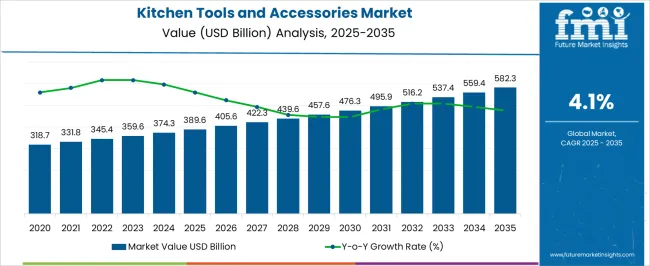

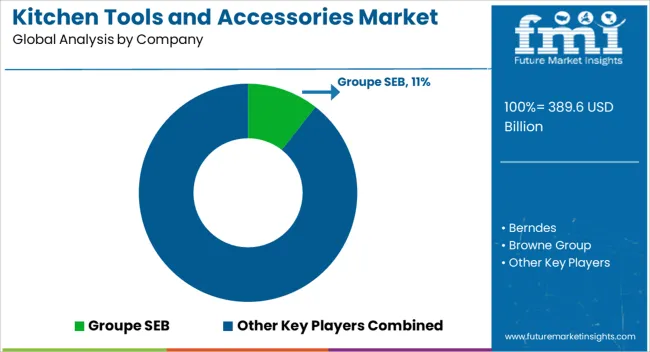

The kitchen tools and accessories market is estimated at USD 389.6 billion in 2025 and is projected to reach USD 582.3 billion by 2035, registering a CAGR of 4.1% during the forecast period. Growth is being influenced by rising consumer focus on home cooking, kitchen aesthetics, and multifunctional tools that simplify meal preparation. Demand is expanding across cookware, cutlery, utensils, storage solutions, and small kitchen gadgets, with premium segments driven by innovation in design, durability, and materials such as stainless steel, silicone, and ceramic coatings. The rise of modular kitchens and lifestyle-driven dining trends has accelerated purchases of both traditional and modern kitchen accessories. E-commerce platforms have enhanced global accessibility, offering customized and designer collections that appeal to younger demographics. Sustainability trends are also shaping the market, with growing adoption of eco-friendly products made from bamboo, recycled plastics, and biodegradable materials.

| Metric | Value |

|---|---|

| Kitchen Tools and Accessories Market Estimated Value in (2025 E) | USD 389.6 billion |

| Kitchen Tools and Accessories Market Forecast Value in (2035 F) | USD 582.3 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The kitchen tools and accessories market is experiencing stable expansion, supported by rising consumer interest in cooking as a lifestyle activity and the continuous evolution of home kitchen setups. Industry developments and product launches have emphasized multifunctional and ergonomic designs that enhance food preparation efficiency. The growing popularity of home cooking, fueled by culinary media content and increased health awareness, has contributed to consistent demand across both urban and suburban households.

Manufacturers have diversified their product portfolios to cater to varying culinary skills, space constraints, and design preferences. Additionally, e-commerce and organized retail networks have improved accessibility to a wider range of products.

Premiumization trends, coupled with the availability of durable and aesthetically appealing materials, are also shaping purchasing decisions. The market’s future growth is expected to be driven by innovations in smart kitchen tools, sustainable materials, and compact designs catering to smaller urban kitchens.

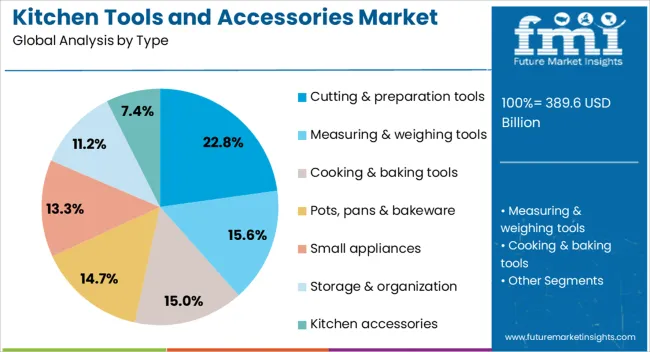

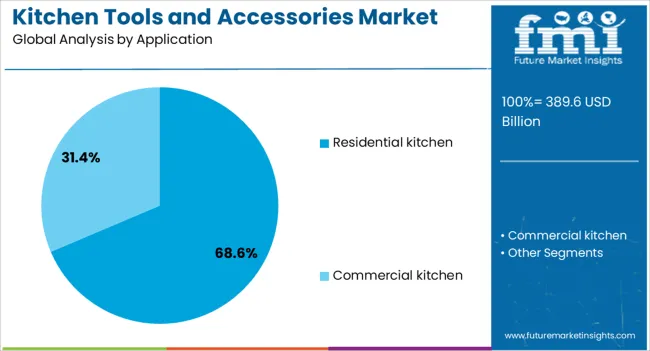

The kitchen tools and accessories market is segmented by type, application, distribution channel, and geographic regions. By type, kitchen tools and accessories market is divided into Cutting & preparation tools, Measuring & weighing tools, Cooking & baking tools, Pots, pans & bakeware, Small appliances, Storage & organization, and Kitchen accessories. In terms of application, kitchen tools and accessories market is classified into Residential kitchen and Commercial kitchen.

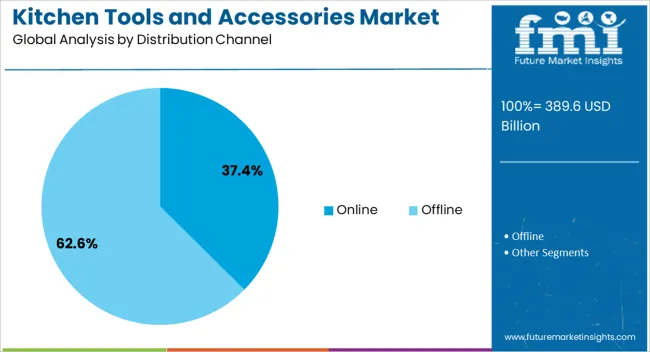

Based on distribution channel, kitchen tools and accessories market is segmented into Online and Offline. Regionally, the kitchen tools and accessories industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Cutting & Preparation Tools segment is projected to account for 22.8% of the kitchen tools and accessories market revenue in 2025, securing a strong position among product categories. Demand in this segment has been supported by its essential role in daily food preparation, spanning from basic cooking tasks to more specialized culinary techniques.

Continuous improvements in blade technology, handle ergonomics, and safety features have enhanced product appeal. Consumers have increasingly opted for multifunctional and space-saving designs that combine several preparation functions into one tool.

Professional and home chefs alike have demonstrated preference for high-quality cutting tools that offer precision, durability, and ease of maintenance. As culinary habits diversify, the Cutting & Preparation Tools segment is expected to sustain growth through both product innovation and replacement demand.

The Residential Kitchen segment is expected to hold 68.6% of the market revenue in 2025, reflecting its dominance in application scope. Growth in this segment has been driven by the rise of home cooking culture, fueled by recipe-sharing platforms, cooking shows, and nutritional awareness campaigns.

Increased investment in home kitchens, particularly in modern, space-efficient designs, has encouraged consumers to purchase tools that enhance convenience and presentation. Seasonal and festive cooking traditions, as well as social gatherings hosted at home, have further reinforced product usage.

The demand for stylish, durable, and functional tools that complement kitchen aesthetics has also shaped buying preferences. As urbanization and home ownership rates rise, the Residential Kitchen segment is anticipated to maintain its lead in the market.

The Online segment is forecasted to contribute 37.4% of the kitchen tools and accessories market revenue in 2025, positioning it as a rapidly expanding distribution channel. Growth in this segment has been enabled by the convenience of comparing product features, prices, and reviews before purchase.

E-commerce platforms and brand-owned websites have expanded their offerings with detailed product demonstrations, bundle deals, and seasonal discounts, attracting a broader consumer base.

The online channel has also facilitated access to niche and specialty kitchen tools that may not be widely available in physical retail. Global reach, quick delivery options, and the ability to source directly from manufacturers have further strengthened its appeal. With continuous growth in digital payment adoption and internet penetration, the Online segment is expected to play an increasingly vital role in market expansion.

The kitchen tools and accessories market is expanding steadily as consumers seek products that enhance cooking efficiency, kitchen organization, and overall culinary experience. These tools contribute durability, ergonomics, and versatility, which are critical for simplifying meal preparation and improving convenience in modern households. Rising disposable incomes and lifestyle-driven interest in home cooking support greater adoption of both basic and premium kitchen tools. Manufacturers focus on innovations in design and materials, including eco-friendly alternatives, multifunctional products, and aesthetic upgrades, to meet diverse consumer preferences while adhering to safety and quality standards.

Consumers increasingly prioritize kitchen tools that provide ease of use, multifunctionality, and durability, driving adoption across categories such as cookware, utensils, and storage solutions. Ergonomic designs, non-stick coatings, and lightweight yet durable materials enhance cooking experiences. The rising culture of home cooking and baking, fueled by digital recipes and cooking shows, supports higher sales of specialized accessories. E-commerce platforms have broadened accessibility, allowing consumers to compare features and designs quickly. Product differentiation also comes from modular and space-saving solutions suited for compact kitchens. This growing focus on convenience and functionality supports premium product sales, encouraging manufacturers to enhance design and utility.

Environmental concerns are pushing manufacturers to develop kitchen tools made from sustainable, recyclable, and biodegradable materials. Stainless steel, bamboo, silicone, and ceramic-based products are gaining traction as eco-friendly alternatives to plastic. Companies are investing in innovative sourcing and production methods to create products that appeal to environmentally conscious consumers. Efforts include using food-grade coatings free from harmful chemicals and developing products with longer lifespans to reduce waste. Some brands offer specialized eco-collections targeting niche markets willing to pay a premium. Regulatory encouragement for safer and greener household goods further boosts adoption. This focus on sustainability fosters long-term consumer trust while broadening market opportunities.

Emerging economies with growing middle-class populations, rising disposable incomes, and expanding urban housing markets present significant opportunities for kitchen tools and accessories. Changing lifestyles and exposure to global culinary trends have encouraged higher adoption of specialized tools beyond traditional cookware. Local manufacturers are scaling production to meet demand for affordable and mid-range products while global brands penetrate premium segments. Expansion of organized retail and online platforms has improved accessibility across rural and semi-urban areas. Government initiatives promoting small appliance and household product manufacturing also support growth. These demographic and economic transitions in emerging regions position them as key demand drivers for global brands.

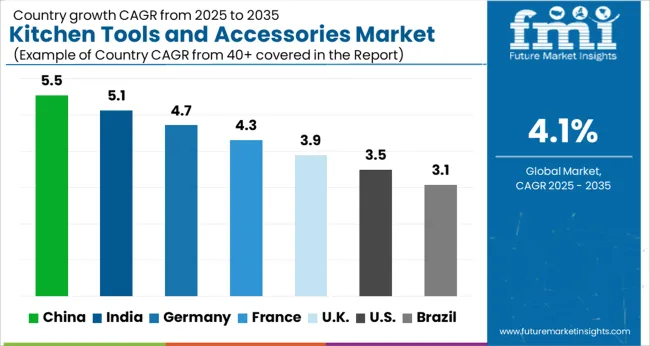

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

China’s kitchen tools and accessories market is projected to grow at a CAGR of 5.5%, supported by rising disposable incomes, rapid urban housing expansion, and increasing interest in modern cooking lifestyles. The penetration of e-commerce platforms has significantly boosted product accessibility, offering both local and international brands. Domestic manufacturers focus on cost-efficient ranges, while premium brands gain traction with stainless steel, ceramic, and multifunctional tools that appeal to urban middle-class consumers. Demand is also reinforced by the growing popularity of home cooking and baking, particularly among younger demographics influenced by digital content and culinary trends. Government-backed initiatives to promote domestic manufacturing further strengthen growth opportunities.

E-commerce expansion boosts accessibility across cities

Premium demand rises for stainless steel and ceramic tools

Young consumers drive interest in baking and specialty products

India’s kitchen tools and accessories market is forecast to grow at a CAGR of 5.1%, driven by a rising middle-class population, growing nuclear households, and increasing awareness of modern cooking methods. Affordable yet durable utensils and cookware dominate demand, while premium multifunctional gadgets are gaining visibility in urban centers. The spread of organized retail and online platforms has enhanced access, enabling consumers to purchase branded and imported products. Manufacturers are increasingly offering eco-friendly materials such as bamboo and silicone to cater to environmentally conscious buyers. The rising popularity of cooking shows, recipe platforms, and festive gifting further supports strong adoption across categories.

Affordable, durable tools dominate in mass market segments

Eco-friendly products gain traction in urban centers

Online platforms expand reach of global and premium brands

Germany’s kitchen tools and accessories market is projected to grow at a CAGR of 4.7%, supported by strong consumer preference for premium quality, durable, and ergonomically designed products. German households emphasize functionality and long product life, encouraging adoption of stainless steel, ceramic, and eco-certified materials. Established kitchenware brands maintain dominance, while niche companies focus on design-driven and modular solutions. The rise of sustainable living has fueled demand for eco-friendly accessories, including biodegradable and recyclable products. Specialty stores and online retailers cater to consumer interest in high-end and customized tools. Demand is also reinforced by Germany’s strong culinary culture, which values both traditional and innovative kitchen solutions.

Premium and durable products dominate consumer preference

Sustainability drives adoption of eco-certified kitchen tools

Strong culinary culture supports high-end product categories

France’s kitchen tools and accessories market is expected to expand at a CAGR of 4.3%, supported by the country’s strong culinary traditions and growing consumer interest in modern kitchen aesthetics. Demand is high for ergonomically designed utensils, specialty cookware, and stylish storage solutions. Eco-friendly products made from bamboo, silicone, and ceramic blends are gaining ground, driven by consumer awareness and regulatory encouragement for safer materials. French households also show preference for compact, multifunctional accessories suited to smaller urban kitchens. Retailers focus on premium branding and lifestyle marketing to appeal to style-conscious consumers. Culinary tourism and cooking classes further encourage adoption of specialty tools and gadgets.

Culinary traditions drive demand for specialty cookware

Eco-friendly tools adopted under stricter regulations

Compact multifunctional products popular in urban households

The United Kingdom’s kitchen tools and accessories market is projected to grow at a CAGR of 3.9%, influenced by strong demand for convenience-oriented products, premium cookware, and modern storage solutions. E-commerce channels dominate sales, with subscription models and direct-to-consumer brands gaining popularity. Multifunctional tools that save space and time are in demand, especially among younger consumers in urban areas. Premium products such as designer cutlery, ceramic-coated pans, and digital kitchen gadgets are becoming status symbols. Eco-conscious buyers are also driving demand for sustainable kitchenware, creating opportunities for brands promoting recyclable and biodegradable materials. Lifestyle marketing, influencer collaborations, and gifting trends support steady growth.

E-commerce and subscription models expand sales reach

Designer and digital gadgets drive premium adoption

Eco-conscious consumers prefer recyclable kitchen tools

The kitchen tools and accessories market is marked by intense competition, with global leaders, mid-tier firms, regional brands, and private labels all competing across different price segments. Established players such as Tefal, Zwilling, Le Creuset, and KitchenAid hold strong positions through brand reputation, premium materials, and innovative designs that appeal to both professional chefs and home cooks. Their scale allows them to dominate international distribution networks, while investments in R&D keep their products at the forefront of durability and functionality. Mid-tier and regional manufacturers compete on affordability and adaptability, often tailoring products to local preferences or introducing eco-friendly ranges to capture environmentally conscious consumers.

Private-label offerings from major retailers are expanding rapidly, especially in cost-sensitive markets, placing pressure on established brands to differentiate through performance, warranties, and value-added features. Competitive strategies increasingly focus on multifunctional, space-saving products suited for modern kitchens, alongside e-commerce channels and influencer-driven branding that capture younger demographics. Consolidation is evident in premium categories, with acquisitions enabling firms to extend geographic presence and diversify design portfolios, while sustainability and customization emerge as key levers for competitive differentiation.

| Item | Value |

|---|---|

| Quantitative Units | USD 389.6 Billion |

| Type | Cutting & preparation tools, Measuring & weighing tools, Cooking & baking tools, Pots, pans & bakeware, Small appliances, Storage & organization, and Kitchen accessories |

| Application | Residential kitchen and Commercial kitchen |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Groupe SEB, Berndes, Browne Group, China ASD, Conair, De Buyer, Fissler, Giza, Kai, Le Creuset, Linkfair, Lifetime, Maspion, Meyer, and Neoflam |

| Additional Attributes | Dollar sales vary by product type, including utensils, cutlery, peelers, graters, and specialty tools; by material, spanning stainless steel, silicone, wood, and plastics; by application, such as cooking, baking, food preparation, and storage; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising home cooking trends, kitchen modernization, and demand for durable, ergonomic, and innovative tools. |

The global kitchen tools and accessories market is estimated to be valued at USD 389.6 billion in 2025.

The market size for the kitchen tools and accessories market is projected to reach USD 582.3 billion by 2035.

The kitchen tools and accessories market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in kitchen tools and accessories market are cutting & preparation tools, measuring & weighing tools, cooking & baking tools, pots, pans & bakeware, small appliances, storage & organization and kitchen accessories.

In terms of application, residential kitchen segment to command 68.6% share in the kitchen tools and accessories market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Kitchen/ Toilet Roll Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Kitchen Trailers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Kitchen Hood System Market Size and Share Forecast Outlook 2025 to 2035

Kitchen Hood Market Insights – Trends & Growth Forecast 2025 to 2035

Kitchen Storage Market

Kitchen & Dining Furniture Market

Kitchen Islands and Carts Market

Kitchen Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

MEA Kitchen Storage Market Growth – Trends & Forecast 2025 to 2035

Toy Kitchens and Play Food Market Size and Share Forecast Outlook 2025 to 2035

Smart Kitchen Appliances Market Size and Share Forecast Outlook 2025 to 2035

Cloud Kitchen Market Trends – Size, Demand & Forecast 2025-2035

Small Kitchen Appliances Market Growth – Demand & Trends to 2033

Outdoor Kitchen Appliances Market Size and Share Forecast Outlook 2025 to 2035

Modular Kitchen Baskets Market Size and Share Forecast Outlook 2025 to 2035

Built-In Kitchen Appliance Market Outlook – Size, Share & Innovations 2025 to 2035

Household Kitchen Appliances Market Size and Share Forecast Outlook 2025 to 2035

Table and Kitchen Linen Market Size and Share Forecast Outlook 2025 to 2035

Commercial Kitchen Ventilation System Market Growth - Trends & Forecast 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA