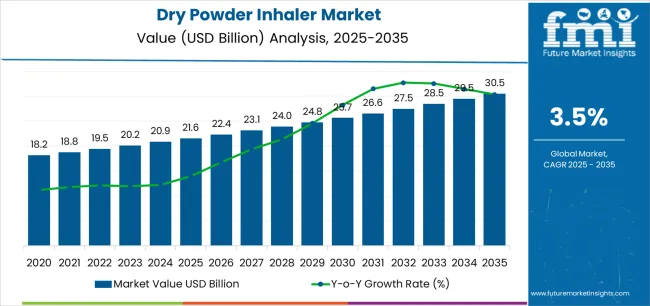

The Dry Powder Inhaler Market is estimated to be valued at USD 21.6 billion in 2025 and is projected to reach USD 30.5 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

The dry powder inhaler market is expanding steadily due to increasing prevalence of respiratory disorders, growing patient inclination toward self-administered drug delivery systems, and continuous technological advancements in inhalation devices. Current dynamics reflect rising awareness regarding effective disease management, supported by favorable healthcare policies and improved access to pulmonary care treatments. The market is being further driven by ongoing product innovations aimed at enhancing dosage accuracy, ease of use, and patient compliance.

Manufacturers are focusing on ergonomic device designs, efficient powder dispersion mechanisms, and optimized drug formulations to improve therapeutic outcomes. The future outlook remains positive as chronic respiratory diseases such as asthma and COPD continue to pose a global health burden.

Growing emphasis on home-based care, digital health integration, and device miniaturization is expected to reinforce long-term growth The overall market trajectory is supported by strong clinical acceptance, expanding distribution channels, and continuous alignment with regulatory and quality standards across developed and emerging economies.

| Metric | Value |

|---|---|

| Dry Powder Inhaler Market Estimated Value in (2025 E) | USD 21.6 billion |

| Dry Powder Inhaler Market Forecast Value in (2035 F) | USD 30.5 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

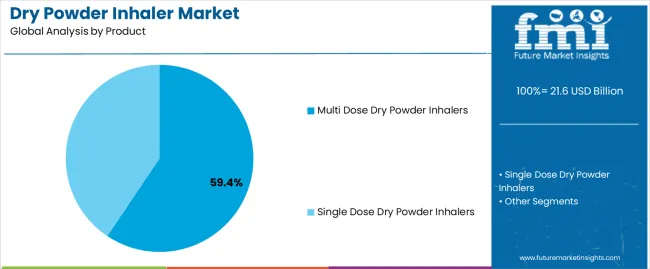

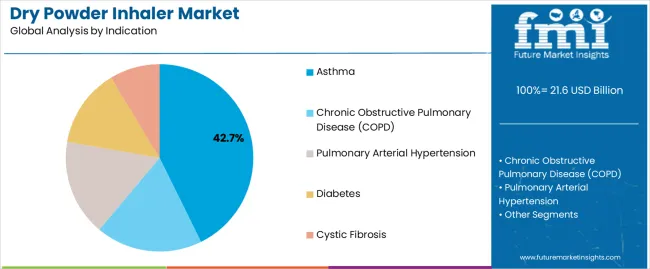

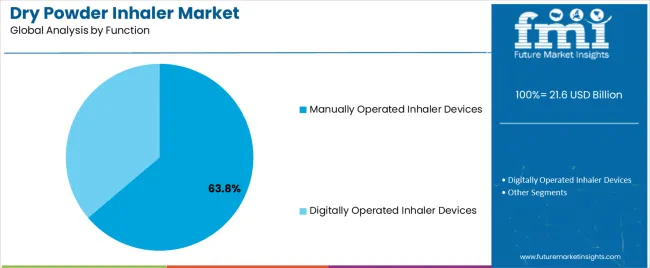

The market is segmented by Product, Indication, Function, and End User and region. By Product, the market is divided into Multi Dose Dry Powder Inhalers and Single Dose Dry Powder Inhalers. In terms of Indication, the market is classified into Asthma, Chronic Obstructive Pulmonary Disease (COPD), Pulmonary Arterial Hypertension, Diabetes, and Cystic Fibrosis. Based on Function, the market is segmented into Manually Operated Inhaler Devices and Digitally Operated Inhaler Devices. By End User, the market is divided into Retail Pharmacies, Institutional Sales, Hospital Pharmacies, Cancer Research, Office based Specialty Clinics, Retail Sales, Drug Stores, and Mail Order Pharmacies. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The multi dose dry powder inhalers segment, holding 59.40% of the product category, dominates the market owing to its superior convenience, cost-effectiveness, and capability to deliver multiple doses without frequent device replacement. Its popularity among healthcare professionals and patients has been reinforced by reduced medication wastage and improved dosing consistency.

The design allows for controlled powder dispersion and accurate dose measurement, ensuring higher therapeutic efficiency and patient adherence. Increased usage across chronic respiratory treatments and the integration of user-friendly features such as dose counters have further strengthened adoption.

The segment’s leadership is also supported by advancements in formulation stability, enabling extended shelf life and ease of transportation Future growth will be sustained by the expanding base of asthma and COPD patients, continued product innovation, and the transition toward smart inhaler systems enhancing monitoring and disease management capabilities.

The asthma segment, representing 42.70% of the indication category, has maintained dominance as the leading therapeutic area for dry powder inhalers. The segment’s strength stems from the growing incidence of asthma among both adult and pediatric populations, coupled with rising awareness regarding early diagnosis and treatment adherence.

The demand for dry powder inhalers in asthma management has been bolstered by their ability to provide consistent drug delivery and ease of use, reducing dependency on clinical administration. Pharmaceutical companies are investing in improved formulations and breath-actuated devices that enhance comfort and dosage precision for patients.

Increasing inclusion of inhalation therapies in treatment guidelines and the widespread availability of combination therapies are supporting sustained adoption The segment is expected to continue its upward trajectory, supported by technological refinements and increasing preference for preventive and maintenance therapies.

The manually operated inhaler devices segment, accounting for 63.80% of the function category, leads the market due to its simplicity, reliability, and cost-efficiency in drug administration. The segment has benefited from extensive patient familiarity and widespread clinical acceptance, as these devices require minimal training and deliver predictable performance.

Manufacturers have optimized design ergonomics and airflow mechanisms to ensure consistent powder dispersion and improved therapeutic outcomes. The affordability and mechanical dependability of manually operated inhalers have made them the preferred choice in both developed and emerging markets.

Ongoing product improvements, including the integration of dose-tracking indicators and compatibility with multiple drug formulations, are strengthening market stability The segment’s continued leadership is supported by its suitability for large-scale distribution, sustained patient trust, and adaptability to evolving clinical and regulatory requirements.

| Historical Value in 2020 | USD 16.96 billion |

|---|---|

| Historical Value in 2025 | USD 20.72 billion |

| Market Estimated Size in 2025 | USD 20.83 billion |

| Projected Market Value in 2035 | USD 29.95 billion |

From 2020 to 2025, the dry powder inhaler market witnessed notable growth trends, driven by rising respiratory disease prevalence and technological advancements. During this period, increased awareness of respiratory health and the introduction of innovative DPIs contributed to market expansion. Regulatory support and strategic collaborations also played pivotal roles in shaping the industry landscape.

Looking ahead from 2025 to 2035, industry forecast projections suggest sustained growth fueled by several factors. The aging population, coupled with a higher incidence of respiratory diseases, is expected to drive demand for DPIs.

Technological innovations, including smart inhalers and digital health solutions, will further enhance patient adherence and treatment outcomes. Regulatory frameworks are anticipated to become more streamlined, facilitating market access for new DPI products.

Challenges such as stringent regulatory requirements and intensifying competition may pose obstacles to market growth. Companies will need to invest in research and development to stay ahead in the competitive landscape. Ensuring affordability and accessibility of DPIs, especially in emerging markets, will be crucial for sustained growth.

In the dry powder inhaler market, India commands a notable share of 5.20%, reflecting its substantial demand for respiratory treatments. Following closely, Indonesia holds 4.7%, indicating a growing market presence. Spain and Canada contribute 2.90% and 3.1%, respectively, highlighting their significance in the global landscape.

France accounts for 2.40%, underscoring its steady foothold. These diverse market shares across regions showcase the evolving healthcare needs and market dynamics, emphasizing the importance of catering to varying patient populations and regulatory environments in the dry powder inhaler industry.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| India | 5.20% |

| Indonesia | 4.7% |

| Canada | 3.1% |

| Spain | 2.90% |

| France | 2.40% |

India emerges as a pivotal driver in the dry powder inhaler industry, exhibiting a projected CAGR of 5.20% until 2035. This growth trajectory is propelled by several factors. Its large population, coupled with increasing urbanization and industrialization, drives up pollution levels, leading to a higher incidence of respiratory ailments like asthma and Chronic Obstructive Pulmonary Disease (COPD). There is a growing demand for efficient inhalation therapies, including DPIs, to manage these conditions.

Its rapidly expanding healthcare infrastructure and rising healthcare expenditure facilitate improved access to advanced respiratory treatments across urban and rural areas. Government initiatives aimed at enhancing healthcare access and affordability further bolster market growth.

The presence of a robust pharmaceutical industry and a burgeoning market for generic medications in India foster innovation and competition in the DPI segment. With a focus on research and development, local and multinational companies are continually introducing new DPI products tailored to Indian market needs.

In the Indonesia dry powder inhaler industry, several emerging drivers are reshaping the landscape beyond conventional factors. Increasing urbanization and pollution levels contribute to a higher prevalence of respiratory diseases like asthma and COPD. As a result, there is a growing demand for effective inhalation therapies, spurring DPI market growth.

The rise of digital health solutions and telemedicine platforms presents new opportunities for patient education, remote monitoring, and personalized treatment plans. This integration of technology enhances patient engagement and adherence to DPI therapies. Regulatory reforms and government initiatives aimed at improving healthcare access and affordability play a crucial role.

Streamlined approval processes and reimbursement policies facilitate market entry for DPI products, encouraging innovation and competition among manufacturers.

Strategic collaborations between pharmaceutical companies and healthcare providers facilitate knowledge exchange, market penetration, and the development of tailored solutions for the Indonesian population. Increasing consumer awareness and advocacy for respiratory health drive demand for eco-friendly DPI devices and sustainable healthcare practices, influencing manufacturers’ product development and marketing strategies.

In the United States dry powder inhaler industry, numerous noteworthy trends are reshaping the landscape beyond traditional drivers. The emergence of advanced inhalation technologies, such as smart inhalers and connected devices, revolutionizes patient care and treatment monitoring. These innovations offer real time data insights and personalized feedback, enhancing medication adherence and improving patient outcomes.

There is a growing focus on product design and usability to cater to diverse patient populations, including children and the elderly. Manufacturers are investing in ergonomic and intuitive DPI designs, incorporating features like dose counters and easy to use mechanisms, to enhance user experience and compliance.

The integration of artificial intelligence and machine learning algorithms into DPI devices enables predictive analytics and personalized dosing recommendations. This data driven approach optimizes treatment efficacy and minimizes adverse effects, fostering patient confidence and trust in DPI therapies.

There is a shift towards patient centric healthcare delivery models, with emphasis on education and empowerment. Healthcare providers are increasingly engaging patients in shared decision making processes and self management strategies, empowering individuals to take control of their respiratory health through informed choices and lifestyle modifications.

In the Spain dry powder inhaler industry, novel trends are reshaping the landscape beyond conventional factors. There is a notable surge in personalized medicine approaches tailored to individual patient needs. With advancements in genetic testing and biomarker identification, DPI therapies are increasingly customized, optimizing treatment outcomes.

There is a growing emphasis on user centric design and patient experience in DPI devices. Manufacturers are innovating ergonomic designs, intuitive interfaces, and enhanced usability features to improve patient adherence and satisfaction with inhalation therapies.

There is a shift towards value based care models and outcomes driven healthcare. Healthcare providers and payers are increasingly prioritizing therapies that demonstrate clinical efficacy, patient satisfaction, and cost effectiveness, incentivizing the adoption of DPIs with proven benefits.

There is a rising focus on real world evidence and data driven insights to inform clinical decision making and healthcare policies. Through data analytics and real world studies, stakeholders gain valuable insights into DPI usage patterns, treatment effectiveness, and patient outcomes, driving continuous improvement and innovation in the industry.

In the France dry powder inhaler industry, novel trends are reshaping the landscape. An emerging trend involves the exploration of novel drug formulations and delivery mechanisms to enhance DPI efficacy and patient outcomes. This includes the development of combination therapies and targeted drug delivery systems tailored to specific respiratory conditions.

There is a growing emphasis on post market surveillance and pharmacovigilance to monitor DPI safety and efficacy, ensuring optimal patient care and regulatory compliance. There is a renewed focus on patient education and training programs to improve inhaler technique and adherence, empowering patients to better manage their respiratory health.

The adoption of sustainable manufacturing practices and eco friendly packaging solutions is gaining traction among DPI manufacturers, reflecting a broader commitment to environmental stewardship and corporate responsibility. The exploration of novel biomarkers and diagnostic tools for respiratory diseases is opening new avenues for early detection and personalized treatment strategies, driving innovation and improving patient outcomes in the France DPI market.

This section highlights the dominant segment of the market, with Chronic Obstructive Pulmonary Disease (COPD) held 57% market share in 2025. Multi dose dry powder inhalers held 39% market share of the market, experiencing profitable growth until 2035.

| Category | Market Share in 2025 |

|---|---|

| Chronic Obstructive Pulmonary Disease (COPD) | 57% |

| Multi dose | 39% |

Chronic Obstructive Pulmonary Disease (COPD) contributed significantly to the global dry powder inhaler market revenue in 2025, accounting for 39%. This substantial share reflects the high prevalence of COPD worldwide and the reliance on inhalation therapies for its management. With COPD being a leading cause of morbidity and mortality, the demand for effective respiratory treatments, including dry powder inhalers, remains robust.

As healthcare systems prioritize COPD management and patients seek convenient and efficient inhalation solutions, the COPD segment emerges as a major revenue driver, shaping the landscape of the global dry powder inhaler market in 2025.

Multi dose dry powder inhalers (MDPIs) anticipate substantial growth, capturing a commanding 57% market share in 2025. This surge is propelled by MDPIs user friendly design, offering multiple doses in a single device, enhancing patient adherence and convenience. With MDPIs catering to diverse patient needs across respiratory conditions like asthma and COPD, their versatility fuels demand.

MDPIs boast longer shelf life and reduced wastage, rendering them cost effective for both patients and healthcare systems. This dominance underscores MDPIs pivotal role in shaping the dry powder inhaler market landscape, reflecting their efficacy and resonance with patients and healthcare providers alike.

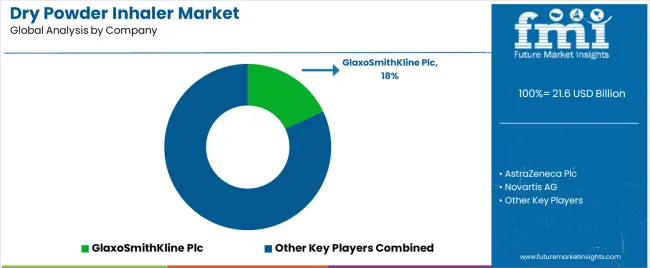

The dry powder inhaler industry is characterized by intense competition driven by key players striving to innovate and capture market share. Established pharmaceutical giants and emerging biotech firms vie for prominence by investing in research and development, enhancing device usability, and expanding therapeutic applications.

Regulatory compliance, technological advancements, and strategic alliances play pivotal roles in shaping the competitive landscape. With a focus on sustainability and patient centric solutions, companies seek to differentiate themselves in this dynamic arena. As demand for respiratory medications grows, competition intensifies, fostering a climate of innovation and driving the evolution of DPI technology.

Product Portfolio

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 21.6 billion |

| Projected Industry Valuation in 2035 | USD 30.5 billion |

| Value-based CAGR 2025 to 2035 | 3.5% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Industry Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Industry Segments Covered | Product, Indication, Function, End User, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | GlaxoSmithKline Plc; AstraZeneca Plc; Novartis AG; Teva Pharmaceutical Industries Limited; Boehringer Ingelheim GmbH; Cipla Limited; Chiesi Farmaceutici S.p.A.; Elpen S.A.; Vectura Group Plc; Beximco Pharmaceuticals Ltd.; Hovione; AptarGroup, Inc.; Iconovo AB (Stevanato Group); Sava Healthcare Ltd.; MannKind Corporation; Mylan N.V; Pharmaxis |

The global dry powder inhaler market is estimated to be valued at USD 21.6 billion in 2025.

The market size for the dry powder inhaler market is projected to reach USD 30.5 billion by 2035.

The dry powder inhaler market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in dry powder inhaler market are multi dose dry powder inhalers and single dose dry powder inhalers.

In terms of indication, asthma segment to command 42.7% share in the dry powder inhaler market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dry Vacuum Pumps Market Size and Share Forecast Outlook 2025 to 2035

Dry Cleaning Solvents Market Size and Share Forecast Outlook 2025 to 2035

Dry Block Heaters Market Size and Share Forecast Outlook 2025 to 2035

Dry Fog Dust Suppression Equipment Market Size and Share Forecast Outlook 2025 to 2035

Dry Scalp Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Eye Syndrome Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Dry Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Dry Herb Cannabis Vaporizers Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Gas Coupling Market Analysis Size and Share Forecast Outlook 2025 to 2035

Dry Mixes Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Dryer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Dry Electrostatic Wipes Market Size and Share Forecast Outlook 2025 to 2035

Drylab Photo Printing Market Size and Share Forecast Outlook 2025 to 2035

Dry and Wet Wipes Market Size and Share Forecast Outlook 2025 to 2035

Dry Yeast Market Report - Size, Demand & Forecast 2025 to 2035

Dry Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA