The Luxury Travel market is experiencing significant growth driven by increasing consumer demand for personalized and premium travel experiences. The future outlook for this market is shaped by rising disposable incomes, growing interest in exclusive destinations, and the adoption of technology-enabled booking and travel planning platforms. Affluent travelers are increasingly seeking curated experiences that combine comfort, convenience, and unique cultural or recreational opportunities.

Advancements in digital platforms and mobile applications have simplified trip planning, providing travelers with real-time information and seamless booking experiences. Increasing investments in luxury hospitality, private aviation, and high-end transportation options are further supporting market expansion.

Additionally, the growing trend of experiential and wellness travel is influencing the offerings in this segment, encouraging providers to create tailored packages that align with consumer expectations As global tourism resumes post-pandemic and international mobility rises, the Luxury Travel market is poised for sustained growth across both emerging and developed regions, with continued emphasis on premium and differentiated travel experiences.

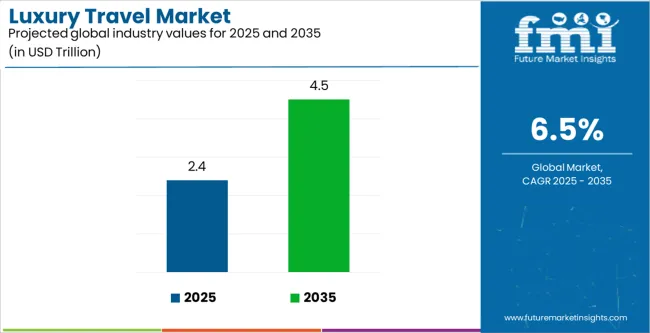

| Metric | Value |

|---|---|

| Luxury Travel Market Estimated Value in (2025 E) | USD 2.4 trillion |

| Luxury Travel Market Forecast Value in (2035 F) | USD 4.5 trillion |

| Forecast CAGR (2025 to 2035) | 6.5% |

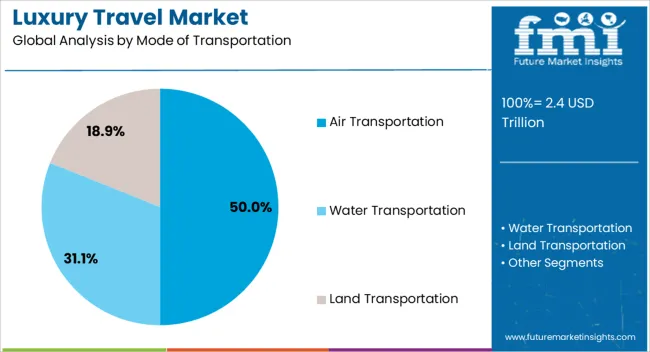

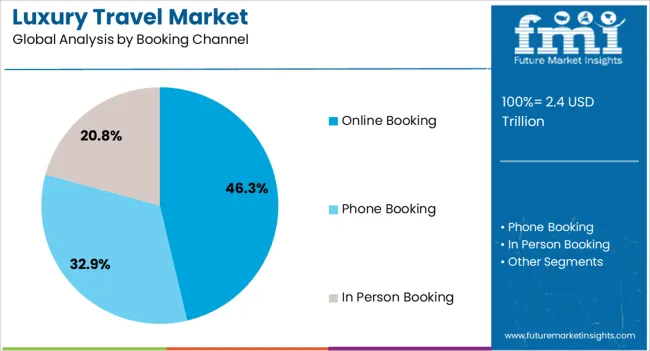

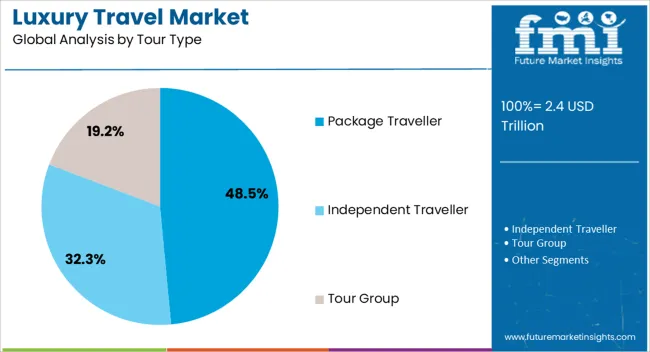

The market is segmented by Mode of Transportation, Booking Channel, Tour Type, Consumer Orientation, and Age Group and region. By Mode of Transportation, the market is divided into Air Transportation, Water Transportation, and Land Transportation. In terms of Booking Channel, the market is classified into Online Booking, Phone Booking, and In Person Booking. Based on Tour Type, the market is segmented into Package Traveller, Independent Traveller, and Tour Group. By Consumer Orientation, the market is divided into Women and Men. By Age Group, the market is segmented into 26-35 Years, 15-25 Years, 36-45 Years, 46-55 Years, 56-65 Years, 66-75 Years, and Above 75. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The air transportation segment is projected to hold 50.0% of the Luxury Travel market revenue share in 2025, making it the leading mode of transportation. This dominance is driven by the preference for speed, convenience, and comfort in long-distance and international travel among high-net-worth individuals.

Air travel enables access to exclusive destinations that may not be reachable via other modes of transport. The segment has benefited from advancements in in-flight services, private jet availability, and loyalty programs, which enhance the luxury travel experience.

Additionally, air transportation offers flexibility in scheduling and route planning, which aligns with the expectations of affluent travelers seeking seamless and time-efficient journeys The growth of air transportation in luxury travel is further supported by expanding global airline networks, increasing investments in airport infrastructure, and rising traveler confidence in air travel safety and convenience.

The online booking segment is expected to capture 46.3% of the Luxury Travel market revenue share in 2025, establishing it as the leading booking channel. Growth in this segment is driven by the convenience and accessibility provided by digital platforms, enabling travelers to plan and book personalized trips with minimal effort.

The integration of AI and recommendation engines on booking platforms has enhanced customer experience, offering tailored itineraries, premium accommodations, and exclusive travel packages. Online booking platforms also provide real-time pricing, availability, and secure payment options, which appeal to tech-savvy luxury travelers.

Additionally, the increasing adoption of mobile applications and digital wallets has further simplified the booking process The segment benefits from the rising preference for self-service and on-demand travel planning, making online booking a dominant and indispensable channel in the luxury travel ecosystem.

The package traveller segment is anticipated to account for 48.5% of the Luxury Travel market revenue share in 2025, positioning it as the leading tour type. The growth of this segment is influenced by the demand for comprehensive and curated travel experiences that combine accommodations, transportation, and leisure activities in a single offering.

Package travel simplifies planning for high-net-worth individuals, providing assurance of quality, convenience, and seamless coordination. The segment has benefited from the development of luxury package options that include private tours, personalized itineraries, and exclusive access to destinations and events.

Additionally, package travel allows for better cost management, itinerary optimization, and risk mitigation, which are valued by discerning travelers The popularity of package travel is further supported by increasing collaboration between travel agencies, hospitality providers, and transport operators to deliver high-end, end-to-end experiences that align with evolving luxury travel preferences.

| Historical CAGR | 5.80% |

|---|---|

| Forecast CAGR | 6.50% |

The historical CAGR of the luxury travel market stands at 5.80%, reflecting steady expansion propelled by the allure of bespoke experiences and unparalleled indulgence.

From exclusive retreats to tailor-made adventures, the market has evolved to cater to the discerning tastes of affluent travelers seeking nothing short of perfection.

The forecasted CAGR of 6.50% paints a picture of continued growth and prosperity in the luxury travel sector. As consumer expectations evolve and demand for immersive, authentic experiences surges, the market is thus poised for further expansion.

With a blend of tradition and innovation, luxury travel providers are primed to unlock new vistas of luxury, captivating travelers with unforgettable journeys and elevating the art of travel to new heights of sophistication and indulgence.

The below section shows the leading segment. Based on booking channel, the online booking segment is accounted to hold a market share of 46.3% in 2025. Based on tour type, the package traveler segment is accounted to hold a market share of 48.5% in 2025.

| Category | Market Share in 2025 |

|---|---|

| Online Booking | 46.3% |

| Package Traveler | 48.5% |

Based on booking channel, the online booking segment stands out, capturing a significant market share of 46.3%. The trend reflects the boom in preference among luxury travelers for the convenience and accessibility offered by online platforms when planning and booking their upscale experiences.

From personalized itineraries to seamless transactions, online booking channels cater to the advancing needs of affluent travelers, propelling their popularity in the luxury travel market.

Based on tour type, the package traveler segment is accounted to hold a market share of 48.5% in 2025. Packaged tours provide a hassle-free and curated experience, offering a blend of exclusive amenities, cultural immersion, and expert guidance.

As luxury travelers continue to seek curated experiences without compromising on comfort and exclusivity, the package traveler segment maintains its stronghold in the dynamic landscape of luxury travel.

The table describes the top five countries ranked by revenue, with Australia holding the top position. Australia dominates the luxury travel market with its natural beauty, diverse landscapes, and unique experiences.

Affluent travelers indulge in luxury vacations for iconic destinations like the Great Barrier Reef and luxury eco-lodges, essaying the temptation as a premier luxury travel destination.

Forecast CAGRs from 2025 to 2035

| Countries | CAGR |

|---|---|

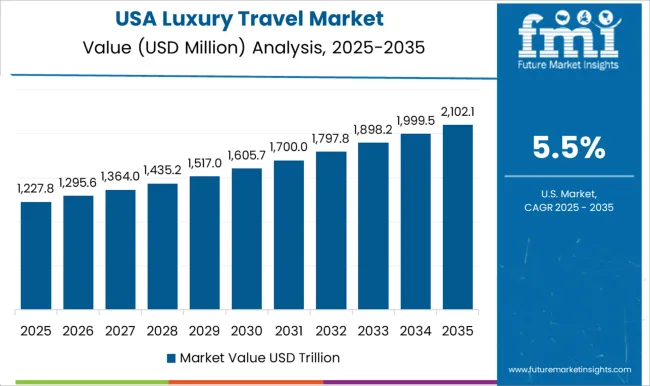

| United States | 7.3% |

| Germany | 7.5% |

| China | 6.9% |

| India | 7.9% |

| Australia | 8.1% |

In the United States, the luxury travel market is predominantly utilized for a variety of purposes, including leisure travel, business travel, and special occasions such as weddings and milestone celebrations.

The United States boasts a vibrant luxury travel market catering to discerning travelers seeking unique experiences, from luxury wilderness retreats in national parks to opulent urban escapes in cosmopolitan cities like New York and Los Angeles.

In Germany, the luxury travel market is utilized by affluent travelers seeking refined and sophisticated travel experiences both domestically and internationally. German travelers often indulge in luxury vacations to iconic destinations such as the French Riviera, the Italian countryside, or exotic tropical islands.

The affluent business community often utilizes luxury travel services for corporate events, incentive trips, and executive retreats, reflecting the demand for exclusive and tailored travel experiences.

In China, the luxury travel market is primarily utilized by affluent travelers seeking prestigious and extravagant travel experiences both domestically and abroad. Luxury travelers often seek high-end accommodations, private tours, and VIP services that showcase luxury and exclusivity.

Luxury travel services are frequently utilized by the business elites of China for corporate meetings, luxury events, and incentive travel programs, reflecting the country's growing affluence and sophistication in luxury travel preferences.

Rising affluence, a burgeoning middle class, and a desire for unique experiences fuel the luxury travel market in India.

Affluent Indian travelers are seeking personalized and immersive experiences both domestically and internationally, driving demand for luxury accommodations, boutique hotels, and experiential stays.

In Australia, the luxury travel market is utilized by affluent travelers seeking unique and exclusive travel experiences that showcase the natural beauty and cultural heritage of the country.

Luxury travel experiences in Australia often emphasize outdoor adventures, wildlife encounters, and luxury eco-lodges that offer sustainable and immersive experiences in nature.

Luxury travel services are utilized by business elites of Australia for corporate retreats, luxury events, and incentive travel programs, reflecting the affluent and adventurous travel preferences of the country.

In the competitive landscape of the luxury travel market, a blend of established players and boutique providers vie for affluent travelers' attention. Boutique operators specializing in niche segments like adventure travel or wellness retreats carve out their niche.

Differentiation through unique experiences, personalized service, and exclusive access to hidden gems defines success in this dynamic and discerning market. Some of the key developments are:

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 2.26 trillion |

| Projected Market Valuation in 2035 | USD 4.24 trillion |

| Value-based CAGR 2025 to 2035 | 6.5% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD trillion |

| Key Regions Covered |

North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Key Market Segments Covered |

Mode of Transportation, Booking Channel, Tourist Type, Tour Type, Consumer Orientation, Age Group, Region |

| Key Countries Profiled |

The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled |

TU Elite; TCS World Travel; Abercrombie & Kent USA; TUI Group; Micato Safaris; Butterfield & Robinson Inc.; Scott Dunn Ltd.; Cox & Kings Ltd.; Exodus travels; Lindblad Expeditions. |

The global luxury travel market is estimated to be valued at USD 2.4 trillion in 2025.

The market size for the luxury travel market is projected to reach USD 4.5 trillion by 2035.

The luxury travel market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in luxury travel market are air transportation, water transportation and land transportation.

In terms of booking channel, online booking segment to command 46.3% share in the luxury travel market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Luxury Car Hoses Market Size and Share Forecast Outlook 2025 to 2035

Luxury Wood Doors For Residential Interiors Market Size and Share Forecast Outlook 2025 to 2035

Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Luxury Rigid Box Market Size and Share Forecast Outlook 2025 to 2035

Luxury Hotel Market Size and Share Forecast Outlook 2025 to 2035

Luxury Electric Vehicle (EV) Market Size and Share Forecast Outlook 2025 to 2035

Luxury Vinyl Tile Flooring Market Size and Share Forecast Outlook 2025 to 2035

Luxury Car Market Size and Share Forecast Outlook 2025 to 2035

Luxury Mattress Market Size and Share Forecast Outlook 2025 to 2035

Luxury Fine Jewellery Market Analysis - Size, Share, and Forecast 2025 to 2035

Luxury SUV Market Size and Share Forecast Outlook 2025 to 2035

Luxury Plumbing Fixtures Market Size and Share Forecast Outlook 2025 to 2035

Luxury Coaches Market Size and Share Forecast Outlook 2025 to 2035

Luxury Interior Fabric Industry Analysis in North America and Europe Growth, Trends and Forecast from 2025 to 2035

Luxury Footwear Market Outlook – Size, Share & Innovations 2025 to 2035

Luxury Furniture Market Insights - Demand, Size, and Industry Trends 2025 to 2035

Competitive Overview of Luxury Yacht Market Share & Providers

Luxury Yacht Industry Analysis by Type, by Size, by Application , by Ownership, and by Region- Forecast for 2025 to 2035

Luxury Handbag Market Analysis by Product Type, Material Type, and Region Through 2035

Luxury Products For Kids Market - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA