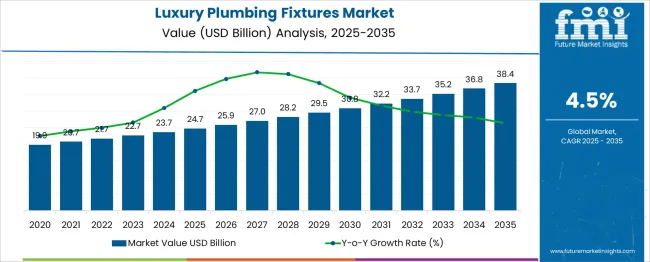

The Luxury Plumbing Fixtures Market is estimated to be valued at USD 24.7 billion in 2025 and is projected to reach USD 38.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. The Luxury Plumbing Fixtures Market is generate an absolute dollar opportunity of USD 13.7 billion over the forecast period. This incremental value highlights the total market expansion potential available for stakeholders across manufacturing, distribution, and retail segments. From 2025 to 2026, the market adds USD 1.2 billion, followed by consistent annual increments of around USD 1.1 to USD 1.5 billion. The absolute dollar opportunity is evenly distributed across the decade, indicating steady growth rather than concentrated spikes. Mid-period contributions, particularly between 2029 and 2032, show slightly higher incremental additions, reflecting possible product innovation cycles and broader adoption in premium residential and hospitality projects.

Cumulatively, the first half of the forecast period (2025–2030) contributes nearly USD 6.1 billion, while the latter half (2030–2035) accounts for about USD 7.6 billion, showing a stronger absolute value expansion in later years. This signals that revenue potential will accelerate moderately as design trends shift towards high-end, water-efficient, and smart plumbing solutions. Overall, the absolute dollar opportunity in the Luxury Plumbing Fixtures Market is substantial and evenly paced, favoring strategic investment planning across the forecast horizon.

| Metric | Value |

|---|---|

| Luxury Plumbing Fixtures Market Estimated Value in (2025 E) | USD 24.7 billion |

| Luxury Plumbing Fixtures Market Forecast Value in (2035 F) | USD 38.4 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The luxury plumbing fixtures market is experiencing robust growth, fueled by increasing investment in high-end residential infrastructure, the rising popularity of wellness-oriented bathroom designs, and a growing emphasis on interior aesthetics. The post-pandemic shift in consumer lifestyle has led to heightened interest in home renovation and spa-like experiences within residential spaces.

Smart integration, water-saving technology, and premium finishes are becoming standard, reflecting a broader movement toward both functionality and elegance. Architects and designers are playing a critical role in shaping demand, as consumers increasingly seek customized, statement fixtures that align with modern architectural themes.

Global urbanization and the emergence of luxury housing and hospitality projects are reinforcing the importance of plumbing fixtures as visual and functional centerpieces. Moreover, the proliferation of omnichannel retail and interactive showroom experiences has improved buyer education and engagement, further accelerating market expansion.

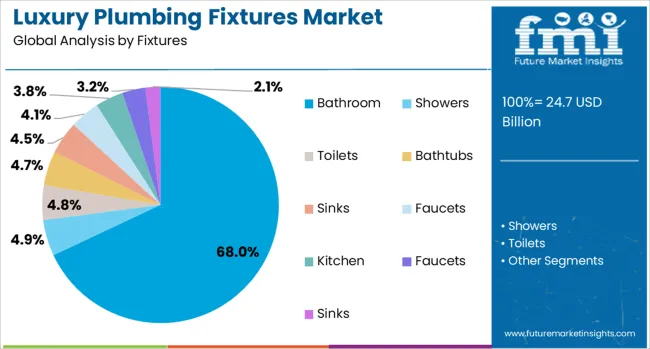

The luxury plumbing fixtures market is segmented by fixture, application, and geographic regions. The luxury plumbing fixtures market is divided into Bathroom, Showers, Toilets, Bathtubs, Sinks, Faucets, Kitchen, and Faucets and Sinks. In terms of application, the luxury plumbing fixtures market is classified into Residential and Commercial. Regionally, the luxury plumbing fixtures industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Bathroom fixtures are anticipated to dominate the market with a 68.00% revenue share in 2025. This segment’s leadership stems from the bathroom’s transformation into a personalized wellness and design space, where aesthetics, hygiene, and innovation converge.

High consumer spending on master suites, en-suite bathrooms, and spa-like configurations is driving demand for luxurious bathtubs, faucets, shower systems, and fittings. The segment is benefiting from the rising popularity of minimalist and contemporary design trends, which place strong emphasis on hardware elegance and tactile quality.

Technological enhancements such as touchless operation, thermostatic controls, and water-efficient systems have elevated the value proposition of bathroom fixtures in premium homes and hospitality environments. Additionally, increased adoption of branded, artisanal, and heritage collections has reinforced this segment’s premium positioning, particularly in metropolitan and high-income residential clusters.

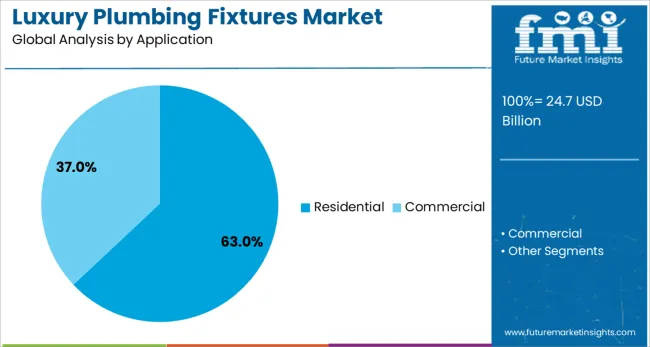

The residential segment is projected to lead with a 63.00% share of the luxury plumbing fixtures market in 2025. This dominance is underpinned by an uptick in luxury home construction, rising disposable income, and heightened consumer focus on wellness, hygiene, and personalized aesthetics.

With urban dwellers investing more in home upgrades and private retreats, bathrooms and kitchens are being reimagined as aspirational living zones. The segment’s expansion is further encouraged by the rise of homeownership in emerging markets, where high-end finishes are increasingly viewed as status symbols.

Real estate developers are also prioritizing premium plumbing fixtures in upscale housing projects to meet the expectations of discerning buyers. Additionally, the growth of digital showrooms and remote interior design consultations has increased accessibility and customization, making luxury upgrades more mainstream in residential environments.

Luxury plumbing fixtures have been developed to offer high functionality, aesthetic appeal, and advanced features for residential, commercial, and hospitality interiors. These products, including high-end faucets, shower systems, bathtubs, and sinks, have been designed with premium materials, intricate finishes, and precision engineering. Their adoption has been influenced by interior design trends, property renovation activities, and the demand for personalized bathroom and kitchen solutions. Manufacturers have integrated smart controls, water-saving technologies, and unique design elements to appeal to consumers seeking both performance and visual sophistication in their living spaces.

High-value residential projects and luxury home renovations have significantly contributed to the demand for premium plumbing fixtures. Homeowners have invested in distinctive bathroom and kitchen fittings to enhance both functionality and property value. Finishes such as brushed gold, matte black, and polished nickel have been favored for their ability to complement high-end interiors. Large rainfall showers, freestanding soaking tubs, and custom-designed basins have become hallmarks of luxury bathrooms. Integrated LED lighting, thermostatic controls, and touchless operation have elevated user experience while supporting hygiene. Renovation activities in upscale residential communities and luxury apartments have maintained consistent demand, particularly in regions with rising investments in high-end real estate.

Luxury hotels, resorts, and boutique accommodations have incorporated premium plumbing fixtures to enhance guest comfort and differentiate their properties. High-end shower enclosures, spa-inspired bathtubs, and sensor-activated faucets have been widely installed in suites and spa facilities. The hospitality industry has prioritized design cohesion between rooms and common areas, selecting fixtures that align with brand aesthetics and provide durability under high-traffic conditions. Multi-function shower systems with steam, massage, and chromotherapy features have been introduced to replicate spa experiences. Property developers have entered long-term agreements with premium fixture brands to ensure consistent quality and design exclusivity, reinforcing the segment’s growth in the hospitality market.

Innovation in materials and manufacturing techniques has elevated the performance and longevity of luxury plumbing fixtures. Solid brass, stainless steel, and advanced ceramic components have been used for structural strength and resistance to corrosion. PVD (physical vapor deposition) coatings have provided scratch resistance and finish durability, even in high-moisture environments. Digital controls have allowed users to preset water temperature and flow, while embedded sensors have enabled touch-free operation. Water-saving aerators and flow regulators have been incorporated without compromising performance. These advancements have enhanced product appeal among both environmentally conscious buyers and those seeking technologically advanced solutions for modern living spaces.

The luxury plumbing fixtures market has faced challenges related to high acquisition costs and specialized installation requirements. Premium materials, intricate designs, and integrated smart technologies have elevated manufacturing expenses, limiting accessibility to affluent buyers. Installation of advanced fixtures often requires professional expertise and, in some cases, structural modifications, adding to total project costs. In price-sensitive regions, mid-range alternatives have gained preference due to lower upfront investment. Additionally, the need for regular maintenance to preserve aesthetic and functional quality has discouraged some potential buyers. Expanding market reach will depend on cost optimization strategies, modular designs, and simplified installation processes that make luxury fixtures more attainable.

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

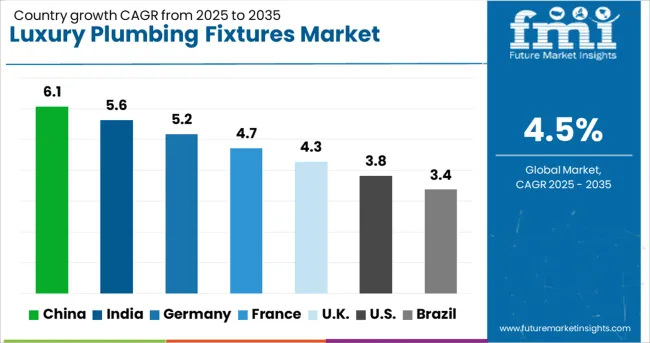

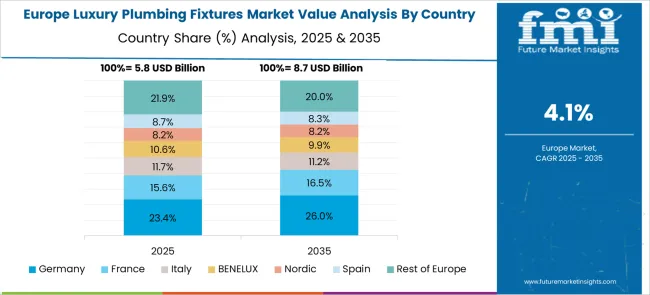

The market is anticipated to expand at a CAGR of 4.5% between 2025 and 2035, influenced by demand for high-end bathroom and kitchen fittings, premium housing projects, and advancements in water-efficient technologies. China is forecasted to grow at 6.1%, driven by upscale residential developments and expanding luxury hospitality construction. India, with a 5.6% CAGR, benefits from rising premium real estate and consumer preference for designer fixtures. Germany, growing at 5.2%, is supported by innovations in sustainable materials and precision engineering. The U.K., with a 4.3% growth rate, gains from home renovation trends and boutique property developments. The U.S., expanding at 3.8%, is influenced by luxury housing investments and demand for technologically advanced fixtures. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to expand at a CAGR of 6.1% between 2025 and 2035 in the luxury plumbing fixtures market, supported by large-scale premium housing developments, high-end hospitality investments, and growing adoption of wellness-focused interiors. Demand is rising for statement bathroom pieces such as designer faucets, rainfall showers, and freestanding bathtubs that combine functionality with visual appeal. Local producers are partnering with international brands to introduce product lines with advanced water-saving features and premium finishes like brushed gold and matte black. Rising disposable spending in tier-one and tier-two cities, alongside expanding luxury retail networks, has enabled stronger market penetration.

India is anticipated to achieve a CAGR of 5.6% in the luxury plumbing fixtures sector during the forecast period, aided by high-value real estate projects, expanding luxury hospitality chains, and evolving consumer preferences toward design-led interiors. Affluent homebuyers and luxury hotel operators are demanding advanced fixtures that combine aesthetics with sustainability, including water-efficient taps, smart showers, and automated flush systems. Domestic brands are scaling their presence in premium showrooms while upgrading product lines to compete with imports, focusing on customization, unique finishes, and smart functionality. The rise in luxury bathroom remodels in metropolitan cities like Mumbai, Delhi, and Bengaluru is further accelerating adoption.

Germany is forecasted to grow at a CAGR of 5.2%, driven by strong manufacturing capabilities, consumer preference for minimalist designs, and a focus on eco-friendly technology in plumbing fixtures. The market is benefiting from a surge in luxury home renovations and new residential developments that incorporate energy-efficient water systems. German brands are leveraging precision engineering to produce thermostatic showers, digitally adjustable faucets, and materials that enhance both longevity and aesthetics. The country’s export strength in luxury bathroom fittings is reinforced by a growing share in the European market, with sustainable production becoming a defining factor in consumer choice.

The United Kingdom is expected to witness a CAGR of 4.3% in the luxury plumbing fixtures market, supported by increasing demand for high-value home renovations and boutique hotel upgrades. Homeowners are investing in spa-inspired bathrooms that feature statement pieces such as freestanding bathtubs, rainfall showers, and heritage brass taps. The growth of online luxury home décor retail has expanded consumer access to international brands, while domestic producers are offering limited-edition collections to appeal to niche premium buyers. Renovation projects in affluent areas of London, Manchester, and Edinburgh are particularly contributing to market expansion.

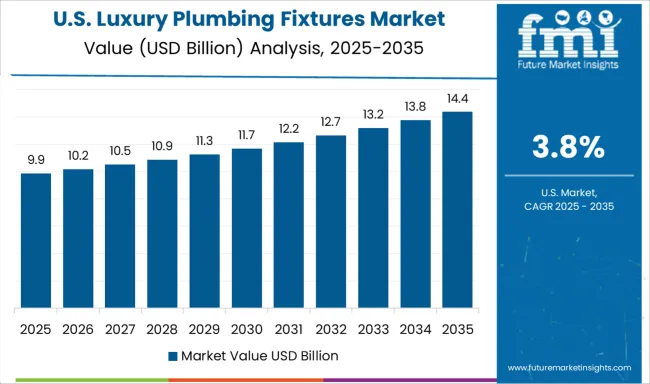

The United States is projected to grow at a CAGR of 3.8% in the luxury plumbing fixtures segment, supported by high levels of remodeling activity, custom bathroom design trends, and adoption of connected plumbing systems. Luxury property developers and high-income households are investing in bespoke bathroom solutions featuring integrated lighting, temperature-controlled water delivery, and water-conserving designs. Growth is concentrated in metropolitan areas and luxury vacation homes, with homeowners increasingly opting for premium finishes that match broader interior themes. Digital retail platforms are also facilitating consumer access to exclusive global collections.

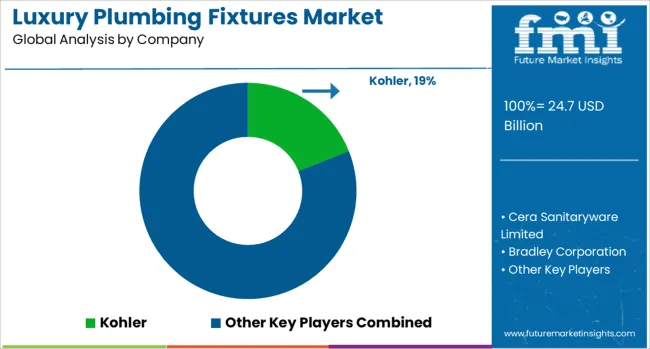

The luxury plumbing fixtures market is shaped by brands that combine advanced functionality with premium aesthetics, catering to high-end residential, commercial, and hospitality projects. Demand is influenced by evolving interior design trends, technological integration, material quality, and the increasing preference for statement pieces in kitchens and bathrooms. Manufacturers differentiate through unique finishes, water efficiency, smart controls, and bespoke design services. Kohler, Toto, and Grohe lead the global premium segment with a strong presence in designer faucets, bathtubs, and intelligent sanitaryware systems. Moen, Delta, and American Standard offer a balance between modern styling and durability, appealing to both upscale homeowners and boutique developers.

Cera Sanitaryware Limited and Sterling Faucet Company provide regionally competitive solutions that integrate contemporary design with robust functionality. Bradley Corporation and Gerber focus on commercial-grade luxury fixtures, serving high-end public spaces, hotels, and institutional environments. Matco-Norca and Natphil address niche markets with customizable hardware and specialty fittings for unique architectural projects. The Noble Corporation and Fiberez Bathware specialize in distinctive material finishes, such as composite stone and reinforced acrylic, enhancing both visual appeal and longevity. Little Giant extends its expertise into functional water movement systems that complement premium fixture installations. Future market expansion is expected to be driven by the integration of touchless technology, sustainable water-use innovations, and increased demand for customized, artisanal designs in luxury residential and commercial interiors.

| Item | Value |

|---|---|

| Quantitative Units | USD 24.7 Billion |

| Fixtures | Bathroom, Showers, Toilets, Bathtubs, Sinks, Faucets, Kitchen, Faucets, and Sinks |

| Application | Residential and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kohler, Cera Sanitaryware Limited, Bradley Corporation, Delta, Gerber, Moen, Little Giant, Grohe, American Standard, Sterling Faucet Company, Natphil, The Noble Corporation, Matco-Norca, Fiberez Bathware, and Toto |

| Additional Attributes | Dollar sales by fixture type and installation area, demand dynamics across residential renovation, premium hospitality, and high-end commercial spaces, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in water-saving aerators, touchless controls, and sustainable metal finishes, environmental impact of water consumption reduction, manufacturing material sourcing, and product lifecycle durability, and emerging use cases in smart home bathroom integration, wellness-focused spa installations, and bespoke designer kitchen concepts. |

The global luxury plumbing fixtures market is estimated to be valued at USD 24.7 billion in 2025.

The market size for the luxury plumbing fixtures market is projected to reach USD 38.4 billion by 2035.

The luxury plumbing fixtures market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in luxury plumbing fixtures market are bathroom, showers, toilets, bathtubs, sinks, faucets, kitchen, faucets and sinks.

In terms of application, residential segment to command 63.0% share in the luxury plumbing fixtures market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Luxury Car Hoses Market Size and Share Forecast Outlook 2025 to 2035

Luxury Travel Market Forecast and Outlook 2025 to 2035

Luxury Wood Doors For Residential Interiors Market Size and Share Forecast Outlook 2025 to 2035

Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Luxury Rigid Box Market Size and Share Forecast Outlook 2025 to 2035

Luxury Hotel Market Size and Share Forecast Outlook 2025 to 2035

Luxury Electric Vehicle (EV) Market Size and Share Forecast Outlook 2025 to 2035

Luxury Vinyl Tile Flooring Market Size and Share Forecast Outlook 2025 to 2035

Luxury Car Market Size and Share Forecast Outlook 2025 to 2035

Luxury Mattress Market Size and Share Forecast Outlook 2025 to 2035

Luxury Fine Jewellery Market Analysis - Size, Share, and Forecast 2025 to 2035

Luxury SUV Market Size and Share Forecast Outlook 2025 to 2035

Luxury Coaches Market Size and Share Forecast Outlook 2025 to 2035

Luxury Interior Fabric Industry Analysis in North America and Europe Growth, Trends and Forecast from 2025 to 2035

Luxury Footwear Market Outlook – Size, Share & Innovations 2025 to 2035

Luxury Furniture Market Insights - Demand, Size, and Industry Trends 2025 to 2035

Competitive Overview of Luxury Yacht Market Share & Providers

Luxury Yacht Industry Analysis by Type, by Size, by Application , by Ownership, and by Region- Forecast for 2025 to 2035

Luxury Handbag Market Analysis by Product Type, Material Type, and Region Through 2035

Luxury Products For Kids Market - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA