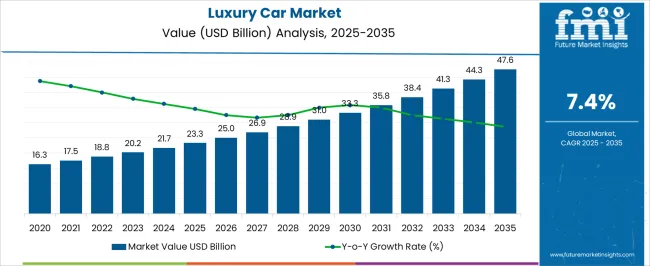

The luxury car sector is expected to expand from USD 23.3 billion in 2025 to USD 47.6 billion by 2035, advancing at a CAGR of 7.4%. The year-on-year analysis shows consistent gains, with values rising from 23.3 billion in 2025 to 28.9 billion in 2028 and 33.3 billion by 2030. This upward trend reflects strong consumer interest in premium vehicles that offer advanced performance, design exclusivity, and high-end comfort features.

Analysts suggest that the YoY curve emphasizes reliability in growth, as aspirational buyers and established affluent segments continue to drive purchases, keeping demand resilient across both mature and emerging markets. By 2031, the industry value is projected at 35.8 billion, reaching 41.3 billion in 2033 and closing at 47.6 billion by 2035. The YoY growth curve highlights steady adoption, underpinned by brand loyalty, product innovation in luxury design, and expanding dealership networks.

Market observers argue that this progression points toward enduring appeal of luxury cars, with buyers valuing craftsmanship and exclusivity. The curve suggests not just incremental growth but also long-term strengthening of luxury as a distinct automotive category, reinforcing its influence on global car manufacturing strategies and its role as a marker of consumer prestige.

| Metric | Value |

|---|---|

| Luxury Car Market Estimated Value in (2025 E) | USD 23.3 billion |

| Luxury Car Market Forecast Value in (2035 F) | USD 47.6 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The luxury car segment is estimated to contribute nearly 14% of the passenger vehicles market, about 12% of the automotive manufacturing market, close to 38% of the premium and high-end vehicles market, nearly 10% of the electric and hybrid vehicles market, and around 8% of the global mobility solutions market. Collectively, this equals an aggregated share of approximately 82% across its parent categories. This proportion emphasizes the commanding role of luxury cars as symbols of performance, craftsmanship, and technological leadership within the automotive sector.

Their contribution has been reinforced through strong demand in regions where consumer preferences prioritize comfort, advanced safety features, and exclusive brand identity. Industry analysts see luxury cars not merely as a sub-segment but as a trend-setting category that influences design, engineering, and marketing strategies across the broader vehicle landscape. Their relevance has been shaped by a growing appetite for electric luxury models, personalization options, and high-performance variants that serve as benchmarks for mass-market vehicles.

The segment’s weight is also visible in its effect on profitability, with luxury cars delivering higher margins and securing brand prestige for global automakers. As such, the luxury car market is regarded as a decisive force within its parent markets, shaping competitive strategies, investment priorities, and consumer perceptions, while continuing to define the premium edge of global automotive demand.

The Luxury Car market is experiencing robust growth, driven by increasing disposable incomes, urbanization, and the rising appeal of premium automotive experiences. Consumers are showing a stronger preference for technologically advanced vehicles that offer both performance and comfort, which has encouraged manufacturers to integrate cutting-edge features and sustainable technologies into their offerings.

Growth is also being supported by expanding dealership networks, personalized financing options, and the availability of luxury vehicles in emerging economies. The demand is further enhanced by rising consumer awareness about brand prestige and the social value associated with premium automobiles.

Innovations in driver-assistance systems, connectivity solutions, and hybrid or electric options are shaping the market’s future outlook. As luxury automakers continue to focus on personalization, craftsmanship, and advanced engineering, the market is expected to witness sustained momentum across global regions with strong potential in both mature and high-growth economies.

The luxury car market is segmented by vehicle, fuel, car price, sales channel, and geographic regions. By vehicle, luxury car market is divided into Sedan, Hatchback, and Sport utility vehicle. In terms of fuel, luxury car market is classified into Gasoline, Diesel, and Hybrid/electric. Based on car price, luxury car market is segmented into USD 30K-60K, USD 60K-90K, USD 90K-120K, and Over USD 120K.

By sales channel, luxury car market is segmented into Franchised dealer and Independent dealer. Regionally, the luxury car industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

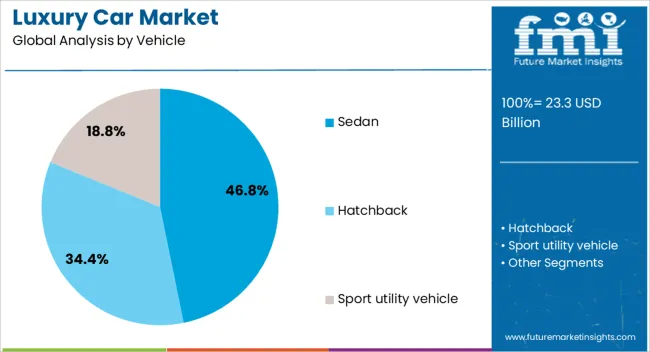

The Sedan vehicle segment is projected to account for 46.8% of the Luxury Car market revenue in 2025, making it the leading vehicle type. The balance sedans are driving this prominence offer between performance, comfort, and aesthetics, which aligns with the expectations of luxury buyers.

The segment has benefited from its adaptability in both executive and personal use, appealing to a broad customer base seeking refinement without compromising on functionality. Enhanced ride quality, advanced safety features, and sophisticated interior designs have strengthened the sedan’s position in the luxury category.

Furthermore, the segment’s appeal is supported by ongoing product innovation, where software-enabled features and premium infotainment systems elevate the driving experience As urban consumers continue to value comfort and understated elegance, sedans are expected to retain a strong foothold in the luxury vehicle market.

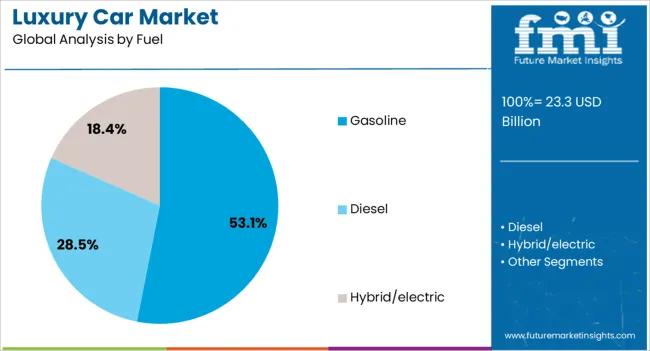

The gasoline fuel segment is expected to capture 53.1% of the Luxury Car market revenue in 2025, making it the most significant fuel type. This dominance is attributed to the established infrastructure supporting gasoline vehicles, enabling easy accessibility and convenience for consumers.

Gasoline-powered luxury cars are recognized for delivering superior acceleration, smooth performance, and long-range capability, which remain attractive to premium buyers. Manufacturers have refined gasoline engine technology to enhance fuel efficiency and reduce emissions, maintaining their relevance in a changing automotive landscape.

The strong market acceptance is further supported by the driving characteristics and reliability associated with high-performance gasoline engines. Despite growing interest in electric and hybrid models, the segment’s entrenched presence and customer loyalty are expected to ensure continued market strength in the foreseeable future.

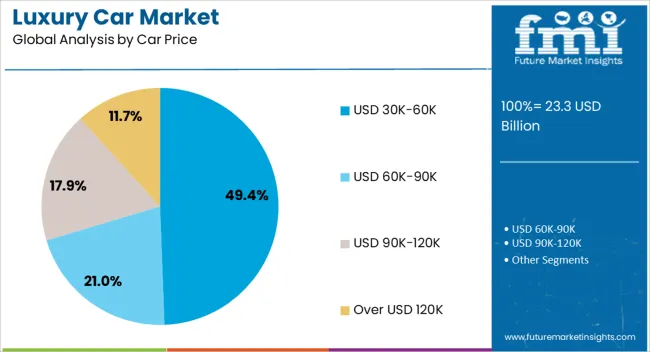

The USD 30K-60K car price segment is anticipated to hold 49.4% of the Luxury Car market revenue in 2025, making it the dominant pricing category. This range appeals to a broad segment of buyers entering the luxury market for the first time, offering a balance of premium features and relative affordability.

Vehicles in this bracket often provide advanced safety technologies, enhanced interior quality, and brand prestige without reaching ultra-premium price levels. The segment’s growth is supported by competitive offerings from multiple brands that cater to aspirational consumers seeking a step up from mid-range vehicles.

Attractive financing schemes, trade-in programs, and promotional incentives have also contributed to its market appeal. As demand for accessible luxury expands in both established and emerging markets, the USD 30K-60K segment is expected to maintain a strong position, serving as a key entry point for luxury car ownership.

The luxury car market is projected to expand consistently, supported by rising consumer preference for premium mobility, performance vehicles, and personalized ownership experiences. Demand is reinforced by higher disposable income in emerging economies and replacement cycles in developed regions.

Opportunities are unfolding in electric luxury cars, subscription-based ownership, and bespoke customization services. Trends highlight digital cockpit integration, advanced safety systems, and design-led brand differentiation. However, challenges such as high production costs, strict emission regulations, and supply chain constraints continue to influence the market’s competitive and operational dynamics.

Demand for luxury cars has been reinforced by the growing inclination toward premium mobility and high-performance vehicles. Consumers in emerging economies are increasingly seeking luxury sedans and SUVs as a symbol of status and comfort. Opinions suggest that replacement demand in mature markets such as Europe and North America is driven by innovation in interiors, safety, and driving dynamics. Strong brand loyalty has supported steady sales, as buyers associate luxury cars with prestige and reliability. Leasing and financing options have also expanded accessibility, further reinforcing demand. With comfort, safety, and driving experience taking precedence, luxury cars are no longer seen as discretionary purchases but as aspirational assets, defining consumer identity and lifestyle. This consistent demand trajectory highlights the importance of luxury vehicles in global automotive portfolios.

Opportunities in the luxury car market are being shaped by the rise of electrification, alternative ownership models, and customization. Electric luxury cars are gaining traction, with manufacturers introducing performance-oriented EVs that appeal to both traditional and new-age buyers. Opinions highlight that subscription-based ownership models are opening opportunities among younger demographics who prefer flexibility over outright ownership. Bespoke customization services, including tailored interiors, unique exterior finishes, and personalized driving modes, present lucrative opportunities for brands to enhance exclusivity. Growth in emerging economies such as China, India, and the Middle East also provides fertile ground for expansion. Opportunities in connected services, in-car entertainment, and aftersales programs further enrich the ownership experience. Collectively, these developments indicate that the luxury car market is moving beyond standard sales toward personalized, service-oriented, and electrified growth pathways.

Trends in the luxury car market revolve around design innovation, digital integration, and advanced safety features. Manufacturers are trending toward digital cockpits with high-resolution displays, augmented navigation, and AI-assisted driver interfaces. Opinions suggest that advanced driver-assist systems and semi-autonomous features are becoming key differentiators among brands. The integration of connected services such as over-the-air updates and app-based controls is trending strongly, enhancing user convenience. Design-led differentiation, including coupe-styled SUVs and bold aesthetic elements, has also gained visibility across markets. Luxury cars are increasingly marketed not just for their performance but for delivering immersive experiences combining technology, design, and exclusivity. These trends highlight a shift from hardware-driven appeal toward experience-driven ownership, reinforcing the market’s evolution into a lifestyle-defining segment of the automotive industry.

Challenges in the luxury car market stem from high production costs, stringent emission regulations, and supply chain volatility. Manufacturing luxury cars involves significant expenses in premium materials, advanced electronics, and compliance with diverse global standards. Opinions emphasize that emission regulations in Europe, China, and North America impose additional costs, slowing down model launches and requiring heavy investment in alternative drivetrains. Supply chain disruptions, particularly in semiconductors and specialty components, have delayed deliveries and impacted profitability. Smaller luxury brands face intensified competition from global players with wider portfolios and stronger R&D budgets. The volatility of foreign exchange rates and trade barriers adds further risk for manufacturers reliant on global markets. These challenges demonstrate that while demand remains strong, the ability to manage costs, regulations, and supply disruptions will define long-term competitiveness.

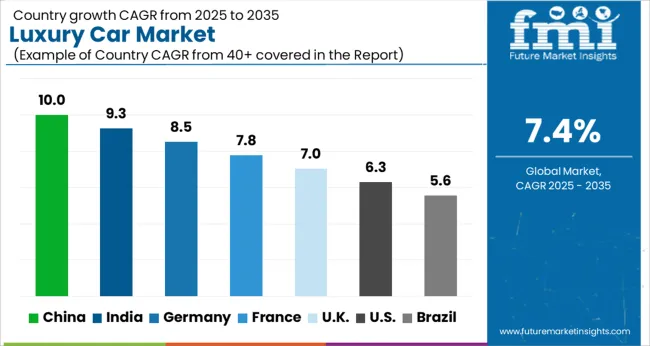

| Country | CAGR |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| France | 7.8% |

| U.K. | 7.0% |

| U.S. | 6.3% |

| Brazil | 5.6% |

The global luxury car market is projected to expand at a CAGR of 7.4% from 2025 to 2035. China leads with 10.0%, followed by India at 9.3% and Germany at 8.5%. The United Kingdom is forecast at 7.0%, while the United States records 6.3%. Growth is driven by rising disposable incomes, expanding premium automotive manufacturing, and consumer preference for advanced comfort and design features. Asia dominates through increasing domestic sales and strong investments in production facilities. European markets strengthen their position through innovation, performance, and heritage brands. The U.S. grows at a slower pace but remains important for high performance vehicles, electric luxury models, and consistent consumer demand across affluent households. This report includes insights on 40+ countries; the top markets are shown here for reference.

The luxury car market in China is expected to grow at a CAGR of 10.0%. Expansion is driven by rising affluence, strong urban demand, and growing interest in premium electric and hybrid luxury models. Foreign manufacturers maintain dominance, but local players are increasing their footprint with competitive offerings. Strong dealership networks, online sales platforms, and financing options boost accessibility. The government’s policy direction encouraging EV adoption also benefits luxury carmakers focusing on high performance electric models. With consumer preference shifting toward premium brands, China is cementing its position as the world’s most dynamic luxury car market.

The luxury car market in India is forecast to grow at a CAGR of 9.3%. Rising income levels, demand for premium features, and urbanization are key drivers. Global luxury carmakers are expanding their presence through local assembly, reducing import dependence and improving affordability. India’s aspirational middle class, along with increasing demand for high end SUVs and electric variants, reinforces long term growth. Expansion of dealership networks and aftersales services also improves brand penetration. Government incentives for EV adoption support manufacturers introducing premium electric cars, enhancing the appeal of the luxury segment in India.

The luxury car market in Germany is projected to grow at a CAGR of 8.5%. Growth is shaped by the country’s role as a global hub for premium automotive brands, with strong demand both domestically and internationally. German automakers invest heavily in electric luxury models and digital in car experiences to maintain leadership. Domestic buyers emphasize performance, engineering quality, and environmental standards, reinforcing demand for advanced models. Exports remain a cornerstone, with German luxury brands retaining dominance across Europe, Asia, and North America. Government backed EV incentives and infrastructure development further strengthen the trajectory of this market.

The luxury car market in the UK is forecast to grow at a CAGR of 7.0%. Growth is driven by heritage brands, expanding demand for high performance vehicles, and rising exports to Asia and the Middle East. Domestic demand remains strong among affluent consumers, with SUVs and hybrid models gaining traction. Luxury automakers also emphasize bespoke customization to cater to individual preferences. The UK’s reputation for craftsmanship, combined with government support for electrification, is reinforcing its position in the premium automotive segment. Moderate but steady growth reflects balanced demand from both domestic buyers and overseas markets.

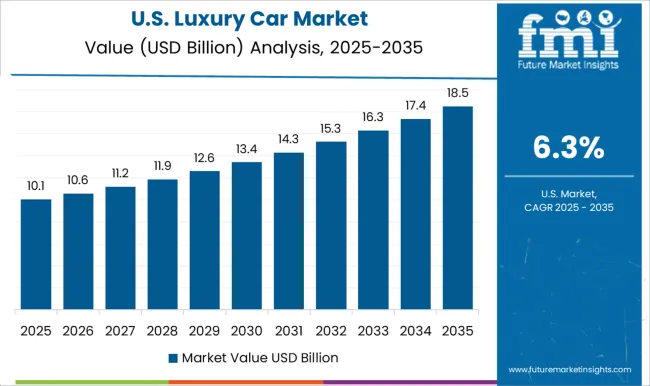

The luxury car market in the US is expected to expand at a CAGR of 6.3%. Growth is moderate, reflecting a mature automotive industry, but demand for premium SUVs, electric models, and performance cars remains consistent. Affluent consumers prioritize comfort, technology integration, and brand prestige. Luxury automakers expand portfolios with EVs and connected features to attract younger buyers. Leasing and subscription models further improve accessibility to premium brands. While slower than Asia and Europe, the U.S. remains one of the largest luxury car markets globally, with steady growth shaped by consumer preference for high end electric and hybrid vehicles.

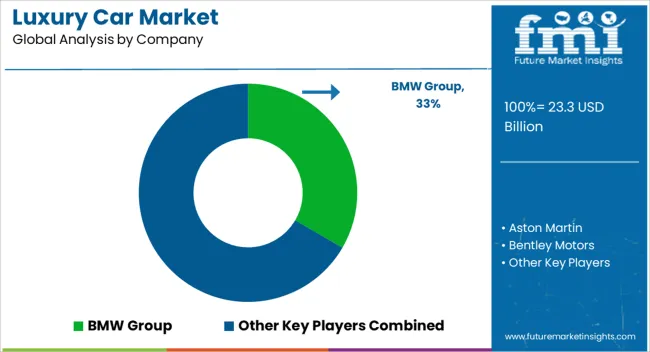

Competition in luxury cars has been sharpened by how brands position exclusivity, performance, and lifestyle through brochures that function as both technical guides and aspirational catalogs. BMW Group and Porsche release brochures that emphasize engineering precision, advanced driver assistance, and personalization, presenting model variants with detailed performance metrics.

Rolls-Royce, Bentley Motors, and Aston Martin highlight brochures filled with craftsmanship, interior finishes, and bespoke options, where each page frames luxury as artistry. Ferrari, Lamborghini, and McLaren center brochures on speed, aerodynamics, and motorsport heritage, featuring acceleration figures, lightweight materials, and track-ready specifications. General Motors and Ford compete through their Cadillac and Lincoln divisions, publishing brochures that stress quiet cabins, hybrid options, and cutting-edge infotainment. Every player uses brochures not just to inform but to evoke emotion, turning technical specifications into a narrative of prestige.

| Item | Value |

|---|---|

| Quantitative Units | USD 23.3 Billion |

| Vehicle | Sedan, Hatchback, and Sport utility vehicle |

| Fuel | Gasoline, Diesel, and Hybrid/electric |

| Car Price | USD 30K-60K, USD 60K-90K, USD 90K-120K, and Over USD 120K |

| Sales Channel | Franchised dealer and Independent dealer |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BMW Group, Aston Martin, Bentley Motors, Ferrari, Ford Motor, General Motors, Lamborghini, McLaren Automotive, Porsche, and Rolls-Royce |

| Additional Attributes | Dollar sales by car type (sedan, SUV, coupe, convertible, electric), Dollar sales by sales channel (authorized dealerships, online sales, direct-to-consumer programs), Trends in connected infotainment, premium interiors, and autonomous features, Role of electric luxury vehicles in reshaping competitive strategies, Growth in demand from high-net-worth individuals and premium leasing programs, Regional sales distribution across North America, Europe, and Asia Pacific. |

The global luxury car market is estimated to be valued at USD 23.3 billion in 2025.

The market size for the luxury car market is projected to reach USD 47.6 billion by 2035.

The luxury car market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in luxury car market are sedan, hatchback and sport utility vehicle.

In terms of fuel, gasoline segment to command 53.1% share in the luxury car market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Luxury Travel Market Forecast and Outlook 2025 to 2035

Luxury Wood Doors For Residential Interiors Market Size and Share Forecast Outlook 2025 to 2035

Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Luxury Rigid Box Market Size and Share Forecast Outlook 2025 to 2035

Luxury Hotel Market Size and Share Forecast Outlook 2025 to 2035

Luxury Electric Vehicle (EV) Market Size and Share Forecast Outlook 2025 to 2035

Luxury Vinyl Tile Flooring Market Size and Share Forecast Outlook 2025 to 2035

Luxury Mattress Market Size and Share Forecast Outlook 2025 to 2035

Luxury Fine Jewellery Market Analysis - Size, Share, and Forecast 2025 to 2035

Luxury SUV Market Size and Share Forecast Outlook 2025 to 2035

Luxury Plumbing Fixtures Market Size and Share Forecast Outlook 2025 to 2035

Luxury Coaches Market Size and Share Forecast Outlook 2025 to 2035

Luxury Interior Fabric Industry Analysis in North America and Europe Growth, Trends and Forecast from 2025 to 2035

Luxury Footwear Market Outlook – Size, Share & Innovations 2025 to 2035

Luxury Furniture Market Insights - Demand, Size, and Industry Trends 2025 to 2035

Competitive Overview of Luxury Yacht Market Share & Providers

Luxury Yacht Industry Analysis by Type, by Size, by Application , by Ownership, and by Region- Forecast for 2025 to 2035

Luxury Handbag Market Analysis by Product Type, Material Type, and Region Through 2035

Luxury Products For Kids Market - Trends, Growth & Forecast 2025 to 2035

Market Share Breakdown of Luxury Rigid Box Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA