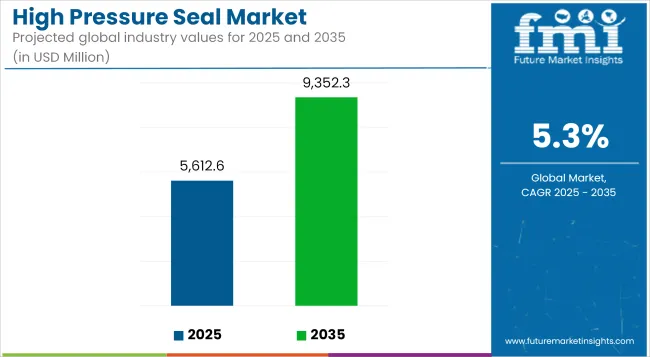

The global high pressure seal market is projected to reach a value of USD 5,612.6 million in 2025 and grow to USD 9,352.3 million by 2035, expanding at a CAGR of 5.3% during the forecast period.

| Market Metrics | Value |

|---|---|

| Industry Size (2025E) | USD 5,612.6 million |

| Industry Value (2035F) | UD 9,352.3 million |

| CAGR (2025 to 2035) | 5.3% |

High pressure seals are critical components used in machinery and equipment operating under extreme pressure conditions, offering leak-proof performance in industrial, oil & gas, aerospace, chemical, and power generation applications.

Asia Pacific is projected to hold the largest share of the global high pressure seal market by 2025, driven by expanding manufacturing output, energy infrastructure upgrades, and strong automotive and chemical processing sectors in China, India, and Southeast Asia. Rapid industrialization and increased investment in oil & gas refineries and power generation facilities are creating favorable demand conditions for high-pressure sealing solutions.

Governments in the region are heavily investing in infrastructure, contributing to rising demand for hydraulic and pneumatic systems, which rely on high pressure seals. Additionally, the growing aerospace and marine equipment manufacturing sector in countries like South Korea and Japan adds to the region’s leading position.

Manufacturers are increasingly using advanced materials like PTFE, PEEK, and metal-polymer composites to enhance seal durability under extreme pressure and temperature. These materials offer superior resistance to corrosion, wear, and aggressive chemicals, making them ideal for aerospace, oil & gas, and nuclear applications.

The trend toward low-maintenance, high-performance sealing systems is also driving adoption of self-lubricating and multi-lip seal designs, which extend equipment life and reduce operational downtime.

With the global shift toward clean energy, high pressure seals are seeing increased use in hydrogen systems, wind turbines, and carbon capture units. These applications require precise, leak-proof seals to operate under high pressure with zero emissions.

Manufacturers are innovating seals that withstand hydrogen embrittlement and extreme cyclic loads, aligning with rising investments in green hydrogen and offshore wind projects. This trend is opening new revenue streams for seal producers.

A significant trend in the high pressure seal market is the ongoing innovation in sealing materials and design. The shift toward composite seals, elastomers, thermoplastics (PTFE, PEEK), and metallic hybrid designs is allowing manufacturers to meet increasingly demanding pressure, temperature, and chemical resistance requirements.

Advanced designs featuring multi-lip geometries and self-lubricating properties are being deployed in critical systems such as hydraulic cylinders, turbo machinery, and compressors.

Companies are also integrating smart seals with embedded sensors for real-time pressure and wear monitoring. These developments are improving seal performance, lifespan, and safety in high-load applications. Adoption is especially high in aerospace, oil & gas, and power generation.

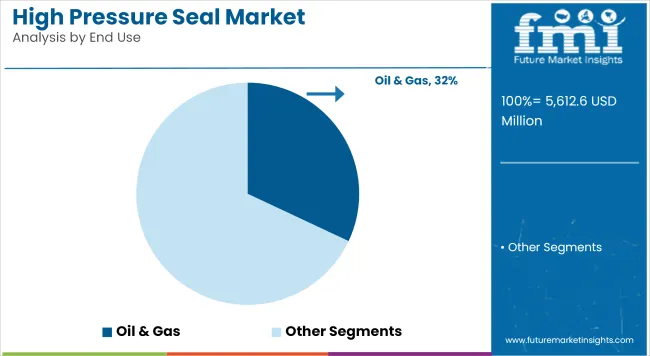

The oil & gas segment is forecasted to hold the largest share of 32% in the global high pressure seal market in 2025 and is expected to grow at a CAGR of 4.9% through 2035. High pressure seals are vital in upstream and downstream processes, including drilling, well completion, pumps, and compressors.

With rising energy demand and increased investments in deep-water and ultra-deep-water exploration, high-performance sealing systems are essential for operational safety and efficiency.

The Middle East, USA, and offshore Africa are key regions driving oilfield equipment demand. Enhanced exploration activity, along with the revival of delayed refinery projects post-pandemic, continues to stimulate demand for reliable sealing solutions in this sector.

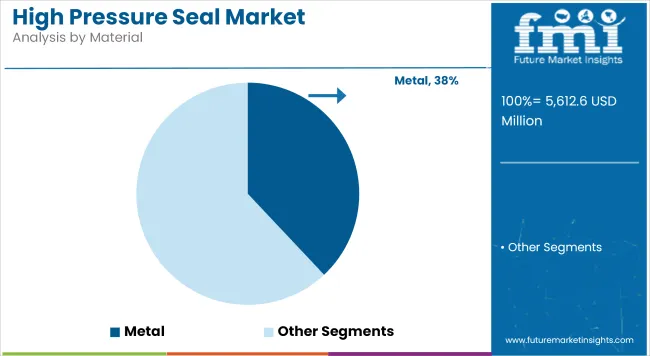

Metal seals are projected to dominate the high pressure seal market, holding a market share of 38% in 2025, expanding at a CAGR of 4.7% over the forecast period. Their superior pressure, temperature, and chemical resistance make them ideal for use in harsh environments such as nuclear power plants, aerospace propulsion systems, and petrochemical units. Compared to elastomer-based seals, metal seals offer longer operational life, improved stability, and zero leakage in extreme conditions.

Companies are focusing on alloy innovation, including Inconel, stainless steel, and Hastelloy-based designs, to enhance performance. With increasing industrial automation and stringent safety regulations, the demand for robust metal seals is steadily rising across global markets.

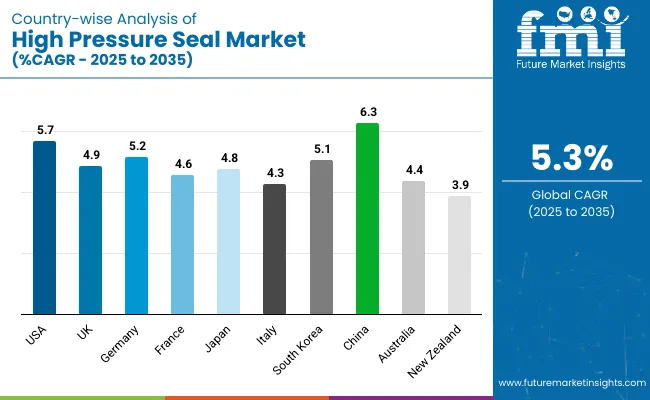

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.7% |

| UK | 4.9% |

| France | 4.6% |

| Germany | 5.2% |

| Italy | 4.3% |

| South Korea | 5.1% |

| Japan | 4.8% |

| China | 6.3% |

| Australia | 4.4% |

| New Zealand | 3.9% |

The USA industry is anticipated to expand steadily through 2035 due to continued investment in the oil and gas, aerospace, and power generation industries. The nation's industrial base is sophisticated but dynamic, and demand for high-performance sealing technology will continue to grow, especially in offshore drilling platforms and nuclear plants.

The trend in the industry is driven by the application of high-performance materials that are resistant to extreme conditions, resulting in enhanced operation reliability and lifespan.

Some of the key players in the USA are Parker Hannifin Corporation, John Crane, and Flowserve Corporation, which keep refining their product offerings through R&D and acquisition strategy. Regulatory needs for environment safety and minimizing emissions are also compelling industrial divisions to shift from conventional sealing arrangements to better high pressure seals. Such an ecosystem encourages innovation and product differentiation, resulting in enhanced industry competitiveness.

UK’sindustry is all set to expand with ongoing innovation in the defense, marine engineering, and energy industries. The decarbonization process and development of clean energy in the nation have opened up more demand for high pressure seals in hydrogen storage units and newer windmills. Heavy industry equipment relocation also favors the inclusion of efficient and long-lasting sealing systems.

Industry leaders include James Walker Group and Trelleborg Sealing Solutions, both of which are heavily investing in engineered seal technologies. Growth is also augmented by extensive cooperation between material research institutes specializing in advanced materials and industrial manufacturing companies. Through automation and digitalization, while the UK retains its industrial power, demand for reliable sealing solutions is predicted to grow during the forecast period.

French industry is projected to see modest growth in the period until 2035 as the nation has a leadership role in nuclear energy, chemical processing, and aircraft production. Machines' dependence on highly precise devices gives push to the increasing requirement for seals against extreme pressure and temperature fluctuations. Aerospace specifically benefits from sealing components that are lightweight yet tough enough to optimize engine efficiency.

Industry leaders like Hutchinson SA and Saint-Gobain Performance Plastics are increasing manufacturing capacity with an emphasis on sustainability and lifecycle efficiency. The use of fluoropolymer-based and elastomeric seals in high-value applications is gaining wider ground. Government-supported innovation policies also facilitate industry growth with the aim of enhancing industrial competitiveness.

Germany's industry will experience strong growth due to its highly sophisticated manufacturing base and the presence of a highly sophisticated mechanical engineering industry. Higher demand by the automobile, energy, and process industries supports more use of precision seals, especially in gas turbines and high-pressure hydraulic equipment. The policy of energy transition (Energiewende) also promotes investment in efficient sealing technology on renewable equipment.

Industry leaders like Freudenberg Sealing Technologies and SKF GmbH are out to create high-performance, low-emission sealing systems, especially for high-load applications. Focus on digitization and Industry 4.0 is driving the move towards predictive maintenance, with seals of high pressure playing a central role in keeping systems offline for as little time as possible while achieving optimum performance. These pressures make Germany a technological powerhouse in the European industry.

Italian industry is likely to grow incrementally on the back of industrial requirements in the petrochemical, energy, and water treatment segment of applications. With Italian infrastructure still being refurbished, most importantly pipeline infrastructure and power plant equipment, requirements for leak-proof and high-durability sealing increase. The use of fluid-handling equipment and pressurized vessels continues to be at the core of the industry's growth prospects.

Companies like Tenute Srl and Guarnitec are capitalizing on advancements in material science to develop seals with enhanced abrasion and chemical resistance. The general shift towards environmentally friendly industrial practices has also prompted the use of the next generation of sealing materials. Increasingly strict safety specifications for industrial processes mean that high pressure seals will continue to play a key role in process-based industries.

South Korea's industry is expected to expand at a significant rate, driven by increased demand from shipbuilding, electronics production, and energy infrastructure. Highly precise seals are increasingly being used because of strong domestic investment in semiconductor manufacturing units that have tight environmental requirements. South Korea's shipbuilding sector also heavily depends on high-pressure parts for propulsion and fluid control systems.

Industry leaders like Samsung Engineering and Sealtech Korea are enhancing their capability to address high-performance requirements. Technology innovation is also receiving government support in the form of industrial automation and clean energy transition policy. As South Korea continues to modernize heavy industries increasingly, long-lasting, efficient high pressure seal applications are sure to become more prevalent.

Japan's industry will continue to increase steadily, pushed by technological growth in the precision engineering, aerospace, and automobile industries. Product quality, reliability, and energy efficiency are promoted in the country, which leads to the usage of seals that guarantee consistent performance in high-load and high-temperature applications. Usage is most prominent in robots and industrial automation systems, where consistent sealing under dynamic conditions is required.

Industry trends are led by industry leaders such as NOK Corporation and Eagle Industry Co., Ltd., which are highly committed to investing in high-quality polymer and composite seal technologies. Japan's research-oriented innovation bias guarantees ongoing seal design enhancement that minimizes friction and maximizes operating life. The emphasis on high-value engineering solutions sustains Japan's industry resilience, and it is anindustry leader in the Asia-Pacific region.

The Chinese industry is also expected to exhibit the highest CAGR among researched countries, fueled by rapid industrialization, growing energy infrastructure, and moving manufacturing processes. Huge investment in petrochemicals, aircraft, and high-speed rail sectors is creating colossal demand for performance-enhanced sealing technologies. Specifically, oil and gas explorations by native activities necessitate advanced seal solutions under unfavorable pressure conditions.

Local producers such as Zhongding Group and DSH Seals are fast developing their technological capability and export performances. Industrial upgrades and environmental protection policies are fostering the implementation of effective and long-term seal systems. As greater attention is paid to quality and reliability, China is increasingly turning into an essential driver of worldwide industry growth.

Australian industry is poised to expand steadily with backing from investment in mining, oil and gas, and water management companies. Conditions of deep drilling mining operations and operational conditions of onshore and offshore drilling rigs necessitate the application of seals that are resistant to abrasive conditions and extreme hydraulic pressure. Continued infrastructure development, especially in remote locations, continues to generate demand for tough sealing solutions for mobile equipment and energy equipment.

Key industry players in this industry include Australian Seals and Seal Innovations, which are concentrating on application-specific sealing solutions. Composite material development and design optimization are improving product performance and value lifecycle. The country's continued emphasis on operational safety and environmental compliance is also driving the industry outlook during the forecast period.

New Zealand's industry is expected to grow moderately, as it is led by infrastructure development, farm processing, and environmental engineering use. Increased use of high-performance seals in water treatment plants, geothermal energy production, and food processing equipment due to the country's focus on green industrial processes has created the impetus for growth. While smaller in magnitude, the industry has sound prospects for specialty sealing products.

Other local manufacturers and suppliers are interfacing with international providers to provide improved sealing technologies appropriate for remote and extreme duty conditions. Dependability, lower maintenance requirements, and sustained performance are influencing buying behavior. Greater infrastructure development and industrial upgrades underway will result in consistent growth in the industry for advanced technical high pressure seals.

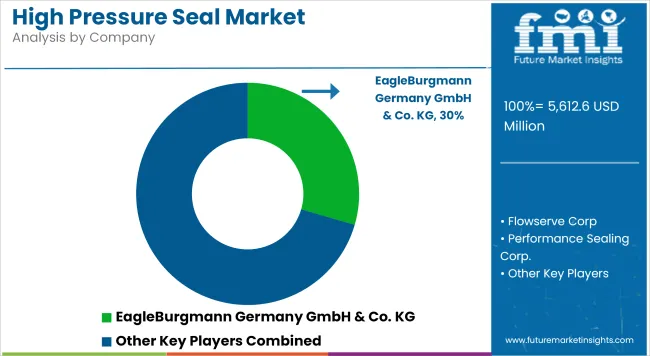

The global high pressure seal market is highly competitive and moderately consolidated, with leading companies focusing on R&D, material innovation, and global expansion strategies. Players like Parker Hannifin, Trelleborg, Freudenberg, and SKF are continuously investing in high-performance materials and customized sealing solutions for mission-critical operations.

Strategic initiatives such as acquisitions, product line expansions, and regional manufacturing hubs are being deployed to serve industry-specific needs. The growing demand for eco-friendly, leak-free, and maintenance-free seals is prompting companies to prioritize sustainable design.

Emerging players, particularly in Asia Pacific and Latin America, are gaining traction through cost-effective offerings. Overall, technological leadership, product durability, and compliance with industry certifications will remain key competitive differentiators.

By material, the industry is segmented into various materials including metal, Thermoplastic Polyurethane (TPU), Hydrogenated Nitrile Butadiene Rubber (HBR), fluorocarbon-based synthetic rubber, and Ethylene Propylene Diene Monomer (EPDM).

By end use, the industry serves a wide range of industries such as oil & gas, chemicals, automotive, mining, aerospace, power generation, healthcare, and others.

By region, the industry is analyzed across several regions including North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

The global industry is estimated to be worth USD 5,612.6 million in 2025.

Sales are projected to grow significantly, reaching USD 9,352.3 million by 2035.

China is expected to experience a CAGR of 6.3%, driven by its rapid industrialization and expanding manufacturing and energy sectors.

Seals made of metals are leading the industry due to their durability and effectiveness in high-pressure applications.

Prominent companies include AES Corporation, Smith’s Group Plc., Garlock Sealing Technologies LLC, AB SKF, Parker Hannifin Corporation, James Walker & Co., EagleBurgmann Germany GmbH & Co. KG, Flowserve Corp., Performance Sealing Corp., and EI du Pont de Nemours & Co.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Voltage Equipment Market Forecast and Outlook 2025 to 2035

High Clear Film Market Size and Share Forecast Outlook 2025 to 2035

High Performance Random Packing Market Forecast Outlook 2025 to 2035

High Precision Microfluidic Pump Market Size and Share Forecast Outlook 2025 to 2035

High Performance Composites Market Forecast Outlook 2025 to 2035

High Performance Medical Plastic Market Forecast Outlook 2025 to 2035

High Temperature Heat Pump Dryers Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

High Purity Tungsten Hexachloride Market Size and Share Forecast Outlook 2025 to 2035

High Purity Nano Aluminum Oxide Powder Market Size and Share Forecast Outlook 2025 to 2035

High Mast Lighting Market Forecast and Outlook 2025 to 2035

High-Protein Pudding Market Forecast and Outlook 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

High-Power Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

High Performance Epoxy Coating Market Size and Share Forecast Outlook 2025 to 2035

High Molecular Ammonium Polyphosphate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Fluoropolymer Market Size and Share Forecast Outlook 2025 to 2035

High Throughput Screening Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films for Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA