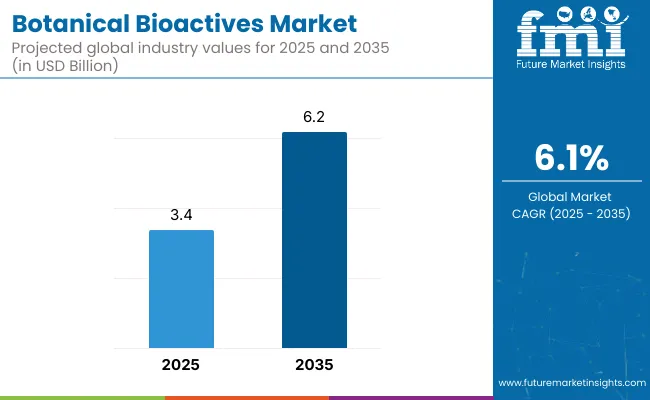

The global botanical bioactives market is projected to reach USD 3.4 billion in 2025 and USD 6.2 billion in 2035, marking an absolute growth of USD 2.78 billion over the decade. This expansion reflects a CAGR of 6.1% and represents a 1.81x increase in market value.

Botanical Bioactives Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 3.4 billion |

| Market Forecast Value in (2035F) | USD 6.2 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

Between 2025 and 2030, market size is expected to rise from USD 3.4 billion to approximately USD 4.56 billion, contributing USD 1.12 billion, or around 40% of the total decade growth. This phase is anticipated to be driven by heightened consumer demand for natural health-enhancing products, increasing clinical validation of plant-derived compounds, and wider adoption in nutraceutical, functional food, and personal care segments.

In the latter half of the forecast period (2030-2035), the market is forecast to accelerate from USD 4.56 billion to USD 6.2 billion, contributing USD 1.66 billion, or 60% of the total growth. Growth momentum during this stage is expected to be supported by regulatory alignment in key markets, innovations in extraction and formulation technologies, and stronger supply-chain traceability programs that enhance product quality and consumer trust. Emerging economies in Asia-Pacific and Latin America are projected to account for a rising share of demand as local production capacity expands and consumer awareness increases.

Regional diversification, bioavailability-enhanced delivery systems, and integration of botanical bioactives into condition-specific health solutions are anticipated to reshape competitive strategies. Premium-positioned products with verified efficacy, clean-label credentials, and sustainability certifications are expected to capture a disproportionate share of incremental value. By 2035, the market landscape is projected to be characterized by consolidation among vertically integrated players, higher compliance standards, and an expanded role for science-backed marketing in driving consumer adoption.

From 2020 to 2024, the botanical bioactives market expanded steadily, driven by increasing demand for plant-derived compounds in nutraceutical, functional food, and personal care applications. During this period, the competitive landscape was dominated by vertically integrated botanical extract manufacturers, controlling most of the global supply through proprietary cultivation, extraction, and standardization processes. Leading players such as Indena S.p.A., Naturex, and Sabinsa Corporation strengthened positions by investing in traceability programs, clinical validation studies, and region-specific formulation partnerships.

In 2025, the market is expected to reach USD 3.4 billion, with the revenue mix increasingly influenced by high-purity standardized extracts and bioavailability-enhanced delivery formats. Over the forecast period, the share of premium, clinically supported products is projected to rise as regulatory scrutiny intensifies across key markets. This shift is anticipated to benefit companies with strong R&D pipelines, robust quality assurance systems, and multi-origin sourcing networks.

By 2035, demand is forecast to reach USD 6.2 billion, with Asia-Pacific and Europe accounting for a growing portion of incremental revenue. Competitive advantage is projected to depend less on raw extraction capacity and more on ecosystem capabilities integrating supply chain transparency, data-backed health claims, and scalable formulation technologies. Emerging entrants specializing in condition-specific bioactive blends, sustainable cultivation, and novel extraction techniques are expected to capture share from incumbents, reinforcing the market’s transition toward science-driven, premium-positioned botanical solutions.

Growth in the botanical bioactives market is being driven by increasing consumer preference for plant-derived health solutions supported by clinical validation and clean-label positioning. Rising demand in dietary supplements and nutraceuticals is being reinforced by expanding awareness of preventive healthcare and natural ingredient efficacy. Regulatory frameworks in key markets are being aligned to Favor standardized extracts with verifiable bioactive content, enabling higher trust and premium pricing.

Advances in extraction technologies, including green solvents and process intensification, are improving yield, purity, and cost efficiency, supporting scalability. Supply chain traceability, enabled through DNA barcoding and isotope analysis, is being adopted to assure authenticity and mitigate adulteration risks. Integration into functional foods, cosmetics, and pharmaceutical formulations is broadening the application base. Strategic investment in R&D for condition-specific formulations, combined with sustainability-focused sourcing, is expected to create long-term value and sustain above-average growth rates across both developed and emerging markets.

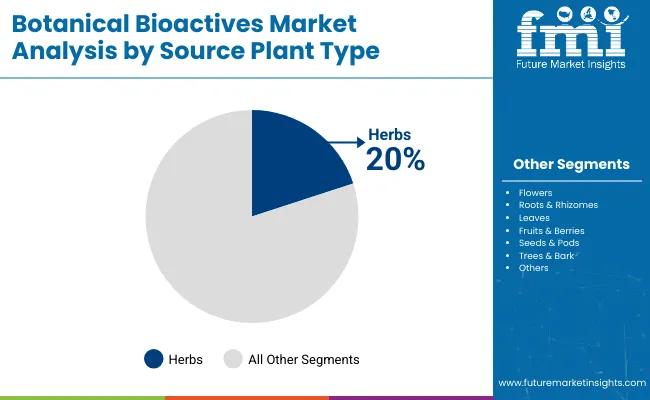

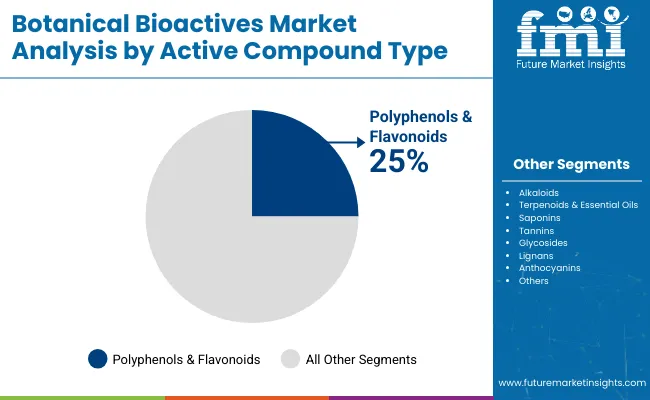

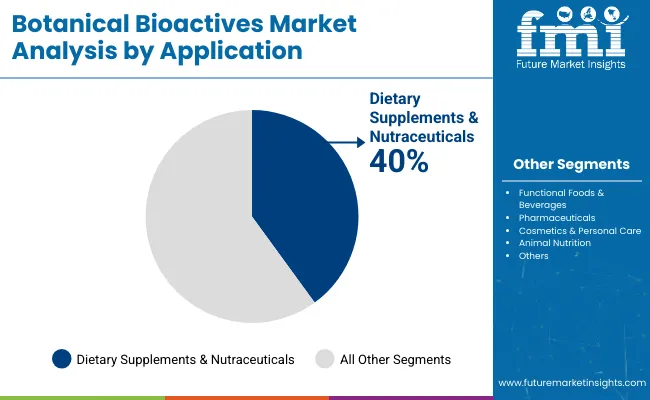

The botanical bioactives market is segmented by source plant type, active compound type, application, and region. Source plant types include herbs, flowers, roots & rhizomes, leaves, fruits & berries, seeds & pods, and trees & bark each providing unique bioactive profiles for targeted applications. Active compound segmentation covers polyphenols & flavonoids, alkaloids, terpenoids & essential oils, saponins, tannins, glycosides, lignans, and anthocyanins, reflecting the diversity of functional benefits.

Applications span dietary supplements & nutraceuticals, functional foods & beverages, pharmaceuticals, cosmetics & personal care, and animal nutrition, driven by growing demand for natural health-enhancing solutions. Regionally, the market scope encompasses North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa, with Asia-Pacific emerging as a high-growth region due to expanding production capabilities and rising consumer awareness. This segmentation framework enables targeted growth strategies, aligns R&D priorities with market demand, and supports value chain optimization.

Source Plant Type Market Value Share, 2025

| Segment | 2025 Share% |

|---|---|

| Herbs | 20% |

| Flowers | 10% |

| Roots & Rhizomes | 18% |

| Leaves | 15% |

| Fruits & Berries | 15% |

| Seeds & Pods | 8% |

| Trees & Bark | 14% |

| Total | 100% |

| Segment | CAGR (2025 to 2035) |

|---|---|

| Herbs | 8.90% |

| Flowers | 8.70% |

| Roots & Rhizomes | 9.10% |

| Leaves | 9.20% |

| Fruits & Berries | 9.30% |

| Seeds & Pods | 8.80% |

| Trees & Bark | 8.60% |

The source plant type segment is expected to be dominated by herbs, driven by their widespread medicinal and nutritional applications. Growing consumer interest in natural wellness products is anticipated to strengthen demand for herbal bioactive. Roots, leaves, and fruits are projected to follow closely, supported by expanding use in dietary supplements, functional foods, and cosmetics.

The diversity of plant sources allows for targeted bioactive extraction, fostering innovation in product development. Rising cultivation of bioactive-rich botanicals and investments in advanced extraction technologies are expected to expand supply capabilities. With rising regulatory support for herbal ingredients and expanding functional benefits, the herbs segment is poised to sustain leadership throughout the forecast period.

Active Compound Type Market Value Share, 2025

| Segment | 2025 Share% |

|---|---|

| Polyphenols & Flavonoids | 25% |

| Alkaloids | 10% |

| Terpenoids & Essential Oils | 12% |

| Saponins | 12% |

| Tannins | 10% |

| Glycosides | 10% |

| Lignans | 8% |

| Anthocyanins | 13% |

| Total | 100% |

| Segment | CAGR (2025 to 2035) |

|---|---|

| Polyphenols & Flavonoids | 9.20% |

| Alkaloids | 8.80% |

| Terpenoids & Essential Oils | 8.90% |

| Saponins | 9.00% |

| Tannins | 8.70% |

| Glycosides | 8.90% |

| Lignans | 8.60% |

| Anthocyanins | 9.10% |

The active compound type segment is anticipated to be led by polyphenols & flavonoids, given their strong antioxidant properties and extensive applications in nutraceutical, cosmetic, and pharmaceutical formulations. Increasing clinical research validating their health benefits is likely to accelerate market adoption. Other key compounds such as terpenoids, saponins, and anthocyanins are projected to witness robust growth, driven by their role in anti-inflammatory, antimicrobial, and cardiovascular health products.

Advancements in extraction purity and bioavailability enhancement technologies are expected to improve efficacy, driving demand further. Strategic partnerships between botanical suppliers and end-product manufacturers are anticipated to fuel targeted formulation development. Overall, polyphenols are positioned to remain a central driver of innovation in botanical bioactive markets.

Application Market Value Share, 2025

| Segment | 2025 Share% |

|---|---|

| Dietary Supplements & Nutraceuticals | 40% |

| Functional Foods & Beverages | 25% |

| Pharmaceuticals | 15% |

| Cosmetics & Personal Care | 12% |

| Animal Nutrition | 8% |

| Total | 100% |

| Segment | CAGR (2025 to 2035) |

|---|---|

| Dietary Supplements & Nutraceuticals | 9.10% |

| Functional Foods & Beverages | 9.40% |

| Pharmaceuticals | 8.90% |

| Cosmetics & Personal Care | 9.00% |

| Animal Nutrition | 8.70% |

The application segment is forecasted to be dominated by dietary supplements & nutraceuticals, reflecting a global shift towards preventive healthcare and wellness-oriented consumption. Consumer preference for plant-based, clean-label products is anticipated to sustain high growth in this category. Functional foods and beverages are projected to expand rapidly, driven by demand for fortified products with added health benefits.

Pharmaceutical applications continue to grow steadily, supported by the integration of botanical bioactive in complementary medicine. The cosmetics segment is expected to leverage the rising trend of natural beauty formulations. As awareness of bioactive health benefits strengthens, cross-sector adoption is likely to accelerate, positioning dietary supplements as the most influential demand driver in the coming decade.

Evolving consumer preferences for natural health solutions, regulatory alignment favouring standardized extracts, and clinical validation are driving botanical bioactives adoption, even as supply chain constraints and raw material cost fluctuations present operational and strategic challenges for industry stakeholders.

Rising Demand for Clinically Validated Natural IngredientsMarket expansion is being propelled by increasing consumer trust in botanical bioactives supported by peer-reviewed clinical studies and regulatory-compliant health claims. Scientific validation is enabling premium pricing, stronger brand differentiation, and deeper penetration into regulated categories such as pharmaceuticals and fortified foods. Regulatory frameworks in key markets are aligning to reward manufacturers with standardized actives, traceable sourcing, and robust safety data.

Investments in bioavailability enhancement and targeted formulations are strengthening value propositions, making clinically validated botanical ingredients a critical growth lever. The driver is expected to remain influential as healthcare systems and consumers increasingly prioritize preventive and functional nutrition.

Supply Chain Volatility and Raw Material Risks Growth is being constrained by vulnerability to climatic fluctuations, geopolitical disruptions, and agricultural yield variability affecting botanical ingredient supply chains. Shortages or quality inconsistencies in high-demand plants, such as ginseng or turmeric, can disrupt production schedules, inflate procurement costs, and erode margins.

Compliance with increasingly stringent quality and sustainability requirements is adding complexity to sourcing strategies, especially for multi-origin supply networks. Without investment in controlled cultivation, vertical integration, and climate-resilient agriculture, dependency on volatile supply chains is projected to limit scalability and challenge market stability, particularly in regions heavily reliant on seasonal harvest cycles.

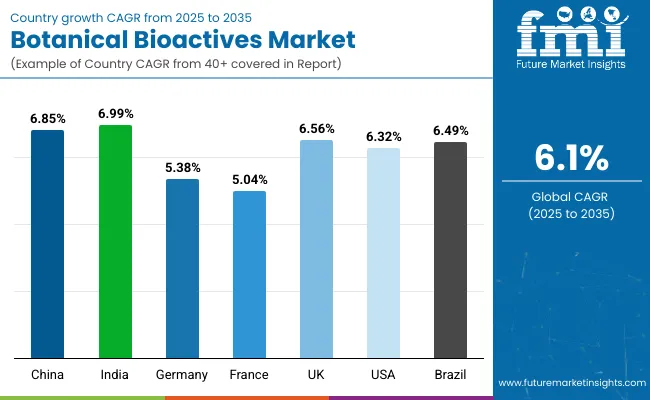

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 6.85% |

| India | 6.99% |

| Germany | 5.38% |

| France | 5.04% |

| UK | 6.56% |

| USA | 6.32% |

| Brazil | 6.49% |

The global botanical bioactives market demonstrates marked regional variation in growth patterns, shaped by dietary supplement penetration, functional food adoption, and evolving regulatory frameworks. Asia-Pacific is projected to be the fastest-growing region, led by China at a CAGR of 6.0% and India at 5.96%.

China’s expansion is expected to be supported by large-scale production ecosystems, extensive cultivation of medicinal plants, and government-backed initiatives promoting standardized herbal products for both domestic and export markets. India’s growth is anticipated to be reinforced by rising investment in nutraceutical manufacturing, increasing adoption of clinically validated botanicals, and diversification of agricultural outputs into high-value medicinal crops.

Europe is forecast to sustain a strong growth profile, with Germany, France, and the UK benefiting from stringent product safety regulations, clean-label consumer demand, and active R&D pipelines for condition-specific bioactive formulations. Regulatory alignment under EU directives is anticipated to Favor standardized, traceable, and sustainably sourced botanical ingredients, maintaining the region’s premium positioning.

North America is expected to record steady expansion, led by the USA, driven by the mainstreaming of plant-based supplements, expansion of functional food portfolios, and integration of botanical actives into sports nutrition and personal care categories. Growth in this region is projected to be service-oriented, with increasing emphasis on product innovation, compliance testing, and brand differentiation through clinical evidence.

| Year | USABotanical Bioactives Market (USD Billion) |

|---|---|

| 2025 | 824.54 |

| 2026 | 880.5 |

| 2027 | 928.6 |

| 2028 | 993.1 |

| 2029 | 1,060.1 |

| 2030 | 1,127.5 |

| 2031 | 1,197.8 |

| 2032 | 1,258.9 |

| 2033 | 1,337.3 |

| 2034 | 1,417.2 |

| 2035 | 1,495.1 |

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 | 5.86% |

| 2026 | 6.79% |

| 2027 | 5.46% |

| 2028 | 6.95% |

| 2029 | 6.74% |

| 2030 | 6.36% |

| 2031 | 6.23% |

| 2032 | 5.11% |

| 2033 | 6.2% |

| 2034 | 5.98% |

| 2035 | 5.50% |

The USA botanical bioactives market is projected to grow at a CAGR of 6.1%, driven by expanding adoption in nutraceuticals, functional foods, and premium personal care formulations. Rising consumer demand for clinically validated plant-based health solutions is creating opportunities for innovation in bioavailability enhancement, condition-specific formulations, and clean-label product lines. Regulatory scrutiny and labelling compliance are expected to strengthen trust in domestically produced botanical actives, further supporting premium positioning.

Pharmaceutical applications are anticipated to gain traction as standardized extracts are increasingly integrated into complementary health therapies. Functional beverages and fortified snacks featuring botanical actives are expected to expand retail penetration, driven by wellness-focused consumer lifestyles. The personal care sector is forecast to integrate more antioxidant-rich and anti-inflammatory botanical ingredients into skincare and haircare ranges.

The UK botanical bioactives market is projected to experience steady growth, supported by rising consumer demand for plant-based supplements and fortified food products. Regulatory alignment under UK food safety and supplement laws is expected to strengthen market confidence. The clean-label trend is anticipated to drive innovation, with manufacturers investing in organic certifications and sustainable sourcing. Premiumization is forecast to remain a key growth lever, with brands differentiating through clinically supported claims and targeted health benefits.

| Countries / Subregion | 2025 |

|---|---|

| UK | 20.95% |

| Germany | 21.81% |

| Italy | 9.91% |

| France | 12.19% |

| Spain | 10.63% |

| BENELUX | 6.13% |

| Nordic | 5.46% |

| Rest of Europe | 13% |

| Total | 100% |

| Country / Subregion | 2035 |

|---|---|

| UK | 18.40% |

| Germany | 20.26% |

| Italy | 11.66% |

| France | 13.04% |

| Spain | 10.28% |

| BENELUX | 5.45% |

| Nordic | 5.07% |

| Rest of Europe | 16% |

| Total | 100% |

India’s botanical bioactives market is projected to expand at a healthy pace, driven by its strong medicinal plant heritage and growing nutraceutical sector. Ayurveda-based formulations are expected to gain wider acceptance in export markets due to improved standardization and regulatory compliance. Domestic demand is anticipated to rise as awareness of preventive health and immunity-boosting products increases. Investment in controlled cultivation and processing infrastructure is likely to enhance quality consistency.

China’s botanical bioactives market is forecast to remain one of the fastest-growing globally, driven by extensive cultivation capacity, government support for traditional medicine modernization, and strong domestic demand. Integration of botanical extracts into functional foods, beverages, and cosmetics is expected to accelerate. Investment in advanced extraction technologies is likely to improve yield and purity. Export competitiveness is anticipated to rise through stricter quality control and certification programs.

Germany’s botanical bioactives market is expected to benefit from stringent quality regulations, a strong herbal medicine tradition, and a high level of consumer trust in plant-based health solutions. Pharmaceutical-grade botanical extracts are anticipated to see steady demand in both domestic and export markets. Growth in functional food and dietary supplement categories is projected to be driven by clinically validated claims and sustainable sourcing initiatives.

| Japan Source Plant Type | 2025 Share% |

|---|---|

| Herbs (e.g., Ginseng, Echinacea) | 21% |

| Flowers (e.g., Chamomile, Hibiscus) | 10% |

| Roots & Rhizomes (e.g., Turmeric, Ginger) | 18% |

| Leaves (e.g., Green Tea, Moringa) | 16% |

| Fruits & Berries (e.g., Goji, Acai) | 15% |

| Seeds & Pods (e.g., Fenugreek, Cardamom) | 7% |

| Trees & Bark (e.g., Willow Bark, Cinnamon) | 13% |

| Total | 100% |

| Japan Source Plant Type | CAGR (2025 to 2035) |

|---|---|

| Herbs (e.g., Ginseng, Echinacea) | 8.80% |

| Flowers (e.g., Chamomile, Hibiscus) | 8.60% |

| Roots & Rhizomes (e.g., Turmeric, Ginger) | 9.00% |

| Leaves (e.g., Green Tea, Moringa) | 9.10% |

| Fruits & Berries (e.g., Goji, Acai) | 9.20% |

| Seeds & Pods (e.g., Fenugreek, Cardamom) | 8.70% |

| Trees & Bark (e.g., Willow Bark, Cinnamon) | 8.50% |

The botanical bioactives market in Japan is projected at USD 250 million in 2025. Herbs dominate with a 21% share, supported by established demand in traditional medicine and modern nutraceutical formulations. Roots & rhizomes hold 18%, driven by turmeric and ginger’s integration into functional beverages and supplements. Fruits & berries, growing at the highest CAGR of 9.20%, are benefiting from rising interest in antioxidant-rich and immunity-enhancing ingredients.

Government-backed Food for Specified Health Uses (FOSHU) approvals are accelerating adoption of clinically validated botanical extracts. Japanese manufacturers are focusing on traceable sourcing, bioavailability enhancement, and scientific validation to sustain consumer trust. Expansion into convenience-oriented formats and fortified daily-use products is expected to further strengthen market penetration.

| S Korea Active Compound Type | 2025 Share% |

|---|---|

| Polyphenols & Flavonoids | 26% |

| Alkaloids | 9% |

| Terpenoids & Essential Oils | 13% |

| Saponins | 12% |

| Tannins | 10% |

| Glycosides | 10% |

| Lignans | 8% |

| Anthocyanins | 12% |

| Total | 100% |

| S Korea Active Compound Type | CAGR (2025 to 2035) |

|---|---|

| Polyphenols & Flavonoids | 9.10% |

| Alkaloids | 8.70% |

| Terpenoids & Essential Oils | 8.80% |

| Saponins | 8.90% |

| Tannins | 8.60% |

| Glycosides | 8.80% |

| Lignans | 8.50% |

| Anthocyanins | 9.00% |

The Botanical Bioactive Market in South Korea is projected to be valued at USD 400 million in 2025. Polyphenols & flavonoids hold the largest share at 26%, reflecting their well-documented antioxidant, anti-inflammatory, and cardiovascular benefits. These compounds are expected to remain integral to functional foods, beverages, and cosmeceuticals, as Korean manufacturers prioritize plant-based formulations with scientifically validated health claims. The expanding integration of botanical actives into K-Beauty skincare and functional nutrition formats is projected to reinforce their market dominance.

Strong growth is anticipated in anthocyanins (12% share, 9.0% CAGR) and saponins (12% share, 8.9% CAGR), driven by their dual applicability in health and cosmetic formulations. Functional claims targeting skin radiance, immune resilience, and metabolic health are expected to gain traction, as regulatory bodies increasingly demand standardized quality documentation and safety profiles. The convergence of nutraceutical and cosmeceutical sectors in South Korea is projected to accelerate demand for these compounds, particularly in premium product lines that combine efficacy with clean-label positioning.

Digital health platforms and personalized nutrition services are expected to further propel targeted botanical bioactive adoption, leveraging consumer health data to recommend ingredient-specific regimens. Supply-side advancements in extraction technologies, coupled with blockchain-enabled traceability, are anticipated to secure consistent quality and improve consumer trust. Over the forecast period, competitive positioning is likely to hinge on the ability to deliver bioactive with proven bioavailability, stability in diverse formulations, and sustainability credentials aligned with South Korea’s eco-conscious consumer base.

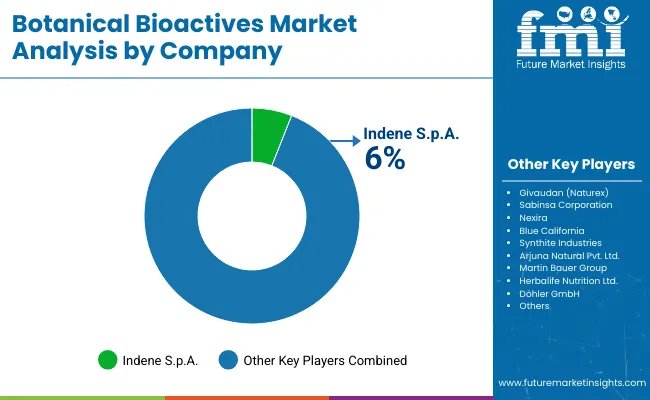

The Botanical Bioactive Market is moderately fragmented, with multinational ingredient producers, mid-sized specialists, and regional extract innovators competing across functional food, nutraceutical, cosmetic, and pharmaceutical applications. Global leaders such asGivaudan (Naturex), Sabinsa Corporation, and Indena S.p.A. are recognized for high-quality, standardized botanical actives supported by robust clinical evidence and strong regulatory compliance. Their strategies are increasingly focused on sustainable sourcing, advanced extraction technologies, and bioavailability-enhancing delivery systems to meet evolving consumer and regulatory demands.

Established mid-sized players, including Nexira, Blue California, and Synthite Industries, are enhancing competitiveness through targeted innovation in antioxidant-rich, adaptogenic, and skin-health-focused compounds. These companies are expanding partnerships with brand owners to co-develop science-backed formulations tailored for emerging wellness categories.

Specialized regional suppliers focus on niche bioactive or traditional botanicals with heritage value, leveraging unique terroirs and cultivation expertise. Their differentiation is rooted in customization, transparent traceability, and strong alignment with clean-label and sustainability trends.

Competitive advantage in this market is expected to shift from price-led procurement toward innovation-led value, where integrated supply chains, clinical substantiation, and eco-responsible operations define leadership. Subscription-based R&D collaborations, personalized nutrition alignment, and biotech-enabled bioactive production are projected to further transform market positioning over the forecast period.

Key Developments in Botanical Bioactive Market

| Item | Value |

|---|---|

| Quantitative Units | USD 3.4 billion (2025) - USD 6.2 billion (2035) |

| Component | Polyphenols & Flavonoids, Alkaloids, Terpenoids & Essential Oils, Saponins, Tannins, Glycosides, Lignans, Anthocyanins |

| Range | Low-potency extracts, Medium-standardized extracts, High-purity bioactive concentrates |

| Technology | Solvent extraction, Supercritical CO₂ extraction, Enzymatic extraction, Ultrasonic-assisted extraction, Fermentation-derived actives |

| Type | Standardized extracts, Powdered bioactive, Liquid concentrates, Encapsulated actives |

| End-use Industry | Functional foods & beverages, Nutraceuticals, Cosmetics & personal care, Pharmaceuticals, Animal nutrition |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea |

| Key Companies Profiled | Givaudan (Naturex), Sabinsa Corporation, Indena S.p.A., Nexira, Blue California, Synthite Industries, Arjuna Natural Pvt. Ltd., Martin Bauer Group, Herbalife Nutrition Ltd., Döhler GmbH |

| Additional Attributes | Dollar sales by active compound type and end-use sector, adoption trends in preventive health and clean-label cosmetics, rising demand for antioxidant and anti-inflammatory actives, sector-specific growth in nutraceuticals and functional beverages, bioavailability and delivery-system innovation, regulatory harmonization trends, sustainability-linked sourcing models, integration with personalized nutrition and AI-based formulation design |

The global Botanical Bioactive Market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the Botanical Bioactive Market is projected to reach USD 6.2 billion by 2035.

The Botanical Bioactive Market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key active compound types in the Botanical Bioactive Market are Polyphenols & Flavonoids, Alkaloids, Terpenoids & Essential Oils, Saponins, Tannins, Glycosides, Lignans, and Anthocyanins.

In terms of active compound type, Polyphenols & Flavonoids are expected to command 26% share in the Botanical Bioactive Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Botanical Flavors Market Size and Share Forecast Outlook 2025 to 2035

Botanical Extracts Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Botanical Ingredient Business

Botanical CO2 Extracts Market Analysis by Cranberry Seed, Blackcurrant, Oat, Carrot, and Rice Bran through 2035.

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Botanical Sugar Market Analysis by product type, application and by region - Growth, trends and forecast from 2025 to 2035

Botanical Packaging Market Analysis & Future Outlook 2024 to 2034

Food Botanicals Market Outlook – Growth, Demand & Forecast 2024 to 2034

Fermented Botanicals for Anti-Aging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA