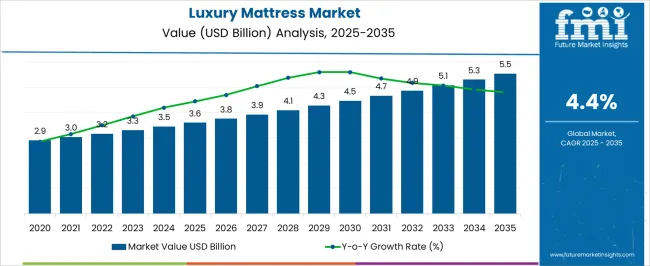

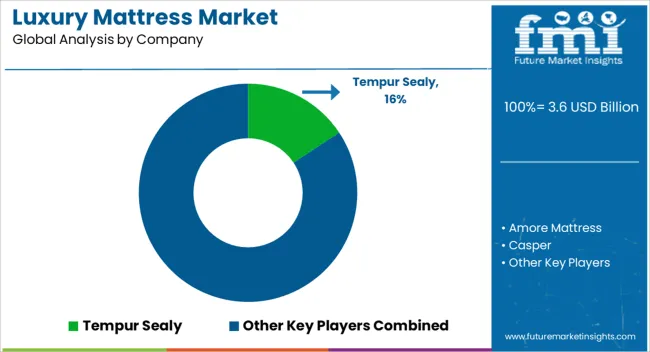

The luxury mattress market is estimated to be valued at USD 3.6 billion in 2025 and is projected to reach USD 5.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

Regional growth analysis indicates a notable imbalance across Asia-Pacific, Europe, and North America, shaped by varying consumer preferences, income levels, and distribution infrastructure. Asia-Pacific is expected to witness comparatively higher growth in market value due to rising demand from emerging high-income urban populations, increasing hotel and premium residential development, and greater penetration of organized retail channels. The CAGR in this region is likely to outpace both Europe and North America, suggesting a faster pace of adoption despite starting from a smaller base.

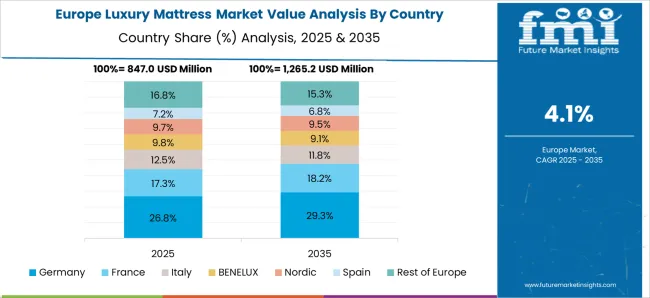

Europe presents a steady growth trajectory, with the market benefitting from established premium retail networks, strong brand recognition, and consistent consumer willingness to invest in luxury home goods. The market expansion is constrained by mature saturation levels in key economies such as Germany, the UK, and France, leading to incremental growth rather than rapid acceleration.

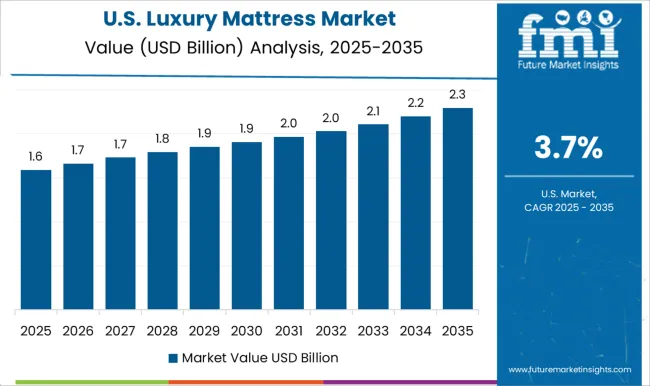

North America maintains a sizable market share, driven by long-standing consumer awareness of premium sleep solutions and the presence of dominant mattress brands, yet growth is relatively stable and moderate due to market maturity. The regional dynamics reveal Asia-Pacific as a high-growth frontier, Europe as a stable yet incremental market, and North America as a mature but consistent contributor, highlighting the need for region-specific strategies to capture demand and optimize distribution and marketing approaches across different geographies.

The luxury mattress market represents a specialized segment within the global bedding and sleep products industry, emphasizing premium comfort, durability, and advanced sleep technology. Within the overall mattress market, it accounts for about 8.2%, driven by rising consumer preference for high-quality sleep solutions. In the premium furniture and home furnishing segment, it holds nearly 7.4%, reflecting demand for ergonomically designed and aesthetically appealing products.

Across the specialty sleep accessories market, the segment captures 5.1%, supporting mattress toppers, adjustable bases, and integrated sleep technology. Within the e-commerce and direct-to-consumer distribution channel category, it represents 4.6%, highlighting the growing importance of online sales. In the hospitality and luxury accommodations sector, it secures 3.9%, emphasizing adoption in hotels, resorts, and high-end residential projects.

Recent developments in this market have focused on material innovation, comfort technology, and personalized sleep solutions. Innovations include hybrid mattresses combining memory foam, latex, and pocket springs for optimized support and pressure relief. Key players are integrating cooling gels, smart sensors, and adjustable firmness mechanisms to enhance sleep quality.

Sustainable and hypoallergenic materials are gaining attention, including organic cotton, natural latex, and recycled foams. Collaborations between mattress manufacturers and sleep technology companies are enabling app-controlled adjustments and sleep tracking. Marketing strategies emphasizing wellness, ergonomic benefits, and luxury experience have strengthened consumer adoption. These advancements demonstrate how comfort, technology, and premium positioning are shaping the luxury mattress market.

| Metric | Value |

|---|---|

| Luxury Mattress Market Estimated Value in (2025 E) | USD 3.6 billion |

| Luxury Mattress Market Forecast Value in (2035 F) | USD 5.5 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The luxury mattress market is witnessing sustained expansion, supported by rising consumer spending on premium home furnishings, growing awareness of sleep health, and heightened demand for products offering superior comfort and durability. Market momentum is being reinforced by innovations in material engineering, ergonomic design, and manufacturing processes that enhance product performance and longevity.

The segment is benefiting from increased penetration in both mature and emerging economies, where urbanization and lifestyle upgrades are driving higher adoption rates. Price resilience in the premium segment, coupled with targeted marketing strategies, is allowing manufacturers to maintain profitability despite fluctuating raw material costs.

Advancements in distribution, particularly through e-commerce platforms and omni-channel retailing, have broadened consumer reach while enabling customization and personalized recommendations Over the forecast period, the combination of design innovation, material quality, and brand positioning is expected to ensure consistent growth, supported by expanding consumer preference for wellness-oriented, high-comfort bedding solutions.

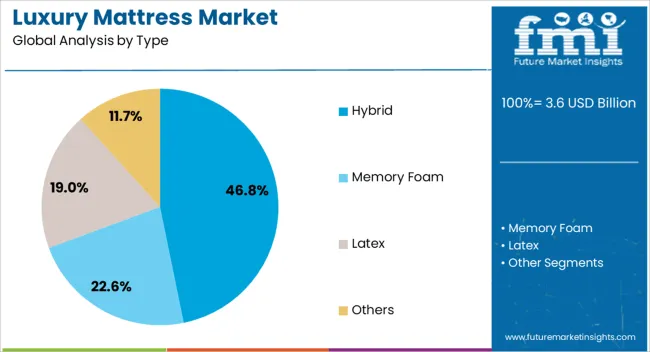

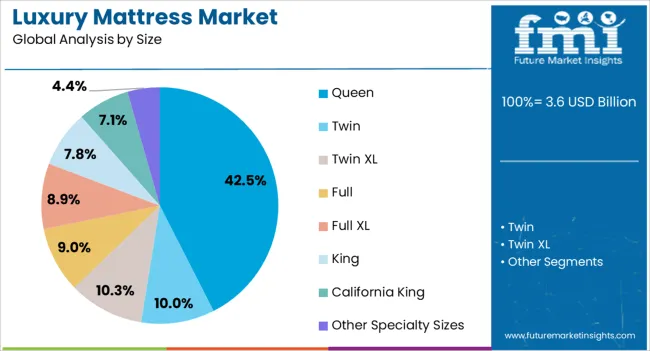

The luxury mattress market is segmented by type, size, thickness, end-use, distribution channel, and geographic regions. By type, luxury mattress market is divided into hybrid, memory foam, latex, and others. In terms of size, luxury mattress market is classified into queen, twin, twin XL, full, full XL, king, California King, and other specialty sizes.

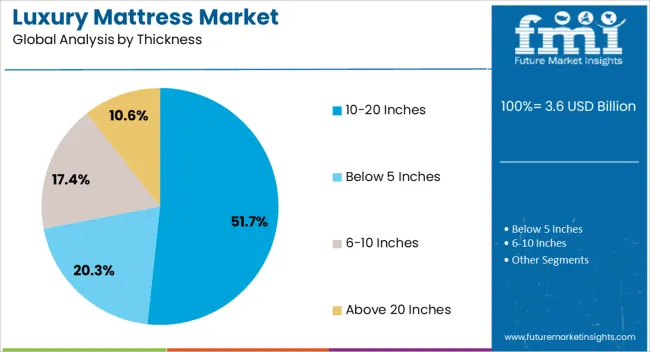

Based on thickness, luxury mattress market is segmented into 10-20 Inches, below 5 Inches, 6-10 Inches, and above 20 Inches. By end-use, luxury mattress market is segmented into residential, commercial, hotels, resorts, and others (Hospitals).

By distribution channel, luxury mattress market is segmented into offline, specialty stores, hypermarket/supermarket, other retail stores, online, company-owned Websites, and e-commerce websites. Regionally, the luxury mattress industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hybrid mattress category, accounting for 46.80% of the type segment, is maintaining its leadership due to its ability to combine the benefits of multiple support and comfort technologies in a single product. Its market share is being sustained by demand from consumers seeking advanced pressure relief, motion isolation, and breathability, which hybrid constructions deliver through the integration of innerspring systems with memory foam or latex layers.

The segment has benefited from continuous product development, including zoned support structures and cooling technologies, which address diverse consumer needs. High durability and superior performance have reinforced its positioning in the premium category, while retail and e-commerce channels have amplified visibility through targeted promotions.

Manufacturing flexibility has allowed brands to offer varied firmness levels, catering to a wider audience, thus consolidating the hybrid segment’s dominance within the luxury mattress market.

The queen-size category, representing 42.50% of the size segment, continues to lead due to its optimal balance between sleeping space and compatibility with standard bedroom dimensions. This segment’s dominance has been supported by high demand from both single sleepers seeking spaciousness and couples preferring a space-efficient alternative to larger beds.

Queen-size mattresses have maintained their appeal across residential and hospitality sectors, driven by their adaptability to diverse room layouts. The segment’s market share is further reinforced by competitive pricing within the luxury category, enabling broader accessibility without compromising on quality.

Increased customization options, including tailored comfort levels and premium finishes, have expanded the segment’s reach, while steady replacement demand from existing households has ensured consistent sales Strategic marketing emphasizing versatility and value within the luxury range has been pivotal in sustaining queen-size mattresses’ leadership position.

The 10–20 inches thickness range, holding 51.70% of the thickness segment, has established its dominance by delivering an optimal balance between support, comfort, and structural integrity. Mattresses within this range have been favored for their ability to incorporate multiple comfort layers and advanced support systems without compromising aesthetics or ease of use.

This segment benefits from engineering innovations that allow precise layering of premium foams, gels, and coils to achieve superior ergonomics. Consumer preference for substantial yet manageable mattress profiles has further reinforced its market share, particularly in luxury categories where both performance and visual presence are valued.

Enhanced durability, improved edge support, and greater resilience against sagging have increased consumer satisfaction and repeat purchases The segment’s leadership is expected to continue as manufacturers leverage this thickness range to introduce advanced features while maintaining compatibility with standard bed frames and accessories.

The market has experienced significant growth due to rising consumer demand for comfort, wellness, and high-quality sleep solutions. Luxury mattresses offer advanced support systems, premium materials, and enhanced durability, making them preferred choices for residential, hospitality, and premium healthcare applications. Innovations such as memory foam, latex, hybrid designs, cooling gels, and adjustable firmness have improved user comfort and ergonomics. Increasing awareness about sleep health, rising disposable incomes, and growing urbanization have reinforced market adoption. Expansion of e-commerce platforms, specialized mattress retailers, and branded showrooms has enhanced product accessibility.

Luxury mattresses utilize advanced materials such as memory foam, natural latex, pocketed coils, gel-infused foams, and organic fibers to deliver superior comfort, pressure relief, and spinal support. Hybrid mattress designs combining multiple layers optimize support and breathability, catering to diverse consumer preferences. Smart technologies, including adjustable firmness, temperature regulation, and sleep tracking sensors, have enhanced the user experience. Innovations in edge support, motion isolation, and anti-allergen treatments further improve functionality and hygiene. These technological advancements have elevated consumer expectations, encouraged premium pricing, and positioned luxury mattresses as essential wellness products, leading to increased adoption across residential, hospitality, and premium healthcare sectors.

The hospitality and healthcare sectors have emerged as significant contributors to luxury mattress demand. Premium hotels, resorts, and serviced apartments prioritize high-quality sleep experiences for guests, incorporating mattresses that offer comfort, durability, and enhanced hygiene. In healthcare facilities, mattresses with pressure-relief features, anti-microbial properties, and ergonomic support are increasingly adopted to improve patient comfort and reduce complications such as bedsores. Rising global tourism, expansion of luxury hotels, and healthcare infrastructure investments in emerging markets have further reinforced demand. Customized solutions for specific applications, including orthopedic or adjustable mattresses, have created opportunities for product differentiation and growth in specialized segments.

The growth of e-commerce platforms and specialized retail channels has enhanced accessibility and visibility of luxury mattresses. Consumers can compare features, read reviews, and make informed purchase decisions online, enabling wider reach and convenience. Direct-to-consumer models, mattress-in-a-box offerings, and free trial programs have simplified the buying process, reducing barriers to purchase. Retail partnerships with furniture stores, lifestyle outlets, and interior design firms have further strengthened market penetration. The combination of online and offline distribution channels ensures availability across urban, semi-urban, and emerging regions, driving adoption and supporting sustained growth in the luxury mattress market globally.

Emerging markets in Asia-Pacific, Latin America, and the Middle East offer substantial growth potential for luxury mattresses due to rising disposable incomes, urbanization, and increasing awareness of sleep quality and wellness. The expansion of premium residential developments, luxury hotels, and wellness centers has driven demand for high-quality sleep solutions. Consumers are increasingly seeking customizable mattresses with advanced features such as temperature regulation, adjustable firmness, and ergonomic designs. Investments in localized production, marketing campaigns, and distribution networks are enabling manufacturers to cater to regional preferences and price sensitivities. These factors collectively position emerging markets as strategic growth areas for luxury mattress manufacturers over the long term.

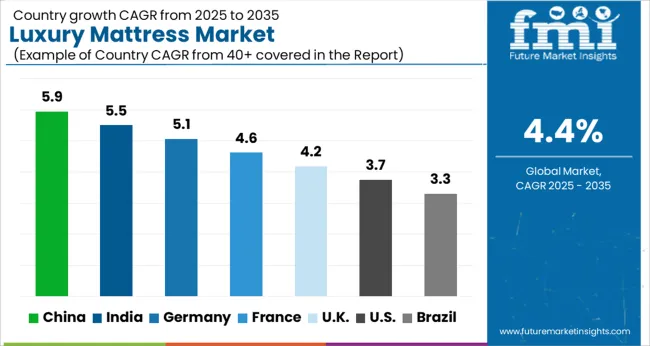

| Country | CAGR |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| UK | 4.2% |

| USA | 3.7% |

| Brazil | 3.3% |

The market is expected to expand steadily over the next decade, driven by rising consumer focus on comfort, sleep health, and premium home products. China leads with a 5.9% growth rate, propelled by increasing urban households and rising demand for high-end bedding. India follows at 5.5%, scaling through expanding middle-class income and luxury furniture adoption.

Germany grows at 5.1%, supported by technological innovations in materials and ergonomic designs. The United Kingdom records 4.2%, innovating through sustainable materials and smart mattress features. The United States achieves 3.7%, where consumer interest in premium home furnishings sustains consistent market activity. Together, these countries demonstrate diverse production, deployment, and technological advancement in luxury mattresses. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is anticipated to grow at a CAGR of 5.9%, driven by rising disposable income, urban middle-class expansion, and increasing awareness of sleep health. Consumers are increasingly opting for premium mattresses that provide enhanced comfort, orthopedic support, and advanced sleep technology features. E-commerce platforms, specialized furniture stores, and high-end retail outlets are making luxury mattresses widely accessible. Brand differentiation, product innovation, and strategic marketing campaigns are helping companies capture consumer attention. Collaborations with home décor and lifestyle brands further enhance visibility. Growing awareness of the health benefits of quality sleep, coupled with trends in modern home interior design, is contributing to steady market growth across urban regions.

India’s market is projected to expand at a CAGR of 5.5%, supported by increasing urbanization, higher disposable income, and rising consumer focus on sleep quality. High-end mattresses offering memory foam, latex, and hybrid technology are gaining traction. Retailers and online platforms are broadening product accessibility in metropolitan and tier-2 cities. Health-conscious consumers are emphasizing the importance of proper spinal alignment and ergonomic support, which premium mattresses provide. Marketing campaigns highlighting comfort, durability, and advanced materials are further influencing purchasing behavior. Partnerships between mattress brands and lifestyle or home furnishing companies are creating new avenues for product visibility and customer engagement, strengthening the market in India.

Germany is expected to grow at a CAGR of 5.1%, driven by rising consumer focus on wellness and premium lifestyle choices. Buyers prefer mattresses that combine comfort, durability, and high-quality materials such as memory foam, pocket springs, and natural fibers. Retail stores and e-commerce channels are enabling wider access to high-end mattresses. Health and wellness awareness, particularly regarding spinal health and sleep quality, is influencing consumer purchasing behavior. Manufacturers are leveraging innovative designs, sustainable materials, and eco-friendly certifications to differentiate their products. Strategic collaborations with interior designers and lifestyle brands are further boosting visibility and adoption in Germany.

The UK market is projected to grow at a CAGR of 4.2%, fueled by increasing awareness of sleep health and rising demand for premium home furnishings. Consumers are seeking mattresses that provide superior comfort, pressure relief, and ergonomic support. E-commerce platforms, high-end furniture stores, and specialized mattress showrooms are enhancing product availability. Marketing initiatives emphasizing quality sleep, advanced materials, and durability are influencing purchase decisions. Collaborations with home décor experts and lifestyle influencers are driving brand visibility. Continued interest in wellness-oriented products and home comfort trends is expected to support steady market expansion in the United Kingdom.

The United States market is expected to grow at a CAGR of 3.7%, supported by rising demand for premium sleep solutions, urban household growth, and increased focus on health and wellness. Consumers are increasingly choosing memory foam, hybrid, and latex mattresses that offer durability, comfort, and superior support. E-commerce and retail channels, including high-end furniture stores, play a key role in product accessibility. Marketing campaigns emphasizing advanced materials, comfort, and sleep quality are shaping consumer preferences. Partnerships with lifestyle and wellness brands, along with targeted online promotions, are enhancing brand visibility and adoption. The focus on wellness and sleep quality continues to drive market momentum in the US.

The market has witnessed substantial growth driven by rising consumer awareness of sleep health, demand for premium comfort, and innovations in mattress technologies. Tempur Sealy is a major player, offering memory foam and hybrid mattresses that combine ergonomic support with luxury features. Amore Mattress and Casper focus on direct-to-consumer models, leveraging online sales channels and advanced foam and spring technologies to deliver high-end comfort at competitive pricing.

Duroflex Pvt. Ltd. and Livpure Pvt. Ltd. provide region-specific solutions, emphasizing durability, natural materials, and orthopedic benefits. HARRISON SPINKS and Hilding Anders International AB specialize in handcrafted and pocket-sprung mattresses that cater to luxury hospitality and premium residential segments.

King Koil Licensing Co. Inc., Kingsdown Mattress, and Magniflex India blend traditional craftsmanship with modern innovations such as gel-infused foams and adaptive support layers to enhance sleep quality. NOCTALIA SLU, Puffy LLC, Purple, Serta, and Sleep Number incorporate smart features, temperature regulation, and customizable firmness to meet evolving consumer expectations. These providers dominate the market by offering diverse, technologically advanced, and ergonomically designed mattresses, establishing strong brand loyalty while driving global market expansion.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.6 nillion |

| Type | Hybrid, Memory Foam, Latex, and Others |

| Size | Queen, Twin, Twin XL, Full, Full XL, King, California King, and Other Specialty Sizes |

| Thickness | 10-20 Inches, Below 5 Inches, 6-10 Inches, and Above 20 Inches |

| End-Use | Residential, Commercial, Hotels, Resorts, and Others (Hospitals) |

| Distribution Channel | Offline, Specialty Stores, Hypermarket/Supermarket, Other Retail Stores, Online, Company-owned Websites, and E-commerce Websites |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Tempur Sealy, Amore Mattress, Casper, Duroflex Pvt. Ltd., HARRISON SPINKS, Hilding Anders International AB, King Koil Licensing Co. Inc., Kingsdown Mattress, Livpure Pvt. Ltd., Magniflex India, NOCTALIA SLU, Puffy LLC, Purple, Serta, and Sleep Number |

| Additional Attributes | Dollar sales by mattress type and material, demand dynamics across residential, hospitality, and premium segments, regional trends in luxury bedding adoption, innovation in comfort technologies, ergonomic design, and smart features, environmental impact of material sourcing and disposal, and emerging use cases in wellness-focused sleep solutions and premium home interiors. |

The global luxury mattress market is estimated to be valued at USD 3.6 billion in 2025.

The market size for the luxury mattress market is projected to reach USD 5.5 billion by 2035.

The luxury mattress market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in luxury mattress market are hybrid, memory foam, latex and others.

In terms of size, queen segment to command 42.5% share in the luxury mattress market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Luxury Travel Market Forecast and Outlook 2025 to 2035

Luxury Wood Doors For Residential Interiors Market Size and Share Forecast Outlook 2025 to 2035

Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Luxury Rigid Box Market Size and Share Forecast Outlook 2025 to 2035

Luxury Hotel Market Size and Share Forecast Outlook 2025 to 2035

Luxury Electric Vehicle (EV) Market Size and Share Forecast Outlook 2025 to 2035

Luxury Vinyl Tile Flooring Market Size and Share Forecast Outlook 2025 to 2035

Luxury Car Market Size and Share Forecast Outlook 2025 to 2035

Luxury Fine Jewellery Market Analysis - Size, Share, and Forecast 2025 to 2035

Luxury SUV Market Size and Share Forecast Outlook 2025 to 2035

Luxury Plumbing Fixtures Market Size and Share Forecast Outlook 2025 to 2035

Luxury Coaches Market Size and Share Forecast Outlook 2025 to 2035

Luxury Interior Fabric Industry Analysis in North America and Europe Growth, Trends and Forecast from 2025 to 2035

Luxury Footwear Market Outlook – Size, Share & Innovations 2025 to 2035

Luxury Furniture Market Insights - Demand, Size, and Industry Trends 2025 to 2035

Competitive Overview of Luxury Yacht Market Share & Providers

Luxury Yacht Industry Analysis by Type, by Size, by Application , by Ownership, and by Region- Forecast for 2025 to 2035

Luxury Handbag Market Analysis by Product Type, Material Type, and Region Through 2035

Luxury Products For Kids Market - Trends, Growth & Forecast 2025 to 2035

Market Share Insights for Luxury Packaging Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA