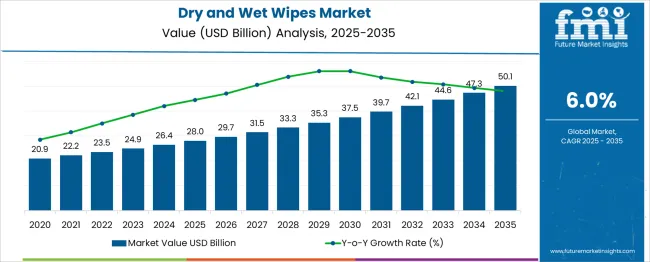

The Dry and Wet Wipes Market is estimated to be valued at USD 28.0 billion in 2025 and is projected to reach USD 50.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. A 10-year growth comparison indicates a steady yet accelerating trajectory over the forecast period. From 2025 to 2030, the market rises from USD 28.0 billion to 35.3 billion, contributing USD 7.3 billion, which accounts for about 33% of the total increase. Annual values in this phase include 29.7 billion in 2026, 31.5 billion in 2027, 33.3 billion in 2028, and 35.3 billion in 2030, driven by growing demand in personal hygiene, baby care, and healthcare applications.

The second half (2030–2035) adds a significantly larger USD 14.8 billion, or 67% of overall growth, as the market advances from 35.3 billion to 50.1 billion, passing through 37.5 billion in 2031, 39.7 billion in 2032, 42.1 billion in 2033, and 44.6 billion in 2034. This back-weighted pattern is supported by the rising adoption of biodegradable and flushable wipes, increasing penetration in industrial and institutional cleaning, and growing demand across emerging economies. Manufacturers investing in eco-friendly raw materials, automation, and innovative packaging formats will be best positioned to capture the accelerating opportunity during the latter half of the forecast horizon.

| Metric | Value |

|---|---|

| Dry and Wet Wipes Market Estimated Value in (2025 E) | USD 28.0 billion |

| Dry and Wet Wipes Market Forecast Value in (2035 F) | USD 50.1 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The dry and wet wipes market is positioned along an extended growth trajectory, reflecting a well-defined adoption lifecycle with distinct regional and application-based variations. Initial adoption was concentrated in personal hygiene and household cleaning, supported by rising consumer preference for convenience-oriented solutions. Over time, the curve steepened as categories such as baby care, facial wipes, and disinfectant wipes gained prominence, with a significant surge during pandemic-driven demand peaks.

Presently, the market remains in a late growth stage rather than saturation, with innovation serving as the key differentiator across premium and mass segments. The adoption lifecycle indicates rapid acceptance in emerging economies across Asia-Pacific, where retail penetration and healthcare infrastructure improvements are driving substantial volume growth. In contrast, mature markets in North America and Europe exhibit high adoption rates, where product differentiation now relies on material sustainability, enhanced texture, and multi-functional performance.

Environmental compliance and flushability concerns are shaping product development, leading to increased investment in biodegradable substrates and eco-friendly formulations. Institutional and commercial segments, including hospitality, healthcare, and automotive, are driving incremental demand, while digital retail channels are accelerating consumer accessibility. This evolutionary pattern positions the category for sustained expansion, reinforced by innovation, regulatory compliance, and diversification into specialized applications.

Rising demand for personal care products that align with fast-paced routines and heightened hygiene standards is driving adoption across demographics. Regulatory emphasis on product safety and biodegradability is influencing innovation in materials and formulations, while premiumization trends are creating opportunities for higher-margin offerings. Future growth is expected to be fueled by increasing penetration in emerging markets, advances in skin-friendly and sustainable wipe technologies, and greater availability through diversified retail formats.

Brands are actively responding to consumer expectations for efficacy, portability, and environmental responsibility, paving the way for continued market expansion and segmentation.

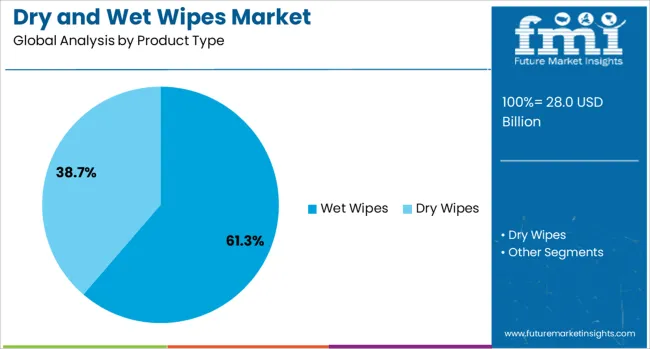

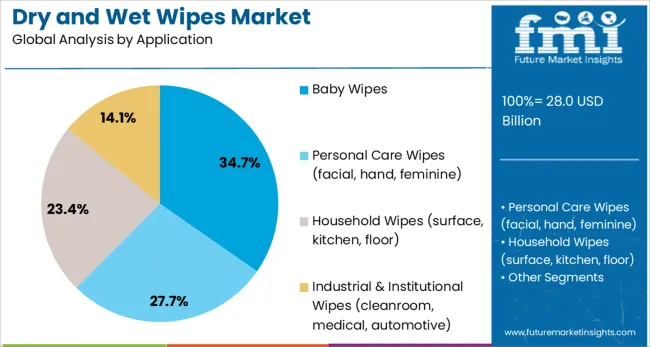

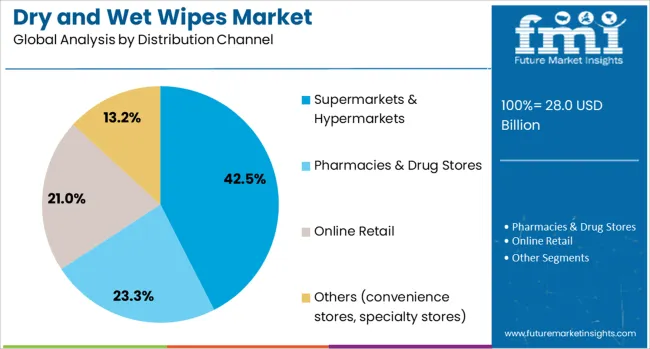

The dry and wet wipes market is segmented by product type, application, distribution channel, and geographic regions. The dry and wet wipes market is divided by product type into Wet Wipes and Dry Wipes. The dry and wet wipes market is classified into Baby Wipes, Personal Care Wipes (facial, hand, feminine), Household Wipes (surface, kitchen, floor), and Industrial & Institutional Wipes (cleanroom, medical, automotive). The dry and wet wipes market is segmented into Supermarkets & Hypermarkets, Pharmacies & Drug Stores, Online Retail, and Others (convenience stores, specialty stores). Regionally, the dry and wet wipes industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product type, wet wipes are anticipated to capture 61.30% of the total market revenue in 2025, maintaining their leadership within the category. This position has been reinforced by the superior convenience and perceived hygiene benefits of pre-moistened wipes for a variety of applications including personal care, household cleaning, and on-the-go sanitation.

Continuous improvements in moisture retention, skin compatibility, and functional additives have enhanced product appeal and expanded use cases. The ability of wet wipes to meet immediate cleaning needs without additional products or water has resonated with consumers prioritizing ease of use and effectiveness.

Furthermore, the segment has benefited from widespread adoption during health crises and increased awareness of infection control practices, solidifying its dominant share in the overall market.

In terms of application, baby wipes are projected to hold 34.7% of the market revenue share in 2025, establishing themselves as the leading application segment. This dominance has been supported by consistent demand from parents seeking safe, gentle, and convenient cleaning solutions for infants and toddlers.

Advances in hypoallergenic and dermatologically tested formulations have strengthened consumer trust and repeat usage within this segment. The necessity of frequent cleaning during infancy, combined with heightened awareness of skin health and hygiene, has sustained steady consumption levels.

The baby wipes category has also been bolstered by innovations in biodegradable materials and attractive packaging designs that appeal to eco-conscious and convenience-driven parents alike. These factors have collectively reinforced the leadership of baby wipes in the application segment.

Segmenting by distribution channel reveals that supermarkets and hypermarkets are expected to account for 42.5% of the market revenue in 2025, maintaining their position as the top-performing channel. This leadership has been driven by the visibility, accessibility, and wide assortment offered through these retail formats, which cater to both planned and impulse purchases.

Consumers have shown a preference for purchasing wipes alongside regular grocery and household items, benefiting from promotional pricing and variety available in-store. The ability of supermarkets and hypermarkets to support bulk buying and feature private-label alternatives has further strengthened their appeal.

Strategic placement of products and in-store marketing initiatives have contributed to increased sales, reinforcing the dominance of this channel within the market.

Dry and wet wipes are pre‑moistened or dry fabric products designed for cleaning, sanitizing, or refreshing surfaces and skin. They are widely used in personal care, household cleaning, healthcare, childcare, and industrial hygiene applications. Demand is driven by the need for convenience and hygiene in everyday use. Manufacturers offering soft, highly absorbent, tear-resistant fabrics with safe formulation options are well positioned to meet user requirements. Products with improved wetness retention, gentle textures, and multi-surface compatibility are shaping purchase decisions among consumers, caregivers, healthcare facilities, and cleaning service providers seeking reliable and easy-to-use wipes.

Heightened hygiene concerns and preference for convenient cleaning solutions have supported growth in the wipes market. Personal care use of wet wipes for infant hygiene, makeup removal, and hand sanitizing has expanded demand. Household adoption of wet wipes for kitchen, bathroom, and surface cleanliness has been driven by time-sensitive routines. In healthcare settings, elevated use of dry and wet wipes for patient care, pre‑procedure cleaning, and infection control has further reinforced uptake patterns. Industrial uses for surface cleaning in manufacturing processes and equipment maintenance have also supported volume growth. Fabric performance attributes such as softness, absorbency, and durability have remained key purchase factors among users seeking fast and effective wiping solutions.

Market expansion has been restrained by fluctuations in nonwoven fabric and chemical formulation prices, which impact production costs. Price-sensitive buyers have shown reluctance toward premium-priced wipe products. Variation in regulatory requirements for disposal and biodegradability across regions has added complexity to product design and compliance. Quality inconsistency among low-cost or counterfeit wipe products has led to reduced consumer trust in some segments. The presence of single-use plastic-based wet wipes raises disposal and waste management challenges, leading to customer resistance in markets with strict environmental policies. Supply chain disruptions and logistic delays have also affected raw material availability, production planning, and delivery reliability in some regions.

Opportunities are being observed in premium wipe formats offering features such as hypoallergenic formulations, pH-balanced cleansing, and plant-derived fabric blends. Institutional markets such as healthcare facilities, childcare centers, fitness centers, and hospitality providers offer recurring demand potential through bulk and contract purchasing. Private label partnerships with retail chains and cleaning service providers have enabled curated wipe offerings. Custom packs with added functional agents like moisturizers, mild disinfectants, or plant extracts appeal to users with sensitive skin. Subscription-based delivery models for household and personal care wipes provide recurring revenue opportunities. Growth in travel kits, auto care packs, and outdoor cleaning wipes presents new segments for product line expansion.

Market direction has been influenced by growth in textiles offering high wettability, fine fiber structures, and lint-free textures suited for precision cleaning. Fabrics infused with moisturizing or soothing agents and pre-saturated solutions with balanced pH have gained popularity in personal care applications. Flow-wrapped individual or travel-sized pack formats are increasingly available for convenience use. Interest in biodegradable wipe substrates and compostable packaging has risen in regions implementing strict waste guidelines. Larger dispenser pack formats for institutional use have been adopted for greater efficiency. Suppliers delivering consistent quality, safe formulation, and improved wetness retention are now setting purchase benchmarks among consumers and procurement professionals.

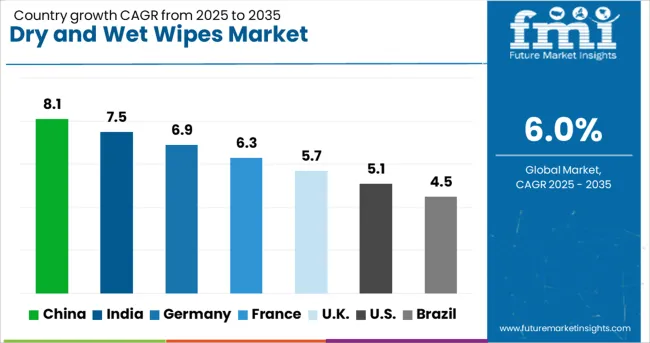

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The dry and wet wipes market is projected to grow at a CAGR of 6.0% between 2025 and 2035, driven by increasing demand in personal hygiene, household cleaning, and healthcare applications. Emerging markets such as China (8.1%) and India (7.5%) lead growth due to rising disposable incomes, population expansion, and improved hygiene awareness. Among OECD economies, Germany (6.9%) remains a strong market supported by premium hygiene brands and eco-friendly wipe variants. France (6.3%) emphasizes wipes with skin-friendly and dermatologically tested formulations, while the United Kingdom (5.7%) sees growth through home care wipes and convenience-based products. Demand is further reinforced by retail and e-commerce penetration,and increased use of biodegradable and flushable wipes to comply with environmental guidelines. The analysis includes over 40 countries, with the top five detailed below.

China is expected to grow at 8.1% CAGR, above the global average of 6.0%, supported by a sharp increase in demand for baby wipes, feminine hygiene wipes, and home care cleaning products. Healthcare facilities are a major growth driver, with high usage of disinfectant wipes in hospitals, diagnostic centers, and outpatient clinics. Local manufacturers dominate production through advanced spunlace and airlaid technologies, ensuring high-quality wipes for both domestic and export markets. Consumer demand for fragrance-free and alcohol-based wipes continues to rise due to their convenience and skin safety features. Large supermarkets and online platforms such as Alibaba and JD.com are key distribution channels, improving availability for urban and semi-urban consumers.

India is forecast to achieve 7.5% CAGR, supported by growing hygiene awareness and higher disposable income. Baby wipes, facial cleansing wipes, and disinfectant wipes lead demand as consumers prioritize convenience-based solutions. Hospitals and clinics remain major buyers of disinfectant wipes under strict hygiene standards. Domestic manufacturers focus on producing cost-effective wipes with specialized formulations like herbal and non-alcohol variants for sensitive skin users. Organized retail and digital platforms ensure better accessibility, while competitive pricing strategies encourage adoption in middle-income households. Private-label brands continue to expand market penetration through supermarkets and online marketplaces, reinforcing affordability and availability.

Germany is expected to register 6.9% CAGR, driven by demand for medical-grade wipes and premium personal care products. Hospitals and nursing homes remain leading consumers of disinfectant wipes, ensuring compliance with hygiene protocols. Household cleaning wipes are gaining adoption in multipurpose applications across kitchens and furniture surfaces. German manufacturers invest in automated production lines and advanced spunlace techniques to deliver high-absorbency wipes with soft-touch textures. Industrial-grade wipes also see rising usage in automotive and machinery cleaning. Distribution through pharmacies, supermarkets, and e-commerce ensures consistent product availability for both institutional and retail consumers.

France is projected to grow at a 6.3% CAGR, supported by healthcare requirements and rising personal care consumption. Disinfectant wipes maintain strong demand across hospitals and outpatient facilities, while household cleaning wipes see increasing use for surface sanitization. Personal care wipes, including facial cleansing and baby wipes, continue to perform well among urban consumers. Manufacturers are diversifying portfolios with fragrance-free, skin-friendly products to attract sensitive skin users. Retail giants and online platforms dominate the distribution landscape, while professional cleaning companies remain key buyers for institutional-grade wipes.

The United Kingdom is forecasted to grow at a 5.7% CAGR, supported by the rising adoption of multipurpose household wipes and disinfectant wipes for institutional cleaning. Baby wipes and facial wipes remain key contributors in the personal care segment due to convenience-driven consumer habits. Private-label brands dominate supermarket shelves with competitively priced options. Premium wipes offering soft-touch textures and pH-balanced formulations are capturing demand from health-conscious consumers. Online marketplaces and subscription-based models are emerging as important sales channels, creating recurring revenue streams for suppliers and improving convenience for consumers.

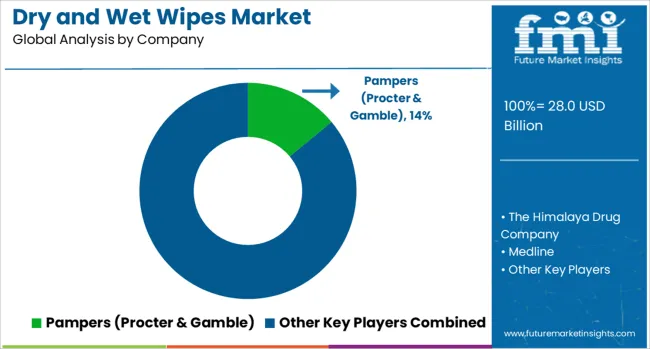

The dry and wet wipes market is highly competitive, driven by major global and regional players such as Pampers (Procter & Gamble), The Himalaya Drug Company, Medline, Unicharm Corporation, Babisil Products Ltd., Johnson & Johnson Pvt. Ltd., Kirkland, Hengan International Group Company Limited, Cotton Babies, Inc., and Moony. These companies serve diverse applications including baby care, personal hygiene, household cleaning, and healthcare.

Procter & Gamble dominates with Pampers-branded baby wipes, leveraging strong distribution networks and product innovation focused on skin-friendly, hypoallergenic formulations. Johnson & Johnson emphasizes dermatologically tested wipes with added moisturizing benefits, while Unicharm and Hengan International strengthen their market share through cost-effective yet premium-positioned products across Asian markets. Medline focuses on medical-grade wipes designed for infection prevention in hospitals and clinics, while The Himalaya Drug Company differentiates through herbal-based wipes targeting consumers seeking natural solutions. Private labels like Kirkland gain traction in price-sensitive markets by offering high-quality wipes at competitive pricing.

The market exhibits moderate entry barriers due to manufacturing scale requirements, regulatory compliance for safety standards, and brand trust in hygiene-sensitive applications. Competitive strategies revolve around softness, durability, chemical-free ingredients, and skin compatibility, with players increasingly incorporating eco-friendly fibers and biodegradable materials to meet consumer preferences. Future competitiveness will focus on antibacterial and alcohol-based wipes for healthcare and household disinfection, along with premium wipes featuring multi-layer textures and advanced packaging for convenience. Innovation is centered on natural formulations, enhanced liquid retention, and skin-protective additives, positioning companies with strong R&D and distribution capabilities for sustained growth.

Manufacturers are introducing wipes made from plant-based fibers such as bamboo and cotton to replace plastic-containing variants. Flushable and biodegradable options are gaining traction, addressing concerns about environmental impact and sewer blockages.

Healthcare and institutional sectors are driving demand for high-efficacy disinfectant wipes, while electronics wipes are emerging for device maintenance in shared environments. The nonwoven technologies, such as spunlace and wood pulp integration, dominate production trends, improving strength and absorbency. These changes reflect a strong focus on performance enhancement and adaptation to evolving consumer expectations.

| Item | Value |

|---|---|

| Quantitative Units | USD 28.0 Billion |

| Product Type | Wet Wipes and Dry Wipes |

| Application | Baby Wipes, Personal Care Wipes (facial, hand, feminine), Household Wipes (surface, kitchen, floor), and Industrial & Institutional Wipes (cleanroom, medical, automotive) |

| Distribution Channel | Supermarkets & Hypermarkets, Pharmacies & Drug Stores, Online Retail, and Others (convenience stores, specialty stores) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Pampers (Procter & Gamble), The Himalaya Drug Company, Medline, Unicharm Corporation, Babisil Products Ltd., Johnson & Johnson Pvt. Ltd., Kirkland, Hengan International Group Company Limited, Cotton Babies, Inc., and Moony |

| Additional Attributes | Dollar sales by product type (baby wipes, personal care wipes, household cleaning wipes, medical disinfectant wipes) and distribution channel (supermarkets, e-commerce, pharmacies, and specialty stores), with demand driven by hygiene awareness, convenience, and infection control requirements. Regional trends indicate strong growth in Asia-Pacific due to urbanization and rising disposable incomes, while North America and Europe focus on premium wipes with dermatological certifications. Innovation trends include alcohol-free sanitizing wipes, skin-soothing agents like aloe vera, and moisture-lock packaging for longer shelf life.Bottom of Form |

The global dry and wet wipes market is estimated to be valued at USD 28.0 billion in 2025.

The market size for the dry and wet wipes market is projected to reach USD 50.1 billion by 2035.

The dry and wet wipes market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in dry and wet wipes market are wet wipes and dry wipes.

In terms of application, baby wipes segment to command 34.7% share in the dry and wet wipes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dry-type Air-core Smoothing Reactor Market Size and Share Forecast Outlook 2025 to 2035

Dry Powder Inhaler Market Size and Share Forecast Outlook 2025 to 2035

Dry Vacuum Pumps Market Size and Share Forecast Outlook 2025 to 2035

Dry Cleaning Solvents Market Size and Share Forecast Outlook 2025 to 2035

Dry Block Heaters Market Size and Share Forecast Outlook 2025 to 2035

Dry Fog Dust Suppression Equipment Market Size and Share Forecast Outlook 2025 to 2035

Dry Scalp Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Eye Syndrome Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Dry Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Dry Herb Cannabis Vaporizers Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Whole Milk Powder Market Size and Share Forecast Outlook 2025 to 2035

Dry Gas Coupling Market Analysis Size and Share Forecast Outlook 2025 to 2035

Dry Mixes Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Dryer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Drylab Photo Printing Market Size and Share Forecast Outlook 2025 to 2035

Dry Yeast Market Report - Size, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA