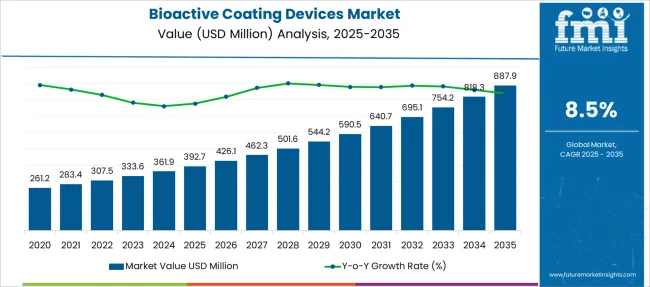

The Bioactive Coating Devices Market is estimated to be valued at USD 392.7 million in 2025 and is projected to reach USD 887.9 million by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period.

| Metric | Value |

|---|---|

| Bioactive Coating Devices Market Estimated Value in (2025 E) | USD 392.7 million |

| Bioactive Coating Devices Market Forecast Value in (2035 F) | USD 887.9 million |

| Forecast CAGR (2025 to 2035) | 8.5% |

The bioactive coating devices market is experiencing consistent expansion due to increasing demand for advanced implantable devices that reduce infection risk and improve biocompatibility. The growing prevalence of chronic diseases and the rise in surgical interventions have intensified the need for coatings that enhance the functionality and safety of medical devices.

Innovations in surface modification technologies and material science are enabling the development of coatings that actively promote tissue integration, reduce microbial colonization, and enhance healing outcomes. Additionally, the healthcare sector's shift toward value-based care and reduced postoperative complications is further supporting the integration of bioactive coatings.

With heightened regulatory focus on patient safety and infection control, the market is expected to witness sustained growth as manufacturers prioritize coatings that optimize device performance and clinical outcomes.

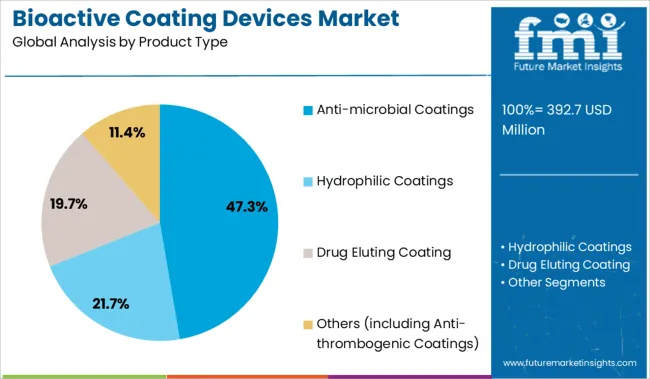

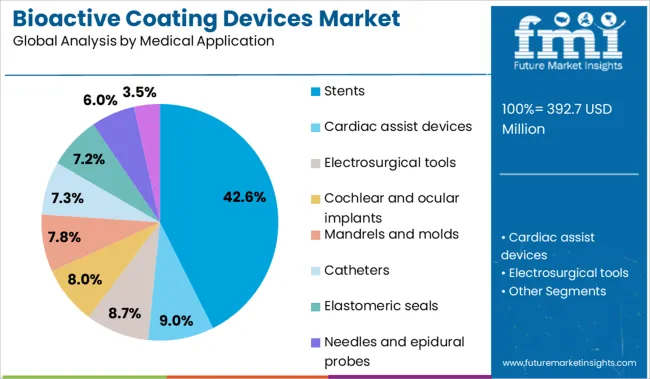

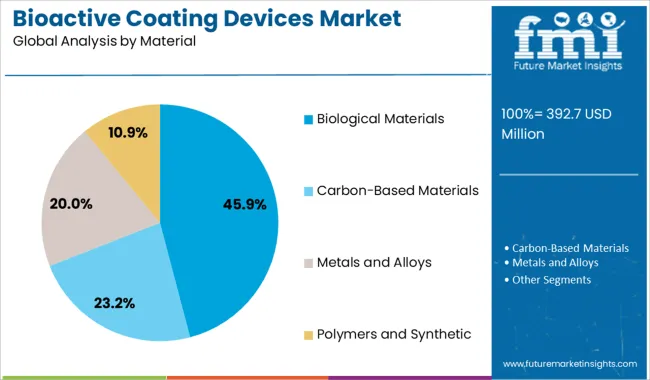

The market is segmented by Product Type, Medical Application, Material, and End User and region. By Product Type, the market is divided into Anti-microbial Coatings, Hydrophilic Coatings, Drug Eluting Coating, and Others (including Anti-thrombogenic Coatings). In terms of Medical Application, the market is classified into Stents, Cardiac assist devices, Electrosurgical tools, Cochlear and ocular implants, Mandrels and molds, Catheters, Elastomeric seals, Needles and epidural probes, and Medical electronics. Based on Material, the market is segmented into Biological Materials, Carbon-Based Materials, Metals and Alloys, and Polymers and Synthetic. By End User, the market is divided into Hospital, Diagnostics Centers, Ambulatory Surgical Centers, and Clinics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The anti microbial coatings segment is projected to represent 47.30% of total market revenue by 2025 within the product type category, making it the dominant segment. This growth is driven by the increasing need to prevent device related infections in surgical settings and long term implantations.

Anti microbial coatings inhibit the growth of harmful microorganisms on device surfaces, thereby reducing the risk of postoperative complications and hospital acquired infections. These coatings have gained preference in a range of devices including catheters, implants, and orthopedic tools due to their ability to maintain sterility and enhance patient outcomes.

The rising incidence of antimicrobial resistance has also prompted the use of coatings as a preventive strategy rather than relying solely on systemic antibiotics. As a result, this segment continues to lead in terms of adoption and innovation.

Within the medical application category, the stents segment is expected to account for 42.60% of total revenue by 2025, positioning it as the leading application. The dominance of this segment is attributed to the critical role of bioactive coatings in improving the biocompatibility and performance of cardiovascular and peripheral stents.

These coatings facilitate endothelialization, reduce restenosis rates, and prevent thrombosis, making them essential in interventional cardiology. As minimally invasive procedures become more prevalent, demand for coated stents has grown significantly due to their ability to extend device longevity and minimize complications.

Technological advancements in drug eluting and biodegradable stents have further increased the relevance of bioactive coatings in enhancing treatment efficacy, thereby consolidating the leadership of this application segment.

In terms of material, biological materials are projected to capture 45.90% of total market revenue by 2025, making it the most utilized category. The preference for biological materials stems from their inherent biocompatibility, biofunctionality, and reduced immunogenic response.

These materials support the body’s natural healing processes and are frequently used in coatings that promote cell adhesion, proliferation, and differentiation. Their application spans across orthopedic implants, tissue scaffolds, and vascular devices, where biological integration is crucial.

Continuous research into collagen, fibrin, and other biologically derived substrates is enhancing the performance and safety profile of bioactive coatings. Given the clinical advantages and increasing adoption in regenerative medicine, biological materials are expected to maintain a leading position in the material segment.

The growing number of hip and knee implant procedures among the obese and elderly population is expected to boost the revenue share of the bioactive coating devices industry during the forecast period. Furthermore, growing investment by leading market players to produce new and better technologically sophisticated products, as well as increased government spending to enhance healthcare infrastructure, is expected to boost industry share in the future years.

Bioactive coatings in implanted medical devices are being pushed forward by investments and research in specialized R&D in developed markets, growing academic interest in cell biology, and a greater emphasis on avoiding antimicrobial contamination to minimize antibiotic indiscriminate usage. Furthermore, the antimicrobial coatings sector may deliver significant gains to the bioactive coating device manufacturers throughout the study period.

Multiple manufacturers are shifting to produce antimicrobial coatings made up of compounds that prevent disease-causing bacteria from growing on a surface while also increasing corrosion resistance, durability, and attractiveness.

Furthermore, bioactive coating devices are gaining popularity due to their numerous advantages, including long-term disease protection, increased longevity, cost-effectiveness, enhanced health and cleanliness, and added infrastructure value.

On the other hand, stents are expected to show strong growth patterns in terms of product application, driven by the incidence of cardiovascular illnesses among the aging population. The bioactive coating on stents protects them from contamination and increases their durability, functioning, and life term, lowering the risk of corrective surgical treatments dramatically.

Due to the availability of modern equipment and qualified and certified medical staff, diagnostic centers may develop as a prominent end-use segment throughout the predicted timeframe. Furthermore, the growing need for better supervision and treatment, as well as enhanced healthcare infrastructure in these settings, are likely to promote revenue growth for key players.

Increased Medication Loading and Delivery to Aid in Unlocking New Opportunities

Implantable devices containing thin films of bioactive molecules are rapidly gaining momentum in the sectors of cardiology and orthopedic joint issues, which are now the two major causes of loss of quality of life and disability. To optimize medication loading and delivery, bioactive molecules are being used by bioactive coating device manufacturers to load and release a large number of material-bound components.

Rising Diseases to Boost the Demand

The increased prevalence of systemic joint disorders, cardiovascular implants, and support - all of which are a direct result of the world's rapidly aging population - are boosting the demand for bioactive coating devices.

Implantable devices containing thin films of bioactive molecules are rapidly gaining adoption in therapeutic areas of cardiology and orthopedic joint diseases - the two major sources of loss of quality of life and disability currently. Bioactive molecules are being used to load and release large number of material bound constituents for enhanced drug loading and delivery.

Generic factors such as increasing incidence of systemic joint diseases, cardiovascular implant and support - both a direct by-product of rapidly ageing global population are accelerating the demand for bioactive coating devices across the world.

Investments in niche R&D in developed markets, growing academic interest in cell biology, and greater focus on reduction of antimicrobial contamination in order to restrict indiscriminate usage of antibiotics - are factors promoting investments and research on bioactive coatings in implantable medical devices.

Barriers of bioactive coating devices market include high probability of loss of effectiveness of the bioactive coating when they come in contact with external physiological environment, finite reservoir of bioactive agents and less number of possible applications presently.

Other hurdles include lack of research awareness, high requirement for funding for continued research and less developed research infrastructure in middle and low income countries among others.

The global bioactive coating devicesmarket is expected to expand at healthy CAGR owing to increasing in the adoption of anti-microbial coatings medical device coatings market, of the products across the world. Among end users, hospital end user segment is expected to account for maximum share due to requirement of advanced healthcare infrastructure and surgical devices.

Geographically, the global bioactive coating devicesmarket is classified into regions namely, North America, Latin America, Western Europe, Eastern Europe, Asia-Pacific, Japan, Middle East and Africa. Among all the regions, North America will continue to lead the global market for bioactive coating devicesmarket due to high purchasing power.

Asia- Pacific is expected to account for second largest share in global market primarily due to low grade medical devices which gets effected by the high concentrated chemical , and adulteration in metals used in prepare the medical devices. Regional overview can be a directly proportional to the usage of medical devices.

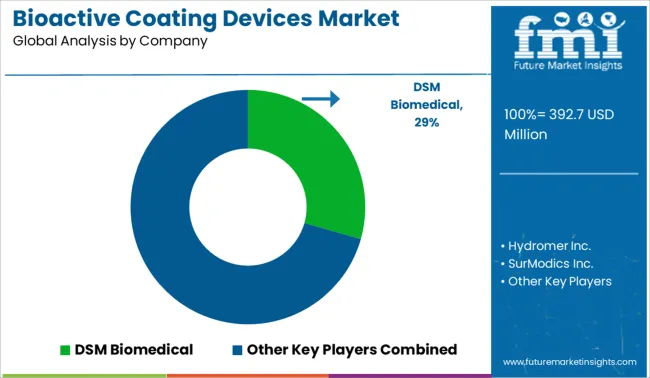

Key players operating in the global bioactive coating devices market are DSM Biomedical, Hydromer Inc., SurModics Inc., Biocoat Inc., AST Products Inc., Specialty Coatings Systems Inc., and others

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies.

The research report provides analysis and information according to categories such as market segments, geographies, type of product and applications.

The global bioactive coating devices market is estimated to be valued at USD 392.7 million in 2025.

The market size for the bioactive coating devices market is projected to reach USD 887.9 million by 2035.

The bioactive coating devices market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in bioactive coating devices market are anti-microbial coatings, hydrophilic coatings, drug eluting coating and others (including anti-thrombogenic coatings).

In terms of medical application, stents segment to command 42.6% share in the bioactive coating devices market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bioactive Bone Grafts Market Size and Share Forecast Outlook 2025 to 2035

Bioactive Retinol Alternatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bioactive Ingredient Market Growth – Functional Nutrition & Industry Trends 2025 to 2035

Bioactive Compounds In Coffee Market

Bioactive Proteins in Coffee Market

Skin Bioactive Market Analysis - Trends, Growth & Forecast 2025 to 2035

Botanical Bioactives Market Size and Share Forecast Outlook 2025 to 2035

Coating Pretreatment Market Size and Share Forecast Outlook 2025 to 2035

Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Coating Auxiliaries Market Size and Share Forecast Outlook 2025 to 2035

Coatings and Application Technologies for Robotics Market Outlook – Trends & Innovations 2025-2035

Coating Additives Market Growth – Trends & Forecast 2025 to 2035

Coating Thickness Gauge Market

Coating Thickness Measurement Instruments Market

AR Coating Liquid Market Size and Share Forecast Outlook 2025 to 2035

UV Coatings Market Growth & Forecast 2025 to 2035

2K Coatings Market Growth – Trends & Forecast 2025 to 2035

Coil Coatings Market Size and Share Forecast Outlook 2025 to 2035

Nano Coating Market Size and Share Forecast Outlook 2025 to 2035

Wood Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA