers are focusing on integrating enhanced seating, infotainment, and eco-friendly features to meet evolving expectations of both operators and passengers. Regulatory encouragement for sustainable transport solutions and rising disposable incomes in emerging economies are also creating favorable conditions for market expansion.

Future growth prospects are anticipated to be shaped by ongoing fleet modernization, adoption of alternative fuels, and partnerships between coach operators and tourism service providers to deliver tailored travel experiences. The combination of operational efficiency, elevated customer expectations, and supportive policy frameworks is paving the way for sustained market development.

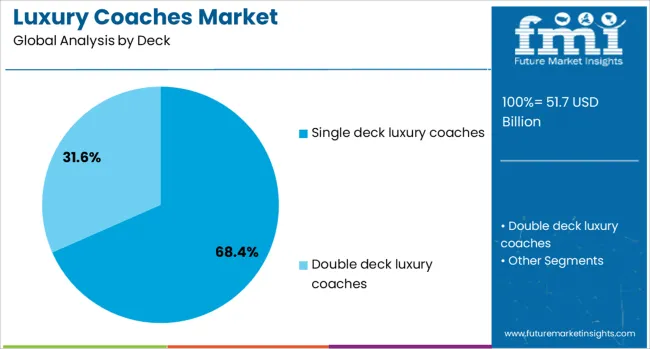

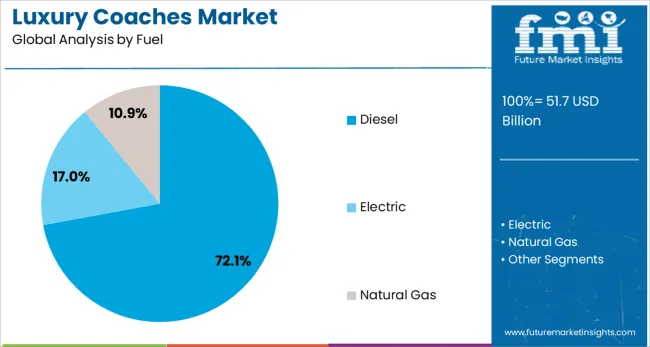

The luxury coaches market is segmented by deck, fuel, and application and geographic regions. The market for luxury coaches is divided into single-deck luxury coaches and double-deck luxury coaches. The luxury coaches market is classified by fuel type into Diesel, Electric, and Natural Gas.

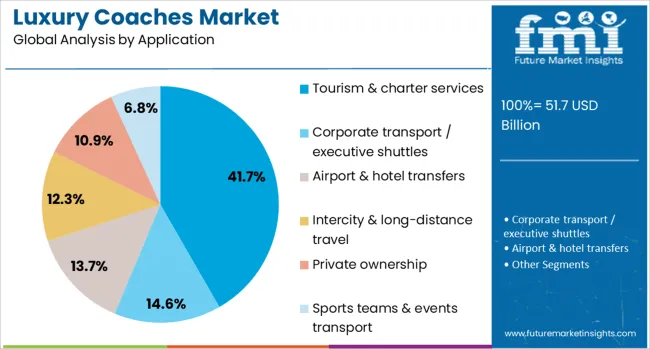

Based on the application of the luxury coaches market, it is segmented into Tourism & charter services, Corporate transport/executive shuttles, Airport & hotel transfers, Intercity & long-distance travel, Private ownership, and Sports teams & events transport. Regionally, the luxury coaches industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by deck, single-deck luxury coaches are estimated to hold 68.40% of the market revenue in 2025, making it the dominant configuration. This leadership is being supported by their cost-effectiveness, operational flexibility, and suitability for a wide range of routes and passenger capacities.

The design simplicity of single-deck coaches allows for easier maintenance, better maneuverability in diverse terrains, and lower upfront investment compared to double-deck alternatives. Operators have favored this segment due to its ability to balance premium comfort with practical economics, making it a preferred choice in both urban and regional markets.

Additionally, single-deck configurations have been widely adopted as they align well with infrastructure constraints such as height limitations in certain regions, further strengthening their market position.

Segmented by fuel type, diesel luxury coaches are expected to command 72.1% of the market revenue in 2025, maintaining their leadership in this category. This predominance is being driven by the widespread availability of diesel infrastructure, proven engine reliability, and lower operating costs per kilometer compared to alternative fuels.

Operators have continued to prioritize diesel vehicles as they offer consistent performance on long-haul routes and in challenging conditions, where alternative fuel options may face limitations. Furthermore, advancements in emission-reduction technologies and compliance with stringent environmental standards have enabled diesel coaches to remain viable while meeting regulatory requirements.

The combination of robust supply chains, familiarity among operators, and ongoing innovations in cleaner diesel technologies has sustained the segment’s prominence within the market.

When segmented by application, tourism and charter services are forecast to account for 41.7% of the market revenue in 2025, emerging as the leading use case. This dominance is being fueled by the resurgence of the tourism industry, growing preference for group travel experiences, and rising demand for high-quality, personalized transport solutions.

Operators have increasingly invested in luxury coaches for tourism and charter purposes as they enable flexible itineraries, enhance passenger comfort, and contribute to memorable travel experiences. Seasonal peaks in travel demand, particularly in scenic and heritage destinations, have further reinforced the segment’s leadership.

The ability to offer premium services to both domestic and international tourists, combined with revenue opportunities from corporate charters and private events, has strengthened the market position of this application segment.

Growth opportunities are visible in luxury electric coaches, particularly for intercity and tourism applications in Europe and Asia. Emerging trends highlight connected infotainment, smart climate systems, and high-end sleeper layouts designed for long-distance travel.

However, the market faces restraints such as high acquisition costs, volatile fuel prices, and dependency on economic conditions influencing travel budgets. Companies focusing on integrated digital platforms and luxury-focused customizations are considered better positioned for long-term success in this evolving mobility segment.

The surge in tourism and upscale corporate travel requirements across major economies has driven growth in the luxury coaches market. In 2024, several operators in Europe expanded fleets of luxury buses equipped with reclining seats, onboard Wi-Fi, and personalized entertainment for high-end travelers. Asian markets, including India and China, witnessed strong adoption in premium intercity services where travelers prefer high-comfort travel over air options for regional trips. It is widely believed that the growing emphasis on passenger experience and integrated comfort amenities will continue to drive the procurement of luxury coaches for commercial operators worldwide.

Opportunities have been created through the introduction of luxury electric and hybrid coaches targeting eco-conscious fleet buyers and premium operators. In 2025, European and North American companies invested in electrified coaches with extended range and zero-emission features tailored for intercity travel. Demand for fully customized interiors with modular luxury seating, entertainment suites, and onboard refreshment zones was reported in Asia-Pacific and the Middle East. It is considered that operators offering highly personalized design services combined with long-term maintenance plans will attract large-scale contracts in both tourism-driven regions and high-income urban corridors.

Emerging trends in the luxury coaches market include the integration of digital ecosystems for passenger comfort and safety. In 2024, manufacturers introduced AI-enabled infotainment, real-time fleet diagnostics, and biometric entry systems for premium fleets in Europe and the US. Demand for luxury sleeper configurations with climate-controlled cabins and touch-enabled entertainment panels is gaining traction for long-distance travel. It is strongly believed that luxury coaches designed with digital interfaces and integrated telematics will dominate procurement pipelines as operators prioritize connected mobility solutions and personalized travel experiences for high-value customer segments.

The market faces significant restraints due to high acquisition and operating costs, which limit penetration in price-sensitive regions. In 2024, multiple fleet operators in Asia-Pacific deferred luxury coach procurement owing to cost challenges and fuel price volatility. Infrastructure limitations, such as a lack of charging stations for electric luxury coaches, also pose constraints for fleet modernization. Additionally, economic fluctuations in the travel and tourism sector influence the willingness of operators to invest in high-end vehicles. It is believed that only operators with strong financial backing and government-supported contracts can maintain competitive positioning under these conditions.

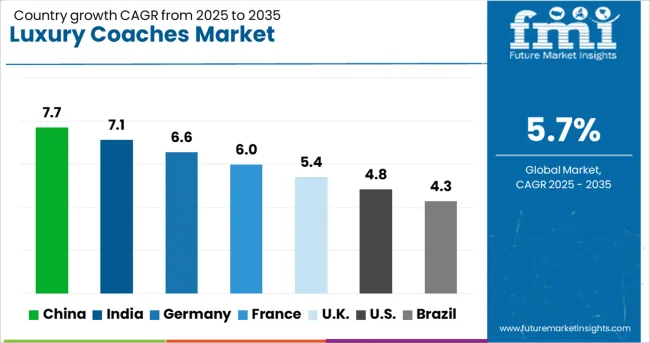

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

The global luxury coaches market is projected to grow at a CAGR of 5.7% from 2025 to 2035. China leads with 7.7%, followed by India at 7.1% and Germany at 6.6%. France records 6.0%, while the United Kingdom posts 5.4%. Growth is driven by rising demand for premium travel experiences, expansion of intercity tourism, and the integration of connected mobility solutions. China and India dominate adoption due to large-scale tourism investments, while Germany focuses on electric and hybrid luxury coaches. France and the UK emphasize compact designs and enhanced safety features for high-end travel services.

The luxury coaches market in China is projected to grow at 7.7%, supported by increasing demand for premium long-distance travel. High-capacity luxury buses dominate intercity and tourism segments. Manufacturers incorporate advanced infotainment and reclining seat systems for superior passenger comfort. Strategic partnerships with travel agencies drive adoption across domestic and cross-border tourism.

The luxury coaches market in India is forecast to grow at 7.1%, driven by growing middle-class spending on leisure travel and organized tours. Sleeper and semi-sleeper configurations dominate demand for intercity travel. Manufacturers introduce Wi-Fi-enabled coaches and ergonomic designs to enhance travel comfort. Increasing popularity of premium pilgrimage and adventure tourism strengthens adoption.

The luxury coaches market in Germany is projected to grow at 6.6%, supported by strong adoption in corporate travel and high-end tourism. Electric luxury coaches dominate new fleet investments to meet emission reduction goals. Manufacturers integrate smart monitoring systems for real-time diagnostics. Demand for customizable interiors drives OEM innovation for executive travel segments.

The luxury coaches market in France is forecast to grow at 6.0%, driven by demand for upscale intercity and sightseeing services. Compact luxury coaches dominate urban and suburban routes for small-group travel. Manufacturers prioritize noise-reduction and panoramic glass features for comfort and aesthetics. Rising focus on sustainable designs promotes hybrid luxury coach models.

The luxury coaches market in the UK is projected to grow at 5.4%, supported by increasing demand for premium airport transfers and event transportation. Double-decker luxury buses dominate event-driven applications for high-capacity transport. Manufacturers introduce advanced safety technologies such as lane assist and collision mitigation. Expansion of corporate event tourism further drives luxury coach rentals.

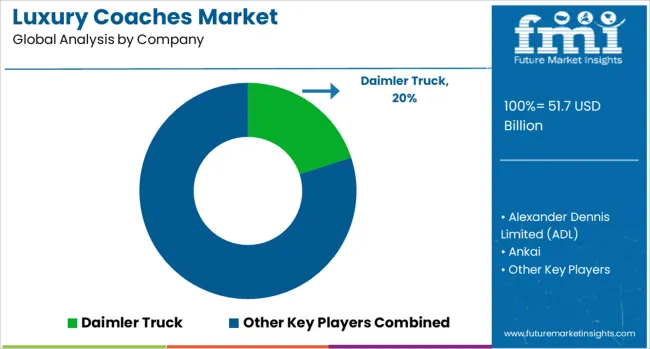

The luxury coaches market is moderately consolidated, with Daimler Truck recognized as a leading player through its premium coach brands such as Setra and Mercedes-Benz, which focus on advanced comfort features, safety systems, and energy-efficient drivetrains. The company’s extensive global dealer network and cutting-edge design capabilities strengthen its dominance in the segment.

Key players include Alexander Dennis Limited (ADL), Ankai, Beiqi Foton Motor, BYD Auto (specializing in electric luxury coaches), Foretravel Motorcoach, Irizar Group, King Long United Automotive, Scania, and Yutong Bus. These companies provide high-end motorcoaches equipped with ergonomic seating, luxury interiors, infotainment systems, and advanced driver assistance features to cater to intercity travel, tourism, and premium charter services.

Market growth is driven by rising demand for luxury travel experiences, increased investment in long-distance tourism infrastructure, and the shift toward electrified and low-emission luxury coaches. Leading manufacturers are integrating smart connectivity solutions, improved energy efficiency, and passenger comfort features, such as climate control and personalized entertainment.

Electric luxury coaches are emerging as a major trend, with BYD and other players focusing on zero-emission models to meet sustainability goals and regulatory mandates. Asia-Pacific and Europe dominate the market due to extensive intercity transportation networks, while North America is witnessing strong demand for luxury charter coaches for leisure and corporate travel.

| Item | Value |

|---|---|

| Quantitative Units | USD 51.7 Billion |

| Deck | Single deck luxury coaches and Double deck luxury coaches |

| Fuel | Diesel, Electric, and Natural Gas |

| Application | Tourism & charter services, Corporate transport / executive shuttles, Airport & hotel transfers, Intercity & long-distance travel, Private ownership, and Sports teams & events transport |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Daimler Truck, Alexander Dennis Limited (ADL), Ankai, Beiqi Foton Motor, BYD Auto (Electric Coaches), Foretravel Motorcoach, Irizar Group, King Long United Automotive, Scania, and Yutong Bus |

| Additional Attributes | Dollar sales by coach type (single-decker vs double-decker), propulsion (diesel, gasoline, electric), and seating capacity (below 20, 20‑35, 36‑50, above 50); regional demand trends (North America holds the largest share, Asia-Pacific shows fastest growth); competitive landscape featuring Volvo, Daimler, Scania, Yutong, and Forest River; buyer preferences center on premium comfort, advanced interiors, and fuel efficiency; integration with luxury tourism, corporate charters, and event transport; innovations include autonomous navigation systems, ultra-lightweight composite materials, electric powertrains, and connectivity-enabled entertainment for enhanced passenger experience. |

The global luxury coaches market is estimated to be valued at USD 51.7 billion in 2025.

The market size for the luxury coaches market is projected to reach USD 90.0 billion by 2035.

The luxury coaches market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in luxury coaches market are single deck luxury coaches and double deck luxury coaches.

In terms of fuel, diesel segment to command 72.1% share in the luxury coaches market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Luxury Car Hoses Market Size and Share Forecast Outlook 2025 to 2035

Luxury Travel Market Forecast and Outlook 2025 to 2035

Luxury Wood Doors For Residential Interiors Market Size and Share Forecast Outlook 2025 to 2035

Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Luxury Rigid Box Market Size and Share Forecast Outlook 2025 to 2035

Luxury Hotel Market Size and Share Forecast Outlook 2025 to 2035

Luxury Electric Vehicle (EV) Market Size and Share Forecast Outlook 2025 to 2035

Luxury Vinyl Tile Flooring Market Size and Share Forecast Outlook 2025 to 2035

Luxury Car Market Size and Share Forecast Outlook 2025 to 2035

Luxury Mattress Market Size and Share Forecast Outlook 2025 to 2035

Luxury Fine Jewellery Market Analysis - Size, Share, and Forecast 2025 to 2035

Luxury SUV Market Size and Share Forecast Outlook 2025 to 2035

Luxury Plumbing Fixtures Market Size and Share Forecast Outlook 2025 to 2035

Luxury Interior Fabric Industry Analysis in North America and Europe Growth, Trends and Forecast from 2025 to 2035

Luxury Footwear Market Outlook – Size, Share & Innovations 2025 to 2035

Luxury Furniture Market Insights - Demand, Size, and Industry Trends 2025 to 2035

Competitive Overview of Luxury Yacht Market Share & Providers

Luxury Yacht Industry Analysis by Type, by Size, by Application , by Ownership, and by Region- Forecast for 2025 to 2035

Luxury Handbag Market Analysis by Product Type, Material Type, and Region Through 2035

Luxury Products For Kids Market - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA