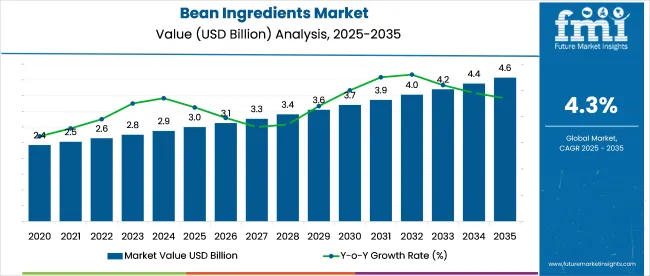

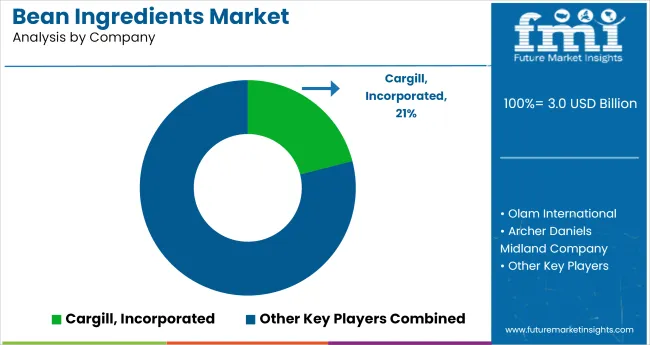

The bean ingredients market is projected to be valued at USD 3 billion in 2025 and expected to expand to USD 4.6 billion by 2035, growing at a CAGR of 4.3% between 2025 and 2035. The adoption of legumes in food processing has continued to expand, supported by advances in functional fractionation and dry extrusion preprocessing.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3 billion |

| Industry Value (2035F) | USD 4.6 billion |

| CAGR (2025 to 2035) | 4.3% |

This approach has enabled producers to isolate polyphenols, oligosaccharides, and other micronutrient-rich subcomponents alongside protein and fiber. These derivatives are being incorporated into edible systems and non-food applications such as cosmetic emulsifiers and biodegradable packaging films. As a result, commercial applications are being diversified beyond traditional consumption formats, reshaping supply chains across both food and industrial ingredient sectors.

The bean ingredients market accounts for varying shares within its parent markets. It contributes approximately 18.5% to the pulse ingredients market, given its focus on black beans, chickpeas, and lentils. Within the broader plant-based ingredients space, its share is estimated at 6.2%, driven by its use in meat substitutes and snacks.

In the functional food ingredients category, bean-based formulations represent nearly 4.7%, owing to their fiber, protein, and micronutrient profile. The contribution to the food additives market remains marginal at around 1.8%, given its limited role beyond nutrition. In the specialty ingredients market, products account for close to 3.5%, primarily linked to gluten-free and allergen-free product applications. These shares highlight the market’s strategic but niche position across interrelated ingredient domains.

Midwestern ethanol biorefineries have retrofitted idle steeping tanks to hydro-fracture pulse hulls, enabling recovery of oligosaccharide-rich soluble that previously entered low-value feed channels. This adaptation, using surplus enzymes from adjacent corn wet-milling lines, now yields a syrup standardized at 22 °Bx. Beverage formulators are incorporating this syrup as a prebiotic ingredient, pricing it nearly 11% below imported chicory inulin.

Residual fiber cakes from the process are torrefied on-site into porous biochar, which serves as a filtration aid in bean protein isolate production, reducing the need for diatomaceous earth by about 7%. This integrated system is helping bean ingredient processors stabilize margins and reduce volatility tied to starch and fuel input costs.

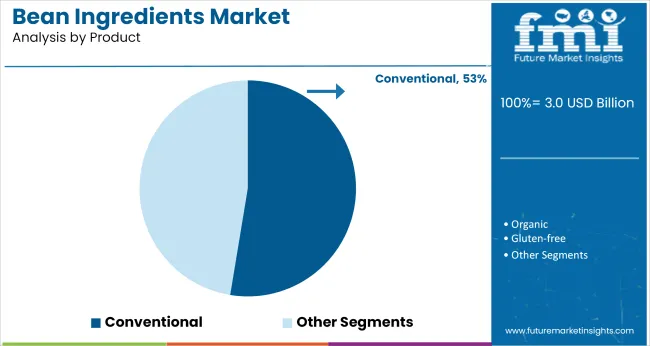

Conventional bean ingredients lead the product type segment due to their cost-efficiency and broad applicability in food manufacturing. Processed food production remains the dominant end-use, with growing interest in coffee-based applications. Modern trade drives distribution, while online platforms emerge as hubs.

Conventional bean ingredients are expected to grow the leading share, accounting for 52.6% of total value in 2025. This dominance is supported by their widespread availability, established supply chains, and cost-efficiency in large-scale food manufacturing.

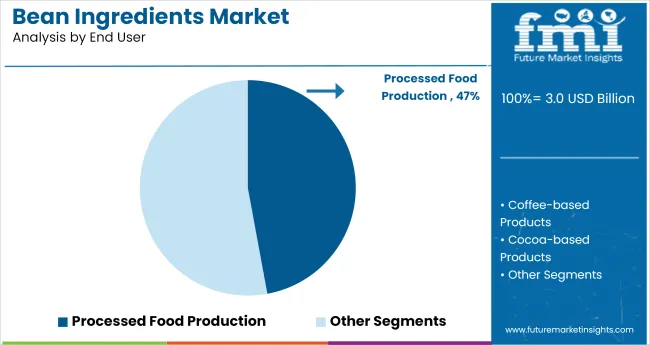

Processed food production is projected to contribute the highest share, estimated at 47.1%, within the usage landscape. This segment includes applications in snacks, soups, ready meals, and plant-based protein products.

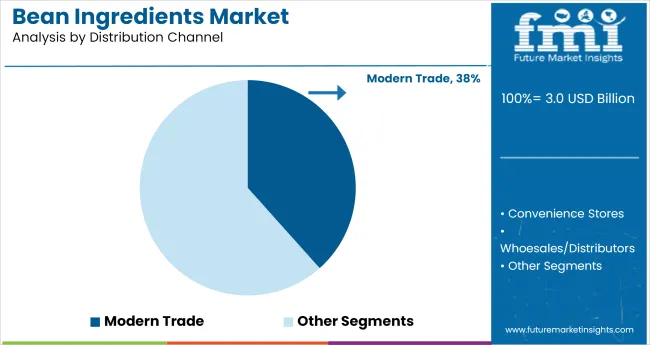

Modern trade is projected to capture the largest share at 38.4% in 2025, led by retail chains, supermarkets, and hypermarkets that offer broad product assortments and favorable shelf placements for bean-based products.

Bean ingredients are gaining traction due to their cost-efficiency, shelf stability, and adaptability in clean-label reformulations. Evolving consumer preferences and regulatory pressures are accelerating, especially in allergen-free and hybrid formulations.

Cost-Efficiency and Supply Chain Resilience

The consistent demand for cost-effective, protein-dense ingredients has driven reliance on beans across mainstream food manufacturing. Bean ingredients are favored for their dual functionality, nutritional and structural, which reduces the need for synthetic additives. The ability to locally source beans in key agrarian economies ensures stable procurement, insulating producers from volatility in animal protein markets.

Manufacturers are also leveraging in applications demanding longer shelf life, such as ambient snacks and dry mixes, which adds commercial appeal. The shift toward reformulating products with label-friendly ingredients continues to make beans an essential input.

Consumer Behavior and Regulatory Pressures Drive

Growing consumer focus on dietary fiber, clean labels, and allergen-free products has redefined the use case of product beyond protein alone. With rising intolerance awareness, especially across North America and Europe, demand for non-soy, gluten-free, and legume-based alternatives is accelerating.

Regulatory frameworks are also influencing product development by enforcing transparency in sourcing and ingredient disclosure. These conditions create a favorable environment for beans as they align with nutritional claims without compromising affordability. Innovation is also being observed in hybrid formulations, combining beans with ancient grains or pulses to enhance texture and nutrient absorption.

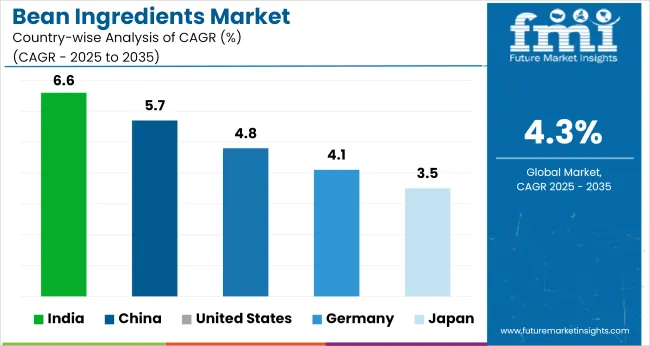

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.8% |

| Germany | 4.1% |

| Japan | 3.5% |

| China | 5.7% |

| India | 6.6% |

Global demand for bean ingredients is projected to rise at a 4.3% CAGR from 2025 to 2035. India, a BRICS member, outpaces the global average with 5.9% growth, supported by strong demand for protein-rich flours, extruded snack bases, and bakery blends. Regional clusters in Maharashtra and Madhya Pradesh are scaling pulse milling operations to serve domestic and Gulf buyers. China grows at 4.7%, fueled by expansion in meat alternatives and prebiotic-rich formulations for beverages.

ASEAN nations, including Thailand and Myanmar, average 4.4%, driven by regional trade in mung bean starches and sprout-based powders used in noodles and desserts. The United States, part of the OECD, tracks at 3.8%, slightly below global levels, due to input price volatility and substitution toward lentil and pea bases. Germany stands at 3.5%, reflecting saturation in meat analog categories and EFSA constraints on novel claims. UK demand slows to 3.1% amid reformulation fatigue and cost-led SKU rationalization.

The report covers a detailed analysis of 40+ countries and the top five countries have been shared as a reference.

The USA bean ingredients market is projected to register a 4.8% CAGR during the forecast period. Growth is being fueled by steady reformulation work across major snack and ready-meal categories, where bean flours and concentrates replace animal proteins without compromising texture. Domestic pulse cultivation under the USDA’s supportive crop-rotation programs has strengthened procurement reliability and narrowed cost spreads versus imported soy.

Retailers are positioning bean-based items as nutrient-dense alternatives in center-store aisles, and foodservice chains are trialing legume blends in burgers and soups to meet menu-calorie targets. Continuous shelf-life studies by mid-sized processors have improved the handling of product, making them practical for large-batch production. Marketing messages now emphasize the fiber-protein combination, resonating with health-conscious households and dietitians.

China’s bean ingredients market is expected to grow at a 5.7% CAGR from 2025 to 2035. Expansion is underpinned by national nutrition guidelines that promote plant-derived proteins amid concerns about meat self-sufficiency. Provincial governments have funded processing clusters that integrate cleaning, milling, and isolation of pulse proteins, lowering entry barriers for beverage and noodle brands.

Demand also rides on e-commerce platforms that spotlight bean-based breakfast powders and children’s snacks, tapping tier-2 and tier-3 urban consumers seeking convenient nutrition. Domestic soy processors are diversifying into mung, adzuki, and chickpea inputs to hedge against price swings in oilseed crush margins. Export-oriented manufacturers see opportunities in Southeast Asia for ready-to-eat bean desserts.

India’s bean ingredients market is forecast to advance at a 6.6% CAGR during the forecast period. A large vegetarian base favors beans as familiar staples, yet rising incomes have shifted consumption toward packaged snacks, instant mixes, and fortified flours that rely on pulse concentrates for protein claims.

Government procurement under the National Food Security Mission maintains consistent raw-material pricing, encouraging processors to expand extrusion and spray-drying capacity. Food Safety and Standards Authority of India guidelines on front-of-pack nutrition labeling have spurred brand investments in high-fiber, low-fat formulations using chickpea and lentil fractions. Export demand from GCC countries for gluten-free bean snacks adds an external growth lever.

Japan’s bean ingredients sector is projected to record a 3.5% CAGR between 2025 and 2035. An aging population with a focus on gut health and muscle maintenance drives steady demand for high-protein, low-fat foods, prompting manufacturers to blend bean proteins into convenience-store meals and functional beverages.

Limited arable land necessitates import agreements with Canada and Myanmar for adzuki and mung beans, ensuring raw-material continuity. Advanced wet-fractionation technology in coastal plants yields ultra-fine bean powders suited to clear drinks and energy gels, formats popular with active seniors. Regulatory frameworks that restrict certain allergen disclosures further support the inclusion of bean derivatives over soy in niche applications.

Germany is anticipated to grow at a 4.1% CAGR in bean ingredients, driven by diet shifts toward lower-impact proteins and strong demand for fiber enrichment in bakery and meat-alternative segments. Federal funding for pulse-processing pilot plants has streamlined dehulling, micronization, and texturizing steps, cutting production costs for small and mid-sized firms.

Supermarket chains promote bean-based cold cuts and spreads under their climate-friendly ranges, with QR codes linking to farm-level sourcing data. Food engineers are blending fava and navy bean proteins with wheat gluten to improve bite in sausages, a formulation now adopted by leading deli brands.

Key companies such as Cargill, Incorporated, Olam International, and Archer Daniels Midland Company drive bulk processing, pulse isolation, and cross-category formulation. Mid-sized innovators like MARA GLOBAL FOODS, Faribault Foods, Inc., and Globeways Canada, Inc. focus on pulse-based ready meals, organic flours, and protein concentrates.

The Organic Collective Limited and BETTER BEAN COMPANY specialize in non-GMO and allergen-free bean pastes and refrigerated items. Emerging players like Inland Empire Foods and Vermont Bean Crafters serve niche markets with craft-style blends and regional pulse-based offerings, highlighting the market’s balance between industrial scale and culinary.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 3.0 billion |

| Projected Market Size (2035) | USD 4.6 billion |

| CAGR (2025 to 2035) | 4.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and volume in metric tons |

| Product Type Analyzed (Segment 1) | Organic, Conventional, Gluten-Free, and Allergen-Free Bean Ingredients. |

| End User Industry Analyzed (Segment 2) | Coffee-Based Products, Processed Food Production, Cocoa-Based Products, and Residential or Commercial Purposes. |

| Distribution Channel Analyzed (Segment 3) | Convenience Stores, Modern Trade, Wholesalers Or Distributors, Online Sales, and Other Sales Channels. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Cargill, Incorporated, Olam International, Archer Daniels Midland Company, MARA GLOBAL FOODS, Faribault Foods, Inc., Globeways Canada, Inc., The Organic Collective Limited, BETTER BEAN COMPANY, Inland Empire Foods, and Vermont Bean Crafters. |

| Additional Attributes | Dollar sales, share by product type, end use, and region, demand trends, sourcing costs, processing, competitor positioning, retail penetration, and future growth pockets. |

The industry is segmented into organic, conventional, gluten-free, and allergen-free bean ingredients.

The key end users include coffee-based products, processed food production, cocoa-based products, and residential or commercial purposes.

The industry finds applications in convenience stores, modern trade, wholesalers or distributors, online sales, and other sales channels.

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The global bean ingredients market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the bean ingredients market is projected to reach USD 5.0 billion by 2035.

The bean ingredients market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in bean ingredients market are organic, conventional, gluten-free and allergen-free.

In terms of end use industry, coffee-based products segment to command 42.9% share in the bean ingredients market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bean Flour Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Bean Flour Manufacturers

Soybean Enzymatic Protein Market Size and Share Forecast Outlook 2025 to 2035

Soybean Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Soybean Meal Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soybean Oil Market

Caribbean Cruises Market Size and Share Forecast Outlook 2025 to 2035

Fava Bean Protein Market Size and Share Forecast Outlook 2025 to 2035

Fava Bean Protein Industry in United States Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Caribbean Destination Wedding Market Trends - Growth & Forecast 2025 to 2035

Fava Beans Market Report – Size, Share & Growth 2025-2035

Cocoa Bean Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Cacao Beans Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cocoa Bean Extract Market Trends - Nature & Cocoa Type Insights

Coffee Bean Grind Machine Market Trends - Growth & Forecast 2025 to 2035

Competitive Landscape of Locust Bean Gum Providers

Vanilla Bean Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bambara Beans Market Size and Share Forecast Outlook 2025 to 2035

Demand for Bean Flour in EU Size and Share Forecast Outlook 2025 to 2035

Green Coffee Bean Extract Market Analysis by Form, Application, and Distribution Channel Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA