The Luxury Hotel Market is estimated to be valued at USD 110.7 billion in 2025 and is projected to reach USD 185.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

| Metric | Value |

|---|---|

| Luxury Hotel Market Estimated Value in (2025 E) | USD 110.7 billion |

| Luxury Hotel Market Forecast Value in (2035 F) | USD 185.6 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The luxury hotel market is experiencing strong momentum driven by rising disposable incomes, increasing international tourism, and growing demand for personalized hospitality experiences. Travelers are seeking premium accommodations that combine comfort, exclusivity, and high quality service standards.

The integration of smart technologies, wellness focused amenities, and sustainable operations has further elevated guest expectations, positioning luxury hotels as benchmarks for innovation in the hospitality sector. Expansion of global travel networks and the resurgence of business and leisure travel in key regions have provided additional growth stimulus.

Regulatory focus on sustainable tourism and the shift toward eco certified luxury properties are also shaping market dynamics. The outlook remains promising as leading hotel operators continue to invest in digital transformation, lifestyle centric experiences, and global expansion to capture evolving consumer preferences.

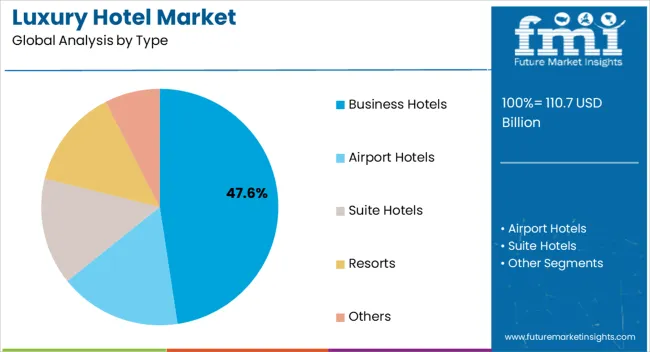

The business hotels type segment is projected to hold 47.60% of total market revenue by 2025, positioning it as the leading type segment. This growth is being driven by an increase in corporate travel, rising demand for conference and meeting facilities, and the provision of premium services tailored to business travelers.

Enhanced connectivity, loyalty programs, and global partnerships have supported stronger occupancy rates in this segment.

The focus on blending work with leisure, often referred to as bleisure travel, has further reinforced demand for high end business hotel accommodations, ensuring their continued market leadership.

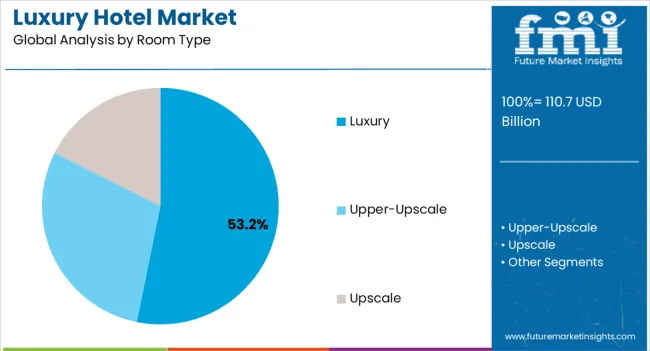

The luxury room type segment is expected to account for 53.20% of total revenue by 2025, making it the most dominant room category. Growth in this segment is being propelled by affluent travelers seeking exclusive experiences, superior amenities, and personalized services.

The trend of wellness integrated stays, smart room technologies, and curated lifestyle offerings has enhanced the appeal of luxury rooms. Operators have also leveraged customization and design innovation to deliver unique experiences that resonate with discerning guests.

As a result, luxury rooms have emerged as the preferred choice for travelers prioritizing comfort and exclusivity.

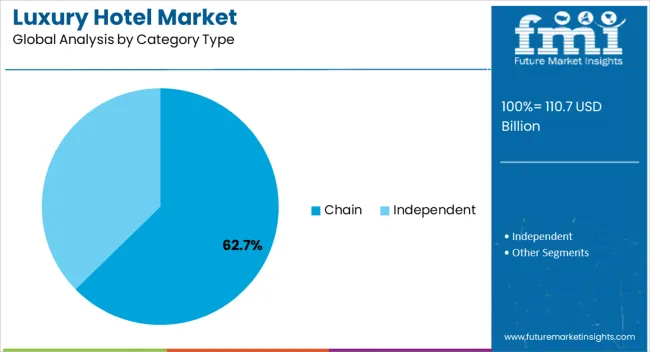

The chain category type segment is anticipated to command 62.70% of total market revenue by 2025, positioning it as the dominant category. This leadership is attributed to the strong global presence of established hotel brands, standardized service quality, and loyalty programs that encourage repeat stays.

Chain hotels benefit from significant investments in technology, brand reputation, and marketing strategies that enhance guest acquisition. Furthermore, partnerships with online travel agencies and corporate clients have expanded reach and occupancy levels.

As travelers increasingly seek reliability and consistent premium experiences, chain operated luxury hotels continue to lead the market.

The demand for unique experiences, rising foreign travel, and increasing disposable incomes contributed to the luxury hotel market's consistent expansion from 2020 to 2025. During this time, there was an emphasis on experiential products and the introduction of new luxury hotel brands.

The market for premium hotels saw a dramatic upheaval between 2025 and 2035. Technological breakthroughs like AI-driven personalization and virtual reality experiences have revolutionized the guest experience. Eco-friendly design and operations have been a primary focus of sustainable practices. To meet the increased demand for well-being-focused luxury travelers, the market saw the integration of wellness and holistic experiences.

As client preferences and expectations changed, the luxury hotel industry developed to offer unmatched luxury, sustainability, and well-being.

Crafting a Strong Brand Identity

The global luxury hotel business benefits greatly from creativity in new marketing initiatives, as it develops a strong brand identity and increases investment in internet advertising. As travelers find it incredibly relaxing and peaceful, more tourists choose to live a high life while on vacation or during the holidays.

This is increasingly done by elderly and newlyweds, who describe their trip as a once-in-a-lifetime experience. This can be related to how luxury hotels are portrayed to the target market and potential guests.

The Relationship between Per Capita Income and Hotel Preferences

A rise in per capita income is likely to boost the demand for luxury hotels significantly. The customer is willing to get the hang of how it feels to be served in such hotels and to experience it, and he is ready to spend the required amount.

Hot Favorite Among VIPs and Celebrities

VIPs and several other celebrities are designed to live prosperous lives and travel in grandeur. This is evident because they would only stay in five-star hotels while traveling.

A common person is inspired by their style of life and strives to match it, which causes a predicted rise in demand for luxury hotels.

National and international events

The government and various corporate bodies conduct certain national and international events. The speakers in such events are usually respected and noted personalities, and the hosts do everything from their side to make the best possible arrangements for their visit. In such cases, they only turn to luxury hotels for all the benefits they provide. As we advance, this might well increase the luxury hotel market share.

| Threat | High Prices - High room charges at five-star hotels and the rise of affordable shared lodging platforms like Airbnb in low-income nations are expected to hinder market expansion. The growth of the luxury hotel business would also be impeded by the abundance of low- and middle-range lodging options worldwide. |

|---|---|

| Emerging Opportunity | Niche Market Advantage - The luxury hotels would want to stay in touch with their current clients to overcome this threat. It is a niche market. Thus the goal is to concentrate more on a small number of customers. For this reason, luxury hotels are creating programs, membership cards, and promotions to entice new customers and retain their existing clientele, ultimately growing their market share. |

| Threat | Lack of interest by the potential customer - A client who can afford the services of a luxury hotel may choose not to use them. Instead, they don't want to use such ostentatious services and seek a basic boarding facility. |

|---|---|

| Emerging Opportunity | Expanding to Meet the Increasing Demand for Comfort - To combat this threat, luxury hotels can offer excessive service. The shift in customer preference for pricey travel, experiences, and comfort is the main cause behind the development in demand for luxury hotels. The customer is prepared to shell out the necessary sum to experience what it's like to be served at such hotels. |

| Threat | Available only at select places - Only major cities have access to the finest hotels. The rationale is that these locations are the only ones where the goods and services needed to run these hotels are offered. This results in such luxurious hotels being absent throughout the country, creating a shortage. |

|---|---|

| Emerging Opportunity | iversifying Offerings and Franchise Locations in the Luxury Hotel Industry - Luxury hotel operators must research and invest heavily to diversify offerings and launch new franchise locations worldwide. The growth of luxury hotels has been significantly impacted by the tourism industry, which also creates new opportunities for the hospitality industry. |

| Attributes | Details |

|---|---|

| North America Market Share - 2025 | 24% |

| United States Market Share - 2025 | 6% |

| Australia Market Share - 2025 | 5.2% |

The luxury hotel market in North America now holds the significant share, and growth is predicted.

The market is anticipated to be driven by North America's burgeoning tourism industry and the significant presence of HNIs. The natural and technological beauty of the area captivates visitors. Some travelers enjoy staying in luxury hotels, which gives them a better experience. This is anticipated to substantially impact the market outlook for luxury hotel in the area.

| Attributes | Details |

|---|---|

| Japan Market Share - 2025 | 4% |

| China Market CAGR (From 2025 to 2035) | 6.5% |

| India Market CAGR (From 2025 to 2035) | 4.5% |

Asia Pacific is the significantly-growing region.

Rapid urbanization, a sudden surge in infrastructure development, and swift technological advances are expected to spur the market. If we compare the historical data on disposable income with the current times, there has been an exponential increase in disposable income. This has ultimately led to people wanting to have new and luxurious experiences. All these factors are expected to affect the luxury hotel market outlook strongly.

| Attributes | Details |

|---|---|

| Europe Market Share - 2025 | 20.1% |

| Germany Market Share - 2025 | 3.5% |

| United Kingdom Market CAGR (From 2025 to 2035) | 6.6% |

The luxury hotel market in Europe, which now holds a sizable share, is anticipated to rise steadily.

Europe is mostly known for its adventurous travel, and the area makes it easy to move freely from one nation to another. Millennials enjoy traveling to the site for its sports and cultural attractions. Many travelers would reserve rooms in upscale accommodations to make their trip memorable and all-encompassing.

Tourists have been much more meticulous about cleanliness since the outbreak. Future developments in the European luxury hotel business are anticipated to benefit from this.

| Category | Room Type |

|---|---|

| Leading Segment | Luxury |

| Market Share | 31% |

The luxury segment leads to 020243.room type share due to substantial offerings and affordable prices.

The Luxury room type is in the lead. Due to its emphasis on exclusivity, unmatched service, and abundant amenities, luxury takes the lead. Modern technology, individualized services, expansive rooms with high-end furniture, and expensive extras like private pools or stunning views are all aspects of luxury hotels. Luxury rooms stand out because they focus on delivering an outstanding and immersive experience, drawing discerning tourists looking for the height of luxury and indulgence.

| Category | Type |

|---|---|

| Leading Segment | Business Hotels |

| Market Share | 28% |

Business hotels have a significant market share based on the type.

According to type, the business hotels segment accounted for about one-third of the global luxury hotel market and is anticipated to hold the top spot throughout the forecast period. As numerous business meetings are hosted in such hotels, huge corporate organizations typically reserve tickets in quantity.

Due to affordable prices, the chain sector holds a considerable share of the category segment.

According to the category type, the chain segment has the leading market share for luxury hotels. The chain hotel segment dominates the market due to the widely dispersed presence of hotels in the chain category on a global scale. The chain hotels in this market are trying to broaden their horizons and fortify their positions in promising areas. This results from its huge market penetration, broad room inventory, and effective services at competitive rates.

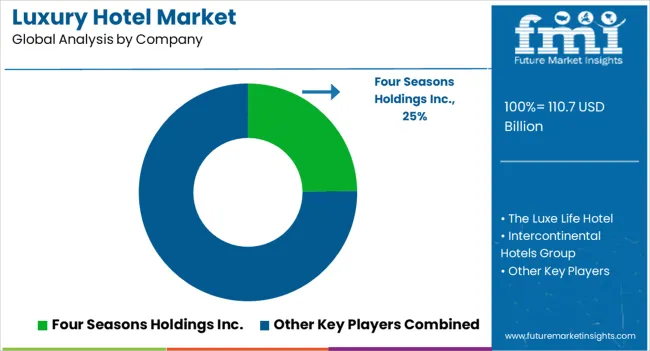

Currently, the key players in the market focus on their offerings, whereas the start-ups focus on managing the workforce. The idea is to update the hotel managers and connect them with their workforce without delay. Other notable start-ups escalating the market share of luxury hotels are Beekeeper, OYO Rooms, and Hosco.

Luxury hotel chains are actively expanding their operations and presence across the nations. Several hotel chains are developing new deals and distinctive market niches and services to draw guests and solidify their positions. They are focusing on membership cards to ensure customers remain hooked to their services.

Marriott International Inc., ITC Hotels Ltd., and Hyatt Corporation are vying to be the best in the world with all guns blazing.

As a current trend in luxury hotels, Sustainability is again at the forefront of the hospitality industry. As a logical extension of avoiding disposable plastics, minimizing needless paper consumption through opt-in receipts, and reducing food waste, decisions taken at the hotel management level are influenced by more extensive ethical and environmental considerations.

For instance, Marriott International declared in August 2020 that all its properties worldwide would no longer have single-use bottles of bath gels, shampoos & conditioners. The hotel chain hopes to cut the amount of plastic used for amenities by around 30% by doing away with such tiny bottles.

Hyatt Corporation, a brand of upscale and executive hotels, makes every effort to give its clients first-rate service. To ensure that its customers are mesmerized by its omnipresence, Hyatt Corporation is on a mission to widen its reach.

Hyatt declared in April 2025 that they are concentrating more on emerging countries and have set a target of about 70% growth in India. A multi-brand presence throughout cities is the goal. This action is being taken when more individuals are willing to spend money on luxury vacations and when South West Asia is expanding rapidly.

Corporate executives frequently book luxurious airport hotels or luxurious city hotels conveniently placed, which is another reason business luxury hotels are growing.

For example, 2L De Blend in Utrecht, Netherlands, won the World Luxury Hotel Awards in the LUXURY BUSINESS HOTEL category twice in 2020 and 2024. The 2L De Blend apartment hotel, which opened in October 2020 and is roughly a kilometer from the Utrecht Zuilen train station, allows guests to stay anywhere between one night and six months.

The location factor has long been emphasized as a success factor in luxury hotels. Compared to a hotel in a less significant area, a hotel in an important location is anticipated to perform well, with the services and amenities being followed.

Even the ITC group is on a mission to expand its presence. In July 2025, ITC Hotels announced that it might come up with two new properties in Gujarat-one in Ahmedabad and the other on the outskirts of Gandhinagar.

New Innovations and Advancements

| Company | Marriott International |

|---|---|

| Strategy | Marriott International's Bold Move to Introduce New Properties |

| Details | In January 2024, Marriott International announced they would open 100 new properties in the Asia Pacific region that year. The goal is to introduce luxury brands and experiences to tourists and visitors in undiscovered locations in the area. |

| Company | The Luxe Life Hotel New York |

|---|---|

| Strategy | The First Jewel in the Luxe Collection |

| Details | In March 2024, The Luxe Life Hotel New York, the first branded property under the Luxe Collection umbrella, debuted in New York City. Zeavola Resort in Thailand, Il Tornabuoni in Florence, Eurostars Magnificent Mile in Chicago, CoolRoomsAtocha in Spain, and The Belmont are adding new 4- and 5-star hotels to this list (Dallas) |

The global luxury hotel market is estimated to be valued at USD 110.7 billion in 2025.

The market size for the luxury hotel market is projected to reach USD 185.6 billion by 2035.

The luxury hotel market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in luxury hotel market are business hotels, airport hotels, suite hotels, resorts and others.

In terms of room type, luxury segment to command 53.2% share in the luxury hotel market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Luxury Car Hoses Market Size and Share Forecast Outlook 2025 to 2035

Luxury Travel Market Forecast and Outlook 2025 to 2035

Luxury Wood Doors For Residential Interiors Market Size and Share Forecast Outlook 2025 to 2035

Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Luxury Rigid Box Market Size and Share Forecast Outlook 2025 to 2035

Luxury Electric Vehicle (EV) Market Size and Share Forecast Outlook 2025 to 2035

Luxury Vinyl Tile Flooring Market Size and Share Forecast Outlook 2025 to 2035

Luxury Car Market Size and Share Forecast Outlook 2025 to 2035

Luxury Mattress Market Size and Share Forecast Outlook 2025 to 2035

Luxury Fine Jewellery Market Analysis - Size, Share, and Forecast 2025 to 2035

Luxury SUV Market Size and Share Forecast Outlook 2025 to 2035

Luxury Plumbing Fixtures Market Size and Share Forecast Outlook 2025 to 2035

Luxury Coaches Market Size and Share Forecast Outlook 2025 to 2035

Hotel Central Reservation System Market Size and Share Forecast Outlook 2025 to 2035

Luxury Interior Fabric Industry Analysis in North America and Europe Growth, Trends and Forecast from 2025 to 2035

Luxury Footwear Market Outlook – Size, Share & Innovations 2025 to 2035

Luxury Furniture Market Insights - Demand, Size, and Industry Trends 2025 to 2035

Hotel Ice Dispensers Market - Hospitality Trends & Industry Forecast 2025 to 2035

Competitive Overview of Luxury Yacht Market Share & Providers

Luxury Yacht Industry Analysis by Type, by Size, by Application , by Ownership, and by Region- Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA