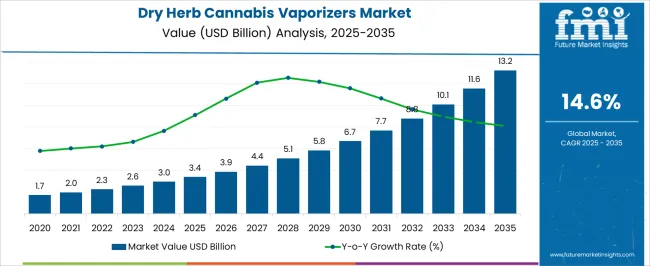

The Dry Herb Cannabis Vaporizers Market is estimated to be valued at USD 3.4 billion in 2025 and is projected to reach USD 13.2 billion by 2035, registering a compound annual growth rate (CAGR) of 14.6% over the forecast period. The absolute dollar opportunity for investors and decision-makers can be examined by tracking the incremental growth in market value year over year.

The market size increases by USD 0.5 billion from 2025 to 2026, reaching USD 3.9 billion. This growth accelerates consistently, with an increase of USD 1.1 billion between 2034 and 2035. Such consistent annual growth reflects strong adoption rates, product innovation, and increasing consumer acceptance of dry herb cannabis vaporizers. Between 2025 and 2030, the market grows from USD 3.4 billion to USD 6.7 billion, creating an incremental opportunity of USD 3.3 billion in the first half of the forecast period.

The second half of the decade sees even greater gains, with the market expanding from USD 6.7 billion in 2030 to USD 13.2 billion in 2035, contributing USD 6.5 billion to the total opportunity. This data-driven assessment reveals that the most significant value creation occurs in the latter years, highlighting long-term growth potential. Strategic investments targeting innovation and distribution in this phase could yield substantial returns.

| Metric | Value |

|---|---|

| Dry Herb Cannabis Vaporizers Market Estimated Value in (2025 E) | USD 3.4 billion |

| Dry Herb Cannabis Vaporizers Market Forecast Value in (2035 F) | USD 13.2 billion |

| Forecast CAGR (2025 to 2035) | 14.6% |

The dry herb cannabis vaporizers market is undergoing strong expansion due to shifting consumer preferences toward smoke-free cannabis consumption, increased legalization across regions, and rising demand for dosage-controlled, health-conscious delivery methods. Advances in portable vaporizer engineering, combined with user-friendly interfaces and rapid heating features, are contributing to product differentiation and adoption.

Regulatory emphasis on product safety and emissions control has pushed manufacturers toward closed-system innovations and standardized heating methods. As consumer education around terpene preservation and cannabinoid efficiency grows, demand for high-performance vaporizers tailored to dry herb formats is intensifying.

The integration of temperature precision, modular power options, and sustainable design materials continues to attract health-focused users and recreational consumers alike. Looking ahead, expansion into regulated retail dispensaries, product bundling with cannabis brands, and hybrid power technologies are expected to define the market’s future direction.

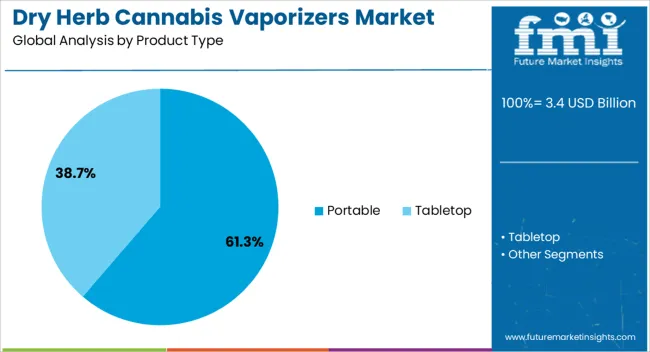

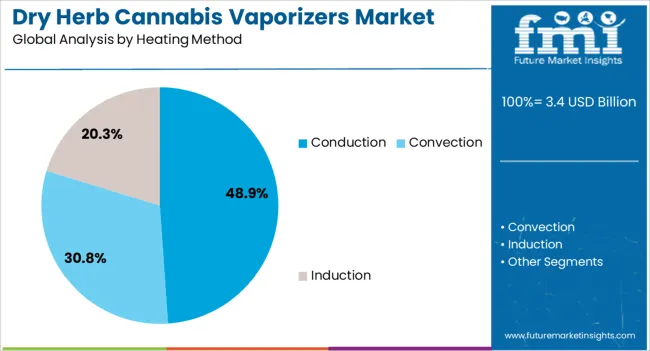

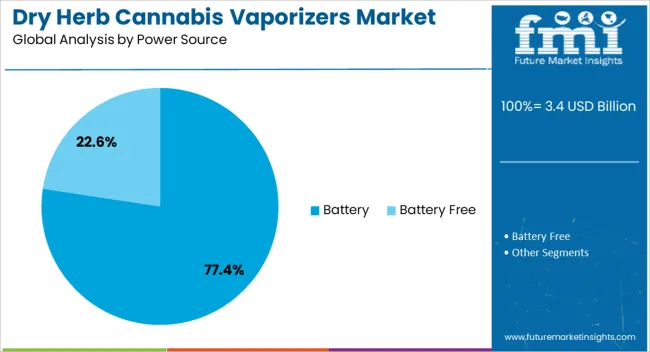

The dry herb cannabis vaporizers market is segmented by product type, heating method, power source, usage, price range, distribution channel, and geographic regions. By product type, the dry herb cannabis vaporizers market is divided into Portable and Tabletop. In terms of heating method, the dry herb cannabis vaporizers market is classified into Conduction, Convection, and Induction. Based on the power source, the dry herb cannabis vaporizers market is segmented into Battery and Battery-Free.

By usage of the dry herb cannabis vaporizers market is segmented into Medical Purpose and Recreational Purpose. The dry herb cannabis vaporizers market is segmented by price range into Medium, Low, and High. The distribution channel of the dry herb cannabis vaporizers market is segmented into Online and Offline. Regionally, the dry herb cannabis vaporizers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Portable vaporizers are projected to account for 61.30% of total revenue in the dry herb cannabis vaporizers market by 2025, making them the leading product type. Their popularity is being driven by user demand for mobility, discretion, and on-demand usage, especially in regions where cannabis is legalized for recreational or medicinal use.

These devices offer compact design, quick heating capabilities, and easy maintenance, aligning with consumer expectations around convenience and performance. Technological advancements such as USB-C fast charging, digital displays, and temperature-controlled chambers have improved functionality and vapor quality.

As younger consumers prioritize portability and aesthetics, manufacturers are investing in minimalist designs and pocket-friendly builds without compromising on performance, reinforcing this segment’s dominance.

Conduction heating methods are expected to hold 48.90% of the overall market share in 2025, leading the heating method category. This prominence stems from the simplicity and cost-efficiency of conduction systems, which allow dry herb material to be heated directly via contact with a hot surface.

The method enables fast heat-up times and lower manufacturing costs, which have made it favorable among entry-level and budget-conscious consumers. Device reliability and consistent vapor output have further supported adoption, especially in portable units.

Innovations in chamber design, including ceramic and hybrid conduction materials, have improved flavor retention and heat distribution. As the market expands into newer geographies and consumer segments, conductive-based devices are expected to retain their appeal due to affordability and straightforward operation.

Battery-powered vaporizers are projected to lead the power source segment with a 77.40% revenue share in 2025. This dominance is being driven by growing consumer demand for cordless, travel-friendly devices with consistent power output.

Advances in lithium-ion battery technology have enabled longer usage times, faster charging, and compact design integration, enhancing overall product usability. Battery-powered units provide higher temperature control, mobility, and compatibility with digital features, making them the preferred choice across premium and mid-tier product lines.

As sustainability becomes a purchasing factor, manufacturers are also introducing replaceable and rechargeable battery modules to extend product life cycles and minimize waste. The battery-powered segment continues to benefit from product innovation, ergonomic upgrades, and increasing support across online and dispensary retail channels.

The market has experienced notable growth, driven by increasing consumer preference for healthier consumption methods and the legalization of cannabis in multiple regions. These devices offer efficient and controlled heating of cannabis flowers without combustion, reducing harmful byproducts. Innovations in temperature control, battery life, and device portability have enhanced user experience and product appeal. The market has benefited from expanding retail distribution channels, including dispensaries and online platforms. The regulatory variations across countries and quality standardization challenges continue to shape market dynamics, influencing product development and consumer adoption rates.

Increasing awareness of the health risks associated with traditional smoking has driven consumers toward dry herb vaporizers, which allow inhalation without combustion. Vaporization preserves cannabinoids and terpenes while minimizing exposure to toxins found in smoke. This trend has been amplified by medical cannabis users seeking safer administration methods. Manufacturers have responded with devices featuring precise temperature controls to optimize cannabinoid release and flavor profiles. The rise in wellness culture and demand for natural consumption alternatives have supported vaporizer adoption. The convenience and discreet nature of portable vaporizers further encourage consumer transition from smoking to vaporization in both recreational and therapeutic markets.

Advancements in vaporizer design have focused on battery efficiency, heating element materials, and device ergonomics to enhance reliability and performance. Ceramic and quartz chambers provide even heating and preserve flavor, while convection and hybrid heating technologies improve vapor quality. Battery improvements extend usage time and enable rapid charging. Smart vaporizers with app integration allow users to customize temperature settings and monitor device status remotely. Compact and sleek designs cater to portability and discretion demands. These innovations have contributed to increased consumer satisfaction and brand loyalty, driving repeat purchases and expanding the market reach beyond traditional cannabis consumers.

The progressive legalization of cannabis for medical and recreational use in various countries and USA states has created a conducive environment for market growth. Regulatory frameworks that allow controlled sales and marketing have facilitated the establishment of retail and online distribution channels for vaporizers. Industry players have leveraged partnerships with licensed cannabis producers and retailers to expand product availability. Regions with favorable regulations have seen increased investment in marketing, product development, and consumer education. However, inconsistent regulatory policies and import/export restrictions in certain jurisdictions limit market penetration, requiring manufacturers to adapt compliance strategies and product certifications accordingly.

Despite growth, the market faces hurdles related to varying safety standards, quality control, and regulatory compliance across different regions. Product certification requirements for electrical safety, emissions, and materials can delay launches and increase costs. The absence of universal quality benchmarks leads to product variability and consumer trust issues. Counterfeit and low-quality devices present additional concerns, prompting stricter oversight and enforcement. Furthermore, advertising restrictions in some markets limit promotional activities, impacting brand visibility. Manufacturers are investing in research and quality assurance processes to meet diverse regulatory demands and build consumer confidence, which will be critical for sustainable market expansion.

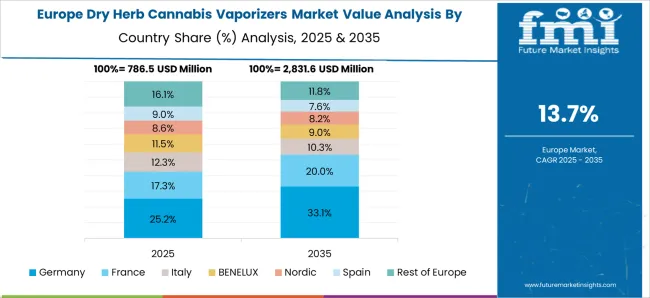

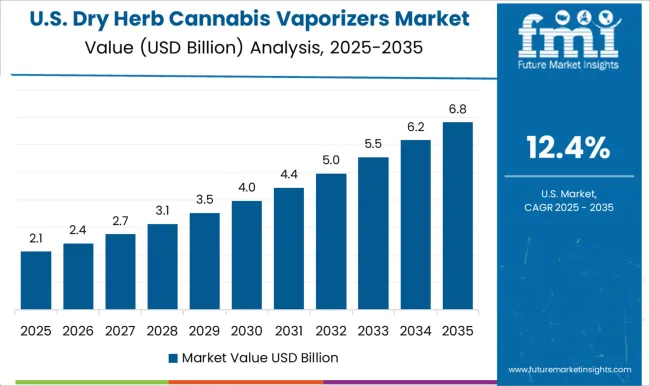

The dry herb cannabis vaporizers market is forecast to grow at a CAGR of 14.6% from 2025 to 2035, driven by increasing legalization, rising consumer preference for smokeless alternatives, and technological innovations in vaporizer devices. Germany, growing at 17.0%, benefits from robust regulatory frameworks and consumer interest in wellness products. The UK, with 14.0% growth, experiences demand from both medical and recreational users. The USA, expanding at 12.0%, remains a key market due to progressive legalization and product diversification. This report includes insights on 40+ countries; the top markets are shown here for reference.

Germany is forecasted to witness a CAGR of 17% in dry herb cannabis vaporizer sales between 2025 and 2035, driven by progressive medical cannabis legalization and growing consumer demand for alternative consumption methods. Local manufacturers are emphasizing quality and precision engineering, resulting in products with improved vapor purity and temperature stability. Collaborations with medical research institutions are fostering innovation focused on therapeutic applications. Retail expansion across health stores and specialty outlets supports accessibility for consumers.

The United Kingdom is expected to experience a CAGR of 14% in dry herb cannabis vaporizer demand from 2025 to 2035, supported by gradual shifts in policy and increasing consumer interest in herbal wellness products. Market players are introducing devices with user-friendly interfaces and smart connectivity features. Investments in supply chain improvements and compliance with evolving regulations are strengthening market confidence. Growth is concentrated in urban areas, with rising online sales complementing physical retail presence.

In the United States, the market is anticipated to grow at a CAGR of 12% during 2025 to 2035, driven by expanding legalization and consumer preference for non-combustion alternatives. Innovation in battery life, device portability, and vapor quality is intensifying competition among leading brands. The medical cannabis market significantly contributes to vaporizer demand. Retailers and dispensaries are broadening product offerings with focus on education and safety. Consumer demographics are diversifying, with younger adults and wellness-focused users leading growth.

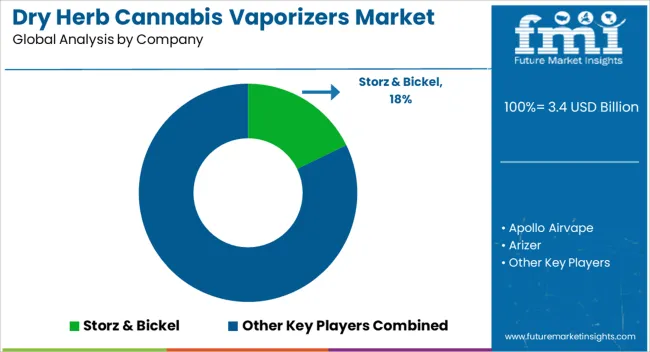

The market includes a variety of companies focusing on portable and desktop vaporizer devices designed for efficient and controlled consumption of cannabis herbs. Storz & Bickel remains a top player, renowned for its high-quality, precision temperature control devices such as the Volcano and Mighty models. Apollo Airvape and Arizer have gained market traction by offering compact, discreet vaporizers with rapid heat-up times and advanced battery life.

Boundless Technology and DaVinci Vaporizer emphasize innovation in airflow design and smart connectivity features to enhance user experience. DynaVap and Flowermate focus on affordability and durable, user-friendly models that appeal to entry-level consumers. Grenco Science and Healthy Rips target the premium segment with sleek aesthetics and multi-functional vaporizers supporting various herbal blends.

Brands like KandyPens and Ooze differentiate themselves through aggressive marketing strategies and wide product ranges catering to diverse user preferences. Pax Labs and Planet of the Vapes leverage design-centric approaches and extensive retail partnerships to expand their global presence.

Emerging companies such as Open Slang Worldwide and Topgreen Technology invest in research and development to improve vapor quality, battery efficiency, and device safety. The market is competitive with continuous product launches, firmware updates, and regulatory compliance initiatives shaping company strategies. Entry barriers include high R&D costs, strict quality and safety standards, brand loyalty, and the need for robust distribution networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.4 Billion |

| Product Type | Portable and Tabletop |

| Heating Method | Conduction, Convection, and Induction |

| Power Source | Battery and Battery Free |

| Usage | Medical Purpose and Recreational Purpose |

| Price Range | Medium, Low, and High |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, Japan, Brazil, South Africa |

| Key Companies Profiled | Storz & Bickel, Apollo Airvape, Arizer, Boundless Technology, DaVinci Vaporizer, DynaVap, Flowermate, Grenco Science, Healthy Rips, KandyPens, Ooze, Open Slang Worldwide, Pax Labs, Planet of the Vapes, and Topgreen Technology |

| Additional Attributes | Dollar sales by vaporizer type and user segment, demand dynamics across medical, recreational, and wellness applications, regional trends in legalization and consumer adoption across North America, Europe, and Asia-Pacific, innovation in temperature control technologies, battery efficiency, and portable design, environmental impact of battery disposal, device materials, and packaging waste, and emerging use cases in personalized dosing, integration with digital health platforms, and hybrid vaporizer-oil systems. |

The global dry herb cannabis vaporizers market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the dry herb cannabis vaporizers market is projected to reach USD 13.2 billion by 2035.

The dry herb cannabis vaporizers market is expected to grow at a 14.6% CAGR between 2025 and 2035.

The key product types in dry herb cannabis vaporizers market are portable and tabletop.

In terms of heating method, conduction segment to command 48.9% share in the dry herb cannabis vaporizers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Herb and Spice Market Size and Share Forecast Outlook 2025 to 2035

Dry-type Air-core Smoothing Reactor Market Size and Share Forecast Outlook 2025 to 2035

Herbal Beauty Product Market Size and Share Forecast Outlook 2025 to 2035

Dry Powder Inhaler Market Size and Share Forecast Outlook 2025 to 2035

Dry Vacuum Pumps Market Size and Share Forecast Outlook 2025 to 2035

Dry Cleaning Solvents Market Size and Share Forecast Outlook 2025 to 2035

Dry Block Heaters Market Size and Share Forecast Outlook 2025 to 2035

Dry Fog Dust Suppression Equipment Market Size and Share Forecast Outlook 2025 to 2035

Herb & Spice Extracts Market Size and Share Forecast Outlook 2025 to 2035

Dry Scalp Treatment Market Size and Share Forecast Outlook 2025 to 2035

Herbal Medicinal Products Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Eye Syndrome Treatment Market Size and Share Forecast Outlook 2025 to 2035

Cannabis Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Dry Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Herbal Personal Care Products Market Size and Share Forecast Outlook 2025 to 2035

Cannabis Beverages Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Transformer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA