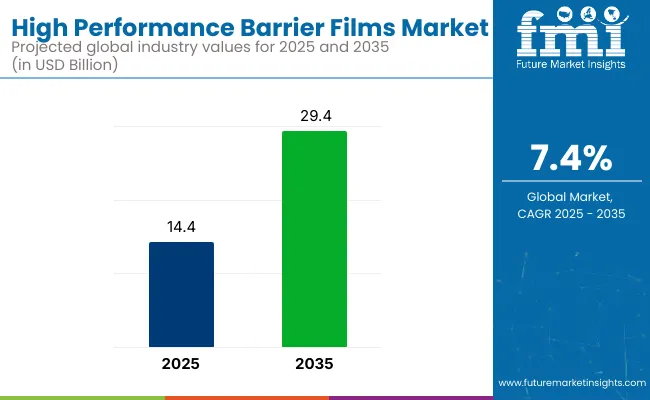

The high performance barrier films market is valued at USD 14.4 billion in 2025 and is slated to reach USD 29.4 billion by 2035, reflecting a CAGR of 7.4%. Growth has been driven by rising demand for moisture, gas, and UV protection packaging across food, pharmaceutical, and electronic applications. High-barrier films have been adopted for their durability, lightweight properties, and ability to enhance product shelf life, making them relevant for industries aiming to improve packaging efficiency and sustainability.

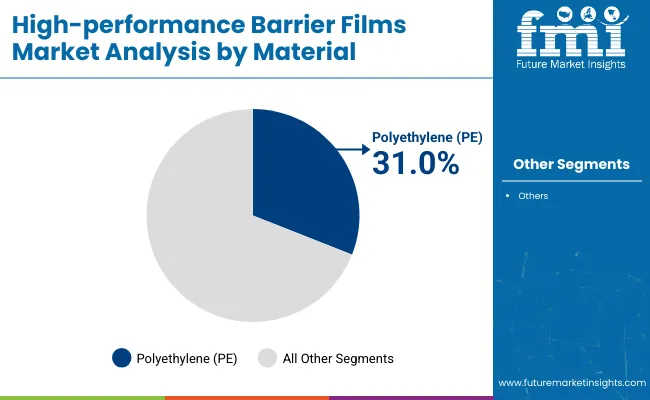

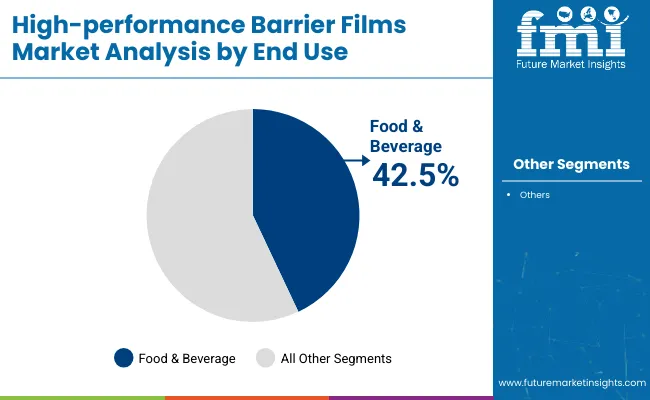

In 2025, polyethylene (PE) has been expected to account for the highest share of material use due to its strength and processability, while polypropylene (PP) is likely to follow. The food & beverage segment has remained the largest end-use segment, contributing approximately 42.5% of total market revenue. France is projected to witness the fastest growth with a CAGR of 6.4% driven by electronics packaging demand and sustainable packaging initiatives.

Technological advancements have been shaping the market with innovations in nano-engineered coatings, biodegradable barrier films, and AI-powered defect detection. Development of smart packaging solutions incorporating sensors for temperature, freshness, and humidity monitoring has been expanding product applications. Companies have been investing in AI-enabled supply chain optimization to minimize wastage and enhance production efficiency.

Sustainability has been a critical focus area with manufacturers adopting biodegradable materials such as PLA and cellulose coatings to reduce environmental impact. Regulations to eliminate single-use plastics have driven investment in recyclable and compostable barrier films, with multilayer eco-friendly designs being commercialized for food and pharma packaging.

Additional factors contributing to market growth include increasing application in flexible electronics, OLED displays, and battery protection films in electric vehicles. The integration of antimicrobial coatings and tamper-proof features has been enhancing product value propositions, encouraging further penetration across industrial applications.

Moreover, collaborative research and development programs with academic institutions and material science laboratories have been fostering innovations in ultra-thin barrier films, high-transparency coatings, and compostable multilayer structures to cater to the evolving needs of global end users.

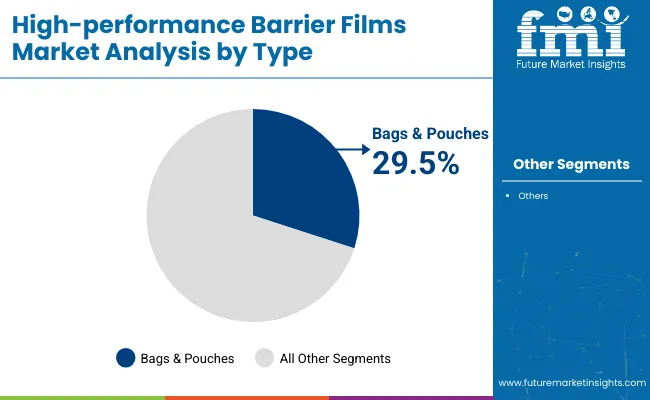

The market is segmented into material, type, end use, and region. By material, the market is divided into polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), polystyrene (PS), polyvinyl chloride (PVC), and polylactic acid (PLA). Based on type, the market is categorized into bags & pouches, stand-up pouches (retort and non-retort), tray lidding films, forming webs, wrapping films, and blister pack base webs.

In terms of end use, the market is segmented into food & beverage, pharmaceuticals, electronics, construction, agriculture & allied industries, and others. Regionally, the market is classified into North America, Latin America, East Asia, South Asia Pacific, Western Europe, Eastern Europe, and Middle East & Africa.

Polyethylene (PE) is projected to lead the material segment, accounting for 31.0% of the global market share by 2025. Its usage has been driven by favorable properties such as lightweight, durability, and cost-efficiency.

Bags & pouches are expected to lead the type segment, securing 29.5% of the global market share by 2025. Growth has been driven by demand for flexible, high-barrier packaging.

The food & beverage segment is projected to lead the end-use category, capturing 42.5% of the global market share in 2025. Adoption has been driven by the need for extended shelf life and food safety compliance.

The high-performance barrier films market is experiencing steady growth, driven by increasing demand for moisture, oxygen, and UV-resistant packaging, sustainable material innovations, and continuous advancements in nano-coating and multilayer production technologies.

Recent Trends in the High Performance Barrier Films Market

Challenges in the High Performance Barrier Films Market

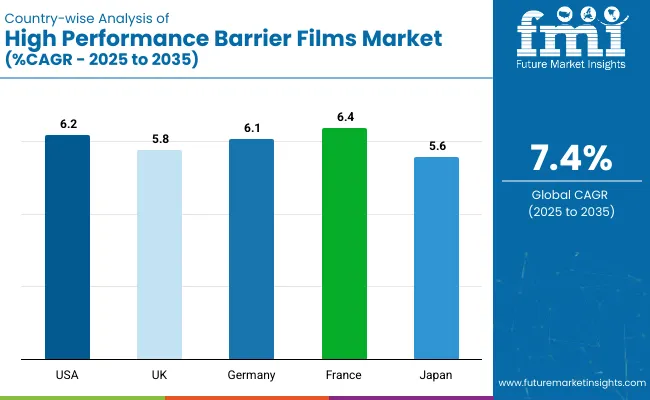

The high performance barrier films revenue in the USA is expected to grow at a CAGR of 6.2% from 2025 to 2035. This growth has been supported by stringent FDA and EPA regulations, demand for food-safe and pharma-compliant packaging, and innovations in nano-coated and active barrier film technologies for consumer goods and industrial applications.

The UK high performance barrier films market is projected to expand at a CAGR of 5.8% during the forecast period. Regulatory pressure to reduce single-use plastics, along with growing adoption of bio-based and recyclable packaging materials in retail, food, and healthcare applications, has been boosting demand for barrier films.

High performance barrier film sales in Germany are forecasted to grow at a CAGR of 6.1% from 2025 to 2035. Growth has been driven by strong demand for recyclable and multilayer films in food packaging, automotive, and industrial applications, coupled with strict EU environmental compliance regulations.

The France high performance barrier films market is projected to grow at a CAGR of 6.4% from 2025 to 2035. Growth has been supported by increasing demand for sustainable packaging in food, cosmetics, and pharma sectors, along with emphasis on eco-certifications and bio-based material innovations.

High performance barrier film demand in Japan is forecasted to grow at a CAGR of 5.6% from 2025 to 2035. The market growth has been supported by demand for precision-engineered films in electronics, pharmaceuticals, and food packaging, alongside advancements in ultra-thin, breathable, and antimicrobial film technologies.

The high performance barrier films market is moderately consolidated, with several global leaders holding significant shares while regional and niche players continue to innovate. Competitive dynamics have been shaped by pricing strategies, technological advancements in nano-engineered and biodegradable films, strategic manufacturing expansions, and mergers or partnerships to strengthen production capabilities and market reach.

Tier-one firms, such as Amcor, Berry Global, Sealed Air Corporation, Toppan Printing, and Uflex Ltd., are competing through large-scale investments in sustainable packaging materials, advanced multilayer technologies, and AI-based defect detection systems. These firms have been forming partnerships with FMCG, electronics, and pharma companies to ensure long-term supply agreements.

Recent High Performance Barrier Films Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 14.4 billion |

| Projected Market Size (2035) | USD 29.4 billion |

| CAGR (2025 to 2035) | 7.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions / Volume in metric tons |

| By Material | Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Polystyrene (PS), Polyvinyl Chloride (PVC), Polylactic Acid (PLA) |

| By Type | Bags & Pouches, Stand-up Pouches (Retort, Non-Retort), Tray Lidding Films, Forming Webs, Wrapping Films, Blister Pack Base Webs |

| By End Use | Food & Beverage, Pharmaceuticals, Electronics, Construction, Agriculture & Allied Industries, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, South Korea, China, Brazil, Australia |

| Key Players | Amcor, Berry Global, Sealed Air Corporation, Toppan Printing, Uflex Ltd., Toray Industries, Treofan Group, Huhtamaki Oyj, Winpak Ltd., Mitsubishi Chemical Holdings |

| Additional Attributes | Dollar sales by value, market share analysis by material and region, country-wise analysis |

The market is expected to reach USD 29.4 billion by 2035.

The global market is projected to grow at a CAGR of 7.4% during this period.

Polyethylene (PE) is expected to lead with a 31.0% market share in 2025.

Bags & pouches are expected to hold a 29.5% share of the market in 2025.

France is anticipated to be the fastest-growing market with a CAGR of 6.4% through 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Throughput Screening Market Size and Share Forecast Outlook 2025 to 2035

High Mast Lighting Market Size and Share Forecast Outlook 2025 to 2035

High-Protein Pudding Market Size and Share Forecast Outlook 2025 to 2035

High Purity Carbonyl Iron Powder (CIP) Market Size and Share Forecast Outlook 2025 to 2035

High Voltage PTC Heater Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Grease Market Size and Share Forecast Outlook 2025 to 2035

High Frequency Chest-Wall Oscillation Devices Market Size and Share Forecast Outlook 2025 to 2035

High-purity Fluoropolymer Valves Market Size and Share Forecast Outlook 2025 to 2035

High Current Ion Implanter Market Size and Share Forecast Outlook 2025 to 2035

High Rate Discharge Test Machine Market Size and Share Forecast Outlook 2025 to 2035

High-precision Confocal Sensor Market Size and Share Forecast Outlook 2025 to 2035

High Heat Waste Packaging Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

High-power Objective Lens Market Size and Share Forecast Outlook 2025 to 2035

High Purity PFA Resins Market Size and Share Forecast Outlook 2025 to 2035

High Purity Mullite Powder Market Size and Share Forecast Outlook 2025 to 2035

High Precision Heavy Load Bearings Market Size and Share Forecast Outlook 2025 to 2035

High Abuse Shrink Bags Market Size and Share Forecast Outlook 2025 to 2035

High-precision Truss Robot Market Size and Share Forecast Outlook 2025 to 2035

High Speed Rolling Bearings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA