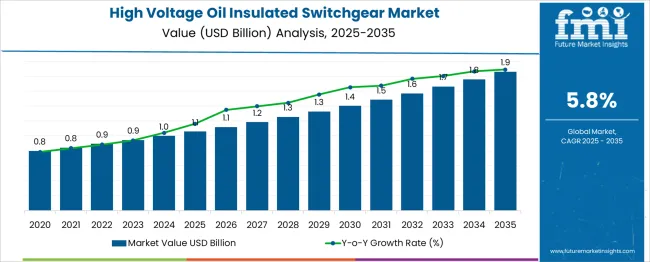

The High Voltage Oil Insulated Switchgear Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 1.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

Year-on-year (YOY) growth analysis shows a steady yet modest trajectory with low volatility across the forecast period. Annual values progress from USD 1.1 billion in 2025 to 1.2 billion in 2027, followed by 1.3 billion in 2028-2029, 1.4 billion in 2030, and 1.5 billion in 2031, before reaching 1.9 billion by 2035.

YOY percentage growth fluctuates within a narrow band of 4.5% to 6.2%, with early years (2026-2028) averaging around 5.5%, a slight dip in the mid-phase, and incremental strengthening in the later stage as grid reinforcement projects and renewable integration expand. Absolute annual additions remain modest, moving from USD 0.05 billion in early years to USD 0.1 billion toward the end, confirming a low-risk, predictable growth pattern.

The standard deviation of YOY rates is minimal, under 0.7 percentage points, signifying high stability. This consistent profile supports long-term investment in manufacturing capacity, emphasizing incremental design improvements and cost optimization strategies rather than aggressive scaling, aligning with steady infrastructure modernization programs worldwide.

| Metric | Value |

|---|---|

| High Voltage Oil Insulated Switchgear Market Estimated Value in (2025 E) | USD 1.1 billion |

| High Voltage Oil Insulated Switchgear Market Forecast Value in (2035 F) | USD 1.9 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The high-voltage oil insulated switchgear (OIS) market plays an essential role within the power infrastructure value chain and contributes varying shares across its parent markets. In the high-voltage switchgear and substation equipment market, OIS accounts for 6–7%, as gas-insulated systems dominate new installations in urban and space-constrained areas. Within the power transmission and distribution infrastructure market, its share is 4–5%, because investments also include transformers, conductors, and automation systems.

The oil-insulated equipment market allocates 30–35% to OIS, reflecting its strong presence in systems where oil dielectric technology remains a trusted solution for insulation and arc suppression. In the electrical network protection and control systems market, OIS captures 5–6%, as this category includes relays, monitoring devices, and protection panels. The utility and industrial substation market assigns around 8–9%, driven by primary substations and rural grid expansion that often favor cost-effective oil-insulated designs.

Demand growth is influenced by grid modernization, renewable integration, and rural electrification programs, which require reliable and affordable switchgear. Key trends shaping the market include the adoption of biodegradable insulating oils, enhanced sealing to minimize leakage risk, and integration of digital monitoring sensors for predictive maintenance. These advancements position oil-insulated switchgear as a robust, long-life solution for diverse high-voltage applications globally.

The high voltage oil insulated switchgear market is undergoing steady growth as energy infrastructure modernization and grid reliability initiatives gain momentum globally. This trend is being supported by rising electricity demand, aging grid components, and the need for dependable equipment in critical transmission and distribution networks.

Utility operators and industrial stakeholders are increasingly favoring oil insulated switchgear for its proven durability, high fault tolerance, and capability to perform under harsh environmental conditions. Technological advancements in insulation materials and enhanced safety mechanisms are further contributing to its sustained adoption.

Looking ahead, expansion of renewable energy projects, urbanization, and grid expansion plans are expected to create additional opportunities for deployment. Strategic investments in grid automation and replacement of obsolete equipment are paving the way for the long-term relevance and growth of the market.

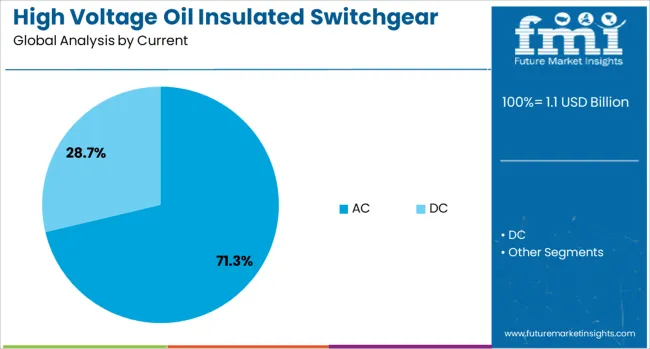

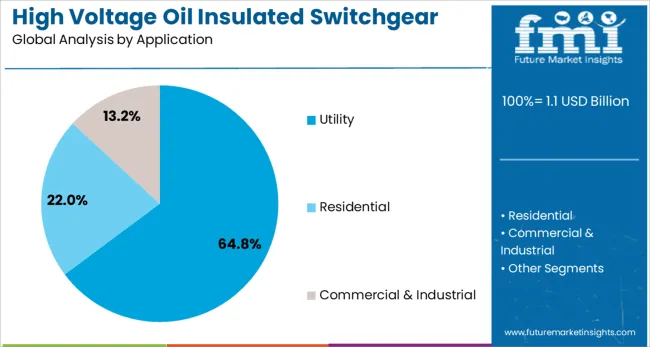

The high voltage oil insulated switchgear market is segmented by current, application, and geographic regions. Currently, the high voltage oil insulated switchgear market is divided into AC and DC. In terms of application, the high voltage oil insulated switchgear market is classified into Utility, Residential, and Commercial & Industrial. Regionally, the high voltage oil insulated switchgear industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by current, the AC subsegment is anticipated to hold 71.30% of the total market revenue in 2025, confirming its dominance within the current category. This leading position is being driven by the widespread deployment of alternating current systems in transmission and distribution networks across the globe.

AC systems are being preferred for their compatibility with existing grid infrastructure, ease of voltage transformation, and cost effectiveness over long distances. The extensive standardization of AC components and the availability of skilled maintenance personnel have further reinforced its dominance.

Utility and industrial players have continued to invest in AC based switchgear as part of their grid reinforcement and upgrade programs, ensuring reliability and interoperability with established networks. The resilience of AC systems under variable loads and their adaptability to both conventional and renewable energy sources have cemented their role as the preferred choice in this segment.

Segmented by application, the utility subsegment is projected to account for 64.8% of the high voltage oil insulated switchgear market revenue in 2025, securing its position as the foremost application area. This leadership is being attributed to the critical need for reliable and continuous power supply in utility operated transmission and distribution networks.

Utilities are prioritizing the adoption of oil insulated switchgear to minimize operational risks, extend equipment life, and ensure safety compliance under high voltage conditions. Their large scale infrastructure and responsibility to meet regulatory and consumer expectations have compelled utilities to invest consistently in proven technologies that enhance grid stability.

Expansion of transmission lines, integration of renewable energy sources, and upgrades to accommodate growing urban and industrial demand have accelerated utility driven deployments. The combination of regulatory mandates, operational dependability, and long term cost benefits has established the utility segment as the primary driver of growth in this market.

High voltage oil insulated switchgear is essential for power transmission and distribution systems, ensuring operational safety and consistent electrical performance. It uses mineral or synthetic oil for insulation and arc quenching, protecting components from dielectric failure. Adoption is prominent in utilities, industrial facilities, and large-scale infrastructure requiring high-voltage stability. Replacement demand in aging grids and installations in electrification projects drives growth. Manufacturers focusing on compact designs, advanced monitoring systems, and extended durability are positioned strongly to support grid modernization and reliable power delivery across diverse applications.

Deployment of oil-insulated switchgear has been driven by the need for stable high-voltage systems that can handle increasing electrical load. Utility projects and rural electrification programs have created strong adoption opportunities in transmission and distribution networks. Proven arc-quenching capability and high dielectric strength of oil have maintained its preference in harsh operating environments. Suppliers have focused on systems that enhance fault detection and provide longer operating cycles, reducing failure risks. Rising energy consumption in industrial clusters has amplified demand for switchgear capable of sustaining heavy-duty operations and voltage fluctuations without compromising performance or safety standards.

Adoption has been limited by environmental concerns arising from oil leaks and the risk of fire, which elevate operational liabilities. Frequent testing and treatment of insulating oil impose additional maintenance requirements, increasing lifetime costs. Performance variation due to inconsistent oil quality has required stringent quality control measures. Delays in replacing outdated installations occur due to high capital expenditure and lengthy procurement processes, slowing market penetration. Certification demands for compliance with regional safety and performance standards add complexity for manufacturers. Competitive offerings from vacuum and gas-based switchgear with reduced maintenance needs have intensified substitution risk.

Significant opportunities exist in retrofitting older switchgear systems with improved oil-based designs or hybrid systems incorporating vacuum interrupters for better efficiency. Growth in large-scale electrification and interconnection projects across developing regions has created a favorable environment for the installation of high-voltage configurations. Retrofit kits have become appealing for utilities aiming to extend the operational life of existing equipment without full system replacement. Service-focused models offering predictive maintenance and condition-based monitoring have strengthened the aftermarket landscape. Partnerships with contractors and grid operators for tailored solutions have opened new revenue streams for suppliers delivering advanced safety features.

Adoption of digital diagnostic tools has increased to track oil condition, pressure, and temperature, improving predictive maintenance strategies for operators. The preference for compact and modular switchgear systems is growing, driven by limited substation space and the need for easier installation. Interest in bio-based or synthetic insulating oils has gained attention for their improved thermal performance and reduced hazard potential. Integration of advanced sensors for condition reporting supports better asset management and uninterrupted power supply. Collaborative programs between equipment manufacturers and utilities have strengthened the development of bespoke systems for critical infrastructure and industrial power distribution.

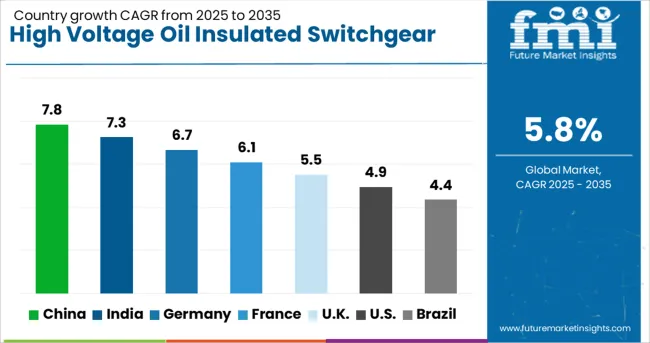

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The global High Voltage Oil Insulated Switchgear market is expected to expand at a 5.8% CAGR from 2025 to 2035. Among the five featured markets out of 40 analyzed, China leads at 7.8%, followed by India at 7.3% and Germany at 6.7%, while France posts 6.1% and the United Kingdom records 5.5%. These rates indicate a growth premium of +34% for China, +26% for India, and +16% for Germany against the global baseline, whereas France trails by +5% and the United Kingdom by –5%. Variations arise from distinct drivers: large-scale transmission projects and ultra-high-voltage corridors in China, renewable integration and grid upgrades in India, energy transition policies and offshore wind in Germany, compact substation designs and diagnostic systems in France, and infrastructure replacement cycles in the United Kingdom. Strategic investment in high-efficiency switchgear designs and automated control systems remains central to these trajectories.

China is projected to achieve the highest CAGR of 7.8%, exceeding the global average of 5.8%. Growth is being driven by ultra-high-voltage transmission projects that support interregional electricity flow. Renewable integration through wind and solar projects continues to fuel procurement of advanced high voltage oil insulated switchgear. Expansion of automated substations and development of large industrial clusters further increases demand. Domestic manufacturers are scaling production for both internal needs and exports to Asia-Pacific and Middle Eastern markets, reinforcing China’s dominance in this segment. Policy-backed investments in grid reliability and long-distance energy corridors ensure sustained market expansion.

India is forecast to grow at 7.3%, supported by renewable energy integration and power transmission upgrades. Development of green energy corridors for solar and wind power drives high demand for high voltage oil insulated switchgear in new and existing substations. Electrification programs for industrial zones and commercial clusters are further influencing procurement decisions. Manufacturers are designing equipment suited for diverse climate conditions to ensure performance and safety. Government-backed projects with financial incentives are accelerating adoption, while digital control and diagnostic technologies improve system reliability and operational efficiency across the network.

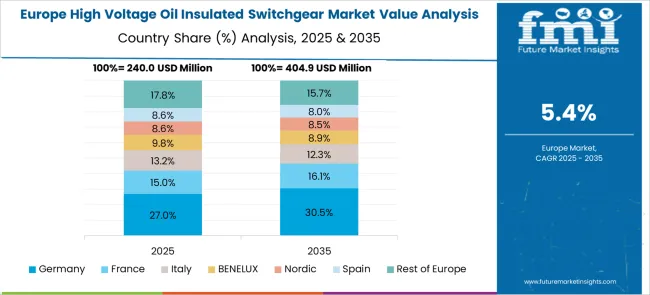

Germany is projected to register 6.7% CAGR, driven by energy transition programs and renewable integration. Offshore wind farms and distributed solar installations are creating strong demand for high voltage oil insulated switchgear across utility grids. Replacement of legacy systems with designs incorporating eco-compliant insulation oils is supporting environmental compliance standards. Automation technologies and condition-monitoring solutions are being deployed to strengthen reliability. Industrial hubs, particularly automotive and heavy manufacturing sectors, are contributing to consistent procurement trends. These developments underline Germany’s position as a strategic market for advanced high-voltage solutions.

France is expected to achieve a 6.1% CAGR, supported by grid reinforcement strategies and renewable integration. National energy programs emphasize substation enhancements to manage distributed energy generation effectively. Electrification of transportation systems and industrial operations is further accelerating equipment procurement. Manufacturers are focusing on modular switchgear designs optimized for compact substations. Investments in advanced diagnostic tools and real-time performance monitoring systems are contributing to improved safety and reduced maintenance costs. Export opportunities across European markets are strengthening France’s competitive positioning.

The United Kingdom is projected to grow at 5.5%, slightly below the global average yet supported by clean energy expansion and substation upgrades. Offshore wind projects remain the key demand driver for high voltage oil insulated switchgear installations. Replacement of aging assets in transmission networks and investment in automated control systems create consistent market opportunities. Manufacturers are introducing advanced solutions designed for compact substations and integrating fault detection capabilities. These developments ensure reliable operation under rising grid loads, reinforcing long-term procurement cycles.

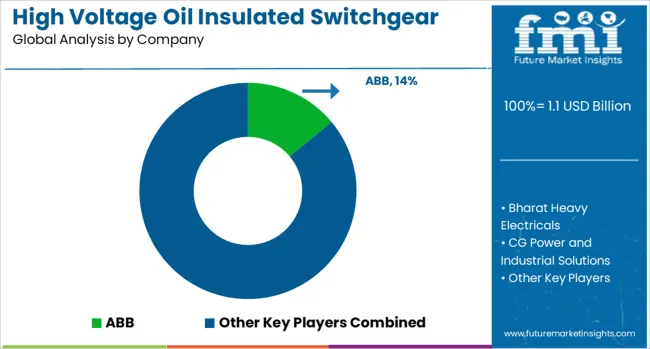

The high voltage oil insulated switchgear market is dominated by global power equipment manufacturers such as ABB, Siemens, Schneider Electric, Mitsubishi Electric, and General Electric, alongside strong regional players including Bharat Heavy Electricals, CG Power and Industrial Solutions, and Hyosung Heavy Industries. These companies cater to critical infrastructure needs for utilities, heavy industries, and transmission networks, focusing on reliability, arc-quenching performance, and operational safety in high-voltage environments.

ABB, Siemens, and Schneider Electric lead the market with integrated solutions that combine oil-insulated switchgear with smart monitoring and control systems for grid stability. Mitsubishi Electric and Hitachi emphasize advanced insulation technologies and compact switchgear designs suitable for high-density installations. Eaton, Fuji Electric, and Toshiba strengthen their positions through diversified offerings that comply with global IEC standards and regional grid codes. Emerging competitors such as CHINT Group and Lucy Group target cost-sensitive markets by delivering standardized, modular switchgear units optimized for ease of installation and maintenance.

Competitive differentiation hinges on dielectric performance, fault-tolerant designs, thermal efficiency, and lifecycle cost advantages, with leading firms investing in IoT-enabled condition monitoring and predictive analytics for enhanced asset management. Entry barriers remain high due to capital-intensive manufacturing processes, long certification timelines, and strict environmental regulations governing oil-based insulating mediums. Future market dynamics will be shaped by modernization of aging grids, expansion of renewable integration projects, and demand for hybrid systems that combine conventional oil insulation with digitalized control for optimized performance. Key performance metrics include insulation reliability, switching capacity, maintenance intervals, and operational safety, positioning innovation-driven players for sustained leadership.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Current | AC and DC |

| Application | Utility, Residential, and Commercial & Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Bharat Heavy Electricals, CG Power and Industrial Solutions, CHINT Group, Eaton, Fuji Electric, General Electric, HD Hyundai Electric, Hitachi, Hyosung Heavy Industries, Lucy Group, Mitsubishi Electric, Ormazabal, Schneider Electric, Siemens, Skema, and Toshiba |

| Additional Attributes | Dollar sales by system configuration (single busbar, double busbar, and breaker-and-half arrangements) and end-use sector (utilities, industrial plants, and transportation infrastructure), with demand driven by the need for high-voltage reliability, fault tolerance, and efficient grid interconnection. Regional trends show strong adoption in Asia-Pacific due to rapid grid expansion, while Europe emphasizes modernization of aging substations. Innovation focuses on compact design, smart monitoring systems, and oil-based arc qu |

The global high voltage oil insulated switchgear market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the high voltage oil insulated switchgear market is projected to reach USD 1.9 billion by 2035.

The high voltage oil insulated switchgear market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in high voltage oil insulated switchgear market are ac and dc.

In terms of application, utility segment to command 64.8% share in the high voltage oil insulated switchgear market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oil Insulated Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Air Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Low Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Porcelain Bushing Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Air-cooled Battery Compartment Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Cable Termination Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Ionising Air Gun Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Equipment Market Forecast and Outlook 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

High Voltage PTC Heater Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Capacitors Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Direct Current (HVDC) Capacitor Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Substation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA