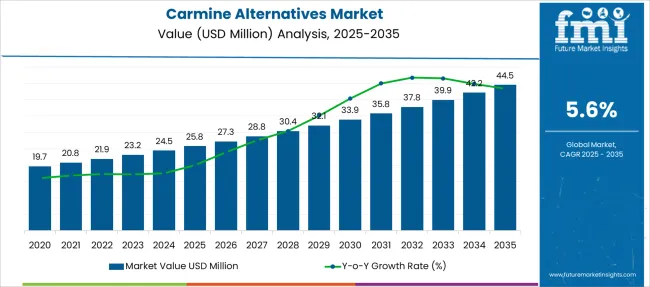

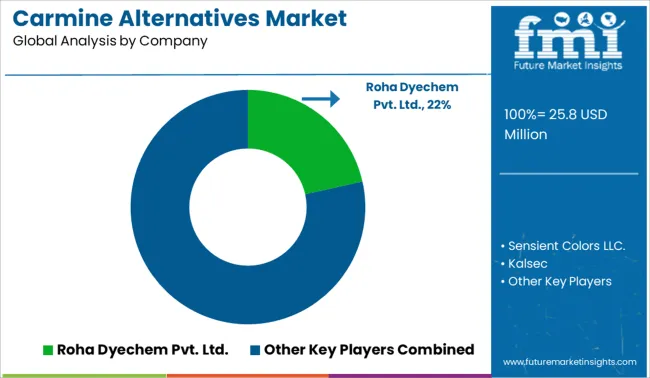

The Carmine Alternatives Market is estimated to be valued at USD 25.8 million in 2025 and is projected to reach USD 44.5 million by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Carmine Alternatives Market Estimated Value in (2025 E) | USD 25.8 million |

| Carmine Alternatives Market Forecast Value in (2035 F) | USD 44.5 million |

| Forecast CAGR (2025 to 2035) | 5.6% |

The carmine alternatives market is witnessing sustained growth, driven by the growing rejection of animal-derived ingredients in favor of plant-based and synthetic-free formulations. This shift is being accelerated by heightened consumer awareness of clean-label products, ethical sourcing, and allergen concerns associated with cochineal extract.

Regulatory pressures in several regions to declare insect-based components on product labels have led manufacturers to explore more transparent and acceptable alternatives. The demand has been further reinforced by food safety authorities and retailers who are pushing for natural and vegan colorants that do not compromise performance in heat or pH-sensitive applications.

Advances in extraction and stabilization techniques for plant pigments, such as anthocyanins and betalains, are enabling more vibrant and stable color expressions in processed foods, beverages, and personal care items As innovation in bio-based pigment technology continues and processing yields improve, the market is expected to gain further momentum with support from ingredient suppliers, formulators, and multinational consumer brands.

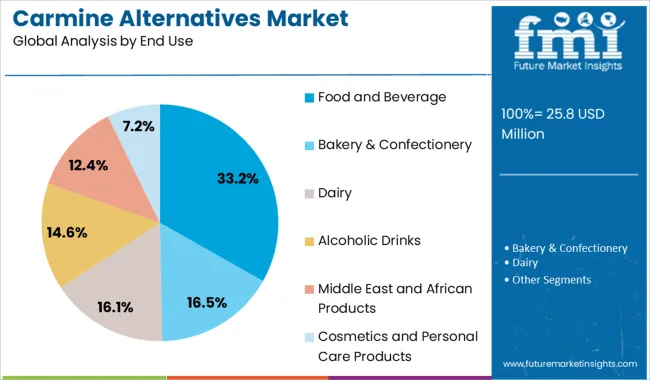

The market is segmented by Form, Source, End Use, and Distribution Channel and region. By Form, the market is divided into Dry and Liquid. In terms of Source, the market is classified into Fruit, Vegetable, and Other Plants. Based on End Use, the market is segmented into Food and Beverage, Bakery & Confectionery, Dairy, Alcoholic Drinks, Middle East and African Products, and Cosmetics and Personal Care Products. By Distribution Channel, the market is divided into Direct Sales Channel, Indirect Sales Channel, Hypermarket/Supermarket, Specialty Stores, Online Retail, and Other Retail Format. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

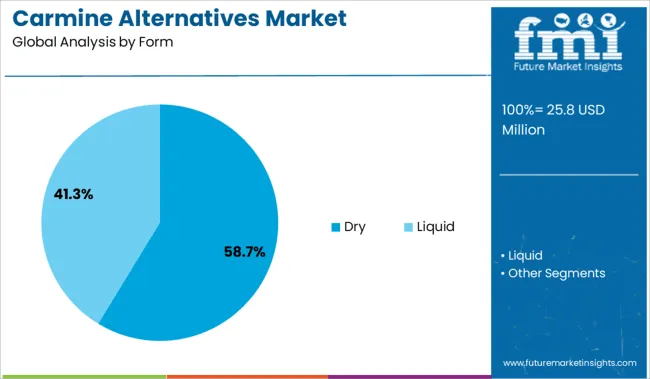

The dry form segment is anticipated to account for 58.7% of the total revenue share in the carmine alternatives market in 2025, positioning it as the dominant format across applications. Its prominence can be attributed to extended shelf life, ease of transportation, and superior formulation versatility compared to liquid counterparts.

Dry formats are widely favored for use in powdered food blends, bakery premixes, confectionery coatings, and nutraceuticals due to their enhanced stability during processing and storage. Reduced moisture content also minimizes the risk of microbial contamination, making dry alternatives ideal for clean-label formulations.

In industrial production, dry carmine substitutes allow for more accurate dosage control, ease of incorporation into various matrices, and reduced packaging and logistic costs The ability to reconstitute these formats into desired concentrations for both water-soluble and oil-dispersible applications has further strengthened their position in global manufacturing pipelines, especially among large-scale food and cosmetic producers aiming for consistency and safety in natural coloring systems.

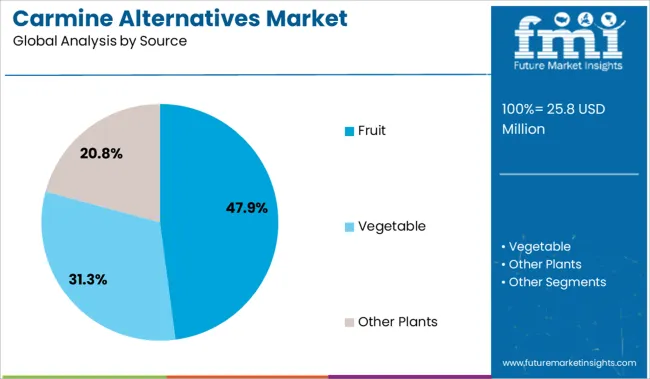

The fruit source segment is expected to hold 47.9% of the overall market share in 2025, emerging as the preferred origin for carmine alternative pigments. This growth is being driven by rising demand for naturally derived and allergen-free colorants sourced from recognizable ingredients such as berries, grapes, and pomegranates.

Fruit-based pigments are perceived as safer and more consumer-friendly, especially in markets with heightened scrutiny around product labeling and ethical sourcing. The color vibrancy, coupled with antioxidant co-benefits often associated with fruit extracts, is supporting their increased adoption in beverages, yogurts, confectionery, and plant-based meat analogs.

Technological advancements in low-heat extraction and color stabilization have improved the functional performance of fruit-derived pigments in varied pH environments, allowing wider applicability across processed foods and cosmetics Their compatibility with vegan, kosher, and halal certifications is also a key factor contributing to the segment’s sustained relevance in global markets where dietary restrictions and lifestyle choices influence purchasing behavior.

The food and beverage segment is projected to contribute 33.2% of the total market revenue in 2025, making it the largest end-use industry for carmine alternatives. This growth has been driven by escalating demand for clean-label ingredients and consumer skepticism toward animal-based additives in edible products. Manufacturers in the beverage, dairy, bakery, and confectionery sectors are increasingly replacing traditional carmine with plant-based and fermented alternatives that meet both regulatory and consumer expectations.

The ability of new-generation carmine substitutes to retain color stability in high-acid and thermally processed environments has been instrumental in their adoption. Additionally, the shift toward transparent ingredient labeling and allergen avoidance has prompted global brands to reformulate existing product lines using fruit and vegetable-derived pigments.

Foodservice chains and packaged food manufacturers are also adopting these alternatives to align with ethical sourcing commitments and sustainability initiatives As demand for functional, visually appealing, and ethically acceptable products continues to rise, the food and beverage sector is expected to remain a key driver of market expansion.

The global carmine alternatives market is significantly driven by the rising consumer trend for natural and plant-based products. Carmine is produced from the ground bodies of cochineal insects using a chemical process that leads to the retained chemical and other additives in the final products and also in the food products. Moreover, carmine can trigger an allergic reaction in a particular class of the population. Considering the buzz around plant-based and natural products, increasing sales of carmine alternatives has increased market opportunity.

Carmine alternatives derived from mostly fruits and vegetables have increased demand from developing nations due to favorable government policies and a flourishing food and beverage industry, cosmetics, and personal care products industry.

The per capita consumption of food and beverage and cosmetics in Asian and Middle Eastern, and African region is increasing at a significant rate. This is fueling the demand for carmine alternatives.

Cochineal production is tempered by the fluctuating climatic conditions leading to the volatile prices of carmine. Therefore, food and beverages, and cosmetics manufacturers are turning away from Carmine and are looking for Carmine alternatives. These carmine alternatives are not only plant-based but also cost-effective products, pushing to invest and search for carmine alternatives since the high and volatile prices of carmine in the global market are resulting in uncertainty.

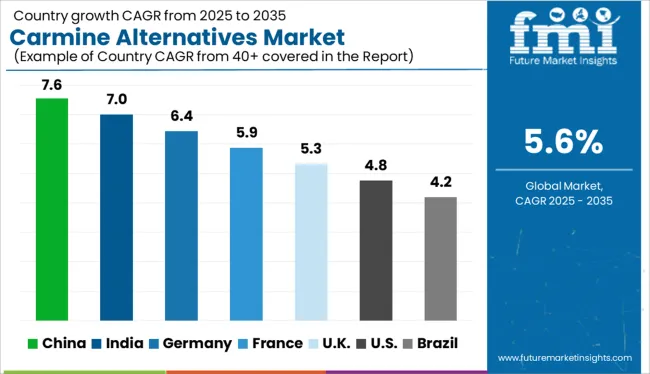

North American and European regions are the major markets in the global carmine alternatives market. However, Asia is anticipated to witness the highest growth rate over the forecast period in the global carmine alternatives market, followed by Middle Eastern and African markets, expanding the market size while increasing the sales of carmine alternatives.

The increasing consumption of processed food products and cosmetics due to the increasing purchasing power is driving the demand for carmine alternatives in these regions.

The positive changes in the country’s GDP, increasing middle-class population, and increasing income of the middle-class working population are affecting the purchasing power of the consumers in a positive way and creating a positive outlook in the global carmine alternatives market, fuelling the sales of carmine alternatives in new market spaces.

The key players of the carmine alternatives market are focusing on mergers and collaborations that are fueling the sales of carmine alternatives including Hansen A/S, Sensient Colours LLC, Kalsec, DDW The Colour House, Archer Daniels Midland Company, GNT Group B.V and Roha Dyechem Pvt. Ltd.

Recent Market Development:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.6% from 2025 to 2035 |

| The base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments Covered | Form, Source, End Use, Distribution & Region |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia; and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, United Arab Emirates(UAE), Iran, South Africa |

| Key companies profiled | Hansen A/S; Sensient Colours LLC; Kalsec; DDW The Colour House; Archer Daniels Midland Company; GNT Group B.V; and Roha Dyechem Pvt. Ltd |

| Customization scope | Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global carmine alternatives market is estimated to be valued at USD 25.8 million in 2025.

The market size for the carmine alternatives market is projected to reach USD 44.5 million by 2035.

The carmine alternatives market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in carmine alternatives market are dry and liquid.

In terms of source, fruit segment to command 47.9% share in the carmine alternatives market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carmine Color Market Size and Share Forecast Outlook 2025 to 2035

Carmine Market Size and Share Forecast Outlook 2025 to 2035

Indigo Carmine Market Size and Share Forecast Outlook 2025 to 2035

Alternatives For Injectable Diabetes Care Market Size and Share Forecast Outlook 2025 to 2035

Milk Alternatives Market – Growth, Demand & Dairy-Free Trends

Dairy Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cheese Alternatives Market Analysis - Size, Share, and Forecast 2025 to 2035

Retinol Alternatives (Bakuchiol) Market Size and Share Forecast Outlook 2025 to 2035

Fish Oil Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Marine Squalene Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Demand for Dairy Alternatives in the EU Size and Share Forecast Outlook 2025 to 2035

Bioactive Retinol Alternatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Sustainable Glycerin Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Carcinogenic Chemical Alternatives Market

Plant-Derived Ceramide Alternatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Titanium-Free Food Color Alternatives Market

Plant-Derived Hyaluronic Acid Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pea Protein Demand in Dairy Alternatives Analysis - Size Share and Forecast outlook 2025 to 2035

High-Protein Plant-Based Cheese Alternatives in the EU Analysis Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA