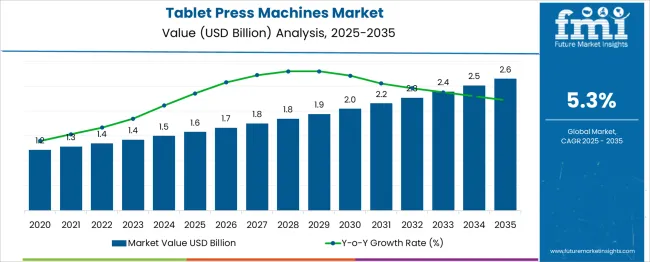

The Tablet Press Machines Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 2.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period. The tablet press machines market is creating an absolute dollar opportunity of USD 1.0 billion over the forecast period. This growth reflects a multiplier of 1.63x, supported by a CAGR of 5.3%, driven by the rising demand for pharmaceutical tablets, dietary supplements, and advancements in tablet manufacturing technologies.

In the first five-year phase (2025 to 2030), the market is expected to reach approximately USD 2.0 billion, adding USD 0.4 billion, which accounts for 40% of the total incremental growth, fueled by technological upgrades, automation, and increasing investments in the pharmaceutical sector.

The second phase (2030 to 2035) contributes USD 0.6 billion, representing 60% of incremental growth, as demand for high-speed and multifunctional tablet presses rises with the expansion of generic drug production and nutraceutical formulations. Annual increments increase from USD 0.08 billion in the early years to USD 0.12 billion by 2035, reflecting consistent adoption in emerging markets.

Manufacturers focusing on high-precision, energy-efficient, and flexible tablet press solutions will capture the largest share of this USD 1.0 billion opportunity, particularly as contract manufacturers and pharmaceutical companies prioritize efficiency and scalability.

| Metric | Value |

|---|---|

| Tablet Press Machines Market Estimated Value in (2025 E) | USD 1.6 billion |

| Tablet Press Machines Market Forecast Value in (2035 F) | USD 2.6 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The tablet press machines market is advancing steadily, driven by rising pharmaceutical demand, advancements in drug formulation technologies, and stringent manufacturing compliance requirements. The growing adoption of high-throughput and precision-controlled equipment has positioned tablet press machines as integral assets for modern pharmaceutical production.

Regulatory frameworks such as cGMP and FDA norms are encouraging manufacturers to invest in machines that ensure dose consistency, minimize waste, and provide real-time process monitoring. Additionally, innovations in sensor integration, automation, and clean-in-place (CIP) systems have enhanced operational efficiency while reducing downtime.

As emerging economies ramp up local pharmaceutical production and nutraceutical companies expand their product portfolios, demand for scalable, automated tablet press solutions is anticipated to accelerate. The future outlook is shaped by digital twin adoption, shift toward continuous manufacturing, and demand for hybrid machines that accommodate multi-layer and special formulation tablets.

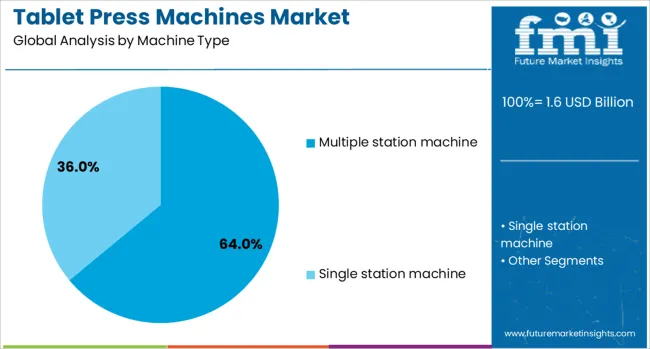

The tablet press machines market is segmented by machine type, mode of operation, capacity, end-use industry, distribution channel, and geographic regions. By machine type, the tablet press machines market is divided into multiple-station machines and single-station machines.

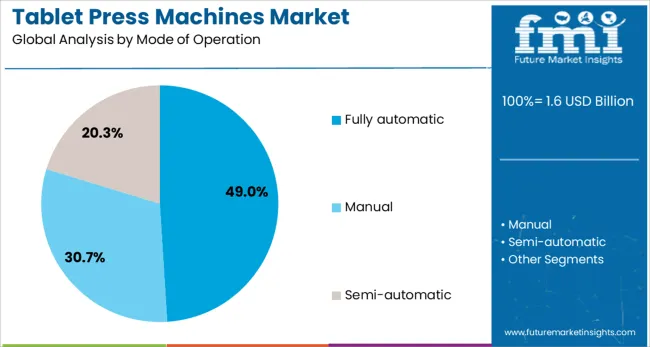

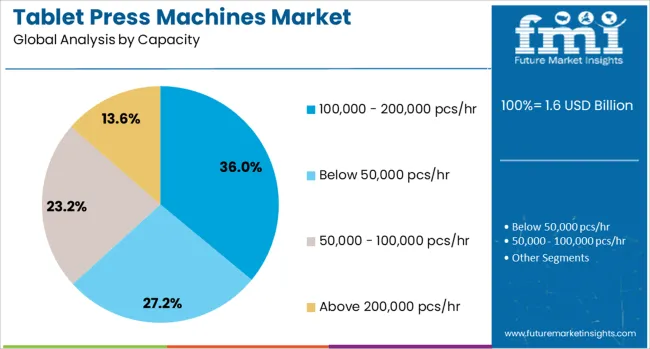

In terms of mode of operation of the tablet press machines market is classified into Fully automatic, ManualSemi-automatic. Based on the capacity of the tablet press machines market, it is segmented into 100,000 - 200,000 pcs/hr, Below 50,000 pcs/hr, 50,000 - 100,000 pcs/hr, and Above 200,000 pcs/hr. By end-use industry, the tablet press machines market is segmented into Pharmaceutical, Food and beverages, Cosmetics and personal care, and others (nutraceuticals, etc.).

The distribution channel of the tablet press machines market is segmented into Direct sales and indirect sales. Regionally, the tablet press machines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Multiple station machines are projected to dominate the market with a 64.0% revenue share in 2025, establishing them as the leading machine type. Their dominance is attributed to their capacity for high-speed production, uniform tablet quality, and integration into continuous processing lines.

These machines support mass-scale pharmaceutical output without compromising on weight, thickness, or hardness, precision key parameters required for regulatory compliance. Enhanced tooling capabilities and quick-change formats have further improved production uptime and flexibility, enabling manufacturers to adapt to varied formulation requirements.

Their compatibility with smart monitoring systems has allowed better traceability, reducing manual errors and improving validation documentation. As pharmaceutical companies strive for efficient scale-up strategies, multiple-station machines remain critical to large-batch, high-speed tablet manufacturing operations.

Fully automatic machines are expected to hold 49.0% of the revenue share in 2025, reflecting their growing appeal among pharmaceutical and nutraceutical manufacturers. Their market leadership stems from enhanced precision, reduced human error, and real-time production analytics offered through automated workflows.

Integration of programmable logic controllers (PLC), servo systems, and data logging tools allows full control over pressure, feeding, and ejection processes, ensuring regulatory conformity and product repeatability. In addition, fully automatic machines contribute to cost savings through reduced labor dependency and improved material utilization.

With rising demand for continuous production and faster batch turnaround, the fully automatic mode of operation is increasingly preferred by large-scale producers prioritizing efficiency, traceability, and quality assurance.

The 100,000 - 200,000 pcs/hr capacity range is projected to account for 36.0% of the tablet press machines market revenue in 2025, leading among capacity segments. This prominence is driven by its suitability for mid- to large-scale pharmaceutical production, striking an optimal balance between throughput and equipment footprint.

Manufacturers favor this capacity range for its compatibility with most commercial-scale tablet formulations without the operational complexities of ultra-high-speed models. Machines in this range are capable of supporting diverse product lines with minimal downtime through modular tooling and rapid batch changeover features.

Furthermore, this segment benefits from energy-efficient designs and enhanced dust extraction systems, ensuring GMP-compliant operations with reduced environmental and occupational risk. As demand rises for multi-product facilities and regional manufacturing hubs, this capacity range continues to be the preferred choice for scalable, compliant production.

The tablet press machines market is expanding due to the increasing demand for efficient manufacturing of pharmaceutical and nutraceutical tablets. In 2024 and 2025, growth drivers include rising demand for customized tablet formulations and the shift toward automation in tablet production. Opportunities lie in the demand for high-speed, high-efficiency tablet presses and integration with IoT for predictive maintenance. Emerging trends include continuous manufacturing systems and demand for smaller, more compact machines. However, high initial capital investment and the complexity of meeting stringent regulatory standards remain key barriers.

The primary growth driver is the increasing need for faster and more efficient tablet production. In 2024 and 2025, pharmaceutical manufacturers sought more advanced tablet press machines capable of handling high volumes and custom formulations. The push towards higher quality control and precise dose formulations further accelerated the demand for automated systems. The growing global demand for pharmaceutical and nutraceutical products, particularly tablets, remains a significant factor driving growth in the tablet press machines market.

Opportunities are rising in automation and the adoption of high-speed tablet press machines. In 2025, manufacturers focused on automation to streamline tablet production lines and minimize human error. Demand for faster, high-capacity machines, capable of producing large quantities without compromising tablet quality, spurred innovation. Additionally, the integration of sensors and IoT technology in machines for predictive maintenance and performance tracking created new market segments. These developments suggest that manufacturers investing in automation and connected technology are well-positioned to capitalize on market demand.

Emerging trends in the tablet press machines market include the shift towards continuous manufacturing processes and more compact machine designs. In 2024, continuous production lines gained popularity, allowing for more consistent tablet quality and increased efficiency. Moreover, the demand for smaller, modular machines that can fit in limited production spaces increased as manufacturers sought to optimize factory layouts. These trends indicate a preference for flexible, high-performance tablet press machines that cater to diverse production needs while maximizing space utilization and productivity.

Key restraints include high initial costs and stringent regulatory compliance. In 2024 and 2025, the high capital expenditure required to acquire advanced tablet press machines limited accessibility for smaller pharmaceutical manufacturers. Additionally, the complexity of meeting regulatory standards, such as GMP (Good Manufacturing Practices) and FDA approvals, delayed the adoption of newer technologies. These barriers highlight the need for cost-effective solutions and more streamlined regulatory processes to enable broader adoption of advanced tablet press machines in the pharmaceutical and nutraceutical industries.

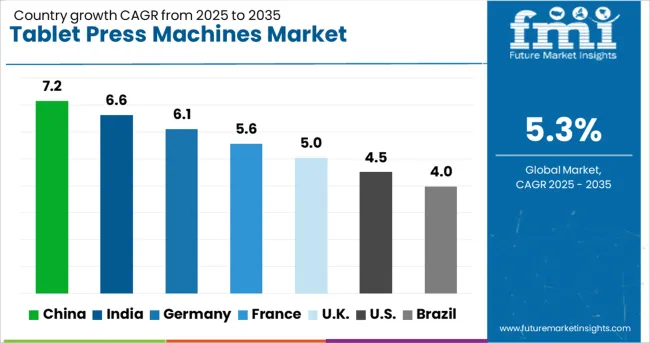

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

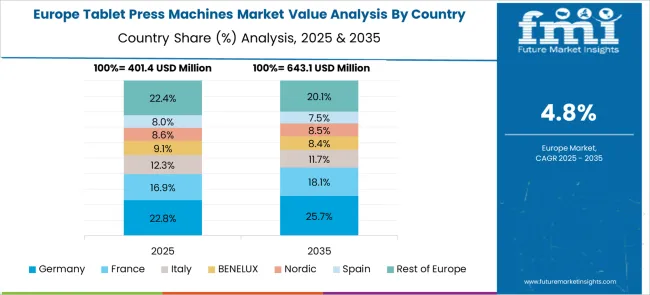

The global tablet press machines market is projected to grow at 5.3% CAGR from 2025 to 2035. China leads with 7.2% CAGR, driven by growing pharmaceutical manufacturing and increasing demand for high-efficiency tablet production. India follows at 6.6%, supported by expanding pharmaceutical and nutraceutical industries and the shift towards automated production. France records 5.6% CAGR, focusing on the production of high-precision and high-speed tablet press machines for pharmaceutical applications. The United Kingdom grows at 5.0%, while the United States posts 4.5%, reflecting steady demand for tablet press machines with advanced functionalities. Asia-Pacific leads in market growth due to expanding pharmaceutical production, while Europe and North America focus on automation and process efficiency. This report includes insights on 40+ countries; the top markets are shown here for reference.

The tablet press machines market in China is forecasted to grow at 7.2% CAGR, driven by the rapid expansion of the pharmaceutical industry and increasing demand for efficient and high-quality tablet production. With China becoming a hub for pharmaceutical manufacturing, tablet press machines with advanced functionalities, such as multi-layer compression and automatic tool changing, see strong demand. Additionally, growing investments in the nutraceutical and dietary supplement industries further contribute to market growth.

The tablet press machines market in India is projected to grow at 6.6% CAGR, supported by the country’s expanding pharmaceutical manufacturing sector. With India becoming one of the largest pharmaceutical producers globally, the need for cost-effective and efficient tablet press machines is increasing. The rise of contract manufacturing organizations (CMOs) and the growth of generic drug production further drive market adoption. Additionally, demand for advanced machines that cater to the growing nutraceutical and herbal medicine markets is also rising.

The tablet press machines market in France is expected to grow at 5.6% CAGR, driven by strong demand in the pharmaceutical industry for high-precision tablet production equipment. With an emphasis on automation and efficiency, manufacturers in France adopt tablet press machines with advanced features such as continuous compression, enhanced tablet quality control, and flexible production capabilities. Additionally, increasing demand for specialized machines for producing biopharmaceuticals and nutraceuticals boosts market growth.

The tablet press machines market in the United Kingdom is projected to grow at 5.0% CAGR, supported by strong pharmaceutical manufacturing and increasing investments in automation. The shift towards high-speed, multi-functional tablet press machines in response to industry needs for cost-effective and high-quality production contributes to the market’s growth. Additionally, the growing nutraceutical and dietary supplement markets in the UK further boost the demand for specialized tablet press machines that can handle various formulations.

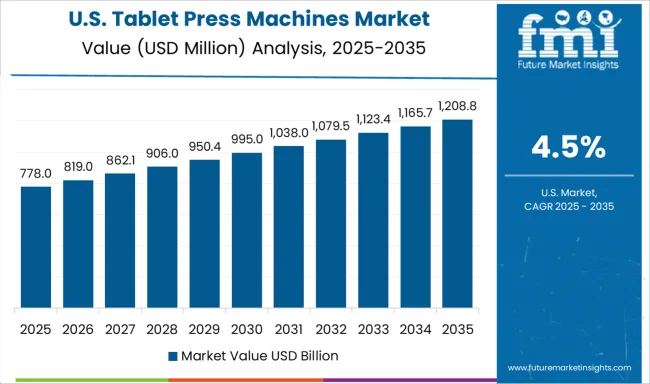

The tablet press machines market in the United States is projected to grow at 4.5% CAGR, reflecting steady demand driven by a mature pharmaceutical industry. The USA market sees a growing preference for tablet press machines that offer flexibility, high production rates, and precision in tablet quality. With the rise of advanced technologies, manufacturers are adopting machines with enhanced monitoring systems, such as in-line inspection for quality control. Increased focus on automation and compliance with FDA regulations further strengthens the market for tablet press machines.

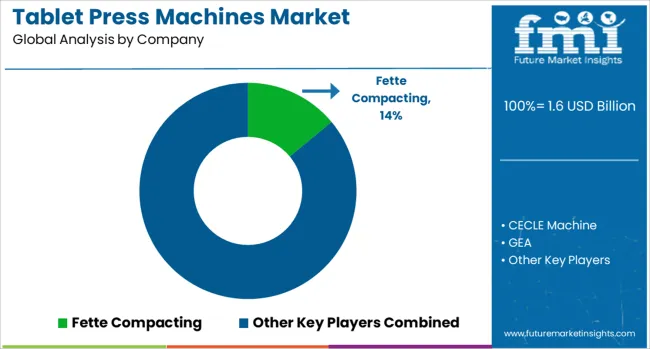

The tablet press machines market is dominated by Fette Compacting, which secures its leadership through innovative, high-performance tablet compression machines tailored for pharmaceutical, nutraceutical, and food industries. Fette Compacting’s dominance is reinforced by its strong R&D focus, advanced technology, and global presence in tablet manufacturing solutions.

Key players such as GEA, IMA Group, Korsch, and Natoli Engineering maintain significant market shares by offering versatile tablet presses that cater to high-speed, high-quality production while ensuring precise control over tablet weight, thickness, and hardness. These companies focus on enhancing automation, improving machine efficiency, and complying with stringent regulatory standards to meet the growing demand for mass production in the pharmaceutical sector.

Emerging players including CECLE Machine, LFA, Lodha International, Romaco, and SaintyCo are expanding their market footprint by providing cost-effective and customizable tablet press solutions for both small and large-scale production. Their strategies focus on offering flexible, user-friendly machines capable of handling a wide range of formulations, from solid tablets to effervescent and chewable tablets.

Market growth is driven by the rising demand for pharmaceutical tablets, increasing production capabilities in emerging markets, and the growing trend toward automation in tablet manufacturing. Continued advancements in tablet press technology, including multi-layer presses and continuous processing systems, are expected to further shape competitive dynamics in the global market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Machine Type | Multiple station machine and Single station machine |

| Mode of Operation | Fully automatic, Manual, and Semi-automatic |

| Capacity | 100,000 - 200,000 pcs/hr, Below 50,000 pcs/hr, 50,000 - 100,000 pcs/hr, and Above 200,000 pcs/hr |

| End Use Industry | Pharmaceutical, Food and beverages, Cosmetics and personal care, and Others (nutraceuticals etc.) |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Fette Compacting, CECLE Machine, GEA, IMA Group, Korsch, LFA, Lodha International, Natoli Engineering, RIVA, Romaco, SaintyCo, SED Pharma, Stokes Tablet Presses, Syntegon Technology, and Tablet Press Company |

| Additional Attributes | Dollar sales by machine type and end use, demand dynamics across pharmaceuticals, nutraceuticals, and cosmetics, regional trends in tablet press adoption, innovation in automation and tooling technologies, impact of regulatory standards like GMP, and sustainability efforts in energy-efficient machine designs. |

The global tablet press machines market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the tablet press machines market is projected to reach USD 2.6 billion by 2035.

The tablet press machines market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in tablet press machines market are multiple station machine and single station machine.

In terms of mode of operation, fully automatic segment to command 49.0% share in the tablet press machines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tabletop CNC Milling Machines Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Compression Testing Machines Market Size and Share Forecast Outlook 2025 to 2035

Membrane Filter Press Machines Market Size and Share Forecast Outlook 2025 to 2035

Pressurized Water Reactor System Market Size and Share Forecast Outlook 2025 to 2035

Pressure Relief Dressing Market Size and Share Forecast Outlook 2025 to 2035

Pressure Compensated Hydraulic Pump Market Size and Share Forecast Outlook 2025 to 2035

Pressure Compensated Pump Market Size and Share Forecast Outlook 2025 to 2035

Pressure Switch Market Forecast Outlook 2025 to 2035

Pressure Reducing Valve Market Size and Share Forecast Outlook 2025 to 2035

Tablet Hardness Testers Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Volume Loop Systems Market Size and Share Forecast Outlook 2025 to 2035

Pressure Transmitter Market Size and Share Forecast Outlook 2025 to 2035

Pressure Monitoring Extension Tubing Sets Market Size and Share Forecast Outlook 2025 to 2035

Pressure Sensitive Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Tablet Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Pressure Bandages Market Size and Share Forecast Outlook 2025 to 2035

Tablets for Oral Suspension Market Analysis Size and Share Forecast Outlook 2025 to 2035

Pressure-Sensitive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Pressure Relief Valve Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA