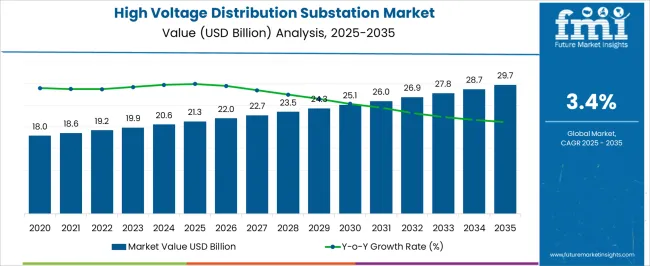

The global high voltage distribution substation market is projected to reach USD 21.3 billion in 2025 and is expected to touch USD 29.7 billion by 2035, registering a compound annual growth rate (CAGR) of 3.4% during this period. An early vs late growth curve comparison reveals a distinctive transition from modest expansion in the initial years to steadier yet more structured growth in the latter phase. In the early stage, spanning from around USD 18.0 billion in the base period to USD 21.3 billion by 2025, the market experiences a cautious build-up where utilities and grid operators prioritize selective upgrades and pilot-scale deployments to modernize infrastructure without overextending budgets. This phase reflects slower momentum, driven primarily by replacement demand, regulatory compliance, and the need for reliability assurance in existing power networks.

As the market progresses beyond 2025, entering the late growth curve from USD 22.0 billion toward USD 29.7 billion by 2035, the expansion becomes more predictable and driven by large-scale planned projects, grid interconnections, and urban electrification demands, which require substantial capital allocation and long-term planning cycles. The late-phase growth displays a more linear pattern, where investment flows stabilize and risk perception among utilities reduces due to established supply chains and proven designs. This shift from conservative early growth to structured late growth illustrates how the market matures, with the focus evolving from experimentation and incremental improvements to broad-based deployment and operational optimization, marking a critical shift in strategic planning for equipment manufacturers, contractors, and public infrastructure planners.

| Metric | Value |

|---|---|

| High Voltage Distribution Substation Market Estimated Value in (2025 E) | USD 21.3 billion |

| High Voltage Distribution Substation Market Forecast Value in (2035 F) | USD 29.7 billion |

| Forecast CAGR (2025 to 2035) | 3.4% |

The high voltage distribution substation market is closely influenced by five interconnected parent markets that collectively drive its adoption and long-term growth. The largest contributor is the power transmission and distribution (T&D) infrastructure market, which accounts for about 40% share, as high voltage substations are essential nodes for stepping down power from transmission levels to distribution levels, ensuring stable electricity flow to urban, industrial, and rural areas. The industrial and commercial electricity demand sector contributes around 25%, driven by large-scale manufacturing plants, data centers, and commercial complexes that require reliable high-capacity substations to support uninterrupted operations and load management. The renewable energy integration market holds close to 15% influence, supported by the need to connect wind, solar, and hydro power plants to the grid through high voltage substations that stabilize variable inputs and maintain grid balance. The electrical equipment and switchgear manufacturing industry adds nearly 12%, as advancements in transformers, circuit breakers, protective relays, and monitoring systems directly enhance the efficiency, safety, and automation of high voltage substations.

The government policy and infrastructure investment sector contributes close to 8%, as public funding, regulatory approvals, and modernization initiatives accelerate the deployment of upgraded substation networks. The distribution of market influence shows that T&D infrastructure and industrial power demand form the backbone of this market, while renewable integration, equipment innovation, and policy support continue to expand its operational and commercial significance.

The high voltage distribution substation market is undergoing substantial expansion, driven by increasing energy demand, rapid industrialization, and urban grid modernization across global regions. Governments and utilities are investing heavily in expanding transmission networks and enhancing grid reliability, especially in emerging economies facing rising peak load demands. Aging infrastructure in developed markets has also created a demand surge for substation upgrades and retrofitting programs.

With renewable integration becoming central to energy strategies, high voltage substations serve as critical nodes for maintaining power quality and operational flexibility. This trend is further amplified by digitalization initiatives and smart grid deployments that are redefining how substations are designed and managed. Additionally, favorable policy mandates and funding allocations for grid strengthening have bolstered market confidence.

Technological advancements in protection, monitoring, and remote control systems have improved substation efficiency, while equipment manufacturers are optimizing product lifecycles and cost-efficiency. As the energy transition accelerates globally, the high voltage distribution substation market is expected to remain a vital infrastructure segment underpinning resilient and sustainable power delivery systems.

The high voltage distribution substation market is segmented by technology, component, category, end use, and geographic regions. By technology, high voltage distribution substation market is divided into Conventional and Digital. In terms of component, high voltage distribution substation market is classified into Substation Automation System, Communication Network, Electrical System, Monitoring & Control System, and Others. Based on category, high voltage distribution substation market is segmented into New and Refurbished. By end use, high voltage distribution substation market is segmented into Utility and Industrial. Regionally, the high voltage distribution substation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

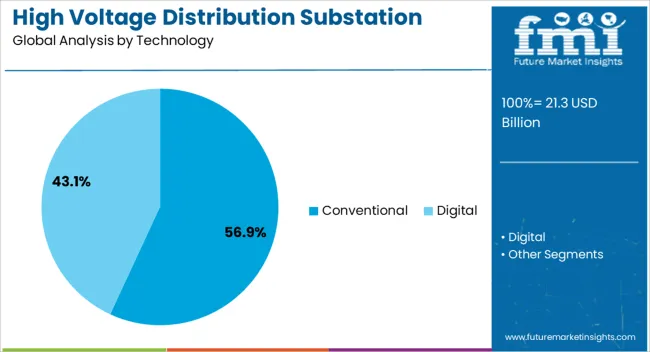

The conventional segment accounts for approximately 56.9% of the market share within the technology category, maintaining its dominance due to widespread legacy deployment and operational familiarity. Despite the emergence of digital substations, conventional setups continue to be favored in regions with limited digital infrastructure or constrained modernization budgets. This segment benefits from proven performance reliability and compatibility with existing transmission systems, allowing for lower transition costs and simplified maintenance.

While digital solutions gain traction, many utilities are adopting hybrid approaches where conventional technologies remain integrated with incremental upgrades. The segment’s prominence is reinforced by lower initial investments, especially in cost-sensitive markets where scalability and ease of implementation are prioritized.

Additionally, conventional substations offer well-documented safety protocols and hardware resilience in high-voltage applications. As modernization timelines vary globally, particularly in rural and underdeveloped grid zones, the conventional segment is projected to retain significant relevance during the forecast period, especially where system interoperability and gradual digital adoption are the prevailing strategies.

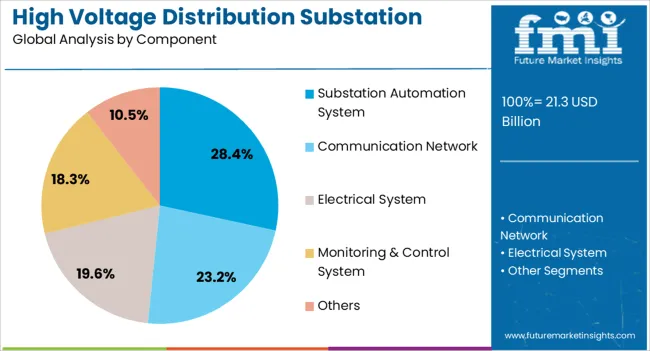

The substation automation system segment leads within the component category, comprising around 28.4% of the overall market share. This segment's growth is attributed to the rising adoption of intelligent control systems and advanced monitoring tools, which enable improved substation reliability and real-time diagnostics. Automation solutions are increasingly being implemented to reduce manual intervention, enhance grid responsiveness, and minimize downtime during fault conditions.

With increasing penetration of renewables and distributed energy resources, substation automation facilitates seamless load balancing and voltage regulation, aligning with the evolving dynamics of smart grids. The segment is further supported by stringent regulatory norms demanding higher energy efficiency and system transparency, which are achievable through integrated automation.

Technological advancements in communication protocols and cybersecurity frameworks have also accelerated deployment. As utilities seek to future-proof their infrastructure with scalable and interoperable systems, the substation automation system segment is anticipated to gain further momentum, serving as a core enabler of next-generation substations across diverse grid topologies.

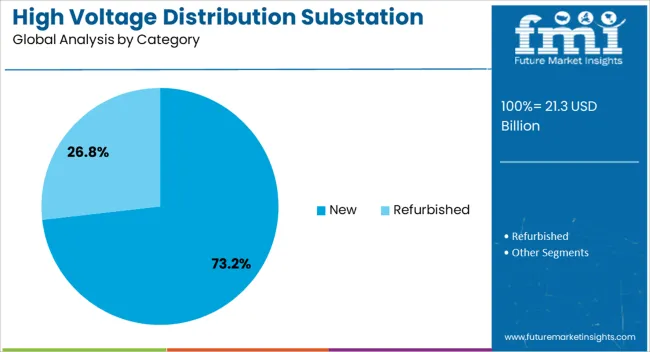

The new category commands a dominant market share of approximately 73.2%, driven by the large-scale development of greenfield energy infrastructure projects and rapid electrification efforts in emerging economies. Governments and utilities are investing in the expansion of new power corridors to meet increasing urban and industrial electricity demand, thereby creating a robust pipeline of new substation projects. This segment benefits from policy support, funding initiatives, and strategic partnerships focused on grid modernization and energy access improvement.

Unlike retrofit projects, new installations allow for end-to-end integration of advanced technologies, including automation, remote monitoring, and fault management systems. The flexibility in design and layout associated with new builds offers better alignment with contemporary grid standards and renewable integration needs.

Additionally, the shift toward decentralized energy models and smart city development has increased the requirement for new, high-capacity substations. Given the pace of global electrification and energy transition programs, the new segment is projected to maintain a commanding share of the high voltage distribution substation market through the forecast horizon.

The high voltage distribution substation market is shaped by rising electricity demand, integration of advanced control systems, regulatory-driven infrastructure investments, and the need to support renewable and industrial power integration. Utilities are focusing on enhancing grid capacity, efficiency, and reliability to meet growing consumption. Digital technologies, automation, and intelligent devices are improving substation performance and reducing operational risks.

Government incentives and funding are accelerating network upgrades, while renewable projects and industrial operations are driving demand for new substations. These combined dynamics are fostering market growth and positioning high voltage distribution substations as essential components of modern power networks.

The high voltage distribution substation market is expanding due to rising electricity consumption from residential, commercial, and industrial sectors. Rapid economic development and increasing electrification in emerging regions are driving new substation projects to strengthen transmission and distribution networks. Utilities are investing in high-capacity substations to reduce transmission losses and improve voltage stability. Urban load centers and industrial hubs are witnessing substantial upgrades in their grid infrastructure, increasing the need for reliable high voltage distribution substations. This growing demand for consistent and high-quality power supply is creating strong growth opportunities for substation equipment manufacturers and engineering service providers globally.

High voltage distribution substations are increasingly adopting advanced monitoring, automation, and control systems to enhance operational efficiency. Smart sensors, SCADA systems, and digital relays are being implemented to provide real-time data, improve fault detection, and reduce downtime. Utilities are shifting toward digital substations to optimize performance and extend asset lifecycles. The integration of intelligent electronic devices (IEDs) allows for remote operation and predictive maintenance, minimizing manual intervention and operational risks. These advancements are improving reliability, safety, and cost-efficiency, driving wider adoption of modernized high voltage distribution substations across transmission and distribution networks worldwide.

Government regulations and large-scale infrastructure investment programs are fueling the deployment of high voltage distribution substations. Regulatory agencies are enforcing strict reliability, safety, and performance standards for power transmission networks. Public funding and private capital are being directed toward upgrading aging grid infrastructure to support growing energy demand. National and regional electrification initiatives in Asia-Pacific, the Middle East, and Africa are promoting extensive substation development. Incentives and long-term contracts are encouraging utilities to adopt advanced substation technologies. These regulatory and financial frameworks are reducing project risks, accelerating implementation, and supporting consistent growth of the global market.

The rise in renewable energy generation and industrial power demand is creating new opportunities for high voltage distribution substations. Wind farms, solar parks, and hydropower facilities require dedicated substations for grid connectivity and power evacuation. Energy-intensive industries such as mining, steel, and petrochemicals are installing high-capacity substations to meet operational needs. Substations play a critical role in stabilizing voltage, managing power fluctuations, and ensuring reliable electricity delivery from variable sources. The integration of renewable and industrial loads is increasing the complexity and scale of substation projects, driving demand for advanced equipment, engineering expertise, and long-term service support.

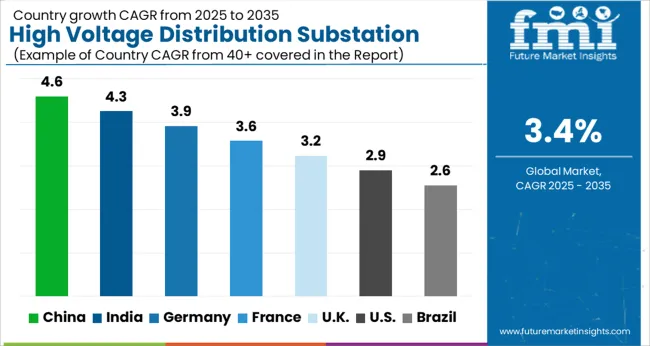

| Country | CAGR |

|---|---|

| China | 4.6% |

| India | 4.3% |

| Germany | 3.9% |

| France | 3.6% |

| U.K. | 3.2% |

| U.S. | 2.9% |

| Brazil | 2.6% |

The global high voltage distribution substation market is projected to grow at a CAGR of 3.4% from 2025 to 2035. China leads with 4.6%, followed by India at 4.3%, Germany at 3.9%, the U.K. at 3.2%, and the U.S. at 2.9%. Growth is driven by rising electricity demand, grid modernization projects, and expanding industrial and urban power networks. BRICS countries, particularly China and India, are scaling infrastructure development, equipment manufacturing, and project investments to strengthen grid reliability. OECD nations such as Germany, the U.K., and the U.S. emphasize automation systems, advanced monitoring technologies, and maintenance upgrades to enhance operational efficiency and service continuity. The analysis spans over 40+ countries, with the leading markets detailed below.

The high voltage distribution substation market in China is projected to grow at a CAGR of 4.6% from 2025 to 2035, driven by large-scale power transmission projects, rapid industrial development, and increasing electricity consumption in urban and rural regions. Continuous investments in ultra-high-voltage (UHV) grid networks are boosting demand for advanced switchgear, transformers, and control systems. State-led grid modernization programs are supporting upgrades to existing substations and building new high-capacity nodes to handle rising load demands. Domestic equipment manufacturers are expanding production capabilities and collaborating with international suppliers to integrate digital monitoring and automation technologies into substations.

The high voltage distribution substation market in India is expected to grow at a CAGR of 4.3% from 2025 to 2035, supported by rising power demand, transmission network expansion, and grid strengthening projects. Government-led rural electrification programs and industrial corridor development are fueling demand for high-capacity substations. Private players are investing in advanced switchgear, GIS-based substations, and modular designs to reduce construction time and operational losses. Collaborative projects with global electrical engineering firms are helping domestic companies adopt smart grid-compatible equipment and predictive maintenance systems.

The high voltage distribution substation market in Germany is projected to grow at a CAGR of 3.9% from 2025 to 2035, driven by the replacement of aging grid infrastructure and rising load requirements from industrial clusters. Regional utilities are investing in upgrading existing substations with digital control systems, high-efficiency transformers, and advanced protection relays. Strict regulatory frameworks are encouraging the deployment of high-reliability components and monitoring systems to reduce downtime. Collaborations with leading electrical equipment suppliers are accelerating the shift toward automated and remotely managed substations.

The high voltage distribution substation market in the United Kingdom is expected to grow at a CAGR of 3.2% from 2025 to 2035, driven by the need to replace outdated grid assets and support rising electricity loads from industrial and residential sectors. Regional utilities are upgrading legacy substations with digital protection, SCADA systems, and high-capacity transformers. Grid operators are also investing in compact, modular substations to improve deployment speed and reduce operational risks. Partnerships with global engineering firms are helping implement advanced diagnostic systems and automated control solutions.

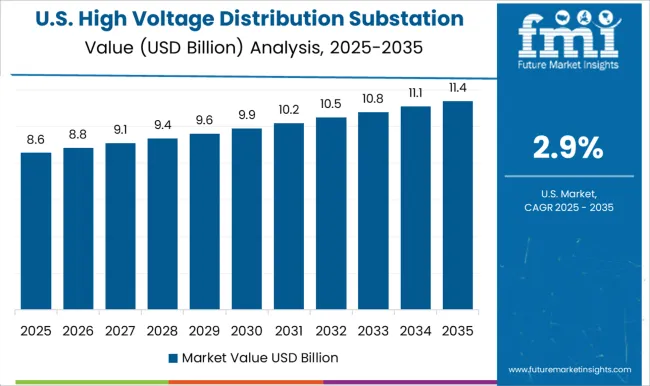

The high voltage distribution substation market in the United States is projected to grow at a CAGR of 2.9% from 2025 to 2035, supported by aging infrastructure replacement programs and rising electricity demand from commercial and industrial sectors. Utilities are allocating capital for grid modernization projects that include installation of advanced switchgear, digital control systems, and predictive maintenance tools. Federal and state-level funding initiatives are promoting investments in grid resilience and reliability. Collaborations between domestic utilities and global electrical technology firms are enabling adoption of automated and smart substation solutions.

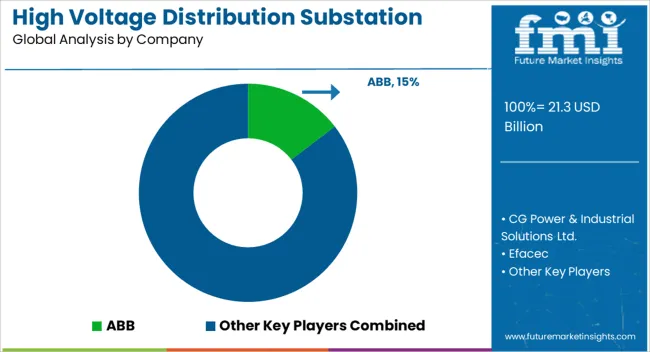

Competition in the high voltage distribution substation market is shaped by grid reliability requirements, advanced automation systems, and scalable substation architectures. ABB leads the market with turnkey high-voltage substations that integrate gas-insulated switchgear, digital protection systems, and modular control units. The company emphasizes compact layouts, fast deployment, and low-loss components for urban and industrial power networks. CG Power & Industrial Solutions Ltd. competes with engineered substation solutions across transmission and distribution networks, offering design-build capabilities, robust switchgear systems, and localized manufacturing advantages to serve utility projects. Efacec provides modular substations with advanced SCADA integration and automation systems tailored for renewable and industrial grid interconnections. Eaton focuses on high-voltage switchgear assemblies and digital relays, supplying complete substation packages designed for enhanced safety, reduced maintenance, and grid modernization initiatives. General Electric delivers high-capacity substations equipped with intelligent electronic devices, protection relays, and advanced monitoring tools, highlighting operational efficiency and smart grid compatibility.

| Item | Value |

|---|---|

| Quantitative Units | USD 21.3 Billion |

| Technology | Conventional and Digital |

| Component | Substation Automation System, Communication Network, Electrical System, Monitoring & Control System, and Others |

| Category | New and Refurbished |

| End Use | Utility and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, CG Power & Industrial Solutions Ltd., Efacec, Eaton, General Electric, Hitachi Energy Ltd., L&T Electrical and Automation, Locamation, Open System International, Inc., Rockwell Automation, Inc., Schneider Electric, Siemens, Texas Instruments Incorporated, and Tesco Automation Inc. |

| Additional Attributes | Dollar sales, share, installation capacity, regional deployment, end-use sector demand, competitor landscape, pricing trends, regulatory standards, grid modernization projects, equipment reliability, maintenance services, technological upgrades. |

The global high voltage distribution substation market is estimated to be valued at USD 21.3 billion in 2025.

The market size for the high voltage distribution substation market is projected to reach USD 29.7 billion by 2035.

The high voltage distribution substation market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in high voltage distribution substation market are conventional and digital.

In terms of component, substation automation system segment to command 28.4% share in the high voltage distribution substation market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Protein Powders Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

High Purity Gas Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Purity Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Performance Permanent Magnet Market Size and Share Forecast Outlook 2025 to 2035

High Airtight Storage Cabinets Market Size and Share Forecast Outlook 2025 to 2035

High Purity Process Systems for Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

High Octane Racing Fuel Market Size and Share Forecast Outlook 2025 to 2035

High Temperature NiMH Battery Market Size and Share Forecast Outlook 2025 to 2035

High Current Power Supply for Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

High Security Wedge Barricades Market Size and Share Forecast Outlook 2025 to 2035

High Purity Chemical Filters Market Size and Share Forecast Outlook 2025 to 2035

High Performance Liquid Chromatography-Tandem Mass Spectrometry System Market Size and Share Forecast Outlook 2025 to 2035

High-vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

High Pressure Grease Hose Market Size and Share Forecast Outlook 2025 to 2035

High Performing Matting Agent Market Size and Share Forecast Outlook 2025 to 2035

High Reliability Oscillators Market Size and Share Forecast Outlook 2025 to 2035

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High-frequency RF Evaluation Board Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA