The high octane racing fuel market is valued at USD 351.8 million in 2025 and is expected to reach USD 506.0 million by 2035, expanding at a CAGR of 3.7%. Demand growth is supported by the consistent expansion of professional motorsport events, increasing participation in amateur racing, and ongoing demand for fuels that deliver optimized combustion and engine performance under extreme operating conditions. Rising technological sophistication in race car engines and the adoption of performance-oriented formulations that meet emission and efficiency standards further drive industry development.

Unleaded fuel represents the leading product type, preferred for its compliance with modern environmental regulations and compatibility with high-compression engines. Continuous innovation in fuel blending techniques, octane enhancement additives, and cleaner-burning hydrocarbons is improving power output while reducing engine deposit formation. Racing teams and event organizers increasingly rely on fuels offering stability, vapor pressure consistency, and reproducible performance across varied temperature and altitude conditions.

Asia Pacific, Europe, and North America remain key growth regions. Asia Pacific benefits from expanding regional motorsport infrastructure, while Europe and North America sustain demand through established racing leagues and high consumer engagement. Major participants include VP Racing Fuels, Sunoco Race Fuels, Renegade Race Fuel, Fuel Factory, ETS Racing Fuels, ExxonMobil, Haltermann Carless, Torco Race Fuels, Chevron, Anglo American Oil Company, Shell, and TotalEnergies AFS.

The high octane racing fuel market is projected to increase from USD 351.8 million in 2025 to USD 506.0 million by 2035, indicating a measured growth phase with selective market share gains. Established fuel manufacturers are expected to maintain dominant positions through long-term partnerships with racing teams and motorsport organizations. The period from 2025 to 2030 will likely show moderate share redistribution as smaller regional producers enter the market with cost-effective formulations targeting local racing circuits. These entrants may capture limited shares from established brands by focusing on niche categories such as amateur motorsports and track-day events.

From 2030 onward, leading suppliers are expected to regain or expand market share through continuous improvements in fuel chemistry and adherence to evolving motorsport emission standards. Increased focus on synthetic and bio-based racing fuels will enable established companies to reinforce brand credibility and technical advantage. Market share erosion among smaller participants is likely as regulatory requirements tighten and production costs rise. The market will display gradual consolidation, with top-tier producers strengthening their position through research-driven product portfolios and consistent supply reliability within global racing and performance segments.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 351.8 million |

| Market Forecast Value (2035) | USD 506.0 million |

| Forecast CAGR (2025 to 2035) | 3.7% |

The high-octane racing fuel market is expanding as the global motorsports industry experiences increased participation and viewership, which raises demand for premium performance fuels. High-octane blends enable high-compression engines in professional and amateur racing to deliver higher power output and improved thermal efficiency, which supports vehicle competitiveness and lap time optimization. Technological advances in fuel formulation, including oxygenated additives and unleaded alternatives, drive adoption among racing teams seeking both compliance with emissions regulations and enhanced performance.

Growth is further supported by investments in race infrastructure in emerging regions and the trend toward more sophisticated vehicle telemetry and fuel-management systems. At the same time, fuel producers are developing specialized fuel types for drag racing, circuit formats and off-road racing, broadening application range. Constraints include high production and logistical cost of specialized fuels, regulatory pressure on lead-containing additives and limited scale outside elite motorsport segments, which may restrict expansion in less-developed regions.

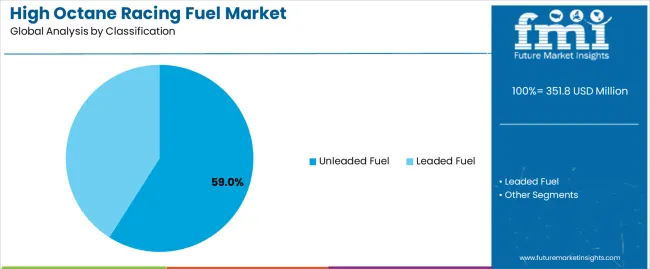

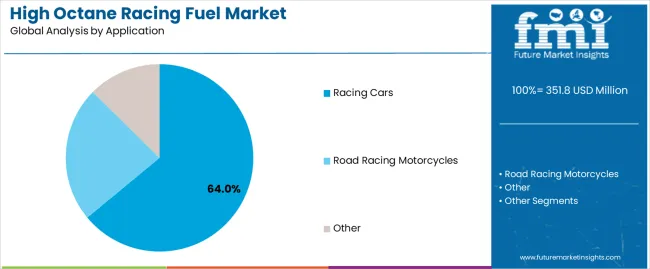

The high octane racing fuel market is segmented by classification and application. By classification, the market is divided into unleaded fuel and leaded fuel. Based on application, the market is categorized into racing cars, road racing motorcycles, and other motorsport applications. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

The unleaded fuel segment holds the leading position in the high octane racing fuel market, representing approximately 59.0% of total share in 2025. Unleaded high-octane formulations have become the industry standard due to their cleaner combustion profile, compliance with emission regulations, and compatibility with advanced racing engines designed for precision performance. These fuels are engineered to deliver high energy density, stable detonation resistance, and consistent burn characteristics under extreme temperature and pressure conditions.

The segment’s dominance is reinforced by the global transition toward environmentally compliant fuels and the phasing out of leaded gasoline in professional motorsport categories. Major racing organizations and regulatory bodies, including the FIA and MotoGP authorities, have progressively adopted unleaded fuel mandates to reduce toxicity and align with green initiatives. Leaded fuel retains niche use in vintage or legacy motorsport applications that require specific tuning characteristics and historical engine configurations.

Key factors supporting the unleaded fuel segment include:

Racing cars account for approximately 64.0% of the high octane racing fuel market in 2025. This segment dominates due to the extensive use of specialized fuel formulations across professional motorsport events such as Formula One, endurance racing, and GT championships. High octane unleaded fuels are essential in achieving optimal engine efficiency, maximizing horsepower, and ensuring reliability during high-speed, long-duration performance cycles.

The road racing motorcycle segment follows as a secondary market, supported by competitive categories requiring fuel formulations with controlled volatility and superior thermal stability. The “other” category includes drag racing, karting, and off-road motorsport events utilizing varied engine configurations.

Primary dynamics supporting demand from racing cars include:

Rising global motorsport participation, advanced engine technologies, and demand for performance fuels are driving market growth.

The High Octane Racing Fuel market is propelled by increased participation in professional and amateur motorsport events worldwide, expanding demand for fuel solutions tailored for high-performance engines. Advancements in engine compression ratios, turbocharging, and hybrid racing powertrains require fuels with elevated octane ratings and stability under extreme conditions. Manufacturers are responding with specialized formulations that improve combustion efficiency, reduce engine knock risk, and enhance power output and reliability. The proliferation of racing series across emerging markets further broadens the addressable market for performance fuel blends.

Regulatory emissions constraints, raw material cost fluctuations, and competition from alternative propulsion limit expansion.

Stringent environmental regulations are curbing the use of leaded fuels and imposing tighter standards on fuel formulations, which increases compliance complexity and costs. Variable crude-oil and additive prices affect production economics for high-octane blends, limiting margin expansion. In addition, the growing shift toward electric and hybrid powertrains in racing and performance vehicles may reduce future dependence on traditional high-octane fuels, thereby affecting long-term demand.

Shift to unleaded/oxygenated blends, integration of digital monitoring tools, and expansion into emerging regions are shaping the market.

The market is seeing accelerated adoption of unleaded and oxygenated racing fuels as teams align with ecofriendly goals and regulatory mandates. Sensor-based fuel-consumption and engine-telemetry systems are being combined with fuel providers’ analytics to offer enhanced performance feedback and optimisation for racing teams. Geography-wise, Asia-Pacific is emerging as a growth hotspot due to escalating interest in motorsport and performance driving, while established markets in North America and Europe continue to invest in premium fuel technologies.

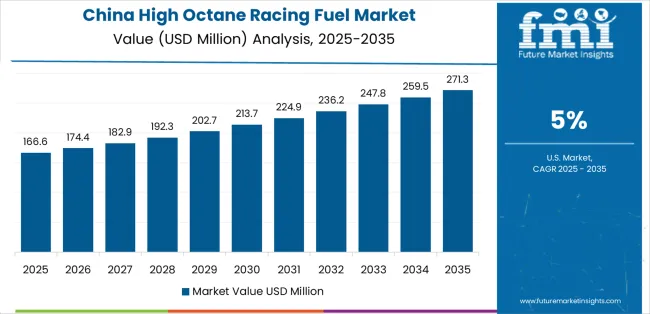

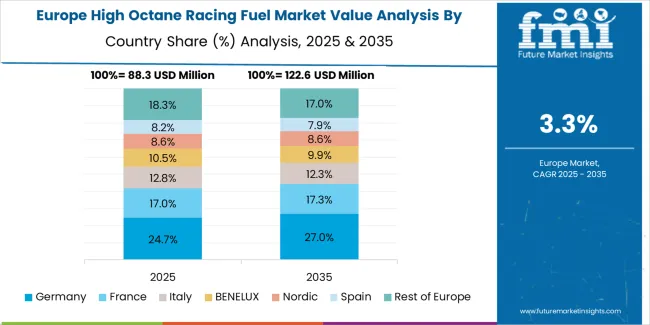

The global high octane racing fuel market is expanding steadily through 2035, supported by growth in motorsport participation, engine optimization technologies, and performance-oriented automotive engineering. China leads the market with a 5.0% CAGR, followed by India at 4.6%, driven by increasing motorsport events and premium automotive demand. Germany’s 4.3% growth reflects advanced fuel innovation and performance testing infrastructure, while Brazil’s 3.9% stems from its expanding domestic racing circuits. The United States, at 3.5%, maintains a mature performance fuel segment supported by organized racing leagues. The United Kingdom (3.1%) and Japan (2.8%) demonstrate steady innovation in synthetic and bio-based racing fuel formulations.

| Country | CAGR (%) |

|---|---|

| China | 5.0 |

| India | 4.6 |

| Germany | 4.3 |

| Brazil | 3.9 |

| USA | 3.5 |

| UK | 3.1 |

| Japan | 2.8 |

China’s high octane racing fuel market grows at 5.0% CAGR, supported by rapid expansion of motorsport culture, automotive performance engineering, and fuel technology R&D. The government’s encouragement of motorsport tourism and industrial innovation has accelerated investment in advanced fuel formulations meeting FIA standards. Domestic refineries and energy firms are producing specialized high-octane blends for racing teams and automotive testing centers. Growth in luxury and sports car ownership is also expanding demand for precision fuels. Increasing collaboration with international motorsport organizations enhances China’s fuel quality certification capabilities and distribution infrastructure across key automotive regions.Key Market Factors:

India’s market expands at 4.6% CAGR, driven by the growing motorsport industry, track development, and increased investment in high-performance fuels. Motorsport federations and private racing clubs are supporting the adoption of specialized octane blends optimized for local conditions. Energy companies are introducing performance-grade fuels designed for turbocharged and high-compression engines. The rising popularity of professional racing events and automotive exhibitions enhances public awareness of premium fuel applications. Refiners are collaborating with racing teams to refine fuel efficiency and consistency standards. The market’s future growth is supported by government focus on clean energy and advanced combustion technologies.Market Development Factors:

Germany’s high octane racing fuel market grows at 4.3% CAGR, supported by its automotive heritage and innovation in fuel chemistry. Research institutions and automotive manufacturers collaborate to enhance combustion efficiency and octane stability under performance conditions. The country’s motorsport ecosystem, including touring car and endurance racing, drives continuous demand for certified performance fuels. Energy companies are investing in renewable-based and synthetic octane fuel alternatives. Regulations supporting green racing fuel development align with the European Union’s carbon reduction objectives. Advanced testing facilities across Munich, Stuttgart, and Hamburg facilitate continuous product improvement and regulatory compliance.Key Market Characteristics:

Brazil’s market grows at 3.9% CAGR, supported by its ethanol-based fuel expertise and expanding motorsport participation. Local fuel producers are developing ethanol-enriched high-octane blends for professional and amateur racing applications. Strong domestic automotive manufacturing and energy sectors contribute to research in advanced combustion fuels. Motorsport associations in São Paulo and Rio de Janeiro are enhancing race event frequency, increasing fuel demand. The combination of bioethanol and synthetic additives ensures improved performance and sustainability. Collaboration with international fuel suppliers supports technology transfer and certification processes for high-performance fuel production.Market Development Factors:

The USA market grows at 3.5% CAGR, driven by mature racing infrastructure and high competition levels across motorsport categories. Domestic refineries and independent producers maintain strong R&D capacity for octane optimization and fuel stability. The presence of major racing leagues such as NASCAR and IndyCar maintain demand for advanced blends. Companies are investing in ecofriendly and ethanol-based high-octane fuels aligned with EPA emission standards. Widespread access to testing and tuning facilities supports consistent market performance. The expansion of aftermarket and performance vehicle segments continues to influence high-octane fuel consumption trends nationwide.Key Market Factors:

The United Kingdom’s market expands at 3.1% CAGR, driven by its established motorsport industry and focus on ecofriendly performance fuels. Research centers and fuel manufacturers collaborate to develop bio-synthetic high-octane blends compatible with advanced engines. Motorsport Valley serves as a development hub for testing fuel performance across categories such as Formula racing and endurance events. Regulatory alignment with European carbon targets promotes innovation in low-emission fuels. Private fuel companies are investing in high-energy density formulations to support competitive performance and environmental standards. Growth in motorsport engineering and automotive innovation continues to maintain domestic market demand.

Market Characteristics:

Japan’s market grows at 2.8% CAGR, supported by continuous advancements in automotive technology and precision fuel engineering. Domestic energy firms are developing clean-burning, high-octane fuels optimized for hybrid and performance vehicle engines. The country’s motorsport participation, including Super GT and endurance racing, promotes steady fuel demand. Research institutions are improving formulation consistency and reducing carbon content. Automotive OEMs are testing synthetic and bio-derived fuels for compatibility with future engine architectures. Japan’s focus on high manufacturing standards and low-emission technologies maintain long-term growth in the high-octane fuel segment.

Market Development Factors:

The high-octane racing fuel market is moderately consolidated, characterized by a mix of specialized motorsport fuel producers and diversified energy corporations. VP Racing Fuels holds the leading position with an estimated 22.0% global market share, supported by its extensive racing partnerships, broad product range, and consistent performance record across major motorsport series. The company’s competitive advantage lies in its precision fuel formulations tailored for specific engine types and regulatory standards.

Sunoco Race Fuels and Renegade Race Fuel follow closely, maintaining strong distribution networks across North America and Europe. Their competitiveness is reinforced by event sponsorships, supply agreements with racing leagues, and ongoing product refinement aligned with evolving engine technologies. Fuel Factory and ETS Racing Fuels cater to niche racing segments, offering customized blends that prioritize engine efficiency and reduced emissions.

Integrated energy companies such as ExxonMobil, Chevron, Shell, and TotalEnergies AFS participate primarily through specialized divisions, leveraging large-scale refining infrastructure to produce consistent, high-purity formulations. Haltermann Carless, Torco Race Fuels, and Anglo American Oil Company maintain focused positions in premium and endurance racing applications through smaller, high-quality production runs.

Competition is based on octane stability, combustion performance, and compliance with racing regulations, rather than price sensitivity. The market continues to evolve toward cleaner-burning, ethanol-compatible formulations, with growth concentrated in regions hosting major motorsport events and performance vehicle industries.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Classification | Unleaded Fuel, Leaded Fuel |

| Application | Racing Cars, Road Racing Motorcycles, Other |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | VP Racing Fuels, Sunoco Race Fuels, Renegade Race Fuel, Fuel Factory, ETS Racing Fuels, ExxonMobil, Haltermann Carless, Torco Race Fuels, Chevron, Anglo American Oil Company, Shell, TotalEnergies AFS |

| Additional Attributes | Dollar sales by classification and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of fuel manufacturers and distributors; advancements in high-performance fuel formulations; integration with motorsport racing regulations and sustainable racing initiatives. |

The global high octane racing fuel market is estimated to be valued at USD 351.8 million in 2025.

The market size for the high octane racing fuel market is projected to reach USD 506.0 million by 2035.

The high octane racing fuel market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in high octane racing fuel market are unleaded fuel and leaded fuel.

In terms of application, racing cars segment to command 64.0% share in the high octane racing fuel market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Voltage Porcelain Bushing Market Size and Share Forecast Outlook 2025 to 2035

High Purity Process Systems for Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Air-cooled Battery Compartment Market Size and Share Forecast Outlook 2025 to 2035

High Temperature NiMH Battery Market Size and Share Forecast Outlook 2025 to 2035

High Current Power Supply for Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Cable Termination Market Size and Share Forecast Outlook 2025 to 2035

High Security Wedge Barricades Market Size and Share Forecast Outlook 2025 to 2035

High Purity Chemical Filters Market Size and Share Forecast Outlook 2025 to 2035

High Performance Liquid Chromatography-Tandem Mass Spectrometry System Market Size and Share Forecast Outlook 2025 to 2035

High-vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

High Pressure Grease Hose Market Size and Share Forecast Outlook 2025 to 2035

High Performing Matting Agent Market Size and Share Forecast Outlook 2025 to 2035

High Reliability Oscillators Market Size and Share Forecast Outlook 2025 to 2035

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High-frequency RF Evaluation Board Market Size and Share Forecast Outlook 2025 to 2035

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Ionising Air Gun Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Equipment Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA