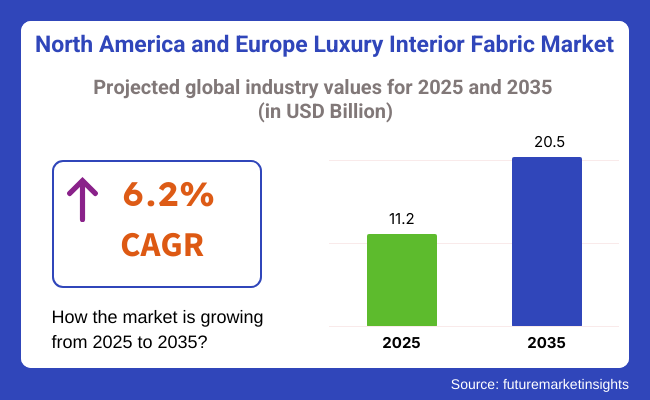

The North America and Europe luxury interior fabric market was worth USD 11.2 billion in 2025 and is anticipated to rise at a 6.2% CAGR during the period from 2025 to 2035. The industry is expected to grow to USD 20.5 billion in 2035.

One of the key drivers for this growth is the increased consumption of premium, sustainably sourced textiles in upscale residential, hospitality, and commercial sectors combined with greater emphasis on artisanal craftsmanship as well as bespoke design experiences.

Consumer tastes in both industries are increasingly converging on high-quality aesthetics, comfort and sustainability. The pandemic-driven revival of interest in home furnishings has driven investments in bespoke interior enhancements. From silk wall panels and velvet drapes to cashmere-upholstered furniture, high-end consumers are seeking tactile opulence and visual spectacles that express individuality and status.

In Europe, heritage design houses and textile mills continue to establish global standards for luxury interiors, with a high focus on natural fiber content and eco-certifications. North American industries, though more performance-driven, are demonstrating a strong affinity for innovation in stain resistance, UV protection, and smart-textile integrations. This coexistence of tradition and technology is creating a hybrid industry defined by both legacy elegance and contemporary utility.

Sustainability is now at the forefront of luxury fabric innovation. Players are spending money on closed-loop manufacturing, organic dyeing processes, and traceability of material sourcing. The demand for hemp, organic cotton, bamboo silk, and recycled synthetic fabrics is increasing, and they will not sacrifice texture or durability. These fibers are now being incorporated into high-end real estate and hospitality developments, where ESG factors are driving procurement decisions.

High-net-worth property owners, interior designers, and architecture firms are principal demand generators. Private jet, yacht and luxury hotel projects are likely to be growth drivers for bespoke fabric applications. With digital visualization technologies strengthening customer involvement in textile choice and pattern design, the industry is poised for long-term growth on the basis of exclusivity, sustainability, and haptic innovation.

The upholstery segment will be the leading contributor to the North America and Europe luxury interior fabric industry in 2025, producing a healthy 52.8% share against curtains, with only 16.7%. This ratio manifests the consumer inclination towards functional luxury home decoration solutions and their personal choice in terms of aesthetic luxury- along with the ongoing design trends in interior space.

Upholstery fabric leads by a huge distance because it covers high-end furniture like so-called sofas and chairs, and it even adds to the luxury bedding. As long as consumers do not stop investing in durable yet aesthetically attractive furniture, luxury upholstery fabrics such as velvet, silk, or high-grade leather will always be in demand.

Brands like Kravet, Sunbrella, and James Hare lead the charge with many offerings geared toward texture, durability, or design versatility. This is due to the increasing customization of interior spaces with premium fabrics, which is an important growth factor for this segment. Also, they serve a dual purpose: as functional uses with aesthetics in a room, hence their attraction to timeless luxury seekers in their interiors.

However, curtains continue to play an important role in terms of industry share; they have less industry share than others. Although they contribute a lot to beautifying a room with added color, texture, and privacy, curtains are considered a lesser part compared to upholstered furniture.

Luxury curtain fabrics, such as silk, linen blends, and embroidered textiles, are still in demand among upper-end homeowners and interior designers. Some of the leading manufacturers of luxury curtain fabrics for high-end, most upscale interiors are Clarke & Clarke and Osborne & Little.

Even though upholstery fabrics continue to monopolize the industry, the opulence of luxury curtains leaves nothing to chance in defining the overall luxury of interior spaces, catering to a significantly smaller but very concerned end-user.

In 2025, velvet and jacquard fabrics will be the leading raw materials in the North America and Europe luxury interior fabric industry, with velvet capturing 27.8% and jacquard accounting for 22.4% of the industry share. These materials are highly favored for their aesthetic appeal and tactile qualities, making them popular choices for high-end interior designs.

As far as textures go, velvet has ruled the roost. For its opulent look, velvet finds its best application in premium upholstery and curtains, plus its favorable connotation with cushions that exude an air of sophistication and timelessness. Such significance is still celebrated in international brands, like in the case of fabulous Fendi Casa furniture or even the grand Roberto Cavalli Home.

Besides all that quintessential luxury, velvet is soft and plush in feel, reflects light and gives depth whenever utilized, hence its massive share of the industry. This trend is largely backed by the increasing trend of maximal interior designs, which highlight bold and indulgent elements with textures like velvet.

Jacquard comes second behind intricate patterns with 22.4% of the industry share because of its durability. This fabric is made by a special loom weaving technique, because these fabrics feature intricate raised designs.

They are consequently much sought after in curtains, furniture, and upholstery for the affluent. Designers Guild and Zoffany, for instance, will often include jacquard in their striking designs, which feature a floral or geometric motif for added depth and elegance in interiors.

This would be somewhat expected, especially in high-class, high-end traditional, and classical interiors, whereby ornate design achieved through intricate details or patterns could be said to be the core focus of such designs.

Certainly, velvet and jacquard are amongst the first few materials related to luxury interior design fabrics. Yet, the different blends of textures and their applications endear different customers to other kinds of markets.

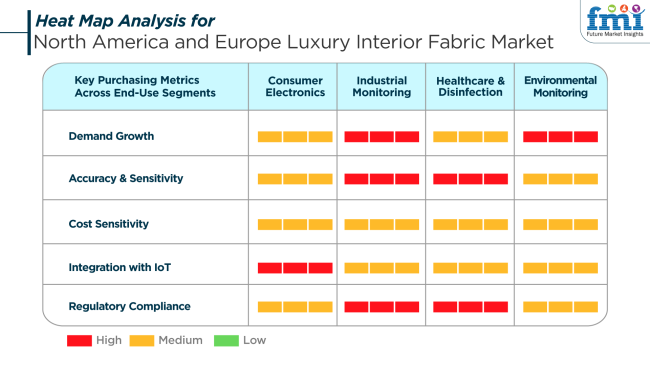

In the North America and Europe luxury interior fabric sector, purchasing decisions are increasingly governed by a blend of aesthetic precision, sustainable sourcing, and regulatory compliance-especially for commercial spaces. High demand growth is seen in residential and hospitality settings where visual impact and tactile experience drive consumer engagement. Buyers prioritize exclusivity, with bespoke fabrics featuring custom prints, weaves, or embroidery.

Accuracy and consistency in texture, colorfastness, and weave are critical, particularly for large-scale commercial installations in hotels or corporate interiors. Buyers expect batch uniformity and compliance with fire-retardant, allergen-free, and non-toxic material standards. As public awareness grows, these requirements are mirrored in healthcare-related environments, where antimicrobial and hypoallergenic properties are prioritized.

While cost sensitivity remains moderate in the luxury segment, environmental compliance and supplier transparency are non-negotiable. Fabrics with clear ESG traceability, including organic certification or low-impact dyeing, are gaining preference. Across all sectors, demand is also increasingly shaped by digital access to fabric libraries, augmented reality for virtual staging, and integration with building information modeling (BIM) tools.

The North America and Europe luxury interior fabric industry is susceptible to several unique risks, particularly supply chain disruptions, evolving consumer values, and regulatory tightening. One key vulnerability is the reliance on rare or natural fibers sourced from geographically constrained regions. Events such as climate anomalies or geopolitical tension can severely impact availability and pricing, threatening production timelines and project continuity.

Consumer values are shifting rapidly toward sustainability and ethical production. Brands that fail to offer transparency in fiber origin, labor practices, or environmental impact may face reputational damage and exclusion from premium procurement rosters. This is particularly critical in Europe, where green certifications increasingly influence public and private sector interior investments.

Finally, tightening regulations around chemical usage in textiles, particularly concerning dyes, flame retardants, and microplastic emissions, are raising compliance costs. Adapting to these standards without compromising fabric quality requires significant investment in innovation and testing. Companies unable to meet these evolving expectations risk being edged out by agile competitors who align luxury with responsibility and innovation. a

From 2020 to 2024, the North America and Europe luxury interior fabric witnessed spectacular growth fueled by growing demand for high-end, sustainable, and bespoke materials for interior home use. The industry was profoundly affected by the COVID-19 pandemic, and more consumers began to focus on enhancing their residential spaces due to increased home time.

There was thus increased demand for quality materials such as silk, velvet, linen, and wool for a variety of applications, including upholstery, curtains, wall coverings, and bedding. Customers appreciated luxury for comfort, whereby they wanted products not just for their beauty but also with a guarantee of longevity along with simple maintenance.

For the future in the decade 2025 to 2035, the North America and Europe luxury interior fabric industry will undergo development with high-tech textile technology, such as programmable smart materials that have the ability to alter color, temperature, or texture with environmental factors. The need for sustainability will increase, and biodegradable materials, fibers from plants, and sustainable color technologies will make more headway.

Augmented reality (AR) will feature prominently in interior design, such that customers will be able to see how certain patterns and textures would look on their homes prior to buying them. Luxury fabrics will also gain greater emphasis in the creation of car interiors and luxury travel, expanding the industry further.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Home renovation boom, comfort-led consumer demand, sustainable consumers, and growing luxury interiors interest. | Smart fabrics, green materials, customized designs, and virtual design technology (AR). |

| Luxury homeowners, interior designers, and high-end hotels, with emphasis on luxury and sustainability. | Sustainably oriented, tech-savvy consumers, luxury interior decorators, and corporate buyers seeking out-of-the-box and eco-friendly solutions. |

| Upmarket materials such as velvet, silk, wool, and eco-friendly cotton for upholstery, drapes, and bedding. | Biodegradable, new texture, bespoke, and smart textiles for particular applications. |

| E-commerce growth, virtual design consultations, and green production practices. | AR-supported design software, smart textiles, and automation of fabric manufacturing and tailoring processes. |

| Increased focus on sustainable, organic, recycled materials. | Full lifecycle sustainability, plant fibers, zero-waste production, and carbon-neutral manufacturing processes. |

| Upscale furniture boutiques, high-end interior design showrooms, and e-commerce platforms. | Virtual design studios, computer-aided fabric selection, and omnichannel retail platforms with augmented reality capabilities. |

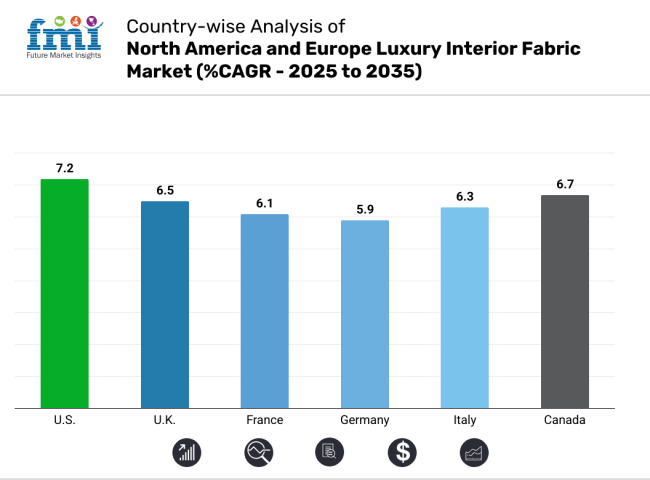

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

| UK | 6.5% |

| France | 6.1% |

| Germany | 5.9% |

| Italy | 6.3% |

| Canada | 6.7% |

The industry in the USA will expand at 7.2% CAGR through the forecast period. The USA North America and Europe luxury interior fabricindustry is driven by increased demand from consumers for exclusive, customized home interiors.

Increased demand for high-end residential design solutions has led to massive investments in innovation and environmentally friendly production. Luxury fabric retailers are going after green, performance-driven materials that answer consumers who are green-conscious while offering the sophistication needed in the luxury industry.

The country also benefits from an evolved interior design industry and growing numbers of high-end consumers who are eager to embellish their environments with high-end beauty and comfort. Additionally, the speed of urbanization and residential property expansion in luxury dwellings and business areas continues to fuel demand.

Collaborations among luxury interior furniture and fabric organizations have promoted an ecosystem that is conducive to expensive customization. Technologies that provide interior visualization of the fabric further assist in purchase decisions, allowing buyers to make informed purchasing decisions. With a well-established e-commerce platform and a culture of embracing design fads, the United States will remain one of the biggest drivers for the North American luxury interior fabric industry until 2035.

The UK industry is expected to grow at 6.5% CAGR during the study period. UK demand for luxury interior fabrics is fueled by the combination of traditional craftsmanship and increasingly modernized tastes. A mature home interior design industry supports the growth of bespoke fabric solutions in both historic and contemporary designs.

Expenditure on home refits and expansion under boutique hotel schemes also contributes to increasing consumption of luxurious fabric for upholstery, curtains, and wall coverings. Affluent consumers in cities such as London and Manchester remain at the forefront of driving the upscale sector, opting to seek custom and high-end interior solutions. Environmental sustainability is also a driving influence on purchasing decisions, with consumption of organically sourced and low-carbon fabrics recording a marked rise.

Technological integration, such as 3D visualization and AR-facilitated room planning, is transforming the customer experience in this industry. Despite Brexit, with its attendant logistic issues, the luxury interior sector has remained solid due to heavy domestic production and innovation. The industry will find continued momentum by virtue of high-end residential refurbishment and bespoke schemes in the luxury commercial sector.

The French industry is expected to grow at 6.1% CAGR during the period of study. France is a leader in global luxury and design, and this carries over to the world of interior fabrics as well. French consumers are extremely fond of hand-tailored detail, texture contrast, and heritage-based patterns in local furnishings.

This cultural inclination explains the steady demand for luxury textiles, particularly those produced by traditional weaving techniques and natural fibers such as silk and linen. Paris continues to be a central location for upscale interior design, driving partnerships between designers and textile producers.

The growing power of French fashion brands expanding into home decor has also supported demand for high-end textiles. Additionally, the government's efforts in encouraging local craftsmanship and sustainable production are in line with international trends of conscious consumerism.

Excessive tourism in luxury hospitality has also necessitated increased luxury interior finishes in hotels and resorts. With a mature industry and international influence in design, France is likely to continue growing steadily as high-end tastes evolve with developments in modern interior design trends.

Germany's industry will expand at 5.9% CAGR during the study period. Germany's interior fabric industry is underpinned by high technical precision and design simplicity that is popular among high-income consumers searching for subtle luxury.

The industry is primarily underpinned by increasing renovations in luxury residential buildings and high growth in the hospitality sector. Sustainably sourced and functionality-focused luxury materials are gaining traction with German customers who value looks as much as functionality.

The strong industrial base of Germany allows for local production of superior-quality textiles, and reduction in import dependency ensures control over design. Interior design trends in German interiors are shifting towards minimalist Scandinavian and Bauhaus styles.

Accordingly, the use of neutral tactile fabrics is gaining popularity for both residential and commercial interior applications. Moreover, integrating smart textiles with digital customization technology is expanding marketplace opportunities.

Although competition is high, demand for locally produced and environmentally certified products is driving the growth trajectory. Germany's emphasis on craftsmanship and environmental responsibility makes it a steady industry in Europe's luxury interiors sector.

Italy's industry will grow at a 6.3% CAGR over the period covered by this study. Italy's profound heritage in fashion and furniture influences its interior textile industry, emerging as a thrilling, style-driven industry. Consistent demand for high-quality bespoke textile finishes on villas, design flats, and luxury hotels propels innovation on a continuous basis.

High-quality demands lead Italian textile mills to raw materials such as velvet, silk, and cashmere blends for highly textured interior environments. Italian brand dominance in the global luxury furniture industry also spurs local consumption of coordinated interior fabrics. Milan is a central trend hub wherein annual design exhibitions trigger product launches and international collaboration.

Digital design integration facilitating live customization and visualization is increasingly valuable in the marketplace. In addition, the move towards sustainable manufacturing, particularly with heritage brands, is enhancing the appeal of the industry to young, high-end consumers. Increased demand for heritage-infused but contemporary interior design will see Italy able to record good growth over the considered period.

The Canadian industry is predicted to grow at a 6.7% CAGR over the study period. Canada's premium interior fabric business is on the rise with a rising affluent populace and strong real estate activity in big cities such as Toronto, Vancouver, and Montreal. Consumers are increasing high-end home furnishings investments towards products that stress texture, workmanship, and sustainability.

Cross-border collaborations on luxury design are supplemented by the proximity to the USA in terms of trend adoption as well as partnering. Canadian homeowners are adopting the influences of worldwide design, even choosing hybrid styling that balances comfort and style.

As the demand for high-performance yet aesthetically elegant textiles increase, manufacturers are concentrating on developing fabric lines that provide durability in conjunction with luxury. E-commerce and online interior customization platforms are increasing access to luxury fabrics outside of metropolitan regions.

Furthermore, the business industry, particularly in high-end retail environments and boutique hotels, is creating new avenues for the application of high-end fabrics. With a solid blend of domestic design innovation and international popularity, Canada's luxury fabric industry is poised for consistent growth in the next decade.

The North America and Europe luxury interior fabricindustry is incredibly competitive, with high-end textile manufacturers, designer names, and boutique fabric producers all vying for space in this industry. Companies like Rubelli, Pierre Frey, and Dedar are flag bearers due to their combination of heritage-based craftsmanship with modern design innovation. These brands nurture close relationships with interior designers, luxury property developers, and high-end hospitality chains to guarantee a constant stream of demand for their luxury fabrics.

On the other hand, there are companies like Designers Guild and Zimmer + Rohde, known for making a strong distinction by their cumulative collections that blend the classic and the current. Up-and-coming boutique brands are beginning to gain ground in appealing to niche audiences that value exclusive, sustainable, and custom-designed fabric offerings.

On the other hand, Kravet Inc. and Romo Group exploit global distribution networks and partnerships with well-known designers to augment their luxury business programs. The cross-competitive focus across the sector relies on the quality of fabrics manufactured, the uniqueness of textures, sustainability certifications, and the ability to offer personalized solutions.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Rubelli Group | 14-16% |

| Pierre Frey | 12-14% |

| Designers Guild | 10-12% |

| Dedar S.p.A | 9-11% |

| Zimmer + Rohde | 7-9% |

| Other Players | 39-43% |

Key Company Insights

Indeed, the Rubelli Group has established itself as a hallmark in the North America and Europe luxury interior fabric sector by fusing traditions steeped in centuries-old Venetian textiles with groundbreaking innovations, particularly in high-performance luxury fabrics for hospitality and ultra-luxury residential purposes.

This strategic focus on historical archives and bespoke services will ensure a continued client base of elite interior designers and architects.Building its industry accentuations, Pierre Frey and Dedar further created partnerships with contemporary artists and integrated further into eco-business luxury fabric collections.

The capacity for innovative adaptation to sustainable materials with little compromise on aesthetic sophistication complements their line in surface finish diversity. Moreover, they're closely in line with the current craze-aligned responsible luxury in interior spaces. Intense concentration in hyper-customization for exclusive luxury fabric use becomes one among the smaller players and boutique brands that leverage unique craftsmanship in their offerings.

By product, the industry is segmented into curtains (doors and windows), upholstery (chairs, sofas, beds, and luxury cushion), bed linen, and mattress coverings.

By raw material, the industry is categorized into cotton, velvet, linen, jacquard, and other materials.

By distribution channel, the industry is divided into offline and online channels.

By end user, the industry is segmented into domestic and commercial users.

By region, the industry is segmented into North America and Europe.

The industry is expected to reach USD 11.2 billion in 2025.

The industry is projected to grow to USD 20.5 billion by 2035.

The industry is expected to grow at a CAGR of approximately 6.2% during the forecast period.

The upholstery segment is a key segment in the industry.

Key players include Rubelli Group, Pierre Frey, Designers Guild, Dedar S.p.A, Zimmer + Rohde, Kravet Inc., Romo Group, Lelievre Paris, Sahco (Kvadrat Group), Jim Thompson, and other players.

Table 1: Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Market Volume (Meter) Forecast by Region, 2019 to 2034

Table 3: Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 4: Market Volume (Meter) Forecast by Product, 2019 to 2034

Table 5: Market Value (US$ Million) Forecast by Raw Material, 2019 to 2034

Table 6: Market Volume (Meter) Forecast by Raw Material, 2019 to 2034

Table 7: Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 8: Market Volume (Meter) Forecast by Distribution Channel, 2019 to 2034

Table 9: Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 10: Market Volume (Meter) Forecast by End-user, 2019 to 2034

Table 11: Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 12: Market Volume (Meter) Forecast by Country, 2019 to 2034

Table 13: Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 14: Market Volume (Meter) Forecast by Product, 2019 to 2034

Table 15: Market Value (US$ Million) Forecast by Raw Material, 2019 to 2034

Table 16: Market Volume (Meter) Forecast by Raw Material, 2019 to 2034

Table 17: Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 18: Market Volume (Meter) Forecast by Distribution Channel, 2019 to 2034

Table 19: Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 20: Market Volume (Meter) Forecast by End-user, 2019 to 2034

Table 21: Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: Market Volume (Meter) Forecast by Country, 2019 to 2034

Table 23: Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 24: Market Volume (Meter) Forecast by Product, 2019 to 2034

Table 25: Market Value (US$ Million) Forecast by Raw Material, 2019 to 2034

Table 26: Market Volume (Meter) Forecast by Raw Material, 2019 to 2034

Table 27: Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 28: Market Volume (Meter) Forecast by Distribution Channel, 2019 to 2034

Table 29: Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 30: Market Volume (Meter) Forecast by End-user, 2019 to 2034

Figure 1: Market Value (US$ Million) by Product, 2024 to 2034

Figure 2: Market Value (US$ Million) by Raw Material, 2024 to 2034

Figure 3: Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 4: Market Value (US$ Million) by End-user, 2024 to 2034

Figure 5: Market Value (US$ Million) by Region, 2024 to 2034

Figure 6: Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Market Volume (Meter) Analysis by Region, 2019 to 2034

Figure 8: Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 9: Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 10: Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 11: Market Volume (Meter) Analysis by Product, 2019 to 2034

Figure 12: Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 13: Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 14: Market Value (US$ Million) Analysis by Raw Material, 2019 to 2034

Figure 15: Market Volume (Meter) Analysis by Raw Material, 2019 to 2034

Figure 16: Market Value Share (%) and BPS Analysis by Raw Material, 2024 to 2034

Figure 17: Market Y-o-Y Growth (%) Projections by Raw Material, 2024 to 2034

Figure 18: Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 19: Market Volume (Meter) Analysis by Distribution Channel, 2019 to 2034

Figure 20: Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 21: Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 22: Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 23: Market Volume (Meter) Analysis by End-user, 2019 to 2034

Figure 24: Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 25: Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 26: Market Attractiveness by Product, 2024 to 2034

Figure 27: Market Attractiveness by Raw Material, 2024 to 2034

Figure 28: Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 29: Market Attractiveness by End-user, 2024 to 2034

Figure 30: Market Attractiveness by Region, 2024 to 2034

Figure 31: Market Value (US$ Million) by Product, 2024 to 2034

Figure 32: Market Value (US$ Million) by Raw Material, 2024 to 2034

Figure 33: Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 34: Market Value (US$ Million) by End-user, 2024 to 2034

Figure 35: Market Value (US$ Million) by Country, 2024 to 2034

Figure 36: Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 37: Market Volume (Meter) Analysis by Country, 2019 to 2034

Figure 38: Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 39: Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 40: Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 41: Market Volume (Meter) Analysis by Product, 2019 to 2034

Figure 42: Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 43: Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 44: Market Value (US$ Million) Analysis by Raw Material, 2019 to 2034

Figure 45: Market Volume (Meter) Analysis by Raw Material, 2019 to 2034

Figure 46: Market Value Share (%) and BPS Analysis by Raw Material, 2024 to 2034

Figure 47: Market Y-o-Y Growth (%) Projections by Raw Material, 2024 to 2034

Figure 48: Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 49: Market Volume (Meter) Analysis by Distribution Channel, 2019 to 2034

Figure 50: Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 51: Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 52: Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 53: Market Volume (Meter) Analysis by End-user, 2019 to 2034

Figure 54: Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 55: Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 56: Market Attractiveness by Product, 2024 to 2034

Figure 57: Market Attractiveness by Raw Material, 2024 to 2034

Figure 58: Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 59: Market Attractiveness by End-user, 2024 to 2034

Figure 60: Market Attractiveness by Country, 2024 to 2034

Figure 61: Market Value (US$ Million) by Product, 2024 to 2034

Figure 62: Market Value (US$ Million) by Raw Material, 2024 to 2034

Figure 63: Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 64: Market Value (US$ Million) by End-user, 2024 to 2034

Figure 65: Market Value (US$ Million) by Country, 2024 to 2034

Figure 66: Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 67: Market Volume (Meter) Analysis by Country, 2019 to 2034

Figure 68: Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 69: Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 70: Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 71: Market Volume (Meter) Analysis by Product, 2019 to 2034

Figure 72: Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 73: Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 74: Market Value (US$ Million) Analysis by Raw Material, 2019 to 2034

Figure 75: Market Volume (Meter) Analysis by Raw Material, 2019 to 2034

Figure 76: Market Value Share (%) and BPS Analysis by Raw Material, 2024 to 2034

Figure 77: Market Y-o-Y Growth (%) Projections by Raw Material, 2024 to 2034

Figure 78: Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 79: Market Volume (Meter) Analysis by Distribution Channel, 2019 to 2034

Figure 80: Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 81: Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 82: Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 83: Market Volume (Meter) Analysis by End-user, 2019 to 2034

Figure 84: Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 85: Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 86: Market Attractiveness by Product, 2024 to 2034

Figure 87: Market Attractiveness by Raw Material, 2024 to 2034

Figure 88: Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 89: Market Attractiveness by End-user, 2024 to 2034

Figure 90: Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Luxury Travel Market Forecast and Outlook 2025 to 2035

Luxury Rigid Box Market Size and Share Forecast Outlook 2025 to 2035

Luxury Hotel Market Size and Share Forecast Outlook 2025 to 2035

Luxury Electric Vehicle (EV) Market Size and Share Forecast Outlook 2025 to 2035

Luxury Car Market Size and Share Forecast Outlook 2025 to 2035

Luxury Mattress Market Size and Share Forecast Outlook 2025 to 2035

Luxury SUV Market Size and Share Forecast Outlook 2025 to 2035

Luxury Coaches Market Size and Share Forecast Outlook 2025 to 2035

Luxury Footwear Market Outlook – Size, Share & Innovations 2025 to 2035

Luxury Furniture Market Insights - Demand, Size, and Industry Trends 2025 to 2035

Luxury Yacht Industry Analysis by Type, by Size, by Application , by Ownership, and by Region- Forecast for 2025 to 2035

Luxury Products For Kids Market - Trends, Growth & Forecast 2025 to 2035

Luxury Perfume Market

Luxury Handbag Market Analysis by Product Type, Material Type, and Region Through 2035

Luxury Vinyl Tile Flooring Market Size and Share Forecast Outlook 2025 to 2035

Luxury Fine Jewellery Market Analysis - Size, Share, and Forecast 2025 to 2035

Luxury Plumbing Fixtures Market Size and Share Forecast Outlook 2025 to 2035

Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Luxury Yacht Market Share & Providers

Market Share Breakdown of Luxury Rigid Box Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA