The luxury furniture market is set for strong growth with an anticipated value of USD 25.2 billion in 2025, to reach USD 43.4 billion by 2035, indicating a CAGR of 5.6% over the forecast period. The industry grows on the basis of some factors like craftsmanship, uniqueness, and the requirement for high-quality living experience.

Residential and hospitality property development, particularly in high-end residential and hotel sectors, again stimulates demand for luxury furniture. With the increasing number of luxury hotels, resorts, and luxury homes spreading worldwide, demand for furnishings to suit luxurious settings is on the rise. In addition, customization and bespoke design capabilities are increasingly becoming essential, providing personalized solutions for fulfilling specific client needs.

Still, the excessive expense of raw material as well as manufacturing can be limitations within the industry. Natural wood, metals, high-grade leathers, and hand labor greatly drive up cost of production. This automatically restricts the customer base and makes the industry niche-oriented. Supply chain disturbances and economic downturns are also challenges.

Another constraint is the increasing green pressure around material sourcing and the carbon footprint of manufacturing and shipment. Consumers and governments are also making more stringent demands for sustainability, which will compel manufacturers to evolve.

Some of the trends influencing the industry are the combination of contemporary and traditional designs, more demand for multifunctional furniture, and global design cultures influencing the industry. Minimalism, mid-century modern, and Art Deco styles are on a comeback, with wellness-oriented furniture that incorporates ergonomic and natural features gaining popularity among luxury consumers.

In addition, partnerships between high-end fashion brands and furniture designers are generating buzz-worthy, limited-edition lines. These inter-industry collaborations boost brand appeal and broaden industry reach. As consumer preferences shift, innovation, heritage, and sustainability continue to be at the heart of the competitive landscape, keeping the industry dynamic in its evolution.

Market Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 25.2 billion |

| Industry Value (2035F) | USD 43.4 billion |

| CAGR (2025 to 2035) | 5.6% |

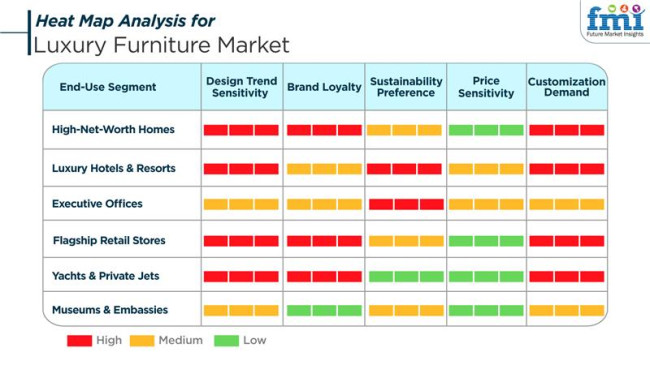

The industry exhibits unique trends and buying patterns in residential, commercial, and retail end-use segments. For the residential industry, consumers focus on design creativity, material quality, and customizability to achieve bespoke, high-end furnishings that mirror lifestyle and taste. Sustainability is picking up speed as an integral driver among environment-aware luxury residential owners.

For use in business settings such as luxury hotels and corporate buildings, functionality and form combine. Purchasers require durability, quality image, and value, knowing the furniture would complement the client or guest experience while adding value to the prestige of the brand. Supply reliability is particularly important here owing to stringent project timelines.

Aesthetic appeal, visual presentation, and modular construction are prioritized in retail and showroom environments for the creation of engaging customer experiences. While cost of production and sustainability are important considerations, presentation and flexibility are prioritized. Brand value, craftsmanship, and design excellence continue to be pan-industry parameters influencing purchase decisions in the luxury furniture segment across segments.

As we transitioned through an unprecedented few years, from 2020 to 2024, the luxury furniture sector experienced a renaissance made possible by the clamor for personalized spaces at home. Amid the remote work patterns and people spending more time in their homes, there was tremendous demand for upgrades to high-end homes.

Luxury furniture brands seized on this trend with customizable collections that struck a balance between craftsmanship and comfort. Roche Bobois, for instance, introduced modular designs that melded artistic aesthetics and ergonomic functionality. There was also newfound attention to sustainability, with the majority of manufacturers using responsibly sourced materials such as FSC-certified wood and eco-leather.

Smart living and sustainable innovation will remain at the forefront as luxury furniture continues to evolve through 2025 to 2035. Luxury furniture will come standard with smart integration, such as wireless charging, ambient lighting, and voice-controlled settings, to name a few.

The industry will adopt circular economy business models like furniture as a service or trade-in. Collaborating with digital space management platforms, customers can visualize and customize luxury furniture accurately before they buy through virtual room replication.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Focus on modular and ergonomic home-based living design | Smart-integrated and AI-activated furniture to enhance living experiences |

| Expansion of eco-materials like bamboo and reclaimed wood | Universal application of biodegradable materials and low-impact manufacture |

| Tailor-made finishes and configurations offered through in-store installations | Computer-based AR/VR technologies for comprehensive customization and planning simulation |

| Attention to ethical procurement and durable making | Circular economy business models such as rental, resale, and refurbishment routes |

| Limited to in-built light or charging outlets | Full IoT connectivity with sensors, climate management, and automaton |

| Upmarket retailing and limited on-line personalization | Immersive web sites with 3D/VR design previews and AI style assistance |

| High-net-worth homeowners and boutique hospitality developments | Expanding to tech-savvy millennials and high-end renters in urban markets |

The luxury furniture industry is extremely sensitive to business cycles. During periods of economic instability or recession, customers tend to reduce discretionary spending, and this immediately affects demand. Since luxury furniture is a non-essential purchase, a decline can rapidly get converted into lower sales, both for high-end manufacturers and retailers.

Luxury furniture tends to depend on scarce materials and expert craftsmanship from all over the globe. This reliance exposes the industry to global supply chain disruptions, including raw material shortages, shipping delays, and geopolitical tensions. Any disruption in the chain can drive up costs and impact product availability and delivery schedules.

There are also constant threats posed by imitation products or counterfeit goods in circulation. The lower-priced replicas can undermine brand value and even cause consumer confusion. Brands are trying to defend their intellectual property as well as maintain authenticity, a challenge which is heightened with the boom in e-commerce and international shipping-based digital marketplaces.

Shifting customer tastes also represents a threat. Consumers increasingly prefer sustainable, minimalist, or multipurpose furniture designs. Established luxury brands have to respond rapidly to these changes or get left behind. Not keeping up with new demands, such as environmentally friendly materials or built-in smart technologies, can lead to lost industry share.

Operating expenses in this category are substantially high because of premium materials, skilled workers, and high-end showrooms. These fixed expenses become crippled during sluggish sales periods. Smaller brands, especially, can be challenged by profitability and cash flow if revenue declines or the economy deteriorates.

In 2025, the industry will see heavy demand for wood-based furniture, with a market share of 45%, while metal luxury furniture will account for 30% of the industry. With a 45% industry share, wood-based furniture will dominate the industry in 2025. Wood is most favored for its premium appeal, durability, and timelessness.

High-end brands like Roche Bobois, Poltrona Frau, and Henredon use solid woods like mahogany, walnut, and oak to create elegant and timeless designs. Mainly in Europe and North America, the demand for custom-made and hand-finished wooden furniture is very high, where consumers emphasize sustainability and craftsmanship.

Also, eco-friendliness is another emerging trend, with luxury furniture being increasingly produced from certified sustainable wood. In this regard, the common acceptance of FSC-certified materials is driven by the fast-growing demand for green luxury living. Now accounting for 30% of the industry share, metal luxury furniture is staking its claim, especially within modern and industrial-style interiors.

Demand for brushed steel, brass, aluminum, and wrought iron furniture is being spurred on by consumer preference for sleek and modern designs. This trend has been capitalized upon by brands such as Knoll, Baxter, and Minotti, which offer minimalist metallic-based furniture solutions appropriate for luxury urban apartments and commercial spaces.

Metal-based furniture is particularly in vogue in the Asia-Pacific markets, where luxury high-rise apartments and penthouses are looking for space-efficient yet modern furniture designs. In addition to this, the technology available for working with metals, such as laser-cut detail and various metallic finishes, has evolved, allowing for the mass production of statement pieces catering to the elite clientele.

As wood remains the dominant material owing to its classic and handcrafted charm, complemented by a growing popularity for contemporary designs in metal, it shows that both segments will continue to remain in great demand within the international luxury furniture industry, catering to the varied tastes of consumers in various regions.

The industry can be said to be residentially driven as it holds 60% of the industry share. The increasing acceptance of high-end customized furniture in luxury homes, villas, and penthouses is creating demand.

Consumers, especially in areas including North America and Europe, are largely interested in aesthetic appeal, durability, and sustainability, which results in greater acceptance of premium materials such as solid wood, genuine leather, and handcrafted metals.

Brands such as Roche Bobo is and Poltrona Frau, as well as Boca do Lobo, appeal to the set of prosperous homeowners favoring exclusive artisanal designs, which speak about status and elegance. Meanwhile, smart multipurpose furnishings integrated with IoT-based solutions are driving the further attractiveness of luxury home furnishings.

Rising disposable incomes of HNWIs in the emerging industry contribute to the fragments' growth. On the other hand, the commercial segment, with a 40% industry share, drives large investments in luxury hotels, premier corporate offices, and restaurants.

The hotel and corporate sectors are rapidly investing in custom-designed furniture in order to provide a luxurious experience for guests. In particular, the Asian Pacific and Middle Eastern regions have high furniture demand for the hospitality industry, and because of this demand, hotels and offices create memorable, unique spaces with bespoke furniture solutions.

Several brands are also creating these statement works for boutique or luxury retail outlets and even executive office spaces, including Fendi Casa, Versace Home, and Bentley Home. With experiential luxury now becoming a common phenomenon in commercial spaces, companies would like to create exclusive, top-quality pieces of furniture that are in line with their brand. The increase in luxury commercial spaces will only see an increase in the demand for sophisticated furniture solutions.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

| UK | 3.8% |

| France | 3.5% |

| Germany | 3.7% |

| Italy | 3.6% |

| South Korea | 4.2% |

| Japan | 3.4% |

| China | 5% |

| Australia | 3.9% |

| New Zealand | 3.7% |

The USA industry is forecast to expand at a CAGR of 4.5% during the period 2025 to 2035. The major growth driver is a robust economy, with a very high rate of high-net-worth consumers looking for high-end domestic furnishings.

Metropolitans in cities like New York, Los Angeles, and Chicago are the primary places in demand for luxury furniture, and there is a consumer preference for modern and traditional styles. The industry is also dominated by a widespread prevalence of Indigenous luxury furniture makers and the increasing trend of personalization and customization of home furnishings.

The UK industry is forecasted to grow at a CAGR of 3.8% over the forecast period. There is a mix of contemporary British craftsmanship and prevailing design trends in the industry. London is the hub for luxury furniture spending, with high-end consumers investing in premium, bespoke furniture. Growing demand for sustainable and eco-friendly materials aligns with the country's growing environmental consciousness.

The French industry is projected to register a 3.5% CAGR over the forecast period from 2025 to 2035. France boasts a strong artistic heritage, and the demand for superb, stylish furniture is therefore high. Paris is still the hub of luxury furniture, and the people who live there like to own modern-age designs that are state-of-the-art yet conventional in style. There is also a greater demand for handcrafted and artisanal furniture, with an emphasis on uniqueness and individuality.

The German industry will register a growth rate of 3.7% CAGR during the forecast period. Germans are accustomed to functionality and quality, and hence there is a demand for minimalist and ergonomic furniture. Berlin and Munich are the major markets where there is immense demand for intelligent furniture with high-tech features. Sustainability is another category where buyers seek materials and processes that are green-friendly.

The Italian industry will increase at a CAGR of 3.6% during the forecast period of 2025 to 2035. The world design capital, Italy, has a rich cultural heritage of handcraftsmanship and innovation in furniture design.

One of the strongest of these hubs is Milan, which has hosted luxury events such as the Salone del Mobile. Italian buyers also demand high-quality materials and craftsmanship, thus necessitating bespoke and designer products infused with the country's design heritage.

The industry in South Korea will grow at a CAGR of 4.2% over the forecast period. Increased urbanization and rising disposable incomes have fueled demand for luxury home furniture, particularly in urban centers like Seoul.

South Korean consumers like minimalist and modern interior designs, typically incorporating smart technology into homes. Western lifestyle trend influence and growing interest in fashion for interior design also fuel industry growth.

Japan's industry will expand at a CAGR of 3.4% during the period 2025 to 2035. The design of the industry is a combination of traditional Japanese and modern design. Osaka and Tokyo citizens prefer minimalist, functional designs with high-quality craftsmanship. There is also increasing demand for multi-functional and space-saving furniture products, which indicates Japan's urban culture and cultural trend towards minimalism.

The Chinese industry will grow significantly in the forecast period with a CAGR of 5%. Urbanization and the growing expansion of the affluent middle class are a few of the most significant factors influencing the increasing demand for luxury home furnishings.

Beijing, Shanghai, and Guangzhou are the top cities that are witnessing the demand for luxury furniture. Global luxury brands, along with domestic luxury brands that incorporate classic Chinese design patterns mixed with contemporary style, are popular among Chinese consumers.

The Australian industry will grow at a CAGR of 3.9% during the period 2025 to 2035. Positive economy and lifestyle-centric culture fuel luxury furniture sales, especially in Sydney and Melbourne cities. Ocean-inspired and fashionable designs are most preferred among Australian consumers, and they appeal to the country's natural surroundings. Rising awareness regarding eco-friendly and locally sourced materials also makes consumers more inclined towards purchasing eco-friendly products.

New Zealand's industry is expected to gain a CAGR of 3.7% through the forecast period. The industry is supported by a customer base of the upper class, which is concerned about quality and artistry. There is an increased demand in Auckland and Wellington for custom and hand-finished pieces of furniture with their taste and lifestyle. New Zealand consumers are increasingly aware of the need to conserve the environment. As a result, there is a need for sustainable practices and materials utilized in luxury furniture items.

The industry is one of the fast-growing markets as high-net-worth individuals (HNWIs) and wealthy households invest premium in premium and aesthetic-oriented high-quality furniture. Disposable incomes rise, there is an increase in the demand for personalized homes, and there is a proliferation of luxury real estate projects opening worldwide. In addition, the sustainability and eco-friendliness trend in furniture marks another influence on industry happenings.

This broad category, including but not limited to luxury and designer indoor and outdoor furniture, includes beautiful and elegant sofas, custom-made dining collections, handmade furnishing for bedrooms, and styled office furniture.

Offering innovation, these include the avant-garde feasibility of using premium materials like marble, exotic woods, gold-smelting metal, leather skin that is hand-stitched, etc. Furthermore, smart luxuries are now being integrated into the furniture class, such as lighting controlled by IoT and temperatures.

This movement towards online shopping and digital showrooms is allowing luxury furniture brands to keep their presence without an exclusive shopping experience. Still, clients can easily access such high-paced checkout and virtual consultations with them, along with 3D room planning.

Sustainable furniture produced from ethically harvested timber and other recycled materials will play a major role in differentiating them. Further, there are now round collections of branded luxury home decorations by labels. The presence of Versace, Armani, and others may also lift the generalization of industry importance and intensity.

With these features, it is easy to attract rich customers as unique collections revolve around customization and limited editions. Manufacturers also focus on green production, heritage in craftsmanship, and working with architects and interior designers to make their brand more exclusive. The Asia-Pacific region, particularly China and India, is still the key growth industry as luxury spending increases and urbanization improves.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Restoration Hardware | 8% |

| Herman Miller | 6% |

| Knoll | 4% |

| Roche Bobois | 2% |

| Ashley Furniture | 1% |

| Other Companies | 79% |

| Company Name | Key Offerings/Activities |

| Restoration Hardware | High-end home furnishings with a focus on design transformation and platform expansion. |

| Herman Miller | Ergonomic and contemporary furniture solutions for both office and home environments. |

| Knoll | Modern furnishings blend functionality with aesthetic appeal for residential and commercial spaces. |

| Roche Bobois | Luxury furniture emphasizes innovative designs and collaborations with renowned designers. |

| Ashley Furniture | A wide range of luxury furnishings combines traditional craftsmanship with modern trends. |

Key Company Insights

Restoration Hardware (8%)

Restoration Hardware has demonstrated resilience amid industry fluctuations, focusing on supply chain diversification and product innovation to maintain its competitive edge.

Knoll (5%)

Knoll has leveraged its expertise in modern and ergonomic designs to cater to both residential and commercial sectors, emphasizing functionality without compromising on luxury.

Herman Miller (4%)

Herman Miller focuses on ergonomic and contemporary furniture solutions, serving both office and home environments with a commitment to quality and design excellence.

Roche Bobois (6%)

Roche Bobois continues to captivate the industry with its distinctive French design aesthetics and collaborations with renowned designers, appealing to a clientele seeking exclusivity.

Ashley Furniture (3%)

Ashley Furniture has expanded its reach by offering a range of luxury furnishings that blend traditional craftsmanship with contemporary trends, appealing to a broad spectrum of consumers.

Other Key Players (74% Combined)

By raw material, the industry is segmented into wood, metal, plastic, and others.

By end user, the industry is categorized into residential and commercial.

By distribution channel, the industry is segmented into online and offline distribution channels. The online segment includes company-owned websites and e-commerce websites, while the offline segment comprises supermarket/hypermarket and independent furniture retailers.

By region, the industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

The industry is projected to reach USD 25.2 billion in 2025.

It is expected to grow significantly, reaching USD 43.4 billion by 2035.

China is anticipated to grow at a CAGR of 5% during the forecast period.

Wood-based furniture remains a dominant segment in the luxury category.

Top companies include Restoration Hardware, Roche Bobois, Knoll, Herman Miller, Ashley Furniture, Boca do Lobo, Cassina, Poltrona Frau, B&B Italia, Minotti, Ligne Roset, Luxury Living Group (Fendi Casa), Fritz Hansen, Kettal, Eichholtz, Turri S.r.l., Paola Lenti, Edra, Manutti, and Muebles Pico.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Raw Material, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Raw Material, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Raw Material, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Raw Material, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Raw Material, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Raw Material, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-user, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Raw Material, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Raw Material, 2023 to 2033

Figure 22: Global Market Attractiveness by End-user, 2023 to 2033

Figure 23: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by End-user, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Raw Material, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Raw Material, 2023 to 2033

Figure 46: North America Market Attractiveness by End-user, 2023 to 2033

Figure 47: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by End-user, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Raw Material, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Raw Material, 2023 to 2033

Figure 70: Latin America Market Attractiveness by End-user, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by End-user, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Raw Material, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 93: Europe Market Attractiveness by Raw Material, 2023 to 2033

Figure 94: Europe Market Attractiveness by End-user, 2023 to 2033

Figure 95: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by End-user, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Raw Material, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Raw Material, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by End-user, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by End-user, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Raw Material, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 141: MEA Market Attractiveness by Raw Material, 2023 to 2033

Figure 142: MEA Market Attractiveness by End-user, 2023 to 2033

Figure 143: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Luxury Wood Doors For Residential Interiors Market Size and Share Forecast Outlook 2025 to 2035

Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Luxury Rigid Box Market Size and Share Forecast Outlook 2025 to 2035

Luxury Hotel Market Size and Share Forecast Outlook 2025 to 2035

Luxury Electric Vehicle (EV) Market Size and Share Forecast Outlook 2025 to 2035

Luxury Vinyl Tile Flooring Market Size and Share Forecast Outlook 2025 to 2035

Luxury Car Market Size and Share Forecast Outlook 2025 to 2035

Luxury Mattress Market Size and Share Forecast Outlook 2025 to 2035

Luxury Fine Jewellery Market Analysis - Size, Share, and Forecast 2025 to 2035

Luxury SUV Market Size and Share Forecast Outlook 2025 to 2035

Luxury Plumbing Fixtures Market Size and Share Forecast Outlook 2025 to 2035

Luxury Coaches Market Size and Share Forecast Outlook 2025 to 2035

Luxury Interior Fabric Industry Analysis in North America and Europe Growth, Trends and Forecast from 2025 to 2035

Luxury Footwear Market Outlook – Size, Share & Innovations 2025 to 2035

Competitive Overview of Luxury Yacht Market Share & Providers

Luxury Yacht Industry Analysis by Type, by Size, by Application , by Ownership, and by Region- Forecast for 2025 to 2035

Luxury Handbag Market Analysis by Product Type, Material Type, and Region Through 2035

Luxury Products For Kids Market - Trends, Growth & Forecast 2025 to 2035

Market Share Insights for Luxury Packaging Providers

Market Share Breakdown of Luxury Rigid Box Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA