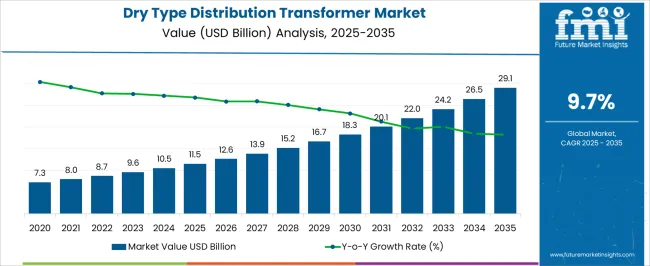

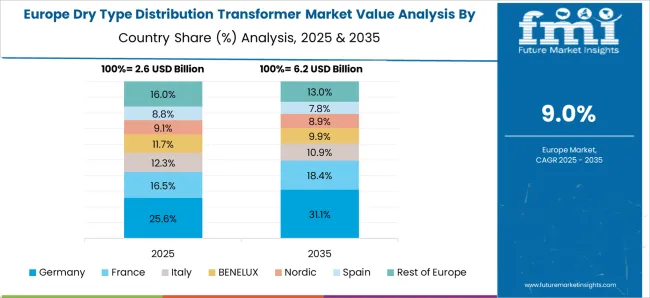

The dry type distribution transformer market is estimated at USD 11.5 billion in 2025 and is projected to reach USD 29.1 billion by 2035, registering a robust CAGR of 9.7%. The regional growth trajectory indicates a pronounced imbalance driven by varying levels of industrialization, infrastructure investment, and grid modernization efforts. Asia-Pacific emerges as the dominant region due to rapid expansion in industrial and commercial sectors, combined with aggressive electrification initiatives in countries such as China and India.

The increasing demand for reliable, low-maintenance, and safer distribution transformers in urban and semi-urban areas is contributing substantially to regional market growth. Europe demonstrates moderate growth owing to a well-established energy infrastructure and strong regulatory frameworks promoting energy efficiency and environmental compliance. The replacement and upgrade of aging transformers, alongside investment in smart grid technologies, support consistent market expansion, albeit at a slower pace compared to Asia-Pacific. North America exhibits stable growth driven by the modernization of aging grids, urban development, and the integration of renewable energy into distribution networks, though the incremental demand is lower relative to the scale observed in Asia-Pacific.

The comparative analysis highlights that Asia-Pacific will account for the majority of market value, with Europe and North America together forming a smaller, yet significant share. Market strategies targeting regional supply chains, local manufacturing, and technology localization are likely to further reinforce Asia-Pacific dominance while sustaining steady adoption in Western markets.

| Metric | Value |

|---|---|

| Dry Type Distribution Transformer Market Estimated Value in (2025 E) | USD 11.5 billion |

| Dry Type Distribution Transformer Market Forecast Value in (2035 F) | USD 29.1 billion |

| Forecast CAGR (2025 to 2035) | 9.7% |

The dry type distribution transformer market forms a specialized area within the global power distribution equipment industry, valued for its safety and operational reliability. Within the broader transformer segment, it accounts for about 5.6%, highlighting its adoption in medium voltage networks and sensitive installations. In the electrical insulation equipment sector, it represents 4.3%, driven by the absence of flammable liquids.

Across the smart grid infrastructure market, dry type transformers capture 3.9%, reflecting their role in modern grid upgrades. Within the renewable power integration equipment category, they hold nearly 3.1%, emphasizing compatibility with wind and solar projects. In the industrial and commercial building electrification space, this segment secures 4.7%, showcasing its relevance in urban infrastructure and data centers.

Recent developments in this market underscore technological progress and energy efficiency priorities. Cast resin transformer designs are increasingly deployed, offering improved moisture resistance and mechanical strength. Manufacturers are focusing on low-loss core materials to align with international efficiency standards. The integration of smart monitoring sensors into dry type transformers has gained momentum, allowing predictive maintenance and grid optimization.

Rising installations in underground and indoor substations are boosting demand due to fire safety advantages. Eco-friendly insulation systems using biodegradable resins are being explored as part of sustainability strategies. Moreover, digital twin technology is being adopted for design and performance optimization, reducing lifecycle costs.

The dry type distribution transformer market is witnessing steady adoption, supported by increasing investments in power distribution infrastructure, enhanced safety requirements, and the rising shift toward energy-efficient electrical equipment. The market has benefited from regulatory frameworks promoting eco-friendly and low-maintenance solutions, as dry type transformers eliminate the need for insulating oils and minimize environmental hazards.

Urbanization, rapid industrialization, and the expansion of commercial facilities have been driving consistent installation rates in both developed and emerging economies. Technological improvements in insulation materials, thermal performance, and compact designs have enhanced operational reliability, extending product lifecycles and reducing downtime for end-users.

In addition, grid modernization programs and renewable energy integration are creating new opportunities, particularly in regions with high electrification targets. The future outlook remains positive, with manufacturers expected to focus on product customization, fire safety compliance, and operational cost reduction, thereby reinforcing the market’s growth trajectory over the forecast period.

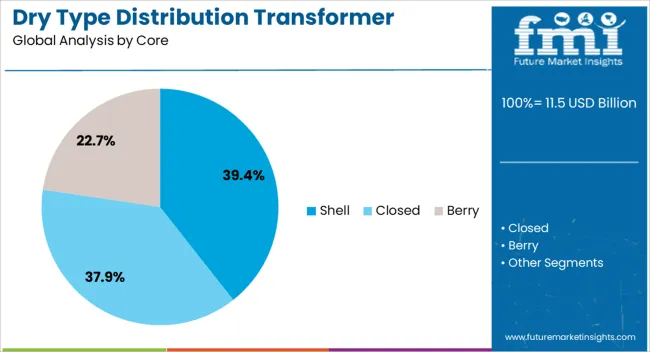

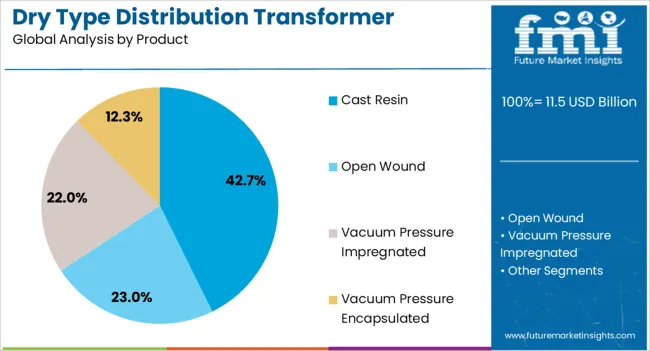

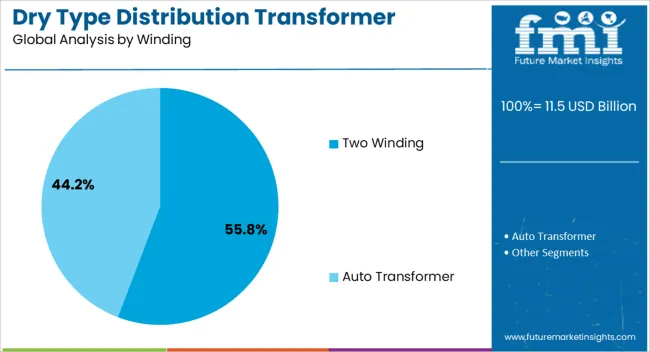

The dry type distribution transformer market is segmented by core, product, winding, rating, application, and geographic regions. By core, dry type distribution transformer market is divided into Shell, Closed, and Berry. In terms of product, dry type distribution transformer market is classified into Cast Resin, Open Wound, Vacuum Pressure Impregnated, and Vacuum Pressure Encapsulated. Based on winding, dry type distribution transformer market is segmented into Two Winding and Auto Transformer.

By rating, dry type distribution transformer market is segmented into ≤ 250 kVA, > 250 kVA to ≤ 1 MVA, and > 1 MVA. By application, dry type distribution transformer market is segmented into Commercial & Industrial, Residential, and Utility. Regionally, the dry type distribution transformer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The shell core segment, accounting for 39.40% of the core category, has maintained a strong position due to its superior mechanical strength, efficient cooling characteristics, and reduced leakage reactance. This configuration has been favored in installations requiring robust performance under high load fluctuations, ensuring reliable operation in industrial and utility applications.

Manufacturing advancements have allowed for better utilization of magnetic materials, improving energy efficiency while reducing heat losses. The segment has also benefited from enhanced design precision, which has improved short-circuit withstand capability and extended operational lifespan.

Demand stability is further reinforced by its suitability for high-voltage and specialized power distribution requirements. As infrastructure expansion continues and grid reliability becomes a priority, the shell core design is expected to retain its market relevance, supported by investments in advanced lamination and insulation technologies that improve operational safety and minimize maintenance costs.

The cast resin product segment, holding 42.70% of the product category, has emerged as the preferred choice for applications prioritizing fire safety, environmental sustainability, and low maintenance. Its encapsulated windings provide strong resistance to moisture, dust, and chemical contaminants, making it ideal for challenging operational environments.

Growth has been supported by stricter building safety codes and the demand for equipment capable of withstanding high humidity and temperature variations without performance degradation. Technological innovations in resin formulation have enhanced thermal conductivity and dielectric strength, enabling higher efficiency and longer service life.

The segment’s widespread adoption in commercial complexes, renewable energy projects, and underground substations has reinforced its market dominance. Over the forecast horizon, the cast resin design is expected to gain further traction through its compatibility with compact installations and its alignment with global trends toward sustainable and maintenance-free electrical infrastructure.

The two winding segment, representing 55.80% of the winding category, has maintained its leadership due to its cost-effectiveness, simplicity in design, and broad applicability in standard voltage transformation needs. Its configuration ensures electrical isolation between primary and secondary windings, enhancing operational safety while maintaining efficiency across diverse load conditions.

Manufacturing processes have been optimized to improve winding compactness and heat dissipation, contributing to reduced energy losses and extended service life. The segment’s dominance is also supported by its adaptability in both indoor and outdoor installations, covering industrial, commercial, and utility-scale requirements.

Procurement trends indicate a strong preference among utilities and contractors for its proven reliability and lower lifecycle costs compared to alternative winding designs. With increasing electrification and grid expansion initiatives, the two-winding design is expected to retain its market share, bolstered by ongoing improvements in conductor materials and insulation systems that further enhance performance and durability.

The market has witnessed substantial growth due to the increasing emphasis on safe, sustainable, and low-maintenance power distribution systems across commercial, industrial, and residential sectors. Unlike traditional oil-filled transformers, these units employ solid insulation and air cooling, significantly reducing fire hazards and environmental risks. Urban infrastructure development, rapid industrialization, and the expansion of renewable energy projects have collectively boosted demand for reliable and compact transformers. Technological advancements, integration with smart grid systems, and global electrification initiatives have further reinforced market expansion, making dry type transformers a critical component in modern power networks and green energy solutions.

Dry type distribution transformers are increasingly favored for their inherent safety and minimal environmental impact. Solid insulation eliminates fire risks associated with oil-based systems, making these transformers ideal for indoor, underground, and densely populated applications. By avoiding potential oil leaks, they also mitigate soil and water contamination risks, aligning with stringent environmental regulations in developed and emerging economies. This safety-centric approach has encouraged utilities, commercial facilities, and industrial complexes to adopt dry type transformers over traditional designs. Additionally, their reduced maintenance requirements and compatibility with fire safety standards make them attractive for urban and high-value installations where operational reliability is critical.

The rise of renewable energy installations has created significant opportunities for dry type distribution transformers. Solar farms, wind turbines, and hybrid microgrids require compact, robust, and low-maintenance transformers capable of handling fluctuating loads. Dry type units, with superior insulation and thermal performance, meet the demands of distributed generation systems while ensuring grid reliability. Their resistance to environmental stressors, such as moisture and temperature variations, allows installation in challenging outdoor conditions without extensive protection. As governments push for renewable energy adoption, transformer suppliers are investing in tailored solutions that integrate with smart grid monitoring systems, ensuring seamless operation and improved energy efficiency.

The growth of commercial complexes, data centers, hospitals, and industrial facilities has fueled demand for dry type distribution transformers. Their compact design allows installation in tight spaces without compromising safety, while solid insulation reduces maintenance and downtime. Industrial operations increasingly rely on reliable, uninterrupted power supply, with transformers required to support high-load machinery and sensitive equipment. In urban centers, indoor installation of dry type transformers avoids fire hazards and minimizes regulatory complications, making them highly suited for metropolitan development projects. Expansion of industrial parks, smart buildings, and electrified infrastructure has reinforced the adoption of these transformers in critical sectors.

Technological innovations and advanced materials have transformed the dry type distribution transformer market. The use of epoxy resins, nanocomposites, and high-grade winding materials has enhanced load capacity, thermal stability, and durability. Integration with smart monitoring and IoT-based predictive maintenance systems allows real-time performance tracking, reducing downtime and operational costs. These innovations have increased the adoption of dry type transformers in critical applications such as airports, hospitals, commercial hubs, and renewable energy plants. As energy infrastructure becomes increasingly digital and efficiency-driven, the combination of advanced materials and intelligent monitoring positions dry type transformers as an essential component in modern and sustainable power distribution networks.

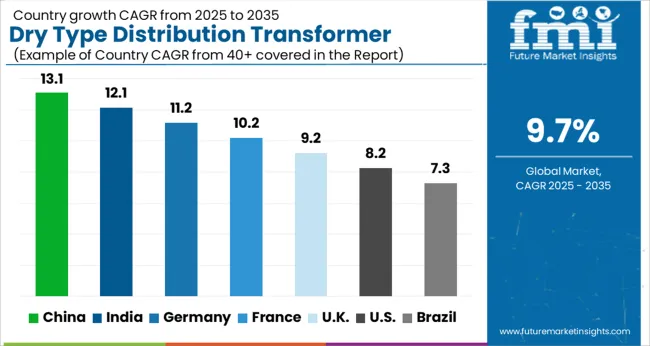

| Country | CAGR |

|---|---|

| China | 13.1% |

| India | 12.1% |

| Germany | 11.2% |

| France | 10.2% |

| UK | 9.2% |

| USA | 8.2% |

| Brazil | 7.3% |

The dry type distribution transformer market is forecast to grow strongly as energy-efficient and safe power distribution systems are adopted worldwide. China leads with 13.1%, supported by extensive grid modernization projects and expanding renewable energy integration. India records 12.1%, where rising electricity demand and government-backed infrastructure programs drive adoption.

Germany captures 11.2%, with emphasis on environmentally safe transformer technologies suited for urban and industrial applications. The United Kingdom achieves 9.2%, as utilities and industries increasingly prefer dry type systems for reliability and safety.

The United States secures 8.2%, influenced by replacement of aging grid infrastructure and technological advancements in medium-voltage solutions. Together, these leading countries highlight a significant transition toward efficient and low-maintenance transformer deployment. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to register a CAGR of 13.1%, driven by expanding electricity demand and large-scale investments in power distribution infrastructure. The push for smart grid modernization and renewable energy integration has created strong demand for dry type distribution transformers due to their safety, efficiency, and lower maintenance needs. Manufacturers are introducing advanced resin cast and vacuum pressure impregnated technologies to meet rising reliability standards. With ongoing industrialization and urban power expansion, adoption of dry type transformers is expected to grow across commercial, residential, and industrial applications.

India is forecast to grow at a CAGR of 12.1%, supported by increasing electricity consumption and grid modernization programs. Government-led rural electrification and industrial development initiatives are encouraging utilities to adopt dry type transformers, which are considered safer in densely populated and industrial areas. The rise of solar and wind projects across multiple states is further boosting demand, as dry type transformers are preferred for renewable integration. Domestic manufacturers are also scaling production to meet growing export demand from neighboring regions.

Germany is anticipated to grow at a CAGR of 11.2%, supported by energy transition policies and renewable power expansion. Dry type transformers are being widely deployed in wind farms, solar parks, and urban power distribution systems due to strict safety and efficiency standards. German engineering expertise is enabling development of innovative insulation materials that enhance reliability and extend service life. The focus on decentralized energy distribution and smart grid upgrades is also contributing to increased adoption. Premium product demand is reinforced by the country’s position as a hub for advanced electrical technologies.

The United Kingdom is projected to record a CAGR of 9.2%, driven by grid modernization programs and rising focus on safer power distribution in urban areas. Dry type transformers are increasingly used in underground substations, commercial complexes, and renewable projects due to their fire-resistant properties and compact design. Investment in offshore wind capacity is expected to further accelerate demand, with manufacturers introducing transformers optimized for challenging operating environments. Regulatory emphasis on efficiency and safety continues to support broader adoption.

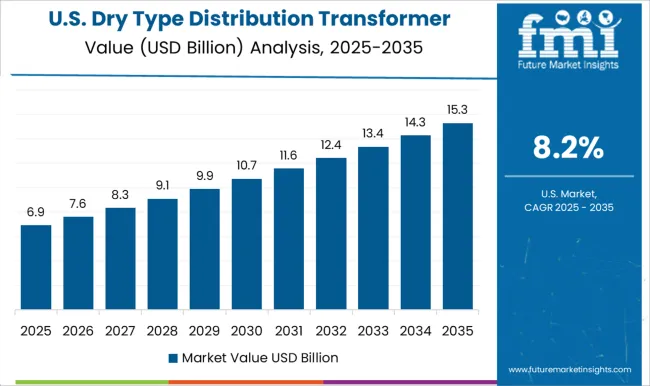

The United States is expected to grow at a CAGR of 8.2%, supported by investment in transmission and distribution infrastructure upgrades. Dry type transformers are gaining traction in commercial and industrial facilities where safety and low maintenance are critical. The growth of data centers, healthcare facilities, and renewable energy projects is expanding demand for compact and reliable solutions. Manufacturers are focusing on energy-efficient designs to meet Department of Energy standards while addressing growing sustainability concerns.

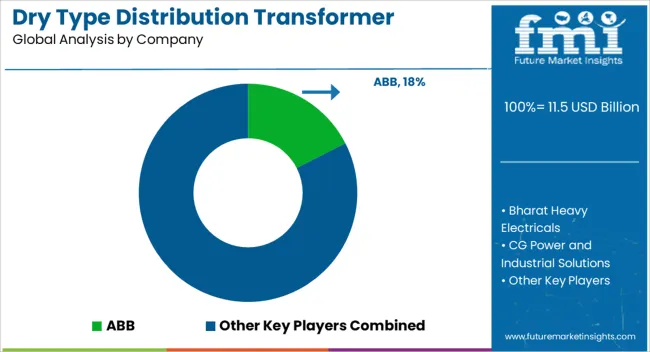

The market is supported by global and regional companies focusing on energy efficiency, safety, and reliability in power distribution. ABB leads with advanced dry type transformer solutions that meet international standards for industrial and utility applications. Bharat Heavy Electricals and CG Power and Industrial Solutions play a crucial role in the Indian market by delivering transformers suitable for high-demand infrastructure projects.

Eaton and Fuji Electric are recognized for compact and eco-friendly transformer technologies designed for both commercial and industrial installations. GE and Hitachi Energy are central to the market with innovative solutions that emphasize smart grid integration and sustainability. Instrument Transformer Equipment and Raychem RPG strengthen the sector by supplying transformers with specialized insulation systems.

Schneider Electric continues to expand its portfolio with energy-efficient transformers optimized for diverse environments. SGB SMIT and Siemens Energy provide large-scale dry type transformer solutions suitable for industrial and grid-level applications. TMC Transformers is noted for its European footprint and specialized designs tailored for renewable integration.Toshiba Energy Systems and Solutions develops highly reliable dry type transformers for both domestic and international markets. URJA Techniques enhances regional growth with customized solutions across commercial and industrial sectors, while WEG offers a global presence with robust transformer designs engineered for durability. Together, these companies drive innovation, efficiency, and resilience within the market.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.5 Billion |

| Core | Shell, Closed, and Berry |

| Product | Cast Resin, Open Wound, Vacuum Pressure Impregnated, and Vacuum Pressure Encapsulated |

| Winding | Two Winding and Auto Transformer |

| Rating | ≤ 250 kVA, > 250 kVA to ≤ 1 MVA, and > 1 MVA |

| Application | Commercial & Industrial, Residential, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Bharat Heavy Electricals, CG Power and Industrial Solutions, Eaton, Fuji Electric, GE, Hitachi Energy, Instrument Transformer Equipment, Raychem RPG, Schneider Electric, SGB SMIT, Siemens Energy, TMC Transformers, Toshiba Energy Systems and Solutions, URJA Techniques, and WEG |

| Additional Attributes | Dollar sales by transformer type and rating, demand dynamics across residential, commercial, and industrial sectors, regional trends in power distribution adoption, innovation in insulation, efficiency, and compact design, environmental impact of energy losses and material usage, and emerging use cases in renewable integration and smart grid infrastructure. |

The global dry type distribution transformer market is estimated to be valued at USD 11.5 billion in 2025.

The market size for the dry type distribution transformer market is projected to reach USD 29.1 billion by 2035.

The dry type distribution transformer market is expected to grow at a 9.7% CAGR between 2025 and 2035.

The key product types in dry type distribution transformer market are shell, closed and berry.

In terms of product, cast resin segment to command 42.7% share in the dry type distribution transformer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dry Powder Inhaler Market Size and Share Forecast Outlook 2025 to 2035

Dry Vacuum Pumps Market Size and Share Forecast Outlook 2025 to 2035

Dry Cleaning Solvents Market Size and Share Forecast Outlook 2025 to 2035

Dry Block Heaters Market Size and Share Forecast Outlook 2025 to 2035

Dry Fog Dust Suppression Equipment Market Size and Share Forecast Outlook 2025 to 2035

Dry Scalp Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dry Eye Syndrome Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dry Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Dry Herb Cannabis Vaporizers Market Size and Share Forecast Outlook 2025 to 2035

Dry Whole Milk Powder Market Size and Share Forecast Outlook 2025 to 2035

Dry Gas Coupling Market Analysis Size and Share Forecast Outlook 2025 to 2035

Dry Mixes Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Dryer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Dry Electrostatic Wipes Market Size and Share Forecast Outlook 2025 to 2035

Drylab Photo Printing Market Size and Share Forecast Outlook 2025 to 2035

Dry and Wet Wipes Market Size and Share Forecast Outlook 2025 to 2035

Dry Yeast Market Report - Size, Demand & Forecast 2025 to 2035

Dry Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Dry-Cleaning and Laundry Services Market Growth, Trends and Forecast from 2025 to 2035

Dry Washer Market Insights - Demand, Size & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA