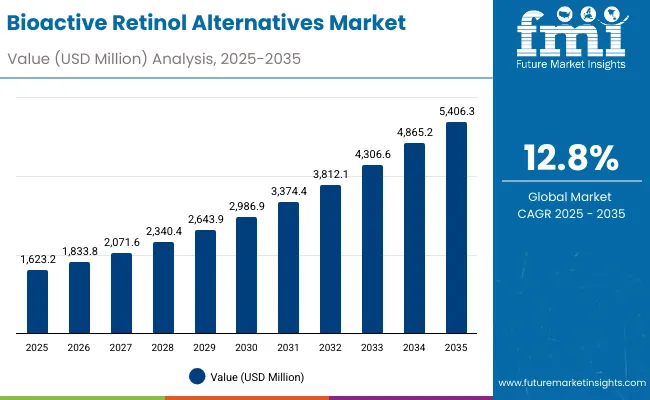

A valuation of USD 1,623.2 million had been estimated for the Bioactive Retinol Alternatives Market in 2025, with projections indicating a rise to USD 5,406.3 million by 2035. This reflects a net increase of USD 3,783.1 million, signifying a 233% expansion over the decade. The market’s long-term trajectory is expected to register a CAGR of 12.8%, effectively more than tripling in size over the period.

Bioactive Retinol Alternatives Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1,623.2 million |

| Market Forecast Value In (2035F) | USD 5,406.3 million |

| Forecast CAGR (2025 to 2035) | 12.80% |

During the initial half of the forecast window (2025-2030), the market is set to grow from USD 1,623.2 million to USD 2,986.9 million, accounting for USD 1,363.7 million, which equals 36% of the projected decade-wide growth. This phase is expected to be marked by surging demand for plant-based actives, driven by consumer preference for clean-label skincare. Bakuchiol and alfalfa extract are anticipated to dominate, reinforced by anti-aging applications gaining widespread formulation preference.

In the subsequent five-year phase (2030-2035), an incremental rise of USD 2,419.4 million is projected, as the market grows from USD 2,986.9 million to USD 5,406.3 million, accounting for 64% of the total decade growth. This acceleration is likely to be powered by regulatory validation, enhanced clinical trials, and brand adoption in APAC. China and India are projected to anchor global momentum, with clinics, professional skincare, and D2C models strengthening uptake.

Through 2035, functional positioning around anti-aging, serums, and professional-grade product tiers is expected to define both volume and value leadership.

Between 2020 and 2024, early interest in bioactive retinol alternatives was primarily driven by sensitivity to synthetic retinoids and a shift toward clean-label cosmeceuticals. Brands emphasized clinical testing, gentle anti-aging, and pregnancy-safe claims, while consumer education accelerated through dermatology-endorsed social platforms.

By 2025, the market is expected to surpass USD 1,600 million, driven by expanding D2C models, professional dermatology use cases, and rising demand for plant-derived formulations. A transition toward clinical-grade botanicals has been initiated by global majors, with emphasis placed on high-purity extraction, encapsulation technology, and regulatory compliance.

From 2025 onward, the revenue mix is projected to shift as functional innovation, regulatory alignment, and co-branding with skin clinics take center stage. Competitive advantage is expected to move away from raw ingredient sourcing toward dermaceutical partnerships, microbiome-safe positioning, and multi-functional performance. Premium brands are likely to scale up hybrid formats supported by AI-powered personalization and barrier-restoring claims, redefining how retinol alternatives are positioned in clinical and commercial skincare portfolios.

The growth of the Bioactive Retinol Alternatives Market has been fueled by a rising demand for gentler, plant-based skincare solutions as concerns surrounding synthetic retinoids continue to mount. Widespread irritation, sensitivity, and regulatory scrutiny have prompted formulators and dermatologists to shift toward safer bioactives. Increased consumer awareness of skin microbiome health and long-term skin integrity has further accelerated this transition.

Clean beauty trends and ingredient transparency mandates have been reinforced by clinical trials validating the efficacy of alternatives like bakuchiol and alfalfa extract. These ingredients have been adopted across premium and mass-market formulations due to their multifunctional properties spanning anti-aging, anti-inflammatory, and skin-brightening effects.

The market expansion has also been supported by D2C brand penetration, regulatory easing in APAC, and strategic investments by key players in natural actives. As professional-grade skincare gains traction in China, India, and the USA, the momentum is expected to sustain, reshaping future formulation strategies across cosmetic and dermaceutical domains.

The Bioactive Retinol Alternatives Market has been segmented to uncover the strategic forces shaping demand across various value pools. Segmentation has been conducted across function, tier, and product type, capturing essential variables that guide purchasing behavior and formulation focus. By dissecting these categories, nuanced shifts in consumer intent and product positioning have been revealed.

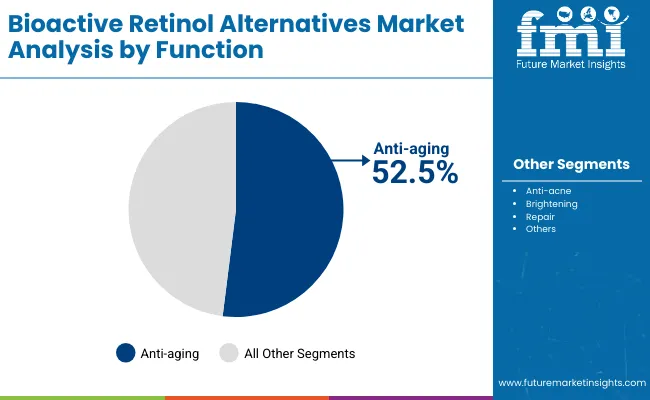

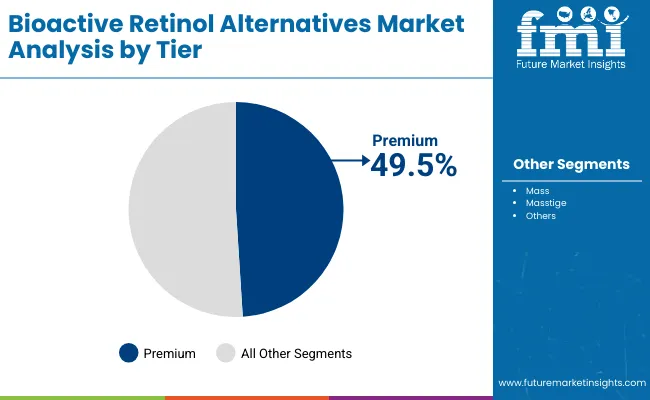

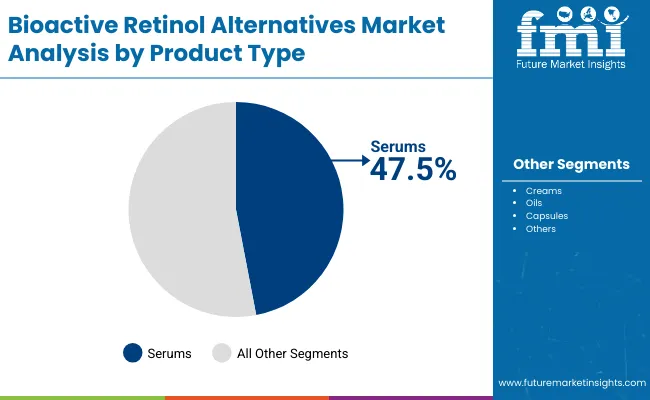

Function-based analysis has spotlighted anti-aging as a leading driver of value, while product tiers highlight the dual momentum of both premium and accessible categories. Simultaneously, product type segmentation indicates a dynamic interplay between concentrated formats like serums and other diversified delivery systems. These segments are expected to evolve in line with dermatological trends, ingredient efficacy, and brand positioning strategies, ultimately dictating innovation direction and revenue potential over the next decade.

| Function | Market Value Share, 2025 |

|---|---|

| Anti-aging | 52.5% |

| Others | 47.5% |

The anti-aging function segment is projected to account for 52.5% share of the Bioactive Retinol Alternatives Market in 2025, valued at USD 840.4 Million, maintaining its position as the largest contributor. Demand is expected to be supported by the rising consumer preference for safe, irritation-free solutions that mimic retinol efficacy. Expansion will likely be reinforced by multi-functional claims such as wrinkle reduction, brightening, and barrier repair. “Others,” holding a 47.5% share (USD 770.6 Million), is anticipated to witness healthy growth, aided by anti-acne positioning and lifestyle-related skin concerns. Together, these functions are expected to drive strong market momentum as brands invest in clinically backed actives and education-led campaigns that elevate trust and usage frequency.

| Tier | Market Value Share, 2025 |

|---|---|

| Premium | 49.5% |

| Others | 50.5% |

The premium tier is estimated to hold 49.5% share of market revenues in 2025, valued at USD 791.9 Million, reflecting growing consumer willingness to pay for clinically substantiated and higher-efficacy formulations. The share of non-premium (50.5%, USD 819.8 Million) is expected to remain relevant, particularly in price-sensitive regions where first-time users are driving penetration. Migration from mass to masstige and premium formats is projected to accelerate, supported by influencer-led marketing and dermatology partnerships. As awareness of skin safety and sustainability increases, consumers are anticipated to favor brands offering traceable sourcing and minimal irritation profiles, ensuring long-term loyalty and stable pricing power across the premium segment.

| Product Type | Market Value Share, 2025 |

|---|---|

| Serums | 47.5% |

| Others | 52.5% |

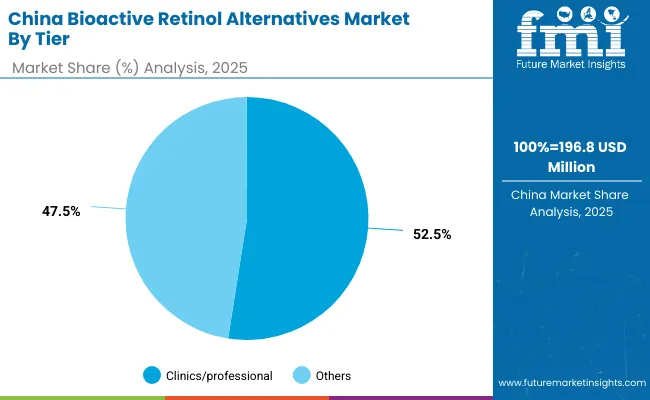

The clinics/professional channel is expected to contribute 52.5% share of total sales in 2025, valued at USD 103.3 Million, underlining its importance in building credibility and accelerating adoption. Other channels, with a 47.5% share (USD 93.5 Million), are projected to expand steadily through e-commerce, D2C platforms, and pharmacies. Professional recommendation is expected to play a pivotal role in reducing consumer hesitation and validating product efficacy, especially in markets such as China and Japan where dermatologist guidance drives trial rates. Digital-first brands are forecasted to leverage omni channel presence to bridge online education with offline conversion, thereby maximizing repeat purchases and strengthening consumer trust in bioactive retinol alternatives.

Growing clinical scrutiny of synthetic retinoids and shifting dermatological standards have challenged conventional product portfolios, even as market readiness for functional, botanical-based alternatives continues to mature across both clinical and commercial skincare verticals.

Institutional Dermatology Partnerships and Ingredient Clinicalization

Strong momentum has been observed through collaborations between ingredient developers and dermatological institutions to validate efficacy via controlled trials. These partnerships have enabled the clinicalization of bioactive retinol alternatives, moving them from anecdotal use into evidence-backed skincare. This alignment with medical professionals has improved trust among physicians and estheticians, facilitating inclusion in post-procedure routines and prescription-led skincare. The development of standardized testing protocols for bakuchiol, alfalfa extract, and rosehip derivatives has further supported their formulation in regulated product classes, strengthening regulatory acceptance across APAC and Western markets.

Positioning of Bioactive Retinols as Microbiome-Friendly Ingredients

Bioactive retinol alternatives have increasingly been repositioned as microbiome-preserving compounds, in contrast to synthetic retinoids known to compromise skin barrier integrity. This positioning has opened avenues for integration into barrier-repair formulations, probiotic skincare, and anti-inflammatory dermaceuticals. Ingredient marketing now emphasizes compatibility with sensitive skin, chronic inflammatory conditions, and post-laser or resurfacing therapies areas traditionally avoided by retinoid users. This trend has elevated their perceived therapeutic value and is expected to redefine formulation strategies over the forecast period.

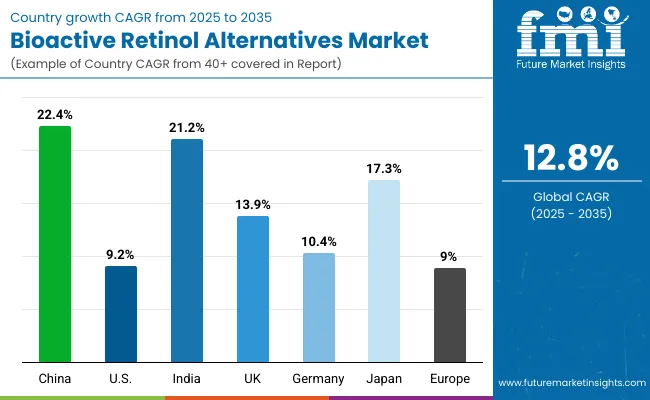

| Countries | CAGR |

|---|---|

| China | 22.4% |

| USA | 9.2% |

| India | 21.2% |

| UK | 13.9% |

| Germany | 10.4% |

| Japan | 17.3% |

The global Bioactive Retinol Alternatives Market has displayed significant geographical variance in growth potential, shaped by factors such as clinical awareness, consumer acceptance of botanical actives, and regulatory flexibility. Asia-Pacific is anticipated to lead the expansion curve, driven by China (22.4% CAGR) and India (21.2%), as both countries continue to invest in clean-label skincare, dermatology infrastructure, and natural ingredient sourcing.

In China, accelerated growth has been supported by strong demand for professional-grade anti-aging solutions and institutional endorsements for plant-derived actives like bakuchiol. Clinics and D2C brands are expected to dominate the premium tier, reflecting evolving consumer sophistication and brand education. India’s trajectory has been catalyzed by rising disposable income, influencer-driven skincare narratives, and greater ingredient transparency.

Japan (17.3%) is projected to maintain steady growth due to innovation in functional cosmetics and a deep-rooted culture of preventive skincare. In contrast, Europe is expected to expand at a moderate pace, led by the UK (13.9%) and Germany (10.4%), supported by compliance with cosmetic safety standards and clean beauty movements.

The USA, while mature, is projected to grow at a 9.2% CAGR, with momentum being maintained through cosmeceutical adoption and channel diversification across clinical and retail ecosystems.

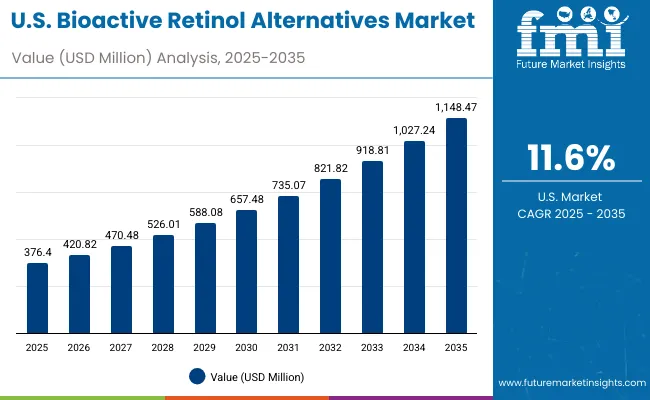

| Year | USA Bioactive Retinol Alternatives Market (USD Million) |

|---|---|

| 2025 | 376.40 |

| 2026 | 420.82 |

| 2027 | 470.48 |

| 2028 | 526.01 |

| 2029 | 588.08 |

| 2030 | 657.48 |

| 2031 | 735.07 |

| 2032 | 821.82 |

| 2033 | 918.81 |

| 2034 | 1,027.24 |

| 2035 | 1,148.47 |

The USA Bioactive Retinol Alternatives Market is projected to expand at a CAGR of 11.6% between 2025 and 2035, rising from USD 376.4 Million to USD 1,148.5 Million. Growth is expected to be fueled by increasing alignment with clinical dermatology standards, rising adoption of premium-tier product lines, and heightened consumer avoidance of synthetic actives.

Formulation science in the USA has increasingly favored bioactive ingredients validated by dermatological trials and regulatory transparency. The shift toward microbiome-safe and pregnancy-safe formulations has further accelerated adoption across both clinical and mass-market skincare portfolios. By the end of the forecast period, the USA market is expected to account for a meaningful share of global sales, reinforced by health-conscious consumers, robust channel diversification, and an innovation-friendly ecosystem.

The UK market is expected to grow at a CAGR of 13.9% between 2025 and 2035, signaling a healthy acceleration driven by the convergence of clean beauty mandates and clinical formulation adoption.

Consumer preference for EU-aligned, ingredient-transparent skincare has continued to shape the adoption of bioactive retinol alternatives. Product education around skin sensitivity, hormonal balance, and long-term skin health has been prioritized across both retail and prescription-grade channels. By 2035, the UK is expected to act as a regulatory benchmark for wider European expansion, particularly for clean-label and sensitive skin-positioned bioactive formulations.

India’s market is projected to expand at a CAGR of 21.2% through 2035, driven by digitally enabled skincare demand, rising disposable incomes, and Ayurveda-aligned active ingredient formulations.

Urban middle-class consumers have embraced preventive skincare routines, especially for pigmentation and early aging, where bakuchiol, rosehip oil, and carrot root extracts have gained popularity. Skin tolerance levels, climate sensitivity, and cultural affinity for botanical remedies have guided product development and consumer trust.

China is forecasted to record a CAGR of 22.4% from 2025 to 2035 one of the highest globally fueled by strong clinical demand, professional skincare expansion, and local brand innovation.

The shift from synthetic to botanical retinoids has been actively supported by dermatological clinics, especially in Tier-1 and Tier-2 cities. Ingredient functionality, safety across skin types, and multi-tasking benefits have been emphasized in brand messaging.

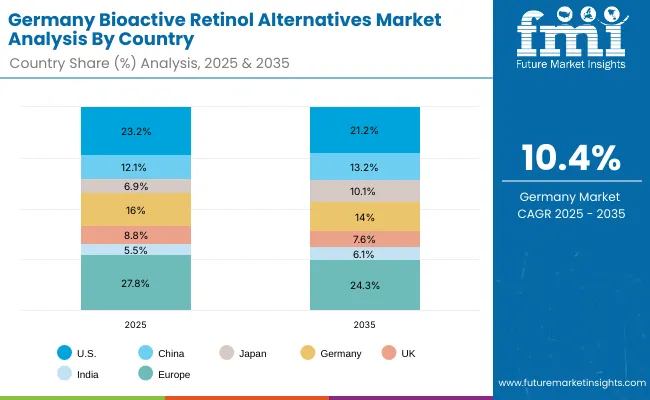

| Countries | 2025 |

|---|---|

| USA | 23.2% |

| China | 12.1% |

| Japan | 6.9% |

| Germany | 16.0% |

| UK | 8.8% |

| India | 5.5% |

| Countries | 2035 |

|---|---|

| USA | 21.2% |

| China | 13.2% |

| Japan | 10.1% |

| Germany | 14.0% |

| UK | 7.6% |

| India | 6.1% |

Germany’s Bioactive Retinol Alternatives Market is projected to grow at a CAGR of 10.4% from 2025 to 2035, supported by established dermocosmetic traditions and strong adherence to ingredient purity.

Sustainability and skin safety have remained critical themes in German cosmetic science. Bioactive retinol alternatives are increasingly adopted across pharmacy-led skincare lines and organic-certified product segments. Local consumers have demonstrated a strong preference for well-researched ingredients with minimal side effects.

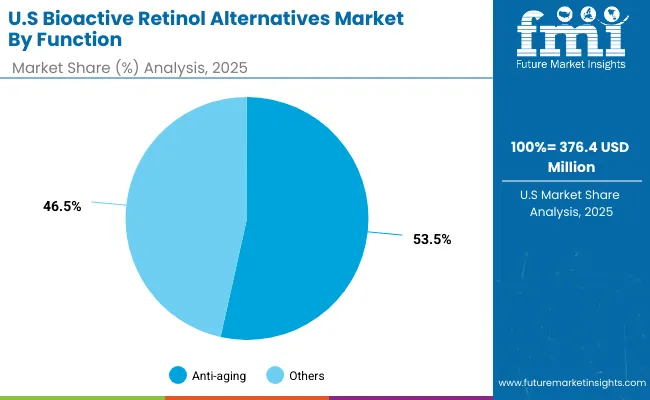

| Segment | Market Value Share, 2025 |

|---|---|

| Anti-aging | 53.5% |

| Others | 46.5% |

The USA Bioactive Retinol Alternatives Market is projected at USD 376.4 Million in 2025, with anti-aging applications contributing 53.5% (USD 201.5 Million) and other functions representing 46.5% (USD 174.9 Million). This dominance of anti-aging is expected to be reinforced by heightened consumer focus on early intervention, wrinkle prevention, and sensitivity-safe alternatives to retinoids. The market is anticipated to expand as brands emphasize clinically validated outcomes and position products as long-term solutions for skin health rather than short-term treatments.

Future growth is likely to be supported by dermocosmetic education campaigns, retailer-driven curation, and the inclusion of bioactive retinol alternatives in premium serums and creams. Subscription-based e-commerce models and dermatologist-recommended regimens are projected to drive repeat purchases and retention. Regulatory clarity on clean-label claims is also expected to strengthen consumer trust, encouraging further adoption. Over the forecast period, innovation around encapsulated delivery systems and combination products addressing both aging and acne concerns will likely shape competitive positioning in the USA market.

| Segment | Market Value Share, 2025 |

|---|---|

| Clinics/professional | 52.5% |

| Others | 47.5% |

The China Bioactive Retinol Alternatives Market is projected at USD 196.8 Million in 2025, with clinics/professional channels contributing 52.5% (USD 103.3 Million) and other distribution formats holding 47.5% (USD 93.5 Million). The dominance of professional clinics is expected to continue as dermatology-led trust and in-clinic recommendations drive consumer adoption of new actives. Growth is anticipated to be fueled by the rising prevalence of preventive skincare routines, with Chinese consumers increasingly seeking irritation-free anti-aging and brightening solutions.

Digital integration with offline clinics is projected to amplify sales, as appointment-based product education and KOL collaborations enhance awareness. Rising disposable incomes and an accelerated premiumization trend are expected to raise average spend per consumer, favoring higher-margin formulations and specialized regimens. Over the forecast period, localization of botanical actives and TCM-inspired innovation is likely to differentiate offerings, positioning China as one of the fastest-growing markets globally.

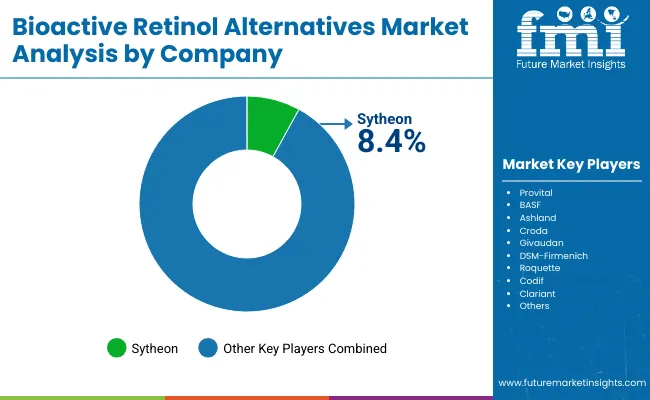

The Bioactive Retinol Alternatives Market is moderately fragmented, with global leaders, mid-sized innovators, and specialized formulators competing across dermatological, cosmeceutical, and wellness-driven skincare segments. Ingredient leaders such as DSM-Firmenich, Givaudan, and BASF have retained dominant market influence due to their extensive R&D infrastructure, regulatory expertise, and clinical validation of key bioactives like bakuchiol and phytosterols. Their portfolios have been increasingly aligned with anti-aging, microbiome-friendly, and pregnancy-safe claims, often supported by multi-center clinical trials and proprietary encapsulation technologies.

Mid-sized players including Ashland, Croda, and Clariant have focused on application-specific delivery systems and botanical extractions tailored for sensitive skin formulations. Customization for hybrid emulsions, time-release serums, and clean-label certifications has been actively prioritized, especially across D2C and premium clinical brands.

Emerging formulators such as Sytheon, Provital, Codif, and Roquette have carved niches by offering high-purity, low-irritation bioactives with strong appeal to minimalist skincare routines. Their strategies have emphasized transparency, local sourcing, and sustainable biotechnology.

Competitive advantage is now shifting from ingredient novelty to formulation compatibility, regulatory transparency, and clinical co-branding potential. Future positioning will likely depend on performance data, sensory profiling, and platform integration into skin diagnostic ecosystems and AI-driven personalization models.

Key Developments in Bioactive Retinol Alternatives Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Market Size (2025) | USD 1,623.2 Million |

| Market Size (2035) | USD 5,406.3 Million |

| Component | Bakuchiol, Alfalfa Extract, Carrot Root Extract, Rosehip Oil, Phytosterols |

| Functionality | Anti-aging, Anti-acne, Brightening, Repair |

| Product Type | Serums, Creams, Oils, Capsules |

| Distribution Channel | E-commerce, Natural Beauty Retail, Pharmacies, D2C |

| Tier | Mass, Masstige, Premium |

| End-use Applications | Clinics/Professional Skincare, OTC Skincare, Cosmeceuticals, Dermaceuticals |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

The global Bioactive Retinol Alternatives Market is estimated to be valued at USD 1,623.2 million in 2025.

The market size for the Bioactive Retinol Alternatives Market is projected to reach USD 5,406.3 million by 2035.

The Bioactive Retinol Alternatives Market is expected to grow at a CAGR of 12.8% during the period from 2025 to 2035.

The key product types include serums, creams, oils, and capsules, with serums and creams leading due to their superior skin absorption and compatibility with anti-aging formulations.

The anti-aging segment is projected to account for the highest share in 2025, contributing 52.5% of the global value, driven by demand for safer, non-irritating alternatives to traditional retinoids.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bioactive Bone Grafts Market Size and Share Forecast Outlook 2025 to 2035

Bioactive Coating Devices Market Size and Share Forecast Outlook 2025 to 2035

Bioactive Ingredient Market Growth – Functional Nutrition & Industry Trends 2025 to 2035

Bioactive Compounds In Coffee Market

Bioactive Proteins in Coffee Market

Skin Bioactive Market Analysis - Trends, Growth & Forecast 2025 to 2035

Botanical Bioactives Market Size and Share Forecast Outlook 2025 to 2035

Retinol Alternatives (Bakuchiol) Market Size and Share Forecast Outlook 2025 to 2035

Water-Soluble Retinol Market Size and Share Forecast Outlook 2025 to 2035

Alternatives For Injectable Diabetes Care Market Size and Share Forecast Outlook 2025 to 2035

Milk Alternatives Market – Growth, Demand & Dairy-Free Trends

Dairy Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cheese Alternatives Market Analysis - Size, Share, and Forecast 2025 to 2035

Carmine Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Fish Oil Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Marine Squalene Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Demand for Dairy Alternatives in the EU Size and Share Forecast Outlook 2025 to 2035

Sustainable Glycerin Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Carcinogenic Chemical Alternatives Market

Plant-Derived Ceramide Alternatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA