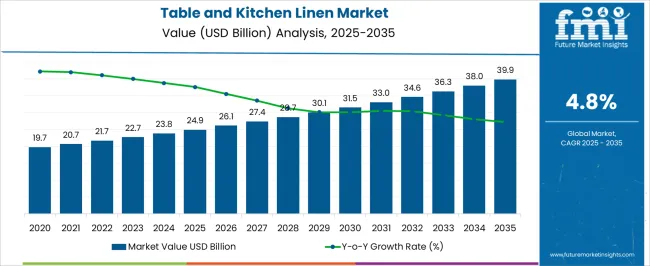

The table and kitchen linen market is estimated to be valued at USD 24.9 billion in 2025 and is projected to reach USD 39.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

The growth is being driven by increasing demand for premium and customized linen products across households, restaurants, hotels, and hospitality sectors. Rising consumer preference for high-quality, durable, and aesthetically appealing textiles is fueling adoption, alongside the expansion of the hospitality and food service industries globally. Manufacturers are focusing on innovative designs, eco-friendly fabrics, and multifunctional products such as stain-resistant, machine-washable, and quick-dry linen to enhance consumer convenience. Regional trends, including higher disposable incomes and changing lifestyles in emerging markets, are stimulating demand for decorative and functional kitchen textiles.

E-commerce platforms and omnichannel retail strategies are widening product reach and accessibility. Additionally, collaborations with interior designers, chefs, and hospitality chains are enabling co-branded and curated linen collections, further driving market growth. The competitive landscape emphasizes product differentiation, colorfastness, texture, and material quality, while supply chain optimization and sustainable sourcing practices are becoming increasingly important for market players.

The table and kitchen linen market is strongly influenced by five interconnected parent markets, each contributing uniquely to overall demand and growth. The hospitality and food service sector holds the largest share at 35%, driven by restaurants, hotels, catering services, and banquet facilities demanding premium, durable, and aesthetically appealing table and kitchen linens to enhance guest experience and brand image.

The retail and e-commerce distribution market contributes 25%, as supermarkets, specialty home décor stores, and online platforms provide accessibility, variety, and convenience, making linens more widely available to households and small businesses. The home décor and interior design market accounts for 15%, where designers integrate customized, color-coordinated, and themed linens into dining and kitchen spaces to improve aesthetic appeal and functionality.

The wholesale and institutional supply market holds a 15% share, catering to bulk orders from hotels, corporate cafeterias, and catering firms seeking cost-effective, standardized linen solutions. Finally, the consumer lifestyle and gifting market represents 10%, driven by seasonal purchases, festive gifting, and personalized linen products. Collectively, hospitality, retail, and interior design segments account for 75% of overall demand, highlighting that service quality, product variety, and design integration remain the primary growth drivers, while wholesale and lifestyle segments offer complementary opportunities for global market expansion.

| Metric | Value |

|---|---|

| Table and Kitchen Linen Market Estimated Value in (2025 E) | USD 24.9 billion |

| Table and Kitchen Linen Market Forecast Value in (2035 F) | USD 39.9 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The table and kitchen linen market is experiencing steady expansion, driven by evolving consumer preferences for aesthetically appealing, durable, and functional home textile products. Lifestyle shifts, increased interest in home décor, and the influence of social media on interior styling have all contributed to heightened demand for coordinated and stylish table and kitchen linens.

Industry sources and trade reports indicate that growing hospitality sector activity, including hotels, restaurants, and catering services, has also boosted procurement of high-quality linens. Advances in textile manufacturing, such as digital printing and stain-resistant treatments, have enhanced both the functionality and design versatility of these products.

Additionally, consumers are increasingly seeking sustainable and easy-care fabrics, prompting manufacturers to invest in eco-friendly production methods. The market outlook remains positive, supported by rising disposable incomes, seasonal product launches, and the global expansion of home goods retail chains. Segmental momentum is expected to be anchored by the Table product category, Cotton as the preferred material, and the Medium price range, which balances affordability with quality.

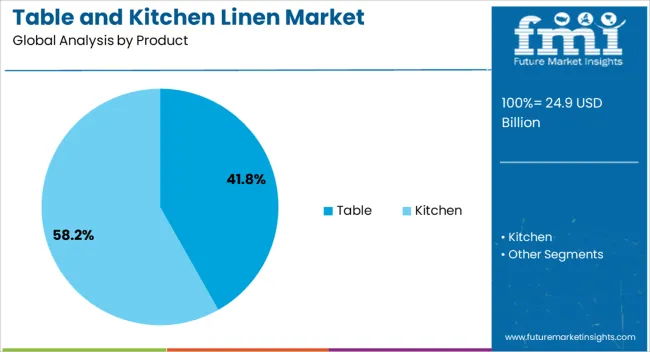

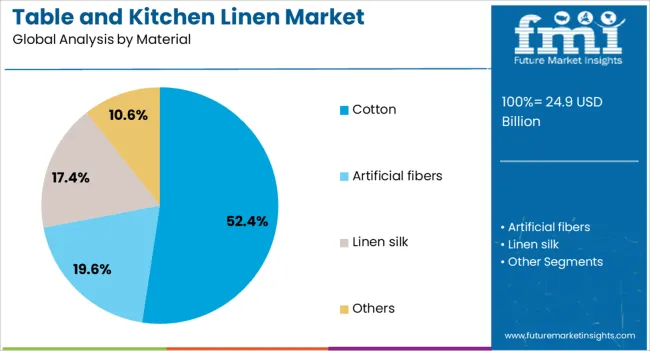

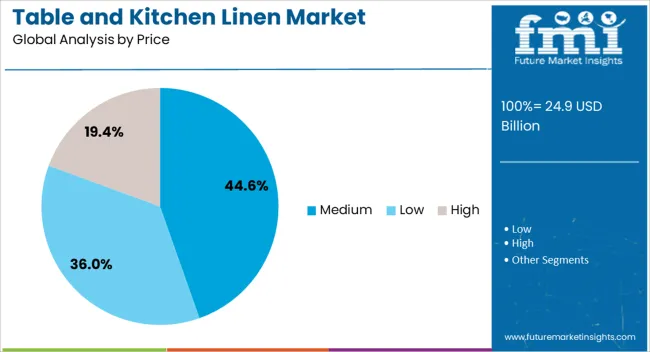

The table and kitchen linen market is segmented by product, material, price, application, distribution channel, and geographic regions. By product, table and kitchen linen market is divided into table and kitchen. In terms of material, table and kitchen linen market is classified into cotton, artificial fibers, linen silk, and others. Based on price, table and kitchen linen market is segmented into medium, low, and high. By application, table and kitchen linen market is segmented into commercial and residential. By distribution channel, table and kitchen linen market is segmented into offline and online. Regionally, the table and kitchen linen industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The table segment is projected to account for 41.8% of the table and kitchen linen market revenue in 2025, maintaining its lead due to sustained demand from both residential and commercial buyers. This segment benefits from its integral role in dining presentation and hospitality settings, where table linens contribute to aesthetic appeal and protection of surfaces.

Trade publications have noted that consumer demand for table linens has been bolstered by seasonal events, festive occasions, and an increasing focus on curated dining experiences at home. Additionally, the rise of thematic and custom-designed table covers, runners, and placemats has broadened product variety, attracting a wider audience.

In the commercial domain, hotels and restaurants continue to invest in premium table linens to reinforce brand image and guest experience. This consistent demand across both personal and institutional use has reinforced the Table segment’s position as a key driver in the market.

The cotton segment is projected to contribute 52.4% of the table and kitchen linen market revenue in 2025, retaining its dominant share due to the material’s durability, softness, and ease of maintenance. Cotton has been favored for its natural feel, breathability, and ability to hold dyes effectively, enabling vibrant and long-lasting designs.

Industry data and supplier reports indicate that cotton linens are also highly valued for their absorbency and resilience in frequent washing cycles, making them ideal for both home and professional use. The shift toward natural and sustainable fibers has further strengthened cotton’s position, as consumers increasingly prefer eco-friendly textile choices.

Additionally, the adaptability of cotton to various fabric finishes such as wrinkle resistance, stain repellence, and blended compositions has expanded its market appeal. With strong consumer trust and versatile application potential, cotton remains the preferred material for table and kitchen linens across diverse markets.

The medium price segment is projected to account for 44.6% of the table and kitchen linen market revenue in 2025, establishing itself as the leading price category by balancing quality with affordability. Consumers in this segment seek products that combine durability, attractive design, and reasonable cost, making it a popular choice for both everyday use and special occasions.

Retail market observations have shown that medium-priced linens offer a competitive blend of high-quality materials, varied design options, and brand reliability without reaching premium price levels. This category also appeals to a broad customer base, including middle-income households and hospitality businesses looking for cost-effective yet stylish solutions.

The availability of medium-priced products across both offline and online retail platforms has further enhanced accessibility. As purchasing behavior continues to prioritize value-for-money without compromising on aesthetics or performance, the Medium price segment is expected to maintain its leading position.

The table and kitchen linen market is primarily driven by hospitality demand, retail accessibility, home décor influence, and institutional bulk purchases. Premiumization, aesthetics, and repeat contracts shape sustained growth.

The table and kitchen linen market is primarily driven by hospitality demand, retail accessibility, home décor influence, and institutional bulk purchases. Premiumization, aesthetics, and repeat contracts shape sustained growth.

The table and kitchen linen market is witnessing strong growth driven by the hospitality and catering sector. Hotels, restaurants, and event management companies are increasingly investing in premium-quality tablecloths, napkins, and kitchen towels to enhance customer experience and brand image. Banquet facilities, luxury resorts, and fine-dining establishments prefer customized linen solutions that align with interior décor, color schemes, and themes. Seasonal demand spikes during peak tourism periods and festive seasons further contribute to dollar sales growth. Hotel chains and catering firms often opt for bulk purchases, influencing market share and encouraging manufacturers to provide high-durability fabrics, stain resistance, and easy maintenance features. Partnerships with linen rental services also support recurring revenue streams.

Retail and e-commerce channels play a crucial role in market expansion by enhancing accessibility and variety for consumers. Supermarkets, home décor stores, and online platforms are introducing curated collections of table and kitchen linens, attracting household buyers, small-scale caterers, and boutique hotels. Seasonal promotions, bundle offers, and direct-to-consumer deliveries support dollar sales growth, while the share of online sales is steadily increasing. Customized embroidery, prints, and color-coordinated sets are marketed to meet regional preferences. Manufacturers leverage retail partnerships for wider distribution and visibility, ensuring availability across urban and semi-urban regions. The growing emphasis on convenience and home décor aesthetics drives repeat purchases, while online reviews and ratings influence buying decisions.

Consumer focus on interior aesthetics is shaping the table and kitchen linen market. Homeowners and designers seek linens that complement kitchen and dining spaces in terms of color palettes, patterns, and textures. Dollar sales are boosted by themed collections, seasonal designs, and coordinated sets that enhance overall dining experiences. Interior designers and décor consultants influence market share by recommending premium and customized linens for modern homes, boutique restaurants, and show kitchens. Manufacturers respond with versatile fabrics, easy-care materials, and aesthetic customization options. The integration of designer collaborations and limited-edition collections also generates higher perceived value. Market dynamics are increasingly driven by lifestyle trends, social media influence, and consumer awareness of high-quality linen products.

Wholesale and institutional supply channels contribute significantly to market growth by catering to bulk demand from hotels, restaurants, catering companies, and corporate cafeterias. Dollar sales are influenced by long-term contracts, standardized product lines, and cost-effective bulk pricing. Institutional buyers focus on durability, maintenance efficiency, and compliance with hygiene standards. The share of large-scale buyers is growing, prompting manufacturers to offer bulk packaging, rental options, and after-sales support. Seasonal orders for events, conferences, and corporate gatherings further increase demand. Partnerships with linen service providers and laundry operators enable repeat purchases and recurring revenue streams. The institutional channel ensures steady market penetration while reinforcing manufacturer credibility and brand recognition.

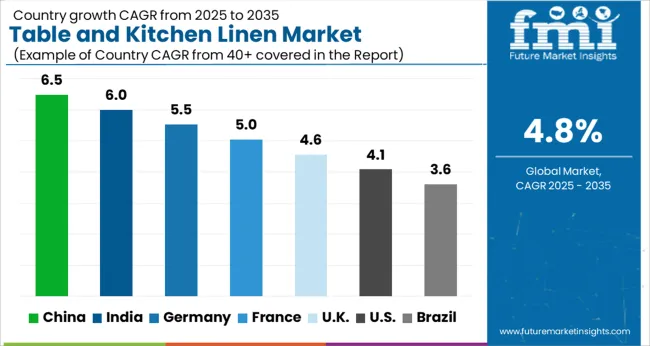

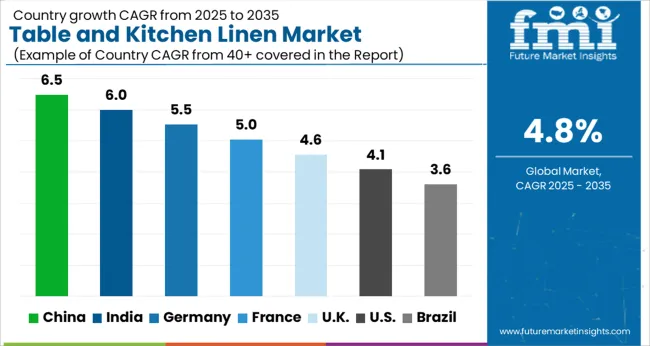

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

The global table and kitchen linen market is projected to grow at a CAGR of 4.8% from 2025 to 2035. China leads at 6.5%, followed by India at 6.0%, France at 5.0%, the UK at 4.6%, and the USA at 4.1%. Growth is driven by rising demand from hospitality, retail, and home décor sectors, with hotels, restaurants, and households seeking premium, customized, and aesthetically appealing linen products. BRICS countries, particularly China and India, are witnessing increased e-commerce penetration and bulk institutional purchases, while OECD nations like France, the UK, and the USA focus on high-quality, durable, and designer linen collections to meet consumer expectations. Seasonal promotions, themed collections, and omnichannel distribution further support dollar sales and market share expansion. The analysis covers over 40+ countries, with the leading markets detailed below.

The table and kitchen linen market in China is projected to grow at a CAGR of 6.5% from 2025 to 2035, driven by rising consumer spending on home décor, hospitality expansions, and e-commerce penetration. Demand is fueled by households and hotels seeking premium, durable, and aesthetically appealing tablecloths, napkins, and kitchen towels. Domestic manufacturers are scaling up production capacities and investing in advanced textile finishing and dyeing technologies to enhance quality, softness, and stain resistance. Retailers are leveraging both physical stores and online marketplaces to increase availability and reach. Seasonal collections, festive designs, and customization options for hotels, restaurants, and banquet services are creating additional growth opportunities. Collaboration with international textile suppliers is introducing innovative fabrics and high-end designs tailored to Chinese consumer preferences.

The table and kitchen linen market in India is expected to expand at a CAGR of 6.0% from 2025 to 2035, supported by rising disposable incomes, expanding hospitality infrastructure, and increasing consumer interest in home décor. Hotels, restaurants, and households are seeking high-quality, colorful, and durable linen products including tablecloths, napkins, kitchen towels, and placemats. Domestic manufacturers are investing in modern weaving, dyeing, and finishing technologies to improve fabric quality, softness, and longevity. Retail chains and e-commerce platforms such as Flipkart and Amazon are widening distribution channels, enabling greater accessibility and visibility. Seasonal product launches, festive designs, and customizable hotel and banquet collections are driving incremental growth. Collaborations with international textile suppliers provide premium fabric options, introducing innovative patterns and eco-friendly treatments.

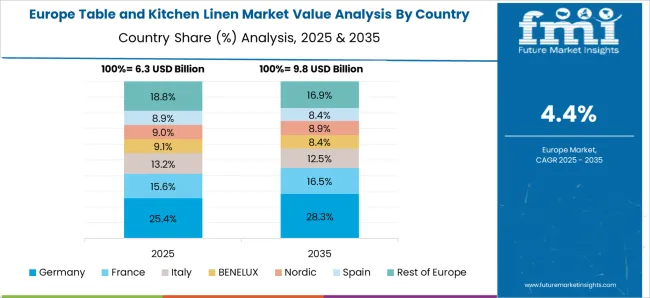

The table and kitchen linen market in France is projected to grow at a CAGR of 5.0% from 2025 to 2035, driven by the country’s strong hospitality industry, premium home décor preferences, and growing e-commerce adoption. Restaurants, hotels, and luxury households seek high-quality linens with elegant designs, soft textures, and stain resistance. Manufacturers focus on premium fabrics, traditional weaving techniques, and eco-friendly materials to align with local consumer preferences. Retailers are expanding omnichannel presence, combining boutique stores with online sales platforms to enhance product reach. Seasonal collections, festival-oriented designs, and collaborations with designers and brands create additional market opportunities. Government initiatives promoting domestic textile production and sustainability also support growth. Export potential to other EU nations further drives industry expansion.

The table and kitchen linen market in the UK is expected to expand at a CAGR of 4.6% from 2025 to 2035, supported by growing consumer focus on home décor, hotel and restaurant upgrades, and e-commerce expansion. Demand is concentrated in urban households, hotels, and event management companies requiring high-quality, durable, and stylish tablecloths, napkins, and kitchen towels. Domestic manufacturers are focusing on improving fabric quality, texture, and stain resistance while incorporating premium and eco-friendly materials. Retailers are strengthening online and offline distribution networks, offering curated seasonal collections and festive designs. Partnerships with interior designers, catering businesses, and international suppliers provide access to innovative fabrics and patterns, further enhancing market share. Trends toward personalized and branded linens for hospitality are emerging.

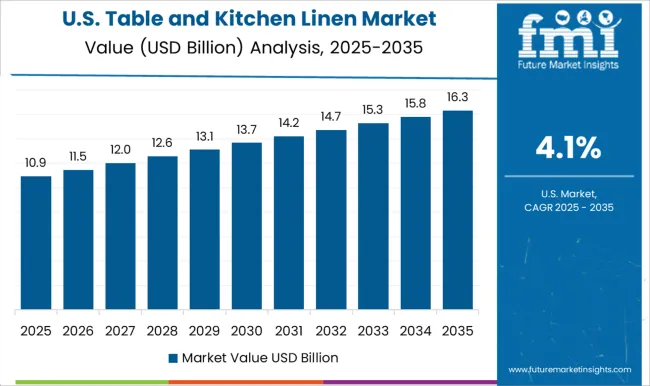

The table and kitchen linen market in the USA is projected to grow at a CAGR of 4.1% from 2025 to 2035, driven by increasing consumer interest in home décor, holiday dining trends, and the expansion of the hospitality sector. Demand is concentrated in households, hotels, restaurants, and banquet services seeking soft, durable, and aesthetically pleasing tablecloths, napkins, and kitchen towels. Domestic manufacturers are investing in high-quality weaving, finishing, and eco-friendly materials to meet consumer expectations. Retailers are strengthening omnichannel distribution through e-commerce and brick-and-mortar stores, offering seasonal and festive designs, designer collaborations, and customized hotel and restaurant collections. Export potential and cross-border partnerships with textile suppliers provide access to innovative fabrics and designs. Sustainability-conscious consumers are driving adoption of organic and premium-quality linens.

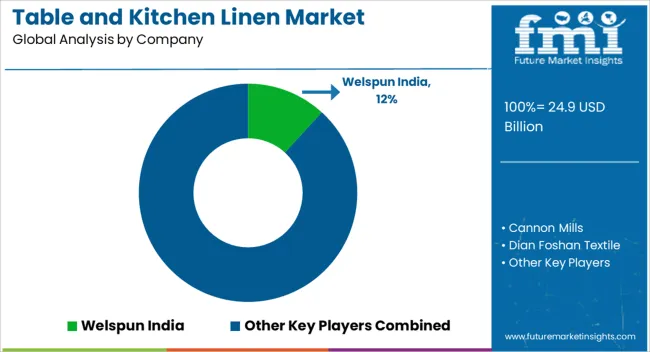

Competition in the table and kitchen linen market is shaped by fabric quality, design aesthetics, and durability for both residential and hospitality applications. Welspun India leads with premium cotton and microfiber linens, emphasizing softness, colorfastness, and innovative patterns for global retail and hospitality clients. Cannon Mills competes with high-quality woven and printed tablecloths, napkins, and kitchen towels, focusing on large-scale production and distribution efficiency. Dian Foshan Textile differentiates through decorative linens, themed collections, and bulk supply for hotels, restaurants, and events. H&M Home leverages global fashion insights, offering trendy designs, seasonal collections, and affordable yet stylish linens targeting urban consumers. Specialty and regional players such as Hampton Linens, Kimbell Foods, LinenMe, and Ralph Lauren Home compete via premium, luxury, and designer-focused product lines, emphasizing unique patterns, embroidery, and eco-friendly materials.

Shree Jee International, SS Rathi Textiles, Standard Textile, Sunvim Group, Trident Group, Uptown Home, and Verenich Home Textiles focus on durability, functional designs, and diverse color palettes suitable for household and hospitality sectors. Strategies include omnichannel distribution, collaboration with interior designers, customization options, and seasonal launches to maintain consumer interest. Product brochures detail fabric composition, thread count, weave patterns, care instructions, dimensions, and stain resistance. Certifications for quality, fire safety, and eco-friendly standards are highlighted. Optional packaging, gifting formats, and bulk supply options are emphasized, reflecting a market concentrated on aesthetics, performance, and versatility in home and hospitality linen solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 24.9 billion |

| Product | Table and Kitchen |

| Material | Cotton, Artificial fibers, Linen silk, and Others |

| Price | Medium, Low, and High |

| Application | Commercial and Residential |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Welspun India, Cannon Mills, Dian Foshan Textile, H&M Home, Hampton Linens, Kimbell Foods, LinenMe, Ralph Lauren Home, Shree Jee International, SS Rathi Textiles, Standard Textile, Sunvim Group, Trident Group, Uptown Home, and Verenich Home Textiles |

| Additional Attributes | Dollar sales, market share by product type (tablecloths, napkins, towels), fabric preferences, premium vs. mass-market segmentation, demand from hospitality and retail, seasonal trends, distribution channels, competitive positioning, and growth projections. |

The global table and kitchen linen market is estimated to be valued at USD 24.9 billion in 2025.

The market size for the table and kitchen linen market is projected to reach USD 39.9 billion by 2035.

The table and kitchen linen market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in table and kitchen linen market are table, tablecloth, table runners, placemats, napkins, coaters, kitchen, dish towel, oven mitts or gloves, aprons, dishcloths and kitchen napkins.

In terms of material, cotton segment to command 52.4% share in the table and kitchen linen market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tablet Hardness Testers Market Size and Share Forecast Outlook 2025 to 2035

Table Tents Market Size and Share Forecast Outlook 2025 to 2035

Tabletop CNC Milling Machines Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Tableware Market Trends – Growth & Forecast 2025 to 2035

Tablet Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tablets for Oral Suspension Market Analysis Size and Share Forecast Outlook 2025 to 2035

Tablet Press Machines Market Size and Share Forecast Outlook 2025 to 2035

Tablet Based E-Detailing Market Size and Share Forecast Outlook 2025 to 2035

Tabletop Pizza Oven Market Size and Share Forecast Outlook 2025 to 2035

Tableau Services Market Size and Share Forecast Outlook 2025 to 2035

Tablet Market Analysis by Product Type, End-Use, Operating System, and Region Through 2035

Key Players & Market Share in Tablet Packing Machine Industry

Competitive Landscape of Tableware Providers

Tablet Counting Machine Market Trends & Forecast 2024-2034

Tablet Cartons Market

Tabletop Tape Dispensers Market

Tablet Tissue Paper Market

Tablet Bottle Market

Table Linen Market Size and Share Forecast Outlook 2025 to 2035

Tableland Tourism Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA