The pressure switch market is experiencing steady growth due to increasing automation, industrial modernization, and demand for reliable monitoring and control systems across diverse applications. The current market scenario reflects strong adoption in process industries, HVAC systems, and hydraulic machinery, where accurate pressure management is essential for operational efficiency and safety. Manufacturers are focusing on developing compact, durable, and energy-efficient devices integrated with smart sensing and digital control capabilities.

Technological advancements in materials and microelectronics are enhancing product reliability and precision. The future outlook indicates continued growth supported by expanding industrial automation, infrastructure upgrades, and the integration of IoT-enabled monitoring systems.

Growth rationale is centered on the rising emphasis on predictive maintenance, reduced downtime, and improved system performance, which are driving replacement and retrofit demand Furthermore, increasing safety regulations and energy optimization initiatives across manufacturing and construction sectors are expected to sustain long-term market expansion globally.

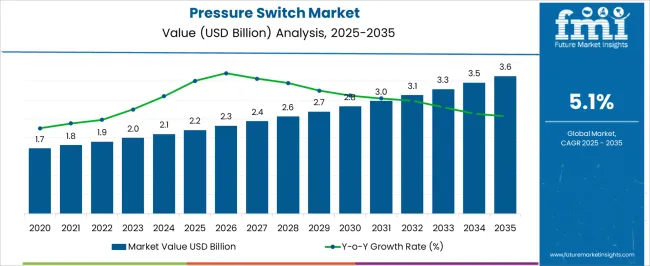

| Metric | Value |

|---|---|

| Pressure Switch Market Estimated Value in (2025 E) | USD 2.2 billion |

| Pressure Switch Market Forecast Value in (2035 F) | USD 3.6 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

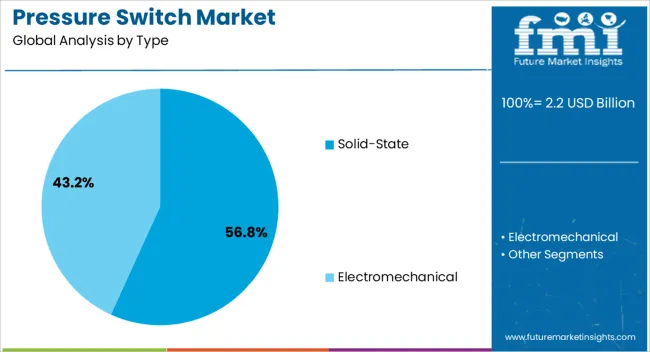

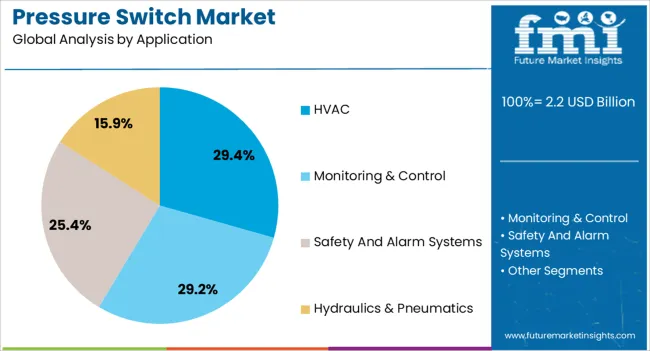

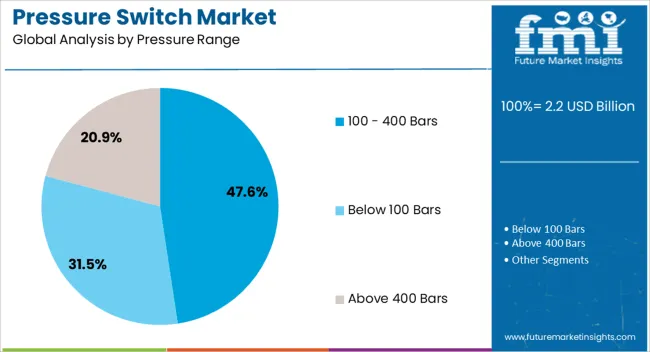

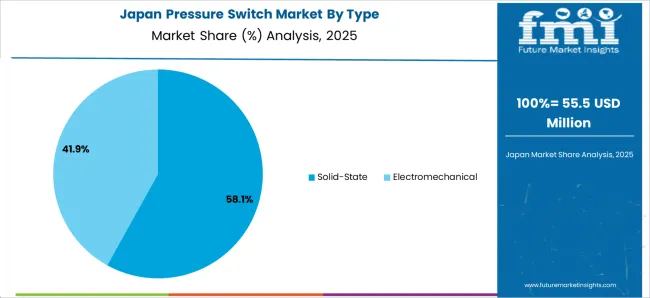

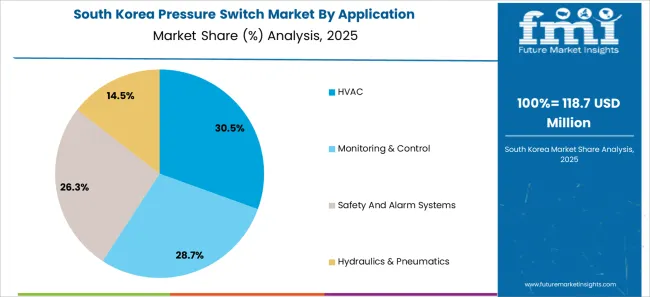

The market is segmented by Type, Application, and Pressure Range and region. By Type, the market is divided into Solid-State and Electromechanical. In terms of Application, the market is classified into HVAC, Monitoring & Control, Safety And Alarm Systems, and Hydraulics & Pneumatics. Based on Pressure Range, the market is segmented into 100 - 400 Bars, Below 100 Bars, and Above 400 Bars. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The solid-state segment, holding 56.80% of the type category, has maintained dominance due to its superior performance, durability, and precision in high-demand industrial environments. These switches operate without mechanical contacts, minimizing wear and extending operational lifespan. Their widespread adoption has been supported by advancements in semiconductor technology and compatibility with automated systems.

Solid-state designs offer faster response times, enhanced sensitivity, and greater resistance to vibration and temperature variations. Manufacturers are increasingly integrating digital communication interfaces, enabling seamless connectivity with control systems.

Continuous improvements in miniaturization and cost efficiency have further strengthened market penetration This segment’s leadership is expected to continue as industries transition toward electronic sensing solutions that provide higher reliability, lower maintenance, and greater adaptability for advanced process control applications.

The HVAC segment, accounting for 29.40% of the application category, has emerged as a key contributor driven by growing demand for efficient pressure regulation in heating, ventilation, and air conditioning systems. Adoption is being reinforced by the need to maintain optimal performance, prevent system failure, and improve energy efficiency in both residential and commercial installations.

The proliferation of smart building technologies and energy management systems has further accelerated the use of advanced pressure switches. Manufacturers are focusing on offering customizable solutions compatible with modern HVAC control architectures.

Increasing construction of energy-efficient buildings and retrofitting of existing systems with automation-enabled components are supporting sustained market growth Regulatory standards promoting environmental sustainability and energy conservation continue to create opportunities for technologically advanced pressure switches within the HVAC industry.

The 100–400 bars segment, representing 47.60% of the pressure range category, has maintained leadership owing to its critical role in high-pressure applications across hydraulic, pneumatic, and process control systems. These switches are preferred for their robustness, accuracy, and ability to function effectively under extreme operating conditions.

Demand has been particularly strong in oil and gas, manufacturing, and heavy equipment industries where precise pressure regulation is vital. Continuous advancements in sealing technology and pressure transducer design have improved performance and reliability.

Manufacturers are developing compact designs capable of withstanding high cyclic loads while ensuring long-term stability As industrial processes become more automated and safety standards more stringent, the 100–400 bars segment is expected to retain its market prominence through consistent innovation and broader application integration across global industrial sectors.

Electromechanical pressure switches are the top type in the market. The pressure range predominantly used in the application of pressure switches is below 100 bars.

Sales of electromechanical pressure switches are expected to progress at a CAGR of 4.9% over the forecast period. Some of the factors influencing the progress of electromagnetic pressure switches are:

| Attributes | Details |

|---|---|

| Top Type | Electromechanical |

| CAGR (2025 to 2035) | 4.9% |

The demand for pressure switches below 100 bar pressure range is predicted to progress at a CAGR of 4.7%. Some of the reasons for the progress of below 100 bars pressure switches are:

| Attributes | Details |

|---|---|

| Top Pressure Range | Below 100 Bars |

| CAGR (2025 to 2035) | 4.7% |

The European inclination toward industry automation is helping the cause of the pressure switch market in the region. North Americans’ tendency to adopt advanced technologies for industrial work positively influences the market in the region.

The developing countries in Asia Pacific are embracing local manufacturing. Thus, the application of pressure switches is increasing in the industrial sector of the region.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.7% |

| China | 5.9% |

| Japan | 6.6% |

| South Korea | 7.4% |

| United States | 5.4% |

The CAGR for the market in the United Kingdom is anticipated to be 3.7% over the forecast period. Some of the factors influencing the growth of the market in the country are:

The market in China is expected to grow at a CAGR of 5.9%. Some of the factors responsible for the growth of the market are:

The market is expected to progress at a CAGR of 6.6% in Japan. Some factors influencing the progress are:

The market is expected to progress at a CAGR of 7.4% in South Korea. Some factors influencing the progress are:

The market is expected to progress at a CAGR of 5.4% in the United States. Some factors influencing the progress are:

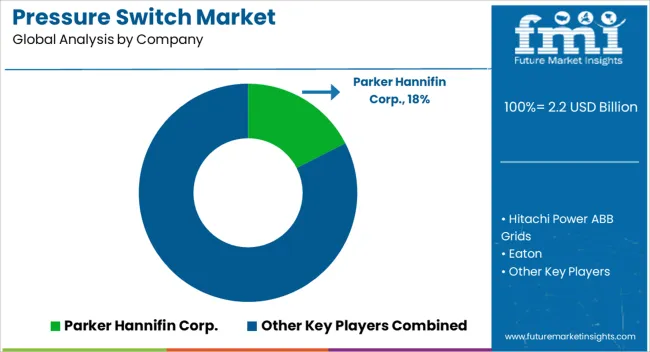

Investments in research and development are high in the pressure switch industry, as a way for the product to incorporate advanced technology. The focus of industry players is on offering cost-effective products to consumers, and thus, improvements in the manufacturing process are also sought.

Players in the market for pressure switches are engaging in collaborative strategies with end-user industries to increase their market footprint. Mergers and acquisitions are also common occurrences in the pressure switch competitive landscape.

Recent Developments in the Pressure Switch Market

The global pressure switch market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the pressure switch market is projected to reach USD 3.6 billion by 2035.

The pressure switch market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in pressure switch market are solid-state and electromechanical.

In terms of application, hvac segment to command 29.4% share in the pressure switch market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Pressure Switch Market

Differential Pressure Switches Market

Automotive Oil Pressure Switch Market

Industrial Electronic Pressure Switch Market Size and Share Forecast Outlook 2025 to 2035

Pressure Compensated Pump Market Size and Share Forecast Outlook 2025 to 2035

Pressure Reducing Valve Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Volume Loop Systems Market Size and Share Forecast Outlook 2025 to 2035

Pressure Transmitter Market Size and Share Forecast Outlook 2025 to 2035

Pressure Monitoring Extension Tubing Sets Market Size and Share Forecast Outlook 2025 to 2035

Pressure Sensitive Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Pressure Bandages Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Sensitive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Pressure Relief Valve Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Controlled Vacuum Sealers Market Size and Share Forecast Outlook 2025 to 2035

Pressure Sensitive Tapes and Labels Market Size, Share & Forecast 2025 to 2035

Pressure Infusion Bags Market Analysis - Size, Share, and Forecast 2025 to 2035

Pressure Ulcer Detection Devices Market Trends – Growth & Forecast 2025 to 2035

Pressure Cushions Market Trends - Growth, Size & Forecast 2025 to 2035

Pressure Infusion Cuffs Market Growth – Trends & Future Outlook 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA