The dry washer market is anticipated to expand steadily, driven by mining efficiency requirements and demand for waterless technologies of reduced ore separation. The industry size is forecasted to be USD 361.4 million in 2025, reaching around USD 474.6 million by 2035, growing at a CAGR of nearly 2.8%.

Aside from industries like gold, silver, and other precious metals, these washers also find applications in industrial minerals like separation of rare earth elements and grading of sands. As international demand for strategic minerals increases, interest in technologies involving dry separations that use less water, and cost less is increasing as well.

Improved technologies are improving efficiency. Contemporary washers currently utilize adjustable airflow capabilities, advanced dust collection efficiency, and control over vibration. Improved recovery levels, reduced loss of particles, and greater comfort features are allowing professional and amateur users alike to reap the full potential benefits from more efficient washers. There are some limitations.

Their efficiency reduces for extremely fine or wet material, and outcomes vary greatly depending upon feedstock. Also, emission-related regulatory stresses for dust as well as work-related health-related concerns might shape design criteria as well as the need for safety from operators.

The recreational gold prospecting industry, especially in North America and Australia, is driving demand for low-cost and portable models. These machines are being used extensively by hobbyists on public lands, goldfields, and dry creek beds, fueled by increasing interest in outdoor and self-sufficient lifestyles.

North America dominates the industry, followed by regions of Africa and Latin America where water deficiency and illegal mining operations are rampant. With environmental consciousness increasing, these washers could find more use in ecologically sensitive regions where conventional wet separation techniques are prohibited.

Market Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 361.4 million |

| Industry Value (2035F) | USD 474.6 million |

| CAGR (2025 to 2035) | 2.8% |

The industry is growing due to increasing demand for efficient and eco-friendly cleaning systems across various industries. These machines are needed in automotive, industrial manufacturing, aviation, and medical industries, where they provide efficient cleaning without water consumption, which meets sustainability goals and regulatory requirements.

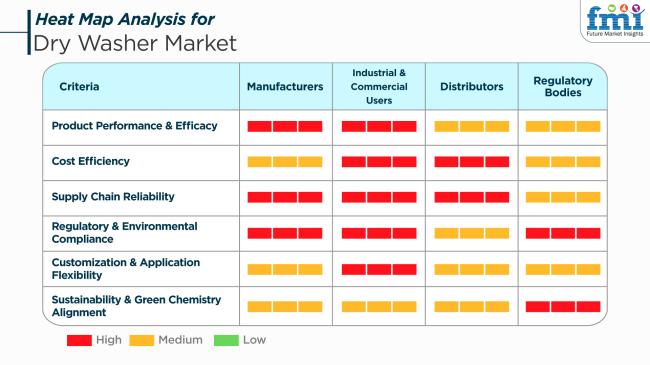

Distributers highlight the continued necessity of a reliable supply chain to meet the needs of industrial and commercial customers-importer-advantaged, offering a wide range of products catering to different uses with timely delivery and competitive price.

Regulatory Agencies set standards of environmental and safety compliance through green and sustainable dry washer technology-use regulations. They have a significant role in influencing the industry by executing regulations that promote the utilization of green-friendly technologies and minimize the environmental impact of industrial processes.

The industry is defined by a combined initiative between stakeholders to create and use products that achieve performance specifications, satisfy environmental conditions, and accommodate changing industry requirements.

Due to the increasing demand for gold and mineral recovery in areas with limited water resources, the industry grew moderately between 2020 and 2024. Dry washing operations in the Third World grew as companies and small-timers desired dry-washing equipment to augment desert recovery figures.

These machines have been around for many years in gold prospecting but have been upgraded to provide better discrimination of finer material. This occurs in the face of challenges such as uncertain commodity prices and some government lockdown orders in affected areas.

The 2025 to 2035 period, on the other hand, will be characterized by dominant disruptions in the industry due to technological innovations in areas such as automation, ubiquitous demand for green mining processes, etc. The next-gen washers with artificial intelligence (AI) and Internet of Things (IoT) compatibility would take the operations to the pinnacle with real-time surveillance and performance optimization.

Increasing awareness regarding the need for filtration systems to address environmental issues and water shortage issues in the world leads to the growth of the industry in such regions with limited resources. The increased use of newer mining technologies with environmental factors and rising demand for green mining solutions will drive the industry for fuel-efficient and greener equipment.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increasing demand for water-saving mining machinery, primarily gold and mineral mining in arid regions | Continued demand for green mining tools, water scarcity, and eco-friendly options leading the growth |

| Increased efficiency in arid washing finer materials and compact design for mobility in remote areas | AI and IoT integration for performance monitoring, energy-saving technology, and automatic arid washing technology |

| Commodity price volatility, regulatory constraints, and the prohibitively high initial cost of advanced option s | Extensive adoption of new technologies, size challenges in green solutions, and evolving regulations |

| Growth in regions of limited water availability, particularly in Africa, the Middle East, and Asia | Extensive adoption in emerging economies in Africa, South America, and the Middle East, with growth in mature economies |

| Regulatory pressure to install water-conserving devices on mining and enhanced environmental regulation | Increased regulation around environmental footprint, with a focus on sustainable and green operations mining |

| Better, more mobile, and more convenient equipment to fit specific modes of mining activity | Integration with information technologies to enhance data-driven decision making, reduce energy expenditure, and increased recovery rates |

The industry is subject to a number of threats that could test its continued development. The most pressing issue in 2025 is the comparatively high initial cost of units when compared to standard dryers.

In price-sensitive industries, particularly in segments of Asia, Latin America, and Africa, this cost barrier is a major hindrance to adoption by middle-income consumers. Additionally, the longer drying times of some washer models are not well aligned with the expectations of users who are used to more rapid drying cycles and may impact customer satisfaction and retention. Limited consumer awareness continues to be an ongoing challenge.

In most developing countries, a lack of awareness regarding the energy-saving and vent less capabilities of these washers leads to a slower adoption curve, especially in home industries where buying decisions are based on familiarity and peer usage. The industry will be influenced by accelerated technological development.

With the advent of more efficient and eco-friendly drying technologies, current models can become obsolete very fast, compelling manufacturers to innovate continuously or lose their industry position. Government policies on energy consumption, appliance efficiency, and noise emissions are becoming more stringent, particularly in Europe and North America. These regulatory changes can require costly design modifications or manufacturing realignments.

The industry is expected to be dominated by the lightweight engine segment in 2025, accounting for 45% of the industry share, while the air-fan assemblies segment is expected to hold 30%. These burgeoning segments are pushing growth for their efficiency, ease of operation, and adaptability toward various industries.

The lightweight engine segment dominates because of its versatility and efficiency, with washers that are portable and easily maneuverable for gold prospecting, mining, and other field-based applications. They are, therefore, the favorites due to their versatility in generating power and allowing easy working and transportability in rugged and remote terrains.

Models from Royal Manufacturing Industries and Keene Engineering, such as the Keene 151 Dry Washer and Royal Gold Dry Washer, powered by lightweight engines, are excellent machines for high-efficiency recovery of gold in extremely harsh conditions.

On the other hand, the air-fan Assemblies are growing vigorously for their superior capacity to optimize airflow during the separation of material in the dry washing process. Such assemblies were built to handle steady airflow and effectively separate dust from the material during dry washing.

Companies like Gold Cube and Aussie Gold Dog have begun to make a strong presence in this zone, with washers using air-fan assemblies such as Gold Cube Super Concentrator and Aussie Gold Dog Dry Washer. Such units are highly regarded in desert areas and in areas where little water is available because air-type systems represent the best solution.

Interest in outdoor activities, mining, and resource recovery is increasing, driving growth in the industry, supported by innovations in operational efficiency and material handling. As demand continues for compact and efficient washing systems, both the lightweight engine and air-fan assembly segments will witness further growth, serving a wide variety of applications.

In 2025, the industry's growth will mainly be credited to the open-pit mining application, which is expected to hold an industry share of 60%. The remaining 40% of the industry share is likely to go to an underground mining application. These trends demonstrate the increasing preference for dry washing systems in all kinds of mining environments, in which both water availability and mining techniques are important factors.

The open-pit mining segment accounts for a major share of large-scale operations and significant volumes processed in open-pit mines. Open-pit mines, especially when situated in dry regions, rely on dry-washing equipment for processing material.

These washers are vital for mining valuable minerals from open-pit operations where water resources are scarce. Companies like Keene Engineering and Royal Manufacturing Industries design specialized washers that cater to open-pit mining with high material throughput and achieve efficient gold recovery during large-scale mining operations.

The underground mining segment is smaller but is still greatly valued in its own right, owing to a particular set of variables that come into play in underground mining operations. Edwards and Sons invariably build washers for underground works to be efficient and thus truly compact with minimum environmental impact in tightly packed areas.

Underground mining is often conducted in areas with little to no water or in tunnels where wet processing techniques are simply not applicable. Compact washer solutions for underground applications are available from Gold Cube and Aussie Gold Dog, enabling miners to work efficiently and safely under such adverse conditions.

The industry's subsequent development in both segments should be encouraged due to growing mining operations pursuing methods to enhance efficiency and sustainability. With the improvement of technology and design, dry washing systems will cater to the diverse demands of open-pit and underground mining applications.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

| UK | 4.9% |

| France | 4.4% |

| Germany | 5.1% |

| Italy | 4.7% |

| South Korea | 5.6% |

| Japan | 4.8% |

| China | 7.3% |

| Australia-NZ | 5.2% |

The USA industry will have a 6.5% CAGR growth during the years of analysis. Increased application in gold panning and small-scale mining operations is driving the industry growth in dry states such as Nevada, Arizona, and California. Advanced technologies such as variable airflow and automatic separation of gold particles are becoming more popular in the USA mining sector.

Furthermore, rising recreational prospecting and do-it-yourself gold mining hobbyists continue to propel equipment demand. The robust foundation of mining equipment producers and the shifting regulatory environment favoring environmentally sound operation has led the USA to be a predominant innovator in the industry.

The industry is also bolstered by a growing trend in hobbyist mineral prospecting facilitated by online purchase sites. As there is an increasing demand for lightweight, compact, and power-saving equipment, USA-based manufacturers are responding to the need for field-ready and transportable machines. Expansion of direct-to-consumer channels and growth in mineral claims in Western states will be set to sustain positive trends throughout the forecast period.

The UK industry is projected to grow at 4.9% CAGR during the study period. Even though there are limited large-scale mineral mining operations, the UK has an ongoing interest in recreational and artisanal gold prospecting, primarily in regions such as Scotland and Wales.

Even though the natural landscape in the UK is less ideal for this industry compared to arid landscapes, technological adjustments and growing interest in low-water mining techniques are widening the niche.

Increased understanding of low-disruption, non-invasive mining techniques is encouraging broader application equipment by hobbyist operators and educational institutions. In addition, the UK's high rate of mining research and technology development is supporting collaboration with foreign manufacturers for industry adaptation.

Limited growth exists, but demand for lightweight, battery-powered washers of appropriate sizes for European terrain presents opportunities for manufacturers that focus on innovation and environmental sustainability.

The French industry is projected to grow at a 4.4% CAGR during the study period. The country's mineral development activities are less frenetic, yet there is a growing interest in sustainable exploration ideas supported by local governments and academics. France is increasingly prioritizing non-mechanized and water-saving methods, making the technology a viable solution.

Southern rural areas of France with relatively arid conditions are becoming hotspots for small-scale prospecting using dry washers. Domestic demand is complemented by the government's general environmental agenda, promoting low-impact mining technologies.

France's manufacturing sector has even shown promise in developing modular parts that are ready for field use and meet European sound and safety standards. With regulation still favoring green methodology, demand will probably see modest but steady growth.

Germany's industry is expected to grow at a 5.1% CAGR during the period of this study. The emphasis on environmentally friendly technology and innovation in Germany has resulted in increasing demand for mining equipment supporting its environmental policies. The technology is becoming increasingly sought-after in research and academic geological exploration due to the minimal requirement for water and its simple transportation.

The industry is supported by a technically skilled population, a growing base of DIY prospectors, and a strong manufacturing base capable of producing high-quality washers. German customers are interested in energy efficiency, automation, and durability, which prompts suppliers to incorporate advanced features into equipment.

Outdoor sports stores that sell multi-purpose field gear with dry washing units also support industry growth. Increasing eco-tourism for gold panning and geological heritage is expected to further propel the industry's growth.

The Italian industry will grow at a 4.7% CAGR during the study period. Although Italy possesses minimal gold reserves, activity in amateur panning and gold exploration on the alluvial riverbed in regions like Tuscany and Piedmont is gaining popularity. The activity of recreational geology and public awareness campaigns involving mineral detection are enhancing the chances of dry washer equipment.

Italy's growing emphasis on environmentally friendly prospecting methods is providing an entry point for low-impact gear like dry washers, especially in conservation natural settings where water-based methods are restricted. Equipment adaptation to Italy's terrain and climatic variability is an emerging trend.

Italian tool and equipment dealers who specialize in artisanal equipment and tools are also beginning to stock these washers, a sign of expanding industry recognition. The industry is benefiting from the expansion of tourism-based prospecting activities and field programs sponsored by universities.

The South Korean industry will register a 5.6% CAGR during the study period. As a highly urbanized nation, South Korea is more and more concerned with resource independence and low-footprint mining technology. These washers are gaining wider use in research and experimental geological field surveys, supported by the government's general policies of innovation.

South Korea's strong electronics and automation sectors are assisting in forging the development of advanced, sensor-enabled washers. Though there is limited domestic mineral production, the potential for export-led production and research makes the country a significant force behind global industry expansion.

Increased participation by government science initiatives and outdoor activity clubs is also driving incremental domestic demand. Additional adoption of AI-based sorting technologies is expected to drive South Korea's position in the global industry.

The Japanese industry will register a 4.8% CAGR during the study period. Japan's legacy of precision machinery and its focus on environmental protection is well-positioned for the evolution of dry washer systems.

Educational institutions are developing more interest in using these washers for research and teaching in geology and mineralogy, particularly in the semi-arid part of central Japan. Domestic demand is specialist but limited, with buyers demanding compact, noise-reduced, and highly efficient machines.

Japanese firms are also collaborating with foreign firms to jointly design equipment for overseas industries, capitalizing on Japan's robotic and control system technology. While outdoor adventure tourism among the younger populations increases, the demand for lightweight and portable kits has been growing, with a niche in adventure and ecological tourism niches.

The Chinese industry will expand at a 7.3% CAGR over the study period. China dominates mining, and dry washers are discovering increased uses in exploratory operations throughout arid regions such as Xinjiang and Inner Mongolia. Industrialization at a very rapid rate, combined with growing national attempts at cleaner mining technology, is propelling the usage of water-saving mine solutions.

Local producers are producing massive amounts of dry washer equipment specifically tailored for small- to medium-scale operations. Government clean mining incentives and the incorporation of AI technologies into exploration workflows are also driving the industry.

China's increasing middle class is also displaying increasing interest in recreational mining activities, which are underpinning growing sales of consumer-grade dry washers. Exporting potential to Southeast Asia and Africa will turn China into a global producer and major customer of dry washer systems.

The Australia-New Zealand industry will expand by 5.2% CAGR over the study period. Australia possesses sufficient mineral resources and vast arid regions that are supportive applications. Western Australia's rich gold states and Queensland are witnessing increasing use for large-scale and small-scale exploration. New Zealand, although less mineralized, is witnessing rising amateur prospecting, especially in the West Coast and Otago regions.

Both countries are promoting green mining, and dry washer machinery is thus greatly sought after. Dry washer-led guided prospecting tours are increasingly provided, which appeal to adventure-seeking visitors. Equipment suitable for rugged terrain, extreme weather, and rapid mobility is greatly sought after. The industry is on the brink of stable growth with a mix of traditional mining and modern eco-tourism-driven exploration.

The industry is largely influenced by the competition among key manufacturers engaged in gold prospecting and mineral extraction equipment and laundry appliances for domestic and industrial applications.

Major players, including Keene Engineering and Royal Manufacturing LLC, target portable and high-efficiency dry washers specially designed for gold recovery and desert mining operations while maximizing fine gold capture through state-of-the-art vibration as well as air separation technologies. They have also retained an impressive industry presence in recreational prospecting and small-scale mining by supplying manual and motorized dry washer units.

Technological advancements and new efficiencies keep this industry competitive. Shandong Xinhai Mining Technology & Equipment Inc. and Shanghai Zenith Minerals Co., Ltd. are emphasizing automated dry-washing systems that incorporate advanced airflow control and dust suppression technologies. Such systems experience increasing acceptance in mineral extraction industries where water scarcity hinders traditional methods of washing.

In the sector of laundry and household appliances, Toshiba, Whirlpool, and Bosch are in competition, offering dry washing machines that are highly efficient, energy-aware, and equipped with smart controls. Differentiation among these brands characterizes AI-powered fabric care systems, innovative waterless cleaning technology, and eco-friendly drying solutions in order to cater to emerging consumer demand for sustainable and water-efficient appliances.

Regional manufacturers and emerging players like Thompson Dry washers and Syntec Engineering target compact and portable options for hobbyists and small-scale operations that belong to the economical category.

The companies have also been developing distribution partnerships and online channels for direct sales to customers in pursuit of an aggressive position in the industry for North America, Australia, and arid regions where mining activities have strong viability.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Keene Engineering | 18-22% |

| Royal Manufacturing LLC | 15-19% |

| Whirlpool | 12-16% |

| Bosch | 8-12% |

| Toshiba | 6-10% |

| Others (combined) | 30-40% |

| Company Name | Key Offerings and Activities |

|---|---|

| Keene Engineering | Specializes in motorized and hand-crank washers for gold prospecting and mining applications. |

| Royal Manufacturing LLC | Offers portable and high-capacity washers with advanced air separation systems. |

| Whirlpool | Develop energy-efficient dry washing appliances with smart AI-driven drying technology. |

| Bosch | Provides eco-friendly and waterless dry washing machines designed for residential and industrial applications. |

| Toshiba | Focuses on high-performance washers with automated fabric care and smart control integration. |

Key Company Insights

Keene Engineering (18-22%)

The industry leader in gold prospecting dry washers with an emphasis on motorized, high-efficiency air separation technology to maximize gold recovery in water-short mining conditions.

Royal Manufacturing LLC (15-19%)

Excels at light as well as portable washers for hobby and small-scale gold mining operations with ease-of-use designs.

Whirlpool (12-16%)

Home appliance industry leader in dry washing technology, featuring AI-based drying solutions for fabric care and energy conservation.

Bosch (8-12%)

Bosch innovates in the waterless dry washing category, incorporating low-energy drying technology for eco-friendly home solutions.

Toshiba (6-10%)

Toshiba is concentrating on automated and environmentally friendly dry washing machines, increasing its share in the residential and commercial laundry markets.

Other Key Players

By types of operation, the industry is segmented based on the types of operation into hand-operated, lightweight engine, and air-fan assemblies.

By application, the industry finds applications in open-pit mining and underground mining.

By region, the industry is divided geographically into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The industry is estimated to reach USD 361.4 million by 2025.

Sales in the industry are projected to grow to USD 474.6 million by 2035.

China is expected to witness notable growth, registering a CAGR of 7.3%.

The lightweight engine segment is at the forefront, preferred for its portability and efficiency in field operations.

Key players include Keene Engineering, Royal Manufacturing LLC, Whirlpool, Bosch, Toshiba, Shandong Xinhai Mining Technology & Equipment Inc., Thompson Drywashers, Shanghai Zenith Minerals Co., Ltd., Syntec Engineering, and Shibang Machinery Co.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Types of Operation, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Types of Operation, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Types of Operation, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Types of Operation, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Types of Operation, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Types of Operation, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Types of Operation, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Types of Operation, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Types of Operation, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Types of Operation, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Types of Operation, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Types of Operation, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Types of Operation, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Types of Operation, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Types of Operation, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Types of Operation, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Types of Operation, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Types of Operation, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Types of Operation, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Types of Operation, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Types of Operation, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Types of Operation, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Types of Operation, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Types of Operation, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Types of Operation, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Types of Operation, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Types of Operation, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Types of Operation, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Types of Operation, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Types of Operation, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Types of Operation, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Types of Operation, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Types of Operation, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Types of Operation, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Types of Operation, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Types of Operation, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Types of Operation, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Types of Operation, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Types of Operation, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Types of Operation, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Types of Operation, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Types of Operation, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Types of Operation, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Types of Operation, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Types of Operation, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Types of Operation, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Types of Operation, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Types of Operation, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Types of Operation, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Types of Operation, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Types of Operation, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Types of Operation, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Types of Operation, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Types of Operation, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Types of Operation, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Types of Operation, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Types of Operation, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Types of Operation, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Types of Operation, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Types of Operation, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Types of Operation, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Types of Operation, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Types of Operation, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Types of Operation, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dry Powder Inhaler Market Size and Share Forecast Outlook 2025 to 2035

Dry Vacuum Pumps Market Size and Share Forecast Outlook 2025 to 2035

Dry Cleaning Solvents Market Size and Share Forecast Outlook 2025 to 2035

Dry Block Heaters Market Size and Share Forecast Outlook 2025 to 2035

Dry Fog Dust Suppression Equipment Market Size and Share Forecast Outlook 2025 to 2035

Dry Scalp Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Eye Syndrome Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Dry Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Dry Herb Cannabis Vaporizers Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Whole Milk Powder Market Size and Share Forecast Outlook 2025 to 2035

Dry Gas Coupling Market Analysis Size and Share Forecast Outlook 2025 to 2035

Dry Mixes Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Dryer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Dry Electrostatic Wipes Market Size and Share Forecast Outlook 2025 to 2035

Drylab Photo Printing Market Size and Share Forecast Outlook 2025 to 2035

Dry and Wet Wipes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA