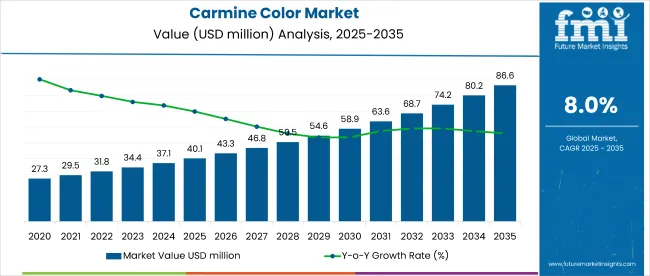

The global carmine color market is worth USD 40.1 million in 2025 and is expected to reach USD 86.6 million by 2035, reflecting a CAGR of 8%.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 40.1 million |

| Projected Value (2035F) | USD 86.6 million |

| CAGR (2025 to 2035) | 8% |

Factors driving this growth include the rising preference for natural food colorants, increased application across processed meat and dairy products, and the expansion of the global food and beverage industry. The increasing demand from sectors such as pharmaceuticals and personal care has also bolstered the overall consumption of carmine color.

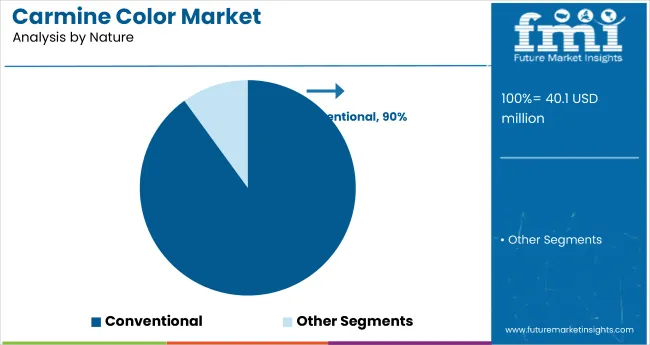

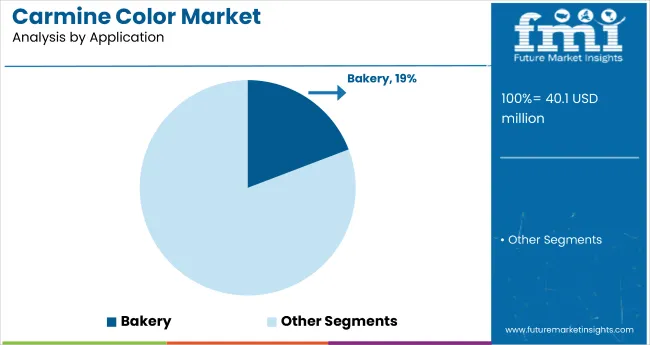

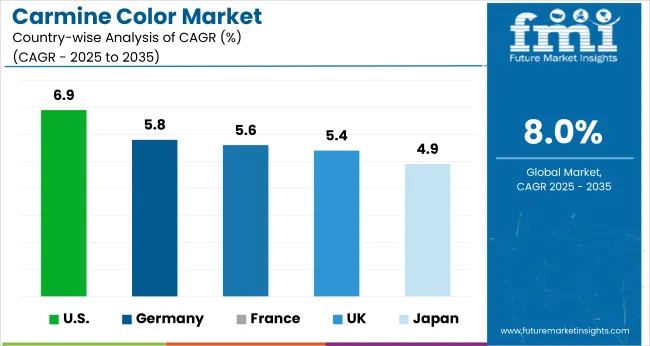

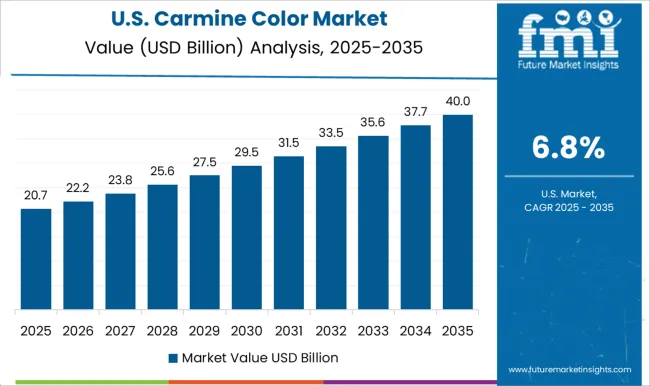

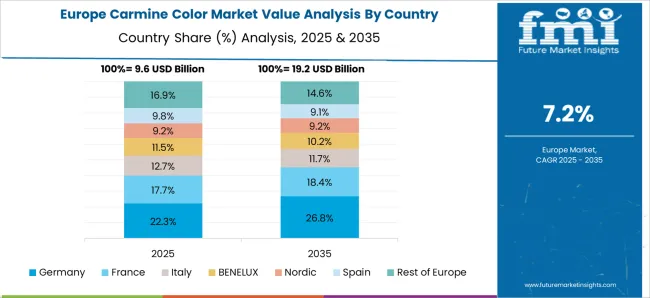

The USA is expected to dominate the global market in 2025, accounting for a significant share due to its high consumption of processed and packaged foods, expected to expand at a CAGR of 6.9%. Meanwhile, Germany and France closely follow this growth with prominent CAGRs of 5.8% and 5.6% respectively. The conventional segment will remain dominant, holding a 90% share by nature, while the bakery segment will lead the application segment with a 19.2% share in 2025.

The market holds a notable share across several broader markets due to its natural origin, stability, and widespread use in food, cosmetic, and pharmaceutical applications. Within the natural food colors market, carmine accounts for approximately 18%, making it one of the most prominent pigment types. In the food additives market, it represents about 2.5%, while in the food coloring agents market, its share is around 6%. Its contribution to the clean label ingredients market is estimated at 3.2%. Carmine also captures nearly 4% of the cosmetic colorants market, highlighting its importance in natural and premium formulations.

Going forward, the market is expected to witness innovations such as beet- and radish-based red alternatives. However, traditional cochineal-extracted carmine will retain a strong presence due to its stability. Governments in developing regions are supporting the use of natural additives through clean-label policies and food safety certifications. Major players are expanding their production capabilities, with DDW acquiring DuPont Natural Colors to enhance global reach and technical expertise.Additionally, the shift toward clean-label and organic ingredients in both food and cosmetics is further contributing to market growth.

The global market is segmented into nature, application and region. Bynature, the market is segmented into organic and conventional. Byapplication, the market includes beverage, bakery, snacks, cereal, candy, dairy, fruit preparations, meat, poultry, and others (cosmetics, pharmaceuticals, and textile printing). By Region,the market covers North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The conventional segment is projected to dominate the market with a 90% share in 2025. This dominance is attributed to cost-efficiency, broader industrial applicability, and relatively simpler processing compared to organic variants. While demand for organic colorants is rising due to clean-label preferences, conventional carmine remains the preferred choice for bulk food processing and large-scale industrial formulations.

The bakery is emerging as one of the most lucrative application segments, capturing a 19.2% share in 2025. Carmine is widely used in pastries, icings, fillings, and specialty breads due to its excellent temperature stability and vibrant red hue. Rising consumption of visually appealing artisanal baked goods and packaged desserts is driving the use of carmine across both industrial and commercial bakery settings.

Recent Trends in the Carmine Color Market

Key Challenges in the Carmine Color Market

Among the top five countries, the USA leads the carmine color market with the highest projected CAGR of 6.9% from 2025 to 2035. Growth is primarily driven by the increasing shift toward clean-label products, FDA-compliant natural formulations, and a surge in demand for naturally derived food colorants across bakery, dairy, and beverage sectors. Germany follows with a CAGR of 5.8%, backed by a mature food processing industry, widespread adoption of organic product lines, and rising investment in R&D for natural ingredients.

France ranks third with a CAGR of 5.6%, supported by its gourmet food, dairy exports, and heightened consumer preference for premium natural additives. The UK projects 5.4% growth due to stricter regulations on synthetic dyes and growing health-consciousness. Japan records a modest but steady CAGR of 4.9%, reflecting a cultural tilt toward umami-rich, additive-free foods, and growing demand for heat-stable, pH-resistant carmine formulations in processed foods.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The carmine color market in the USA is anticipated to grow at a CAGR of 6.9% from 2025 to 2035. As one of the leading consumers of natural food additives, the USA benefits from strong demand across processed foods, bakery, confectionery, and beverages. The rise of premium clean-label offerings and increased focus on FDA-compliant natural colorants have accelerated the adoption of carmine.

The carmine color market in the UK is projected to grow at a CAGR of 5.4% between 2025 and 2035. This growth is supported by rising demand for organic food products and stringent labeling regulations on synthetic colors. Carmine is widely used in the country’s thriving bakery and dairy industries, particularly in private-label supermarket products. A growing focus on allergen-free and natural food solutions continues to support long-term market demand.

Sales of carmine color in Germany are projected to expand at a CAGR of 5.8% from 2025 to 2035. As a major hub for food processing and premium packaged goods, the country’s strong preference for organic and natural ingredients positions carmine as a favored pigment. Its use is also increasing in pet food and cosmetic applications.

Revenue from carmine color in France is projected to grow at a CAGR of 5.6% from 2025 to 2035. The country’s well-established dairy, patisserie, and gourmet food sectors offer a strong foundation for carmine adoption. French consumers associate red hues with indulgence and quality, particularly in desserts and confectionery. Regulatory support for additive-free formulations further aligns with carmine’s positioning as a natural alternative.

The carmine color market in Japan is expected to grow at a CAGR of 4.9% between 2025 and 2035. Japanese manufacturers are prioritizing shelf stability and premium presentation, favoring carmine for its vibrant hue and high-temperature resistance. While traditionally cautious, the country is gradually embracing more natural ingredients, with carmine gaining traction due to its proven safety and functionality. Innovations in food technology and aesthetics continue to support its adoption in the Japanese market.

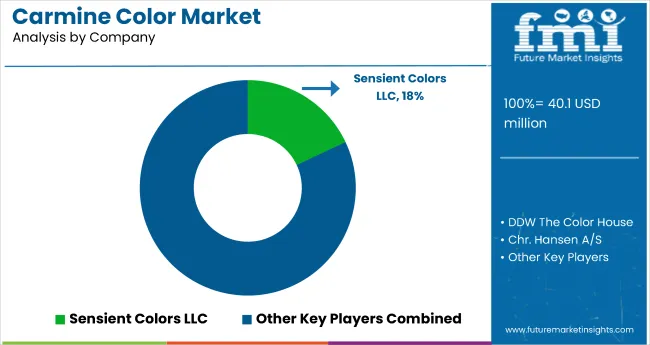

The global market is moderately consolidated, with a mix of global leaders and regional suppliers shaping the competitive landscape. Top-tier players such as DDW The Color House, Sensient Colors LLC, Chr. Hansen A/S and Döhler Group control a sizable share through diversified product portfolios, strong supply networks, and regulatory-compliant natural pigment solutions. These companies are primarily competing on the basis of innovation in extraction techniques, cost efficiency, clean-label certifications, and strategic collaborations with food and beverage manufacturers.

Most leading suppliers are expanding their global production capacities and investing in application-specific carmine variants to cater to diverse consumer needs across the bakery, meat processing, and cosmetic sectors. Pricing strategies are being aligned with value-added offerings such as high-heat stability and pH tolerance. Furthermore, sustainability has become a core focus, with firms pushing for eco-friendly sourcing of cochineal insects and non-GMO certifications. Innovation in hybrid pigment formulations and mergers to expand natural color portfolios are helping firms reinforce their market position.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 40.1 million |

| Projected Market Size (2035) | USD 86.6 million |

| CAGR (2025 to 2035) | 8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD million/Volume in metric tons |

| By Nature | Organic and Conventional |

| By Application | Beverage, Bakery, Snacks, Cereal, Candy, Dairy, Fruit Preparations, Meat, Poultry, and Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ Countries |

| Key Players | DDW The Color House, Archer Daniels Midland Company, McCormick & Company, BioconColors, Naturex S.A., Riken Vitamin Co. Ltd., Döhler Group, Kalsec Inc., Sensient Colors LLC, and Chr. Hansen A/S |

| Additional Attributes | Dollar sales by value, market share analysis by segments, and country-wise analysis |

The global carmine color market is estimated to be valued at USD 40.1 billion in 2025.

The market size for the carmine color market is projected to reach USD 86.6 billion by 2035.

The carmine color market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in carmine color market are organic and conventional.

In terms of application, beverage segment to command 48.6% share in the carmine color market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carmine Market Size and Share Forecast Outlook 2025 to 2035

Color Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Carmine Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Colorectal Cancer Molecular Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Coloring Foodstuffs Market Insights – Natural Pigments & Growth 2025 to 2035

Colorimeter Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in the Colored Gemstones Industry

Colored BIPV Market Report – Trends, Demand & Growth through 2034

Colorimetric Indicator Labels Market Trends – Growth & Forecast 2024-2034

Color Meter Market

Color Concentrates Market

RIP Color Management Software Market Size and Share Forecast Outlook 2025 to 2035

Oil Colors Market Trends – Growth & Demand Forecast 2025 to 2035

Food Color Market Analysis - Size, Share, and Forecast 2025 to 2035

Male Color Cosmetics Market - Trends, Growth & Forecast 2025 to 2035

Multi Colored LED Beads Market Size and Share Forecast Outlook 2025 to 2035

India Colored Gemstones Market Size and Share Forecast Outlook 2025 to 2035

Water Color Market Size and Share Forecast Outlook 2025 to 2035

Multi-Color Printer Market Analysis – Trends & Forecast 2024-2034

Rigid Colored PU Foam Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA