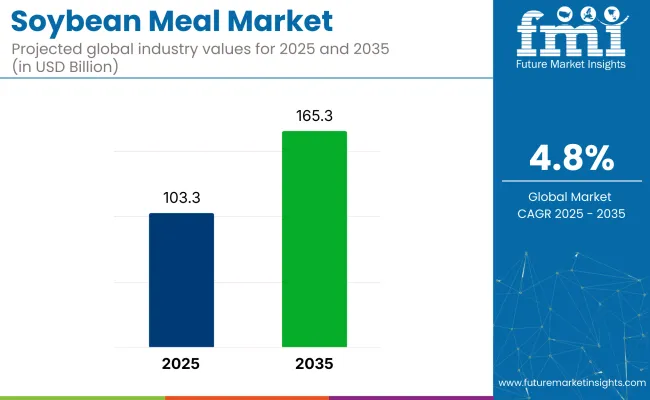

The global soybean meal market is projected to grow from USD 103.3 billion in 2025 to USD 165.3 billion by 2035, registering a CAGR of 4.8%. The market expansion is being driven by the increasing demand for protein-rich animal feed and the rising popularity of plant-based diets.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 103.3 billion |

| Industry Value (2035F) | USD 165.3 billion |

| CAGR (2025 to 2035) | 4.8% |

The growing livestock and poultry industries, coupled with a shift towards sustainable and plant-based proteins, are encouraging wider adoption of soybean meal. Advanced extraction techniques and the increasing use of non-GMO and organic soybean meal products are further boosting market growth.

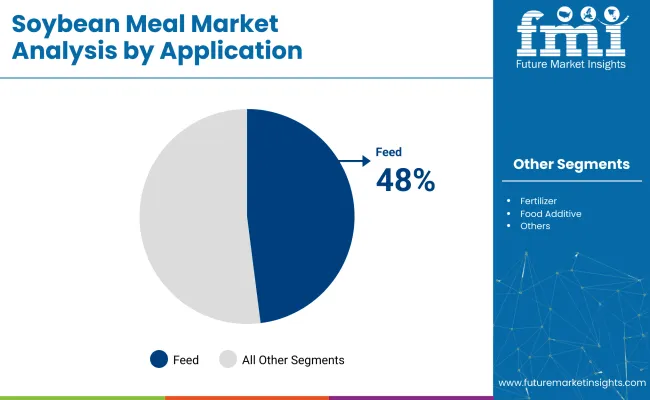

The market holds significant shares in several parent markets. Within the agricultural products market, soybean meal is a major component of global agricultural trade, although its market share varies by region. In the animal feed market, soybean meal is particularly dominant, holding around 48% of the market, primarily for use in dairy, poultry, and swine feeds.

In the food and beverage market, it accounts for a smaller share, approximately 6-7%, due to its use in plant-based food products and supplements. Additionally, in the biofuels market, soybean meal plays a vital role in biodiesel production, contributing about 5% to this sector. These percentages highlight soybean meal’s widespread use across various industries.

Government regulations impacting the market focus on sustainable agriculture, food safety, and environmental concerns. The European Union’s Common Agricultural Policy (CAP) and the USA Renewable Fuel Standard (RFS) mandate the use of biofuels, encouraging the use of soybean meal in biodiesel production.

The Indian Government's initiatives for organic farming and the promotion of plant-based food products are also contributing to the increased adoption of soybean meal. These regulations are driving the growth of advanced soybean extraction methods and encouraging the development of non-GMO and sustainable soy products, enhancing both market growth and product innovation.

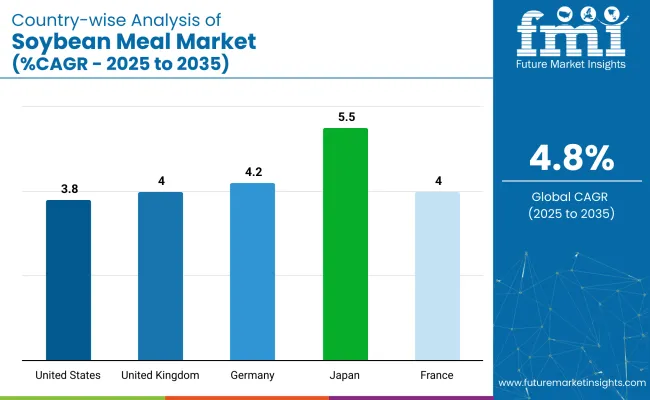

Japan is projected to be the fastest-growing soybean meal market, expanding at a CAGR of 5.5% from 2025 to 2035. Feed will lead the application segment with a 48% share, while conventional soybean meal will dominate the nature segment with 75.3% share. Defatted soybean meal is expected to command 45% of the product type segment. The USA and Germany markets are also projected to grow steadily at CAGRs of 3.8% and 4.2%, respectively.

The soybean meal market is segmented by product type, application, nature, and region. By product type, the market is divided into full-fat soybean meal, defatted soybean meal, and high-protein types. In terms of application, the market is classified into feed (aquaculture, livestock, and pet food), fertilizer, food additive, and others(biofuels, industrial chemicals, animal supplements, organic fertilizers).

Based on nature, the market is bifurcated into organic and conventional. Regionally, the market is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

Defatted soybean meal is projected to lead the product type segment, capturing 45% of the market share by 2025. These units are primarily used in animal feed due to their high protein content and low-fat concentration.

Feed is expected to dominate the application segment, capturing 48% of the global market share by 2025, driven by its widespread use in livestock, poultry, and aquaculture feed.

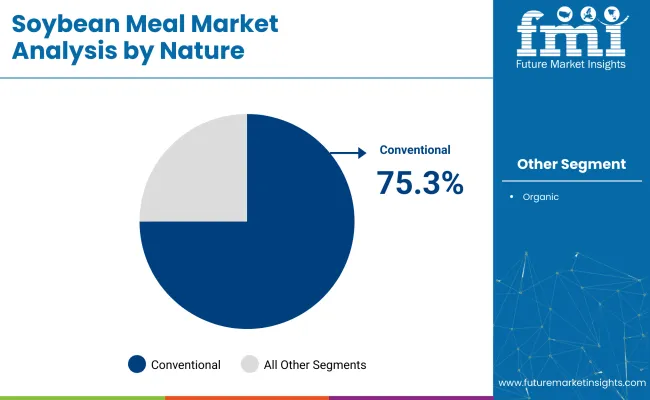

Conventionalis expected to lead the nature segment, holding 75.3% of the market share by 2025, driven by increasing demand for sustainable and natural food and feed ingredients.

The global soybean meal market is experiencing steady growth, driven by the increasing demand for protein-rich feed and plant-based food solutions. Soybean meal plays a crucial role in animal nutrition, especially in livestock, poultry, and aquaculture industries.

Recent Trends in the Soybean Meal Market

Challenges in the Soybean Meal Market

Japan's momentum is anchored in high-efficiency livestock farming, sustainable food production, and alignment with environmental targets. Germany and France maintain consistent demand driven by EU agricultural mandates and sustainability goals under the Green Deal. In contrast, developed economies such as the USA (3.8% CAGR), UK (4%), and Japan (5.5%) are expanding at a steady 0.91-1.00x of the global growth rate.

Japan leads the market with the highest growth, driven by increasing demand for plant-based protein in food and animal feed sectors. Germany follows, supported by EU sustainability and food security regulations, focusing on non-GMO and organic products. France experiences similar growth, driven by national agricultural sustainability goals and biofuel production.

The USA shows steady growth, primarily due to improvements in feed formulations and plant-based food production. The UK grows with a focus on sustainable farming and plant-based food solutions, supported by government-led initiatives for food security and sustainability.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan soybean meal revenue is projected to grow at a CAGR of 5.5% from 2025 to 2035. Growth is driven by the increasing demand for plant-based protein in food and animal feed sectors. As a technology-driven OECD economy, Japan prioritizes high-efficiency, sustainable farming practices integrated into its agricultural systems.

The sales of soybean meal in Germany are poised to expand at a 4.2% CAGR during the forecast period, slightly below the global average but strongly regulation-led. EU carbon-neutral goals, sustainable agriculture standards, and food security regulations are pushing the adoption of plant-based feed ingredients like soybean meal.

The French soybean meal market is projected to grow at a 4% CAGR during the forecast period, mirroring Germany’s policy-backed adoption trajectory. Demand is driven by national agricultural sustainability targets, plant-based food product growth, and biofuel production. Agriculture sectors such as livestock, poultry, and aquaculture are major consumers.

The USA soybean meal market is projected to grow at a 3.8% CAGR from 2025 to 2035, translating to 0.93x the global rate. Unlike emerging markets focused on new installations, USA demand is tied to improving feed formulations, increasing plant-based food production, and meeting sustainable farming standards.

The UK soybean meal revenue is projected to grow at a 4% CAGR from 2025 to 2035, representing steady growth, at 0.91 times the global pace. Growth is supported by workplace regulations in industries like food processing, livestock, and plant-based food production. Post-Brexit regulatory divergence has slightly slowed capital investment.

The soybean meal market is moderately consolidated, with leading players like UFAC-UK, The United Soybean Board (USB), Satavie, SoyKitty, and Afrizon Pte Ltd. dominating the industry. These companies provide high-quality soybean meal catering to sectors such as animal feed, plant-based food, and biofuel production. UFAC-UK focuses on high-protein soybean meal, while The United Soybean Board (USB) specializes in sustainable soybean farming and meal production solutions.

Satavie is known for its innovative plant-based meal formulations, and SoyKitty offers specialized meal products for pet food. Afrizon Pte Ltd. focuses on sustainable sourcing practices. Other key players like Mamta Hygiene Products Pvt Ltd, Guru Soya Foods Pvt. Ltd., Delta Equities LLC, Prorich Agro Private Limited, and The Delong Co., Inc. contribute by providing specialized, high-performance soybean meal solutions for a wide range of industrial and agricultural applications.

Recent Soybean Meal Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 103.3 billion |

| Projected Market Size (2035) | USD 165.3 billion |

| CAGR (2025 to 2035) | 4.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/volume in metric tons |

| Product Type Analyzed | Full-fat Soybean Meal, Defatted Soybean Meal, and High-protein Types |

| Application Analyzed | Feed (Aquaculture, Livestock, Pet Food), Fertilizer, Food Additive, and Others (Biofuels, Industrial Chemicals, Animal Supplements, Organic Fertilizers ) . |

| Nature Analyzed | Organic and Conventional |

| Region Covered | North America, Latin America, Western Europe, South Asia, East Asia, Oceania, and Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | UFAC-UK, The United Soybean Board (USB), Satavie, SoyKitty, Afrizon Pte Ltd., Mamta Hygiene Products Pvt Ltd, Guru Soya Foods Pvt. Ltd., Delta Equities LLC, Prorich Agro Private Limited, The Delong Co., Inc. |

| Additional Attributes | Dollar sales by product type, share by nature, regional demand growth, policy influence, sustainability trends, competitive benchmarking |

The market is valued at USD 103.3 billion in 2025.

The market is forecasted to reach USD 165.3 billion by 2035, reflecting a CAGR of 4.8%.

Defatted soybean meal will lead the product type segment, capturing 45% of the global market share in 2025.

Feed will dominate the application segment with a 48% share in 2025.

Japan is projected to grow at the fastest rate, with a CAGR of 5.5% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Soybean Enzymatic Protein Market Size and Share Forecast Outlook 2025 to 2035

Soybean Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Soybean Oil Market

Epoxidized Soybean Oil Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the High Oleic Soybean Sector

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Meal Voucher Market Size and Share Forecast Outlook 2025 to 2035

Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Meal Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Meal Replacement Bars Market Size, Growth, and Forecast for 2025 to 2035

Meal Replacement Products Market Analysis by Product type, source, application and region Through 2035

Meal Kit Delivery Service Market - Trends & Forecast 2025 to 2035

Meal Replacement Shake Market Trends - Powder & Liquid Analysis

UK Meal Replacement Products Market Trends – Growth, Demand & Forecast 2025-2035

Oatmeal market Analysis by Nature, Type and Sales Channel Through 2025 to 2035

Fishmeal and Fish Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA Meal Replacement Products Market Insights – Size, Share & Forecast 2025-2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Market Leaders & Share in the Fish Meal Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA