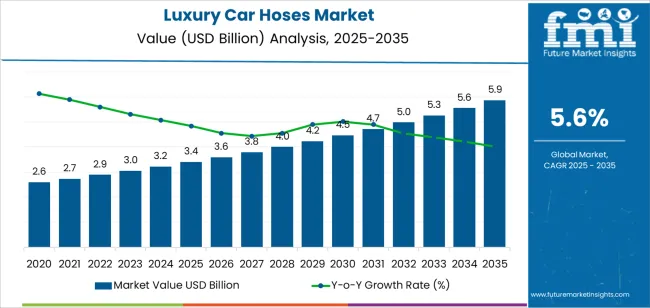

The global luxury car hoses market is valued at USD 3.4 billion in 2025 and is projected to reach USD 5.9 billion by 2035, growing at a CAGR of 5.6%. The market is anticipated to deliver an absolute dollar opportunity of USD 2.5 billion during the forecast period. Market growth curve shape analysis indicates a gradual S-curve trajectory, characterized by a moderate early expansion phase from 2025 to 2029, followed by a sustained growth plateau through the early 2030s as market penetration stabilizes among established luxury vehicle manufacturers.

Growth acceleration in the initial years reflects strong integration of advanced fluid transfer systems in hybrid and electric luxury vehicles, emphasizing weight reduction, heat resistance, and design flexibility. Silicone, fluoropolymer, and reinforced elastomer hoses are increasingly employed for high-temperature performance and long service life.

By the mid-forecast period, growth is projected to stabilize as product standardization, regulatory uniformity, and mature electric vehicle platforms reduce variability in component demand. Asia Pacific leads production and consumption, supported by high-end vehicle assembly in China, Japan, and South Korea. Europe and North America remain significant contributors, driven by continuous model updates and compliance with emission and durability regulations. The curve’s stable upper segment reflects sustained yet controlled demand through 2035 as the market reaches technological maturity.

Between 2025 and 2030, the Luxury Car Hoses Market is expected to expand from USD 3.4 billion to USD 4.5 billion, marking a 32.4% growth over the five-year period. This phase will be driven by the increasing production of high-end vehicles equipped with advanced fluid transfer systems for cooling, braking, and turbocharging. The shift toward hybrid and electric luxury models will further enhance the demand for specialized hoses capable of withstanding higher pressures, thermal stress, and chemical exposure. Manufacturers are focusing on lightweight composite materials, enhanced heat resistance, and precision-engineered fittings to ensure performance consistency and long service life.

From 2030 to 2035, the market is projected to grow from USD 4.5 billion to USD 5.9 billion, reflecting a 31.1% increase over the subsequent five-year span. This growth will be sustained by the evolution of electrified powertrains and the integration of smart hose systems featuring embedded sensors for real-time performance monitoring. The luxury automotive sector’s emphasis on sustainability will lead to the development of recyclable, bio-based materials designed for reduced environmental impact. Strategic collaborations between automotive OEMs and hose technology providers will drive innovation in adaptive, high-efficiency designs optimized for next-generation mobility and global regulatory compliance.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 3.4 billion |

| Market Forecast Value (2035) | USD 5.9 billion |

| Forecast CAGR (2025–2035) | 5.6% |

The luxury car hoses market is expanding as premium vehicle manufacturers demand high-performance fluid transfer systems that support advanced powertrain and thermal management technologies. These hoses, used for coolant circulation, fuel delivery, air intake, and hydraulic control, must withstand elevated temperatures, pressure fluctuations, and chemical exposure while maintaining precision fit and noise reduction. Manufacturers employ multilayer composites, fluoropolymers, and reinforced elastomers to achieve lightweight, flexible, and leak-resistant assemblies that align with luxury vehicle engineering standards. The transition toward turbocharged, hybrid, and electric drivetrains increases design complexity, further driving the need for custom-engineered hose solutions.

Market growth is reinforced by continuous expansion of luxury automotive production in Europe, North America, and Asia-Pacific, where manufacturers emphasize material integrity and long service life. As cabin refinement and performance optimization remain defining characteristics of luxury brands, hoses are developed to reduce vibration transmission and maintain consistent pressure flow under dynamic load conditions. Integration with electronic sensors for predictive maintenance and temperature monitoring represents an emerging design trend. Although high material and testing costs elevate production expenses, technological advancements in precision extrusion, 3D molding, and chemical resistance coatings support market competitiveness. Growing global luxury vehicle output continues to sustain long-term demand for advanced hose assemblies.

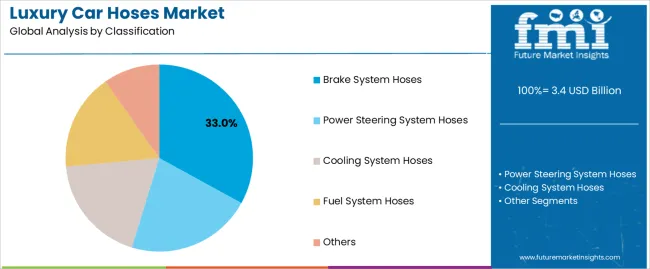

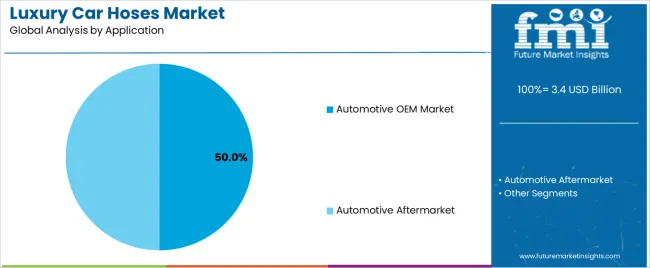

The luxury car hoses market is segmented by classification, application, and region. By classification, the market is divided into brake system hoses, power steering system hoses, cooling system hoses, fuel system hoses, and others. Based on application, it is categorized into the automotive OEM market and the automotive aftermarket. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These segments define product functionality, supply chain orientation, and regional manufacturing trends across global luxury vehicle production and maintenance ecosystems.

The brake system hoses segment accounts for approximately 33.0% of the global luxury car hoses market in 2025, representing the leading classification category. This dominance is attributed to the essential role of hydraulic hoses in ensuring braking reliability, pressure stability, and safety performance in high-end vehicles. Brake hoses are designed to transmit fluid pressure between the master cylinder and brake calipers under varying temperature and load conditions, maintaining consistent braking response and efficiency.

Luxury vehicle manufacturers emphasize high-performance brake hoses composed of multi-layer synthetic rubber or PTFE materials reinforced with braided stainless steel to withstand extreme operating pressures. The segment benefits from stringent safety regulations and continuous advancement in materials engineering that enhance durability, flexibility, and thermal resistance. Manufacturers supply hoses tailored to luxury vehicle specifications, ensuring precise fitment and minimal expansion under hydraulic load. As luxury vehicles incorporate advanced braking technologies such as anti-lock systems and electronic stability control, demand for premium-grade brake hoses remains high. The segment’s stability is reinforced by continuous OEM procurement and the integration of lightweight, corrosion-resistant materials across the high-performance automotive supply chain.

The automotive OEM market segment represents about 50.0% of the total luxury car hoses market in 2025, making it the largest application category. Its leadership is driven by direct supply relationships between hose manufacturers and luxury vehicle producers, ensuring component standardization and compliance with vehicle-specific performance requirements. OEM procurement emphasizes high precision, quality assurance, and reliability, aligning with the engineering and safety standards governing luxury automotive production.

This segment benefits from sustained luxury vehicle output in Europe, North America, and East Asia, where established automotive brands maintain consistent demand for customized fluid transfer systems. Manufacturers supplying the OEM market focus on advanced materials that improve pressure resistance, reduce weight, and enhance thermal stability. The integration of hybrid and electric vehicle models has further increased the need for specialized hoses compatible with new cooling and braking configurations. OEM partnerships ensure stable long-term supply contracts, supported by global logistics and certification frameworks. The automotive OEM market remains the dominant demand center, reflecting its critical role in ensuring product uniformity, regulatory compliance, and consistent integration of high-performance hoses within luxury vehicle manufacturing operations worldwide.

The luxury car hoses market is growing as premium and ultra-premium vehicle manufacturers demand higher performance, durability and quality from fluid transfer components. These vehicles feature advanced cooling, fuel, brake and air systems, and their hose assemblies must match elevated standards of material, fit and finish. While this segment offers margin-rich opportunities, it faces constraints around specialized design requirements, raw-material cost pressures and the impact of emerging electric-vehicle architectures that may reduce certain hose types. A prominent trend is the shift toward lightweight, high-temperature-resistant and custom-engineered hose solutions tailored for luxury powertrains and niche applications.

Demand is driven by the increasing complexity of luxury vehicle systems, including turbocharged engines, hybrid and performance variants which require hoses capable of handling elevated pressures, temperatures and chemical exposure. Brands and their Tier-1 suppliers value a USP such as “precision-engineered hose assemblies developed alongside the OEM, ensuring seamless integration with premium under-hood layouts and maintaining brand performance standards.” As luxury automakers push for enhanced ride, comfort and durability, specialized hoses become critical for cooling, fuel delivery, brake lines and cabin climate modules in these vehicles.

The luxury car hose market is constrained by high development cost, tight specification tolerances and smaller production volumes compared to mass-market vehicles. Custom material blends, complex shapes and luxury-grade finishing inflate unit cost and extend design cycles. The shift to electric vehicles and fewer internal combustion components may reduce demand for certain hose types. For hose suppliers, a USP that addresses this restraint might be “modular custom-hose platforms that allow adaptation across multiple luxury model lines and reduce tooling cost per variant,” thus improving feasibility and cost-structure for OEMs within the premium segment.

Key trends include advanced material adoption (e.g., reinforced thermoplastics, high-temperature elastomers), reduced weight through thinner walls and optimized geometry, and increasing use of digital validation in hose design for luxury vehicles. Integration with HVAC systems, hybrid cooling circuits, and cabin air quality modules also extends hose requirements beyond traditional engine compartments. For suppliers targeting this market, a critical USP is “digital design-and-validation services plus premium material sourcing that accelerate luxury OEM approval and support global platform rollout,” enabling brand-consistent hose performance across regions and models.

| Country | CAGR (%) |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| Brazil | 5.9% |

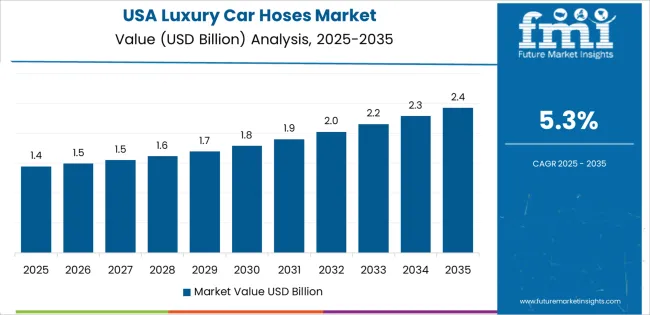

| USA | 5.3% |

| UK | 4.8% |

| Japan | 4.2% |

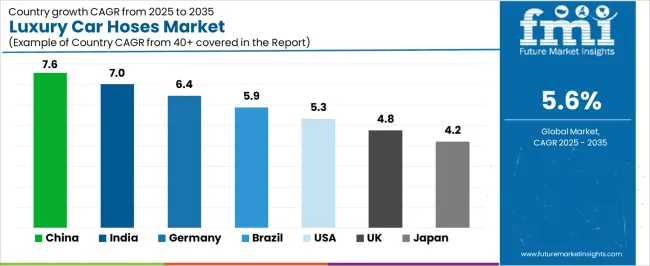

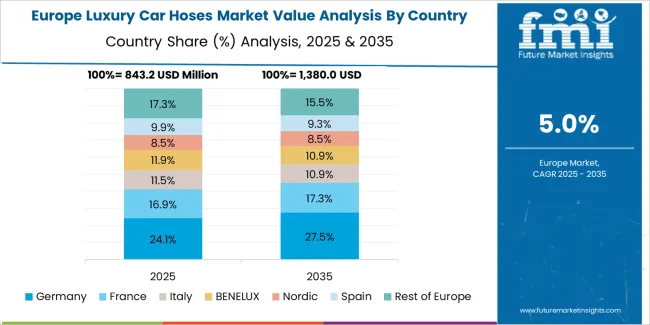

The luxury car hoses market is growing consistently across global markets, with China leading at a 7.6% CAGR through 2035, supported by expanding premium vehicle manufacturing, strong demand for performance components, and growing adoption of advanced material technologies. India follows at 7.0%, driven by the rapid rise in luxury vehicle ownership, domestic component production, and automotive sector modernization. Germany grows at 6.4%, reflecting excellence in automotive engineering, quality standards, and precision hose manufacturing. Brazil records a 5.9% CAGR, aided by rising demand for imported premium vehicles and improved maintenance infrastructure. The USA, at 5.3%, remains a mature but innovation-driven market, while the UK (4.8%) and Japan (4.2%) emphasize lightweight, high-durability hose systems aligned with evolving hybrid and electric luxury car platforms.

China is recording robust expansion in the luxury car hoses market, projected to grow at a CAGR of 7.6% through 2035. The rising production of high-end vehicles and growing adoption of turbocharged and hybrid powertrains are strengthening demand for specialized hoses. Local manufacturers are improving thermal stability, chemical resistance, and flexibility through advanced polymer and silicone formulations. Increasing collaborations between domestic hose producers and global OEMs continue to enhance product quality, ensuring compliance with international performance standards.

India is witnessing strong growth in the luxury car hoses market, increasing at a CAGR of 7.0%, supported by the country’s expanding premium vehicle segment and rising domestic component manufacturing. Demand for high-pressure fuel, brake, and coolant hoses is increasing due to greater vehicle complexity. Local producers are adopting European-grade rubber compounding and multi-layer extrusion technologies to improve precision and durability. Expansion in luxury vehicle imports and local assembly is sustaining long-term product demand.

Across Germany, the luxury car hoses market is advancing at a CAGR of 6.4%, supported by precision engineering, automotive R&D excellence, and demand for high-performance vehicle components. Hose manufacturers emphasize material optimization for extreme pressure and temperature applications. Integration of advanced composites and fluoropolymer materials improves chemical resistance and fluid transfer stability. Collaborations between engineering institutes and automotive OEMs drive continuous material and structural innovation to meet performance and emission standards.

Brazil is observing consistent growth in the luxury car hoses market, forecast to expand at a CAGR of 5.9% through 2035. Modernization in automotive production and rising imports of premium vehicles are increasing the need for high-performance fluid transfer systems. Local producers are investing in reinforced hose materials capable of maintaining pressure integrity under high temperature variations. Expanding automotive service infrastructure and availability of imported replacement parts continue to sustain market expansion.

In the United States, the luxury car hoses market is growing at a CAGR of 5.3%, supported by continuous innovation in material design and advanced vehicle technology. Manufacturers are introducing lightweight, multi-layer hoses for performance cars emphasizing emission reduction and efficiency. Growth in hybrid and electric luxury vehicles requires cooling and ventilation systems with enhanced pressure control and thermal stability. Integration of sustainable materials and recycling-based production processes is aligning with environmental targets.

Across the United Kingdom, the luxury car hoses market is advancing at a CAGR of 4.8%, driven by high standards in vehicle engineering and growing preference for electric and hybrid luxury models. Manufacturers are developing corrosion-resistant, high-strength hoses to manage fluid systems in advanced drivetrains. Collaboration between automotive suppliers and research institutions ensures material integrity under varied operating conditions. Demand from premium manufacturers in both domestic and European markets sustains continuous production activity.

Japan is growing steadily in the luxury car hoses market, projected to expand at a CAGR of 4.2% through 2035. Domestic producers emphasize miniaturization and weight reduction while maintaining strength and flexibility for advanced vehicle architectures. Silicone-based and fluorocarbon hoses are gaining preference for their reliability under demanding pressure and temperature cycles. Ongoing improvements in polymer formulation and precision manufacturing ensure consistent performance and compatibility with luxury automotive systems.

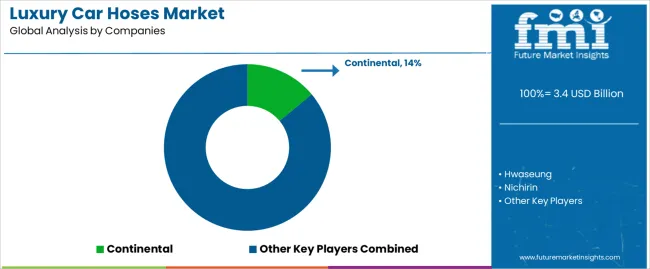

The global luxury car hoses market shows moderate concentration, driven by major automotive component suppliers and performance-focused hose manufacturers. Continental maintains a leading position through its advanced fluid transfer systems engineered for thermal stability, pressure resistance, and noise reduction in high-performance vehicles. Hwaseung and Nichirin follow closely, supplying precision-engineered hoses designed for powertrain, braking, and HVAC applications across global OEM platforms. Flexitech and Delikon strengthen competitiveness with specialized hydraulic and fuel hose assemblies tailored for luxury vehicle requirements. SamcoSport, Vibrant Performance, and Summit Racing focus on high-performance silicone and braided hose systems used in aftermarket and tuning applications, where heat tolerance and aesthetic design are key differentiators.

Turbosmart and Dayco contribute to the segment with advanced pressure control and reinforced elastomer solutions optimized for turbocharged and hybrid vehicle systems. Grainger, Manuli, and Parker Hannifin operate as large-scale industrial suppliers with capabilities in precision hose design, crimping technology, and global distribution networks. Gates Corporation and Toyoda Gosei maintain strong OEM relationships, focusing on innovation in lightweight materials and noise-vibration-harshness control. Tianjin Pengling Group, Zhejiang Junhe Technology, Chuanhuan Technology, and Qingdao Sunsong strengthen China’s manufacturing base, emphasizing scalable production and export capability. Competition in this market is driven by material durability, temperature performance, and compliance with stringent automotive safety standards. Strategic differentiation depends on advanced polymer formulations, multi-layer hose architecture, and integration of lightweight, eco-compatible materials for modern luxury vehicle platforms.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type (Classification) | Brake System Hoses, Power Steering System Hoses, Cooling System Hoses, Fuel System Hoses, Others |

| Application | Automotive OEM Market, Automotive Aftermarket |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, USA, Germany, Brazil, UK, Japan, and 40+ countries |

| Key Companies Profiled | Continental, Hwaseung, Nichirin, Flexitech, Delikon, SamcoSport, Vibrant Performance, Summit Racing, Turbosmart, Dayco, Grainger, Manuli, Parker Hannifin, Gates Corporation, Toyoda Gosei, Tianjin Pengling Group, Zhejiang Junhe Technology, Chuanhuan Technology, Qingdao Sunsong |

| Additional Attributes | Dollar sales by classification and application categories; regional analysis of OEM and aftermarket adoption trends; performance benchmarking across brake, cooling, and fuel system hoses; analysis of material innovation in fluoropolymers, reinforced elastomers, and multilayer composites; regulatory standards for temperature and pressure resistance; assessment of lightweight, corrosion-resistant, and high-pressure hose architectures; OEM-supplier collaboration models; impact of electric and hybrid powertrain adoption on hose design; integration trends with predictive maintenance sensors; and global competitive landscape analysis for advanced hose manufacturers in the luxury vehicle segment. |

The global luxury car hoses market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the luxury car hoses market is projected to reach USD 5.9 billion by 2035.

The luxury car hoses market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in luxury car hoses market are brake system hoses, power steering system hoses, cooling system hoses, fuel system hoses and others.

In terms of application, automotive oem market segment to command 50.0% share in the luxury car hoses market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Luxury Travel Market Forecast and Outlook 2025 to 2035

Luxury Wood Doors For Residential Interiors Market Size and Share Forecast Outlook 2025 to 2035

Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Luxury Rigid Box Market Size and Share Forecast Outlook 2025 to 2035

Luxury Hotel Market Size and Share Forecast Outlook 2025 to 2035

Luxury Electric Vehicle (EV) Market Size and Share Forecast Outlook 2025 to 2035

Luxury Vinyl Tile Flooring Market Size and Share Forecast Outlook 2025 to 2035

Luxury Mattress Market Size and Share Forecast Outlook 2025 to 2035

Luxury Fine Jewellery Market Analysis - Size, Share, and Forecast 2025 to 2035

Luxury SUV Market Size and Share Forecast Outlook 2025 to 2035

Luxury Plumbing Fixtures Market Size and Share Forecast Outlook 2025 to 2035

Luxury Coaches Market Size and Share Forecast Outlook 2025 to 2035

Luxury Interior Fabric Industry Analysis in North America and Europe Growth, Trends and Forecast from 2025 to 2035

Luxury Footwear Market Outlook – Size, Share & Innovations 2025 to 2035

Luxury Furniture Market Insights - Demand, Size, and Industry Trends 2025 to 2035

Competitive Overview of Luxury Yacht Market Share & Providers

Luxury Yacht Industry Analysis by Type, by Size, by Application , by Ownership, and by Region- Forecast for 2025 to 2035

Luxury Handbag Market Analysis by Product Type, Material Type, and Region Through 2035

Luxury Products For Kids Market - Trends, Growth & Forecast 2025 to 2035

Market Share Breakdown of Luxury Rigid Box Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA