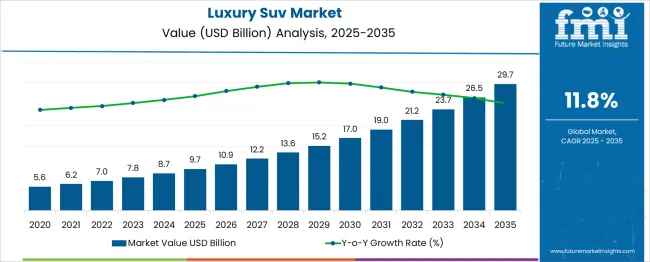

The Luxury SUV Market is estimated to be valued at USD 9.7 billion in 2025 and is projected to reach USD 29.7 billion by 2035, registering a compound annual growth rate (CAGR) of 11.8% over the forecast period. Analyzing the 5-year growth blocks reveals a strong upward trajectory in market value. The first growth block (2025–2030) will see the market increase by USD 10.3 billion, reaching USD 19.0 billion by 2030.

This represents an average annual growth of approximately USD 2.1 billion or around 21% growth per year. In this phase, increasing demand for high-end, feature-rich SUVs, driven by rising disposable incomes, evolving consumer preferences, and an expanding global middle class, will fuel the market's growth. The next 5-year block (2030 to 2035) will further accelerate the market, adding USD 10.7 billion to reach USD 29.7 billion by 2035.

This block demonstrates a slightly higher growth rate, with an average annual growth of USD 2.1 billion. Factors contributing to this acceleration include advancements in electric vehicles (EVs) and hybrid technology in the luxury SUV segment, alongside higher consumer demand for autonomous and connected vehicle features. Overall, the market's steady expansion reflects the growing appeal of luxury SUVs as a preferred mode of transportation in affluent consumer segments across global regions.

| Metric | Value |

|---|---|

| Luxury SUV Market Estimated Value in (2025 E) | USD 9.7 billion |

| Luxury SUV Market Forecast Value in (2035 F) | USD 29.7 billion |

| Forecast CAGR (2025 to 2035) | 11.8% |

The luxury SUV market is expanding steadily, driven by rising affluence among urban consumers, evolving lifestyle preferences, and continuous technological innovations in the automotive sector. The segment benefits from increasing demand for high-performance vehicles with enhanced comfort, spacious interiors, and advanced driver assistance systems.

Automakers are focusing on integrating luxury aesthetics with utility features, making SUVs a preferred choice over sedans in the premium category. Infrastructural improvements and growing highway connectivity are further supporting the shift toward larger vehicles.

Additionally, the market is influenced by aggressive product launches, strategic collaborations, and marketing efforts targeting affluent millennials and business professionals. With increasing availability of financing options and global expansion of premium brands, the market is set to witness continued growth, especially in emerging economies where luxury mobility is gaining aspirational value.

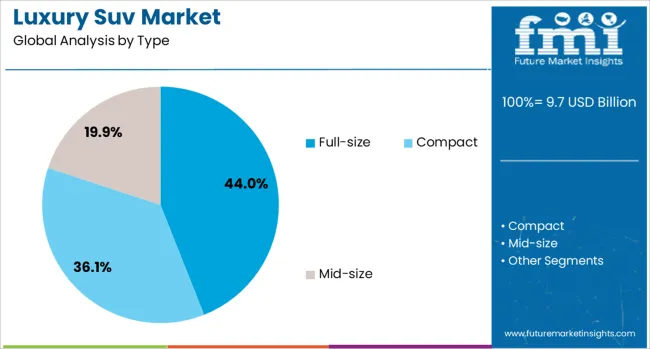

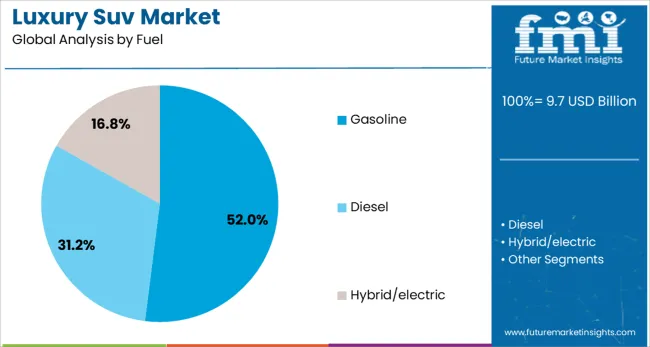

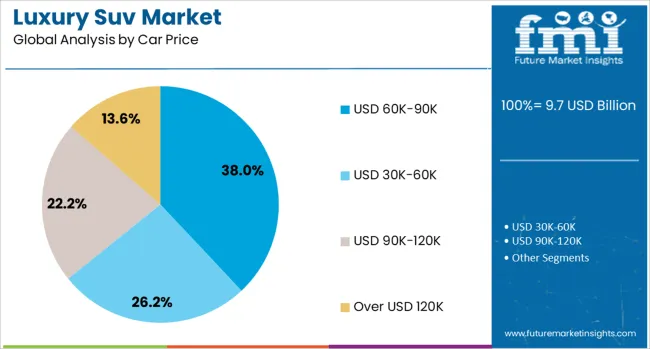

The luxury SUV market is segmented by type, fuel, car price, sales channel, and geographic regions. The luxury SUV market is divided into Full-size, Compact, and Mid-size. In terms of fuel, the luxury SUV market is classified into Gasoline, Diesel, Hybrid/electric. The luxury SUV market is segmented into USD 60K-90K, USD 30K-60K, USD 90K-120K, and over USD 120K.

The sales channel of the luxury SUV market is segmented into Franchised dealers and independent dealers. Regionally, the luxury SUV industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Full-size SUVs are projected to lead the market with a 44.0% revenue share in 2025, making them the dominant vehicle type in the luxury SUV segment. This leadership is being supported by rising demand for superior cabin space, towing capacity, and multi-terrain performance.

Consumers are increasingly valuing the commanding road presence and elevated seating positions offered by full-size SUVs. Enhanced suspension systems, premium infotainment features, and the ability to incorporate third-row seating have strengthened their appeal among families and business users alike.

Additionally, advancements in vehicle weight reduction and fuel efficiency have addressed some traditional concerns related to operational cost and maneuverability, further solidifying their market leadership.

Gasoline-powered luxury SUVs are expected to capture 52.0% of the total market revenue in 2025, making them the leading fuel type segment. This preference is being driven by smoother engine performance, reduced noise levels, and wider model availability.

Gasoline engines are seen as more refined and compatible with the comfort expectations of luxury vehicle buyers. Furthermore, in markets where EV infrastructure is still developing, gasoline vehicles continue to dominate due to their range convenience and ease of refueling.

OEMs have also introduced advanced turbocharged gasoline variants that deliver strong acceleration and reduced emissions, making them compliant with regulatory standards while preserving the driving dynamics favored in the luxury segment.

Vehicles priced between USD 60,000 and USD 90,000 are projected to account for 38.0% of the market revenue in 2025, positioning this as the top-performing price segment. This range strikes a balance between luxury features and perceived value, making it attractive to upper-middle-class buyers and corporate fleet managers.

Manufacturers are packing models within this range with cutting-edge infotainment, superior interior trims, semi-autonomous driving capabilities, and customizable features that offer a premium experience without exceeding psychological price barriers. Competitive leasing programs and accessible financing options have further enhanced demand in this bracket.

As aspirational ownership trends continue to influence buying behavior, this price segment is expected to retain its lead in volume contribution.

The luxury SUV segment is expanding rapidly, fueled by increasing disposable incomes and a growing preference for high-end features, alongside the demand for versatile vehicles that offer both comfort and utility. Automakers are responding to the rising interest in sustainable yet high-performance vehicles by introducing electric and hybrid models. Despite challenges such as high maintenance costs, fuel inefficiency, and environmental concerns, there are significant opportunities for growth. Innovations in technology, electrification, and design advancements are creating new avenues for the luxury SUV market, particularly in emerging economies and among environmentally conscious consumers.

The luxury SUV market has been fueled by increasing disposable income, particularly in emerging economies, which allows consumers to afford premium, high-performance vehicles. The shift in consumer preference towards SUVs, owing to their size, comfort, and versatility, has significantly contributed to this market’s growth. Luxury SUVs are often equipped with advanced technology, performance-enhancing features, and high-end interiors, making them appealing to consumers seeking a more luxurious and functional driving experience. Additionally, these vehicles are increasingly favored by younger, affluent consumers who are prioritizing both style and performance, driving the demand for top-tier brands. As consumer needs evolve, manufacturers are integrating innovative solutions and premium offerings to meet rising expectations.

The luxury SUV market faces significant challenges, particularly high ownership costs. While luxury SUVs offer superior performance and comfort, they often come with high insurance premiums, maintenance costs, and fuel consumption, which may deter potential buyers. Additionally, larger vehicles tend to be less fuel-efficient, contributing to environmental concerns about rising emissions. As consumer preferences shift towards more sustainable options, manufacturers face pressure to meet stricter emission standards and offer eco-friendly alternatives, such as electric and hybrid models, without sacrificing luxury features. This shift requires substantial investment in new technologies and innovations to balance environmental goals with consumer demand for luxury, power, and performance.

Substantial opportunities in the luxury SUV segment as manufacturers increasingly invest in electrification. Electric and hybrid luxury SUVs are gaining popularity due to growing environmental awareness and the demand for more sustainable transportation. These vehicles provide a combination of luxury, performance, and reduced carbon emissions, appealing to both affluent and eco-conscious consumers. Additionally, the integration of advanced technologies such as autonomous driving, smart infotainment systems, and AI-powered driver assistance features presents further growth prospects. As the demand for connectivity and personalized experiences increases, automakers have the opportunity to differentiate their offerings with cutting-edge features, positioning electric and hybrid luxury SUVs as the future of automotive luxury.

The luxury SUV market is witnessing a trend toward design innovation, with automakers focusing on creating sleek, dynamic, and more aerodynamic models while maintaining the rugged appeal associated with SUVs. There’s a noticeable shift towards hybrid and electric vehicles as more consumers demand eco-friendly yet high-performance options. Luxury SUV manufacturers are embracing electrification to meet growing environmental concerns and government regulations. Advanced infotainment systems, connectivity, and autonomous driving features are becoming key selling points for luxury SUVs, appealing to consumers seeking convenience and technology integration. Additionally, over-the-air software updates and AI-driven systems for enhanced driving assistance and performance optimization are setting new industry standards. These trends are reshaping the market, positioning luxury SUVs with the latest technological advancements as more than just vehicles, but connected, high-performance lifestyles.

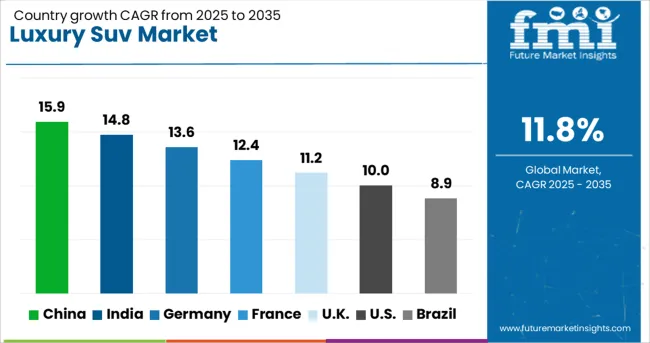

| Country | CAGR |

|---|---|

| China | 15.9% |

| India | 14.8% |

| Germany | 13.6% |

| France | 12.4% |

| UK | 11.2% |

| USA | 10.0% |

| Brazil | 8.9% |

The luxury SUV market is projected to grow globally at a CAGR of 11.8% from 2025 to 2035. Among the top markets, China leads at 15.9%, followed by India at 14.8%, while Germany posts 13.6%, the United Kingdom records 11.2%, and the United States stands at 10.0%. These growth rates represent a premium of +35% for China and +25% for India compared to the global average, while Germany stays ahead by +15%, and the UK and US trail at –5% and –15%, respectively. The divergence reflects strong demand from BRICS economies, supported by rising disposable income and increased adoption of premium vehicles, while OECD countries show steady growth driven by high consumer spending on luxury vehicles and continued interest in electric and hybrid luxury SUVs. The analysis spans over 40 countries, with the leading markets detailed below.

India is projected to grow at a CAGR of 14.8% through 2035, supported by rising incomes, urbanization, and a growing demand for luxury and high-performance vehicles. The luxury SUV market is driven by increasing preference for high-end, spacious, and versatile vehicles. As middle-class affluence rises, many Indian consumers are opting for premium vehicles, and brands are catering to the evolving tastes of younger generations. With government incentives encouraging the use of electric vehicles (EVs), more eco-conscious buyers are shifting towards luxury EVs. The availability of financing options and improved road infrastructure further support the growth of the luxury SUV market in urban areas. Additionally, a growing interest in outdoor and adventure tourism is fueling the popularity of SUVs in India.

China is expected to grow at a CAGR of 15.9% through 2035, propelled by the growing demand for premium vehicles in urban and rural markets. With the expanding middle class, luxury SUVs are becoming a status symbol, especially in major cities like Beijing and Shanghai. The country’s increasing appetite for international and domestic luxury brands drives demand for SUVs, as they offer space and versatility while delivering superior driving experiences. Additionally, Chinese consumers are showing an increasing preference for electric luxury SUVs, supported by government policies and incentives promoting clean energy vehicles. Local brands like BYD and NIO are also venturing into the luxury SUV market, competing with global leaders like BMW and Mercedes-Benz. The adoption of advanced technology, high safety standards, and luxury features is central to the market's growth.

Germany is projected to grow at a CAGR of 13.6% through 2035, with the country continuing to dominate in the premium automotive sector. Known for its luxury car brands like Mercedes-Benz, BMW, and Audi, demand for luxury SUVs is largely driven by high-income consumers who prioritize performance, quality, and innovation. Additionally, the shift towards electric mobility in Germany is significant, with consumers increasingly opting for electric or hybrid luxury SUVs due to environmental awareness and government incentives. The country’s strong automotive manufacturing base, combined with a robust infrastructure network, supports the widespread adoption of luxury SUVs. As German automakers continue to innovate with features such as autonomous driving and cutting-edge infotainment systems, the market for luxury SUVs remains strong and competitive.

The United Kingdom is projected to grow at a CAGR of 11.2% through 2035, with increasing demand for luxury SUVs driven by a growing middle class, improved living standards, and heightened consumer interest in high-performance vehicles. As consumers seek premium comfort and versatility, the popularity of luxury SUVs continues to rise. Electric vehicle adoption is also on the rise, spurred by government policies favoring low-emission vehicles and consumer interest in eco-friendly options. UK-based automakers, along with international brands, are expanding their offerings of electric and hybrid luxury SUVs. Moreover, increasing interest in adventure and outdoor tourism among younger consumers is further promoting demand for SUVs. The availability of financing options and a well-established retail network are additional growth factors for the UK luxury SUV market.

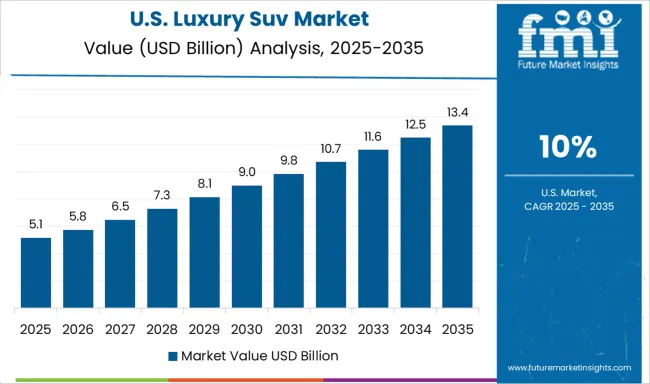

The United States is projected to grow at a CAGR of 10.0% through 2035, driven by continued demand for high-performance luxury vehicles, particularly SUVs. The USA market for luxury SUVs is characterized by a strong preference for comfort, advanced technology, and superior driving experiences. Increasing interest in electric vehicles (EVs) further supports the adoption of luxury electric SUVs, with American manufacturers like Tesla, as well as global brands like Mercedes-Benz and Audi, leading the shift toward electric luxury offerings. The trend of suburban living and family-oriented vehicles also fuels the demand for larger SUVs, while growing interest in sustainable transportation options is encouraging the development of eco-friendly luxury SUVs. Additionally, the USA market’s competitive nature, with an emphasis on vehicle customization and innovation, continues to drive sales and innovation.

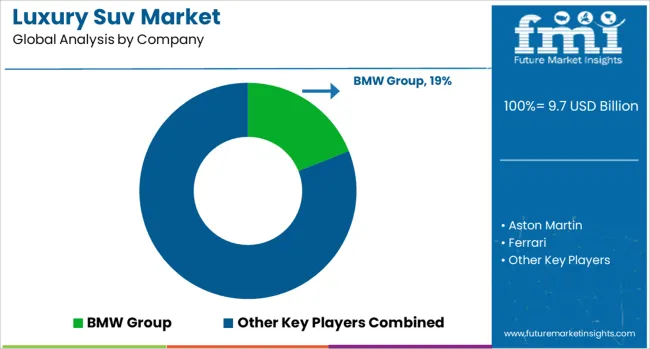

The luxury SUV market is driven by premium automakers offering high-performance, stylish, and technologically advanced vehicles catering to affluent consumers worldwide. BMW Group leads the market with its extensive lineup of luxury SUVs, such as the X5 and X7, combining cutting-edge technology, powerful engines, and sophisticated interiors.

Porsche offers a high-performance alternative with its Cayenne and Macan models, focusing on dynamic driving experiences and sleek designs. Aston Martin and Ferrari cater to the ultra-luxury segment, producing bespoke SUVs such as the DBX and Purosangue, respectively, which combine performance with exclusivity.

Rolls-Royce, known for its super-luxury offerings, has entered the luxury SUV market with its Cullinan, providing a blend of opulence and powerful off-road capabilities. General Motors brings luxury to the SUV segment with brands like Cadillac and Chevrolet, offering high-end models such as the Escalade and the Chevy Suburban. Tata Motors offers luxury SUVs through its Land Rover brand, including models like the Range Rover and Discovery, which excel in both luxury and off-road performance.

Toyota Motor and Volkswagen serve the mass luxury SUV market with models such as the Lexus RX and Audi Q7, respectively, providing luxury features at a more accessible price point. Competitive differentiation revolves around vehicle performance, luxury features, brand prestige, and technological innovations, including electric vehicle (EV) capabilities and autonomous driving features.

Barriers to entry include high R&D costs, premium brand establishment, and strong dealer networks. Strategic priorities include the development of hybrid and fully electric luxury SUVs to meet the growing demand for sustainability and performance.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.7 Billion |

| Type | Full-size, Compact, and Mid-size |

| Fuel | Gasoline, Diesel, and Hybrid/electric |

| Car Price | USD 60K-90K, USD 30K-60K, USD 90K-120K, and Over USD 120K |

| Sales Channel | Franchised dealer and Independent dealer |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BMW Group, Aston Martin, Ferrari, General Motors, Porsche, Rolls-Royce, Tata Motors, Toyota Motor, Volkswagen, and Volvo Car |

| Additional Attributes | Dollar sales by SUV type (full-size, mid-size, compact luxury SUVs) and end-use segments (urban commuting, off-road adventures, performance-focused). Demand dynamics are driven by increasing consumer interest in high-end SUVs offering both luxury and versatility, alongside rising demand for environmentally friendly, electric luxury SUVs. Regional trends indicate North America and Europe as dominant markets, driven by affluent consumer bases. |

The global luxury SUV market is estimated to be valued at USD 9.7 billion in 2025.

The market size for the luxury SUV market is projected to reach USD 29.7 billion by 2035.

The luxury SUV market is expected to grow at a 11.8% CAGR between 2025 and 2035.

The key product types in luxury SUV market are full-size, compact and mid-size.

In terms of fuel, gasoline segment to command 52.0% share in the luxury SUV market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Luxury Car Hoses Market Size and Share Forecast Outlook 2025 to 2035

Luxury Travel Market Forecast and Outlook 2025 to 2035

Luxury Wood Doors For Residential Interiors Market Size and Share Forecast Outlook 2025 to 2035

Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Luxury Rigid Box Market Size and Share Forecast Outlook 2025 to 2035

Luxury Hotel Market Size and Share Forecast Outlook 2025 to 2035

Luxury Electric Vehicle (EV) Market Size and Share Forecast Outlook 2025 to 2035

Luxury Vinyl Tile Flooring Market Size and Share Forecast Outlook 2025 to 2035

Luxury Car Market Size and Share Forecast Outlook 2025 to 2035

Luxury Mattress Market Size and Share Forecast Outlook 2025 to 2035

Luxury Fine Jewellery Market Analysis - Size, Share, and Forecast 2025 to 2035

Luxury Plumbing Fixtures Market Size and Share Forecast Outlook 2025 to 2035

Luxury Coaches Market Size and Share Forecast Outlook 2025 to 2035

Luxury Interior Fabric Industry Analysis in North America and Europe Growth, Trends and Forecast from 2025 to 2035

Luxury Footwear Market Outlook – Size, Share & Innovations 2025 to 2035

Luxury Furniture Market Insights - Demand, Size, and Industry Trends 2025 to 2035

Competitive Overview of Luxury Yacht Market Share & Providers

Luxury Yacht Industry Analysis by Type, by Size, by Application , by Ownership, and by Region- Forecast for 2025 to 2035

Luxury Handbag Market Analysis by Product Type, Material Type, and Region Through 2035

Luxury Products For Kids Market - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA