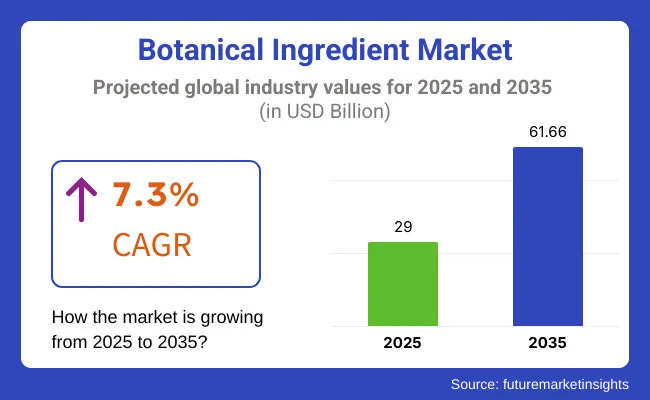

The global botanical ingredient market is expected to reach USD 61.66 billion by 2035, registering a CAGR of 7.3% during the forecast period. The market is valued at USD 29.00 billion in 2025. Herbs & spices will dominate the ingredient category with a 44% share, while dried plants will account for 70% share of the form segment in 2025.

Health-focused consumer preferences and clean-label transparency have been driving the demand for botanical ingredients. As manufacturers increasingly adopt these natural components across food, beverages, dietary supplements, and cosmetics, their applications are being expanded to cover multiple product categories. In particular, the food and beverage sector is witnessing high usage of botanical ingredients as natural colorants, preservatives, and flavor enhancers.

Rising interest in organic and plant-based lifestyles has further encouraged the use of botanical extracts that are perceived as safer and more environmentally friendly alternatives to synthetic inputs. With consumer trust in traditional herbal remedies growing, brands are enhancing product lines using botanicals that offer immunity-boosting, anti-inflammatory, and antioxidant benefits.

The growth is also being supported by technological advancements in extraction and processing, which are enhancing ingredient bioavailability and potency. The shift toward preventive healthcare and wellness has widened the use of botanicals in supplements aimed at anxiety, obesity, and vascular health.

Global brands are expanding production capabilities, while smaller firms are finding niche success in regional markets. Overall, market momentum remains strong, with both consumer demand and regulatory acceptance favoring botanical inputs across personal care, pharmaceuticals, and food industries.

The global botanical ingredient market has been analyzed across a comprehensive set of segments to evaluate investment hotspots from 2025 to 2035. Key segmentation categories include ingredient type (herbs & spices, fruits, flowers, leaves, others), form (dried plants, liquid extracts, oils, powders).

Each of these segments presents distinct growth opportunities, shaped by consumer preferences, regulatory trends, and regional dynamics. By region, the market has been segmented into North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa, with China emerging as the fastest-growing country through 2035.

Herbs & spices are expected to dominate the botanical ingredient market in 2025, capturing a 44% share due to their broad applicability across food, beverage, and pharmaceutical sectors. Their health-enhancing properties-such as antioxidant, anti-inflammatory, and digestive benefits-make them highly attractive for manufacturers focused on natural and functional product development.

Dried plants are projected to lead the form segment in 2025, accounting for 70% of the total market share. Their extended shelf life, ease of processing, and compatibility with various applications have positioned them as the most widely adopted form across industries.

The botanical ingredient market is witnessing diverse growth trajectories across key regions. China stands out as the fastest-growing market with a projected CAGR of 8.1%, driven by rich biodiversity, strong export capacity, and a robust traditional medicine sector. The United States, with a 6.0% CAGR, continues to lead in terms of market size due to widespread adoption in functional foods, supplements, and clean-label personal care.

France (5.6%) and the UK (5.1%) are gaining momentum as eco-conscious consumers increasingly prefer botanical-based solutions. Germany, growing at 4.8%, benefits from strong demand in skincare and certified herbal supplements, while Japan, despite a modest 2.8% CAGR, maintains a premium-focused market led by quality and innovation in aging-care and wellness products.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 6.0% |

| United Kingdom | 5.1% |

| France | 5.6% |

| Germany | 4.8% |

| Japan | 2.8% |

The US botanical ingredients market continues to thrive on the back of clean-label trends and rising demand for plant-based wellness. Functional beverages, botanical supplements, and natural cosmetics are leading product categories.

Demand for botanical ingredient in United Kingdom is experiencing strong growth due to rising demand for plant-based nutrition and sustainable skincare. E-commerce and private labels are actively promoting clean botanical solutions.

France botanical ingredient market is witnessing increased use of botanical ingredients in both gourmet foods and skincare. Domestic and EU-based brands are actively launching clean-label offerings.

Germany botanical ingredient sales remains a regulated, eco-conscious market with strong demand in personal care and herbal supplements. Consumers prefer products with EU organic certification and ingredient traceability.

Japan’s market grows slowly but steadily, backed by quality-focused innovation and an aging population’s need for preventive health solutions.

The global botanical ingredient market is structured across three tiers, with Tier 1 players dominating global operations through broad product portfolios, advanced processing technologies, and extensive distribution capabilities. These leading firms are heavily investing in R&D to develop high-purity, standardized extracts and are forming strategic alliances to expand reach in emerging markets. Partnerships with food and personal care brands are being leveraged to launch novel applications and secure long-term supply contracts.

Tier 2 players maintain strong regional presence and influence, particularly in North America and Europe. While not as globally expansive as Tier 1 firms, these companies offer technologically capable solutions and adhere to regional regulatory norms. Many Tier 2 manufacturers are scaling operations through private label collaborations and niche product innovation, especially in dietary supplements and natural cosmetics.

Tier 3 companies typically operate in localized ecosystems, supplying niche botanicals to traditional medicine and organic product markets. These players often focus on specific plants or extraction formats and are increasingly visible on e-commerce platforms. Their growth is shaped by regional consumer trends, especially in Asia and Latin America.

Leading manufacturers in this space include Archer Daniels Midland Company, Koninklijke DSM NV, Givaudan, Döhler GmbH, Martin Bauer Group, Bell Flavors & Fragrances, International Flavors & Fragrances Inc., NutraSorb LLC, and Botanical Ingredients Ltd. These companies are actively expanding their botanical sourcing capabilities and product formulations to meet growing demand across food, pharmaceuticals, and personal care industries.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 29.00 billion |

| Projected Market Size (2035) | USD 61.66 billion |

| CAGR (2025 to 2035) | 7.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion |

| Ingredient Types Analyzed | Herbs & Spices, Fruits, Leaves, Flowers, Others |

| Form Types Analyzed | Dried Plants, Liquid Extracts, Oils, Powders |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, India, Japan, South Korea, Brazil, 40+ countries |

| Key Players Profiled | ADM, DSM, Döhler, Givaudan, Martin Bauer, Bell Flavors & Fragrances, Botanical Ingredients Ltd. |

| Additional Attributes | Regulatory trends, regional demand shifts, innovation in extraction technologies |

By ingredient, methods industry has been categorized into Herbs & Spices, Roots, Leaves, Seeds, Nuts and Berries

By form, industry has been categorized into Plant Extract, Essential Oils and Dried Plants

Industry analysis has been carried out in key countries of North America; Europe, Middle East, Africa, ASEAN, South Asia, Asia, New Zealand and Australia

The market is valued at USD 29.00 billion in 2025 and is projected to reach USD 61.66 billion by 2035.

Herbs & spices lead the ingredient segment with a 44% market share in 2025.

The market is expected to grow at a CAGR of 7.3% during the forecast period.

China is the fastest-growing market, registering a CAGR of 8.1% between 2025 and 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Botanical Flavors Market Size and Share Forecast Outlook 2025 to 2035

Botanical Extracts Market Size and Share Forecast Outlook 2025 to 2035

Botanical Bioactives Market Size and Share Forecast Outlook 2025 to 2035

Botanical CO2 Extracts Market Analysis by Cranberry Seed, Blackcurrant, Oat, Carrot, and Rice Bran through 2035.

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Botanical Sugar Market Analysis by product type, application and by region - Growth, trends and forecast from 2025 to 2035

Botanical Packaging Market Analysis & Future Outlook 2024 to 2034

Food Botanicals Market Outlook – Growth, Demand & Forecast 2024 to 2034

Fermented Botanicals for Anti-Aging Market Size and Share Forecast Outlook 2025 to 2035

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Fig Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Bean Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Malt Ingredients Market Analysis by Raw Material, Product Type, Grade, End-use, and Region through 2035

Pulse Ingredient Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredient Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredient Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Aroma Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Paint Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA