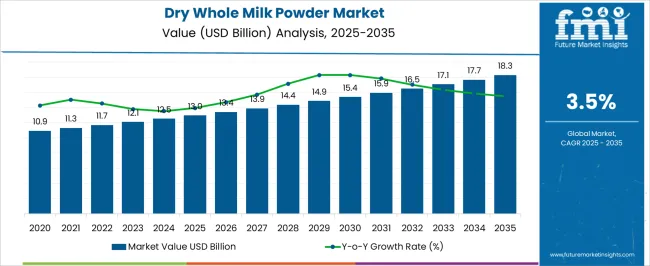

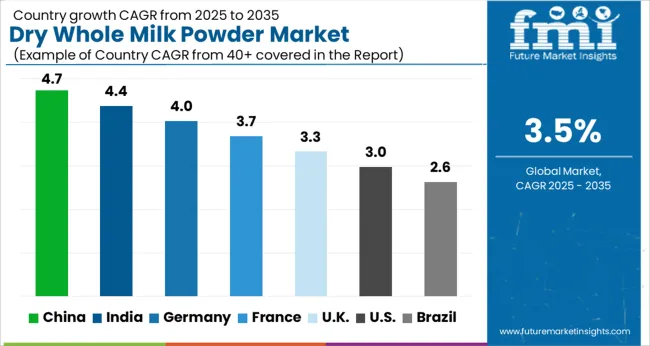

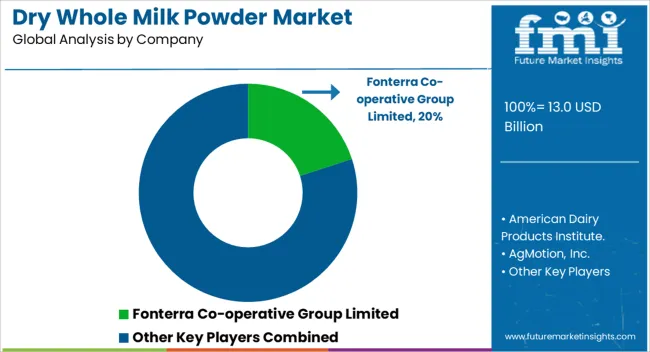

The Dry Whole Milk Powder Market is estimated to be valued at USD 13.0 billion in 2025 and is projected to reach USD 18.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

| Metric | Value |

|---|---|

| Dry Whole Milk Powder Market Estimated Value in (2025 E) | USD 13.0 billion |

| Dry Whole Milk Powder Market Forecast Value in (2035 F) | USD 18.3 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

The Dry Whole Milk Powder market is showing consistent growth due to increasing global demand for shelf-stable dairy ingredients used in both food and beverage manufacturing. Strong consumption trends in infant nutrition, bakery, confectionery, and dairy-based products are contributing to the market’s expansion. The demand is being further supported by global supply chain shifts, improvements in milk preservation technologies, and the rising preference for dairy ingredients in emerging markets.

Statements from dairy cooperatives and food manufacturing firms have pointed to higher output and trade volumes of whole milk powder, particularly in regions with robust export capabilities. Technological innovations in drying and packaging processes are helping improve product stability and solubility, which has increased acceptance across food service and industrial sectors.

The future outlook remains positive as growing urbanization, rising disposable incomes, and a shift toward convenient nutrition formats continue to shape global consumption habits The market is also benefitting from consistent investments in dairy infrastructure, especially in regions with strong agricultural productivity.

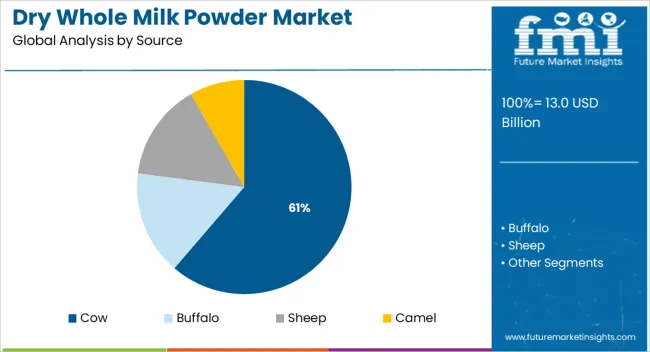

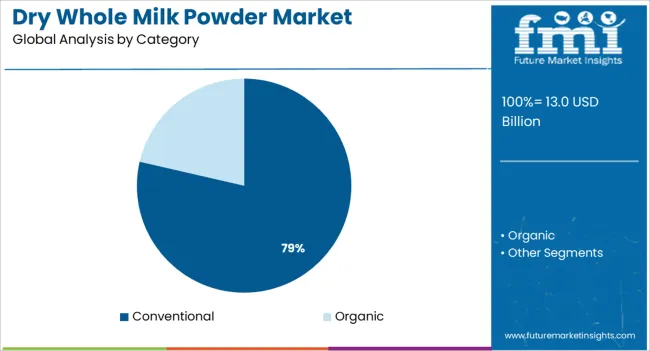

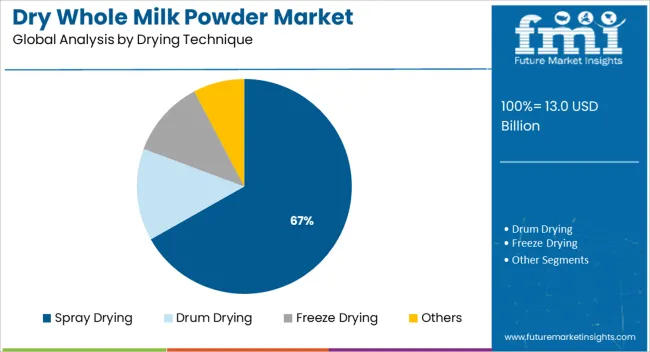

The market is segmented by Source, Category, Drying Technique, and Application and region. By Source, the market is divided into Cow, Buffalo, Sheep, and Camel. In terms of Category, the market is classified into Conventional and Organic. Based on Drying Technique, the market is segmented into Spray Drying, Drum Drying, Freeze Drying, and Others. By Application, the market is divided into Infant Nutrition, Dairy Products, Confectionary, Bakery Items, Ready to Eat, Nutritional Foods, Protein Supplements, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cow source segment is projected to account for 61.3% of the Dry Whole Milk Powder market revenue share in 2025, making it the leading source segment. This dominance is being driven by the widespread availability of cow milk and its global acceptance in both food processing and direct consumption.

Food industry sources and dairy processors have indicated that cow milk offers a balanced nutritional profile, which makes it suitable for use across various product applications such as infant formula, confectionery, and ready-to-mix beverages. The segment's growth is also being influenced by established dairy farming infrastructure and consistent supply chains in key producing regions.

Additionally, regulatory bodies have provided favorable guidelines supporting the processing of cow milk into powder form, helping manufacturers achieve product consistency and quality standards The reliability of cow milk as a raw material for powder production, combined with its nutritional familiarity among consumers, continues to support its leading role in the global market.

The conventional category is expected to contribute 78.6% of the Dry Whole Milk Powder market revenue share in 2025, maintaining its position as the dominant product category. This share is being supported by its cost-effectiveness, well-established production methods, and broad acceptance in commercial and industrial applications. Conventional production offers scalability and efficiency, making it the preferred choice for large-scale food processors, as reported in corporate communications and trade publications.

The lower production costs associated with conventional methods enable competitive pricing, which is crucial for price-sensitive markets. Additionally, a steady and consistent supply of raw milk inputs without the regulatory complexities associated with organic certification has favored the continued use of conventional milk powder.

The segment has also benefitted from strong export volumes and international trade agreements, particularly from countries with surplus dairy output These factors together have reinforced the segment’s leadership and global market share.

The spray drying technique is forecasted to hold 66.8% of the Dry Whole Milk Powder market revenue share in 2025, positioning it as the leading drying method. This growth is being attributed to the technique's efficiency in preserving nutritional content while ensuring powder uniformity and solubility.

Industry sources and food engineering publications have outlined that spray drying allows for better control of moisture content, resulting in a more stable product with an extended shelf life. The method is widely adopted by dairy processing facilities due to its adaptability for continuous operation and its ability to produce fine, free-flowing powder suitable for large-scale food manufacturing.

The energy efficiency and automation potential of spray drying systems have also been highlighted in equipment manufacturers’ updates, making it the preferred choice for high-capacity production These operational and quality-related advantages have firmly established spray drying as the dominant technique in the production of dry whole milk powder.

In addition to ice cream, cultured milk, yogurt, chocolate, confectionery, bakery products, soups, and sauces, milk powder is an ingredient in numerous food products. The demand for dry whole milk powders grew steadily over the past years in the food sector.

Dried whole milk powder can be used in a variety of products, including dairy items, confectionery items, infant formula, nutrient supplements, and as a saturating agent in biotechnology. Furthermore, whole dry milk offers a richer, creamier taste and contains more nutrients than its alternatives, including skimmed milk. However, consumers with lactose intolerance prefer to buy skimmed milk for its low-fat content.

Short Term (2025 to 2025): Following the outbreak of the pandemic, consumers began stockpiling food products, which increased the demand for shelf-stable foods. Having a longer shelf life than liquid milk, consumers started buying milk powder instead of liquid milk. To capitalize on this trend, manufacturers introduced highly enriched milk powder.

Medium Term (2025 to 2035): A variety of factors such as the increasing use of powdered milk in baby foods and the presence of vitamins C, B12, thiamine, and high amounts of protein contribute to the growth of the milk market worldwide.

Long Term (2035 to 2035): In comparison to other whey products, powdered whole milk is most commonly used by food manufacturers. If other developing countries follow suit, the market for milk powder will grow dramatically during the outlook period. Whole milk powder is primarily consumed by food manufacturers in the United States. Using whole milk powder in an environmentally-friendly manner has become a priority for food manufacturers and scientists in recent years.

| Historical CAGR | 4.80% |

|---|---|

| Historical Market Value (2025) | USD 11.8 Billion |

| Forecast CAGR | 3.50% |

Rising Demand for Nutritional Food Products

The overall demand for baby or infant formula has increased following the rise in breast cancer incidences and women's increasing involvement in household responsibilities. According to a report published by LA Leche League International in 2024, approximately 41% of babies worldwide are exclusively breastfed for six months, and only 45% continue to do so for up to two years.

In addition, there are large differences in breastfeeding rates across regions. This illustrates the difficulties of breastfeeding globally, which leads to high demand for infant or baby formula. Furthermore, WHO estimates that nearly 12.5 million women across the globe will suffer from breast cancer by 2024, killing 685,000 of them.

Furthermore, malnutrition among children and nutrient deficiencies are also pushing the demand for dietary supplements. A report reported that nearly 35 percent of Indian children are stunted by the age of five. Even so, dry whole milk has become an integral part of food aid supplies distributed by the United Nations in war-torn or impoverished regions of the African continent.

With Rapid Urbanization, Growing Tea Consumption, and Soaring Disposable Income Levels, Market Demand is Expected to Soar

The lifestyle of urban dwellers is dynamic and eventful. Therefore, dry whole milk is a staple in consumers' lives due to its long shelf life. There is approximately 59 percent of the world's population (4.46 billion) lives in urban areas, but this number is expected to increase to 68 percent (6.68 billion) by the year 2024.

Furthermore, the market has been supported by a rise in tea consumption in both developed and developing countries. US tea consumption reached 12.5 billion gallons in 2024, according to the Tea Association of the USA.

Meanwhile, Turkish tea consumption per capita reached 3.16 kg. In addition, the growing disposable incomes of consumers in developed, as well as developing countries, have encouraged the growth of this market.

Reduction in Storage and Transportation Costs

In addition to being an inexpensive source of dairy products, whole milk powder is an easily reconstituted solid form of the liquid milk that is easily reconstituted. The cost of storing and transporting liquid milk can be reduced by using whole milk powder instead of liquid milk.

As a result of the reduction of storage space and the uncooled shipping and storage of undiluted milk powder, cost savings are achieved.

The number of vegans is increasing slowly as animal welfare organizations increase their efforts to promote animal cruelty awareness. In 2024 alone, the Vegan Society registered 16,439 products with The Vegan Trademark, according to statistics published by a charity firm, the Vegan Society.

Moreover, the Vegan Trademark is present in 87 countries around the world, with more than 50% of products registered coming from companies based outside of the UK.

Depending on the source, the market can be segmented into cow, buffalo, sheep, and camel milk, with cow milk holding the largest share in 2025. This growth is due to its cost-effective and nutrient-rich nature.

Consumption of cow milk is beneficial in inhibiting bacterial growth, reducing high blood pressure, and augmenting bone development because of its iodine, vitamin B12, whey, and casein content. Cow milk has become a primary ingredient for confectionery manufacturers globally.

In India, it is used for many desserts, including Gulab Jamun and Chum Chum (the most popular sweets or desserts). It is also used in several nut butter recipes to absorb the oil, but over the forecast period, cow and camel milk is expected to grow at the fastest rate with a CAGR of 4.2%.

Due to its calcium, iron, and potassium-rich nature camel milk plays a significant role in promoting body growth. This growth is owing to rising incidences of stunting caused by malnutrition.

The global dry whole milk powder market in terms of product type is segmented into regular, instant, UHT, caramelized, and organic. Among all, the instant segment holds dominance with the segment expected to represent 29.4% of the market by the end of 2025.

The instant dry whole milk powder segment is expected to expand at an attractive 4.7% CAGR in the forecast period. This will enable the segment to become worth USD 13 Million by the end of 2025.

| Segment | Product Type |

|---|---|

| Attributes | Instant |

| Details (CAGR) | 4.70% |

| Market Share | 29.40% |

| Market Value | USD 13 Million |

Depending on the distribution channel, the market can be further segmented into offline and online segments. The offline segment held the largest share in 2025.

Convenience and modern lifestyles are responsible for the growth, along with an increase in supermarkets/hypermarkets throughout the world, particularly in developing countries. Convenient and comfortable shopping that saves consumers time, sweeping urbanization, migration from rural areas to urban areas in search of better lifestyles, and an increase in demand due to the growth of the population.

However, the online segment is expected to grow at the fastest rate with a CAGR of 3.5% over the forecast period. The proliferating dominance of online shopping platforms is responsible for this growth, as they provide a variety of advantages, including tranquility and economics.

Further factors aiding demand include an increase in smartphone users, a rise in tech-savvy people, and the growing trend of work-at-home jobs.

The Asia Pacific region is currently the most attractive market for dry whole milk powder and is poised to dominate the overall market. The rising purchasing power of emerging economies in the Asia Pacific is contributing to the growth of this region's economy.

By the end of 2025, the Asia Pacific dry whole milk powder market is expected to reach USD 9121.74 Million at a 5.4% CAGR. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 2.1% and 3.7% respectively.

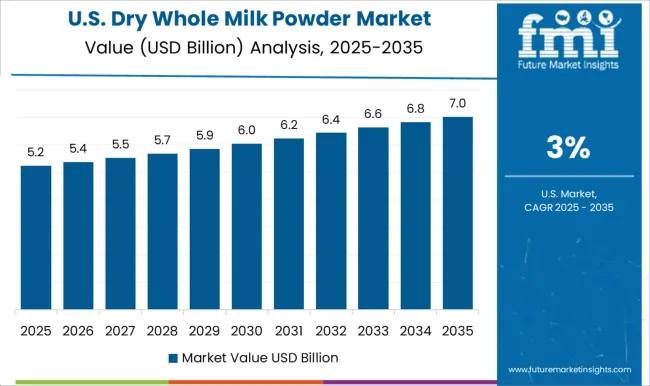

The United States has been leading in the North American dry whole milk powder industry for the past decade and is predicted to maintain its lead throughout the forecast period. The highly advanced food sector and increase in investment by key manufacturers are boosting the demand growth in the USA

With a CAGR of 4.5%, the dry whole milk powder market in the United States is expected to reach USD 18.3 Billion by 2035. The high disposable income per capita and the fast-paced lifestyle of people have contributed to this trend. Furthermore, the whole milk powder business in this country should grow as a result of the availability of various types of fortified whole milk powder.

The growth of the market in China is owing to factors such as the high consumption of dairy and associated products. China is known for its large consumption of dry whole milk powder. China’s consumption was recorded at 2,185 thousand metric tons in 2024.

Nevertheless, China is expected to be the fastest-growing country over the forecast period. China’s dry whole milk powder market is expected to reach USD 18.3 Billion by 2035 at a 7.2% CAGR. The reason for this growth is a large working population, increased middle-class consumption, rapid urbanization, eventful lifestyles, and rising disposable incomes.

However, government initiatives to promote domestic industries have further contributed to the growth of the market in the said country.

Start-ups Leverage Processing Technologies and Microbiology: The Dry Whole Milk Powder Market

A prominent application of whole milk powder in the manufacturing of chocolate is the advent of various food fortification techniques and processing technologies. As a result, the global dry whole milk powder market has seen growth due to advancements in the confectionery industry.

As a result of advancements made in microbiology and bioengineering, companies can vary the taste and nutritional profile of their products. Additionally, they can prolong the shelf life of products. Additionally, developing products with different wettability and dispersibility will drive the dry whole milk powder market by allowing end-use applications to expand. Players are focusing on offering the best quality consistently.

Multi-performance variants are being introduced by several manufacturers to expand their product portfolios and attract consumers from various industry verticals. Mergers and acquisitions are among the strategies employed by companies to improve their position in the market.

By implementing these strategies, the company has become more competitive and improved its market position. For instance, the growing demand for functional foods that boost immunity led Jatenergy to launch two lactoferrin-enriched milk powders in June 2024.

The global dry whole milk powder market is growing at a steady pace. To capitalize on existing opportunities, key players are focusing on launching quality products and acquiring existing companies.

Moreover, these major players are introducing innovative products in the market to attract more consumer base which may help them to expand their geographical presence and hold on the market. For instance,

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value and MT for Volume |

| Key Regions Covered | North America; Latin America; Europe; The Middle East and Africa (MEA); East Asia |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Chile, Peru, Germany, UK, Spain, Italy, France, Russia, Poland, China, India, Japan, Australia, New Zealand, GCC Countries, North Africa, South Africa, and Turkey |

| Key Segments Covered | Source, Category, Drying Technique, Application, Distribution channel, Packaging, Region |

| Key Companies Profiled | American Dairy Products Institute.; AgMotion, Inc.; Agri-Dairy Products Inc.; Alamfoods Inc.; Global DairyTrade Holdings Limited; The LittleOak Company; Bluegrass Ingredients, Inc.; Breen Dairy Trading, Inc.; Cayuga Milk Ingredients; Chicago Dairy Corporation; Clofine Dairy; All American Foods; Dairy Trade USA LLC.; Nestle; Lactalis Group; Fonterra Co-operative Group Limited; DANA DAIRY GROUP; Saputo Inc.; Amul Dairy Anand |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global dry whole milk powder market is estimated to be valued at USD 13.0 billion in 2025.

The market size for the dry whole milk powder market is projected to reach USD 18.3 billion by 2035.

The dry whole milk powder market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in dry whole milk powder market are cow, buffalo, sheep and camel.

In terms of category, conventional segment to command 78.6% share in the dry whole milk powder market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dry-type Air-core Smoothing Reactor Market Size and Share Forecast Outlook 2025 to 2035

Dry Vacuum Pumps Market Size and Share Forecast Outlook 2025 to 2035

Dry Cleaning Solvents Market Size and Share Forecast Outlook 2025 to 2035

Dry Block Heaters Market Size and Share Forecast Outlook 2025 to 2035

Dry Fog Dust Suppression Equipment Market Size and Share Forecast Outlook 2025 to 2035

Dry Scalp Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Eye Syndrome Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Dry Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Dry Herb Cannabis Vaporizers Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Gas Coupling Market Analysis Size and Share Forecast Outlook 2025 to 2035

Dry Mixes Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Dryer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Dry Electrostatic Wipes Market Size and Share Forecast Outlook 2025 to 2035

Drylab Photo Printing Market Size and Share Forecast Outlook 2025 to 2035

Dry and Wet Wipes Market Size and Share Forecast Outlook 2025 to 2035

Dry Yeast Market Report - Size, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA