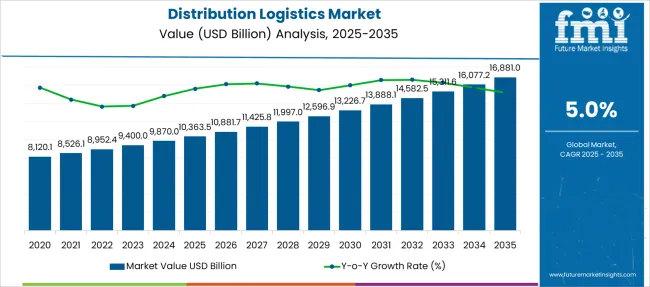

The Distribution Logistics Market is estimated to be valued at USD 10363.5 billion in 2025 and is projected to reach USD 16881.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Distribution Logistics Market Estimated Value in (2025 E) | USD 10363.5 billion |

| Distribution Logistics Market Forecast Value in (2035 F) | USD 16881.0 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The Distribution Logistics market is undergoing significant transformation, supported by the acceleration of digital commerce, supply chain optimization efforts, and infrastructure modernization. The integration of intelligent logistics platforms, demand forecasting tools, and inventory automation systems has enabled organizations to streamline operations and reduce inefficiencies.

Growing demand for last-mile connectivity, rising consumer expectations for fast and accurate deliveries, and the expansion of omni-channel retail models are shaping the future of this market. Investments in transportation networks, particularly in emerging markets, and the adoption of real-time tracking systems are further contributing to overall market efficiency.

As businesses prioritize resilience, scalability, and cost-effective solutions, the role of strategic distribution logistics has become central to competitive advantage. The increasing need for integrated services that align inventory control, warehousing, and delivery has positioned the market for sustained growth across sectors, with technology-driven innovations continuing to set the pace..

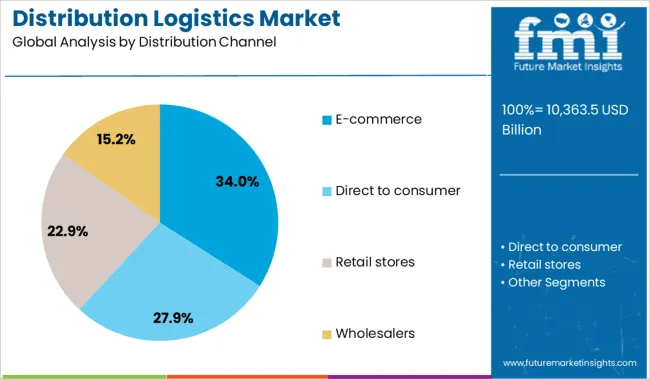

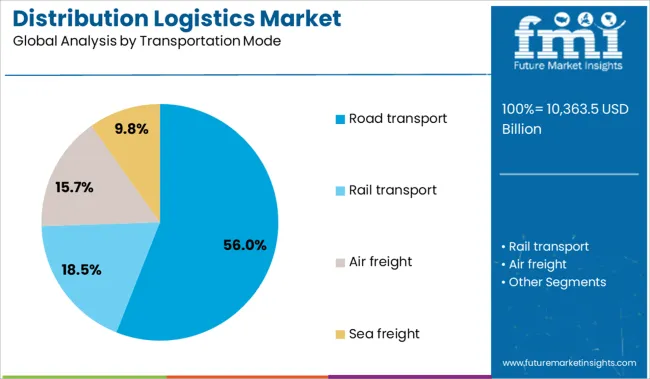

The market is segmented by Distribution Channel, Transportation Mode, and Inventory Management and region. By Distribution Channel, the market is divided into E-commerce, Direct to consumer, Retail stores, and Wholesalers. In terms of Transportation Mode, the market is classified into Road transport, Rail transport, Air freight, and Sea freight.

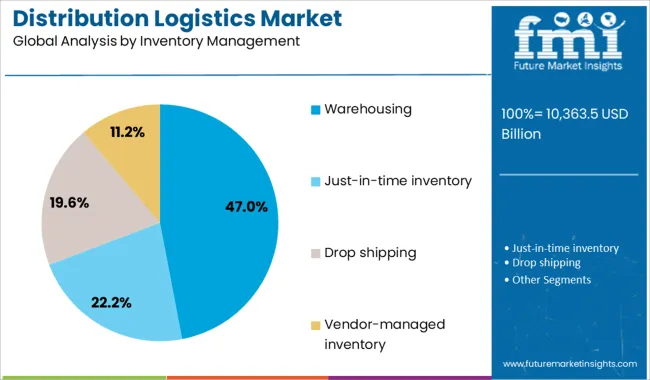

Based on Inventory Management, the market is segmented into Warehousing, Just-in-time inventory, Drop shipping, and Vendor-managed inventory. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The e-commerce distribution channel is expected to account for 34% of the Distribution Logistics market revenue in 2025, establishing itself as the leading channel. This segment has gained momentum due to the rapid digitalization of retail and the exponential rise in online consumer transactions.

The shift in consumer behavior toward convenient, on-demand shopping has significantly influenced distribution strategies, prompting logistics providers to restructure networks for direct-to-consumer models. It has been observed that the demand for speed, flexibility, and transparency has driven investment in e-commerce logistics solutions, including automated fulfillment centers and smart tracking systems.

The scalability and efficiency offered by e-commerce channels have made them a preferred choice for both large enterprises and small businesses. Additionally, the continuous growth in cross-border e-commerce and the expansion of third-party logistics providers have reinforced the dominance of this segment in the distribution network landscape..

The road transport segment is projected to hold a dominant 56% share of the Distribution Logistics market revenue in 2025, making it the primary mode of transportation. Its leadership position has been driven by its operational flexibility, cost efficiency, and extensive reach across urban, semi-urban, and rural areas.

Road transport has been particularly essential in last-mile delivery solutions, where agility and route optimization are critical. Businesses have increasingly relied on road freight services to maintain consistent supply chain flow and timely fulfillment, especially for short-haul and regional deliveries.

Infrastructure improvements and the adoption of telematics and GPS-based fleet management systems have enhanced the reliability and efficiency of road logistics. As e-commerce and retail volumes continue to expand, the need for responsive and scalable transport solutions has cemented the importance of road networks in distribution logistics operations..

The warehousing segment is anticipated to contribute 47% to the Distribution Logistics market revenue in 2025, positioning it as the leading function within inventory management. The prominence of this segment has been reinforced by the increasing need for real-time inventory visibility, just-in-time stock replenishment, and centralized storage solutions.

Warehousing has become a strategic component of logistics operations, enabling businesses to maintain service levels, reduce transportation costs, and support omni-channel fulfillment models. The integration of warehouse management systems, robotics, and automation technologies has transformed traditional warehousing into intelligent storage hubs capable of handling high order volumes with precision.

Rising expectations for faster delivery and order accuracy have led to the development of regional and micro-fulfillment centers. As companies continue to optimize supply chains, warehousing has played a crucial role in ensuring operational continuity and customer satisfaction across global and regional markets..

Post-harvest and logistics upgrades have enhanced inventory efficiency and repositioned bambara beans as a fast-moving, responsive commodity. Simultaneously, health-driven positioning has boosted retail demand through functional food channels across Africa and Europe.

Post-harvest streamlining has become central to commercial viability for bambara bean producers and distributors. In Q1 2025, storage durations in Nigerian and Ghanaian hubs fell to 63 days, aided by regionally subsidized vacuum-sealed liners and solar-powered dryers. This shift has enabled wholesalers in East Africa to reduce idle stock levels by nearly 14 %, improving cash flow cycles. Supermarkets in Botswana now rotate bambara bean products 1.7 × faster than black-eyed peas, prompting relabeling and slotting fees to favor quick-turn SKUs. Importers in North Africa have aligned with these supply shifts, cutting standby port time by 19 %. The improved synchronization of farming, aggregation, and cross-border logistics is repositioning bambara beans as a responsive commodity in competitive legume markets.

New trials from Makerere University confirm that roasted bambara bean powder contributes to sustained energy release and improved satiety levels. This has fueled its adoption in meal-replacement categories across African and European specialty chains. In March 2025, a South African health foods retailer reported a 32 % YoY growth in sales of protein-fortified porridges incorporating bambara flour. Beverage startups in Nigeria have launched smoothie concentrates containing fermented bambara extracts, marketed for digestive support. UK-based e-commerce platforms now tag bambara-derived supplements as low-allergen and gut-friendly, with conversions up by 23 % since January 2025. Retailers are responding by bundling bambara-based SKUs with subscription health kits, expanding the bean’s footprint in functional food and wellness-oriented portfolios.

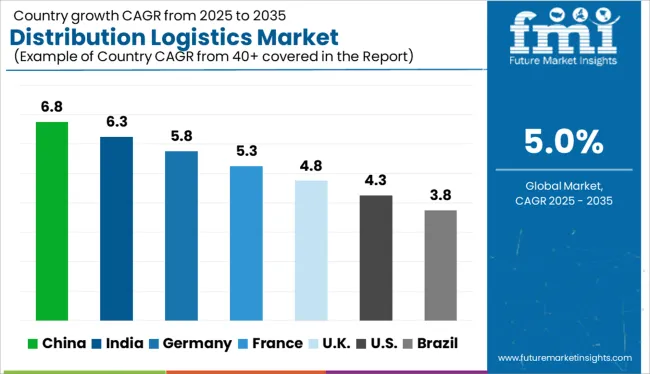

| Country | CAGR |

|---|---|

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| U.K. | 4.8% |

| U.S. | 4.3% |

| Brazil | 3.8% |

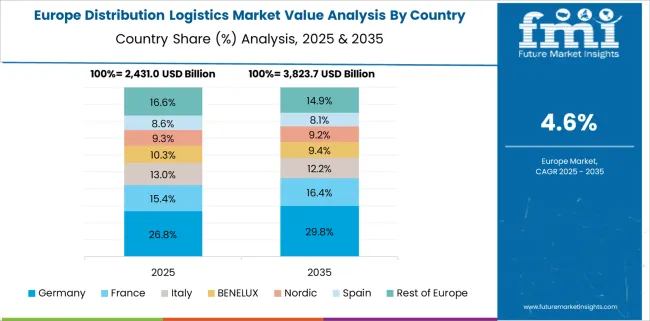

The global distribution logistics market is projected to expand at a CAGR of 5.0% from 2025 to 2035, supported by advancements in cold chain logistics, digital fleet management, and the proliferation of omnichannel retail. The sector is increasingly shaped by automation, last-mile optimization, and resilient supply chain networks. BRICS economies are outperforming the global average, with China growing at 6.8% and India at 6.3%. Rapid e-commerce penetration, infrastructure upgrades, and government-backed logistics corridors are driving this momentum. Both countries are also investing heavily in AI-enabled warehousing and multimodal freight integration. Among OECD economies, Germany leads with a 5.8% CAGR, leveraging its central position in European trade and robust logistics technology ecosystem. The UK (4.8%) and US (4.3%) show steady gains, with strong demand for temperature-sensitive and high-precision delivery systems across healthcare and high-tech industries. ASEAN countries, especially Vietnam and Thailand, are evolving as critical distribution nodes due to nearshoring trends and rising intraregional trade volumes

The CAGR for the UK distribution logistics market increased from 4.1% during 2020–2024 to 4.8% for 2025–2035. This rise reflects improvements in last-mile infrastructure and retailer-led demand for faster SKU rotation cycles. A key enabler was the UK’s expanded investment in regional warehousing and automation hubs, particularly in the Midlands and Southeast. Between 2022 and 2024, parcel delivery automation rose by 2.3×, enabling better inventory alignment with omnichannel demand. Additionally, Brexit-led customs optimization created leaner import cycles. Cold-chain distribution also expanded due to growth in pharma and food e-commerce. The rise in click-and-collect retail models pushed logistics providers to restructure delivery nodes, increasing efficiency while absorbing higher fulfillment volumes.

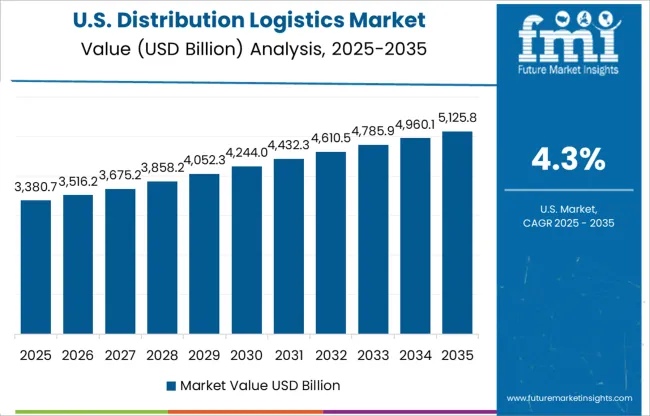

The U.S. market grew at a CAGR of 3.4% from 2020–2024 and is now expected to expand at 4.3% through 2025–2035. This acceleration is fueled by high-value sectors like pharmaceuticals, electronics, and e-commerce. Retailers pushed for deeper integration of real-time tracking and predictive analytics, reducing lead times by up to 21% since 2023. The shift to regionalized supply chains has also helped to localize fulfillment and ease interstate freight pressures. Investment in smart warehousing and cross-dock facilities in California, Texas, and Illinois has driven operational savings. Increased EV adoption for last-mile fleets has complemented carbon compliance while enhancing delivery frequency in suburban areas.

Germany’s distribution logistics CAGR improved from 4.9% during 2020–2024 to 5.8% for 2025–2035. This uptrend reflects stronger regional supply chain integration in Central Europe and the rise of Industrie 4.0 warehousing. Logistics firms have invested in collaborative robotics and adaptive picking systems, improving fulfillment rates by 19% between 2022 and 2024. The rapid expansion of urban consolidation centers around Frankfurt, Munich, and Berlin reduced urban freight delays. Regulatory shifts promoting intermodal transport use have also contributed to modal efficiency. Cross-border e-commerce, especially with Austria, Poland, and Czechia, increased demand for scalable logistics solutions with real-time inventory control.

China's CAGR for distribution logistics increased from 5.4% during 2020–2024 to 6.8% for 2025–2035, bolstered by large-scale smart logistics integration and regional digital freight corridors. Provinces like Zhejiang, Guangdong, and Shandong saw accelerated infrastructure investment, including IoT-embedded warehouse parks and cross-border e-commerce highways. Government-backed programs for digital logistics platforms reduced delivery errors by 29% and helped scale temperature-sensitive cargo. Growth in B2C and B2B e-commerce post-2024 drove demand for AI-enabled routing, predictive inventory management, and regional distribution automation. China's "dual circulation" strategy further enhanced domestic logistics flow efficiencies.

India's distribution logistics CAGR rose from 4.7% during 2020–2024 to 6.3% between 2025 and 2035. The surge is attributed to digital logistics parks in states like Maharashtra, Gujarat, and Tamil Nadu. GST streamlining and e-way bill compliance accelerated freight corridor deployment. Tier 2 and 3 cities became logistics hotspots due to rising e-commerce penetration, with delivery frequency increasing by 3.2× since 2023. Drone-assisted delivery pilots began in pharma and agri-input sectors in Telangana and Karnataka. Additionally, the government's PM Gati Shakti initiative drove multimodal integration, improving turnaround time across ports, rail, and road logistics.

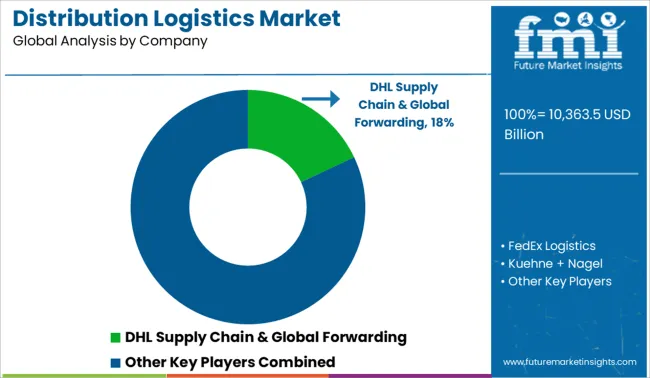

In the global distribution logistics market, major players are focusing on multimodal integration, warehouse automation, and last-mile efficiency to meet evolving fulfillment demands. DHL Supply Chain & Global Forwarding leads with scalable warehousing, cold-chain expertise, and AI-driven routing systems, especially across Europe and Asia-Pacific. FedEx Logistics offers cross-border compliance and time-sensitive freight solutions, targeting e-commerce and healthcare sectors. Kuehne + Nagel is expanding its sea-air intermodal offerings and digitized inventory platforms, supporting high-volume retail logistics. XPO Logistics emphasizes freight brokerage and dynamic route optimization across North America. DB Schenker is enhancing its green logistics fleet and regionalized hubs across EU member states for faster delivery cycles.

In June 2025, DHL Group announced an investment exceeding EUR 500 million in the Middle East, specifically targeting the Gulf markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 10363.5 Billion |

| Distribution Channel | E-commerce, Direct to consumer, Retail stores, and Wholesalers |

| Transportation Mode | Road transport, Rail transport, Air freight, and Sea freight |

| Inventory Management | Warehousing, Just-in-time inventory, Drop shipping, and Vendor-managed inventory |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DHL Supply Chain & Global Forwarding, FedEx Logistics, Kuehne + Nagel, XPO Logistics, and DB Schenker |

| Additional Attributes | Dollar sales, share by region, growth by mode (road, rail, air), tech adoption trends, last-mile demand shifts, competitor strategies, and warehousing expansions. |

The global distribution logistics market is estimated to be valued at USD 10,363.5 billion in 2025.

The market size for the distribution logistics market is projected to reach USD 16,881.0 billion by 2035.

The distribution logistics market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in distribution logistics market are e-commerce, direct to consumer, retail stores and wholesalers.

In terms of transportation mode, road transport segment to command 56.0% share in the distribution logistics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Distribution Board Market Forecast Outlook 2025 to 2035

Distribution Components Market Size and Share Forecast Outlook 2025 to 2035

Distribution Automation Market Size and Share Forecast Outlook 2025 to 2035

Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Distribution Lines And Poles Market Size and Share Forecast Outlook 2025 to 2035

Distribution Transformers Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Cable Distribution Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Unit (PDU) Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Automation Components Market Analysis by Component, End-Use and Region: Forecast for 2025 to 2035

Hadoop Distribution Market Insights - Trends & Forecast 2025 to 2035

Content Distribution Software Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Chemical Distribution Market Size and Share Forecast Outlook 2025 to 2035

Electric Distribution Utility Market Size and Share Forecast Outlook 2025 to 2035

Advanced Distribution Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Software Distribution Industry

Software Distribution Market Analysis by Deployment Type, by Organization Size and by Industry Vertical Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA