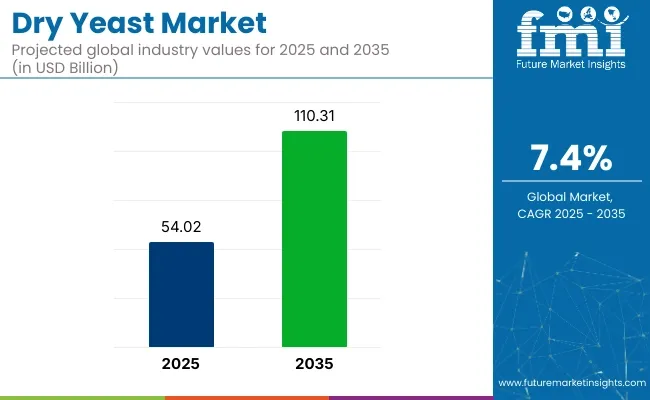

The dry yeast market is expected to post healthy growth, reaching roughly USD 110.3 billion by 2035 from about USD 54 billion in 2025, at a CAGR of 7.4%. Growth will be driven by rising demand for processed bakery items, convenient snack formats, and fermented beverages.

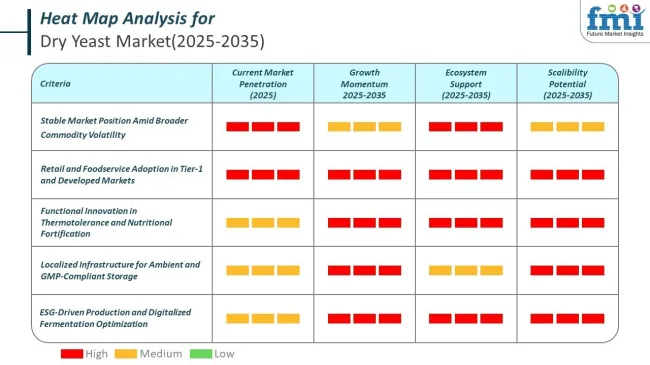

Robust leavening capabilities, long shelf life, and easy storage have positioned dry yeast as a preferred ingredient across foodservice and retail sectors. Momentum is being reinforced by clean-label reformulations and the introduction of non-GMO, organic, and gluten-free variants that cater to evolving dietary preferences.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 54 billion |

| Industry Value (2035F) | USD 110.3 billion |

| CAGR (2025 to 2035) | 7.4% |

The United States is projected to maintain the largest share of the dry yeast market through 2035, benefiting from sustained bread and beer consumption. China is likely to register the fastest absolute growth, supported by large-scale bakery expansion and a flourishing craft-brew scene. Europe’s demand is expected to be strengthened by clean-label trends and heightened interest in artisanal baked goods.

According to the Confederation of EU Yeast Producers (COFALEC) 2024 bulletin, investments in high-efficiency fermentation processes and non-GMO strains were stepped up across member countries, signaling regulatory and industry alignment toward safe, traceable yeast supply chains.

As global dietary habits continue to pivot toward convenience and wellness, steady advances in yeast technology, diversified application bases, and supportive regulatory frameworks are expected to underpin the dry yeast market’s robust outlook over the next decade.

It is anticipated that the dry yeast market will enter a phase of accelerated diversification, with precision-engineered strains being rolled out to improve fermentation efficiency in next-generation bakery, beverage, and bio-industrial lines. Product portfolios are expected to shift toward clean-label, non-GMO, and allergen-friendly variants that satisfy stricter regulatory thresholds and rising consumer scrutiny.

In Germany, average dry yeast consumption is estimated at 110 grams per person each year. The United States follows at approximately 64 grams, while Japan records about 40 grams and China around 20 grams per person annually. India, where most wheat products are unleavened, sees minimal dry yeast use at roughly 8 grams per person per year.

The global dry yeast trade is anchored by the European Union led by France, Belgium, the Netherlands, and Germany alongside China, Turkey, the United States, and Canada. The EU and China together account for most of the world’s export volumes, with Turkey and North America operating as secondary hubs.

Dry yeast’s two‑year shelf life and lack of cold‑chain requirements make it ideal for long‑distance, containerized transport, positioning it as the primary yeast form for international markets despite cost and competitive pressures.

The market is segmented based on product type, form, base, nature, and region. By product type, the market is divided into active dry yeast and inactive dry yeast. In terms of form, it is segmented into powder and flakes. Based on base, the market is categorized into fortified and unfortified variants.

By nature, the market includes organic and conventional dry yeast. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The unfortified segment is projected to lead the dry yeast market in 2025, accounting for a substantial 79.1% share. This segment’s strength lies in its appeal to consumers who seek natural, clean-label food ingredients without synthetic additives or enrichment. Unfortified dry yeast is highly favored in baking, brewing, and snack production, where purity and authenticity of ingredients are valued.

Its versatility allows it to integrate easily across a variety of culinary applications, from artisan bread to savory snacks, supporting demand from both food manufacturers and end consumers. The segment is also buoyed by the growing demand for vegan and vegetarian-friendly ingredients, as unfortified yeast is often free from allergens, gluten, and added nutrients.

Meanwhile, the fortified segment caters to niche health-conscious consumers seeking added vitamins, particularly B-complex, but is witnessing comparatively slower adoption in mainstream food production. This segment accounts for 20.9% share.

Leading companies are emphasizing unfortified offerings in their product lines, responding to rising demand for transparency and ingredient simplicity. As health trends and dietary awareness continue to influence purchase decisions, the unfortified segment is expected to maintain its stronghold in the dry yeast market from 2025 to 2035.

| Base | Share (2025) |

|---|---|

| Unfortified | 79.1% |

| Fortified | 20.9% |

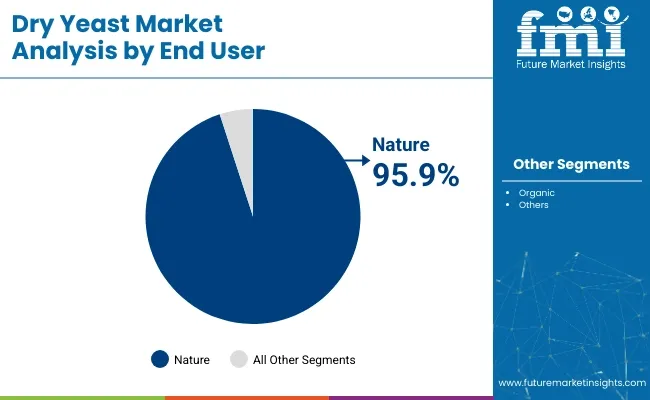

The conventional segment is expected to dominate the dry yeast market in 2025 with a projected market share of 95.9%. This share reflects continued consumer trust in traditionally processed food ingredients, particularly in bakery and brewing sectors where familiarity, consistency, and cost-effectiveness are key. Conventional dry yeast is produced without GMOs or synthetic additives, aligning with growing preferences for naturally derived, minimally processed food items.

It is widely adopted by commercial bakeries, packaged food brands, and household consumers due to its established performance and reliability in fermentation processes. Although organic yeast has seen growing interest, it remains limited by higher production costs, certification challenges, and narrower distribution channels. Consequently, organic dry yeast continues to serve a niche audience, mostly in premium health food markets and specialty product segments.

The organic segment occupies 4.1% market share. Market leaders such as Lallemand, Lesaffre, and Angel Yeast have a strong presence in the conventional segment, supporting its scale through robust global supply chains. As inflationary pressures influence cost-sensitive markets and consumers seek stable ingredient sources, the conventional segment is likely to maintain its dominance well during the forecast period.

| Nature | Share (2025) |

|---|---|

| Conventional | 95.9% |

| Organic | 4.1% |

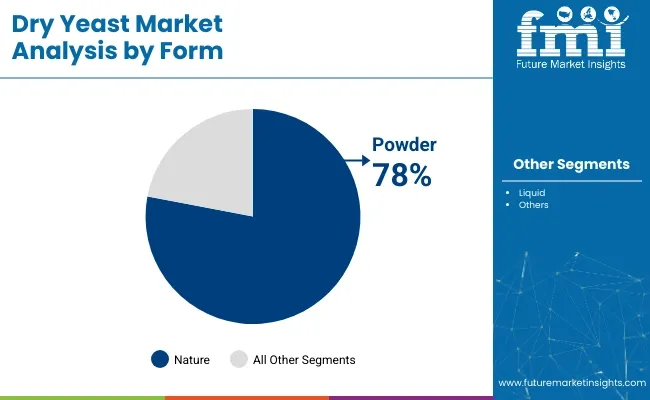

The powder segment of the dry yeast market is anticipated to grow at a CAGR of 5.2% from 2025 to 2035 and holds 78% share, emerging as a key driver of long-term market expansion. Powdered dry yeast is widely used in both commercial and domestic settings for its extended shelf life, easy storage, and efficient rehydration capabilities.

Its convenience and compatibility with automated baking processes make it highly preferred in the packaged food, snacks, and ready-mix bakery industries. As manufacturers aim to streamline operations and reduce waste, powdered yeast becomes an optimal choice for consistent leavening and fermentation across large production batches. The segment is further bolstered by increased demand for home baking, plant-based foods, and meat alternatives, where powdered yeast plays a vital role in flavor development and texture.

While flake-form yeast is gaining niche popularity for its use as a seasoning and nutritional enhancer, it remains more common in retail and health food channels. With expanding food processing industries in Asia Pacific, Latin America, and Eastern Europe, powdered yeast is expected to maintain steady global traction. Its affordability, ease of transport, and high yield per gram ensure sustained demand over the forecast period. Moreover, the liquid segment accounts for 22% share.

| Form | Share (2025) |

|---|---|

| Powder | 78% |

| Liquid | 22% |

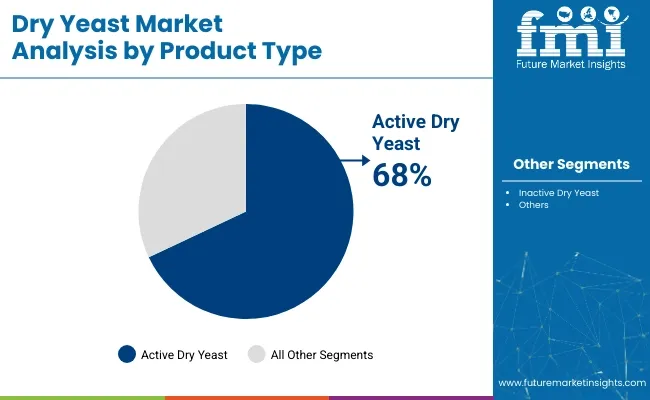

The active dry yeast segment is forecasted to grow at a CAGR of 5.6% from 2025 to 2035 and holds 68% share, fueled by consistent demand across the baking, brewing, and food service sectors. Active dry yeast is widely used due to its strong fermentation activity, ease of storage, and extended shelf life compared to fresh yeast.

It is particularly favored in commercial and home baking applications where reliable rising and dough conditioning are essential. The resurgence of artisanal baking, along with increased consumer interest in home cooking and traditional fermentation methods, is contributing to steady growth in this segment. Its granular format allows for simplified dosing and handling, making it a practical option for both industrial bakeries and small-scale users.

While inactive dry yeast is gaining attention as a nutritional supplement and seasoning due to its high vitamin B content and umami flavor, it remains niche compared to the broad application base of active dry yeast. It holds 32% market share. Manufacturers are also innovating within the active yeast category by offering instant and rapid-rise variants to enhance convenience. As food processing expands across emerging economies, active dry yeast will remain a staple input across a variety of baking and fermented food applications.

| Product Type | Share (2025) |

|---|---|

| Active Dry Yeast | 68% |

| Inactive Dry Yeast | 32% |

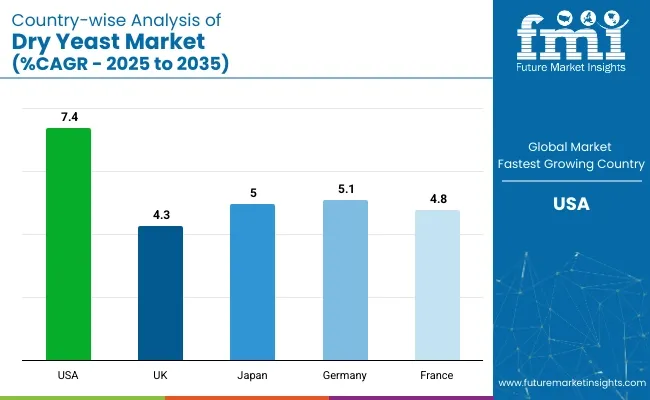

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| USA | 7.4% |

| UK | 4.3% |

| Japan | 5.0% |

| Germany | 5.1% |

| France | 4.8% |

The USA dry yeast market is estimated to grow at a 7.4% CAGR during the study period, driven by increasing demand for baked goods and convenient food products. Dry yeast is a vital ingredient in bread, pastries, and cakes, which are staples in the American diet. During the COVID-19 pandemic, home baking surged, significantly boosting retail yeast sales, a trend that has continued.

For example, busy households now prefer dry yeast for its long shelf life and ease of use. Additionally, the shift toward plant-based diets has increased the consumption of yeast-derived products like nutritional yeast, which is rich in B vitamins. These combined trends are encouraging manufacturers to expand production and innovate in dry yeast formulations.

The UK dry yeast market is estimated to grow at a 4.3% CAGR during the study period, supported by increased home baking and a rising preference for organic food products. The COVID-19 lockdowns sparked a revival in home cooking, especially bread-making, which significantly boosted yeast consumption. For example, supermarkets reported temporary shortages as demand soared.

This momentum has continued post-pandemic, with consumers seeking natural, high-quality baking ingredients. Dry yeast’s versatility and long shelf life make it a preferred product in UK households. Additionally, the growth of artisanal and gluten-free baking trends is prompting food companies to innovate yeast-based product lines that cater to evolving dietary preferences.

The Japanese dry yeast market is estimated to grow at a 5.0% CAGR during the study period, reflecting the rising demand for Western-style baked goods and savory seasonings derived from yeast. Japan’s affinity for culinary innovation and quality ingredients has led to broader uses of dry yeast, from traditional breads to Japanese-style baked goods and umami seasonings.

For example, yeast extract is a popular component in ramen broths and sauces. Health-conscious consumers are also turning to nutritional yeast as a plant-based source of B vitamins. Additionally, Japan’s aging population is fostering demand for easily digestible and nutrient-rich food, pushing dry yeast consumption both in the retail and foodservice sectors.

The German dry yeast market is estimated to grow at a 5.1% CAGR during the study period, largely influenced by its strong traditions in baking and brewing. Dry yeast is integral to both artisan bread-making and the beer industry, particularly under Germany’s Reinheitsgebot or Beer Purity Law. For example, traditional German sourdough and rye breads heavily rely on consistent yeast fermentation.

The growth of home baking and microbrewing has fueled retail demand for high-quality dry yeast. Additionally, Germany's health-conscious consumers are increasingly interested in clean-label and organic food ingredients, prompting the development of non-GMO and preservative-free dry yeast options in the market.

The French dry yeast market is estimated to grow at a 4.8% CAGR during the study period, thanks to its deep-rooted culture of baking and growing interest in organic and artisanal products. French households are known for their consumption of bread and viennoiseries, which rely heavily on quality yeast. For example, bakers across France continue to favor dry yeast for its reliability and shelf life.

The surge in home baking, especially during and after the pandemic, has further strengthened this trend. Moreover, the expanding demand for natural and sustainable food ingredients is encouraging innovation in yeast production, including gluten-free and fortified dry yeast formulations aimed at the health-conscious French consumer.

The global dry yeast industry is organised around a small circle of tier-1 producers, Lesaffre, AB Mauri, Angel Yeast, and Lallemand, supported by a wider group of tier-2 specialists such as Chr. Hansen, Pakmaya, Alltech, DSM-Firmenich, Kothari Yeast, and Guangxi Forise.

Production footprints have been expanded across Europe, North America, and China, while new capacity has been commissioned in Brazil, Vietnam, and Egypt to shorten logistics chains and hedge currency risk. Strategic focus has been placed on bio-innovation; suppliers have channelled R-and-D funds into non-GMO, organic, and gluten-free strains that deliver faster proofing and cleaner flavour profiles.

Cost leadership is being maintained through high-efficiency fermenters and energy-recovery loops, yet premiumization is being pursued in parallel via nutrient-enriched and probiotic-fortified formats that address health-centric demand.

Consolidation has been favoured over fragmentation. Cross-licensing agreements between yeast makers and enzyme developers have been signed so that combined starter cultures can be offered to industrial bakers seeking consistent dough rheology. Digital fermentation controls powered by AI are being piloted, allowing plants to reduce batch-to-batch variation and to cut waste water volumes. Collaboration with brewery groups has intensified; several global lager brands have locked in long-term supply contracts to secure instant dry yeast lines engineered for low-temperature fermentation.

Recent Industry News

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 54 billion |

| Projected Market Size (2035) | USD 110.3 billion |

| CAGR (2025 to 2035) | 7.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value |

| By Product Type | Active Dry Yeast and Inactive Dry Yeast |

| By Form | Powder and Flakes |

| By Base | Fortified and Unfortified |

| By Nature | Organic and Conventional |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa |

| Countries Covered | United States, United Kingdom, France, Germany, Japan |

| Key Players | Kerry Group, Bio Springer S.A, Koninklijke DSM N.V., Lallemand Inc, Sensient Technologies Corporation, Leiber GmbH, KOHJIN Life Science Co., Ltd, Angel Yeast Co., Ltd, Titan Biotech Ltd, Associated British Foods Plc |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The global dry yeast market is expected to reach USD 110.31 billion by 2035, growing from USD 54.02 billion in 2025, at a CAGR of 7.4% during the forecast period.

The active dry yeast segment is projected to grow at the fastest pace, registering a CAGR of 5.6% from 2025 to 2035, driven by its widespread use in baking, brewing, and home fermentation applications.

The powder form segment is anticipated to grow at a CAGR of 5.2% from 2025 to 2035, owing to its extended shelf life, easy handling, and strong demand from both industrial food processors and home bakers.

Major drivers include rising consumption of bakery and fermented foods, demand for clean-label and vegan ingredients, expansion of the brewing industry, and growing applications in animal feed, bioethanol, and dietary supplements.

Key players include Kerry Group, Bio Springer S.A, Koninklijke DSM N.V., Lallemand Inc, Angel Yeast Co., Ltd, and Associated British Foods Plc, all actively innovating with non-GMO, fortified, and functional yeast offerings.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Instant Dry Yeast Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Instant Dry Yeast Sector

Organic Dry Yeast Market

Australia Instant Dry Yeast Market Trends – Growth, Demand & Forecast 2025-2035

Dry-type Air-core Smoothing Reactor Market Size and Share Forecast Outlook 2025 to 2035

Dry Powder Inhaler Market Size and Share Forecast Outlook 2025 to 2035

Dry Vacuum Pumps Market Size and Share Forecast Outlook 2025 to 2035

Dry Cleaning Solvents Market Size and Share Forecast Outlook 2025 to 2035

Yeast Beta Glucan Market Size and Share Forecast Outlook 2025 to 2035

Dry Block Heaters Market Size and Share Forecast Outlook 2025 to 2035

Dry Fog Dust Suppression Equipment Market Size and Share Forecast Outlook 2025 to 2035

Dry Scalp Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

Yeast Based Aqua Protein Market Size and Share Forecast Outlook 2025 to 2035

Dry Eye Syndrome Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Yeast Market Outlook - Size, Demand & Forecast 2025 to 2035

Dry Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Yeast-based Spreads Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA