Luxury Fine Jewellery Market Segment is expectedto Achieve Steady Growth Trend from 2025 to 2035. Trends indicate a move towards high-end, bespoke jewellery made with an emphasis on ethical diamonds, rare gemstones and sustainable materials, reflecting the increased demand for a responsible luxury jewellery offering. Key jewellery brands are catering to the luxury needs of their customers through AI-driven customization, blockchain-based authentication, and immersive retail experiences.

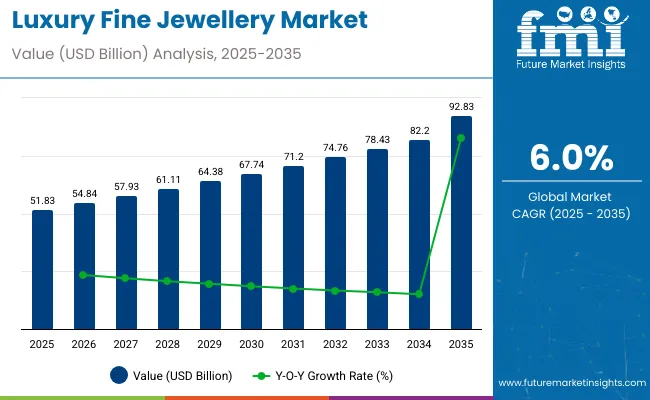

According to the research report, the Order Processing Software market is estimated to reach USD 92.83 billion by 2035, its 2025 value being USD 51.83 billion. The Order Processing Software market CAGR is 6.0% during the period 2025 to 2035.

The expansion of the market is being driven by growing demand for investment-grade jewellery, an increase in the population of high-net-worth individuals (HNWI) and the increasing popularity of branded jewellery. The use of elements like lab-grown diamonds, digital jewellery showrooms and AI-driven trend forecasting is carving up the future of our industry.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 51.83 billion |

| Market Value (2035F) | USD 92.83 billion |

| CAGR (2025 to 2035) | 6.0% |

Per capita spending on luxury fine jewellery reflects both economic capacity and cultural affinity for high-end adornment. While overall spending is concentrated among affluent consumers, global averages are shaped by population size, wealth distribution, and retail access. Fine jewellery includes premium items such as diamond rings, gemstone-studded necklaces, and gold pieces from prestigious brands, often serving as symbols of status, tradition, and investment.

The global trade of luxury fine jewellery is shaped by craftsmanship excellence, resource availability, brand presence, and consumer demand. High-value items such as gold and diamond jewellery, often produced by renowned heritage houses or artisanal workshops, are traded across continents to cater to luxury buyers and investors.

The Luxury Fine Jewellery Market is studied across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America accounts for the largest share in the market, followed by United States; supported by the strong luxury retail spaces and high population density of ultra-high-net-worth individuals (UHNWIs) in the region.

High-end brands such as Tiffany & Co., Harry Winston and Cartier are moving towards personalised and experience-based retail products, offering customers rare collections and bespoke jewellery. The increasing demand for synthetic diamonds and ethically sourced gemstones are altering consumer preferences, with technology playing an outsized role in facilitating digital strategies such as virtual consultations and AIassisted jewellery selection that are transforming the luxury shopping experience.

Europe remains a key driver of the luxury jewellery market, with heritage maisons from France, Italy and Switzerland, among others, at the forefront. Luxury brands such as Bulgari, Chopard and Van Cleef & Arpels are pairing historic craftsmanship with tech to devise hyper-detailed, limited-run collections for consumers.

“A very high demand for vintage, collectible and investment-grade jewellery has been seen all around the region, as affluent buyers are looking to own pieces that increase in value over time.” Building in sustainability is another increasing trend where European consumers show a growing interest for Fairmined gold, conflict-free diamonds and traceable supply chains.

Asia-Pacific is expected to be the fastest-growing region, driven largely by China, India and Japan, where increasing wealth together with a cultural predilection for gold and gemstone ornamentation continues to drive demand. Growing number of luxury consumers in China, rising the global demand of branded jewellery and solid demand for any customization are some of the factors pushing the market expansion.

India, the second largest consumer of yellow metal in the world, remains a destination for high-value wedding and bridal jewellery, with the trend for designs of modern jewellery also thriving. On the other hand, Japan’s minimalist-but-high-precision luxury jewellery is courting a growing class of wealthy millennials. Digital-first jewellery labels and tech-powered jewellery authentication are also rattling the industry in the region.

Counterfeiting and Grey Market Sales

The luxury fine jewellery sector has long faced a persistent challenge from counterfeit goods, grey market sales and fake gemstone certificates. The growth of counterfeit online marketplaces and copy-cat jewellery brands threatens the illustrious standing of leading jewellers. Clever Implementation Offers Authenticity, Traceability, and Brand Protection Block chain-based tracking, digital certificates, and AI-enabled counterfeit detection sharing nature of buyers and sellers are vital in maintaining consumer trust and protecting brand identity.

Digital Transformation and AI-Driven Personalization

AI-led personalization, augmented reality (AR), try-ons, and blockchain-based authentication are changing the way consumers purchase luxury jewels. With AI-backed design advice, real-time virtual consultations, and 3D-printed models, brands are going further than ever to provide a personalized, sensory shopping experience.

Moreover, NFT-backed jewellery ownership, digital jewellery vaults, and the rise of smart jewellery with embedded technology all offer fresh opportunities to explore in the jewellery space and require new thinking. Adapting high-tech luxury retail experiences and omnichannel engagement strategies will give companies a decisive competitive edge in the developing fine jewellery market.

The luxury fine jewellery market saw strong growth from 2020 to 2024, supported by digitalisation, ethical sourcing and changing consumer trends towards personalised jewellery.

Growing consumer demand for sustainability and ethical sourcing led the market, as eco-conscious consumers sought out conflict-free diamonds, recycled gold and lab-grown gems. Volatile markets prompted leading brands to implement blockchain-based provenance tracking, giving the supply chain transparency while simultaneously enhancing ESG (Environmental, Social and Governance) factors.

The market was reshaped by millennials and Gen Z, who prefer bespoke, gender-fluid and investment-grade jewellery. Modern, practical pieces of affordable luxury trumped traditional statement pieces, and heritage brands responded through customization and AI-powered jewellery design suggestions.

Despite continued strong underlying demand, raw material availability and pricing impacted positively but were still challenged by inflation, geopolitical tensions, and supply chain disruptions. And yet, brands adapted to these challenges by diversifying sourcing strategies as well as capitalizing on regional hubs of manufacturing to ensure supply stability.

Transformative forces will reshape the luxury fine jewellery market between 2025 and 2035, with AI-driven personalization, a shift towards circular luxury and immersive shopping experiences taking hold.

Novel technologies such as artificial intelligence and big data analytics will redefine luxury jewellery design, enabling brands to provide hyper-personalised designs based on consumer preferences, digital avatars and real-time trend analysis. Platforms powered by AI will help customers create custom jewellery pieces through 3D visualization, removing the necessity of having a physical prototype.

Circular luxury will gather steam, with brands launching buy-back programmes and pre owned luxury jewellery resale, as well as upcycled gemstone collections. The industry will be predominantly composed of sustainable materials, such as bioengineered diamonds and responsibly sourced rare gemstones.

The high-end luxury market will be ruled by experiences, leading to the transformation of flagship stores into phygital (physical + digital) showrooms, where jewellery is showcased through holographic displays, customers are helped in styling with AR, and metaverse shopping experiences are provided for VIP clients. Luxury jewellery maisons would embrace integration with Web3 tech, NFTs and blockchain verified digital certificates to authenticate and increase the value of their creations.

Investment attractiveness of fine jewellery will grow - rare and limited-edition and heritage-inspired collections will be pursued by ultra-high-net-worth individuals (UHNWIs) as alternative investment assets. Brands will partner with formidable artists, such as fashion designers and even AI-generated creative entities, to produce exclusive one-of- a-kind jewellery pieces.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Digital Transformation | E-commerce, AR try-ons, and online luxury concierge services. |

| Sustainability & Ethical Sourcing | Increased demand for lab-grown diamonds and recycled gold. |

| Personalization & Customization | AI-assisted jewellery recommendations and bespoke designs. |

| Investment-Grade Jewellery | Rising demand for heirloom and high-value pieces. |

| Experiential Retail | Hybrid shopping models (in-store + online). |

| Ultra-Luxury & Exclusive Collaborations | Limited-edition collaborations with designers and artists. |

| Consumer Demographics | Millennials and Gen Z driving market evolution. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Digital Transformation | AI-driven virtual customization, Web3-based digital showrooms. |

| Sustainability & Ethical Sourcing | Expansion of circular economy, resale luxury, and bioengineered gems. |

| Personalization & Customization | AI-driven hyper-personalization with predictive consumer analytics. |

| Investment-Grade Jewellery | Growth of exclusive, NFT-backed, and blockchain -authenticated collections. |

| Experiential Retail | Immersive phygital luxury showrooms and metaverse -based jewellery boutiques. |

| Ultra-Luxury & Exclusive Collaborations | AI-generated jewellery design and partnerships with digital influencers. |

| Consumer Demographics | Global UHNWIs and digital-native collectors shaping the future. |

Demand for premium personalised jewellery, growing purchasing power of the consumers, and awareness of celebrity endorsements are fuelling the growth of luxury fine jewellery market in the US. Ethically sourced materials and well-sourced diamonds and recycled metals are slowly but surely changing the landscape of the Jewellery industry.

Digital transformation also plays an important role here, as luxury jewellery brands are also taking advantage of e-commerce platforms and virtual try-on technologies to make the consumer experience better. Furthermore, increasing jewellery acquisition for investment purpose is on the rise, which is expected to boost - market growth.

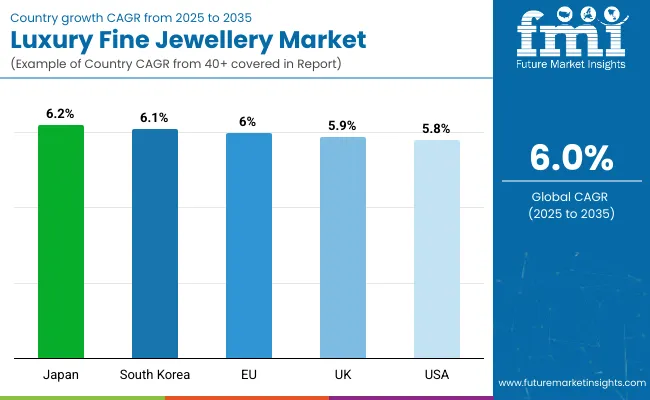

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.8% |

The luxury fine jewellery market is thriving in UK as consumer interest towards heritage and bespoke jewellery pieces is increasing. Market trends are dictated by the demand for vintage and antique designs as well as the popularity of lab-grown diamonds.

Market growth, too, is driven by the rising number of high-net-worth individuals investing in rare gemstones and limited-edition jewellery. Moreover, the boom in digital interaction and digital luxury shopping has made it easier for consumers to access premium jewellery brands, boosting sales and brand visibility.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.9% |

The European luxury fine Jewellry market is growing steadily because of strong presence of famous jewellery houses in countries like France, Italy and Switzerland. The region has a long-standing heritage of craftsmanship and growing disposable incomes are driving demand for premium Jewellery.

Sustainability is still high on the agenda, as brands embrace responsible sourcing practices and tout circular fashion initiatives through resale and repurposing efforts. Further discussing the expansion of duty free luxury retail and the influence of tourism, EMEA market growth will be fueled within key shopping destinations such as Paris, Milan, and Geneva.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.0% |

The Japanese luxury fine jewellery market is known for a deep appreciation for precision craftsmanship, minimalist esthetics and sumptuous materials. Japanese buyers place great value on uniqueness and timeless sophistication, driving strong interest in limited-edition and bespoke pieces.

The market is also gaining from the increasing popularity in gender neutral jewellery and newer materials like ceramic and titanium. To appeal to Japan's upscale demographic, luxury jewellery players are building their presence in the country through exclusive in-store experiences and partnerships with local artisans.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.2% |

The booming South Korean luxury fine jewellery market is growing rapidly, driven by the influence of K-pop culture, celebrity endorsements, and social media-induced sartorial trends. Statement jewellery and mix-and-match styling are in high demand from young consumers, prompting brands to adopt contemporary and versatile styles.

The other main driver is the growing desire for quality yet affordable fine jewellery, with demi-fine lines increasingly popular, effectively meeting the demand between fashion jewellery and traditional luxury pieces. The growing emphasis on ethical sourcing and sustainable practices is also shaping purchasing behaviors among eco-minded consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.1% |

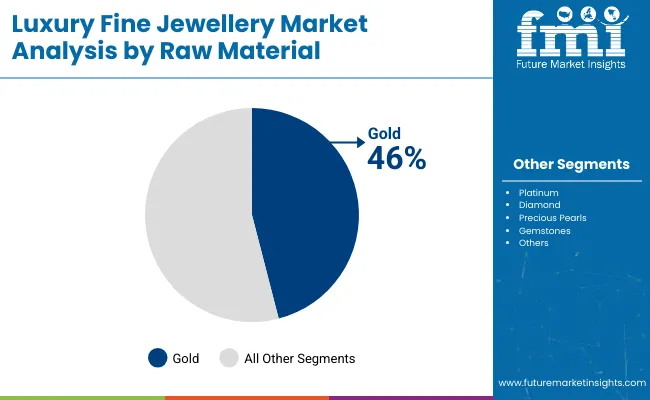

Fine luxury gold jewellery is in demand due to its timeless appeal, status symbolism, and investment value. Consumers view gold jewellery as both a fashion statement and a long-term asset that retains or increases in value. Rising disposable incomes, especially in emerging markets, have fueled demand for premium and custom-designed pieces.

Gold's cultural significance in weddings and celebrations also sustains consistent interest. Additionally, luxury brands emphasize craftsmanship, exclusivity, and ethical sourcing, appealing to affluent buyers seeking authenticity and prestige. The growth of online retail and influencer marketing has further expanded access and desirability among younger, style-conscious consumers.

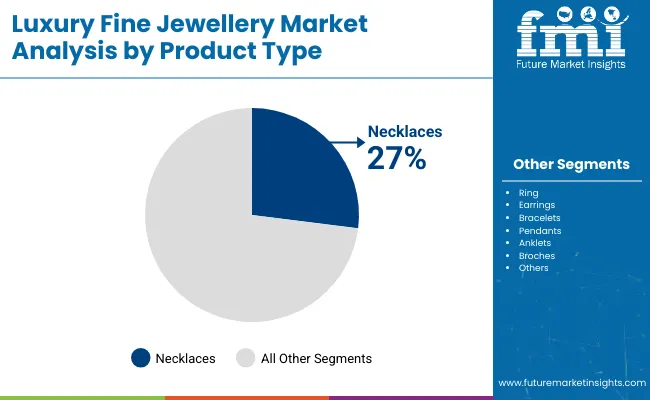

Fine luxury necklaces are in demand due to their ability to combine elegance, status, and personal expression. They serve as standout pieces that elevate any outfit, making them popular for both everyday wear and special occasions. High-end necklaces often feature precious metals and gemstones, which enhance their aesthetic and investment value.

Consumers are drawn to the craftsmanship, exclusivity, and heritage associated with luxury brands. Additionally, rising affluence and a growing interest in self-gifting and meaningful purchases drive demand. Social media and celebrity endorsements also influence trends, making fine luxury necklaces desirable symbols of sophistication and individuality.

The luxury fine-jewellery market continues to expand, thanks to consumer demand for expensive, artisan-made jewels driven by wealth expansion, cultural heritage and personal designs. Business owners in this sector relay codes of refinement, materials of natural origin, and digital technique to meet the needs of wealthy shoppers, collectors, and the growing luxury-graphing shoppers.

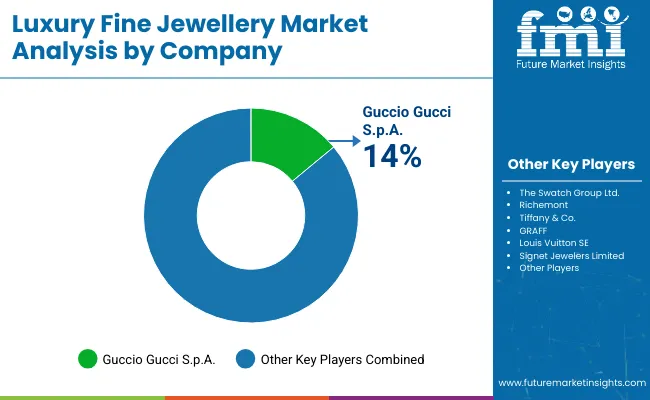

| Company Name | Estimated Market Share (%) |

|---|---|

| Guccio Gucci S.p.A. | 14-18% |

| The Swatch Group Ltd. | 12-16% |

| Richemont | 12-16% |

| Tiffany & Co. | 10-14% |

| GRAFF | 8-12% |

| Louis Vuitton SE | 7-11% |

| Signet Jewelers Limited | 6-10% |

| Chopard International SA | 5-9% |

| MIKIMOTO | 4-8% |

| Pandora Jewelry , LLC | 4-7% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Guccio Gucci S.p.A. | Creates luxury jewellery collections inspired by Italian craftsmanship, heritage, and modern aesthetics. |

| The Swatch Group Ltd. | Manufactures high-end jewellery under brands like Harry Winston, blending traditional artistry with innovation. |

| Richemont | Owns prestigious brands like Cartier, Van Cleef & Arpels , and Piaget, renowned for elegance and sophistication. |

| Tiffany & Co. | Specializes in iconic diamond jewellery and engagement rings, setting global luxury trends. |

| GRAFF | Offers ultra-premium, rare diamond jewellery, famous for large, flawless gemstones. |

| Louis Vuitton SE | Expands high jewellery lines with bold designs and avant-garde aesthetics. |

| Signet Jewelers Limited | Operates Kay, Zales , and Jared, targeting aspirational luxury jewellery buyers. |

| Chopard International SA | Crafts Swiss-made jewellery with a focus on sustainable gold and Fairmined -certified diamonds. |

| MIKIMOTO | Leads luxury pearl jewellery, setting standards for cultured pearls and timeless designs. |

| Pandora Jewelry , LLC | Dominates the mass-luxury segment with customizable, charm-based jewellery collections. |

Guccio Gucci S.p.A. (14-18%)

Gucci dominates the market by offeringfashion-forward luxury jewellerythat mergesItalian heritage with contemporary influences.

The Swatch Group Ltd. (12-16%)

Swatch strengthens its position with Harry Winston’s exceptional diamond craftsmanship and high jewellery expertise.

Richemont (12-16%)

Richemont controls top-tier brands like Cartier and Van Cleef & Arpels, blending traditional elegance with modern luxury.

Tiffany & Co. (10-14%)

Tiffany maintains its iconic status with legendary diamond engagement rings and premium custom jewellery services.

GRAFF (8-12%)

GRAFF crafts some of the world’s rarest and largest diamonds, catering to ultra-high-net-worth collectors.

Louis Vuitton SE (7-11%)

Louis Vuitton expands its fine jewellery segment by introducing high-concept collections with bold, architectural designs.

Signet Jewelers Limited (6-10%)

Signet leads the accessible luxury jewellery market, offering bridal, everyday fine jewellery, and lab-grown diamonds.

Chopard International SA (5-9%)

Chopard pioneers ethical luxury with sustainable gold and high jewellery craftsmanship.

MIKIMOTO (4-8%)

MIKIMOTO dominates the luxury pearl jewellery market, setting standards for cultured pearl excellence.

Pandora Jewelry, LLC (4-7%)

Pandora revolutionizes affordable luxury jewellery with customizable charms and mass-market appeal.

Other Key Players (25-35% Combined)

Independent jewellers and boutique luxury brands contribute to exclusive, bespoke jewellery trends. Notable players include:

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 51.83 billion |

| Projected Market Size (2035) | USD 92.83 billion |

| CAGR (2025 to 2035) | 6.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand units for volume |

| Raw Materials Analyzed (Segment 1) | Gold, Platinum, Diamond, Precious Pearls, Gemstones, Others |

| Product Types Analyzed (Segment 2) | Necklaces, Rings, Earrings, Bracelets, Pendants, Anklets, Brooches, Others |

| Consumer Orientations Analyzed (Segment 3) | Men, Women, Children |

| Sales Channels Analyzed (Segment 4) | Individual Jewellery Stores, Specialty Stores, Online Retailers, Other Sales Channels |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Luxury Fine Jewellery Market | Guccio Gucci S.p.A., The Swatch Group Ltd., Richemont, Tiffany & Co., GRAFF, Louis Vuitton SE, Signet Jewelers Limited, Chopard International SA, MIKIMOTO, Pandora Jewelry, LLC |

| Additional Attributes | Market trends in raw material preference, Demand shifts in product type and consumer segments, Impact of online retail growth, Branding and luxury positioning strategies |

| Customization and Pricing | Customization and Pricing Available on Request |

The overall market size for the Luxury Fine Jewellery Market was USD 51.83 billion in 2025.

The Luxury Fine Jewellery Market is expected to reach USD 92.83 billion in 2035.

The demand is driven by rising disposable incomes, increasing preference for high-end personalized jewellery, growth in e-commerce luxury sales, and the influence of celebrity endorsements and branding.

The top 5 countries driving market growth are the USA, UK, Europe, Japan and South Korea.

Diamonds hold a dominant position in the luxury fine jewellery market.

Table 1: Global Value (US$ million) Forecast, By Raw Material, 2017 to 2032

Table 2: Global Volume (Units) Forecast, By Raw Material, 2017 to 2032

Table 3: Global Value (US$ million) Forecast, By Product Type, 2017 to 2032

Table 4: Global Volume (Units) Forecast, By Product Type, 2017 to 2032

Table 5: Global Value (US$ million) Forecast, By Consumer Orientation, 2017 to 2032

Table 6: Global Volume (Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 7: Global Value (US$ million) Forecast, By Sales Channel, 2017 to 2032

Table 8: Global Volume (Units) Forecast, By Sales Channel, 2017 to 2032

Table 9: Global Volume (Units) Forecast, By Region, 2017 to 2033

Table 10: Global Volume (Units) Forecast, By Region, 2017 to 2034

Table 11: North America Value (US$ million) Forecast, By Country, 2017 to 2032

Table 12: North America Volume (Units) Forecast, By Country, 2017 to 2032

Table 13: North America Value (US$ million) Forecast, By Raw Material, 2017 to 2032

Table 14: North America Volume (Units) Forecast, By Raw Material, 2017 to 2032

Table 15: North America Value (US$ million) Forecast, By Product Type, 2017 to 2032

Table 16: North America Volume (Units) Forecast, By Product Type, 2017 to 2032

Table 17: North America Value (US$ million) Forecast, By Consumer Orientation, 2017 to 2032

Table 18: North America Volume (Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 19: North America Value (US$ million) Forecast, By Sales Channel, 2017 to 2032

Table 20: North America Volume (Units) Forecast, By Sales Channel, 2017 to 2032

Table 21: Latin America Value (US$ million) Forecast, By Country, 2017 to 2032

Table 22: Latin America Volume (Units) Forecast, By Country, 2017 to 2032

Table 23: Latin America Value (US$ million) Forecast, By Raw Material, 2017 to 2032

Table 24: Latin America Volume (Units) Forecast, By Raw Material, 2017 to 2032

Table 25: Latin America Value (US$ million) Forecast, By Product Type, 2017 to 2032

Table 26: Latin America Volume (Units) Forecast, By Product Type, 2017 to 2032

Table 27: Latin America Value (US$ million) Forecast, By Consumer Orientation, 2017 to 2032

Table 28: Latin America Volume (Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 29: Latin America Value (US$ million) Forecast, By Sales Channel, 2017 to 2032

Table 30: Latin America Volume (Units) Forecast, By Sales Channel, 2017 to 2032

Table 31: Europe Value (US$ million) Forecast, By Country, 2017 to 2032

Table 32: Europe Volume (Units) Forecast, By Country, 2017 to 2032

Table 33: Europe Value (US$ million) Forecast, By Raw Material, 2017 to 2032

Table 34: Europe Volume (Units) Forecast, By Raw Material, 2017 to 2032

Table 35: Europe Value (US$ million) Forecast, By Product Type, 2017 to 2032

Table 36: Europe Volume (Units) Forecast, By Product Type, 2017 to 2032

Table 37: Europe Value (US$ million) Forecast, By Consumer Orientation, 2017 to 2032

Table 38: Europe Volume (Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 39: Europe Value (US$ million) Forecast, By Sales Channel, 2017 to 2032

Table 40: Europe Volume (Units) Forecast, By Sales Channel, 2017 to 2032

Table 41: East Asia Value (US$ million) Forecast, By Country, 2017 to 2032

Table 42: East Asia Volume (Units) Forecast, By Country, 2017 to 2032

Table 43: East Asia Value (US$ million) Forecast, By Raw Material, 2017 to 2032

Table 44: East Asia Volume (Units) Forecast, By Raw Material, 2017 to 2032

Table 45: East Asia Value (US$ million) Forecast, By Product Type, 2017 to 2032

Table 46: East Asia Volume (Units) Forecast, By Product Type, 2017 to 2032

Table 47: East Asia Value (US$ million) Forecast, By Consumer Orientation, 2017 to 2032

Table 48: East Asia Volume (Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 49: East Asia Value (US$ million) Forecast, By Sales Channel, 2017 to 2032

Table 50: East Asia Volume (Units) Forecast, By Sales Channel, 2017 to 2032

Table 51: South Asia Value (US$ million) Forecast, By Country, 2017 to 2032

Table 52: South Asia Volume (Units) Forecast, By Country, 2017 to 2032

Table 53: South Asia Value (US$ million) Forecast, By Raw Material, 2017 to 2032

Table 54: South Asia Volume (Units) Forecast, By Raw Material, 2017 to 2032

Table 55: South Asia Value (US$ million) Forecast, By Product Type, 2017 to 2032

Table 56: South Asia Volume (Units) Forecast, By Product Type, 2017 to 2032

Table 57: South Asia Value (US$ million) Forecast, By Consumer Orientation, 2017 to 2032

Table 58: South Asia Volume (Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 59: South Asia Value (US$ million) Forecast, By Sales Channel, 2017 to 2032

Table 60: South Asia Volume (Units) Forecast, By Sales Channel, 2017 to 2032

Table 61: Oceania Value (US$ million) Forecast, By Country, 2017 to 2032

Table 62: Oceania Volume (Units) Forecast, By Country, 2017 to 2032

Table 63: Oceania Value (US$ million) Forecast, By Raw Material, 2017 to 2032

Table 64: Oceania Volume (Units) Forecast, By Raw Material, 2017 to 2032

Table 65: Oceania Value (US$ million) Forecast, By Product Type, 2017 to 2032

Table 66: Oceania Volume (Units) Forecast, By Product Type, 2017 to 2032

Table 67: Oceania Value (US$ million) Forecast, By Consumer Orientation, 2017 to 2032

Table 68: Oceania Volume (Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 69: Oceania Value (US$ million) Forecast, By Sales Channel, 2017 to 2032

Table 70: Oceania Volume (Units) Forecast, By Sales Channel, 2017 to 2032

Table 71: MEA Value (US$ million) Forecast, By Country, 2017 to 2032

Table 72: MEA Volume (Units) Forecast, By Country, 2017 to 2032

Table 73: MEA Value (US$ million) Forecast, By Raw Material, 2017 to 2032

Table 74: MEA Volume (Units) Forecast, By Raw Material, 2017 to 2032

Table 75: MEA Value (US$ million) Forecast, By Product Type, 2017 to 2032

Table 76: MEA Volume (Units) Forecast, By Product Type, 2017 to 2032

Table 77: MEA Value (US$ million) Forecast, By Consumer Orientation, 2017 to 2032

Table 78: MEA Volume (Units) Forecast, By Consumer Orientation, 2017 to 2032

Table 79: MEA Value (US$ million) Forecast, By Sales Channel, 2017 to 2032

Table 80: MEA Volume (Units) Forecast, By Sales Channel, 2017 to 2032

Figure 01: Global Value (US$ million) and Volume (Units) Analysis, 2017 to 2032

Figure 02: Global Value (US$ million) and Volume (Units) Forecast 2022 to 2032

Figure 03: Global Value (US$ million) and Volume (Units), 2017 to 2032

Figure 04: Global Absolute $ Opportunity (US$ million) 2022 to 2032

Figure 05: Global Value (US$ million) and Volume (Units) Forecast 2022 to 2032

Figure 06: Global Value (US$ million) Analysis by Raw Material, 2017 to 2032

Figure 07: Global Volume (Units) Analysis by Raw Material, 2017 to 2032

Figure 08: Global Market Y-o-Y Growth (%) Projections, By Raw Material, 2022 to 2032

Figure 09: Global Market Attractiveness by Raw Material, 2022 to 2032

Figure 10: Global Value (US$ million) Analysis by Product Type, 2017 to 2032

Figure 11: Global Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 12: Global Market Y-o-Y Growth (%) Projections, By Product Type, 2022 to 2032

Figure 13: Global Market Attractiveness by Product Type, 2022 to 2032

Figure 14: Global Value (US$ million) by Consumer Orientation, 2022 - 2033

Figure 15: Global Volume (Units) Analysis by Consumer Orientation, 2017 to 2032

Figure 16: Global Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2022 to 2032

Figure 17: Global Market Attractiveness by Consumer Orientation, 2022 to 2032

Figure 18: Global Value (US$ million) Analysis by Region, 2017 to 2032

Figure 19: Global Volume (Units) Analysis by Region, 2017 to 2032

Figure 20: Global Market Y-o-Y Growth (%) Projections, By Region, 2022 to 2032

Figure 21: Global Market Attractiveness by Region, 2022 to 2032

Figure 22: Global Value (US$ million) Analysis by Sales Channel, 2017 to 2032

Figure 23: Global Volume (Units) Analysis by Sales Channel, 2017 to 2032

Figure 24: Global Market Y-o-Y Growth (%) Projections, By Sales Channel, 2022 to 2032

Figure 25: Global Market Attractiveness by Sales Channel, 2022 to 2032

Figure 26: North America Value (US$ million) Analysis by Country, 2017 to 2032

Figure 27: North America Volume (Units) Analysis by Country, 2017 to 2032

Figure 28: North America Market Y-o-Y Growth (%) Projections, By Country, 2022 to 2032

Figure 29: North America Market Attractiveness by Country, 2022 to 2032

Figure 30: North America Value (US$ million) Analysis by Raw Material, 2017 to 2032

Figure 31: North America Volume (Units) Analysis by Raw Material, 2017 to 2032

Figure 32: North America Market Y-o-Y Growth (%) Projections, By Raw Material, 2022 to 2032

Figure 33: North America Market Attractiveness by Raw Material, 2022 to 2032

Figure 34: North America Value (US$ million) Analysis by Product Type, 2017 to 2032

Figure 35: North America Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 36: North America Market Y-o-Y Growth (%) Projections, By Product Type, 2022 to 2032

Figure 37: North America Market Attractiveness by Product Type, 2022 to 2032

Figure 38: North America Value (US$ million) by Consumer Orientation, 2022 to 2033

Figure 39: North America Volume (Units) Analysis by Consumer Orientation, 2017 to 2032

Figure 40: North America Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2022 to 2032

Figure 41: North America Market Attractiveness by Consumer Orientation, 2022 to 2032

Figure 42: North America Value (US$ million) Analysis by Sales Channel, 2017 to 2032

Figure 43: North America Volume (Units) Analysis by Sales Channel, 2017 to 2032

Figure 44: North America Market Y-o-Y Growth (%) Projections, By Sales Channel, 2022 to 2032

Figure 45: North America Market Attractiveness by Sales Channel, 2022 to 2032

Figure 46: Latin America Value (US$ million) Analysis by Country, 2017 to 2032

Figure 47: Latin America Volume (Units) Analysis by Country, 2017 to 2032

Figure 48: Latin America Market Y-o-Y Growth (%) Projections, By Country, 2022 to 2032

Figure 49: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 50: Latin America Value (US$ million) Analysis by Raw Material, 2017 to 2032

Figure 51: Latin America Volume (Units) Analysis by Raw Material, 2017 to 2032

Figure 52: Latin America Market Y-o-Y Growth (%) Projections, By Raw Material, 2022 to 2032

Figure 53: Latin America Market Attractiveness by Raw Material, 2022 to 2032

Figure 54: Latin America Value (US$ million) Analysis by Product Type, 2017 to 2032

Figure 55: Latin America Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 56: Latin America Market Y-o-Y Growth (%) Projections, By Product Type, 2022 to 2032

Figure 57: Latin America Market Attractiveness by Product Type, 2022 to 2032

Figure 58: Latin America Value (US$ million) by Consumer Orientation, 2022 - 2033

Figure 59: Latin America Volume (Units) Analysis by Consumer Orientation, 2017 to 2032

Figure 60: Latin America Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2022 to 2032

Figure 61: Latin America Market Attractiveness by Consumer Orientation, 2022 to 2032

Figure 62: Latin America Value (US$ million) Analysis by Sales Channel, 2017 to 2032

Figure 63: Latin America Volume (Units) Analysis by Sales Channel, 2017 to 2032

Figure 64: Latin America Market Y-o-Y Growth (%) Projections, By Sales Channel, 2022 to 2032

Figure 65: Latin America Market Attractiveness by Sales Channel, 2022 to 2032

Figure 66: Europe Value (US$ million) Analysis by Country, 2017 to 2032

Figure 67: Europe Volume (Units) Analysis by Country, 2017 to 2032

Figure 68: Europe Market Y-o-Y Growth (%) Projections, By Country, 2022 to 2032

Figure 69: Europe Market Attractiveness by Country, 2022 to 2032

Figure 70: Europe Value (US$ million) Analysis by Raw Material, 2017 to 2032

Figure 71: Europe Volume (Units) Analysis by Raw Material, 2017 to 2032

Figure 72: Europe Market Y-o-Y Growth (%) Projections, By Raw Material, 2022 to 2032

Figure 73: Europe Market Attractiveness by Raw Material, 2022 to 2032

Figure 74: Europe Value (US$ million) Analysis by Product Type, 2017 to 2032

Figure 75: Europe Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 76: Europe Market Y-o-Y Growth (%) Projections, By Product Type, 2022 to 2032

Figure 77: Europe Market Attractiveness by Product Type, 2022 to 2032

Figure 78: Europe Value (US$ million) by Consumer Orientation, 2022 - 2033

Figure 79: Europe Volume (Units) Analysis by Consumer Orientation, 2017 to 2032

Figure 80: Europe Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2022 to 2032

Figure 81: Europe Market Attractiveness by Consumer Orientation, 2022 to 2032

Figure 82: Europe Value (US$ million) Analysis by Sales Channel, 2017 to 2032

Figure 83: Europe Volume (Units) Analysis by Sales Channel, 2017 to 2032

Figure 84: Europe Market Y-o-Y Growth (%) Projections, By Sales Channel, 2022 to 2032

Figure 85: Europe Market Attractiveness by Sales Channel, 2022 to 2032

Figure 86: East Asia Value (US$ million) Analysis by Country, 2017 to 2032

Figure 87: East Asia Volume (Units) Analysis by Country, 2017 to 2032

Figure 88: East Asia Market Y-o-Y Growth (%) Projections, By Country, 2022 to 2032

Figure 89: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 90: East Asia Value (US$ million) Analysis by Raw Material, 2017 to 2032

Figure 91: East Asia Volume (Units) Analysis by Raw Material, 2017 to 2032

Figure 92: East Asia Market Y-o-Y Growth (%) Projections, By Raw Material, 2022 to 2032

Figure 93: East Asia Market Attractiveness by Raw Material, 2022 to 2032

Figure 94: East Asia Value (US$ million) Analysis by Product Type, 2017 to 2032

Figure 95: East Asia Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 96: East Asia Market Y-o-Y Growth (%) Projections, By Product Type, 2022 to 2032

Figure 97: East Asia Market Attractiveness by Product Type, 2022 to 2032

Figure 98: East Asia Value (US$ million) by Consumer Orientation, 2022 - 2033

Figure 99: East Asia Volume (Units) Analysis by Consumer Orientation, 2017 to 2032

Figure 100: East Asia Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2022 to 2032

Figure 101: East Asia Market Attractiveness by Consumer Orientation, 2022 to 2032

Figure 102: East Asia Value (US$ million) Analysis by Sales Channel, 2017 to 2032

Figure 103: East Asia Volume (Units) Analysis by Sales Channel, 2017 to 2032

Figure 104: East Asia Market Y-o-Y Growth (%) Projections, By Sales Channel, 2022 to 2032

Figure 105: East Asia Market Attractiveness by Sales Channel, 2022 to 2032

Figure 106: South Asia Value (US$ million) Analysis by Country, 2017 to 2032

Figure 107: South Asia Volume (Units) Analysis by Country, 2017 to 2032

Figure 108: South Asia Market Y-o-Y Growth (%) Projections, By Country, 2022 to 2032

Figure 109: South Asia Market Attractiveness by Country, 2022 to 2032

Figure 110: South Asia Value (US$ million) Analysis by Raw Material, 2017 to 2032

Figure 111: South Asia Volume (Units) Analysis by Raw Material, 2017 to 2032

Figure 112: South Asia Market Y-o-Y Growth (%) Projections, By Raw Material, 2022 to 2032

Figure 113: South Asia Market Attractiveness by Raw Material, 2022 to 2032

Figure 114: South Asia Value (US$ million) Analysis by Product Type, 2017 to 2032

Figure 115: South Asia Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 116: South Asia Market Y-o-Y Growth (%) Projections, By Product Type, 2022 to 2032

Figure 117: South Asia Market Attractiveness by Product Type, 2022 to 2032

Figure 118: South Asia Value (US$ million) by Consumer Orientation, 2022 - 2033

Figure 119: South Asia Volume (Units) Analysis by Consumer Orientation, 2017 to 2032

Figure 120: South Asia Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2022 to 2032

Figure 121: South Asia Market Attractiveness by Consumer Orientation, 2022 to 2032

Figure 122: South Asia Value (US$ million) Analysis by Sales Channel, 2017 to 2032

Figure 123: South Asia Volume (Units) Analysis by Sales Channel, 2017 to 2032

Figure 124: South Asia Market Y-o-Y Growth (%) Projections, By Sales Channel, 2022 to 2032

Figure 125: South Asia Market Attractiveness by Sales Channel, 2022 to 2032

Figure 126: Oceania Value (US$ million) Analysis by Country, 2017 to 2032

Figure 127: Oceania Volume (Units) Analysis by Country, 2017 to 2032

Figure 128: Oceania Market Y-o-Y Growth (%) Projections, By Country, 2022 to 2032

Figure 129: Oceania Market Attractiveness by Country, 2022 to 2032

Figure 130: Oceania Value (US$ million) Analysis by Raw Material, 2017 to 2032

Figure 131: Oceania Volume (Units) Analysis by Raw Material, 2017 to 2032

Figure 132: Oceania Market Y-o-Y Growth (%) Projections, By Raw Material, 2022 to 2032

Figure 133: Oceania Market Attractiveness by Raw Material, 2022 to 2032

Figure 134: Oceania Value (US$ million) Analysis by Product Type, 2017 to 2032

Figure 135: Oceania Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 136: Oceania Market Y-o-Y Growth (%) Projections, By Product Type, 2022 to 2032

Figure 137: Oceania Market Attractiveness by Product Type, 2022 to 2032

Figure 138: Oceania Value (US$ million) by Consumer Orientation, 2022 - 2033

Figure 139: Oceania Volume (Units) Analysis by Consumer Orientation, 2017 to 2032

Figure 140: Oceania Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2022 to 2032

Figure 141: Oceania Market Attractiveness by Consumer Orientation, 2022 to 2032

Figure 142: Oceania Value (US$ million) Analysis by Sales Channel, 2017 to 2032

Figure 143: Oceania Volume (Units) Analysis by Sales Channel, 2017 to 2032

Figure 144: Oceania Market Y-o-Y Growth (%) Projections, By Sales Channel, 2022 to 2032

Figure 145: Oceania Market Attractiveness by Sales Channel, 2022 to 2032

Figure 146: MEA Value (US$ million) Analysis by Country, 2017 to 2032

Figure 147: MEA Volume (Units) Analysis by Country, 2017 to 2032

Figure 148: MEA Market Y-o-Y Growth (%) Projections, By Country, 2022 to 2032

Figure 149: MEA Market Attractiveness by Country, 2022 to 2032

Figure 150: MEA Value (US$ million) Analysis by Raw Material, 2017 to 2032

Figure 151: MEA Volume (Units) Analysis by Raw Material, 2017 to 2032

Figure 152: MEA Market Y-o-Y Growth (%) Projections, By Raw Material, 2022 to 2032

Figure 153: MEA Market Attractiveness by Raw Material, 2022 to 2032

Figure 154: MEA Value (US$ million) Analysis by Product Type, 2017 to 2032

Figure 155: MEA Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 156: MEA Market Y-o-Y Growth (%) Projections, By Product Type, 2022 to 2032

Figure 157: MEA Market Attractiveness by Product Type, 2022 to 2032

Figure 158: MEA Value (US$ million) by Consumer Orientation, 2022 - 2033

Figure 159: MEA Volume (Units) Analysis by Consumer Orientation, 2017 to 2032

Figure 160: MEA Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2022 to 2032

Figure 161: MEA Market Attractiveness by Consumer Orientation, 2022 to 2032

Figure 162: MEA Value (US$ million) Analysis by Sales Channel, 2017 to 2032

Figure 163: MEA Volume (Units) Analysis by Sales Channel, 2017 to 2032

Figure 164: MEA Market Y-o-Y Growth (%) Projections, By Sales Channel, 2022 to 2032

Figure 165: MEA Market Attractiveness by Sales Channel, 2022 to 2032

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Evaluating USA Luxury Fine Jewelry Market Share & Provider Insights

US Luxury Fine Jewelry Market Insights 2024 to 2034

Luxury Car Hoses Market Size and Share Forecast Outlook 2025 to 2035

Luxury Travel Market Forecast and Outlook 2025 to 2035

Luxury Wood Doors For Residential Interiors Market Size and Share Forecast Outlook 2025 to 2035

Fine Bubble Diffuser Market Size and Share Forecast Outlook 2025 to 2035

Fine Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Jewellery Box Market Size and Share Forecast Outlook 2025 to 2035

Luxury Rigid Box Market Size and Share Forecast Outlook 2025 to 2035

Luxury Hotel Market Size and Share Forecast Outlook 2025 to 2035

Luxury Electric Vehicle (EV) Market Size and Share Forecast Outlook 2025 to 2035

Luxury Vinyl Tile Flooring Market Size and Share Forecast Outlook 2025 to 2035

Luxury Car Market Size and Share Forecast Outlook 2025 to 2035

Luxury Mattress Market Size and Share Forecast Outlook 2025 to 2035

Luxury SUV Market Size and Share Forecast Outlook 2025 to 2035

Luxury Plumbing Fixtures Market Size and Share Forecast Outlook 2025 to 2035

Luxury Coaches Market Size and Share Forecast Outlook 2025 to 2035

Fine Hydrates Market Analysis & Forecast 2025 to 2035

Luxury Interior Fabric Industry Analysis in North America and Europe Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA