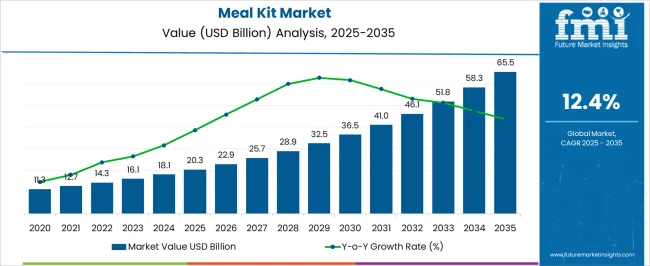

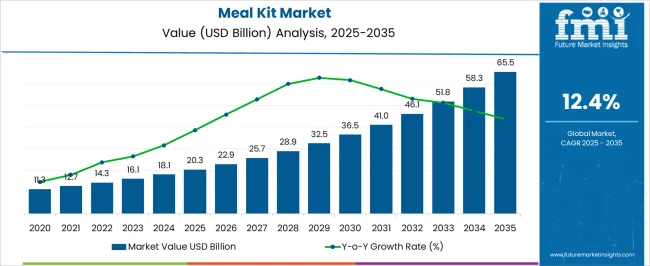

The global meal kit market is projected to reach USD 20.3 billion by 2025 and is anticipated to surge to nearly USD 65.5 billion by 2035, recording a compound annual growth rate (CAGR) of 12.4%, representing an absolute dollar opportunity of approximately USD 45.2 billion during the forecast period. The year-wise expansion pattern shows a consistent acceleration, starting from USD 11.3 billion and climbing to USD 12.7 billion with a YoY increase of around 12.4%. The progression continues as the market reaches USD 14.3 billion and USD 16.1 billion, showing similar annual growth.

Moving ahead, the industry is anticipated to grow from USD 18.1 billion to USD 20.3 billion, and further to USD 22.9 billion, highlighting an upward trajectory in consumer adoption. This momentum carries forward as revenue rises to USD 25.7 billion and USD 28.9 billion, each reflecting strong year-on-year gains. The market is expected to cross USD 32.5 billion, then advance to USD 36.5 billion and USD 41.0 billion, maintaining double-digit growth. The expansion becomes more prominent toward the latter half of the period, with revenue anticipated to reach USD 46.1 billion, then USD 51.8 billion, and USD 58.3 billion, before hitting USD 65.5 billion by 2035. This sizable absolute dollar opportunity highlights how evolving consumer lifestyles, demand for convenient home cooking solutions, and the growing popularity of customizable subscription-based meal services are driving substantial revenue growth across this sector, setting a clear growth pathway for industry participants throughout the coming years.

| Metric | Value |

|---|---|

| Meal Kit Market Estimated Value in (2025 E) | USD 20.3 billion |

| Meal Kit Market Forecast Value in (2035 F) | USD 65.5 billion |

| Forecast CAGR (2025 to 2035) | 12.4% |

The meal kit market is closely influenced by five interconnected parent markets that collectively drive its adoption and long-term growth. The largest contributor is the online grocery and e-commerce food delivery market, which accounts for about 35% share, as meal kits are predominantly sold through digital platforms that offer convenience, subscription models, and doorstep delivery, making them accessible to a growing consumer base. The packaged and ready-to-cook food market contributes around 25%, as meal kits capitalize on trends in pre-portioned ingredients, recipe-based cooking, and time-saving meal preparation, bridging the gap between fresh produce and fully prepared meals. The health and wellness food market holds close to 15% influence, supported by consumer demand for balanced nutrition, calorie-controlled portions, and dietary customization in line with keto, vegan, or gluten-free preferences.

The kitchen appliances and culinary tools sector adds nearly 12%, as the popularity of meal kits encourages the use of specialized cookware, measuring devices, and cooking gadgets to enhance user experience and recipe execution. The restaurant and experiential dining market contributes close to 8%, as meal kits often replicate restaurant-quality meals at home, creating opportunities for chefs and brands to extend their offerings beyond physical dining spaces. The distribution of market influence shows that digital commerce and convenience-focused food solutions remain the backbone of growth, while health-conscious and experiential trends continue to expand the market’s appeal.

The edible animal fat market is expanding steadily, driven by evolving food processing techniques and the resurgence of traditional fat-based ingredients in culinary applications. Rising demand for flavor-rich, natural fats in packaged and processed foods has contributed to the market’s growth, particularly in bakery, confectionery, and foodservice industries.

Increased consumption of animal-based products in emerging markets, along with the shift toward clean-label and high-energy ingredients, has positioned edible fats as vital functional components. Butter, lard, and tallow are experiencing renewed popularity as consumers move away from synthetic and hydrogenated alternatives.

Advancements in rendering technologies, combined with improved cold chain logistics, are enabling wider product distribution across regions. The market is expected to benefit from consistent demand in artisanal food production and expanding applications in ready-to-eat and convenience food categories, thereby reinforcing the relevance of edible animal fat across global food systems.

The meal kit market is segmented by meal type, offering, distribution channel, and geographic regions. By meal type, meal kit market is divided into Vegetarian, Non-vegetarian, Vegan, Paleo, Keto, Mediterranean, and Others. In terms of offering, meal kit market is classified into Cook & eat, Heat & eat, and Ready-to-eat. Based on distribution channel, meal kit market is segmented into Online, Grocery stores, and Other. Regionally, the meal kit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The butter segment commands a leading 35% share in the type category, supported by its strong cultural and culinary presence in both traditional and commercial food formulations. Butter is widely used for its distinct taste, texture-enhancing qualities, and versatility across a wide range of recipes.

Its perceived naturalness and clean-label status make it a preferred choice among consumers and food manufacturers seeking alternatives to synthetic or margarine-based fats. Technological improvements in dairy processing and premiumization trends in bakery and confectionery segments have further strengthened the segment’s performance.

In addition, growing demand for clarified butter and region-specific variants such as ghee has expanded the product’s footprint across both Western and Asian markets. The segment’s ability to serve as a flavor carrier and structure enhancer positions butter as a critical input across evolving food applications, ensuring continued market leadership.

Cattle-derived fats hold a dominant 42% share within the source category, reflecting their widespread use in both edible and industrial applications. These fats, including tallow and butterfat, are valued for their high energy content, stability at high temperatures, and functional versatility in food formulations.

The prevalence of cattle farming across major producing countries has ensured a stable and cost-effective supply, further promoting its adoption in commercial food processing. Demand for cattle fats is particularly strong in baked goods, fried foods, and snack coatings due to their flavor-enhancing and texture-improving properties.

As food manufacturers continue to prioritize shelf-stable and naturally sourced ingredients, cattle-based fats are poised to maintain their relevance. Regulatory support for traditional fats in contrast to artificial trans fats is also bolstering this segment’s credibility, ensuring long-term stability in both developed and emerging markets.

The bakery and confectionery segment accounts for a significant 39% share in the application category, driven by the essential role of edible animal fats in delivering desirable texture, flavor, and moisture retention in baked products. These fats are integral to enhancing the mouthfeel, flakiness, and overall sensory appeal of pastries, cookies, cakes, and confectionery coatings.

The segment has seen steady growth as global bakery consumption rises and premiumization trends encourage the use of authentic, full-fat ingredients. Edible animal fats are increasingly being favored over synthetic shortenings due to their natural origin and better nutritional perception among certain consumer groups.

The resurgence of artisanal baking, combined with demand for clean-label and indulgent food offerings, has further reinforced the role of animal fats in this segment. With continued innovation in product formulations and growing demand for high-quality baked goods, the bakery and confectionery segment is expected to remain a strong growth area within the edible animal fat market.

The meal kit market is being shaped by rising demand for convenient home dining, expansion of e-commerce channels, focus on health-conscious meals, and regional diversification of cuisine. Consumers are increasingly seeking ready-to-cook solutions that save time while offering nutritional value and culinary variety. Online platforms are making it easier for households to access meal kits regularly, while providers are innovating with customized menus and health-focused options. Regional expansion and inclusion of international recipes are enhancing engagement and market penetration. These combined factors are driving the market’s rapid growth, creating opportunities for both new entrants and established players in the evolving meal kit landscape.

The market is experiencing strong growth due to rising consumer preference for ready-to-cook meal solutions. Busy lifestyles and limited time for grocery shopping and cooking have made meal kits an attractive choice for households seeking convenience. Retailers and online platforms are expanding their offerings with customizable menus and diverse cuisine options, which enhances consumer appeal. Subscription-based models are gaining traction as they ensure regular deliveries and predictable revenue streams for providers. The growing interest in home-cooked meals without the need for planning or extensive preparation is driving the market’s expansion, particularly in urban centers and digitally connected regions.

E-commerce platforms and online grocery delivery services are accelerating the adoption of meal kits. Companies are leveraging digital channels to reach broader audiences, providing seamless ordering and subscription management. Mobile applications and websites allow consumers to browse meal options, schedule deliveries, and receive personalized recommendations. This ease of access has widened the customer base and encouraged repeat purchases. Partnerships between meal kit providers and online grocery retailers are further strengthening distribution networks. The expansion of digital commerce infrastructure has reduced barriers to entry, making it simpler for new players to penetrate the market and for consumers to consistently access high-quality, fresh ingredients.

Health-conscious consumers are increasingly influencing the meal kit market, driving demand for nutritionally balanced options. Providers are incorporating calorie-controlled, protein-rich, and plant-based meals to cater to specific dietary preferences. Meal kits with organic or minimally processed ingredients are gaining popularity among health-aware demographics. Customizable meal plans targeting weight management, fitness goals, and special dietary needs are also being offered. These factors are increasing consumer loyalty and perceived value, prompting providers to continuously innovate menus. By addressing nutrition and wellness concerns, the market is tapping into a broader segment of health-focused households, ensuring sustained adoption and growth.

Meal kit providers are diversifying their offerings by including international cuisine and region-specific recipes. Consumers are seeking novel culinary experiences at home, which drives demand for global flavors and seasonal ingredients. Companies are scaling operations to serve multiple regions, adapting packaging and delivery processes to maintain freshness. This regional expansion is enhancing accessibility in previously under-served areas. Collaboration with local farms and ingredient suppliers ensures supply chain efficiency and ingredient quality. The trend of exploring diverse culinary experiences at home is strengthening consumer engagement, positioning the market for continuous growth while enabling companies to capitalize on evolving food preferences across different geographies.

| Country | CAGR |

|---|---|

| China | 16.7% |

| India | 15.5% |

| Germany | 14.3% |

| France | 13.0% |

| UK | 11.8% |

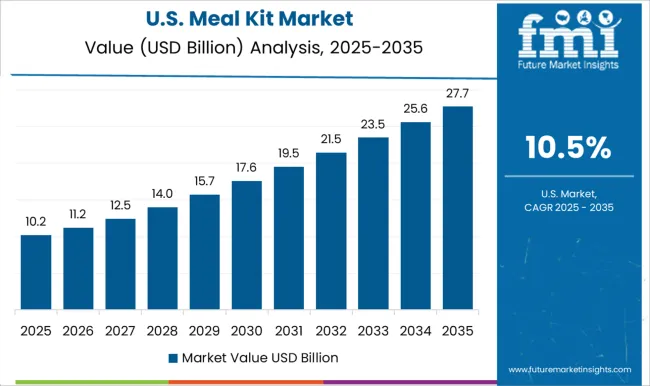

| USA | 10.5% |

| Brazil | 9.3% |

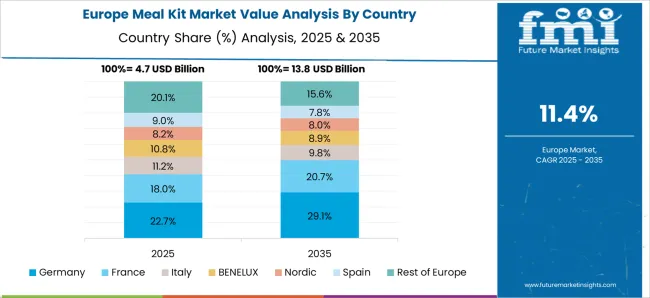

The global meal kit market is projected to grow at a CAGR of 12.4% between 2025 and 2035. China and India, as leading BRICS economies, drive growth through rising urban households, evolving eating habits, and increasing adoption of ready-to-cook solutions. Germany, the UK, and the USA, representing OECD markets, focus on premium convenience offerings, subscription-based services, and health-conscious meal options. Growth is further supported by the popularity of online grocery platforms, demand for time-saving culinary solutions, and the trend of personalized nutrition. Asia dominates in consumer base expansion, while Europe and North America lead in high-value meal kit formats, quality assurance, and innovative service models. The analysis includes over 40+ countries, with the leading markets detailed below.

The meal kit market in China is projected to grow at a CAGR of 16.7% from 2025 to 2035, supported by rising urban consumer demand, increasing disposable incomes, and a preference for convenient home-cooked meals. Tier 1 and Tier 2 cities are experiencing rapid adoption of meal kit services, which offer both traditional Chinese dishes and international cuisines to cater to evolving tastes. E-commerce platforms and advanced logistics infrastructure enable timely delivery of fresh ingredients, expanding accessibility across urban centers. Government regulations focused on food safety and quality enhance consumer trust, while domestic and international providers are investing in production and distribution networks to scale efficiently. Marketing campaigns leveraging influencers and social media further drive awareness and adoption of meal kits.

The meal kit market in India is expected to grow at a CAGR of 15.5% between 2025 and 2035, supported by increasing dual-income households and busy lifestyles. Consumers are seeking quick, nutritious, and easy-to-prepare meal solutions, prompting meal kit providers to offer region-specific recipes that reflect diverse local flavors. The rise of online food delivery platforms and digital payment systems has expanded access to meal kits nationwide. Private players are investing in heliciculture-scale supply and processing infrastructure to ensure reliable ingredient sourcing. Marketing strategies highlight convenience, health benefits, and variety, appealing to young, urban consumers with rising disposable income. The combination of convenience-driven demand and digital penetration ensures strong growth prospects for the market.

The meal kit market in Germany is projected to grow at a CAGR of 14.3% from 2025 to 2035, supported by consumer preferences for quality, convenience, and healthy eating. Meal kit providers are increasingly offering organic, locally sourced, and premium ingredients, meeting growing consumer expectations for clean and nutritious meals. Busy professionals and families seek time-saving solutions without compromising on flavor or nutrition. Subscription-based models and e-commerce delivery services enhance convenience, providing regular access to fresh, pre-portioned ingredients. Industrial partnerships and technology-enabled logistics improve supply chain efficiency. Germany’s focus on sustainability and quality standards drives both consumer trust and long-term adoption of meal kit services.

The meal kit market in the UK is expected to grow at a CAGR of 11.8% between 2025 and 2035, supported by rising interest in cooking at home and trying international cuisines. Consumers are seeking variety and convenience, prompting providers to offer pre-portioned ingredients for a wide range of recipes. The growth of online marketplaces and delivery services has made meal kits increasingly accessible to urban professionals and families. Health-conscious eating trends, focusing on balanced and nutritious meals, further support market expansion. Strategic marketing campaigns, including influencer promotion and recipe storytelling, drive consumer engagement and adoption across urban centers.

The meal kit market in the USA is projected to grow at a CAGR of 10.5% from 2025 to 2035, supported by fast-paced lifestyles and the demand for convenient, home-cooked meals. Providers offer pre-portioned ingredients and easy-to-follow recipes to reduce meal preparation time while catering to diverse dietary preferences, including keto, vegan, and gluten-free options. E-commerce and subscription models ensure consistent delivery and enhanced consumer accessibility. High awareness of health, wellness, and quality ingredients drives premium adoption. Strategic partnerships between ingredient suppliers and meal kit companies facilitate scalable supply, while marketing emphasizes convenience, nutrition, and culinary exploration.

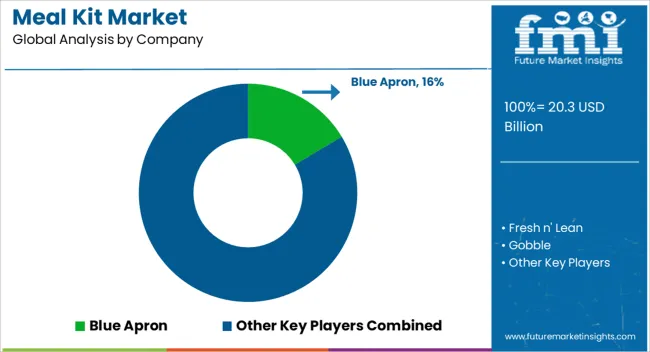

Competition in the meal kit market is shaped by menu variety, ingredient quality, delivery reliability, and digital ordering platforms. Blue Apron leads with customizable weekly meal plans and partnerships with local suppliers. Fresh n' Lean focuses on ready-to-eat, health-oriented meals targeting calorie-conscious consumers. Gobble emphasizes speed and convenience with pre-prepped ingredients that reduce cooking time. HelloFresh competes with broad geographic reach, seasonal recipes, and subscription flexibility. Hungryroot integrates AI-driven meal recommendations and grocery delivery for personalized nutrition. Marley Spoon leverages Martha Stewart-inspired recipes and premium ingredients for home chefs. Purple Carrot specializes in plant-based meal kits, appealing to vegan and vegetarian markets. Relish Labs targets niche health-focused offerings with modular meal components. Sun Basket emphasizes organic ingredients, clean-label meals, and customizable diet plans. Strategies highlight menu innovation, subscription retention programs, and supply chain optimization. Differentiation is achieved through meal customization, ingredient sourcing, dietary focus, and digital ordering experience. Partnerships with local farms, eco-friendly packaging, and AI-enabled personalization are leveraged to secure customer loyalty. Operational efficiency, consistent meal quality, and flexible subscription options are key competitive levers. Product catalogs provide details such as meal type (ready-to-cook vs ready-to-eat), dietary classification (vegetarian, vegan, keto, gluten-free), portion sizes, ingredient sourcing, and cooking times. Recipe guides, nutritional information, and packaging specifications support end consumers. Specialized kits highlight gourmet, international, or functional nutrition offerings. Delivery and storage instructions ensure freshness, while digital apps and online platforms provide ordering convenience, meal tracking, and subscription management for diverse consumer segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 20.3 Billion |

| Meal Type | Vegetarian, Non-vegetarian, Vegan, Paleo, Keto, Mediterranean, and Others |

| Offering | Cook & eat, Heat & eat, and Ready-to-eat |

| Distribution Channel | Online, Grocery stores, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Blue Apron, Fresh n' Lean, Gobble, HelloFresh, Hungryroot, Marley Spoon, Purple Carrot, Relish Labs, and Sun Basket |

| Additional Attributes | Dollar sales, share, subscription trends, consumer preferences, regional demand, ingredient sourcing, pricing strategies, competitor landscape, delivery logistics, emerging diet-specific offerings, promotional effectiveness. |

The global meal kit market is estimated to be valued at USD 20.3 billion in 2025.

The market size for the meal kit market is projected to reach USD 65.5 billion by 2035.

The meal kit market is expected to grow at a 12.4% CAGR between 2025 and 2035.

The key product types in meal kit market are vegetarian, non-vegetarian, vegan, paleo, keto, mediterranean and others.

In terms of offering, cook & eat segment to command 37.6% share in the meal kit market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Meal Kit Delivery Service Market - Trends & Forecast 2025 to 2035

Analysis and Growth Projections for Chilled Meal Kits Market

Plant-Based Meal Kit Market Analysis by Product Type and Distribution Channel Through 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

United States Plant-Based Meal Kits Market Analysis by Product Type, Format, Sales Channel - Growth, Trends and Forecast from 2025 to 2035

Kitchen/ Toilet Roll Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Kitting Robots Market Size and Share Forecast Outlook 2025 to 2035

Meal Voucher Market Size and Share Forecast Outlook 2025 to 2035

Kitchen Tools and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Kitchen Trailers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Kitchen Hood System Market Size and Share Forecast Outlook 2025 to 2035

Kitchen Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Meal Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Meal Replacement Bars Market Size, Growth, and Forecast for 2025 to 2035

Meal Replacement Products Market Analysis by Product type, source, application and region Through 2035

Kitchen Hood Market Insights – Trends & Growth Forecast 2025 to 2035

Meal Replacement Shake Market Trends - Powder & Liquid Analysis

Kitchen Islands and Carts Market

Kitchen Storage Market

Kitchen & Dining Furniture Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA