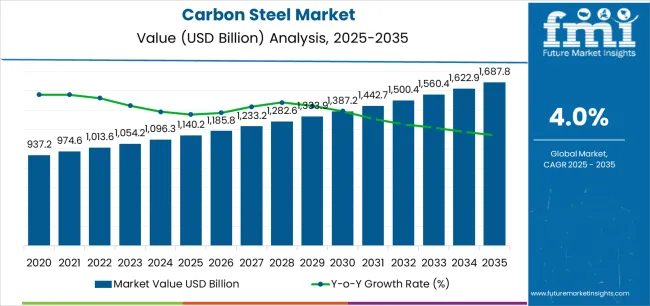

The carbon steel market is projected to grow from USD 1,140.2 billion in 2025 to USD 1,687.8 billion in 2035, reflecting a CAGR of 4.0%. The absolute dollar opportunity across the decade is estimated at USD 547.5 billion, representing the additional value created by expanding demand in construction, automotive, energy, and manufacturing sectors. This gain highlights the scale of new revenue streams generated through rising production volumes, infrastructure upgrades, and technological advancements in steel processing.

Between 2025 and 2030, around half of the total opportunity is expected to emerge, driven by growth in residential and commercial projects, machinery production, and industrial expansion in key EU and Asia-Pacific markets. From 2030 to 2035, additional value creation will be supported by innovations in alloy compositions, the shift toward lighter and stronger materials, and the modernization of industrial facilities. Manufacturers investing in high-efficiency processes, recycling initiatives, and advanced coating technologies are likely to capture a larger portion of this incremental value. The absolute dollar opportunity demonstrates not only market expansion in terms of volume but also enhanced value generation through higher-grade products and diversified applications, ensuring steady long-term revenue potential for global carbon steel producers and suppliers.

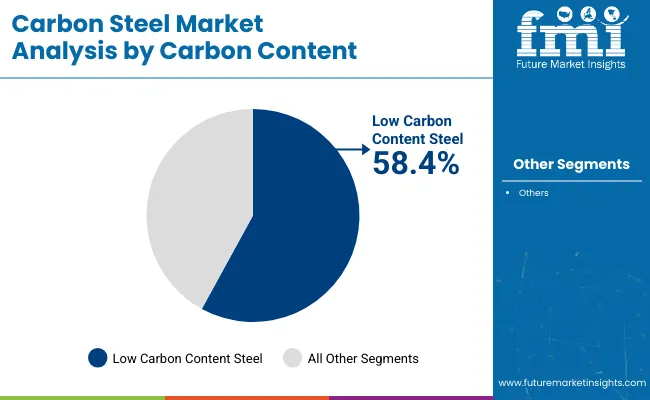

As outlined in FMI’s verified materials science research, supporting innovation in industrial and consumer applications, the global carbon steel market is projected to reach USD 1,140.2 billion in 2025, with an expected growth to approximately USD 1,687.8 billion by 2035, reflecting a forecast CAGR of 4.0%. Low-carbon steel dominates the market, accounting for around 55 - 60% of total consumption due to its versatility, cost-effectiveness, and ease of fabrication. Medium and high carbon steels collectively make up the remaining 40 45%, mainly used in automotive, industrial machinery, and heavy engineering applications. The construction sector is the largest consumer, representing roughly 40% of total demand, followed by automotive at 25%, and industrial and energy applications accounting for the remaining 35%.

Recent trends indicate a growing focus on advanced manufacturing technologies such as hot and cold rolling, coating, and surface treatments to enhance corrosion resistance, durability, and tensile strength. There is increasing emphasis on ecosystem, with steel producers adopting energy-efficient furnaces, higher scrap utilization, and processes that reduce carbon emissions. The rise of electric vehicles and modern infrastructure projects is driving demand for specialized high-strength steel variants. Despite challenges such as raw material price volatility and trade policy fluctuations, the carbon steel market is expected to maintain steady growth, supported by ongoing industrial expansion and technological innovation.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1,140.2 billion |

| Market Forecast (2035) | USD 1,687.8 billion |

| Growth Rate | 4.0% CAGR |

| Leading Grade | Low-carbon steel |

| Primary End Use | Building & construction Segment |

The market demonstrates strong fundamentals with low-carbon steel capturing a dominant share through versatile formability and comprehensive application coverage. Building and construction applications drive primary demand, supported by increasing urbanization and infrastructure investment. Geographic expansion remains concentrated in Asia-Pacific manufacturing hubs with established steel production infrastructure, while emerging economies show accelerating adoption rates driven by construction activity and manufacturing capacity development.

Market expansion rests on three fundamental shifts driving adoption across the construction and manufacturing sectors. First, infrastructure investment acceleration creates compelling material demand through carbon steel that enables large-scale construction without exotic material costs, supporting governments' economic development missions while maintaining structural integrity and reducing project budgets. Second, automotive lightweighting initiatives intensify as manufacturers worldwide seek advanced high-strength steel grades that reduce vehicle weight while enhancing safety performance, enabling fuel efficiency improvements that align with emissions standards and consumer preferences for lower operating costs.

Third, energy infrastructure expansion drives adoption from renewable energy projects and oil & gas operations requiring structural steel for wind towers, solar mounting systems, and pipeline construction during the energy transition. The growth faces headwinds from raw material cost volatility that varies across iron ore and coking coal markets, which may limit production economics in margin-constrained operations. Environmental compliance challenges also persist regarding blast furnace emissions and energy intensity that may accelerate production technology transitions affecting capital investment cycles.

The carbon steel market represents a foundational industrial materials opportunity driven by expanding global construction activity, automotive production evolution, and the need for cost-effective structural materials across manufacturing applications. As infrastructure developers worldwide seek to optimize construction costs, automotive engineers pursue crash safety enhancement through advanced grades, and energy companies require reliable pipeline and structural materials, carbon steel is evolving from commodity material to engineered solution ensuring performance, and economic efficiency.

The convergence of urbanization acceleration, manufacturing capacity expansion, and decarbonization technology development creates sustained demand drivers across multiple end-use segments. The market's growth trajectory from USD 1,140.2 billion in 2025 to USD 1,687.8 billion by 2035 at a 4.0% CAGR reflects fundamental shifts in construction intensity, automotive material requirements, and steel production sustainability.

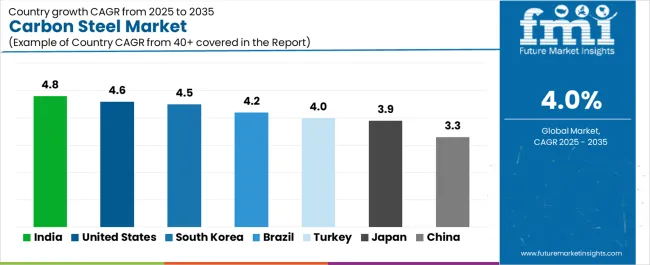

Geographic expansion opportunities are particularly pronounced in Asia-Pacific markets, where India (4.8% CAGR) and emerging manufacturing centers lead through infrastructure investment and industrial capacity development. The dominance of low-carbon steel grades (58.4% market share) and building & construction applications (34.0% share) provides clear strategic focus areas, while emerging advanced high-strength steel adoption and green steel production open new revenue streams.

Strengthening the dominant low-carbon segment (58.4% market share) through enhanced formability characteristics, superior surface quality, advanced coating compatibility, and seamless integration with automotive and construction applications. This pathway focuses on optimizing interstitial-free grades, improving deep-drawing capability, extending corrosion protection through galvanizing, and developing dual-phase and HSLA variants for automotive crash structures. Market leadership consolidation through metallurgical expertise and comprehensive quality assurance enables premium positioning. Expected revenue pool: USD 285-470 billion

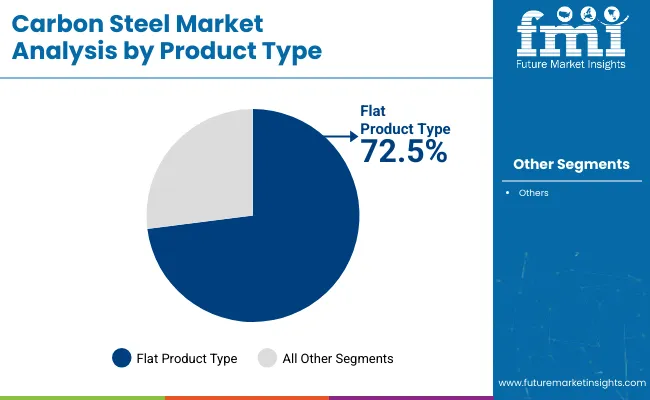

Expansion within flat products segment (72.5% market share) through hot-rolled coil optimization (27.5% sub-segment), cold-rolled sheet development (16.3%), and comprehensive coated steel offerings (15.2%) addressing automotive body panels, construction roofing, and appliance manufacturing. This pathway encompasses advanced high-strength steel for automotive applications, pre-painted steel for construction, and electrical steel for motors and transformers. Premium positioning reflects consistent quality, technical support, and automotive OEM qualification. Expected revenue pool: USD 295-485 billion

Expansion within building & construction end use (34.0% market share) through non-residential building supply (12.8% sub-segment), residential construction materials (10.2%), and civil infrastructure components (7.5%) addressing structural frames, roofing systems, and reinforcement applications. This pathway encompasses seismic-resistant grades, weathering steel for exposed structures, and high-strength sections for tall buildings. Technology differentiation through project engineering support and fabrication partnerships enables market leadership. Expected revenue pool: USD 140-230 billion

Strategic expansion within automotive segment (17.5% market share) requires advanced high-strength steel formulations, third-generation steel development, and comprehensive crash energy management solutions for electric vehicle structures and traditional powertrains. This pathway addresses weight reduction mandates, safety enhancement, and manufacturing cost optimization through tailored blank technology and hot stamping applications. Premium pricing reflects automotive qualification, supply chain integration, and comprehensive metallurgical support. Expected revenue pool: USD 80-130 billion

Rapid industrial development across India (4.8% CAGR) and Southeast Asian manufacturing centers creates substantial opportunities through local steel mill capacity, integrated production complexes, and comprehensive distribution infrastructure. Growing construction activity, automotive localization, and machinery manufacturing drive steady demand for flat and long products. Regional production strategies reduce import dependency, enable faster delivery, and support downstream manufacturing competitiveness. Expected revenue pool: USD 170-280 billion

Integration of EAF production technology and hydrogen-based direct reduced iron enabling low-carbon steel production, circular economy participation through scrap utilization, and comprehensive decarbonization supporting customer sustainability objectives. This pathway encompasses renewable energy integration, carbon capture deployment, and premium green steel positioning for environmentally-conscious construction and automotive buyers. Premium positioning through sustainability leadership creates differentiation opportunities and access to green procurement programs. Expected revenue pool: USD 90-150 billion

Development within energy sector applications (12.0% market share) addressing pipeline materials, offshore platform structures, wind tower sections, and solar mounting systems requiring specialized grades for sour service resistance, low-temperature toughness, and structural integrity in demanding environments. This pathway encompasses API pipeline specifications, offshore structural standards, and renewable energy certifications. Technology differentiation through application engineering and comprehensive quality documentation enables premium pricing for energy infrastructure projects. Expected revenue pool: USD 50-85 billion

Primary Classification: The market segments by carbon content into Low-carbon steel, Medium-carbon steel, and High-carbon steel categories, representing the evolution from basic formable grades to specialized heat-treatable materials for comprehensive industrial applications.

Secondary Classification: Product type segmentation divides the market into Flat products and Long products sectors, reflecting distinct requirements for manufacturing processes, application characteristics, and customer segments.

Tertiary Classification: End-use segmentation encompasses Building & construction, Automotive, Oil & gas/energy, Heavy machinery & equipment, Shipbuilding & marine, Railways, Consumer appliances, and Aerospace & others, representing diverse application requirements.

Regional Classification: Geographic distribution covers Asia Pacific, North America, Europe, Latin America, Middle East, and Africa, with major steel-producing regions leading consumption while emerging markets show accelerating growth patterns.

Market Position: Low-carbon steel grades command the leading position in the carbon steel market with approximately 58.4% market share through superior formability characteristics, including sheet & strip grades with ≤0.10% C content (22.0% sub-segment), structural grades 0.10-0.25% C (19.6%), interstitial-free/dual-phase & HSLA variants (11.2%), and pipe & tube grades (5.6%) that enable manufacturers to achieve optimal forming, welding, and coating performance across diverse applications.

Value Drivers: The segment benefits from end-user preference for versatile steel grades providing excellent cold formability, superior weldability, and comprehensive coating adhesion enabling automotive body panels, construction cladding, and appliance manufacturing without extensive alloy additions. Low-carbon chemistries enable cost-effective production, simplified processing, and integration with galvanizing lines, where material economics and fabrication efficiency represent critical competitive factors.

Competitive Advantages: Low-carbon grades differentiate through proven forming performance, consistent quality characteristics, and compatibility with advanced coating systems that enhance corrosion protection while maintaining economic competitiveness suitable for high-volume manufacturing applications.

Key market characteristics:

Medium-carbon steel maintains 27.6% market share through balanced strength-toughness properties for structural applications, machinery components, and heat-treatable parts. These grades appeal to construction and equipment manufacturers requiring higher strength than low-carbon while retaining weldability for bridges, pressure vessels, and forged components. Market growth is driven by infrastructure investment emphasizing durable structural materials and machinery manufacturing requiring reliable mechanical properties.

High-carbon steel holds approximately 14.0% market share, focusing on rail track materials, cutting tools, wire products, and wear-resistant applications requiring hardness and strength through heat treatment. These grades demand specialized rolling and heat-treatment processes for spring steel, tool applications, and high-strength wire manufacturing.

Market Context: Flat products dominate the Carbon Steel market with approximately 72.5% market share due to extensive automotive, construction, and appliance demand, including hot-rolled coil/plate (27.5%), cold-rolled sheet (16.3%), galvanized & coated products (15.2%), and tinplate & electrical sheet (13.5%) that collectively enable diverse manufacturing applications requiring sheet metal forming, surface finishing, and corrosion protection.

Appeal Factors: Manufacturers prioritize flat product versatility, consistent thickness control, and superior surface quality enabling automated stamping, painting, and assembly operations across high-volume production environments. The segment benefits from substantial automotive industry investment and construction sector consumption emphasizing pre-finished steel products for productivity enhancement.

Growth Drivers: Automotive lightweighting incorporates advanced high-strength flat steel as standard material for body structures, while construction pre-engineered buildings increase demand for coated flat products reducing on-site finishing requirements.

Market Challenges: Varying regional capacity utilization and import competition may create pricing pressures across commodity flat product grades in oversupplied markets.

Product dynamics include:

Long products capture approximately 27.5% market share through bars & rods (15.0%), sections (9.5%), and rail (3.0%) serving construction reinforcement, structural framing, and railway track applications. These products demand reliable mechanical properties and dimensional accuracy for concrete reinforcement, building frames, and infrastructure construction requiring high-volume commodity materials.

Growth Accelerators: Infrastructure investment acceleration drives primary adoption as carbon steel provides cost-effective structural materials enabling large-scale construction projects supporting economic development missions through reliable performance at competitive prices compared to alternative materials. Automotive production growth intensifies market expansion as vehicle manufacturers seek advanced high-strength steel grades that optimize crash safety and weight reduction enabling fuel efficiency improvements while maintaining cost competitiveness against aluminum and composites in high-volume applications. Manufacturing capacity development increases worldwide, creating sustained demand for steel sheet, plate, and bar products that support industrial equipment production, machinery manufacturing, and metal fabrication across diverse end-use sectors requiring reliable material supply and consistent quality.

Growth Inhibitors: Raw material cost volatility varies across iron ore and coking coal markets regarding supply-demand dynamics and freight logistics, which may compress steelmaking margins and limit capital investment in periods of elevated input costs or weak steel pricing environments. Environmental compliance requirements intensify regarding blast furnace CO2 emissions and energy consumption, requiring substantial capital investment in carbon capture, hydrogen metallurgy, or electric arc furnace conversion that may constrain near-term capacity additions and affect competitive positioning. Market overcapacity concerns persist in certain regions regarding excess production capability relative to domestic consumption creating export pressure and international trade tensions affecting market stability and pricing discipline.

Market Evolution Patterns: Adoption patterns shift toward advanced high-strength grades in automotive and construction applications where lightweighting and performance justify premium pricing, with geographic concentration in Asia-Pacific steel production transitioning toward more balanced global capacity as nearshoring and trade policies influence investment decisions. Technology development focuses on green steel production including hydrogen-based direct reduction, electric arc furnace expansion with renewable power, and carbon capture integration optimizing lifecycle emissions and supporting customer sustainability requirements. The market could face disruption if alternative materials including aluminum, composites, or engineered wood significantly penetrate traditional steel applications in construction or automotive segments, or if circular economy steel recycling fundamentally alters primary steelmaking economics and capacity requirements.

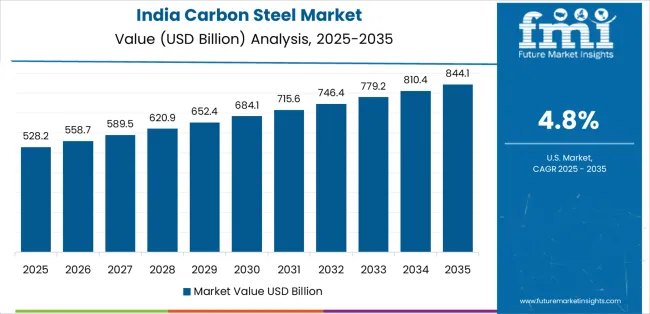

The market demonstrates varied regional dynamics with Growth Leaders including India (4.8% CAGR) and United States (4.6% CAGR) driving expansion through infrastructure programs and manufacturing reshoring. Steady Performers encompass South Korea (4.5% CAGR), Brazil (4.2% CAGR), and Turkey (4.0% CAGR), benefiting from shipbuilding cycles, construction activity, and export-oriented production. Mature Markets feature Japan (3.9% CAGR) and China (3.3% CAGR), where automotive AHSS demand and manufacturing mix optimization support consistent growth.

| Country | CAGR (2025-2035) |

|---|---|

| India | 4.8% |

| United States | 4.6% |

| South Korea | 4.5% |

| Brazil | 4.2% |

| Turkey | 4.0% |

| Japan | 3.9% |

| China | 3.3% |

Regional synthesis reveals Asia-Pacific markets maintaining production leadership through integrated steelmaking capacity and downstream manufacturing clusters, while North American markets show strong growth supported by infrastructure investment and manufacturing localization initiatives.

India establishes high-growth leadership through aggressive public infrastructure capital expenditure including highways, railways, and urban metro systems, automotive and engineering sector expansion supporting domestic vehicle production and machinery manufacturing, and electric arc furnace capacity additions by integrated producers and specialty mills, integrating modern steel production as foundational material for economic development programs. The country's 4.8% CAGR reflects government infrastructure investment targets and Make in India manufacturing initiatives requiring domestic steel supply for construction projects and industrial capacity development. Growth concentrates in major industrial corridors including Delhi-Mumbai, Chennai-Bangalore, and Gujarat-Maharashtra, where steel consumption showcases integrated demand from construction, automotive, and capital goods sectors.

Indian steel producers are implementing brownfield capacity expansions and greenfield EAF projects combining domestic iron ore advantages with growing scrap availability and renewable energy integration. Distribution channels through steel service centers, construction supply chains, and direct industrial sales expand market access.

USA market expansion benefits from energy infrastructure including pipeline construction, renewable energy projects requiring wind towers and solar structures, and oil & gas field development, manufacturing reshoring initiatives bringing automotive, appliances, and industrial production capacity back to domestic locations, and new sheet mill capacity including Nucor's Apple Grove facility and other EAF-based flat steel investments supporting domestic supply chain development. The country maintains 4.6% CAGR driven by Infrastructure Investment and Jobs Act funding, Inflation Reduction Act clean energy incentives, and industrial policy supporting domestic manufacturing competitiveness.

American steel demand emphasizes flat products for automotive and energy applications, with growing emphasis on domestic content requirements and supply chain resilience supporting capital investment in USA-based steelmaking capacity. Market dynamics focus on specialty grades, technical service, and just-in-time delivery supporting advanced manufacturing requirements.

South Korean market expansion benefits from shipbuilding industry recovery including container vessel orders, LNG carrier construction supporting global energy transition, and naval shipbuilding programs requiring specialized steel grades, offshore structure fabrication for floating production storage and wind turbine foundations, and premium flat steel exports including automotive-grade advanced high-strength steel, cold-rolled products, and electrical steel serving Japanese, North American, and European OEMs requiring superior surface quality and mechanical properties. The country maintains 4.5% CAGR driven by maritime sector cyclical recovery, green shipping regulations requiring larger and more efficient vessels, and technological leadership in advanced steel grade development supporting export competitiveness despite higher regional production costs.

Korean integrated steel producers emphasize product innovation, comprehensive technical service, and application engineering capabilities creating sustainable competitive advantages in automotive and shipbuilding steel supply chains. Market dynamics focus on specialty grades, surface quality excellence, and customer collaboration supporting advanced manufacturing requirements across automotive electrification and high-value maritime applications.

Brazilian market expansion benefits from construction sector recovery including residential housing projects, commercial real estate development, and infrastructure investments requiring structural steel and reinforcement products, agribusiness equipment manufacturing supporting combine harvesters, tractors, and implement production for domestic and export markets, oil & gas development projects in pre-salt offshore fields requiring specialized pipeline grades and platform steel, and rail & port infrastructure modernization supporting commodity export logistics and intermodal connectivity. The country maintains 4.2% CAGR driven by domestic economic stabilization, agricultural sector strength supporting equipment demand, and infrastructure investment programs enhancing transportation networks and urban development.

Brazilian steel consumption emphasizes long products for construction applications, with growing flat steel requirements supporting automotive production and agricultural machinery manufacturing serving South American markets. Market dynamics focus on domestic supply chain integration, regional distribution networks, and competitive pricing supporting construction and manufacturing growth across diverse end-use sectors.

Turkish market expansion benefits from earthquake reconstruction demand driving substantial building materials consumption including reinforcement bars, structural steel, and roofing products across affected southeastern regions, export-oriented long products production including construction reinforcement and merchant sections serving Middle Eastern construction markets and European infrastructure projects, and EAF modernization investments improving energy efficiency, environmental compliance, and product quality supporting competitive positioning. The country maintains 4.0% CAGR driven by domestic reconstruction urgency, strategic geographic advantages for regional export access, and established scrap-based production infrastructure supporting cost-effective steelmaking operations.

Turkish steel sector emphasizes production flexibility, regional market access, and downstream fabrication capabilities creating integrated value chains from steelmaking through construction products. Market dynamics focus on export market diversification, domestic reconstruction priorities, and operational efficiency improvements supporting competitiveness across construction and industrial applications in regional markets.

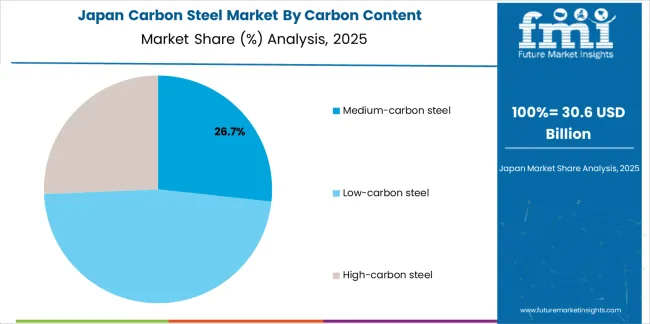

Japan demonstrates steady market development with 3.9% CAGR, distinguished by automotive industry demand for advanced high-strength steel supporting lightweighting and crash safety requirements, machinery exports including construction equipment, industrial automation, and precision manufacturing, and operational efficiency upgrades optimizing blast furnace performance and reducing carbon intensity. The market prioritizes advanced metallurgy, consistent quality, and comprehensive technical service reflecting Japanese manufacturing industry standards and automotive OEM requirements.

Chinese steel market demonstrates moderate growth with 3.3% CAGR through downstream manufacturing mix shift toward higher value-added automotive, appliances, and machinery production, grid infrastructure and renewable energy projects requiring electrical steel and structural materials, and capacity replacement programs transitioning from basic oxygen furnace to electric arc furnace production with green steel integration. The country's mature steel consumption and focus on quality over quantity support steady but moderated growth compared to historical expansion rates.

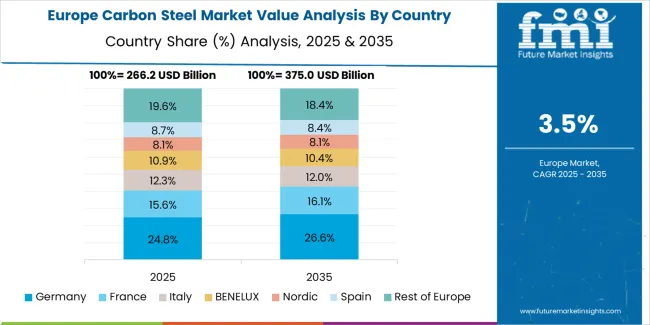

Europe accounts for 22.8% of global carbon steel revenue (USD 260.0 billion) in 2025. Within Europe, Germany leads with 19.5% (USD 50.7 billion), followed by Italy 16.0% (USD 41.6 billion), France 13.5% (USD 35.1 billion), United Kingdom 11.5% (USD 29.9 billion), Spain 9.5% (USD 24.7 billion), Poland 6.5% (USD 16.9 billion), Benelux 5.5% (USD 14.3 billion), Nordics 5.0% (USD 13.0 billion), and Rest of Europe 13.0% (USD 33.8 billion). The regional demand structure is comprehensively anchored by non-residential construction including commercial buildings and industrial facilities, automotive flat steel consumption including advanced high-strength and coated products for European OEM platforms, and grid infrastructure and renewable energy hardware supporting energy transition investments. Decarbonization programs across the region accelerate electric arc furnace and direct reduced iron investments replacing traditional blast furnace capacity, while coated flat-product upgrades and specialty grade development enhance European steel industry competitiveness in premium automotive and construction applications supporting regional manufacturing capabilities and sustainability leadership objectives.

In Japan, the Carbon Steel market prioritizes advanced high-strength steel formulations, which capture the dominant automotive segment share through proven crashworthiness performance and seamless integration with precision automotive manufacturing systems. Japanese automakers emphasize safety innovation, weight optimization, and manufacturing efficiency, creating sustained demand for third-generation AHSS providing superior strength-ductility combinations and adaptive metallurgy based on strict vehicle safety standards and fuel economy requirements for hybrid and electric vehicle platforms supporting domestic and export production.

Market Characteristics:

In South Korea, the market structure favors integrated steel producers including POSCO and Hyundai Steel, which maintain dominant positions through comprehensive product portfolios from commodity grades to ultra-high-strength automotive steel and established relationships with major shipbuilders, automotive OEMs, and construction companies supporting domestic consumption and export markets. These producers offer complete solutions combining advanced steelmaking technology with professional technical services and ongoing application support appealing to Korean manufacturers seeking reliable material supply and metallurgical expertise. Regional EAF operators and specialty mills capture moderate market share through long products and niche applications serving construction and industrial segments.

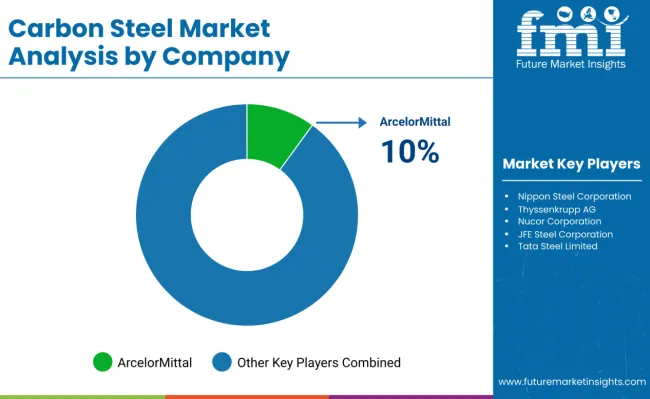

The market operates with moderate concentration globally, featuring approximately 25-35 meaningful participants, where leading companies control roughly 35-40% of the global market share through integrated production assets and regional market dominance. China Baowu Group maintains the leading position with approximately 9.0% market share through extensive integrated steelmaking capacity, vertical integration, and domestic market leadership in China. Competition emphasizes production scale, cost efficiency, product quality, and regional market access rather than global brand positioning.

Market Leaders encompass China Baowu Group, ArcelorMittal, and Nippon Steel, which maintain competitive advantages through large-scale integrated steelmaking facilities, captive raw material sources including iron ore mines and coking coal assets, comprehensive product portfolios spanning commodity to specialty grades, and established customer relationships across automotive, construction, and industrial sectors creating supply chain integration and supporting stable pricing. These companies leverage decades of steelmaking expertise and substantial ongoing capital investment to develop advanced production technologies including blast furnace optimization, electric arc furnace expansion, and emerging green steel routes with hydrogen-based direct reduction.

Technology Innovators include POSCO, JFE Steel, and Nucor, which compete through specialized production technologies including FINEX direct reduction, thin-slab casting, and high-efficiency EAF operation that appeal to customers seeking advanced metallurgical capabilities and sustainable production routes. These companies differentiate through rapid product development, application engineering support, and environmental performance leadership.

Regional Specialists feature companies like HBIS Group, Jiangsu Shagang, Ansteel Group, and Tata Steel, which focus on domestic and regional markets with cost-competitive production, local distribution infrastructure, and responsive customer service. Market dynamics favor participants that combine reliable production capability with competitive pricing, consistent quality, and technical support including metallurgical consulting and application development. Competitive pressure intensifies as Chinese producers expand export orientation while regional integrated mills and EAF operators invest in capacity and capability upgrades defending market positions against imports and alternative materials in key end-use applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 1,140.2 billion |

| Carbon Content | Low-carbon steel, Medium-carbon steel, High-carbon steel |

| Product Type | Flat products (hot-rolled coil/plate, cold-rolled sheet, galvanized & coated, tinplate & electrical sheet), Long products (bars & rods, sections, rail) |

| End Use | Building & construction, Automotive, Oil & gas/energy, Heavy machinery & equipment, Shipbuilding & marine, Railways, Consumer appliances, Aerospace & others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | India, United States, South Korea, Brazil, Turkey, Japan, China, and 25+ additional countries |

| Key Companies Profiled | China Baowu Group, ArcelorMittal, Nippon Steel, POSCO, HBIS Group, Jiangsu Shagang |

| Additional Attributes | Dollar sales by carbon content and product type categories, regional production and consumption trends across Asia-Pacific, North America, and Europe, competitive landscape with integrated steel producers and mini-mill operators, customer preferences for advanced high-strength grades and sustainable production, integration with automotive OEM platforms and construction supply chains, innovations in electric arc furnace technology and hydrogen-based steelmaking, and development of green steel solutions with enhanced lifecycle carbon performance and circular economy participation capabilities. |

The global carbon steel market is estimated to be valued at USD 1,140.2 billion in 2025.

The market size for the carbon steel market is projected to reach USD 1,687.8 billion by 2035.

The carbon steel market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in carbon steel market are medium-carbon steel, low-carbon steel and high-carbon steel.

In terms of product type, flat products segment to command 72.5% share in the carbon steel market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carbon Steel Industry Analysis in North America Forecast & Analysis: 2025 to 2035

Global Carbon Steel Tubing in Oil and Gas Lift Applications Market Insights – Size, Share & Forecast 2025–2035

Carbon Steel IBC Market Demand and Forecast 2025 to 2035

High Carbon Bearing Steel Market Growth 2025 to 2035

Medium Carbon Steel Market

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Brush Market Size and Share Forecast Outlook 2025 to 2035

Carbon Offset Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tapes Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Free Waste Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Carbon Labeled Packaged Meal Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Bike Wheelset Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Lasers Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Packaging Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Construction Repair Market Size and Share Forecast Outlook 2025 to 2035

Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Dioxide Synthesis Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Neutral Skincare Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA