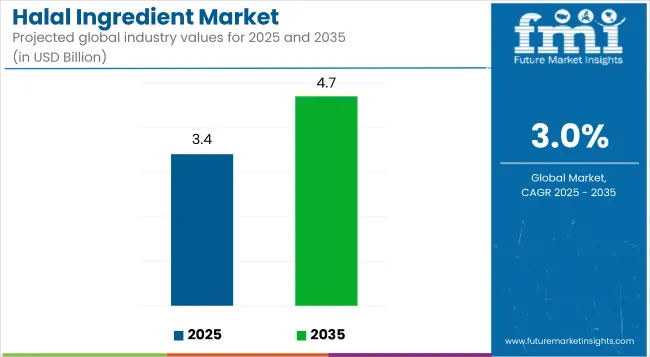

The global halal ingredient market is projected to grow from USD 3.4 billion in 2025 to USD 4.7 billion by 2035, reflecting a CAGR of 3%.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 3.4 billion |

| Forecast Value (2035) | USD 4.7 billion |

| CAGR (2025 to 2035) | 3% |

The market growth is driven by an increasing demand for halal-certified food and beverages and growing consumer awareness regarding ethical sourcing and sustainability. In addition, the growing popularity of halal ingredients, driven by the perception of high quality and safety, is further expanding the market.

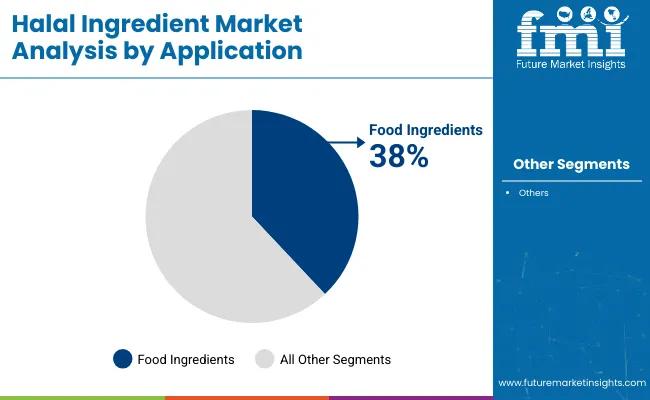

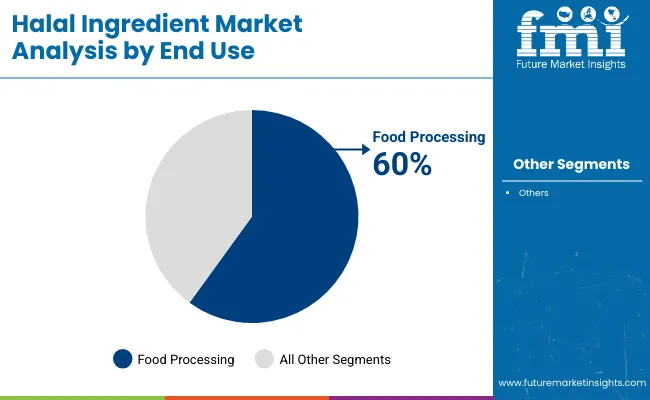

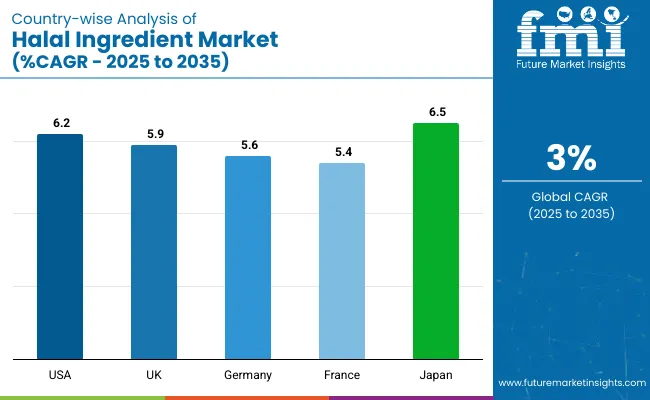

The USA will remain the largest contributor to the growth of the halal ingredient market, expanding at a CAGR of 6.2%. Meanwhile, Japan is anticipated to register the fastest growth at 6.5% CAGR, closely followed by the UK, growing at a CAGR of 5.9%. Food ingredients by application segment account for 38% of the market share, while by end-use segment, food processing holds a prominent market share of 60% in 2025.

The halal ingredient market holds varying shares across its parent industries. It accounts for approximately 8% of the global food ingredients market, driven by rising halal-certified packaged foods. In the beverage ingredients market, halal ingredients capture nearly 6%, largely due to demand for juices, soft drinks, and nutritional beverages.

Within the cosmetics ingredients market, halal-certified inputs represent around 4%, as ethical beauty trends rise. In the pharmaceutical ingredients space, the share stands at 3%, with growing emphasis on halal APIs and excipients. Across the clean label and ethical ingredients markets, halal makes up roughly 7% and 6%, respectively.

Looking forward, the halal ingredient market is set to witness innovations in product offerings, especially in plant-based ingredients and functional foods. Governments worldwide are continuing to support halal certification through legislation and regulations that facilitate smooth market operations.

Additionally, the growing emphasis on sustainability and traceability will further shape the future of the halal ingredient market. Companies are expected to strengthen their presence in both mature and emerging markets, especially in regions like Southeast Asia and the Middle East.

The market is divided into several key applications, end-use, and regional segments. The application segments include food ingredients (which encompasses sauces and marinades, thickening agents, sugar substitutes, flavors, and other food ingredients), beverage (covering coffee, tea, concentrated beverages and juices, soft drinks, and health and nutritional drinks), cosmetic Industry (which includes body and skin care, oral care, fragrance, and hair care), pharmaceutical (encompassing active pharma ingredients and excipients), and others (covering additional miscellaneous sectors).

The end-use segments include HoReCa (hotels, restaurants, and catering) and food processing. By region, it covers North America, Latin America, Western Europe, South Asia and the Pacific, East Asia, the Middle East and Africa.

In the halal ingredient market, food ingredients lead the application segment with a projected 38% market share in 2025. The demand is driven by their extensive use in sauces, marinades, flavors, and sugar substitutes that cater to the rising consumption of halal-certified packaged foods and culinary products.

The shift toward clean-label, compliant formulations across processed and frozen foods is further propelling growth in this segment, especially in Southeast Asia, the Middle East, and parts of Europe.

In the halal ingredient market, the food processing segment is projected to dominate the end-use category, capturing a 60% market share in 2025. This dominance is attributed to the rising demand for mass-produced halal-certified products in packaged foods, snacks, beverages, and ready-to-eat meals.

With the expansion of halal food exports and stricter compliance requirements across processing facilities, manufacturers are investing significantly in halal-certified ingredients to meet regulatory and consumer expectations.

Recent Trends in the Halal Ingredient Market

Key Challenges in the Halal Ingredient Market

Among the leading countries in the halal ingredient market, Japan is projected to witness the fastest growth with a CAGR of 6.5% from 2025 to 2035, driven by halal tourism and export expansion. The USA follows closely with a 6.2% CAGR, fueled by a growing disposable incomeand rising clean-label preferences.

The UK market is set to grow at 5.9%, backed by a strong halal retail presence. Germany and France are expected to expand at 5.6% and 5.4%, respectively, due to their large immigrant bases and evolving consumer demands. Overall, East Asia and North America show the strongest momentum.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The halal ingredient revenue in the USA is expected to grow at a CAGR of 6.2% from 2025 to 2035. The country shows increasing demand for halal-certified food and personal care products due to growing awareness about clean-label and ethical sourcing. Leading food manufacturers are expanding their halal portfolios to tap into this demographic.

The halal ingredient market in the UK is projected to expand at a CAGR of 5.9% between 2025 and 2035. The demand for halal-certified ingredients is rising across food, beverages, cosmetics, and pharmaceuticals. Supermarkets and foodservice providers are rapidly integrating halal-certified products into their offerings.

There venue from halal ingredients in Germany is estimated to rise at a CAGR of 5.6% from 2025 to 2035. The country’s large immigrant population and increasing emphasis on food safety and traceability are creating favorable conditions for halal-certified food and beverage ingredients. German manufacturers are also investing in halal compliance to cater to domestic and export markets, particularly in the Middle East and Asia.

The sales of halal ingredients in France are expected to register a CAGR of 5.4% from 2025 to 2035. An evolving consumer preference for traceable, clean-label food and cosmetic products is driving market momentum. Halal-certified bakery items, flavorings, and nutraceuticals are gaining traction. Furthermore, French retailers are expanding their halal portfolios, supported by dedicated halal aisles in major supermarkets.

The halal ingredient market in Japan is forecast to flourish at a CAGR of 6.5% from 2025 to 2035, making it one of the fastest-growing markets in East Asia. The country is actively improving halal infrastructure to cater to rising inbound tourism. Japanese firms are developing halal-certified food additives, sauces, and skincare products to serve both domestic and regional demand.

The market is moderately fragmented, with both multinational corporations and regional players actively competing across the food, beverage, cosmetic, and pharmaceutical sectors. Major companies like Nestlé S.A., ADM, Ingredion, BASF SE, and Givaudan are leveraging their R&D capabilities, global supply chains, and certification partnerships to expand halal-compliant portfolios and penetrate high-growth markets.

These players focus on expanding halal offerings in dairy alternatives, flavor systems, functional food ingredients, and clean-label additives to stay competitive.

Leading companies are emphasizing strategic collaborations with halal certification bodies, regional production facility expansions, and product innovation tailored for diverse halal applications. For instance, ADM and Ingredion are investing in plant-based halal protein sources, while Givaudan and Kerry are focusing on halal-certified sensory solutions.

Pricing competitiveness, local sourcing, and sustainability are other key areas driving differentiation. Multinational players are also forming alliances with Islamic councils and regulatory institutions to streamline product approvals in Southeast Asia and the Middle East.

Recent Halal Ingredients Industry News

In June 2025, Ingredion extended its long-standing partnership with Univar Solutions to include distribution of functional starches, proteins, and stevia sweeteners.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 3.4 billion |

| Projected Market Size (2035) | USD 4.7 billion |

| CAGR (2025 to 2035) | 3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in kilotons |

| By Application | Food Ingredients (Sauces & Marinades, Thickening Agents, Sugar Substitutes, Flavors, Others), Beverages (Coffee, Tea, Concentrated Beverages and Juices, Soft Drinks, Health and Nutritional Drinks), Cosmetic Industry (Body & Skin Care, Oral Care, Fragrance, Hair Care), Pharmaceutical (Active Pharma Ingredients, Excipients) |

| By End Use | HoReCa, Food Processing |

| Regions Covered | North America, Latin America, Western Europe, South Asia and Pacific, East Asia, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Nestlé S.A., ADM (Archer Daniels Midland), Ingredion, AB Mauri Malaysia Sdn. Bhd, BASF SE, Ashland Inc., Givaudan, Kerry, Kingherbs Limited |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

Various applications of the product are food ingredients, the beverage industry, the cosmetic industry, and the pharmaceutical. The food ingredients segment is further divided into thickening agents, sauces and marinades, flavors, sugar substitutes, and others.

The beverage industry is segmented into coffee, tea, concentrated beverages, and juices, soft drinks, and health and nutritional drinks. The cosmetic industry is categorized into body and skin care, oral care, fragrance, and hair care. The pharmaceutical sector further is bifurcated into active pharma ingredients and excipients.

In terms of end use, the industry is bifurcated into HoReCa and food processing.

Halal ingredient market analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, the Middle East and Africa, and Oceania.

The market size is valued at USD 3.4 billion in 2025.

The market is projected to reach USD 4.7 billion by 2035, expanding at a CAGR of 3%.

Food ingredients are expected to dominate with a 38% market share in 2025.

Food processing is projected to lead with a 60% share in 2025.

Japan is anticipated to grow at the highest CAGR of 6.5% through 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Halal Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Halal Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Halal Nutraceuticals and Vaccines Market Growth - Trends & Forecast 2025 to 2035

Analysis and Growth Projections for Halal Cheese Market

Market Share Breakdown of Halal Tourism Services

Halal Tourism Market Analysis by Tour Type, Tourist Type, Tourist Demography, Age Group, and by Booking Channel - Forecast for 2025 to 2035

UK Halal Tourism Market Analysis – Growth, Applications & Outlook 2025-2035

United States Halal Tourism Market Outlook – Trends, Demand & Forecast 2025–2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Germany Halal Tourism Market Report – Trends & Innovations 2025-2035

Ortho Phthalaldehyde Market Size and Share Forecast Outlook 2025 to 2035

GCC Countries Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Fig Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Bean Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Malt Ingredients Market Analysis by Raw Material, Product Type, Grade, End-use, and Region through 2035

Pulse Ingredient Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredient Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredient Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA